Naphthalene Derivatives Market by Form (Powder, Liquid), Derivative (SNF, Phthalic Anhydride, Naphthalene Sulfonic Acid, Alkyl Naphthalene Sulfonates, Naphthols), End-Use Industry (Construction, Agrochemicals), and Region - Global Forecast to 2022

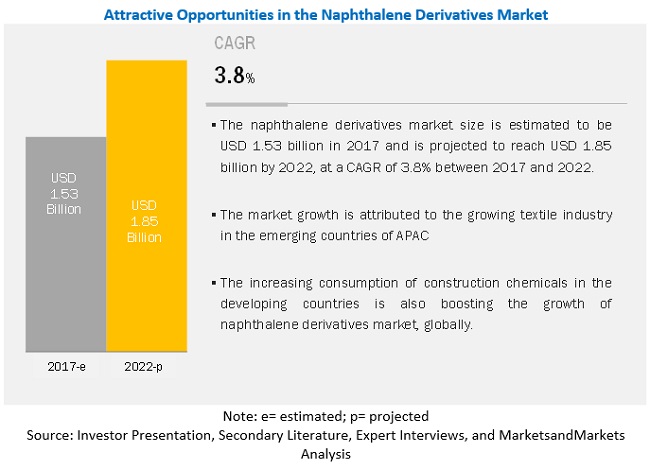

The naphthalene derivatives market size is projected to grow from USD 1.53 billion in 2017 to USD 1.85 billion by 2022, at a CAGR of 3.8%. The market is witnessing growth due to the growing demand from the textile industry, especially in the emerging countries of Asia Pacific, and increasing consumption of construction chemicals in developing countries. Other end-use industries such as construction, agrochemicals, textile, oil & gas, paints & coating, pulp & paper, and pharmaceuticals are also expected to offer lucrative opportunities for the growth of the naphthalene derivatives market.

To know about the assumptions considered for the study, Request for Free Sample Report

The Powder segment is expected to be the faster-growing form of naphthalene derivatives during the forecast period.

Powder is estimated to be the fastest-growing form segment of the naphthalene derivatives market during the forecast period. The demand for powder form naphthalene derivatives has been stimulated due to the growth in textile industry and increasing construction activities. Easy availability of powdered form of naphthalene derivatives at room temperature and their convenient transportation and packaging in comparison to liquid form are the key factors responsible for the rapid demand for powdered form of naphthalene derivatives.

The Sulfonated Naphthalene Formaldehyde (SNF) segment accounts for the largest market segment of the naphthalene derivatives market.

SNF is estimated to be the largest segment, by derivative, during the forecast period (2017-2022). The rapid growth of this segment is attributed to its excellent water reducing ability in concrete admixtures. SNF is used as a superplasticizer in concrete admixtures. The increase in demand for high-grade concrete which provides stability, tensile strength, and is cost effective in nature is expected to lead to a rapid growth of this segment in the future.

The construction industry accounts for the largest market end-use industry for the naphthalene derivatives market.

Based on end-use industry, construction was the largest segment of the naphthalene derivatives market in 2016. Increasing use of naphthalene derivatives such as SNF and phthalic anhydride which are used as superplasticizers in concrete and manufacture of PVC plastics in infrastructural development is driving the demand from the construction industry. Furthermore, the increase in repair and maintenance activities, growing construction of residential complexes to accommodate the mounting population, and increase in service sector economy are also expected to contribute in making construction the largest end-use industry in the naphthalene derivatives market.

To know about the assumptions considered for the study, download the pdf brochure

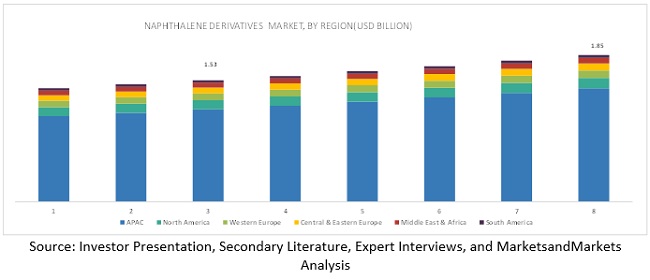

APAC is expected to account for the largest market share during the forecast period.

Asia Pacific was the largest market for naphthalene derivatives in 2016. The region’s flourishing manufacturing sector, ample availability of labor, competitive cost base, and increasing consumer demand are expected to drive the market for naphthalene derivatives across the region. Furthermore, the influence of macroeconomic stimuli such as population growth, rise in disposable income, and increasing investments in building & construction activities in Southeast Asian countries are also expected to make the region one of the most promising markets for naphthalene derivatives.

