Concrete Superplasticizers Market by Type (PC, SNF, SMF, MLF), Application (Ready-Mix Concrete, Precast Concrete, High Performance Concrete), and Region (North America, APAC, Europe, South America, the Middle East & Africa) - Global Forecast to 2024

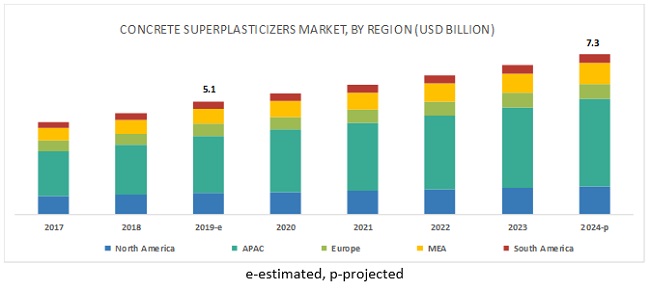

[135 Pages Report] The global concrete superplasticizers market size is estimated to be USD 5.1 billion in 2019 and is projected to reach USD 7.3 billion by 2024, at a CAGR of 7.4%. The growing demand for the concrete superplasticizers can be attributed to the growing consumption of the concrete, globally. The majority of the concrete demand is generated from emerging economies of APAC.

The PC segment dominated the concrete superplasticizers market in 2018 and is also expected to be the fastest-growing segment during the forecast period.

The PC-based superplasticizers can achieve water reduction of up to 40.0% at very low dosage rates compared to their counterparts. Excellent water reduction capability and dispersibility are expected to drive the demand for PC-based concrete superplasticizers in the next five years. Polycarboxylate superplasticizers are used as high-range water reducers in high performance concrete, high-strength concrete, high volume fly ash/slag concrete, cement grouting, and dry mortar. Therefore, it is estimated that PC segment will be the fastest-growing segment during forecast period.

The ready-mix concrete segment accounted for the largest market share in 2018

Ready-mix concrete is the largest manufactured concrete, globally, owing to its ease in transportation and a wide range of applications across residential, commercial, and industrial constructions. The major demand driver for the growing ready-mix concrete consumption is shortage of labor and space limitation at construction sites. Also, it is very convenient for construction companies to reduce the inventory and labor cost by opting for the ready-mix concrete instead of site-mixed concrete. Owing to these factors, ready-mix concrete is projected to be largest segment of the concrete superplasticizers market.

APAC is expected to register the highest CAGR during the forecast period.

APAC is projected to be the largest market for concrete superplasticizers. This dominant market size and highest growth rate are owing to the high consumption of concrete by the APAC region. APAC is the largest producer and consumer of the concrete accounting for more than 50% of the global consumption of concrete. Growing urbanization trend across emerging economies of APAC drives the concrete superplasticizers market. APAC countries namely China, Japan, South Korea, Vietnam, Indonesia, Philippines, Thailand, and India are among the top 20 consumers of cement. Owing to the high consumption of cement and demographics, the APAC region is projected to be the largest consumer of the concrete superplasticizers.

Key Market Players

Arkema (France), Sika (Switzerland), BASF (Germany), GCP Applied Technologies (US), Mapei (Italy), Kao Corporation (Japan), Enaspol (Czech Republic), Concrete Additives and Chemicals (India), Rhein-Chemotechnik (Germany), and Rain Carbon (US) are the key players operating in the concrete superplasticizers market.

These companies have adopted various organic as well as inorganic growth strategies between 2015 and 2019 to strengthen their positions in the market. Expansion is the key growth strategy adopted by these leading players to enhance regional presence and develop product portfolios to meet the growing demand for concrete superplasticizers from emerging economies.

