Containerized Data Center Market by Container Types (20 ft 40 ft, customized), by Application (Greenfield, Brownfield, Upgrade and Consolidation), by Deployment size, by Vertical, and by Regions - Forecasts and Analysis (2014-2019)

[146 Pages Report] MarketsandMarkets forecasts the global containerized data center market to grow from $2.27 billion in 2014 to $7.47 billion by 2019, at a Compound Annual Growth Rate (CAGR) of 26.9%.

For years corporate data centers have been growing exponentially, to fulfill the continuously surging demand of data storage. This exponential growth is forcing data center companies to continuously expand the capacity of their data centers. But, building a new data center for enhancing capacity is not always a practical solution, as it involves huge investment. So, numerous data center companies nowadays are showing inclination towards the modular approach to data center capacity expansion. Containerization of data center is emerging as a modular solution to the issue of data center capacity expansion. Containerized data center is a fully enclosed and integrated data center, which is placed in an enclosure and works on the plug and play principle.

Containerized data center comes in the form of a box or container (ISO or non ISO) in different size variants i.e. 10, 20, 40, 53 feet etc., and contains all the basic functional data center modules including IT (Information and Technology)/data, power, cooling, and monitoring, assembled and integrated inside it. Containerized data center market solutions are cost effective, energy efficient, and can be deployed in lesser duration of time, providing users plug and play benefits. This gives them an edge over the traditional brick-and-mortar data centers.

In the present scenario, containerized data centers are experiencing significant adoption, and the containerized data center market is experiencing escalating growth rate. This rate of adoption is expected to grow at rapid pace in the future as well. Major players in the market are HP, IBM, Dell, Huawei, Schneider, Emerson Network Power, Cisco and SGI. The research report discuss the strategies and insights of the key vendors in the industry, and provides an in-depth study of driving forces and challenges for this market. The report also analyzes global adoption trends and future growth potentials across different geographical regions. Company profiles of major players are also included in the report to provide insights of product offerings given by them to the customers.

The forecast period for containerized data center is 2014-2019, with 2014 as a base year throughout the research report. MarketsandMarkets has segmented the global containerized data center market by type of containers, deployment size, industry verticals, and geographical regions. The report also consists of MarketsandMarkets views of the key players and the analyst insights on various developments that are taking place in the containerized data center market. The research report covers complete industry and categorizes into the following sub-markets:

On the basis of type of container:

- 20 Feet container

- 40 Feet container

- Customized (10 Feet, 53 Feet, and custom containers)

On the basis of application:

- Greenfield

- Brownfield

- Upgrade and consolidation

On the basis of deployment size:

- Small business

- Midsize business

- Large business

On the basis of industry verticals:

- Banking, Financial Services and Insurance (BFSI)

- Telecom and IT

- Government and public

- Defense

- Energy

- Healthcare

- Education

- Other verticals (mining, media and entertainment, retail, automotive, manufacturing, transport, and research)

On the basis of geographical regions:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In todays competitive era, data and its secure storage is one the most curtail element for any organization to stay competitive. Data centers contribute to a major chunk of IT expenditure in any organization. Increasing pressure of shrinking IT budgets and reducing infrastructural investments is forcing organizations to adopt solutions, which can provide and ensure high and improved business efficiency and continuity with minimum capital and operational expenses. Containerized data center has emerged as one of such solutions, with benefits including speedy deployment; lower Capital Expenditure (CAPEX), Operational Expenditure (OPEX), and Total cost of Ownership (TCO); high energy efficiency; and mobility. In the solutions available at containerized data center market all the individual modules such as IT/data, power, cooling, and monitoring are integrated inside an enclosure. Complete integration is performed in a controlled factory environment, which highly reduces the assembling efforts, time, and also the possibility of its failure at site. These data centers can be transported to any place and are designed to withstand the harsh climatic and environmental conditions.

Containerized data center is experiencing high adoption and preference rate among data center managers as they provide huge reduction in capital and operational expenditures (approximately 20 - 25%) compared to the traditional brick-and-mortar facility, while ensuring optimal utilization of available space. Containerized data center consist of all the necessary power, cooling, IT and support equipment in an enclosed structure and are provided as single solution to the end users. It provides and ensures end-user high scalability and flexibility, as it can be easily added or removed according to the current and future data center requirements. It supports high degree of customization and can be designed, manufactured and deployed according to the specific requirements of costumers in a reduced time frame.

