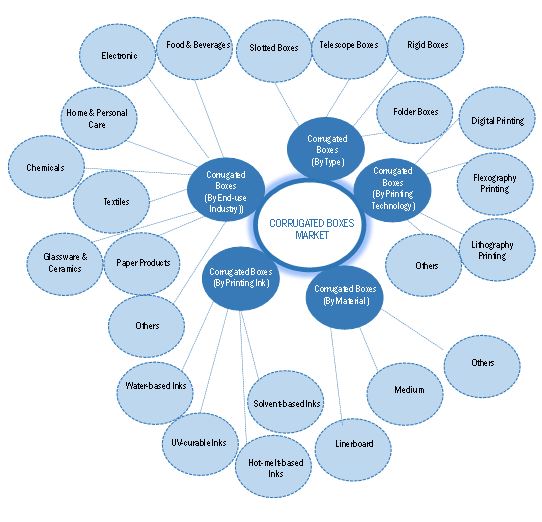

Corrugated Boxes Market by Type, Material (Linerboard, Medium), Printing Ink( Water-based, UV-curable, Hot melt-based, Solvent-based), Printing Technology (Digital, Flexography, Lithography), End-use Industry, and Region - Global Forecast to 2026

Updated on : August 25, 2025

Corrugated Boxes Market

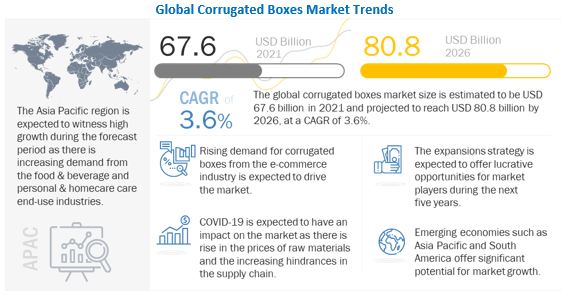

The corrugated boxes market was valued at USD 67.6 billion in 2021 and is projected to reach USD 80.8 billion by 2026, growing at 3.6% cagr from 2021 to 2026. The market is witnessing high growth owing to the growing corrugated boxes demands from the e-commerce sector, food & beverage industry, electronic industry, industrial sector and the increasing disposable income in developing countries. The increasing inclination towards consumer goods and other end-uses is also driving the market. These are the key factors driving the corrugated boxes demand during the forecast period.

Corrugated Boxes Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Corrugated Boxes Market

Corrugated Boxes Market Dynamics

Driver: Sustainability accompanied with increase in online shopping across Central & Eastern Europe to drive market

Approximately 45% of the consumers in Central and Eastern Europe prefer online shopping due to the COVID-19 pandemic. Studies and surveys predict that the new online buyers are expected to continue online shopping. Almost 80% of the population in Central and Eastern Europe appreciate the incorporation of a sustainable approach and eco-friendly material in the corrugated boxes used for packaging. 77% consumers use sustainable corrugated packaging solutions for their online shopping. Approximately 57% are willing to pay more for customizable as well as sustainable corrugated packaging solutions. The online business has seen a boost after the COVID-19 pandemic. People are becoming increasingly concerned and vocal about the use of sustainable products. This factor is leading to the growth of the market.

Restraint: Significant competition from flexible plastic packaging

Flexible plastic packaging provides the highest advantage for manufacturers and retailers as it reduces the weight of packaging which can result in reduced shipping and warehousing costs, thereby enabling the requirement for significantly less space. For consumers, it provides convenience through features such as single-serve portions, easy-to-open, and easy-peel options, and the food tastes better in retort pouches than that in traditional tin cans. Flexible packaging is 40% lower in terms of the overall packaging cost, which amounts to a 50% reduction in landfill waste and 62% reduction in greenhouse gas (GHG) emissions over rigid packaging. Hence, factors such as convenience, portability, cost savings, sustainability, and health benefits are leading product packaging manufacturers and packaging converters to shift from standard rigid materials to flexible materials.

Opportunity: Smurfit Kappa is incorporating digitalization in corrugated industry by developing a new range of paper

Smurfit Kappa, a renowned manufacturer of corrugated packaging solutions enhanced the incorporation of digitalization in the corrugated industry. It has developed a range of multi-purpose paper that is expected to be suitable for both, digital and flexography printers. The development of multi-purpose paper was undertaken to fulfil the purpose of enabling the printer to work together with the packaging material. This advancement widens the dimensions of optimum digital printing and is expected to maximize the capabilities of digital printing. Customized graphic design has delivered a range such as greater flexibility and an increase in sales. The company is also looking forward to developing new solutions and enhancing the existing sustainable technologies. These advancements are driving the digitalization of the paper-based packaging industry and offers significant potential for market growth.

Challenges: Adherence to environmental standards during production

One of the major challenges that corrugated box manufacturers are expected to face over a period of time is reducing greenhouse gas emissions and developing highly efficient & eco-friendly methods of manufacturing products. Corrugated boxes are experiencing increased demand among consumers; however, the high consumption of energy and the impact on the environment acts as a major hindrance for it to be considered as a highly sought-after packaging product. As corrugated boxes are made from wood pulp, their production has a significant impact on forests. The energy required for production is significantly higher than the energy required for producing plastic. It requires 34% higher energy to produce corrugated boxes than in the production of reusable plastic containers. CO2 emissions are also higher when manufacturing corrugated boxes. Thus, adhering to environmental standards during production may prove to be a challenge for corrugated box manufacturers.

Slotted boxes is the largest type segment of the corrugated boxes market

On the basis of type, the market is segmented into slotted boxes, telescope boxes, rigid boxes, and folder boxes. The slotted boxes segment led the market in terms of both value and volume. They are generally made from one piece of corrugated board which is usually stitched, taped, or glued. The blank, or tray, is scored and fitted to allow folding after which the boxes are dispatched flat to the user. To make a box, the user needs to square it up, place the product in the box, and shut the flaps. The flute is placed parallel to the depth to provide enough loading strength. The slotted box is a very efficiently designed product, as it generates minimal waste during its manufacturing process. It is ideal for shipping a variety of products such as cups, mugs, and books among others.

Linerboard is the largest material segment of the corrugated boxes market

On the basis of material, the market is segmented into linerboard, medium, and others. The linerboard material segment led the market in terms of both value and volume. Kraft liner contains at least 80% virgin kraft pulp fibers. Due to its high strength and moisture resistance, kraft liner is used as an outer and intermediate ply in corrugated boxes. The kraft linerboard is primarily used for the manufacture of high-grade color-printed corrugated boxes for the food & beverages, home & personal care, and other industries. Recycled linerboard, also known as a test liner, contains less than 80% virgin kraft pulp fibers. It is also used for the outer and intermediate plies of corrugated board. However, it is not as strong as kraft liner as it has a higher recycled fiber content. Recycled linerboard is less expensive than kraft liner. The recycled materials used for manufacturing recycled board include double line kraft clippings and old corrugated containers.