Scope of the Report:

|

Report Metric |

Details |

|

Years considered for the study |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Units considered |

Volume (Kiloton) and Value (USD) |

|

Segments |

Type, Form, Application, and Region |

|

Regions |

North America, APAC, Europe, South America, and the Middle East & Africa |

|

Companies |

Arkema (France), Sika (Switzerland), BASF (Germany), GCP Applied Technologies (US), Mapei (Italy), Kao Corporation (Japan), Enaspol (Czech Republic), Concrete Additives and Chemicals (India), Rhein-Chemotechnik (Germany), and Rain Carbon (US). |

This research report categorizes the concrete superplasticizers market based on type, form, application, and region.

By Type:

- PC

- SNF

- SMF

- MLS

- Others

By Form

- Liquid

- Powder

By Application:

- Ready-Mix Concrete

- Precast Concrete

- High Performance Concrete

- Others

By Region:

- North America

- APAC

- Europe

- South America

- The Middle East & Africa

The concrete superplasticizers market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In September 2019, Arkema launched a new superplasticizer, namely, Ethacryl DM, which will cater to the dry mix concrete application. This will allow the company to cater to the dry mix mortar segment of the market.

- In March 2019, BASF launched Melflux SELECT 4411 F superplasticizer. It is polycarboxylate ester-based superplasticizer. It comes in powder form, which enables long duration slump retention. This new product will cater to the dry mix concrete consumers.

- In May 2018, BASF established a manufacturing plant in Myanmar. This plant produces a range of construction chemicals for the local market. This strategy aligns the company with its objective to establish itself in the emerging economies of APAC.

Critical Questions the Report Answers:

- What are the upcoming hot bets for the concrete superplasticizers market?

- What are the various forms of concrete superplasticizers? What are the market dynamics for different types of concrete superplasticizers?

- What are the major applications of concrete superplasticizers?

- Who are the major manufacturers of concrete superplasticizers? What are the latest developments in the concrete superplasticizers market?

- What are the factors driving the concrete superplasticizers market in each region?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.3.1 Concrete Superplasticizers Market Analysis Through Primary Interviews

2.4 Limitations

2.5 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Global Concrete Superplasticizers Market

4.2 Concrete Superplasticizers Market in APAC, 2018

4.3 Concrete Superplasticizers Market, By Type

4.4 Concrete Superplasticizers Market, By Application

4.5 Concrete Superplasticizers Market Growth Rate, By Key Country

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Mega Projects Globally to Drive the Concrete Superplasticizers Market

