Healthcare IT Market Size, Growth, Share & Trends Analysis

Healthcare IT Market by Solution [Clinical (EHR, PHM, PACs & VNA, Telehealth, RCM, CDSS, LIS), Nonclinical (Analytics, RCM, Pharmacy, Interoperability), Service (Claim, Billing, Supply)], End User (Hospital, ASC, Pharmacy, Payer) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

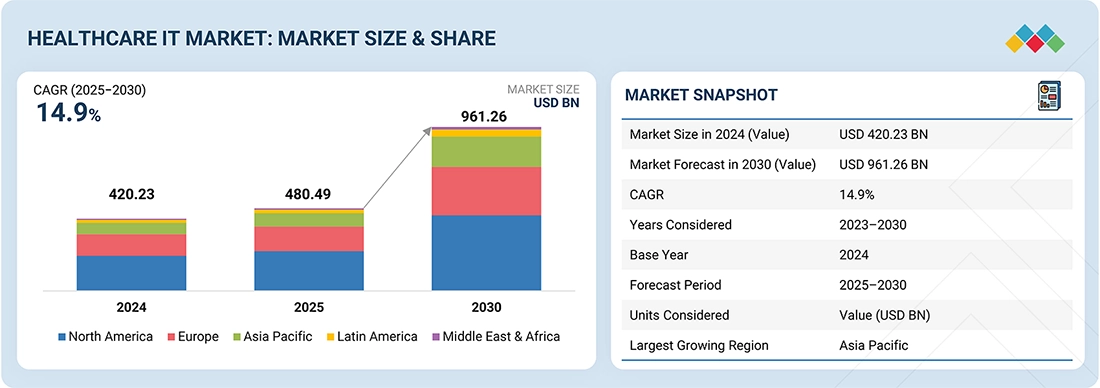

The global healthcare IT market, valued at US$420.23 billion in 2024, stood at US$480.49 billion in 2025 and is projected to advance at a resilient CAGR of 14.9% from 2025 to 2030, culminating in a forecasted valuation of US$961.26 billion by the end of the period., driven by rapid digital transformation across hospitals, increasing adoption of cloud-based solutions, and greater integration of AI to improve clinical and the efficiency of operations.

KEY TAKEAWAYS

-

By RegionNorth America accounted for the largest share of 48.1% of the global healthcare IT market in 2024.

-

By Solution & ServiceIn 2024, the clinical solutions segment for healthcare providers accounted for 76.8% of the HCIT market.

-

By ComponentThe software segment is projected to register the highest CAGR during the forecast period.

-

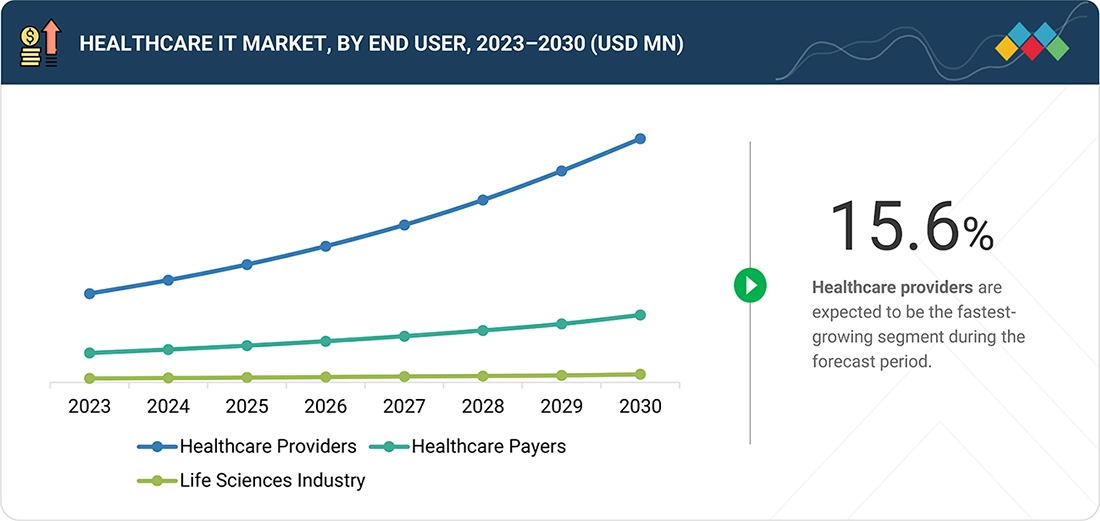

By End UserHealthcare providers accounted for the largest share of the HCIT market at a CAGR of 15.6% during the forecast period.