Containerized data center vendors are constantly focusing on developing and improving new and existing technologies such as advanced cooling and power systems to deliver low Power Usage Effectiveness (PUE) and reduced operational expenses. In the present scenario, the adoption for container data centers is increasing across various verticals including telecom and IT, BFSI, government, healthcare, education, energy; because of its high degree of operability, speedy deployment, mobility, cost-effectiveness, and reduced PUE. This containerized data center market holds a very small part of the complete data center industry, but due to the associated cost and efficiency benefits this market is expected to grow significantly in the forecast period.

In this report, MarketsandMarkets provides an in-depth study of the market trends, market sizing, competitive mapping, and market dynamics of the containerized data center market. The global market is segmented across geographical regions including North America, Europe, APAC, MEA, and Latin America. The market has also been segmented into various industry verticals including BFSI, telecom and IT, government and public, defense, energy, healthcare, education, and other verticals. In terms of deployment size, the containerized data center market is segmented into small size business, mid size business, and large business. North America is expected to remain the major contributor by 2019. However, APAC is expected to emerge as major revenue pocket region in the next five years due to rising data center demand. The telecommunication and IT and BFSI verticals are estimated to hold major share in the total revenue generated in the market.

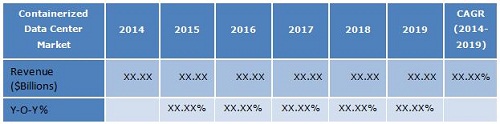

MarketsandMarkets forecasts the global containerized data center market to grow from $2.27 billion in 2014 to $7.47 billion by 2019, at a Compound Annual Growth Rate (CAGR) of 26.9%. The table given below highlights the overall market size and Y-O-Y growth for the forecast period of 2014-2019.

Containerized Data Center: Market Size, 2014-2019 ($Billion, Y-O-Y %)

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Market Scope

2 Research Methodology (Page No. - 19)

2.1 Market Size Estimation

2.2 Market Share Estimation

2.2.1 Key Data Points Taken From Secondary Sources

2.2.2 Key Data Points From Primary Sources

2.2.2.1 Key Industry Insights

2.2.3 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Market Opportunities in Converged Infrastructure