Some of the key players operating in the naphthalene derivatives market are Koppers (US), BASF (Germany), Rütgers (Belgium), Evonik (Germany), Cromogenia Units (Spain), King Industries, Inc. (US), Carbon Tech Group (Iran), JFE Chemical Corporation (Japan), Clariant (Switzerland) and Huntsman Corporation (US).

Market Dynamics

Driver: Growing textile industry in the emerging countries of APAC

Alkyl naphthalene sulfonates are extensively used in the textiles industry for bleaching and dying operations because of their wetting and defoaming properties. Azo dyes that constitute a major part of commercial dyes are used extensively in the textiles industry. These dyes use alkyl naphthalene sulfonates as a precursor. They are used for a variety of fabrics and offer a wide range of colors. Some of the other derivatives of naphthalene such as naphthylamines and sulfuric acid salts are also useful as intermediates in dye production.

APAC has the highest population in the world and is a major hub for the textiles and garment industries, with China being a dominating market since the 1980s. The growth in the textiles industry of APAC is increasing because of the development of economy, which has increased the purchasing power of consumers, thereby propelling the per-capita consumption of goods, including textiles. The industry significantly contributes to the overall GDP of the region and plays an important role in creating employment opportunities. China is the largest producer and exporter of textiles and clothing because of its low production costs. Singapore is also a hub for the textiles industries in the region. Vietnam’s garment and textiles industries are estimated to register an annual growth rate of 25–30%. The apparel industry of Indonesia contributes significantly to the textiles industry in APAC. Thus, the growing textiles industry in the region is expected to drive the naphthalene derivatives market.

Restraint: Toxicity of naphthalene derivatives

The diffusion of Naphthalene and its derivatives into the air through moth repellent, cigarette smoke, burning of wood, and accidental spills can cause environmental risks. Naphthalene and its derivatives easily pass through soil particles into water. They can also evaporate easily into the air owing to their volatility. Naphthalene is easily converted into 1 naphthol or 2-naphthol in the presence of moisture and sunlight, which can increase the level of toxicity in the air causing many health hazards.

Acute exposure of human beings to naphthalene by inhalation, ingestion, and dermal contact can cause hemolytic anemia and liver and neurological damages. Chronic exposure of human beings and rodents to naphthalene can cause cataracts and damage to the retina. Exposure to naphthalene can also cause anemia in a pregnant woman, which may also be transferred to the unborn child. Naphthalene can also move from mother’s blood to the baby’s blood through breastfeeding. Apart from these, naphthalene and its derivatives can cause reproductive damages in certain animals and are reported to be carcinogenic. Vapors of naphthalene and coal tar can develop laryngeal carcinomas or neoplasms of the pylorus and cecum. Therefore, the International Agency for Research on Cancer (IARC) has concluded that naphthalene is possibly carcinogenic to humans and under the EPA 1986 cancer guidelines, naphthalene was assigned to Group C - possible human carcinogen.

Stringent rules and regulations related to the naphthalene derivatives are being set by various government organizations and associations because of the increasing toxicity and carcinogenic effect of these derivatives. Some of the major agencies governing the toxicological standards for naphthalene and its derivatives are the International Agency for Research on Cancer (IARC), the American Conference of Governmental Industrial Hygienists (ACGIH), and the National Institute for Occupational Safety and Health (NIOSH). Thus, the toxic nature of these derivatives is restricting the growth of the market.

Opportunity: Wide scale applications of naphthalene derivatives

Naphthalene derivatives are used in a wide variety of end-use industries such as building & construction, agrochemicals, textiles, detergent, oil & gas, paints & coating, pulp & paper, pharmaceuticals, rubber synthesis, and leather tanning. Among these industries, the building & construction industry is growing rapidly in the emerging countries, globally, which will play a significant role in providing growth opportunities to the naphthalene derivatives in the future. Naphthalene derivatives are extensively used in agrochemical industries as insecticides and pesticides. 1-naphthyl-N-methylcarbamate (carbaryl) is one of the major insecticides used in the agricultural industry. Naphthalene acetic acid is used as growth regulators in plants enhancing the yield of cereals.