Water-based ink is the largest printing ink segment of the corrugated boxes market

On the basis of printing ink, the market is segmented into, water-based inks, UV-curable inks, hot melt-based inks, and solvent-based inks. The water-based ink segment led the printing ink segment of the market by both value and volume. Water-based inks are composed of pigments or dyes in a colloidal suspension with water-soluble resins or resin emulsions. Typically, water-based inks contain a higher percentage of solids, which implies that there is less liquid to be removed. Owing to the nature of resins present in the water system, a thinner layer of ink is often used. Water-based inks are available in two varieties: dye and pigment. Although dye inks result in high-quality images, they are not waterproof and fade if exposed to UV light. Pigment inks are short-term waterproof inks with high stability in UV light.

Flexography printing is the largest printing technology segment of the corrugated boxes industry

On the basis of printing technology, the market is divided into digital printing, flexography printing, lithography printing, and others (offset, screen, and gravure printing technologies). Flexography segment led the printing technology of the market. Flexography is a quick and economical printing technique which is widely used in packaging printing due to the wide range of benefits offered. It is used to apply simple designs and colors to a wide range of packaging materials, such as corrugated boxes, plastic containers, tapes, envelopes, and metal foils. Flexography printing technology has the highest demand for printing on corrugated boxes. It is a form of relief printing which uses rubber or polymer plates to transmit an image onto a corrugated board such as in an automated rubber stamp. Flexography printing was invented in order to print on rough and uneven surfaces such as corrugated boards. The printing ink used in flexography printing is fast drying and of low viscosity. It is therefore considered to be a quick printing method. As corrugated boards are highly porous, flexography printing is ideal for plain text or 1-2 color graphical images.

Food & beverages is the largest end-use industry segment of the corrugated boxes market

On the basis of end-use industry, the market is segmented into food & beverages, electronic goods, home & personal care goods, chemicals, textile goods, glassware & ceramics, paper products, and others. The food & beverages segment led the market in terms of both value and volume. The key categories found in the food & beverage industry include fresh produce, processed food, and non-perishables. The food & beverages sector requires packaging for the storage, handling, and transportation of products. Corrugated boxes are requiring while transporting products that have varying strengths, which includes extremely delicate, perishable products to processed food products. As corrugated boxes are non-reactive, they are an appropriate medium to package, transport, and store food for a long period of time. The packaging of processed food requires safe packaging material which is suitable to the buyer and also confirms product safety. Therefore, corrugated boxes are used for the packaging of processed foods.

APAC is the largest market for corrugated boxes industry

The APAC region is projected to be the largest market, in terms of value. APAC is also expected to grow at the highest CAGR during the forecast period. Growth in APAC is backed by the efficient demand and supply cycle of the food & beverage, electronic, and personal care industry majorly in countries like China, India, and Japan among others. A significant increase in e-commerce business development is driving the market in the area. APAC is also an industrial hub with a significantly large market size. Other factors, such as the increasing consumer goods demand, innovation in electronics and other sectors, etc are expected to support the growth of this regional market during the forecast period.

Rengo Co., Ltd. (Japan), Mondi Group (UK), DS Smith (UK), Smurfit Kappa Group (Ireland), and International Paper (US) are key players in corrugated boxes market.

To know about the assumptions considered for the study, download the pdf brochure

Corrugated Boxes Market Interconnections

Corrugated Boxes Market Players

Rengo Co., Ltd. (Japan), Mondi Group (UK), DS Smith (UK), Smurfit Kappa Group (Ireland), and International Paper (US) are the key players operating in the corrugated boxes market.

These companies have adopted several growth strategies to strengthen their position in the market. Expansion, new product development, merger & acquisition, and collaboration are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for to corrugated boxes from emerging economies.

Read More: Corrugated Boxes Companies

Corrugated Boxes Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 67.6 Billion |

|

Revenue Forecast in 2026 |

USD 80.8 Billion |

|

CAGR |

3.6% |

|

Market size available for years |

2019-2026 |

|

Base year |

2020 |

|

Forecast period |

2021-2026 |

|

Units considered |

Value (USD Million), Volume (Million Square Meters) |

|

Segments |

Type, Material, Prinitng Ink, Prinitng Technology, End-use Industry and Region |

|

Regions |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies |

Rengo Co., Ltd. (Japan), Mondi Group (UK), DS Smith (UK), Smurfit Kappa Group (Ireland), and International Paper (US) |

This research report categorizes the corrugated boxes market based on type, application, technology and region.

Corrugated Boxes Market by Type:

- Slotted Boxes

- Telescope Boxes

- Rigid Boxes

- Folder Boxes

Corrugated Boxes Market by Material:

- Linerboard

- Medium

- Others

Corrugated Boxes Market by Printing Ink:

- Water-Based Ink

- Uv-Curable Ink

- Hot Melt-Based Ink

- Solvent-Based Ink

Corrugated Boxes Market by Printing Technology:

- Digital Printing

- Flexography Printing

- Lithography Printing

- Others

Corrugated Boxes Market by End-use:

- Food & Beverages

- Electronic Goods

- Home & Personal Care Goods

- Chemicals

- Textile Goods

- Glassware & Ceramics

- Paper Products

- Others

Corrugated Boxes Market by Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In October 2021, Smurfit Kappa Group completed the acquisition of Verzuolo. As a result of this acquisition, the company converted the PM9 machine into a state-of-the-art 661,387-ton recycled containerboard machine in 2019. It complements the already existing and strategically located operational facilities near the port of Savona. This is expected to benefit the company as well as the customer base.

- In September 2021, Rengo Co., Ltd. announced that its joint venture in Vietnam, Vina Kraft Paper Co., Ltd., has opted to build a new containerboard production site. Due to continued foreign direct investments, majorly in the export industry, and expanding domestic consumption, Vietnam's total annual demand for containerboard was over three million tons in 2019. Vina Kraft Paper is expected to firmly establish itself as a market leader in the Vietnam containerboard sector, with the newly constructed mill aiming for long-term development and expansion. It is also expected to boost Vietnam's local integrated containerboard to corrugated box production system.

- In September 2021, the Mondi Group expanded by installing new equipment at its corrugated box production plant in Szczecin, Poland. This expansion aims at expanding the company’s packaging portfolio and enhance production processes. This expansion is expected to further strengthen the company's presence as a preferred e-commerce packaging supplier to the growing European markets.