-

Competitive LandscapeOracle, Optum, Inc., and Epic Systems Corporation were identified as some of the star players in the healthcare IT market (global), given their strong market share and product footprint.

-

Competitive LandscapeConifer Health Solutions and CitiusTech, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The growth of the healthcare IT market is driven by technological advancements, the rising adoption of telehealth solutions, and the increasing importance of user-generated digital health data. Additionally, the current shift toward patient-centered, value-based care and the use of Real-World (RWE) data for healthcare management are driving the market for healthcare IT solutions. However, the lack of evidence-based standards, data governance issues, and ethical concerns regarding consent pose a challenge to market growth.

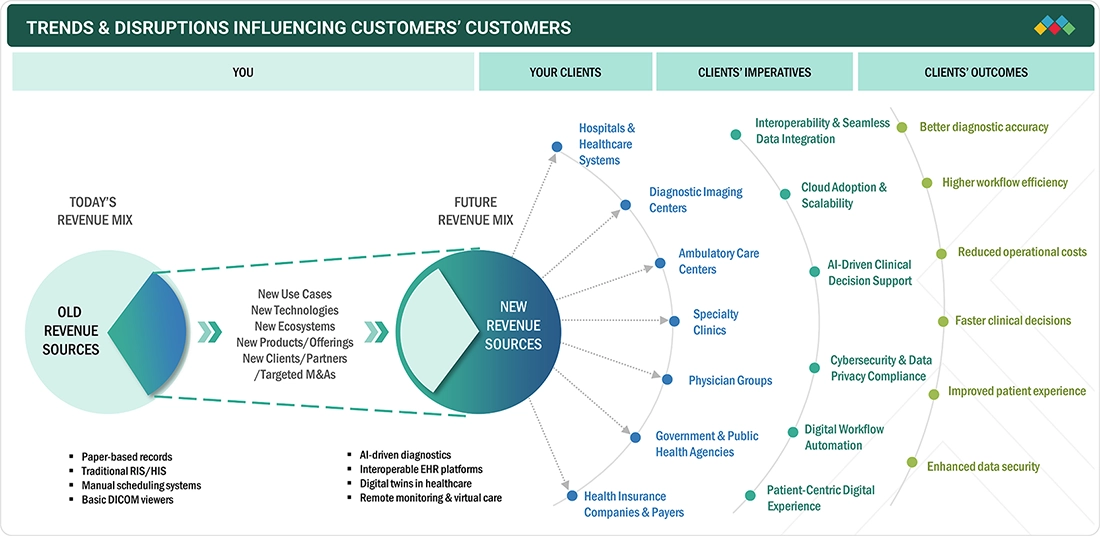

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Healthcare IT is experiencing disruptive changes through cloud adoption, AI-powered diagnostics, predictive analytics, and interoperability standards that are rapidly transforming how healthcare systems operate. Newer technologies like generative AI, digital twins, remote monitoring, and automation are changing how clinics function, reducing inefficiencies and enabling real-time, data-driven care. Additionally, growing concerns about cybersecurity threats and regulatory requirements are prompting organizations to upgrade their infrastructure. Secure, scalable platforms are becoming essential. These trends are collectively driving digital transformation, reshaping the vendor landscape, and redefining the value proposition for providers, payers, and technology companies across the healthcare system.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Government mandates & support for HCIT solutions

-

Rising use of big data in healthcare

Level

-

IT infrastructure constraints in developing countries

-

High cost of deployment in small and medium-sized hospitals in emerging economies

