Insulated Packaging Market by Material (Plastic, Wood, Corrugated Cardboard, Glass), Application (Food & Beverages, Industrial, Pharmaceutical, Cosmetics), Packaging Type, Type (Rigid, Flexible, Semi-rigid) and Region - Global Forecast to 2025

Updated on : June 18, 2024

Insulated Packaging Market

The global insulated packaging market was valued at USD 11.4 billion in 2020 and is projected to reach USD 15.8 billion by 2025, growing at 6.7% cagr from 2020 to 2025. The driving factors for the market is its growing demand from automotive industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Insulated Packaging Market

The global Insulated packaging market includes major Tier I and II suppliers like as Deutsche Post DHL (Germany), E. I. Du Pont De Nemours and Co. (US), Amcor Limited (Australia), Sonoco Products Company (US), and Huhtamaki OYJ (Finland). These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, and Rest of the World. COVID-19 has impacted their businesses as well.

These players have announced the suspension of production due to the lowered demand, supply chain bottlenecks, and to protect the safety of their employees in the US, France, Germany, Italy, and Spain during the COVID-19 pandemic. As a result, the demand for insulated packaging is expected to decline in 2020. Manufacturers are likely to adjust production to prevent bottlenecks and plan production according to demand from tier 1 manufacturers.

Insulated Packaging Market Dynamics

Driver: Surging demand for temperature-sensitive goods

Globalization has reduced the distance between different regions of the world. Owing to this, the imports and exports among different countries are increasing. Several types of goods can be damaged by shocks, while some can be damaged due to temperature variations. Insulated packaging is the only solution for goods that require special temperature conditions. The growth of the pharmaceuticals and food & beverages industries has led to an increased demand for temperature-sensitive goods.

Changing lifestyles and high disposable incomes have led to people relying on processed and packaged food products as well as luxury products. Processed and frozen products are generally ready-to-eat meals, which help the working population save the time and efforts required to cook proper meals. Insulated packaging is required for products such as frozen foods, fish, meat, vegetables, fruits, and medical supplies to keep them at stable temperature regardless of the conditions outside the packaging.

The key factors for the growing demand for insulated packaging are growing global manufacturing output and increasing consumer spending on packaged goods worldwide.

Restraint: Increasing raw material costs

The manufacturers of insulated materials are facing a shortage of primary raw materials, such as plastic, glass, paper, and metal. Volatile currency exchange rates lead to an increase in the prices of raw materials from international markets. Raw material manufacturers are facing intense competition for margins due to the volatile prices of materials and chemicals. The increased price of crude oil is the major obstacle for the development of polymers, such as polyurethane, polyethylene, and polystyrene.

The increasing cost forces manufacturers to utilize recycled agriculture waste, recycled paper, and plastic waste as raw materials. Advanced research & development is required to develop substitute materials for insulated packaging. Thus, increasing raw material costs and the requirement of advanced R&D are restraining the market’s growth.

Opportunity: High growth potential in developing countries

High growth potential in developing countries such as Brazil, India, and China provides significant opportunities for the logistics of insulated packaged products. These countries also offer extensive availability of raw materials. Strong economic development in China and India has provided a stimulus for the manufacturing sector, including food & beverages, automobile, electronics, and chemicals. The Chinese production sector is gaining the benefits of the low cost of labor. This market is driven by the growing use of packaging across various food products, particularly meat, fish, and poultry products.

The rising consumption of ready meals and other convenience-oriented products is also driving the insulated packaging market in European countries such as France, Germany, Russia, and the UK. Considering the increasing urban population and the development of the manufacturing sector in developing economies, packaging companies need to explore the untapped potential in these developing countries to optimize their market share.

Challenges: Fluctuations in prices of raw materials

The increasing prices of raw materials, such as plastic, metals, paper, and glass, adversely affect the operations in the packaging industry. The prices of other raw materials, such as water and fuel, are also increasing due to weather conditions, market fluctuations, exchange rates, currency control, and government control. Fluctuations in raw material prices increase the operating cost, resulting in expensive end products.

Continuous fluctuations in the supply of raw materials lead to a significant increase in prices and delay production. This disruption in the demand and supply cycle can adversely affect the packaging industry.