4.2 Type of Containers

4.3 Market Across Various Regions

4.4 Converged Infrastructure Architecture Type Market Across Various Regions

4.5 Life Cycle Analysis, By Geography

5 Containerized Data Center Market Overview (Page No. - 29)

5.1 Introduction

5.2 Evolution

5.3 Containerized Data Center Market Segmentation

5.3.1 By Type of Container

5.3.2 By Application

5.3.3 By Deployment Size

5.3.4 By Vertical

5.3.5 By Region

5.4 Containerized Data Center Market Dynamics

5.4.1 Drivers

5.4.1.1 Need for Mobility

5.4.1.2 Need for Scalable Data Center Solutions

5.4.1.3 Lowering of Capex, Opex, Tco, and Deployment Time

5.4.1.4 Disaster Recovery

5.4.1.5 Lowering of Pue

5.4.2 Restraints

5.4.2.1 Vendor Lock-in

5.4.2.2 Lack of Knowledge

5.4.2.3 High-Performance Computing (HPc)

5.4.3 Opportunities

5.4.3.1 Educating Companies to Utilize Traditional Brick-and-Mortar Data Centers

5.4.3.2 Complete Alternative to Traditional Data Centers

5.4.3.3 Reduction in Data Center-Related Cost

5.4.3.4 Service-Level Agreement (Sla)

6 Industry Trends (Page No. - 42)

6.1 Value Chain Analysis

6.2 Need for Containerized Data Center

7 Containerized Data Center Market, By Type of Container (Page No. - 43)

7.1 Introduction

7.2 20 FT Container

7.2.1 Overview

7.2.2 Market Size and forecast

7.2.2.1 Market Size and forecast By Application

7.2.2.2 Market Size and forecast By Deployment Size

7.2.2.3 Market Size and forecast By Region

7.3 40 FT Container

7.3.1 Overview

7.3.2 Market Size and forecast

7.3.2.1 Market Size and forecast By Application

7.3.2.2 Market Size and forecast By Deployment Size

7.3.2.3 Market Size and forecast By Region

7.4 Customized Container

7.4.1 Overview

7.4.2 Market Size and forecast

7.4.2.1 Market Size and forecast By Application

7.4.2.2 Market Size and forecast By Deployment Size

7.4.2.3 Market Size and forecast By Region

8 Containerized Data Center Market, By Application (Page No. - 59)

8.1 Introduction

8.2 Greenfield

8.2.1 Overview

8.2.2 Market Size and forecast By Vertical

8.3 Brownfield

8.3.1 Overview

8.3.2 Market Size and forecast By Vertical

8.4 Upgrade and Consolidation

8.4.1 Overview

8.4.2 Market Size and forecast By Vertical

9 Containerized Data Center Market, By Verticals (Page No. - 68)

9.1 Introduction

9.2 Banking, Financial Services and Insurance

9.2.1 Overview

9.2.2 Market Size and forecast By Type of Container

9.3 Telecom and It

9.3.1 Overview

9.3.2 Market Size and forecast By Type of Container

9.4 Government and Public

9.4.1 Overview

9.4.2 Market Size and forecast By Type of Container

9.5 Defence

9.5.1 Overview

9.5.2 Market Size and forecast By Type of Container

9.6 Energy

9.6.1 Overview

9.6.2 Market Size and forecast By Type of Container

9.7 Healthcare

9.7.1 Overview

9.7.2 Market Size and forecast By Type of Container

9.8 Education

9.8.1 Overview

9.8.2 Market Size and forecast By Type of Container

9.9 Other Vertical

9.9.1 Overview

9.9.2 Market Size and forecast By Type of Container

10 Containerized Data Center Market, By Deployment Size (Page No. - 85)

10.1 Introduction

10.2 Small Business

10.2.1 Overview

10.2.2 Market Size and forecast By Application

10.3 Midsize Business

10.3.1 Overview

10.3.2 Market Size and forecast By Application

10.4 Large Business

10.4.1 Overview

10.4.2 Market Size and forecast By Application

11 Geographic Analysis (Page No. - 92)

11.1 Introduction

11.1.1 Parfait Charts

11.2 North America

11.2.1 Overview

11.2.2 Market Size and forecast

11.2.2.1 Market Size and forecast By Application

11.2.2.2 Market Size and forecast By Deployment Size

11.3 Europe

11.3.1 Overview

11.3.2 Market Size and forecast

11.3.2.1 Market Size and forecast By Application

11.3.2.2 Market Size and forecast By Deployment Size

11.4 Asia Pacific

11.4.1 Overview

11.4.2 Market Size and forecast

11.4.2.1 Market Size and forecast By Application

11.4.2.2 Market Size and forecast By Deployment Size

11.5 Middle East and Africa

11.5.1 Overview

11.5.2 Market Size and forecast

11.5.2.1 Market Size and forecast By Application

11.5.2.2 Market Size and forecast By Deployment Size

11.6 Latin America

11.6.1 Overview

11.6.2 Market Size and forecast

11.6.2.1 Market Size and forecast By Application

11.6.2.2 Market Size and forecast By Deployment Size

12 Competitive Landscape (Page No. - 109)

12.1 Overview

12.2 New Product Launches

13 Company Profiles (Page No. - 112)

13.1 CISCO

13.1.1 Business Overview