Level

-

Rising use of HCIT solutions in outpatient care facilities

-

Cloud-based EHR solutions

Level

-

Rising data breach concerns

-

Limited availability of skilled personnel

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Government mandates & support for HCIT solutions

Driven by the benefits of HCIT solutions and an integrated healthcare information network, governments across the globe are taking several initiatives to promote the implementation of HCIT solutions and services. Optimized productivity of healthcare systems and cost reduction are at the center of these initiatives. Moreover, the adoption of HCIT solutions helps deliver better health outcomes in terms of access, quality, and affordability. The overall growth of the HCIT industry is driven by the implementation of favorable government initiatives supporting the adoption of IT solutions in their respective healthcare systems. For instance, EHRs (electronic health records) form a central component of HCIT as they enable the easy exchange of information and communication among all stakeholders in a healthcare system. Governments across several countries are undertaking initiatives to promote the adoption of EMRs (electronic medical records) and other similar solutions, which, in turn, would drive the HCIT market.

Restraint: IT infrastructure constraints in developing countries

Cost issues are one of the major barriers to the adoption of HCIT solutions. The maintenance and software update costs of these systems are higher than the price of the software. Support and maintenance services, which include software upgrades as per changing user requirements, represent a recurring expenditure amounting to almost 30% of the total cost of ownership. Moreover, the lack of internal IT expertise in the healthcare industry necessitates training for end users to maximize the efficiency of various solutions, thereby adding to the cost of ownership of these systems.

Opportunity: Rising use of HCIT solutions in outpatient care facilities

In response to the rising pressures on healthcare systems to lower costs, the industry is shifting toward outpatient settings. It is estimated that a procedure performed in an outpatient surgery center costs 30- 60% less than in inpatient hospital settings. Convenience is another key factor driving the rise of ambulatory care. With the increase in outpatient settings and patient influx, the demand and usage of HCIT solutions in outpatient settings will increase. According to a survey sponsored by UnitedHealth (US) in 2021, around 10% of US hospitals had dedicated HCIT clinical documentation improvement programs for their outpatient settings. An additional 10% is planned to implement these services. Furthermore, 14% of hospitals planned to implement advanced solutions in the near future. This trend is expected to drive the use of HCIT solutions, such as RCM solutions, for outpatient settings in the coming years.

Challenge: Rising data breach concerns

In healthcare, approximately one-third of data breaches result in medical identity theft due to a lack of internal control over patient information, a lack of top management support, outdated policies and procedures, or non-adherence to existing ones, and inadequate personnel training, all of which contribute to the rise in data breaches and medical identity theft cases in the industry. This makes patient confidentiality a major challenge in the healthcare industry. Patient data contains personal, private, or confidential information that requires strict safeguards to prevent its misuse. The growing use of automated technologies (such as EHRs and medical claims processing), as well as the shifting trend toward health information exchanges (HIEs), has altered the healthcare privacy and security landscape.

HEALTHCARE IT MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Population health analytics platform enabling payers & providers to analyze claims, EHR data, and risk profiles | Reduced costs, improved care coordination, better risk management |

|

Digital transformation for hospitals through EHR integration, automation, and interoperability across systems | Streamlined workflows, fewer errors, enhanced patient experience |

|

Cloud-based radiology workflow platform (PACS, Reporting, AI tools) for imaging centers and hospitals | Faster diagnoses, higher radiologist productivity, optimized imaging operations |

|

Healthcare data infrastructure modernization using cloud, edge devices, and secure storage for clinical systems | Scalability, secure data access, lower IT maintenance |

|

AI-enabled imaging and clinical decision support integrated into modalities and radiology workflows | Improved diagnostic accuracy, reduced turnaround time, enhanced clinician efficiency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The healthcare IT market ecosystem comprises leading technology vendors such as GE HealthCare, Optum, and Oracle that provide core digital infrastructure, EHR systems, analytics platforms, and healthcare software, while startups and SMEs like Carestream, Practice Fusion, and InterSystems drive innovation in cloud-based clinical solutions and data management. Regulatory bodies, including the US FDA, GOV.UK, and international standards organizations, ensure compliance, data security, and patient safety across all solutions. End users such as AdventHealth, Mayo Clinic, Texas Children’s Hospital, and Johns Hopkins Medicine adopt these technologies to enhance clinical workflows, improve patient outcomes, and enable efficient, data-driven healthcare. Collaboration across vendors, regulators, and healthcare providers underpins advancements in interoperability, AI-driven diagnostics, and value-based care, driving overall market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Healthcare IT Market, By Product & Service