Alkyl naphthalene sulfonates (ANS) is used as wetting agents that effectively disperse colloidal systems in aqueous media. The major commercial applications of ANS are in the textiles industry, which uses the wetting and defoaming properties of ANS for bleaching and dying operations. The amino naphthalene sulfonic acids, substituted with amines and sulfonic acids, are intermediates used in the preparation of many synthetic dyes. Naphthalene sulfonic acids are used in the synthesis of 1-naphthol and 2-naphthol, which are the precursors for various pigments, dyestuffs, rubber processing chemicals, and other chemical and pharmaceutical products. In Croatia, naphthalene derived from a natural mineral oil after distillation is used to treat skin diseases, including eczema. Therefore, the increasing use of naphthalene derivatives in different end-use industries will create high growth opportunities for the market.

Challenge: Fluctuating energy prices and overcapacity in china affecting the naphthalene derivatives consumption

Naphthalene and its derivatives are manufactured mainly from two routes coal tar distillation and petroleum (crude oil). Approximately, 90% of the naphthalene and its derivatives are manufactured from coal tar distillation. Fluctuation in coal tar prices and its consumption has affected industrial naphthalene demands severely, thereby posing a challenge to the market. China, a major producer of deep processed coal tar products such as naphthalene, cresol, anthracene, and phenol, faced massive overcapacity owing to its rapid expansions in the recent years. Thus, coal tar prices declined significantly owing to demand-supply imbalance. However, in the beginning of 2016, the coal tar prices increased, and this trend continued until September 2017. This was supported by cutting down of excess capacity and growth in utilization of carbon pitch products and naphthalene derivatives.

The second route of manufacturing naphthalene from crude oil contributes to about 10% of the overall naphthalene production. The fluctuation in its price is most likely to hamper the naphthalene export and import globally. Naphthalene is produced in one of the fractions during distillation of crude oil. Therefore, the reduction in the cost of raw feedstock affects the cost incurred to produce chemicals. The decreasing crude oil prices will show an immediate and significant impact on the cost structures of naphthalene and its derivatives. For most commodity chemicals, including naphthalene, the production costs of the small-scale producer will increase, which will, in turn, increase the prices of these chemicals. Thus, fluctuation in naphthalene prices because of the decline in crude oil prices gives leverage to the naphthalene manufacturers gain a profit margin by increasing prices.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2015-2022 |

|

Base year considered |

2016 |

|

Forecast period |

2017-2022 |

|

Units considered |

Value (USD Million) and Volume (Kilotons) |

|

Segments covered |

Form, derivative, end-use industry and Region |

|

Regions covered |

APAC, North America, Western Europe, Central & Eastern Europe, Middle East & Africa, and South America |

|

Companies profiled |

Koppers (US), BASF (Germany), Rütgers (Belgium), Evonik (Germany), Cromogenia Units (Spain), King Industries, Inc. (US), Carbon Tech Group (Iran), JFE Chemical Corporation (Japan), Clariant (Switzerland) and Huntsman Corporation (US), among others. Total 19 key players of naphthalene derivatives market are covered. |

This research report categorizes the naphthalene derivatives market based on type, application, and region.

Naphthalene derivatives Market, by Form:

- Liquid form

- Powder form

Naphthalene derivatives Market, by Derivative:

- Sulphonated Naphthalene Formaldehyde (SNF)

- Phthalic Anhydride

- Naphthalene Sulphonic Acid

- Alkyl Naphthalene Sulphonates Salts (ANS)

- Naphthols

- Others

Naphthalene derivatives Market, by End-use Industry:

- Construction

- Textiles

- Agrochemicals

- Pharmaceuticals

- Oil & gas

- Paints & Coatings

- Pulp & Paper

- Others

Naphthalene derivatives Market, by Region:

- APAC

- Western Europe

- Central & eastern Europe

- North America

- Middle East & Africa

- South America

Key Market Players

- Koppers (US) - https://www.koppers.com/

- BASF (Germany) - https://www.basf.com/global/en.html

- Rütgers (Belgium ) - https://global.rutgers.edu/program-search/details/vesalius-college-belgium

- Evonik Industries AG (Germany) - https://corporate.evonik.com/en/

- Cromogenia Units (Spain) - https://www.cromogenia.com/en/

- King Industries, Inc. (US) - https://www.kingindustries.com/

- Carbon Tech Group (Iran) - https://carbontechco.com/about/

- JFE Chemical Corporation (Japan )- https://www.jfe-chem.com/en/company/group/

- Clariant (Switzerland) - https://www.clariant.com/en/Corporate

- Huntsman Corporation (US) - https://www.huntsman.com/corporate/a/Home

Recent Developments

- In May 2017, Cromogenia Units collaborated with CETIM (France) and developed a new project for universal superplasticizer additive for concrete known as Hormiplast. The main objective behind this product launch is the development of a new generation universal super fluidifying additive. It will help the company to manufacture fluid or self-compacting concretes that can be used in various formulations.