- In August 2021, DS Smith developed a completely recyclable e-commerce packaging for Blaue Helden. This sustainably developed e-commerce packaging from DS Smith imparts the environment-friendly cleaning tabs from Blaue Helden, an enhanced appearance catering to online retail, with 100% corrugated cardboard and no plastic filling material at all.

- In March 2021, International Paper completed the purchase of two state-of-the-art corrugated box plants in Spain. This purchase will enhance the capabilities of the company in Madrid and Catalonia. Corrugated packaging business is of strategic importance to the company with respect to the EMEA. It offers its customers high-quality packaging solutions in the industrial, fresh fruits and vegetables, and e-commerce segments. The two businesses have been the part of International Paper from April 1, 2021.

Frequently Asked Questions (FAQ):

How big is the Corrugated Box Market?

Corrugated Box Market worth $80.8 billion by 2026.

What is the growth rate of Corrugated Boxes Market?

Corrugated Boxes Market grows at a CAGR of 3.6% during the forecast period.

What are the upcoming hot bets for the corrugated boxes industry?

Rise in demand for corrugated boxes from emerging economies and growing popularity of growing demand from e-commerce, food & beverage and electronic sectors are hot bets for the market.

What are the market dynamics for the different type of corrugated boxes?

On the basis of type, the market is segmented into slotted boxes, telescope boxes, rigid boxes, and folder boxes. Slotted boxes are generally made from one piece of corrugated board which is usually stitched, taped, or glued. The blank, or tray, is scored and fitted to allow folding after which the boxes are dispatched flat to the user. To make a box, the user needs to square it up, place the product in the box, and shut the flaps. The flute is placed parallel to the depth to provide enough loading strength. The slotted box is a very efficiently designed product, as it generates minimal waste during its manufacturing process. It is ideal for shipping a variety of products such as cups, mugs, and books among others.

What are the market dynamics for the different materials used to manufacture corrugated boxes?

On the basis of material, the market is segmented into linerboard, medium, and others. Kraft liner contains at least 80% virgin kraft pulp fibers. Due to its high strength and moisture resistance, kraft liner is used as an outer and intermediate ply in corrugated boxes. The kraft linerboard is primarily used for the manufacture of high-grade color-printed corrugated boxes for the food & beverages, home & personal care, and other industries. Recycled linerboard, also known as a test liner, contains less than 80% virgin kraft pulp fibers. It is also used for the outer and intermediate plies of corrugated board. However, it is not as strong as kraft liner as it has a higher recycled fiber content. Recycled linerboard is less expensive than kraft liner. The recycled materials used for manufacturing recycled board include double line kraft clippings and old corrugated containers.

What are the market dynamics for the different printing inks used with corrugated boxes?

On the basis of printing ink, the market is segmented into, water-based inks, UV-curable inks, hot melt-based inks, and solvent-based inks. Water-based inks are composed of pigments or dyes in a colloidal suspension with water-soluble resins or resin emulsions. Typically, water-based inks contain a higher percentage of solids, which implies that there is less liquid to be removed. Owing to the nature of resins present in the water system, a thinner layer of ink is often used. Water-based inks are available in two varieties: dye and pigment. Although dye inks result in high-quality images, they are not waterproof and fade if exposed to UV light. Pigment inks are short-term waterproof inks with high stability in UV light.

What are the market dynamics for the different printing technologies used to make corrugated boxes?

On the basis of printing technology, the market is divided into digital printing, flexography printing, lithography printing, and others. Flexography is a quick and economical printing technique which is widely used in packaging printing due to the wide range of benefits offered. It is used to apply simple designs and colors to a wide range of packaging materials, such as corrugated boxes, plastic containers, tapes, envelopes, and metal foils. Flexography printing technology has the highest demand for printing on corrugated boxes. It is a form of relief printing which uses rubber or polymer plates to transmit an image onto a corrugated board such as in an automated rubber stamp. Flexography printing was invented in order to print on rough and uneven surfaces such as corrugated boards. The printing ink used in flexography printing is fast drying and of low viscosity. It is therefore considered to be a quick printing method. As corrugated boards are highly porous, flexography printing is ideal for plain text or 1-2 color graphical images.

What are the market dynamics for the different end-uses of corrugated boxes?

On the basis of end-use industry, the market is segmented into food & beverages, electronic goods, home & personal care goods, chemicals, textile goods, glassware & ceramics, paper products, and others. The key categories found in the food & beverage industry include fresh produce, processed food, and non-perishables. The food & beverages sector requires packaging for the storage, handling, and transportation of products. Corrugated boxes are requiring while transporting products that have varying strengths, which includes extremely delicate, perishable products to processed food products. As corrugated boxes are non-reactive, they are an appropriate medium to package, transport, and store food for a long period of time. The packaging of processed food requires safe packaging material which is suitable to the buyer and also confirms product safety. Therefore, corrugated boxes are used for the packaging of processed foods.

Who are the major manufacturers of the corrugated boxes market?

Rengo Co., Ltd. (Japan), Mondi Group (UK), DS Smith (UK), Smurfit Kappa Group (Ireland), and International Paper (US) are the key players operating in the corrugated boxes market.

What are the major factors which will impact market growth during the forecast period?

Stringent government regulations will be a restraint to the growth of the market during the forecast period. Governments worldwide are addressing this issue by imposing strict laws, which results in the corrugated boxes market being subjected to governance.

What are the effects of COVID-19 on the corrugated boxes market?

The COVID-19 pandemic has significantly impacted the aluminum industry worldwide, and it is difficult to ascertain the extent and severity of the impact in the long term. The outbreak of the coronavirus disease resulted in the shutdown of approximately 198,000 active dental hospitals and clinics in the US (data as of August 2020). The packaging industry was adversely impacted due to the recession which prevailed after the outbreak of the pandemic. The unexpected fall and uncertainty in the prices of raw material before and after the COVID-19 pandemic has been a worldwide concern for packaging solution manufacturers. However, there has been a signification increase in e-commerce after the pandemic. E-commerce retail sales are experiencing a significant spike in numvers. The annual growth in e-commerce trade in Europe is expected to be approximately 20%. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 CORRUGATED BOXES MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 1 CORRUGATED BOXES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary research

2.1.2 PRIMARY DATA

2.1.2.1 Critical primary inputs

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 BASE NUMBER CALCULATION APPROACH

2.2.1 ESTIMATION OF CORRUGATED BOXES MARKET SIZE BASED ON MARKET SHARE ANALYSIS

FIGURE 2 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 3 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