5.2.1.2 Improving the Quality and Economics of Construction

5.2.2 Restraints

5.2.2.1 Fluctuating Raw Material Prices

5.2.3 Opportunities

5.2.3.1 The Growing Use of Ready-Mix Concrete in Emerging Economies

5.2.4 Challenges

5.2.4.1 Established Infrastructure in Developed Countries

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

6 Concrete Superplasticizers Market, By Application (Page No. - 41)

6.1 Introduction

6.2 Ready-Mix Concrete (RMC)

6.2.1 Growth of the Construction Industry Augmenting the Demand for RMC

6.3 Precast Concrete

6.3.1 Sustainable Production and Good Efficiency are Driving the Demand for Precast Concrete

6.4 High-Performance Concrete

6.4.1 High Strength and Durability of High-Performance Concrete to Fuel the Demand for Superplasticizers

6.5 Others

6.5.1 Shotcrete

6.5.1.1 Easy Workability of Shotcrete Driving the Demand, Globally

6.5.2 Self-Compacting Concrete (SCC)

6.5.2.1 Improved Flowability and Use in Complicated Construction to Fuel Its Demand

6.5.3 Fly Ash Concrete (FAC)

6.5.3.1 Improved Characteristics in Fresh and Hardened Concrete Mixtures to Increase the Demand for Superplasticizers

7 Concrete Superplasticizers Market, By Type (Page No. - 49)

7.1 Introduction

7.2 PC Derivatives

7.2.1 Excellent Water Reduction Capability and Dispersibility to Drive the Demand in the Next Five Years

7.2.2 Polycarboxylic Ether Based (PCE)

7.2.3 Polycarboxylic Ester Based

7.2.4 Polycarboxylic Acid Based (PCA)

7.3 Sulfonated Naphthalene Formaldehydes (SNF)

7.3.1 Easy Availability and Production are the Governing Factors for the Growth of Naphthalene Superplasticizers

7.4 Sulfonated Melamine Formaldehydes (SMF)

7.4.1 Non-Toxicity and Good Thermal Stability Driving the Market

7.5 Modified Lignosulfonates (MLS)

7.5.1 Long-Term Functionality and Durability to Drive the Demand in the Next Five Years

8 Concrete Superplasticizers Market, By Form (Page No. - 57)

8.1 Introduction

8.2 Liquid Form

8.2.1 Flowability and Easy Pouring of Concrete Drive the Liquid Form of Concrete Superplasticizers Demand

8.3 Powder Form

8.3.1 Less Sensitivity to Temperature to Drive the Demand for Powder Form of Superplasticizers

9 Concrete Superplasticizers Market, By Region (Page No. - 60)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Proliferation of Mega Projects to Drive the Concrete Superplasticizers Market in the US

9.2.2 Canada

9.2.2.1 Increased Demand for Public Infrastructure to Boost the Demand for Concrete Superplasticizers

9.2.3 Mexico

9.2.3.1 Growth of the Market in the Country Will Be Mainly Driven By Investment in Public Infrastructure

9.3 APAC

9.3.1 China

9.3.1.1 China Accounted for the Largest Share in the Global Concrete Superplasticizers Market

9.3.2 India

9.3.2.1 India Leads the Concrete Superplasticizers Market With the Fastest Growth Rate

9.3.3 Japan

9.3.3.1 Mega Cities and Transportation Infrastructure Projects to Drive the Concrete Superplasticizers Demand

9.3.4 South Korea

9.3.4.1 Mega Construction Projects to Drive Superplasticizers Demand in South Korea

9.3.5 Rest of APAC

9.4 Europe

9.4.1 Germany

9.4.1.1 Germany to Lead the Concrete Superplasticizers Market With the Largest Share in Europe

9.4.2 France

9.4.2.1 Increased Consumption of Ready-Mix Concrete in the Country to Drive the Market

9.4.3 UK

9.4.3.1 Upgradation and Expansion of Public Infrastructure Projects to Drive the Concrete Superplasticizers Demand in the UK

9.4.4 Italy

9.4.4.1 The Growing Number of Public Infrastructure Projects to Fuel the Concrete Superplasticizers Demand

9.4.5 Spain

9.4.5.1 Spain to Register the Highest CAGR During the Forecast Period

9.4.6 Rest of Europe

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.1.1 High Rise Buildings and Expansion of Metro Lines and Highways to Drive the Concrete Superplasticizers Market Growth

9.5.2 Turkey

9.5.2.1 Turkey is Forecasted to Be the Fastest-Growing Concrete Superplasticizers Market in the Middle East & Africa

9.5.3 South Africa

9.5.3.1 Public Infrastructure Projects Across Country to Drive Superplasticizers Growth

9.5.4 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.1.1 Brazil Accounted for the Largest Market Share in South America

9.6.2 Rest of South America

10 Competitive Landscape (Page No. - 100)

10.1 Overview

10.2 Competitive Leadership Mapping, 2019

10.2.1 Visionary Leaders

10.2.2 Innovators

10.2.3 Emerging Companies

10.3 Strength of Product Portfolio

10.4 Business Strategy Excellence

10.5 Market Ranking of Key Players, 2019

10.6 Competitive Scenario

10.6.1 New Product Launches

10.6.2 Expansions

11 Company Profiles (Page No. - 108)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Arkema

11.2 BASF

11.3 GCP Applied Technologies Inc.

11.4 KAO Corporation

11.5 Sika

11.6 Mapei

11.7 Enaspol

11.8 Concrete Additives and Chemicals

11.9 Rhein-Chemotechnik

11.10 Rain Carbon

11.11 Other Companies

11.11.1 Shandong Wanshan Chemical

11.11.2 Sakshi Chem Sciences

11.11.3 Fritz-Pak Corporation

11.11.4 Fuclear Technologies

11.11.5 Ha-Be Betonchemie

11.11.6 Lanya Concrete Admixtures

11.11.7 Muhu (China) Construction Materials

11.11.8 Sure Chemical

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 129)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (108 Tables)