13.1.2 Products and Services

13.1.3 Key Strategy

13.1.4 Recent Development

13.1.5 SWOT

13.1.6 MNM View

13.2 Dell

13.2.1 Business Overview

13.2.2 Products and Services

13.2.3 Key Strategy

13.2.4 Recent Development

13.2.5 SWOT Analysis

13.2.6 MNM View

13.3 Emerson Network Power

13.3.1 Business Overview

13.3.2 Products and Services

13.3.3 Key Strategy

13.3.4 Recent Development

13.3.5 MNM View

13.4 HP

13.4.1 Business Overview

13.4.2 Products and Services

13.4.3 Key Strategy

13.4.4 Recent Development

13.4.5 SWOT

13.4.6 MNM View

13.5 Huawei

13.5.1 Business Overview

13.5.2 Products and Services

13.5.3 Key Strategy

13.5.4 Recent Development

13.5.5 MNM View

13.6 IBM

13.6.1 Business Overview

13.6.2 Products and Services

13.6.3 Key Strategy

13.6.4 Recent Development

13.6.5 SWOT

13.6.6 MNM View

13.7 Johnson Controls

13.7.1 Business Overview

13.7.2 Products and Services

13.7.3 Key Strategy

13.7.4 Recent Development

13.7.5 MNM View

13.8 Power Distribution Inc. (Pdi)

13.8.1 Business Overview

13.8.2 Products and Services

13.8.3 Key Strategy

13.8.4 Recent Development

13.8.5 MNM View

13.9 Schneider Electric

13.9.1 Business Overview

13.9.2 Products and Services

13.9.3 Key Strategy

13.9.4 Recent Development

13.9.5 SWOT

13.9.6 MNM View

13.10 SGI

13.10.1 Business Overview

13.10.2 Products and Services

13.10.3 Key Strategy

13.10.4 Recent Development

13.10.5 MNM View

14 Appendix (Page No. - 137)

14.1 Discussion Guide

14.1.1 Section 1 General Awareness

14.1.2 Section 2 Types of Container

14.1.3 Section 3 Types of Application

14.1.4 Section 4 Deployment Size

14.1.5 Section 5 Verticals

14.1.6 Section 6 Regional Markets

14.1.7 Section 7 Company Outlook

14.2 Introducing Rt: Real Time Market Intelligence

14.3 Available Customizations

14.4 Related Reports

List of Tables (82 Tables)

Table 1 Global Containerized Data Center Market: Assumptions

Table 2 Market Size, 2014 2019 ($Billion, Y-O-Y %)

Table 3 Need for Mobility and Scalability is Driving the Demand of Containerized Data Center

Table 4 Vendor Lock-in Presents A Critical Restraint in the Market

Table 5 Increasing Incidence of Lifestyle Diseases is Propelling the Growth of Poc Diagnostics Market

Table 6 Containerized Data Center, Market Size, By Type of Container, 2014 2019 ($Billion)

Table 7 Containerized Data Center Market, By Type of Container, 2014 2019, Y-O-Y (%)

Table 8 20 FT Container Market Size, By Application, 2014 2019 ($Million)

Table 9 20 FT Container Market, By Application, 2014 2019, Y-O-Y (%)

Table 10 20 FT Container Market Size, By Deployment Size, 2014 2019 ($Million)

Table 11 20 FT Container Market, By Deployment Size, 2014 2019, Y-O-Y (%)

Table 12 20 FT Container Market Size, By Region, 2014 2019 ($Million)

Table 13 20 FT Container Market, By Region, 2014 2019, Y-O-Y (%)

Table 14 40 FT Container Market Size, By Application, 2014 2019 ($Million)

Table 15 40 FT Container Market, By Application, 2014 2019, Y-O-Y (%)

Table 16 40 FT Container Market Size, By Deployment Size, 2014 2019 ($Million)

Table 17 40 FT Container Market, By Deployment Size, 2014 2019, Y-O-Y (%)

Table 18 40 FT Container Market Size, By Region, 2014 2019 ($Million)

Table 19 40 FT Container Market, By Region, 2014 2019, Y-O-Y (%)

Table 20 Customized Container Market Size, By Application, 2014 2019 ($Million)

Table 21 Customized Container Market, By Application, 2014 2019, Y-O-Y (%)

Table 22 Customized Container Market Size, By Deployment Size, 2014 2019 ($Million)

Table 23 Customized Container Market, By Deployment Size, 2014 2019, Y-O-Y (%)

Table 24 Customized Container Market Size, By Region, 2014 2019 ($Million)

Table 25 Customized Container Market, By Region, 2014 2019, Y-O-Y (%)

Table 26 Containerized Data Center, Market Size, By Application, 2014 2019 ($Billion)

Table 27 Containerized Data Center Market, By Application, 2014 2019, Y-O-Y (%)

Table 28 Greenfield Market Size, By Vertical, 2014 2019 ($Million)

Table 29 Greenfield Market, By Vertical, 2014 2019, Y-O-Y (%)

Table 30 Brownfield Market Size, By Vertical, 2014 2019 ($Million)

Table 31 Brownfield Market, By Vertical, 2014 2019, Y-O-Y (%)

Table 32 Upgrade and Consolidation Market Size, By Vertical, 2014 2019 ($Million)

Table 33 Upgrade and Consolidation Market, By Vertical, 2014 2019, Y-O-Y (%)

Table 34 Containerized Data Center Market Size, By Vertical, 2014 2019 ($Billion)

Table 35 Market, By Vertical, 2014 2019, Y-O-Y (%)