2.3 MARKET SIZE ESTIMATION

2.3.1 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 4 CORRUGATED BOXES MARKET: DATA TRIANGULATION

2.4.1 ASSUMPTIONS AND LIMITATIONS

2.4.2 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RISKS

TABLE 2 RISKS

2.4.3 LIMITATIONS

2.4.4 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 5 FOOD & BEVERAGES SEGMENT TO LEAD CORRUGATED BOXES MARKET BY 2026

FIGURE 6 SLOTTED BOXES SEGMENT LED MARKET IN 2020

FIGURE 7 FLEXOGRAPHY PRINTING SEGMENT TO DOMINATE PRINTING TECHNOLOGY IN CORRUGATED BOXES MARKET

FIGURE 8 ASIA PACIFIC ACCOUNTED FOR THE LARGEST SHARE OF THE CORRUGATED BOXES MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 HIGHER DEMAND FOR CORRUGATED BOXES EXPECTED FROM EMERGING ECONOMIES

FIGURE 9 EMERGING ECONOMIES OFFERING ATTRACTIVE GROWTH OPPORTUNITIES FOR CORRUGATED BOXES MARKET

4.2 CORRUGATED BOXES MARKET, BY REGION

FIGURE 10 ASIA PACIFIC PROJECTED TO LEAD CORRUGATED BOXES MARKET FROM 2021 TO 2026

4.3 ASIA PACIFIC: CORRUGATED BOXES MARKET, BY TYPE AND COUNTRY, 2020

FIGURE 11 CHINA AND SLOTTED BOXES SEGMENT ACCOUNTED FOR THE HIGHEST SHARES

4.4 CORRUGATED BOXES MARKET, BY KEY COUNTRIES

FIGURE 12 CORRUGATED BOXES MARKET IN CHINA AND INDIA TO GROW AT HIGHEST CAGRS FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET EVOLUTION

FIGURE 13 EVOLUTION OF THE CORRUGATED BOXES MARKET

5.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 14 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.4 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CORRUGATED BOXES MARKET

5.4.1 DRIVERS

5.4.1.1 Sustainability accompanied with increase in online shopping across Central & Eastern Europe to drive market

5.4.1.2 Growth of packaging industry in Asia Pacific

FIGURE 16 E-COMMERCE INDUSTRY IN INDIA, 2020 VS. 2024

5.4.1.3 Recyclability of corrugated boxes

5.4.2 RESTRAINTS

5.4.2.1 Significant competition from flexible plastic packaging

5.4.2.2 Supply-side restraints

5.4.2.2.1 Increase in prices of raw materials

5.4.2.3 Demand-side restraints

5.4.2.3.1 Availability of low-cost alternatives

5.4.3 OPPORTUNITIES

5.4.3.1 Smurfit Kappa is incorporating digitalization in corrugated industry by developing a new range of paper

5.4.3.2 Market penetration of different applications in emerging nations

5.4.3.3 Emergence of shelf-ready packaging technology

5.4.4 CHALLENGES

5.4.4.1 Adherence to environmental standards during production

5.4.4.2 Inability in enabling eco-friendly online shopping could affect companies’ sales

6 INDUSTRY TRENDS (Page No. - 65)

6.1 VALUE CHAIN

FIGURE 17 CORRUGATED BOXES: VALUE CHAIN

6.1.1 IMPACT OF COVID-19 ON END-USE APPLICATIONS OF CORRUGATED BOXES

6.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS OF CORRUGATED BOXES

TABLE 3 CORRUGATED BOXES MARKET: PORTER’S FIVE FORCE ANALYSIS

6.2.1 THREAT OF NEW ENTRANTS

6.2.1.1 Economies of scale

6.2.1.2 High initial investment, need for efficient distribution channels, and critical role of R&D

6.2.2 THREAT OF SUBSTITUTES

6.2.3 BARGAINING POWER OF SUPPLIERS

6.2.3.1 Large number of suppliers in the market

6.2.3.2 Low switching cost

6.2.4 BARGAINING POWER OF BUYERS

6.2.4.1 Bulk product purchases

6.2.4.2 High bargaining leverage

6.2.4.3 Consumer is price-sensitive

6.2.5 RIVALRY AMONG EXISTING COMPETITORS

6.2.5.1 Established players

6.2.5.2 High entry and exit barriers

6.2.5.3 Lucrative market growth potential

6.3 YC-YCC DRIVERS

FIGURE 19 YC-YCC DRIVERS

6.4 SUPPLY CHAIN ANALYSIS

FIGURE 20 CORRUGATED BOXES MARKET: SUPPLY CHAIN

TABLE 4 CORRUGATED BOXES MARKET: ECOSYSTEM

6.4.1 PROMINENT COMPANIES

6.4.2 SMALL & MEDIUM ENTERPRISES

6.5 MARKET MAPPING/ ECOSYSTEM MAP

FIGURE 21 ECOSYSTEM MAP

6.6 TARIFF AND REGULATORY ANALYSIS

6.7 PRICING ANALYSIS

TABLE 5 PRICES OF CORRUGATED CARDBOARD SHEETS AS GIVEN BY BOXFORLESS.COM

TABLE 6 PRICES OF HIGH STRENGTH DOUBLE WALL BROWN CORRUGATED BOXES AS GIVEN BY U PACK (INDIA)

6.8 TRADE ANALYSIS

TABLE 7 IMPORTS OF CORRUGATED PAPER, PAPER BOARD, AND PAPER BOARD CONTAINERS FROM VARIOUS COUNTRIES IN INDIA

TABLE 8 EXPORTS OF CORRUGATED PAPER, PAPER BOARD, AND PAPER BOARD CONTAINERS TO VARIOUS COUNTRIES FROM INDIA

TABLE 9 IMPORTS OF CARTONS, BOXES & CASES, CORRUGATED PAPER & PAPERBD HS CODE 481910 FROM VARIOUS COUNTRIES IN US

TABLE 10 EXPORTS OF CARTONS, BOXES & CASES, CORRUGATED PAPER & PAPERBD HS CODE 481910 TO VARIOUS COUNTRIES FROM US

6.9 TECHNOLOGY ANALYSIS

6.9.1 PROCESS IN THE MANUFACTURE OF CORRUGATED BOXES

6.10 CASE STUDY

6.11 PATENT ANALYSIS

6.11.1 INTRODUCTION

6.11.2 METHODOLOGY

6.11.3 DOCUMENT TYPE

FIGURE 22 CORRUGATED BOXES MARKET: GRANTED PATENTS, LIMITED PATENTS, AND PATENT APPLICATIONS

FIGURE 23 PUBLICATION TRENDS - LAST TEN YEARS

6.11.4 INSIGHTS

6.11.5 LEGAL STATUS OF PATENTS

FIGURE 24 LEGAL STATUS

FIGURE 25 JURISDICTION ANALYSIS

6.11.6 TOP COMPANIES/APPLICANTS

FIGURE 26 TOP APPLICANTS OF CORRUGATED BOXES

TABLE 11 LIST OF PATENTS BY FUJIAN WENSONG COLOR PRINTING CO LTD.