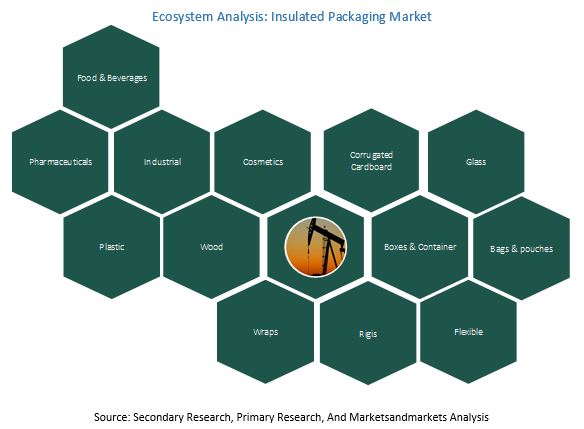

Insulated Packaging Market Ecosystem

The Insulated packaging market is projected to register a CAGR of 6.7% during the forecast period, in terms of value.

The global Insulated packaging market is estimated to be USD 11.4 billion in 2020 and is projected to reach USD 15.8 billion by 2025, at a CAGR of 6.7% from 2020 to 2025. The market is witnessing moderate growth, owing to increasing application, technological advancements, and growing demand for these insulated packaging in the Asia Pacific and Europe. Insulated packaging are largely used in the iron & steel industry. The increasing use of insulated packaging and the rising construction activities is driving the insulated packaging market. Strict environmental and government regulations is the restraints for the Insulated packaging market.

Food & Beverages segment is expected to lead the Insulated packaging market during the forecast period.

The food & beverages industry will continue to lead the Insulated packaging market, , accounting for a share of 33.3% of the overall market, in 2019 terms of value. This was due to the increasing demand for vehicles development and mounting demand for consumer goods such as automobiles. The increasing preference for high-cost, high-performance insulated packaging is driven by the need to improve the quality of life, health & environment, and shift to clean, alternative sources of manufacturing.

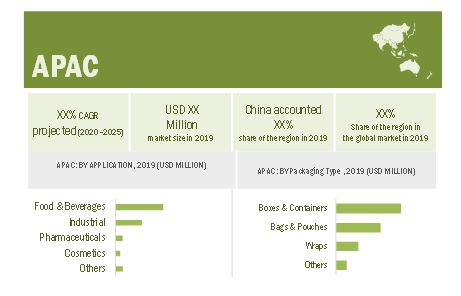

Asia Pacific is the largest market for Insulated packaging.

Asia Pacific accounted for the largest share of the Insulated packaging market in 2020. Factors such as the rapidly increasing consumption of insulated packaging in the food & beverages and pharamaceuticals industries in countries such as China, Japan, and India have led to an increased demand for Insulated packaging in the Asia Pacific region.

Insulated Packaging Market Players

Insulated packaging is a diversified and competitive market with a large number of global players and few regional and local players. Deutsche Post DHL (Germany), E. I. Du Pont De Nemours and Co. (US), Amcor Limited (Australia), Sonoco Products Company (US), and Huhtamaki OYJ (Finland) are some of the key players in the market.

Recent Developments

- In June 2019, Amcor acquired Bemis Company Inc. The combined company will now operate as Amcor plc (Amcor), trading on the New York Stock Exchange under the ticker symbol AMCR and on the Australian Securities Exchange under the ticker symbol AMC.

- In August 2020, Sonoco acquired Can Packaging, a privately-owned designer and manufacturer of sustainable paper packaging and related manufacturing equipment, based in Habsheim, France, for approximately USD 49 million. >

- In March 2020, Huhtamaki acquired full ownership of its joint venture company Laminor S.A. in Brazil. Laminor is specialized in high-quality tube laminates, particularly for oral care applications, and was set up in 2002 as a 50–50 joint venture together with Bemis Company, which is now part of Amcor.

Frequently Asked Questions (FAQ):

Does this report cover volume tables in addition to the value tables?

Yes, volume tables are provided for each segment except offering.

Which countries are considered in the European region?

The report includes the following European countries

- Germany

- U.K.

- Italy

- Russia

- France

- Rest of Europe

What is the COVID-19 impact on the insulated packaging market?