Healthcare provider solutions are expected to register the highest growth. The growth of the segment can be attributed to the demand for value-based care, government initiatives to improve patient care, the rising use of advanced technology solutions, and the need for more efficient delivery of healthcare services. The transition from paper-driven systems to electronic medical records (EMRs) not only mitigates the cost-of-error problem but also curtails administrative expenses. Thus, healthcare providers are increasingly turning towards depending on online tools to access health records and services, emphasizing the demand for effective, tech-savvy healthcare solutions.

Healthcare IT Market, By Component

Services accounted for the largest share of the healthcare IT components market. The healthcare IT services sector draws most of its revenue from consulting services, especially in emerging economies. This is because healthcare providers are still developing IT infrastructure and thus require expert consultation. Such services include conducting feasibility studies before implementing IT solutions and technical consulting (providers suggest database designs and software & system development solutions). The major players that provide consulting services are Accenture (Ireland), Cerner Corporation (US), Optum (US), and Cognizant (US), among others.

Healthcare IT Market, By End User

Providers are expected to hold the largest share of the healthcare IT end-user market, driven by the rising rates of chronic conditions such as diabetes, heart disease, and obesity; legislative reforms; expanding access to healthcare; the increasing number of insured patients; increased healthcare spending; and an aging population. The global population aged above 60 is expected to grow from 1 billion in 2020 to 1.4 billion in 2030, which will greatly increase the incidence of age-related ailments and increase the demand for healthcare services.

REGION

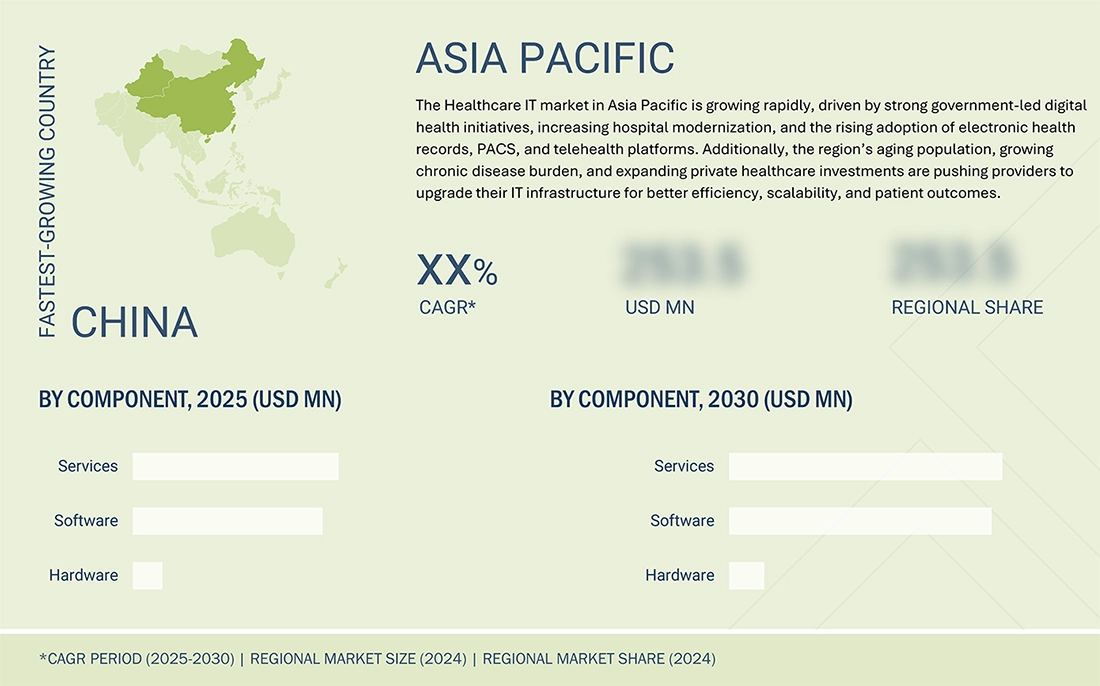

Asia Pacific registered the highest CAGR during the forecast period (2024-2029) in the healthcare IT market