- In January 2017, Koppers signed an agreement with ORV Fuels LLC (U.S.) to close its Follansbee, W.Va., coal tar distillation facility. Koppers will cease its naphthalene refining activities at the Follansbee facility in approximately one year and will continue to utilize the site as a distribution terminal.

- In September 2016, RÜTGERS and Severstal (Russia) entered into a joint venture to establish RÜTGERS Severtar, a new production unit which will manufacture premium quality pitch products, naphthalene and technical oils from coal tar. The production facility is equipped with automated tar distillation control systems, which would reduce the risk of negative impact caused due to human errors during the processes. With this JV, RÜTGERS Severtar would be able to produce up to 300 thousand tons of high-quality products per year for the Russian and international markets.

- In January 2016, BASF launched MasterEase, an innovative admixture range for low-viscosity concrete. As a global leader of concrete admixtures, the Master Builders Solutions have developed MasterEase bringing significant improvement in the rheological properties of concrete.

- In January 2016, Koppers built a naphthalene plant in Illinois, US. The main objective behind the company's strategy to build a new plant is to consolidate its coal tar distillation operations in North America.

Key questions addressed by the report

- Which are top players in naphthalene derivatives market?

- What are the upcoming technologies, R&D activities, and new product launches in the global naphthalene derivatives market?

- Which are the emerging and high-growth segments of the naphthalene derivatives market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Market Size Estimation: Top-Down Approach

2.2.2 Market Size Estimation: Bottom-Up Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Naphthalene Derivatives Market

4.2 Naphthalene Derivatives Market, By Derivative

4.3 Naphthalene Derivatives Market in APAC, By End-Use Industry and Country

4.4 Naphthalene Derivatives Market Attractiveness

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Textiless Industry in Emerging Countries of APAC

5.2.1.2 Increased Consumption of Naphthalene Derivatives in Construction Chemicals

5.2.2 Restraints

5.2.2.1 Toxicity of Naphthalene Derivatives

5.2.2.2 Preference for Alternate Feedstock for Phthalic Anhydride

5.2.3 Opportunities

5.2.3.1 Wide-Scale Applications of Naphthalene Derivatives

5.2.4 Challenges

5.2.4.1 Fluctuating Energy Prices and Overcapacity in China Affecting Naphthalene Derivatives Consumption

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Bargaining Power of Buyers

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Overview and Trends

5.4.1 Trends and Forecast of GDP

5.4.2 Trend in Crude Oil Prices

5.4.3 Trend in Coal Prices

6 Naphthalene Derivatives Market: By Source (Page No. - 45)

6.1 Introduction

6.2 Coal Tar

6.3 Petroleum-Based Feedstock

7 Naphthalene Derivatives Market, By Form (Page No. - 47)

7.1 Introduction

7.2 Liquid Form

7.2.1 Emerging Construction and Petrochemical Industries That Uses Naphthalene-Based Derivatives on A Large Scale Drives the Market

7.3 Powder Form

7.3.1 Extensive Use in the Textile Industry to Drive the Demand for Powder Naphthalene Derivatives

8 Naphthalene Derivatives Market : By Derivative (Page No. - 53)

8.1 Introduction

8.2 Sulphonated Naphthalene Formaldehyde (SNF)

8.2.1 Extensive Usage of Snf as Superplasticizer in Building & Construction Industry to Drive the Market

8.3 Phthalic Anhydride

8.3.1 Increasing Usage in the Production of Polyester Resins and Alkyd Resins to Boost the Demand for Phthalic Anhydride

8.4 Naphthalene Sulphonic Acid

8.4.1 Growing Textile and Leather Industries to Drive the Market

8.5 Alkyl Naphthalene Sulphonates Salts (ANS)

8.4.1 The Emerging Textile Industry in the Major Economies to Drive the Demand for Ans Salts

8.6 Naphthols

8.4.1 The Growing Textile Industry Alongwith the Improved Living Standards to Boost the Demand for Naphthols

8.7 Others

9 Naphthalene Derivatives Market: By End-Use Industry (Page No. - 62)

9.1 Introduction

9.2 Construction

8.4.1 The Mounting Industrilization and the Increasing Building and Infrastructural Activities to Drive the Demand in Construction Industry