Industry experts believe that COVID-19 would have a impact on insulated packaging market as there is an increase in demand for insulated packaging in various industries such as food & Beverafes and pharamceuticals. Furthermore, they also believe that the market will rebound in Q4 in 2020. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 UNIT

1.7 STAKEHOLDERS

1.8 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 SUPPLY-SIDE ANALYSIS

2.3 MARKET NUMBER ESTIMATION

2.3.1 FORECAST

2.4 DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 31)

3.1 EVOLUTION OF INSULATED PACKAGING

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 ATTRACTIVE OPPORTUNITIES IN INSULATED PACKAGING MARKET

4.2 INSULATED PACKAGING MARKET, BY MATERIAL

4.3 INSULATED PACKAGING MARKET, BY TYPE

4.4 INSULATED PACKAGING MARKET, BY APPLICATION AND REGION

5 MARKET OVERVIEW (Page No. - 36)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Surging demand for temperature-sensitive goods

5.2.1.2 Increasing global urban population

5.2.1.3 Growing e-commerce industry

5.2.2 RESTRAINTS

5.2.2.1 Increasing raw material costs

5.2.2.2 Stringent government regulations

5.2.3 OPPORTUNITIES

5.2.3.1 High growth potential in developing countries

5.2.3.2 Growth in pharmaceuticals industry

5.2.4 CHALLENGES

5.2.4.1 Fluctuations in prices of raw materials

6 INDUSTRY TRENDS (Page No. - 42)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

6.2.1 MAJOR VALUE ADDITION TAKES PLACE IN THE MANUFACTURING AND ASSEMBLY OF INSULATED PACKAGING

6.3 SUPPLY CHAIN ANALYSIS

6.3.1 PROMINENT COMPANIES

6.3.2 SMALL & MEDIUM ENTERPRISES

6.4 IMPACT OF COVID-19 ON INSULATED PACKAGING MATERIALS MARKET

6.4.1 IMPACT OF COVID-19 ON SUPPLY CHAIN

6.5 REGULATIONS

6.6 PORTER’S FIVE FORCES FRAMEWORK

6.6.1 THREAT OF NEW ENTRANTS

6.6.2 THREAT OF SUBSTITUTES

6.6.3 BARGAINING POWER OF SUPPLIERS

6.6.4 BARGAINING POWER OF BUYERS

6.6.5 INTENSITY OF COMPETITIVE RIVALRY

6.7 MACROECONOMIC FACTORS

6.7.1 INTRODUCTION

6.7.2 TRENDS AND FORECAST OF GDP

6.7.3 RISING POPULATION

6.7.4 INCREASING MIDDLE-CLASS POPULATION, 2009-2030

6.7.5 PERSONAL CARE AND COSMETICS

6.8 THERMALLY INSULATING PACKAGING PATENT ANALYSIS.

6.8.1 METHODOLOGY:

6.8.2 DOCUMENT TYPE:

6.8.3 INSIGHT

6.8.4 TOP APPLICANTS.

7 INSULATED PACKAGING MARKET, BY MATERIAL TYPE (Page No. - 54)

7.1 INTRODUCTION

7.2 PLASTICS

7.2.1 MOST WIDELY USED PACKAGING MATERIAL ACROSS ALL APPLICATIONS

7.3 WOOD

7.3.1 FOOD & BEVERAGES SEGMENT HOLDS THE MAJOR SHARE IN WOOD INSULATED PACKAGING MARKET

7.4 CORRUGATED CARDBOARD

7.4.1 FOOD & BEVERAGES HOLDS A MAJOR SHARE IN CORRUGATED& CARDBOARD BOXES INSULATED MATERIAL TYPE MARKET

7.5 GLASS

7.5.1 DEMAND FOR GLASS INSULATED PACKAGING IS INCREASING IN THE PHARMACEUTICALS APPLICATION

7.6 OTHERS

8 INSULATED PACKAGING MARKET, BY APPLICATION (Page No. - 59)

8.1 INTRODUCTION

8.2 FOOD & BEVERAGES

8.2.1 DEMAND FOR READY TO SERVE PRODUCTS IS DRIVING THE MARKET

8.3 INDUSTRIAL

8.3.1 INCREASING TRADE AMONG COUNTRIES WILL DRIVE THE INSULATED PACKAGING MARKET IN THE INDUSTRIAL APPLICATION SEGMENT

8.4 PHARMACEUTICALS

8.4.1 GROWING AWARENESS REGARDING HEALTH AMONG CONSUMERS IS DRIVING THE MARKET FOR INSULATED PHARMACEUTICALS PACKAGING

8.5 COSMETICS

8.5.1 INNOVATIVE PACKAGING SOLUTIONS ARE EXPECTED TO DRIVE COSMETIC INSULATED PACKAGING MARKET

8.6 OTHERS

9 INSULATED PACKAGING MARKET, BY PACKAGING TYPE (Page No. - 63)

9.1 INTRODUCTION

9.2 BOXES & CONTAINERS

9.2.1 FOOD & BEVERAGES IS THE KEY APPLICATION OF BOXES & CONTAINERS

9.3 BAGS & POUCHES

9.3.1 FOOD & BEVERAGES IS A LARGE MARKET FOR BAGS & POUCHES

9.4 WRAPS

9.4.1 FOOD & BEVERAGES AND PHARMACEUTICALS ARE HIGH-GROWTH MARKETS FOR WRAPS

9.5 OTHERS

10 INSULATED PACKAGING MARKET, BY TYPE (Page No. - 67)

10.1 INTRODUCTION

10.2 RIGID

10.2.1 INDUSTRIAL PACKAGING TO DOMINATE RIGID INSULATED PACKAGING MARKET

10.3 FLEXIBLE

10.3.1 FOOD & BEVERAGES HOLDS THE MAJOR SHARE IN THE FLEXIBLE INSULATED PACKAGING MARKET

10.4 SEMI-RIGID