The Asia Pacific is projected to see the highest growth, driven by increasing disposable incomes and evolving healthcare needs, especially in countries like China, where the senior population grows by 10 million annually. Governments are taking initiatives like China's Healthy China 2030, while healthcare in India has increased over 20% in five years due to higher spending and better technology. Investment in APAC healthcare is rapidly rising, notably in Southeast Asia, through infrastructure and digital advances. Foreign investment, especially from the US, has also recovered post-pandemic. The Personalised Health Index, which helps leaders assess their readiness for providing personalized care, shows Singapore leading due to its digital infrastructure and the National Precision Medicine Programme. Indonesia and India are also progressing in the wearables and consumer trust sectors.

HEALTHCARE IT MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS: COMPANY EVALUATION MATRIX

Oracle (Star) stands out with high market revenue and a wide product base, fueled by its comprehensive healthcare cloud platforms, EHR systems, and data analytics tools, scalable enterprise systems widely used by all kinds of hospitals, payers, and healthcare networks. TCS (Emerging Leader) has been widely adopted because of its niche health IT solutions, and is expanding its portfolio in the areas of interoperability, patient engagement, and analytics through AI. Although Oracle leads, through scale, deep product integration, & global reach, TCS has shown a substantial potential to move towards the leaders' quadrant as the pace of the demand for the digital transformation of the healthcare value chain intensifies and becomes more data-driven healthcare solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Optum, Inc. (US)

- Cognizant (US)

- Koninklijke Philips N.V. (Netherlands)

- Oracle (US)

- GE Healthcare (US)

- Dell Inc. (US)

- Wipro (India)

- eClinicalWorks (US)

- SAS Institute Inc. (US)

- Inovalon (US)

- Infor. (US)

- Conifer Health Solutions, LLC. (US)

- Nuance Communications, Inc. (US)

- 3M (US)

- Merative (US)

- Epic Systems Corporation. (US)

- InterSystems Corporation (US)

- Veradigm (US)

- Salesforce, Inc. (US)

- CitiusTech (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 420.23 BN |

| Market Forecast in 2030 (Value) | USD 961.26 BN |

| Growth Rate | 14.90% |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

| Related Segment & Geographic Reports |

Pharmaceutical Manufacturing Software Market Medical Coding Market Asia Pacific Healthcare IT Market US Healthcare IT Market Europe Healthcare IT Market |

