Non-phthalate Plasticizers Market by Type (Adipates, Trimellitates, Benzoates, Epoxies, and Others), Application (Flooring & Wall Coverings, Wires & Cables, Films & Sheets, Coated Fabrics, Consumer Goods), and Region - Global Forecast to 2025

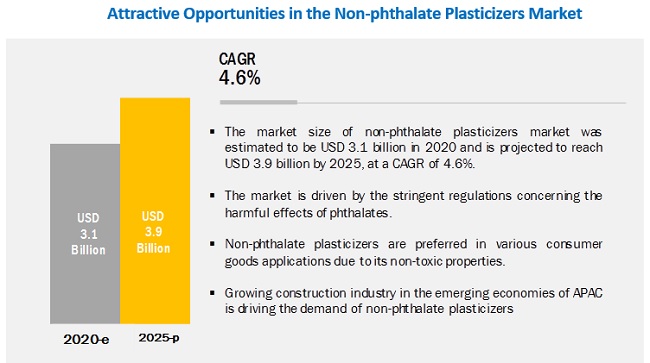

[144 Pages Report] The market size of non-phthalate plasticizers is estimated at USD 3.1 billion in 2020 and is projected to reach USD 3.9 billion by 2025, at a CAGR of 4.6%. The growing demand for non-phthalate plasticizers is due to the stringent regulations on the phthalate plasticizers and the growing awareness about the harmful effects over the use of phthalate plasticizers.

Flooring & wall coverings is estimated to be the largest application of non-phthalate plasticizers.

On the basis of application, the non-phthalate plasticizers market has been categorized into flooring & wall coverings, wires & cables, films & sheets, coated fabrics, consumer goods, and others. The flooring & wall coverings segment was the largest consumer of non-phthalate plasticizers in 2019, whereas the films & sheets segment is projected to be the fastest-growing application during the forecast period.

Trimellitates is projected to register the highest CAGR during the forecast period.

On the basis of type, the non-phthalate plasticizers market has been segmented into adipates, trimellitates, benzoates, epoxies, and others. Adipates is the largest type, whereas trimellitates is the fastest-growing non-phthalate plasticizers type owing to its high-temperature performance properties.

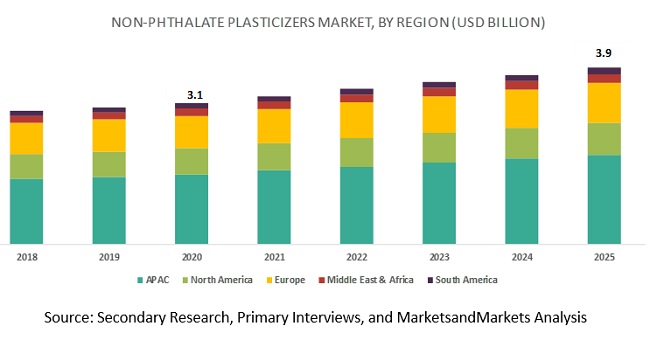

APAC is projected to be the largest market during the forecast period.

On the basis of region, the non-phthalate plasticizers market has been segmented into APAC, Europe, North America, the Middle East & Africa, and South America. APAC is projected to register the highest growth in the global non-phthalate plasticizers market during the forecast period. The demand for non-phthalate plasticizers is high in developing economies, such as China and India. The growth of the non-phthalate plasticizers market in APAC is mainly driven by the increasing demand for PVC in flooring & wall coverings application. The rising population and growing industries have led to innovation and development, making APAC an important industrial hub, globally. High growth and innovation, along with industry consolidations, are expected to lead to the rapid growth of the market in the region.

Key Market Players

The key players profiled in this report include BASF (Germany), Eastman Chemical Company (US), ExxonMobil (US), Evonik Industries (Germany), DIC Corporation (Japan), Perstorp (Sweden), Lanxess AG (Germany), KLJ Group (India), Polynt (Italy), and Mitsubishi Chemical Corporation (Japan). These companies have adopted various organic as well as inorganic growth strategies between 2014 and 2020 to enhance their regional presence and meet the growing demand for non-phthalate plasticizers from emerging economies.

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

|

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Billion) and Volume (Kiloton) |

|

Segments |

Type, Application, and Region |

|

Regions |

APAC, Europe, North America, South America, and Middle East & Africa. |

|

Companies |

Total of 10 major players covered: |

This research report categorizes the non-phthalate plasticizers market based on type, application, and region.