10.4.1 FOOD & BEVERAGES TO GROW AT THE HIGHEST CAGR IN SEMI-RIGID INSULATED PACKAGING MARKET

11 INSULATED PACKAGING MARKET, BY REGION (Page No. - 70)

11.1 INTRODUCTION

11.2 APAC

11.2.1 IMPACT OF COVID-19 ON INSULATED PACKAGING MARKET IN APAC

11.2.2 CHINA

11.2.2.1 Growing awareness about non-eco-friendly packaging drives the market for insulated packaging in China

11.2.3 INDIA

11.2.3.1 Food & beverages segment holds the major share in Indian insulated packaging market

11.2.4 JAPAN

11.2.4.1 Flexible insulated packaging to grow at the highest rate in Japan

11.2.5 AUSTRALIA

11.2.5.1 Bags & pouches packaging type dominates the Australian insulated packaging market

11.2.6 REST OF APAC

11.3 EUROPE

11.3.1 IMPACT OF COVID-19 ON INSULATED PACKAGING MARKET IN EUROPE

11.3.2 GERMANY

11.3.2.1 Plastic material dominates the Germany insulated packaging market

11.3.3 UK

11.3.3.1 Growing demand from the pharmaceutical segment in UK drives the insulated packaging market

11.3.4 FRANCE

11.3.4.1 Bags & pouches to grow at the highest rate in France insulated packaging market

11.3.5 RUSSIA

11.3.5.1 Growing e-commerce sales drives the market in Russia

11.3.6 ITALY

11.3.6.1 Plastic material holds the major share in Italy insulated packaging market

11.3.7 REST OF EUROPE

11.4 NORTH AMERICA

11.4.1 IMPACT OF COVID-19 ON INSULATED PACKAGING MARKET IN NORTH AMERICA

11.4.2 US

11.4.2.1 Plastic material to grow at the highest CAGR in the US insulated packaging market

11.4.3 CANADA

11.4.3.1 Food & beverages segment to grow at the highest rate in the Canadian insulated packaging market

11.4.4 MEXICO

11.4.4.1 Boxes & containers segment dominates the Mexico insulated packaging market

11.5 REST OF THE WORLD

11.5.1 IMPACT OF COVID-19 INSULATED PACKAGING MARKET IN ROW

11.5.2 BRAZIL

11.5.2.1 Plastic segment to grow at the highest CAGR in Brazil insulated packaging market

11.5.3 ARGENTINA

11.5.3.1 Food & beverages segment holds the major share in Argentina insulated packaging market

11.5.4 SOUTH AFRICA

11.5.4.1 Flexible insulated packaging to dominate South African market

11.5.5 OTHERS

12 COMPETITIVE LANDSCAPE (Page No. - 139)

12.1 OVERVIEW

12.2 MARKET RANKING ANALYSIS

12.3 COMPETITIVE SCENARIO

12.3.1 MERGERS & ACQUISITIONS

12.3.2 EXPANSIONS

13 COMPANY PROFILES (Page No. - 144)

13.1 DEUTSCHE POST DHL

13.1.1 BUSINESS OVERVIEW

13.1.2 PRODUCTS OFFERED

13.1.3 RECENT DEVELOPMENTS

13.1.4 SWOT ANALYSIS

13.1.5 WINNING IMPERATIVES

13.1.6 CURRENT FOCUS AND STRATEGIES

13.1.7 THREAT FROM COMPETITION

13.1.8 RIGHT TO WIN

13.2 E.I. DU PONT DE NEMOURS AND CO.

13.2.1 BUSINESS OVERVIEW

13.2.2 PRODUCTS OFFERED

13.2.3 RECENT DEVELOPMENTS

13.2.4 SWOT ANALYSIS

13.2.5 WINNING IMPERATIVES

13.2.6 CURRENT FOCUS AND STRATEGIES

13.2.7 THREAT FROM COMPETITION

13.2.8 RIGHT TO WIN

13.3 AMCOR LIMITED

13.3.1 BUSINESS OVERVIEW

13.3.2 PRODUCTS OFFERED

13.3.3 RECENT DEVELOPMENTS

13.3.4 SWOT ANALYSIS

13.3.5 WINNING IMPERATIVES

13.3.6 CURRENT FOCUS AND STRATEGIES

13.3.7 THREAT FROM COMPETITION

13.3.8 RIGHT TO WIN

13.4 SONOCO PRODUCTS COMPANY

13.4.1 BUSINESS OVERVIEW

13.4.2 PRODUCTS OFFERED

13.4.3 RECENT DEVELOPMENTS

13.4.4 SWOT ANALYSIS

13.4.5 WINNING IMPERATIVES

13.4.6 CURRENT FOCUS AND STRATEGIES

13.4.7 THREAT FROM COMPETITORS

13.4.8 RIGHT TO WIN

13.5 HUHTAMAKI OYJ

13.5.1 BUSINESS OVERVIEW

13.5.2 PRODUCTS OFFERED

13.5.3 RECENT DEVELOPMENTS

13.5.4 SWOT ANALYSIS

13.5.5 WINNING IMPERATIVES

13.5.6 CURRENT FOCUS AND STRATEGIES

13.5.7 THREAT FROM COMPETITORS

13.5.8 RIGHT TO WIN

13.6 CONSTANTIA FLEXIBLES

13.6.1 BUSINESS OVERVIEW

13.6.2 PRODUCTS OFFERED

13.6.3 MNM VIEW

13.7 GREINER GROUP

13.7.1 BUSINESS OVERVIEW

13.7.2 PRODUCTS OFFERED

13.7.3 MNM VIEW

13.8 INNOVIA FILMS

13.8.1 BUSINESS OVERVIEW

13.8.2 PRODUCTS OFFERED

13.8.3 MNM VIEW

13.9 SOFRIGAM

13.9.1 BUSINESS OVERVIEW

13.9.2 PRODUCTS OFFERED

13.9.3 MNM VIEW

13.10 OTHER COMPANIES

13.10.1 INNOVATIVE ENERGY INC.

13.10.2 COLD ICE INC.

13.10.3 WINPAK

14 APPENDIX (Page No. - 170)

14.1 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.2 AVAILABLE CUSTOMIZATIONS