TABLE 12 LIST OF PATENTS BY CHANGZHOU DINGFENG PAPER PRODUCTS CO LTD

TABLE 13 LIST OF PATENTS BY CROWD PACKAGING LTD.

TABLE 14 LIST OF PATENTS BY GEORGIA-PACIFIC CORRUGATED LLC

TABLE 15 LIST OF TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6.12 IMPACT OF COVID-19 IMPACT ON THE CORRUGATED BOXES MARKET

6.12.1 INTRODUCTION

6.12.2 IMPACT OF COVID-19 ON THE CORRUGATED BOXES MARKET

6.13 RANGE SCENARIO ANALYSIS

FIGURE 27 RANGE SCENARIO FOR CORRUGATED BOXES MARKET

6.13.1 OPTIMISTIC SCENARIO

6.13.2 PESSIMISTIC SCENARIO

6.13.3 REALISTIC SCENARIO

7 CORRUGATED BOXES MARKET, BY MATERIAL (Page No. - 90)

7.1 INTRODUCTION

FIGURE 28 LINERBOARD SEGMENT DOMINATED THE CORRUGATED BOXES MARKET IN 2020

TABLE 16 CORRUGATED BOXES MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 17 CORRUGATED BOXES MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METERS)

7.2 LINERBOARD

7.2.1 HIGH STRENGTH AND MOISTURE-RESISTANCE TO BOOST MARKET

TABLE 18 LINERBOARD: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 19 LINERBOARD: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019-2026 (MILLION SQUARE METERS)

7.3 MEDIUM

7.3.1 RECYCLABILITY AND SUSTAINABILITY TO BOOST MARKET

TABLE 20 MEDIUM: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 21 MEDIUM: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METERS)

7.4 OTHERS

7.4.1 STARCH OFFERS MOISTURE-RESISTANCE AND IS EXPECTED TO BOOST MARKET

TABLE 22 OTHERS: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 23 OTHERS: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METERS)

8 CORRUGATED BOXES MARKET, BY PRINTING INK (Page No. - 96)

8.1 INTRODUCTION

FIGURE 29 WATER-BASED INK SEGMENT TO DOMINATE CORRUGATED BOXES MARKET

TABLE 24 CORRUGATED BOXES MARKET SIZE, BY PRINTING INK, 2019–2026(USD MILLION)

TABLE 25 CORRUGATED BOXES MARKET SIZE, BY PRINTING INK, 2019–2026 (MILLION SQUARE METER)

8.2 WATER-BASED INK

8.2.1 HIGH STABILITY OF WATER-BASED INK DRIVING MARKET

TABLE 26 WATER-BASED INKBY IN: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026 (USD MILLION)

TABLE 27 WATER-BASED INK: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026 (MILLION SQUARE METER)

8.3 UV-CURABLE INKS

8.3.1 ENVIRONMENTAL BENEFITS, HIGH SPEED, AND FASTER TURNAROUND TIME TO BOOST THE GROWTH

TABLE 28 UV-CURABLE INKS: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026(USD MILLION)

TABLE 29 UV-CURABLE INKS: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026(MILLION SQUARE METER)

8.4 HOT MELT-BASED INKS

8.4.1 FLEXIBILITY AND EASE OF WORKABILITY TO DRIVE MARKET

TABLE 30 HOT-MELT-BASED INKS: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026 (USD MILLION)

TABLE 31 HOT-MELT-BASED INKS: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026 (MILLION SQUARE METER)

8.5 SOLVENT-BASED INKS

8.5.1 LOW COST TO BOOST MARKET

TABLE 32 SOLVENT-BASED INKS: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026 (USD MILLION)

TABLE 33 SOLVENT-BASED INKS: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026 (MILLION SQUARE METER)

9 CORRUGATED BOXES MARKET, BY PRINTING TECHNOLOGY (Page No. - 103)

9.1 INTRODUCTION

FIGURE 30 FLEXOGRAPHY PRINTING SEGMENT TO DOMINATE CORRUGATED BOXES MARKET

TABLE 34 CORRUGATED BOXES MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026(USD MILLION)

TABLE 35 CORRUGATED BOXES MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION SQUARE METER)

9.2 FLEXOGRAPHY PRINTING

9.2.1 ECONOMICAL FLEXOGRAPHY PRINTING DRIVING THE MARKET

TABLE 36 FLEXOGRAPHY PRINTING: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026 (USD MILLION)

TABLE 37 FLEXOGRAPHY PRINTING: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026 (MILLION SQUARE METER)

9.3 LITHOGRAPHY PRINTING

9.3.1 HIGH STRENGTH OF CUK TO BOOST GROWTH

9.3.2 HIGHER IMAGE QUALITY TO DRIVE LITHOGRAPHY PRINTING SEGMENT

TABLE 38 LITHOGRAPHY PRINTING: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026(USD MILLION)

TABLE 39 LITHOGRAPHY PRINTING: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026(MILLION SQUARE METER)

9.4 DIGITAL PRINTING

9.4.1 DIRECT PRINTING OPTION TO DRIVE MARKET

TABLE 40 DIGITAL PRINTING: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026 (USD MILLION)

TABLE 41 DIGITAL PRINTING: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026 (MILLION SQUARE METER)

9.5 OTHERS

9.5.1 SCREEN PRINTING

9.5.2 GRAVURE PRINTING

9.5.3 OFFSET PRINTING

TABLE 42 OTHERS: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026 (USD MILLION)

TABLE 43 OTHERS: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026 (MILLION SQUARE METER)

10 CORRUGATED BOXES MARKET, BY TYPE (Page No. - 110)

10.1 INTRODUCTION

FIGURE 31 SLOTTED BOXES SEGMENT DOMINATED THE CORRUGATED BOXES MARKET IN 2020

TABLE 44 SLOTTED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 45 SLOTTED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

10.2 SLOTTED BOX

10.2.1 RISING DEMAND FROM E-COMMERCE TO BOOST MARKET

TABLE 46 SLOTTED BOXES: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 47 SLOTTED BOXES: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