9.3 Textiles

8.4.1 The Use of Naphthalene Derivatives as Precursors for the Synthesis of Dyes and Pigments Drive the Demand in the Textiles Industry

9.4 Agrochemicals

8.4.1 The Use of Naphthalene Derivatives as As A Moth-Repellent and Fumigant Pesticides in the Agrochemicals Industry to Drive the Market

9.5 Pharmaceutical

8.4.1 High Consumption of Naphthalene Derivatives in Drugs and Medicines is Driving the Market Globally

9.6 Oil & Gas

8.4.1 The Use of Concrete Admixtures Such as Snf Superplasticizer in Improving the Fluidity and Hydration of Cement Additives Drive the Demand for Naphthalene Derivatives in the Oil & Gas Industry

9.7 Paints & Coatings

8.4.1 The Growing Building and Infrastructural Developments to Drive the Market for Naphthalene Derivatives Extensively Used in Various Paint & Coatings Formulations.

9.8 Pulp & Paper

8.4.1 The Increased Use of Naphthalene Derivatives in Preparation of Dye and Pigments Used in Paper Industry to Drive the Demand for Naphthalene Derivatives

9.9 Other Industries

10 Naphthalene Derivatives Market, By Region (Page No. - 71)

10.1 Introduction

10.2 APAC

10.2.1 China

10.2.1.1 Strong Demand for Snf is Increasing the Consumption of Naphthalene Derivatives in the Construction Industry in China

10.2.2 Japan

10.2.2.1 Increasing Demand From Rebounding in Residential Construction and Projects Related to the 2020 Tokyo Olympics to Drive the Market

10.2.3 India

10.2.3.1 The Industrial Growth in the Country to Increase the Penetration of Naphthalene Derivatives in Various Industries

10.2.4 South Korea

10.2.4.1 The Growing Infrastructural Projects and Rapid Industrialization to Increase the Demand for Naphthalene Derivatives in Various Construction Projects in the Country

10.2.5 Indonesia

10.2.5.1 The Increasing Building & Construction Activities in the Country are Expected to Generate A High Demand for Naphthalene Derivatives

10.2.6 Rest of APAC

10.3 North America

10.3.1 US

10.3.1.1 Steady Rebound in Construction Activities and Continuous Investments in Industrial Sectors to Boost the Demand for Naphthalene Derivatives in The Country

10.3.2 Canada

10.3.2.1 The Growing Infrastructure Building Activities are Expected to Augment the Growth of the Naphthalene Derivatives Market in the Country

10.3.3 Mexico

10.3.3.1 The Growing Investments in the Infrastructure and the Energy Sectors to Fuel the Demand for Naphthalene Derivatives in the Country.

10.4 Western Europe

10.4.1 Germany

10.4.1.1 The Rising Number of Expansion Activities and Presence of Key Manufacturers to Fuel the Growth of the Naphthalene Derivatives Market in Germany.

10.4.2 Italy

10.4.2.1 The Recovering Demand From the Construction Industry is Expected to Drive the Consumption of Naphthalene Derivatives in the Country

10.4.3 France

10.4.3.1 Increasing Construction Activities to Play A Significant Role in Driving the Market for Naphthalene Derivatives in the Country

10.4.4 UK

10.4.4.1 Increase in the Demand for Superplasticizers in the House Building Activities in the Country is Expected to Drive the Demand

10.4.5 Spain

10.4.5.1 The Increasing Infrastructural Developments is Expected to Drive the Demand for Naphthalene Derivatives in Spain.. 92

10.4.6 Rest of Western Europe

10.5 Central & Eastern Europe

10.5.1 Russia

10.5.1.1 The Increase in Oil Recovery and Production Activities is Expected to Drive the Demand for Surfactants Manufactured From Alkyl Naphthalene Sulphonate Derivatives

10.5.2 Turkey

10.5.2.1 Affordable Housing Projects, Foreign Investments, and Increasing Urbanization has Increased the Demand for Naphthalene Derivatives in the Country

10.5.3 Poland

10.5.3.1 Increasing Foreign Investments to Boost the Construction and Paints & Coatings Industries are Expected to Help in the Growth of the Naphthalene Derivatives Market in the Country

10.5.4 Rest of Central & Eastern Europe

10.6 Middle East & Africa

10.6.1 Saudi Arabia

10.6.1.1 The Increasing Use of Pesticides and Agrochemicals to Increase the Demand for Naphthalene Derivatives in Saudi Arabia.. 101