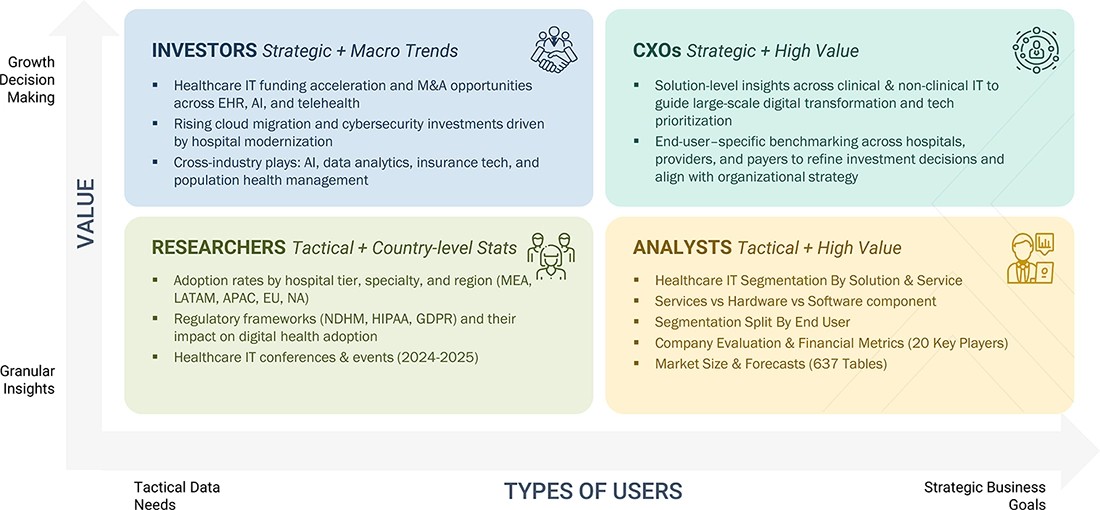

WHAT IS IN IT FOR YOU: HEALTHCARE IT MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Detailed Insights on Healthcare Provider IT Solutions | Segmented analysis of clinical & non-clinical solutions with detailed mapping of EHR, PACS/VNA, RCM, telehealth, interoperability, and analytics | Facilitated targeted investment choices within the clusters of high growth solutions |

| Competitive Landscape Enhancement | Additional profiling of 15–20 regional HCIT vendors and emerging digital health startups | Improved vendor benchmarking and partnership strategy development |

| Regional Market Breakout | Country-level data for the US, Canada, Germany, UK, China, India, and Japan with growth drivers | Supported market-entry prioritization based on opportunity size and regulatory landscape |

| End-User Workload & Adoption Insights | Detailed analysis of adoption trends for hospitals, ambulatory centers, payers, and life sciences companies | Strengthened go-to-market strategy with sharper understanding of buyer needs |

| Outsourcing Services Deep-Dive | Expanded view of HCIT outsourcing: RCM services, claims processing, LIMS, IT infrastructure management, BPM | Helped identify high-margin service opportunities and outsourcing hotspots |

RECENT DEVELOPMENTS

- October 2024 : Royal Philips and Siloam Hospitals Group announced plans to strengthen AI capabilities in Indonesia's healthcare sector with the signing of an MoU focusing on clinical care, developing local professionals, and supporting government goals for healthcare improvement.

- September 2024 : GE HealthCare (US) introduced VenueSprint, its portable ultrasound solution that offers advanced AI functionality and wireless connectivity to deliver better patient care.

- June 2024 : Optum, Inc. (US) introduced a new solution known as DME Navigator to enable patients to gain faster access to medical equipment.

- May 2024 : EClinicalWorks (US) and the Pacific Islands Primary Care Association, along with its partner HealthEfficient (US), collaborated to improve the accessibility and quality of healthcare at community health centers throughout the Pacific Islands, utilizing cutting-edge electronic health record systems.

Table of Contents

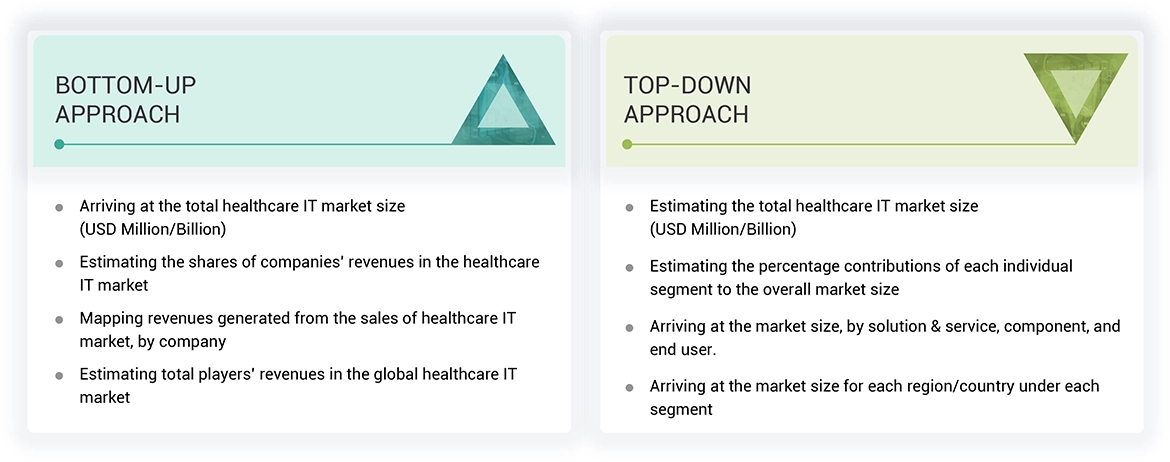

Methodology

The study involved five major activities to estimate the current size of the Healthcare IT market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for the study of Healthcare IT Market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