Table 36 BFSI Market Size, By Type of Container, 2014 2019 ($Million)

Table 37 BFSI Market, By Type of Container, 2014 2019, Y-O-Y (%)

Table 38 Telecom and IT Market Size, By Type of Container, 2014 2019 ($Million)

Table 39 Telecom and IT Market, By Type of Container, 2014 2019, Y-O-Y (%)

Table 40 Government and Public Market Size, By Type of Container, 2014 2019 ($Million)

Table 41 Government and Public Market, By Type of Container, 2014 2019, Y-O-Y (%)

Table 42 Defence Market Size, By Type of Container, 2014 2019 ($Million)

Table 43 Defence Market, By Type of Container, 2014 2019, Y-O-Y (%)

Table 44 Energy Market Size, By Type of Container, 2014 2019 ($Million)

Table 45 Energy Market, By Type of Container, 2014 2019, Y-O-Y (%)

Table 46 Healthcare Market Size, By Type of Container, 2014 2019 ($Million)

Table 47 Healthcare Market, By Type of Container, 2014 2019, Y-O-Y (%)

Table 48 Education Market Size, By Type of Container, 2014 2019 ($Million)

Table 49 Education Market, By Type of Container, 2014 2019, Y-O-Y (%)

Table 50 Other Vertical Market Size, By Type of Container, 2014 2019 ($Million)

Table 51 Other Vertical Market, By Type of Container, 2014 2019, Y-O-Y (%)

Table 52 Containerized Data Center, Market Size, By Deployment Size, 2014 2019 ($Billion)

Table 53 Containerized Data Center Market, By Deployment Size, 2014 2019, Y-O-Y (%)

Table 54 Small Business Market Size, By Application, 2014 2019 ($Million)

Table 55 Small Business Market, By Application, 2014 2019, Y-O-Y (%)

Table 56 Midsize Business Market Size, By Application, 2014 2019 ($Million)

Table 57 Midsize Business Market, By Application, 2014 2019, Y-O-Y (%)

Table 58 Large Business Market Size, By Application, 2014 2019 ($Million)

Table 59 Large Business Market, By Application, 2014 2019, Y-O-Y (%)

Table 60 Containerized Data Center, Market Size, By Region, 2014 2019 ($Billion)

Table 61 Containerized Data Center Market, By Region, 2014 2019, Y-O-Y (%)

Table 62 North America Containerized Data Center Market Size, By Application, 2014 2019 ($Million)

Table 63 North America Market, By Application, 2014 2019, Y-O-Y (%)

Table 64 North America Market Size, By Deployment Size, 2014 2019 ($Million)

Table 65 North America Market, By Deployment Size, 2014 2019, Y-O-Y (%)

Table 66 Europe Containerized Data Center Market Size, By Application, 2014 2019 ($Million)

Table 67 Europe Market, By Application, 2014 2019, Y-O-Y (%)

Table 68 Europe Market Size, By Deployment Size, 2014 2019 ($Million)

Table 69 Europe Market, By Deployment Size, 2014 2019, Y-O-Y (%)

Table 70 APAC Containerized Data Center Market Size, By Application, 2014 2019 ($Million)

Table 71 APAC Market, By Application, 2014 2019, Y-O-Y (%)

Table 72 APAC Market Size, By Deployment Size, 2014 2019 ($Million)

Table 73 APAC Market, By Deployment Size, 2014 2019, Y-O-Y (%)

Table 74 MEA Containerized Data Center Market Size, By Application, 2014 2019 ($Million)

Table 75 MEA Market, By Application, 2014 2019, Y-O-Y (%)

Table 76 MEA Market Size, By Deployment Size, 2014 2019 ($Million)

Table 77 MEA Market, By Deployment Size, 2014 2019, Y-O-Y (%)

Table 78 Latin America Containerized Data Center Market Size, By Application, 2014 2019 ($Million)

Table 79 Latin America Market, By Application, 2014 2019, Y-O-Y (%)

Table 80 Latin America Market Size, By Deployment Size, 2014 2019 ($Million)

Table 81 Latin America Market, By Deployment Size, 2014 2019, Y-O-Y (%)

Table 82 New Product Launches, 20112014

List of Figures (59 Figures)

Figure 1 Containerized Data Center: Stakeholders

Figure 2 Containerized Data Center: Research Methodology

Figure 3 Containerized Data Center Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: top-Down Approach