10.6.2 UAE

10.6.2.1 The Demand for Naphthalene Derivatives in the UAE is Mainly Dependent on the Industries Such as Construction, Oil & Gas, and Leather Tanning

10.6.3 Rest of Middle East & Africa

10.7 South America

10.7.1 Brazil

10.7.1.1 Rising Urbanization and Industrialization to Augment Infrastructural Activities in the Country are Expected to Fuel the Demand for Naphthalene Derivatives in Brazil

10.7.2 Argentina

10.7.2.1 The Country’s Gradual Recovery in Its Economic Conditions is Expected to Boost the Industrial Growth, Thereby, Increasing the Demand for Naphthalene Derivatives

10.7.3 Rest of South America

11 Competitive Landscape (Page No. - 109)

11.1 Introduction

11.2 Market Ranking of Key Players

11.3 Competitive Scenario

11.3.1 New Product Developments

11.3.2 Expansions

11.3.3 Agreements & Joint Ventures

11.3.4 Mergers & Acquisitions

12 Company Profiles (Page No. - 113)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Koppers

12.1.1 Business Overview

12.1.2 Products Offered

12.1.3 Recent Developments

12.1.4 SWOT Analysis

12.1.5 MnM View

12.2 Rütgers

12.2.1 Business Overview

12.2.2 Products Offered

12.2.3 Recent Developments

12.2.4 SWOT Analysis

12.2.5 MnM View

12.3 Cromogenia Units

12.3.1 Business Overview

12.3.2 Products Offered

12.3.3 Recent Developments

12.3.4 SWOT Analysis

12.3.5 MnM View

12.4 Evonik

12.4.1 Business Overview

12.4.2 Products Offered

12.4.3 Recent Developments

12.4.4 SWOT Analysis

12.4.5 MnM View

12.5 BASF

12.5.1 Business Overview

12.5.2 Products Offered

12.5.3 Recent Developments

12.5.4 SWOT Analysis

12.5.5 MnM View

12.6 Huntsman

12.6.1 Business Overview

12.6.2 Products Offered

12.6.3 Recent Developments

12.6.4 SWOT Analysis

12.6.5 MnM View

12.7 King Industries, Inc

12.7.1 Business Overview

12.7.2 Products Offered

12.7.3 Recent Developments

12.7.4 MnM View

12.8 Carbon Tech Group

12.8.1 Business Overview

12.8.2 Products Offered

12.8.3 Recent Developments

12.8.4 MnM View

12.9 JFE Chemical Corporation

12.9.1 Business Overview

12.9.2 Products Offered

12.9.3 Recent Developments

12.9.4 MnM View

12.10 Clariant

12.10.1 Business Overview

12.10.2 Products Offered

12.10.3 Recent Developments

12.10.4 MnM View

12.11 Additional Company Profiles

12.11.1 KAO

12.11.2 Epsilon Carbon

12.11.3 GEO Specialty Chemicals, Inc.

12.11.4 Deza A.S.

12.11.5 Shandong Jufu Chemical Technology Co., Ltd

12.11.6 Industrial Química Del Nalón Sa

12.11.7 Iwaki Seiyaku Co., Ltd.

12.11.8 Merck Millipore

12.11.9 Akzonobel

12.11.10 Manish Minerals & Chemicals

12.11.11 Chemsons Industrial Corporation

12.11.12 Shandong Wanshan Chemical

12.11.13 Trisha Speciality Chemical Pvt. Ltd

12.11.14 PCC SE

12.11.15 Monument Chemical

*Details Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 138)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (75 Tables)

Table 1 Trend of Growth in World GDP Per Capita, in Million (2015–2022)

Table 2 Trend in Global Crude Oil Prices in the Past Five Years (2012–2016)

Table 3 Trend in Global Coal Prices in the Past Five Years (2012–2016)

Table 4 Naphthalne Derivatives Market, By Form, 2015—2022 (USD Million)

Table 5 Naphthalne Derivatives Market, By Form, 2015—2022 (Kiloton)

Table 6 Liquid Naphthalene Derivatives Market Size, By Region, 2015—2022 (USD Million)

Table 7 Liquid Naphthalene Derivatives Market Size, By Region, 2015—2022 (Kiloton)

Table 8 Powder Naphthalene Derivatives Market Size, By Region, 2015—2022 (USD Million)

Table 9 Powder Naphthalene Derivatives Market Size, By Region, 2015—2022 (Kiloton)

Table 10 Naphthalene Derivatives Market Size, By Derivative, 2015—2022 (USD Million)