On the basis of type, the non-phthalate plasticizers market has been segmented as follows:

- Adipates

- Trimellitates

- Benzoates

- Epoxies

- Others

On the basis of application, the non-phthalate plasticizers market has been segmented as follows:

- Flooring & wall coverings

- Wires & cables

- Films & sheets

- Coated fabrics

- Consumer goods

- Others

On the basis of region, the non-phthalate plasticizers market has been segmented as follows:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In September 2019, Perstorp introduced a renewable polyol ester (non-phthalate) plasticizer, Pevalen Pro. It has various properties such as good plasticizing efficiency, faster processing, low volatility, high UV stability, and long-life performance. It offers a higher level of renewable content and is used for applications, such as coated fabrics, artificial leather, flooring, wall covering, automotive interiors, and sports & leisure products.

- In October 2019, DIC Corporation developed a new polyester plasticizer named Polycizer W-180-BIO. This plasticizer is completely derived from biomass resources and has been granted “Biomass 100%” Biomass Mark. As it has been derived from plants, it contributes to de-carbonization. It is mainly used in food contact materials.

- In September 2018, Eastman Chemical Company completed the capacity expansion of its Eastman 168 non-phthalate plasticizers at its manufacturing facility in Texas City, Texas. This expansion has increased the capacity by approximately 15%. It is expected to help the company to meet the growing demand from the end-users, such as building & construction, health & wellness, and a broad range of consumer products.

Critical questions the report answers:

- Are there any upcoming hot bets for the non-phthalate plasticizers market?

- How are the market dynamics in the different applications of non-phthalate plasticizers?

- What are the upcoming opportunities for the different types of non-phthalate plasticizers in emerging economies?

- What are the significant trends in applications that are influencing the non-phthalate plasticizers market?

- Who are the major manufacturers of non-phthalate plasticizers?

- What are the factors governing the non-phthalate plasticizers market in each of the regions?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

2.4 NON-PHTHALATE PLASTICIZERS MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

2.4.1 NON-PHTHALATE PLASTICIZERS MARKET ANALYSIS THROUGH SECONDARY SOURCES

2.4.2 NON-PHTHALATE PLASTICIZERS MARKET ANALYSIS

2.5 LIMITATIONS

2.6 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 28)

4 PREMIUM INSIGHTS (Page No. - 31)

4.1 ATTRACTIVE OPPORTUNITIES IN THE NON-PHTHALATE PLASTICIZERS MARKET

4.2 NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE

4.3 NON-PHTHALATE PLASTICIZERS MARKET, BY APPLICATION

4.4 NON-PHTHALATE PLASTICIZERS MARKET, BY MAJOR COUNTRIES

4.5 APAC: NON-PHTHALATE PLASTICIZERS MARKET, BY APPLICATION AND COUNTRY

5 MARKET OVERVIEW (Page No. - 34)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Stringent regulations on the use of phthalate plasticizers

5.2.1.2 Growing demand for PVC in tandem with the growing construction industry in emerging countries

5.2.2 RESTRAINTS

5.2.2.1 Higher price of non-phthalate plasticizers in comparison to phthalate plasticizers

5.2.3 OPPORTUNITIES

5.2.3.1 Growing awareness about the harmful effects over the use of phthalate plasticizers

5.2.3.2 Emerging market for bio-based plasticizers

5.2.4 CHALLENGES

5.2.4.1 Poor performance and incompatibility of few non-phthalate plasticizers

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN OF NON-PHTHALATE PLASTICIZERS