Table 1 Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 2 Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 3 Ready-Mix Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 4 Ready-Mix Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 5 Precast Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 6 Precast Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 7 High-Performance Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 8 High-Performance Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 9 Other Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 10 Other Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 11 Concrete Superplasticizers Market Size, By Type, 2017–2024 (Kiloton)

Table 12 Concrete Superplasticizers Market Size, By Type, 2017–2024 (USD Million)

Table 13 PC Concrete Superplasticizers Market Size, By Region, 2017–2024 (Kiloton)

Table 14 PC Concrete Superplasticizers Market Size, By Region, 2017–2024 (USD Million)

Table 15 SNF Concrete Superplasticizers Market Size, By Region, 2017–2024 (Kiloton)

Table 16 SNF Concrete Superplasticizers Market Size, By Region, 2017–2024 (USD Million)

Table 17 SMF Concrete Superplasticizers Market Size, By Region, 2017–2024 (Kiloton)

Table 18 SMF Concrete Superplasticizers Market Size, By Region, 2017–2024 (USD Million)

Table 19 MLS Concrete Superplasticizers Market Size, By Region, 2017–2024 (Kiloton)

Table 20 MLS Concrete Superplasticizers Market Size, By Region, 2017–2024 (USD Million)

Table 21 Other Concrete Superplasticizers Market Size, By Region, 2017–2024 (Kiloton)

Table 22 Other Concrete Superplasticizers Market Size, By Region, 2017–2024 (USD Million)

Table 23 Concrete Superplasticizers Market Size, By Form, 2017–2024 (Kiloton)

Table 24 Concrete Superplasticizers Market Size, By Form, 2017–2024 (USD Million)

Table 25 Concrete Superplasticizers Market Size, By Region, 2017–2024 (Kiloton)

Table 26 Concrete Superplasticizers Market Size, By Region, 2017–2024 (USD Million)

Table 27 North America: Concrete Superplasticizers Market Size, By Country, 2017–2024 (Kiloton)

Table 28 North America: Concrete Superplasticizers Market Size, By Country, 2017–2024 (USD Million)

Table 29 North America: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 30 North America: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 31 North America: Concrete Superplasticizers Market Size, By Type, 2017–2024 (Kiloton)

Table 32 North America: Concrete Superplasticizers Market Size, By Type, 2017–2024 (USD Million)

Table 33 North America: Concrete Superplasticizers Market Size, By Form, 2017–2024, (Kiloton)

Table 34 North America: Concrete Superplasticizers Market Size, By Form, 2017–2024, (USD Million)

Table 35 US: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 36 US: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 37 Canada: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 38 Canada: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 39 Mexico: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 40 Mexico: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 41 APAC: Concrete Superplasticizers Market Size, By Country, 2017–2024, (Kiloton)

Table 42 APAC: Concrete Superplasticizers Market Size, By Country, 2017–2024, (USD Million)

Table 43 APAC: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 44 APAC: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 45 APAC: Concrete Superplasticizers Market Size, By Type, 2017–2024 (Kiloton)

Table 46 APAC: Concrete Superplasticizers Market Size, By Type, 2017–2024 (USD Million)

Table 47 APAC: Concrete Superplasticizers Market Size, By Form, 2017–2024, (Kiloton)

Table 48 APAC: Concrete Superplasticizers Market Size, By Form, 2017–2024, (USD Million)

Table 49 China: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 50 China: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 51 India: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 52 India: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 53 Japan: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 54 Japan: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 55 South Korea: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 56 South Korea: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 57 Rest of APAC: Concrete Superplasticizers Market Size, By Application, 2017–2024, (Kiloton)