10.2.2 REGULAR SLOTTED CONTAINERS (RSC)

10.2.3 HALF SLOTTED CONTAINERS (HSC)

10.2.4 FULL OVERLAP SLOTTED BOXES (FOL)

10.3 TELESCOPE BOXES

10.3.1 HIGH DEMAND FROM PERSONAL CARE INDUSTRY TO BOOST MARKET

TABLE 48 TELESCOPE BOXES: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 49 TELESCOPE BOXES: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

10.3.2 FULL TELESCOPE DESIGN CONTAINER

10.3.3 HALF TELESCOPE DESIGN CONTAINER

10.4 RIGID BOXES

10.4.1 HIGH DEMAND FROM HEAVY GOODS INDUSTRY TO BOOST MARKET

TABLE 50 RIGID BOXES: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 51 RIGID BOXES: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

10.5 FOLDER BOXES

TABLE 52 FOLDER BOXES: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 53 FOLDER BOXES: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

10.5.1 ONE-PIECE FOLDER

10.5.2 FIVE-PANEL FOLDER

11 CORRUGATED BOXES MARKET, BY END-USE INDUSTRY (Page No. - 117)

11.1 INTRODUCTION

FIGURE 32 FOOD & BEVERAGES SEGMENT TO LEAD CORRUGATED BOXES MARKET DURING FORECAST PERIOD

TABLE 54 CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 55 CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

11.2 FOOD & BEVERAGES

11.2.1 GROWING DEMAND FOR PACKAGED AND BRANDED PRODUCTS TO BOOST MARKET

TABLE 56 FOOD & BEVERAGES: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026 (USD MILLION)

TABLE 57 FOOD & BEVERAGES: CORRUGATED BOXES MARKET SIZE BY REGION, 2019–2026 (MILLION SQUARE METER)

11.3 ELECTRONIC GOODS

11.3.1 PROTECTION DURING TRANSPORTATION TO BOOST MARKET

TABLE 58 ELECTRONIC GOODS: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 59 ELECTRONIC GOODS: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

11.4 HOME & PERSONAL CARE

11.4.1 AFFORDABLE SMALL PACK SIZE PACKAGING TO BOOST MARKET

TABLE 60 HOME & PERSONAL CARE GOODS: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 61 HOME & PERSONAL CARE: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

11.5 CHEMICALS

11.5.1 PROTECTION AND SAFETY FOR BULKY AND HAZARDOUS PRODUCTS TO BOOST MARKET

TABLE 62 CHEMICALS: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 63 CHEMICALS: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

11.6 TEXTILE

11.6.1 HIGH LOAD-BEARING CAPACITY FOR TEXTILE PRODUCTS TO BOOST MARKET

TABLE 64 TEXTILE: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 65 TEXTILE: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

11.7 GLASSWARE & CERAMICS

11.7.1 IDEAL PROTECTION FOR FRAGILE ITEMS TO BOOST MARKET

TABLE 66 GLASSWARE & CERAMICS: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 67 GLASSWARE & CERAMICS: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

11.8 PAPER PRODUCTS

11.8.1 COST-EFFECTIVENESS OF CORRUGATED BOXES TO BOOST MARKET

TABLE 68 PAPER PRODUCTS: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 69 PAPER PRODUCTS: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

11.9 OTHERS

11.9.1 COST-EFFECTIVENESS OF CORRUGATED BOXES TO BOOST MARKET

TABLE 70 OTHERS: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 71 OTHERS: CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

12 CORRUGATED BOXES MARKET, BY REGION (Page No. - 128)

12.1 INTRODUCTION

FIGURE 33 MARKET IN ASIA PACIFIC TO GROW AT FASTEST RATE DURING FORECAST PERIOD

TABLE 72 CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 73 CORRUGATED BOXES MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

TABLE 74 CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 76 CORRUGATED BOXES MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 77 CORRUGATED BOXES MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 78 CORRUGATED BOXES MARKET SIZE, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 79 CORRUGATED BOXES MARKET SIZE, BY PRINTING INK, 2019–2026 (MILLION SQUARE METER)

TABLE 80 CORRUGATED BOXES MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 81 CORRUGATED BOXES MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION SQUARE METER)

TABLE 82 CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 83 CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.2 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: CORRUGATED BOXES MARKET SNAPSHOT

TABLE 84 ASIA PACIFIC: CORRUGATED BOXES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 85 ASIA PACIFIC: CORRUGATED BOXES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 86 ASIA PACIFIC: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 ASIA PACIFIC: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 88 ASIA PACIFIC: CORRUGATED BOXES MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 89 ASIA PACIFIC: CORRUGATED BOXES MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 90 ASIA PACIFIC: CORRUGATED BOXES MARKET SIZE, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 91 ASIA PACIFIC: CORRUGATED BOXES MARKET SIZE, BY PRINTING INK, 2019–2026 (MILLION SQUARE METER)

TABLE 92 ASIA PACIFIC: CORRUGATED BOXES MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 93 ASIA PACIFIC: CORRUGATED BOXES MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION SQUARE METER)

TABLE 94 ASIA PACIFIC: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 95 ASIA PACIFIC: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.2.1 CHINA

12.2.1.1 Boost in paper production in the country to fuel the growth of corrugated boxes

TABLE 96 CHINA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 CHINA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 98 CHINA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 99 CHINA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.2.2 JAPAN

12.2.2.1 Rising demand from healthcare industry to accelerate market growth

TABLE 100 JAPAN: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 JAPAN: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 102 JAPAN: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 103 JAPAN: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.2.3 INDIA

12.2.3.1 Growing food industry and rapid industrialization are driving market

TABLE 104 INDIA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 105 INDIA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 106 INDIA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 107 INDIA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.2.4 SOUTH KOREA

12.2.4.1 Growing consumer demand for eco-friendly packaging market

TABLE 108 SOUTH KOREA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 SOUTH KOREA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 110 SOUTH KOREA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 111 SOUTH KOREA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.2.5 INDONESIA

TABLE 112 INDONESIA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 113 INDONESIA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 114 INDONESIA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 115 INDONESIA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.2.6 REST OF ASIA PACIFIC

TABLE 116 REST OF ASIA PACIFIC: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 117 REST OF ASIA PACIFIC: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 118 REST OF ASIA PACIFIC: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 119 REST OF ASIA PACIFIC: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.3 NORTH AMERICA

FIGURE 35 NORTH AMERICA: CORRUGATED BOXES MARKET SNAPSHOT

TABLE 120 NORTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 121 NORTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 122 NORTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 NORTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 124 NORTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 125 NORTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 126 NORTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 127 NORTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY PRINTING INK, 2019–2026 (MILLION SQUARE METER)