Figure 5 Break Down of Primary Interviews: By Company Type, Designation, & Region

Figure 6 Containerized Data Center, Market, 2014 2019, Y-O-Y (%)

Figure 7 Global Containerized Data Center Market Share 2014

Figure 8 Attractive Market Opportunities in the Market

Figure 9 Custom Containerized Data Centers Are Expected to Grow At the Fastest Rate Among the Three Container Types in the Market

Figure 10 Global Market Share, 2014

Figure 11 Global Containerized Data Center Application Market Share, 2014

Figure 12 APAC Market Soon to Enter Exponential Growth Phase in Coming Years

Figure 13 Containerized Data Center Market Evolution

Figure 14 Market Segmentation By Type of Container

Figure 15 Market Segmentation By Application

Figure 16 Market Segmentation By Deployment Size

Figure 17 Market Segmentation By Vertical

Figure 18 Market Segmentation By Region

Figure 19 Need for Mobility and Scalability Will Spur the Demand of Containerized Data Center

Figure 20 Containerized Data Center Market Value Chain

Figure 21 Need for Containerized Data Center

Figure 22 Market Size, By Type of Container

Figure 23 Market, By Type of Container, 2014 2019, Y-O-Y (%)

Figure 24 20 FT Container Market Size, 2014 2019 ($Billion, Y-O-Y %)

Figure 25 40 FT Container Market Size, 2014 2019 ($Billion, Y-O-Y %)

Figure 26 Customized Container Market Size, 2014 2019 ($Billion, Y-O-Y %)

Figure 27 Containerized Data Center Market Size, By Application

Figure 28 Containerized Data Center Market, By Application, 2014 2019, Y-O-Y (%)

Figure 29 Greenfield Market Size, 2014 2019 ($Billion, Y-O-Y %)

Figure 30 Brownfield Market Size, 2014 2019 ($Billion, Y-O-Y %)

Figure 31 Upgrade and Consolidation Market Size, 2014 2019 ($Billion, Y-O-Y %)

Figure 32 Containerized Data Center, Market Size, By Vertical

Figure 33 Containerized Data Center Market, By Vertical, 2014 2019, Y-O-Y (%)

Figure 34 BFSI Market, 2014 2019 ($Billion, Y-O-Y %)

Figure 35 Telecom and IT Market, 2014 2019 ($Billion, Y-O-Y %)

Figure 36 Government and Public Market, 2014 2019 ($Billion, Y-O-Y %)

Figure 37 Defence Market, 2014 2019 ($Billion, Y-O-Y %)

Figure 38 Energy Market, 2014 2019 ($Billion, Y-O-Y %)

Figure 39 Healthcare Market, 2014 2019 ($Billion, Y-O-Y %)

Figure 40 Education Market, 2014 2019 ($Billion, Y-O-Y %)

Figure 41 Other Vertical Market, 2014 2019 ($Billion, Y-O-Y %)

Figure 42 Containerized Data Center, Market Size, By Deployment Size

Figure 43 Containerized Data Center Market, By Deployment Size, 2014 2019, Y-O-Y (%)

Figure 44 Small Business Market Size, 2014 2019 ($Billion, Y-O-Y %)

Figure 45 Midsize Business Market Size, 2014 2019 ($Billion, Y-O-Y %)

Figure 46 Large Business Market Size, 2014 2019 ($Billion, Y-O-Y %)

Figure 47 Containerized Data Center, Market Size, By Region

Figure 48 Containerized Data Center Market, By Region, 2014 2019, Y-O-Y (%)

Figure 49 North America Market Size, 2014 2019 ($Billion, Y-O-Y %)

Figure 50 Europe Market Size, 2014 2019 ($Billion, Y-O-Y %)

Figure 51 APAC Market Size, 2014 2019 ($Billion, Y-O-Y %)

Figure 52 MEA Market Size, 2014 2019 ($Billion, Y-O-Y %)

Figure 53 Latin America Market Size, 2014 2019 ($Billion, Y-O-Y %)

Figure 54 Companies Adopted Product Innovation As the Key Growth Strategy Over the Last Three Years

Figure 55 Cisco SWOT

Figure 56 Dell SWOT

Figure 57 HP SWOT

Figure 58 IBM SWOT

Figure 59 Schneider Electric SWOT

Growth opportunities and latent adjacency in Containerized Data Center Market