Table 58 Rest of APAC: Concrete Superplasticizers Market Size, By Application, 2017–2024, (USD Million)

Table 59 Europe: Concrete Superplasticizers Market Size, By Country, 2017–2024 (Kiloton)

Table 60 Europe: Concrete Superplasticizers Market Size, By Country, 2017–2024 (USD Million)

Table 61 Europe: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 62 Europe: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 63 Europe: Concrete Superplasticizers Market Size, By Type, 2017–2024 (Kiloton)

Table 64 Europe: Concrete Superplasticizers Market Size, By Type, 2017–2024 (USD Million)

Table 65 Europe: Concrete Superplasticizers Market Size, By Form, 2017–2024 (Kiloton)

Table 66 Europe: Concrete Superplasticizers Market Size, By Form, 2017–2024 (USD Million)

Table 67 Germany: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 68 Germany: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 69 France: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 70 France: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 71 UK: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 72 UK: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 73 Italy: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 74 Italy: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 75 Spain: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 76 Spain: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 77 Rest of Europe: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 78 Rest of Europe: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 79 Middle East & Africa: Concrete Superplasticizers Market Size, By Country, 2017–2024 (Kiloton)

Table 80 Middle East & Africa: Concrete Superplasticizers Market Size, By Country, 2017–2024 (USD Million)

Table 81 Middle East & Africa: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 82 Middle East & Africa: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 83 Middle East & Africa: Concrete Superplasticizers Market Size, By Type, 2017–2024 (Kiloton)

Table 84 Middle East & Africa: Concrete Superplasticizers Market Size, By Type, 2017–2024 (USD Million)

Table 85 Middle East & Africa: Concrete Superplasticizers Market Size, By Form, 2017–2024 (Kiloton)

Table 86 Middle East & Africa: Concrete Superplasticizers Market Size, By Form, 2017–2024 (USD Million)

Table 87 Saudi Arabia: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 88 Saudi Arabia: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 89 Turkey: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 90 Turkey: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 91 South Africa: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 92 South Africa: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 93 Rest of Middle East & Africa: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 94 Rest of Middle East & Africa: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 95 South America: Concrete Superplasticizers Market Size, By Country, 2017–2024 (Kiloton)

Table 96 South America: Concrete Superplasticizers Market Size, By Country, 2017–2024 (USD Million)

Table 97 South America: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 98 South America: Concrete Superplasticizers Size, By Application, 2017–2024 (USD Million)

Table 99 South America: Concrete Superplasticizers Market Size, By Form, 2017–2024 (Kiloton)

Table 100 South America: Concrete Superplasticizers Market Size, By Form, 2017–2024 (USD Million)

Table 101 South America: Concrete Superplasticizers Market Size, By Type, 2017–2024 (Kiloton)

Table 102 South America: Concrete Superplasticizers Market Size, By Type, 2017–2024 (USD Million)

Table 103 Brazil: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 104 Brazil: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 105 Rest of South America: Concrete Superplasticizers Market Size, By Application, 2017–2024 (Kiloton)

Table 106 Rest of South America: Concrete Superplasticizers Market Size, By Application, 2017–2024 (USD Million)

Table 107 New Product Launches, 2015–2019

Table 108 Expansions, 2015–2019

List of Figures (39 Figures)

Figure 1 Concrete Superplasticizers Market: Research Design

Figure 2 Breakdown of Primary Interviews

Figure 3 Concrete Superplasticizers Market: Bottom-Up Approach

Figure 4 Concrete Superplasticizers Market: Top-Down Approach

Figure 5 Concrete Superplasticizers Market: Data Triangulation

Figure 6 Concrete Superplasticizers Market Analysis

Figure 7 PC Type Accounted for the Largest Share in the Concrete Superplasticizers Market in 2018 (USD Million)

Figure 8 Liquid Held the Larger Share in the Concrete Superplasticizers Market in 2018 (USD Million)