TABLE 128 NORTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 129 NORTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION SQUARE METER)

TABLE 130 NORTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 131 NORTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.3.1 US

12.3.1.1 Presence of established players to lead market in 2026

TABLE 132 US: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 133 US: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 134 US: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 135 US: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.3.2 CANADA

12.3.2.1 Rising demand from food & beverages and home & personal care industries drives market growth

TABLE 136 CANADA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 137 CANADA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 138 CANADA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 139 CANADA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.3.3 MEXICO

12.3.3.1 The food & beverage and home & personal care sectors to boost market

TABLE 140 MEXICO: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 141 MEXICO: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 142 MEXICO: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 143 MEXICO: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.4 EUROPE

FIGURE 36 EUROPE: CORRUGATED BOXES MARKET SNAPSHOT

TABLE 144 EUROPE: CORRUGATED BOXES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 145 EUROPE: CORRUGATED BOXES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 146 EUROPE: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 147 EUROPE: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 148 EUROPE: CORRUGATED BOXES MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 149 EUROPE: CORRUGATED BOXES MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 150 EUROPE: CORRUGATED BOXES MARKET SIZE, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 151 EUROPE: CORRUGATED BOXES MARKET SIZE, BY PRINTING INK, 2019–2026 (MILLION SQUARE METER)

TABLE 152 EUROPE: CORRUGATED BOXES MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 153 EUROPE: CORRUGATED BOXES MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION SQUARE METER)

TABLE 154 EUROPE: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 155 EUROPE: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.4.1 GERMANY

12.4.1.1 Market in Germany is growing due to high demand from food & beverage industry

TABLE 156 GERMANY: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 157 GERMANY: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 158 GERMANY: CORRUGATED BOXES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 159 GERMANY: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.4.2 FRANCE

12.4.2.1 Growing healthcare industry to boost market

TABLE 160 FRANCE: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 161 FRANCE: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 162 FRANCE: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 163 FRANCE: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.4.3 UK

12.4.3.1 Growth of food industry to offer lucrative market opportunities

TABLE 164 UK: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 165 UK: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 166 UK: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 167 UK: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.4.4 ITALY

12.4.4.1 Increasing demand from the retail, food, and healthcare industries to drive market

TABLE 168 ITALY: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 169 ITALY: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 170 ITALY: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 171 ITALY: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.4.5 SPAIN

12.4.5.1 Increasing demand from electronic and electrical industries to drive market

TABLE 172 SPAIN: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 173 SPAIN: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 174 SPAIN: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 175 SPAIN: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.4.6 REST OF EUROPE

TABLE 176 REST OF EUROPE: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 177 REST OF EUROPE: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 178 REST OF EUROPE: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 179 REST OF EUROPE: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.5 MIDDLE EAST & AFRICA

TABLE 180 MIDDLE EAST & AFRICA: CORRUGATED BOXES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: CORRUGATED BOXES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 182 MIDDLE EAST & AFRICA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 183 MIDDLE EAST & AFRICA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 184 MIDDLE EAST & AFRICA: CORRUGATED BOXES MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: CORRUGATED BOXES MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 186 MIDDLE EAST & AFRICA: CORRUGATED BOXES MARKET SIZE, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 187 MIDDLE EAST & AFRICA: CORRUGATED BOXES MARKET SIZE, BY PRINTING INK, 2019–2026 (MILLION SQUARE METER)

TABLE 188 MIDDLE EAST & AFRICA: CORRUGATED BOXES MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 189 MIDDLE EAST & AFRICA: CORRUGATED BOXES MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION SQUARE METER)

TABLE 190 MIDDLE EAST & AFRICA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.5.1 SAUDI ARABIA

12.5.1.1 Saudi Arabia to be fastest-growing market in the region

TABLE 192 SAUDI ARABIA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 193 SAUDI ARABIA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 194 SAUDI ARABIA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 195 SAUDI ARABIA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.5.2 UAE

12.5.2.1 Rising preference for sustainable packaging to drive market

TABLE 196 UAE: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 197 UAE: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 198 UAE: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 199 UAE: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.5.3 SOUTH AFRICA

12.5.3.1 Increasing industrialization and urbanization to drive market

TABLE 200 SOUTH AFRICA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 201 SOUTH AFRICA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 202 SOUTH AFRICA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 203 SOUTH AFRICA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 204 REST OF MIDDLE EAST & AFRICA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 205 REST OF MIDDLE EAST & AFRICA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 206 REST OF MIDDLE EAST & AFRICA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 207 REST OF MIDDLE EAST & AFRICA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.6 SOUTH AMERICA

TABLE 208 SOUTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 209 SOUTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 210 SOUTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 211 SOUTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 212 SOUTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 213 SOUTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 214 SOUTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 215 SOUTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY PRINTING INK, 2019–2026 (MILLION SQUARE METER)

TABLE 216 SOUTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 217 SOUTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION SQUARE METER)

TABLE 218 SOUTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 219 SOUTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.6.1 BRAZIL

12.6.1.1 Brazil to dominate market due to increasing online shopping in South America

TABLE 220 BRAZIL: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 221 BRAZIL: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 222 BRAZIL: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 223 BRAZIL: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.6.2 ARGENTINA

12.6.2.1 Increasing demand from food & beverages, chemical, electronic, and pharmaceutical industries expected to drive market in Argentina

TABLE 224 ARGENTINA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 225 ARGENTINA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 226 ARGENTINA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 227 ARGENTINA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

12.6.3 REST OF SOUTH AMERICA

TABLE 228 REST OF SOUTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 229 REST OF SOUTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 230 REST OF SOUTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 231 REST OF SOUTH AMERICA: CORRUGATED BOXES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METER)

13 COMPETITIVE LANDSCAPE (Page No. - 192)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 232 COMPANIES ADOPTED EXPANSIONS AS KEY GROWTH STRATEGY DURING 2017–2021

13.3 MARKET RANKING

FIGURE 37 MARKET RANKING OF KEY PLAYERS, 2020

13.3.1 RENGO CO., LTD.

13.3.2 MONDI GROUP

13.3.3 DS SMITH

13.3.4 SMURFIT KAPPA GROUP

13.3.5 INTERNATIONAL PAPER

13.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 38 REVENUE ANALYSIS FOR KEY COMPANIES IN CORRUGATED BOXES MARKET