5.4.1 RAW MATERIAL SUPPLIERS

5.4.2 MANUFACTURERS

5.4.3 DISTRIBUTORS

5.4.4 END-USERS

5.5 OPERATIONAL DATA

5.5.1 GDP BY COUNTRY

5.5.2 CONSTRUCTION & PACKAGING DATA BY COUNTRY

5.5.3 COVID-19 IMPACT ON PLASTIC DEMAND

6 NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE (Page No. - 42)

6.1 INTRODUCTION

6.2 ADIPATES

6.2.1 SUPERIOR LOW-TEMPERATURE PROPERTIES THAN PHTHALATE PLASTICIZERS IS DRIVING THE MARKET

6.3 TRIMELLITATES

6.3.1 LOW VOLATILITY, LOW MIGRATION RATE, AND HIGH EXTRACTION RESISTANCE, TO BOOST THE MARKET

6.4 BENZOATES

6.4.1 HIGH SOLVATING POWER AND LOW MOLECULAR WEIGHT TO DRIVE THE MARKET

6.5 EPOXIES

6.5.1 IMPROVED HEAT STABILITY IN THE PRODUCTION OF PVC ARTICLE TO BOOST THE MARKET

6.6 OTHERS

7 NON-PHTHALATE PLASTICIZERS MARKET, BY APPLICATION (Page No. - 46)

7.1 INTRODUCTION

7.2 FLOORING & WALL COVERING

7.2.1 LOW VOLATILITY AND HIGH EXTRACTION RESISTANCE OF NON-PHTHALATE PLASTICIZERS TO BOOST THE MARKET

7.3 WIRE & CABLE

7.3.1 LOW VOLATILITY OF NON-PHTHALATE PLASTICIZERS MAKE PVC EFFECTIVE IN HIGH TEMPERATURES AND RESISTANT TO DEGRADATION

7.4 FILM & SHEET

7.4.1 SUPERIOR PROPERTIES IMPARTED BY NON-PHTHALATE PLASTICIZERS TO FLEXIBLE PVC ARE DRIVING THE MARKET

7.5 COATED FABRICS

7.5.1 INCREASED DURABILITY AND STRONG RESISTANCE PROPERTIES TO DRIVE THE MARKET

7.6 CONSUMER GOODS

7.6.1 NON-TOXIC NATURE OF NON-PHTHALATE PLASTICIZERS IS DRIVING ITS USE IN PVC FOR CONSUMER GOODS

7.7 OTHERS

8 NON-PHTHALATE PLASTICIZERS MARKET, BY REGION (Page No. - 58)

8.1 INTRODUCTION

8.2 APAC

8.2.1 CHINA

8.2.1.1 High growth in the commercial building & construction industry to have a positive impact on the market

8.2.2 INDIA

8.2.2.1 Growing urban construction projects will propel the market

8.2.3 JAPAN

8.2.3.1 The increasing commercial infrastructure sector in Japan to boost the market

8.2.4 SOUTH KOREA

8.2.4.1 Flooring & wall covering application to be the largest consumer of non-phthalate plasticizers

8.2.5 TAIWAN

8.2.5.1 High investments in residential development to fuel the market

8.2.6 INDONESIA

8.2.6.1 High investments in textile and coated fabrics to spur the market demand

8.2.7 REST OF APAC

8.3 NORTH AMERICA

8.3.1 US

8.3.1.1 Growing construction industry in suburban cities to boost the market

8.3.2 CANADA

8.3.2.1 The market is mainly driven by the investment in commercial infrastructure

8.3.3 MEXICO

8.3.3.1 Growth in commercial construction is influencing the market

8.4 EUROPE

8.4.1 GERMANY

8.4.1.1 Growing construction industry and presence of highly integrated chemical parks boosting the demand

8.4.2 ITALY

8.4.2.1 Presence of numerous raw material manufacturers is driving the market

8.4.3 FRANCE

8.4.3.1 Growing construction and chemical industries are driving the market

8.4.4 UK

8.4.4.1 Government initiatives in the construction sector will boost the market

8.4.5 SPAIN

8.4.5.1 Huge investments in construction projects and regulations for environmental protection to spur the market

8.4.6 RUSSIA

8.4.6.1 Presence of growing chemical industries in the country to drive the market

8.4.7 REST OF EUROPE

8.5 MIDDLE EAST & AFRICA

8.5.1 SAUDI ARABIA

8.5.1.1 Rapid development in infrastructure to spur the market growth

8.5.2 SOUTH AFRICA

8.5.2.1 Rapid developments in the economy, with growing construction and electronics industries, are driving the market

8.5.3 TURKEY

8.5.3.1 Growing economy and huge investment in building & construction to boost the demand

8.5.4 REST OF MIDDLE EAST & AFRICA

8.6 SOUTH AMERICA

8.6.1 BRAZIL

8.6.1.1 Rising home ownership and improving living standards to boost the market growth

8.6.2 ARGENTINA

8.6.2.1 Overall economic development and growing industrial sector to drive the market

8.6.3 REST OF SOUTH AMERICA

9 COMPETITIVE LANDSCAPE (Page No. - 98)

9.1 INTRODUCTION

9.2 COMPETITIVE LEADERSHIP MAPPING, 2019

9.2.1 VISIONARY LEADERS

9.2.2 INNOVATORS

9.2.3 DYNAMIC DIFFERENTIATORS

9.2.4 EMERGING COMPANIES

9.3 STRENGTH OF PRODUCT PORTFOLIO

9.4 BUSINESS STRATEGY EXCELLENCE