Figure 9 Ready-Mix Concrete to Be the Fastest-Growing Application of Concrete Superplasticizers

Figure 10 APAC to Be the Fastest-Growing Market

Figure 11 Increasing Demand for Concrete Superplasticizers in Emerging Countries

Figure 12 Ready-Mix Concrete to Be the Largest Application Segment and China to Be the Largest Market in APAC

Figure 13 PC to Be the Largest Type of Concrete Superplasticizers Between 2019 and 2024

Figure 14 Ready-Mix to Be the Largest Application During the Forecast Period

Figure 15 India to Register the Highest CAGR

Figure 16 Drivers, Restraints, Opportunities, and Challenges in the Concrete Superplasticizers Market

Figure 17 Porter’s Five Forces Analysis: Concrete Superplasticizers Market

Figure 18 Ready-Mix Concrete to Dominate the Concrete Superplasticizers Market, Globally

Figure 19 PC Segment to Account for the Largest Market Share

Figure 20 Liquid Segment to Account for the Largest Market Share

Figure 21 APAC to Lead the Concrete Superplasticizers Market

Figure 22 North America: Concrete Superplasticizers Market Snapshot

Figure 23 APAC: Concrete Superplasticizers Market Snapshot

Figure 24 Europe: Concrete Superplasticizers Market Snapshot

Figure 25 Companies Adopted New Product Launch as the Key Strategy Between 2015 and 2019

Figure 26 Concrete Superplasticizers Market (Global): Competitive Leadership Mapping, 2019

Figure 27 Market Ranking, 2019

Figure 28 Company Snapshot: Arkema

Figure 29 Arkema: SWOT Analysis

Figure 30 Company Snapshot: BASF

Figure 31 BASF: SWOT Analysis

Figure 32 Company Snapshot: GCP Applied Technologies

Figure 33 GCP Applied Technologies: GCP Applied Technologies

Figure 34 Company Snapshot: KAO Corporation

Figure 35 KAO Corporation: SWOT Analysis

Figure 36 Company Snapshot: Sika

Figure 37 Sika: SWOT Analysis

Figure 38 Company Snapshot: Mapei

Figure 39 Mapei: SWOT Analysis

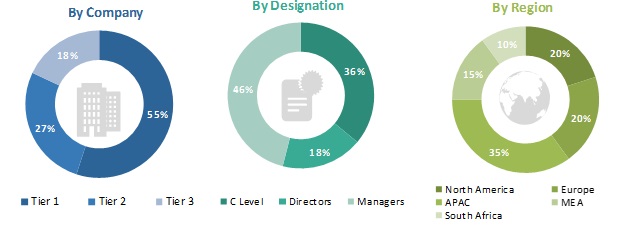

The study involved four major activities in estimating the current market size for concrete superplasticizers. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Factiva, Zauba, Hoovers, and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, concrete associations, cement association, regulatory bodies, and databases.

Primary Research

The concrete superplasticizers market comprises several stakeholders, such as raw material suppliers, distributors of concrete superplasticizers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market consists of automotive OEM, compounders, manufacturer of consumer households, and electronics equipment manufacturer. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the concrete superplasticizers market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of concrete superplasticizers and their applications.

Objectives of the Study:

- To define, describe, and forecast the concrete superplasticizers market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by type, form, and application

- To forecast the size of the market with respect to five regions, namely, APAC, Europe, North America, South America, and the Middle East & Africa along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as new product launch, acquisition, and expansion undertaken in the market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies2

Notes: Micro markets1 are the subsegments of the concrete superplasticizers market included in the report.

Core competencies2 of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the concrete superplasticizers market

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Concrete Superplasticizers Market

Proposed contribution in on Concrete Superplasticizers Market Study

concrete admixtures, in particular super plasticizers, retarders, accelerators, air entraining agents

Sample for Super plasticizer market report currently in production

Market information on superplasticizer market for the GCC region

Informaion on powder form of superplasticizer for developing ultra high performance concrete, with profitability levels at various nodes in the value chain.