13.5 MARKET SHARE ANALYSIS

TABLE 233 CORRUGATED BOXES MARKET: SHARES OF KEY PLAYERS

FIGURE 39 SHARE OF LEADING COMPANIES IN CORRUGATED BOXES MARKET

13.6 COMPANY EVALUATION QUADRANT

FIGURE 40 COMPETITIVE LEADERSHIP MAPPING: CORRUGATED BOXES MARKET, 2020

13.6.1 STAR

13.6.2 PERVASIVE

13.6.3 EMERGING LEADER

13.6.4 PARTICIPANT

13.7 COMPETITIVE BENCHMARKING

FIGURE 41 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 42 BUSINESS STRATEGY EXCELLENCE

TABLE 234 COMPANY MATERIAL FOOTPRINT

TABLE 235 COMPANY PRINTING INK FOOTPRINT

TABLE 236 COMPANY PRINTING TECHNOLOGY FOOTPRINT

TABLE 237 COMPANY TYPE FOOTPRINT

FIGURE 43 COMPANY APPLICATION FOOTPRINT

TABLE 238 COMPANY REGION FOOTPRINT

13.8 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES)

13.8.1 PROGRESSIVE COMPANIES

13.8.2 RESPONSIVE COMPANIES

13.8.3 STARTING BLOCKS

13.8.4 DYNAMIC COMPANIES

FIGURE 44 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES), 2020

13.9 COMPETITIVE SCENARIO AND TRENDS

13.9.1 DEALS

TABLE 239 CORRUGATED BOXES MARKET: DEALS, JANUARY 2017–NOVEMBER 2021

13.9.2 OTHERS

TABLE 240 CORRUGATED BOXES MARKET: OTHERS, JANUARY 2017–AUGUST 2021

14 COMPANY PROFILES (Page No. - 211)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

14.1 MAJOR PLAYERS

14.1.1 MONDI GROUP

TABLE 241 MONDI GROUP: BUSINESS OVERVIEW

FIGURE 45 MONDI GROUP: COMPANY SNAPSHOT

TABLE 242 MONDI GROUP: NEW PRODUCT LAUNCHES

14.1.2 INTERNATIONAL PAPER

TABLE 243 INTERNATIONAL PAPER: BUSINESS OVERVIEW

FIGURE 46 INTERNATIONAL PAPER: COMPANY SNAPSHOT

14.1.3 WESTROCK COMPANY

TABLE 244 WESTROCK COMPANY: BUSINESS OVERVIEW

FIGURE 47 WESTROCK COMPANY: COMPANY SNAPSHOT

14.1.4 DS SMITH

TABLE 245 DS SMITH: BUSINESS OVERVIEW

FIGURE 48 DS SMITH: COMPANY SNAPSHOT

TABLE 246 DS SMITH: NEW PRODUCT LAUNCHES

14.1.5 SMURFIT KAPPA GROUP

TABLE 247 SMURFIT KAPPA GROUP: BUSINESS OVERVIEW

FIGURE 49 SMURFIT KAPPA GROUP: COMPANY SNAPSHOT

TABLE 248 SMURFIT KAPPA GROUP: NEW PRODUCT LAUNCHES

14.1.6 RENGO CO., LTD.

TABLE 249 RENGO CO., LTD.: BUSINESS OVERVIEW

FIGURE 50 RENGO CO., LTD.: COMPANY SNAPSHOT

14.1.7 CASCADES INC.

TABLE 250 CASCADES INC.: BUSINESS OVERVIEW

FIGURE 51 CASCADES INC.: COMPANY SNAPSHOT

TABLE 251 CASCADES INC.: NEW PRODUCT LAUNCHES

14.1.8 PACKAGING CORPORATION OF AMERICA

TABLE 252 PACKAGING CORPORATION OF AMERICA: BUSINESS OVERVIEW

FIGURE 52 PACKAGING CORPORATION OF AMERICA: COMPANY SNAPSHOT

14.1.9 GEORGIA-PACIFIC, LLC

TABLE 253 GEORGIA-PACIFIC, LLC: BUSINESS OVERVIEW

TABLE 254 GEORGIA-PACIFIC, LLC.: NEW PRODUCT LAUNCHES

14.1.10 NINE DRAGONS WORLDWIDE (CHINA) INVESTMENT GROUP CO., LTD.

TABLE 255 NINE DRAGONS WORLDWIDE (CHINA) INVESTMENT GROUP CO., LTD.: BUSINESS OVERVIEW

FIGURE 53 NINE DRAGONS WORLDWIDE (CHINA) INVESTMENT GROUP CO., LTD.: COMPANY SNAPSHOT

Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

14.2 ADDITIONAL PLAYERS

14.2.1 FEDERAL INDUSTRIES CORPORATION

14.2.2 NIPPON PAPER INDUSTRIES CO., LTD.

14.2.3 ICUSTOMBOXES

14.2.4 STORA ENSO

14.2.5 SVENSKA CELLULOSA AKTIEBOLAGET

14.2.6 SAPPI

14.2.7 BRØDRENE HARTMANN

14.2.8 UFP TECHNOLOGIES

14.2.9 DELUXE PACKAGING

14.2.10 LARSEN PACKAGING PRODUCTS, INC.

14.2.11 ORCON INDUSTRIES

14.2.12 TRIDENT PAPER BOX INDUSTRIES

14.2.13 TGI PACKAGING PVT. LTD.

14.2.14 KAPCO PACKAGING

14.2.15 AVON PACFO SERVICES PVT. LTD.

15 APPENDIX (Page No. - 265)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

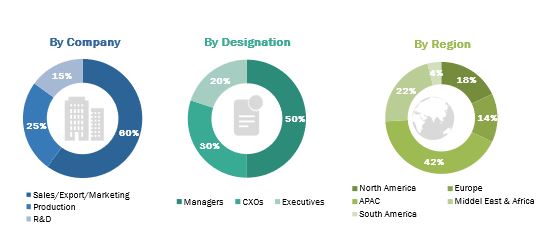

The study involved four major activities in estimating the current market size for the corrugated boxes market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding various trends related to process, end-use sector, and region. Stakeholders from the demand side, such as automobile, industrial, building & construction companies, and other companies of the customer/end users who are using aluminum cast products were interviewed to understand the buyers’ perspective on suppliers, products, service providers, and their current use of corrugated boxes and outlook of their business, which will affect the overall market.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the corrugated boxes market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global corrugated boxes market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the corrugated boxes market based on process and end-use

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, South America, and Middle East & Africa along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, merger & acquisition, collaboration, and new product developments in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations

- MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

- The following customization options are available for the report

Corrugated Packaging Market Overview

Corrugated Packaging Industry Trends

Top Companies in Corrugated Packaging Market

Corrugated Packaging Market Impact on Different Industries

Speak to our Analyst today to know more about corrugated packaging Market!

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Corrugated Boxes Market