Table 11 Naphthalene Derivatives Market Size, By Derivative, 2015—2022 (Kiloton)

Table 12 Naphthalene Market Size for SNF, By Region, 2015—2022 (USD Million)

Table 13 Naphthalene Market Size for SNF , By Region, 2015—2022 (Kiloton)

Table 14 Naphthalene Market Size for Phthalic Anhydride, By Region, 2015—2022 (USD Million)

Table 15 Naphthalene Market Size for Phthalic Anhydride, By Region, 2015—2022 (Kiloton)

Table 16 Naphthalene Market Size for Naphthalene Sulfonic Acid, By Region, 2015—2022 (USD Million)

Table 17 Naphthalene Market Size for Naphthalene Sulfonic Acid, By Region, 2015—2022 (Kiloton)

Table 18 Naphthalene Market Size for Alkyl Naphthalene Sulfonates Salts, By Region, 2015—2022 (USD Million)

Table 19 Naphthalene Market Size for Alkyl Naphthalene Sulfonates Salts, By Region, 2015—2022 (Kiloton)

Table 20 Naphthalene Market Size for Naphthols, By Region, 2015—2022 (USD Million)

Table 21 Naphthalene Market Size for Naphthols, By Region, 2015—2022 (Kiloton)

Table 22 Naphthalene Market Size for Other Naphthalene Derivatives, By Region, 2015—2022 (USD Million)

Table 23 Naphthalene Market Size for Other Naphthalene Derivatives, By Region, 2015—2022 (Kiloton)

Table 24 By Market, By End-Use Industry, 2015—2022 (USD Million)

Table 25 By Market Size in Construction Industry, By Region, 2015—2022 (USD Million)

Table 26 By Market Size in Textiles Industry, By Region, 2015—2022 (USD Million)

Table 27 By Market Size in Agrochemical Industry, By Region, 2015—2022 (USD Million)

Table 28 By Market Size in Pharmaceutical Industry, By Region, 2015—2022 (USD Million)

Table 29 By Market Size in Oil & Gas Industry, By Region, 2015—2022 (USD Million)

Table 30 By Market Size in Paints & Coatings Industry, By Region, 2015—2022 (USD Million)

Table 31 By Market Size in Pulp & Paper Industry, By Region, 2015—2022 (USD Million)

Table 32 By Market Size in Other Industries, By Region, 2015—2022 (USD Million)

Table 33 By Market Size, By Region, 2015—2022 (USD Million)

Table 34 By Market Size, By Region, 2015—2022 (Kiloton)

Table 35 APAC: By Market Size, By Country, 2015—2022 (USD Million)

Table 36 APAC: By Market Size, By Country, 2015—2022 (Kiloton)

Table 37 China: By Market, By End-Use Industry 2015—2022 (USD Million)

Table 38 Japan: By Market, By End-Use Industry 2015—2022 (USD Million)

Table 39 India: By Market, By End-Use Industry 2015—2022 (USD Million)

Table 40 South Korea: By Market, By End-Use Industry 2015—2022 (USD Million)

Table 41 Indonesia: By Market, By End-Use Industry 2015—2022 (USD Million)

Table 42 Rest of APAC: By Market, By End-Use Industry 2015—2022 (USD Million)

Table 43 North America: By Market Size, By Country, 2015—2022 (USD Million)

Table 44 North America: By Market Size, By Country, 2015—2022 (Kiloton)

Table 45 US: By Market, By End-Use Industry, 2015—2022 (USD Million)

Table 46 Canada: By Market, By End-Use Industry 2015—2022 (USD Million)

Table 47 Mexico: By Market, By End-Use Industry, 2015—2022 (USD Million)

Table 48 Western Europe: By Market Size, By Country, 2015—2022 (USD Million)

Table 49 Western Europe: By Market Size, By Country, 2015—2022 (Kiloton)

Table 50 Germany: By Market, By End-Use Industry 2015—2022 (USD Million)

Table 51 Italy: By Market, By End-Use Industry 2015—2022 (USD Million)

Table 52 France: By Market, By End-Use Industry 2015—2022 (USD Million)

Table 53 UK: By Market, By End-Use Industry 2015—2022 (USD Million)

Table 54 Spain: By Market, By End-Use Industry 2015—2022 (USD Million)

Table 55 Rest of Western Europe: By Market, By End-Use Industry 2015—2022 (USD Million)

Table 56 Central & Eastern Europe: By Market Size, By Country, 2015—2022 (USD Million)