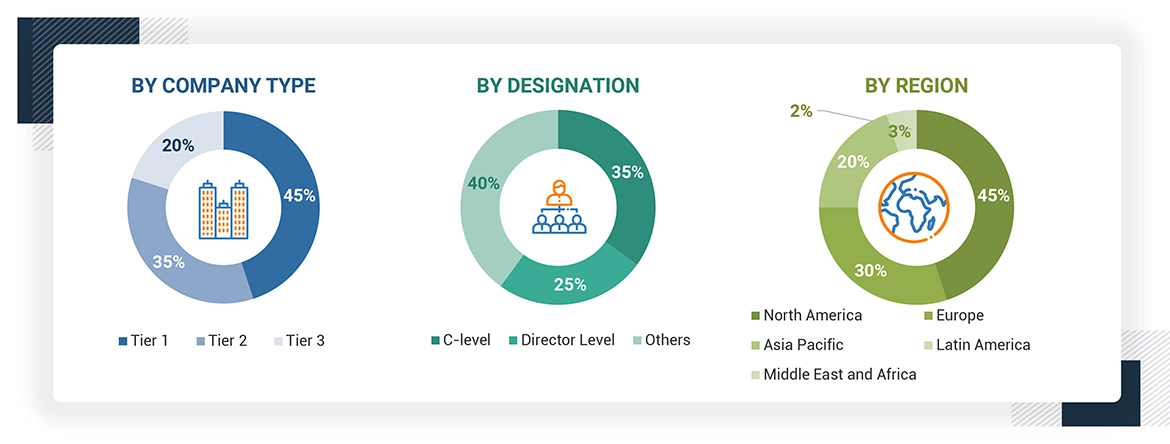

Extensive primary research was conducted after acquiring basic knowledge about the global Healthcare IT market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Hospital directors, Hospital Vice Presidents, Department heads, and Critical care specialists ) and supply side (such as C-level and D-level executives, technology experts, product managers, marketing and sales managers, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews

The following is a breakdown of the primary respondents:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers of companies are defined on the basis of their total revenues in 2023. Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the healthcare IT market. These methods were also used extensively to estimate the size of various subsegments in the market.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Healthcare IT Market.

Market Definition

Healthcare Information Technology (HCIT) involves designing, developing, creating, using, and maintaining information systems related to the healthcare industry. Healthcare IT digitizes existing paper-based healthcare systems, ensuring effective care and patient safety. The solutions encompass the use of software, or infrastructure to record, store, protect, and retrieve clinical, administrative, or financial information by healthcare providers, payers, or other end users.

Stakeholders

- Healthcare IT solution providers

- Healthcare IT vendors

- Healthcare IT service providers

- Healthcare payers

- Academic research institutes

- Government institutes

- Market research and consulting firms

- Venture capitalists and investors

Report Objectives

- To define, describe, and forecast the global Healthcare IT market based on solution & service, component, end user, and region.

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall Healthcare IT market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To strategically analyze the market structure profile of the key players of the Healthcare IT market and comprehensively analyze their core competencies.

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

- To track and analyze competitive developments such as product launches and enhancements and investments, partnerships, collaborations, acquisitions, expansions, agreements, sales contracts, and alliances in the Healthcare IT market during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Healthcare IT Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Healthcare IT Market

Julia

May, 2022

pls help with your market intelligence to grow and sustain in Healthcare IT market.

Rainer

May, 2022

Looking for detailed Market size valuation pointers of Healthcare IT market from 2022 to 2030.

Peter

Mar, 2022

In what way COVID19 is Impacting the global growth of the Healthcare IT Market?.