9.5 RANKING OF KEY MARKET PLAYERS

9.5.1 BASF

9.5.2 EASTMAN CHEMICAL COMPANY

9.5.3 EXXONMOBIL

9.5.4 EVONIK INDUSTRIES

9.5.5 DIC CORPORATION

9.6 COMPETITIVE SCENARIO

9.6.1 NEW PRODUCT LAUNCH

9.6.2 EXPANSION

10 COMPANY PROFILES (Page No. - 106)

10.1 BASF SE

10.1.1 BUSINESS OVERVIEW

10.1.2 PRODUCTS OFFERED

10.1.3 RECENT DEVELOPMENTS

10.1.4 SWOT ANALYSIS

10.1.5 WINNING IMPERATIVES

10.1.6 CURRENT FOCUS AND STRATEGIES

10.1.7 THREAT FROM COMPETITION

10.1.8 RIGHT TO WIN

10.2 EASTMAN CHEMICAL COMPANY

10.2.1 BUSINESS OVERVIEW

10.2.2 PRODUCTS OFFERED

10.2.3 RECENT DEVELOPMENTS

10.2.4 SWOT ANALYSIS

10.2.5 WINNING IMPERATIVES

10.2.6 CURRENT FOCUS AND STRATEGIES

10.2.7 THREAT FROM COMPETITION

10.2.8 RIGHT TO WIN

10.3 EVONIK INDUSTRIES AG

10.3.1 BUSINESS OVERVIEW

10.3.2 PRODUCTS OFFERED

10.3.3 SWOT ANALYSIS

10.3.4 WINNING IMPERATIVES

10.3.5 CURRENT FOCUS AND STRATEGIES

10.3.6 THREAT FROM COMPETITION

10.3.7 RIGHT TO WIN

10.4 EXXONMOBIL

10.4.1 BUSINESS OVERVIEW

10.4.2 PRODUCTS OFFERED

10.4.3 SWOT ANALYSIS

10.4.4 WINNING IMPERATIVES

10.4.5 MNM VIEW

10.5 DIC CORPORATION

10.5.1 BUSINESS OVERVIEW

10.5.2 PRODUCTS OFFERED

10.5.3 RECENT DEVELOPMENTS

10.5.4 SWOT ANALYSIS

10.5.5 WINNING IMPERATIVES

10.5.6 CURRENT FOCUS AND STRATEGIES

10.5.7 THREAT FROM COMPETITORS

10.5.8 RIGHT TO WIN

10.6 PERSTORP

10.6.1 BUSINESS OVERVIEW

10.6.2 PRODUCTS OFFERED

10.6.3 RECENT DEVELOPMENTS

10.6.4 MNM VIEW

10.7 LANXESS AG

10.7.1 BUSINESS OVERVIEW

10.7.2 PRODUCTS OFFERED

10.7.3 MNM VIEW

10.8 KLJ GROUP

10.8.1 BUSINESS OVERVIEW

10.8.2 PRODUCTS OFFERED

10.8.3 MNM VIEW

10.9 POLYNT

10.9.1 BUSINESS OVERVIEW

10.9.2 PRODUCTS OFFERED

10.9.3 MNM VIEW

10.10 MITSUBISHI CHEMICAL CORPORATION

10.10.1 BUSINESS OVERVIEW

10.10.2 PRODUCTS OFFERED

10.10.3 MNM VIEW

10.11 OTHER MARKET PLAYERS

10.11.1 OXEA CORPORATION

10.11.2 HALLSTAR

10.11.3 KAO CORPORATION

10.11.4 VELSICOL CHEMICAL LLC

10.11.5 VALTRIS SPECIALTY CHEMICALS

10.11.6 LG CHEM

10.11.7 NAN YA PLASTICS

10.11.8 SHANDONG QILU PLASTICIZERS CO. LTD.

10.11.9 UPC TECHNOLOGY CORPORATION

10.11.10 EMERALD PERFORMANCE MATERIALS LLC

11 APPENDIX (Page No. - 136)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

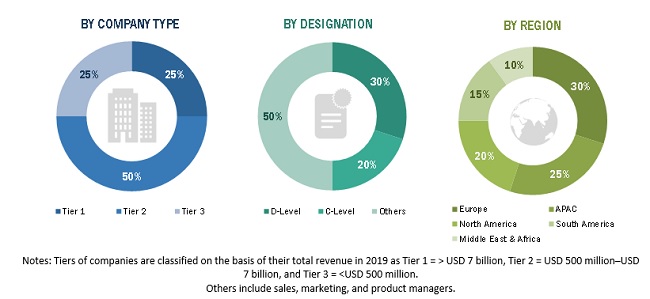

The study involves four major activities in estimating the current market size of non-phthalate plasticizers. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; and databases.

Primary Research

The non-phthalate plasticizers market comprises several stakeholders, such as raw material suppliers, distributors of non-phthalate plasticizers, industry associations, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market consists of manufacturers of flooring & wall coverings, wires & cables, films & sheets, coated fabrics, and consumer goods, whereas the supply side consists of non-phthalate plasticizer manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary interviews—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the non-phthalate plasticizers market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. Data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study:

- To analyze and forecast the non-phthalate plasticizers market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define and describe the market by type and application

- To forecast the size of the market with respect to five regions, namely, Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micro markets with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments, such as expansion and new product launch, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies, along with the market data. The following customization options are available for this report:

Product Analysis

- A product matrix that provides a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of APAC non-phthalate plasticizers market

Company Information:

- Detailed analysis and profiles of additional market players.

Growth opportunities and latent adjacency in Non-phthalate Plasticizers Market