Table 57 Central & Eastern Europe: By Market Size, By Country, 2015—2022 (Kiloton)

Table 58 Russia: By Market, By End-Use Industry, 2015—2022 (USD Million)

Table 59 Turkey: By Market, By End-Use Industry, 2015—2022 (USD Million)

Table 60 Poland: By Market, By End-Use Industry, 2015—2022 (USD Million)

Table 61 Rest of Central & Eastern Europe: By Market, By End-Use Industry, 2015—2022 (USD Million)

Table 62 Middle East and Africa: By Market Size, By Country, 2015—2022 (USD Million)

Table 63 Middle East and Africa: By Market Size, By Country, 2015—2022 (Kiloton)

Table 64 Saudi Arabia: By Market, By End-Use Industry 2015—2022 (USD Million)

Table 65 UAE: By Market, By End-Use Industry 2015—2022 (USD Million)

Table 66 Rest of Middle East & Africa: By Market, By End-Use Industry 2015—2022 (USD Million)

Table 67 South America: By Market Size, By Country, 2015—2022 (USD Million)

Table 68 South America: By Market Size, By Country, 2015—2022 (Kiloton)

Table 69 Brazil: By Market, By End-Use Industry, 2015—2022 (USD Million)

Table 70 Argentina: By Market, By End-Use Industry, 2015—2022 (USD Million)

Table 71 Rest of South America: By Market, By End-Use Industry, 2015—2022 (USD Million)

Table 72 New Product Developments, 2013-2017

Table 73 Expansion, 2013-2017

Table 74 Agreement & Joint Venture, 2013-2017

Table 75 Merger & Acquisition, 2013-2017

List of Figures (35 Figures)

Figure 1 Naphthalene Derivatives Market: Research Design

Figure 2 Naphthalene Derivatives Market: Data Triangulation

Figure 3 SNF Was the Largest Derivative in the Naphthalene Derivatives Market in 2016

Figure 4 Construction Industry Expected to Lead the Naphthalene Derivatives Market Between 2017 and 2022

Figure 5 Powder Form is Expected to Dominate the Naphthalene Derivatives Market Between 2017 and 2022

Figure 6 APAC Was the Largest Naphthalene Derivatives Market in 2016

Figure 7 Naphthalene Derivatives Market Size, 2017–2022 (Kiloton)

Figure 8 SNF to Be the Fastest-Growing Derivative Between 2017 and 2022

Figure 9 China Accounted for the Largest Share of the Naphthalene Derivatives Market

Figure 10 Naphthalene Derivatives Market to Register High Growth in China and India Between 2017 and 2022

Figure 11 Factors Governing the Naphthalene Derivatives Market

Figure 12 Naphthalene Derivatives Market: Porter’s Five Forces Analysis

Figure 13 Mega Trends in the Naphthalene Derivatives Market

Figure 14 Crude Oil Prices Declined Significantly in 2016

Figure 15 Coal Prices Declined Between 2015 and 2016

Figure 16 Naphthalene Manufacturing Process From Coal Tar and Petroleum

Figure 17 Powder Form to Drive the Naphthalene Derivatives Market

Figure 18 APAC to Be the Fastest-Growing Liquid Naphthalene Derivatives Market

Figure 19 APAC to Be the Largest Market for Powder Naphthalene Derivatives

Figure 20 SNF to Dominate the Naphthalene Derivatives Market

Figure 21 APAC to Be the Largest Market for SNF Between 2017 and 2022

Figure 22 Construction to Be the Largest End-Use Industry of Naphthalene Derivatives

Figure 23 APAC to Be the Largest Market for Naphthalene Derivatives in the Construction Industry

Figure 24 APAC: Naphthalene Derivatives Market Snapshot

Figure 25 North America: Naphthalene Derivatives Market Snapshot

Figure 26 Western Europe: Naphthalene Derivatives Market Snapshot

Figure 27 Saudi Arabia to Be the Fastest-Growing Market

Figure 28 Brazil to Be the Fastest-Growing Market Between 2017 and 2022

Figure 29 Companies Primarily Adopted Inorganic Growth Strategies (2013-2017)

Figure 30 Naphthalene Derivatives Market Ranking, 2016

Figure 31 Koppers: Company Snapshot

Figure 32 Evonik: Company Snapshot

Figure 33 BASF: Company Snapshot

Figure 34 Huntsman: Company Snapshot

Figure 35 Clariant: Company Snapshot

Growth opportunities and latent adjacency in Naphthalene Derivatives Market