14.3 RELATED REPORTS

14.4 AUTHOR DETAILS

LIST OF TABLES (200 Tables)

TABLE 1 TRENDS AND FORECAST OF GDP, BY COUNTRY, 2016–2023 (USD MILLION)

TABLE 2 LIST OF PATENTS BY VERICOOL INC

TABLE 3 LIST OF PATENTS BY ALCOA CORP.

TABLE 4 LIST OF PATENTS BY PELI BIOTHERMAL LTD.

TABLE 5 INSULATED PACKAGING MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 6 INSULATED PACKAGING MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (KILOTONS)

TABLE 7 INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 8 INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 9 INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 10 INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 11 INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 12 INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 13 INSULATED PACKAGING MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 14 INSULATED PACKAGING MARKET SIZE, BY REGION, 2018–2025 (KILOTONS)

TABLE 15 APAC: INSULATED PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 16 APAC: INSULATED PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 17 APAC: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 18 APAC: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 19 APAC: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 20 APAC: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 21 APAC: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 22 APAC: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 23 APAC: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 24 APAC: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 25 CHINA: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 26 CHINA: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 27 CHINA: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 28 CHINA: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 29 CHINA: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 30 CHINA: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 31 CHINA: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 32 CHINA: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 33 INDIA: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 34 INDIA: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 35 INDIA: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 36 INDIA: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 37 INDIA: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 38 INDIA: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 39 INDIA: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 40 INDIA: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 41 JAPAN: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 42 JAPAN: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 43 JAPAN: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 44 JAPAN: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 45 JAPAN: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 46 JAPAN: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 47 JAPAN: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 48 JAPAN: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 49 AUSTRALIA: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 50 AUSTRALIA: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 51 AUSTRALIA: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 52 AUSTRALIA: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 53 AUSTRALIA: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 54 AUSTRALIA: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 55 AUSTRALIA: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 56 AUSTRALIA: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 57 REST OF APAC: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 58 REST OF APAC: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 59 REST OF APAC: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 60 REST OF APAC: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 61 REST OF APAC: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 62 REST OF APAC: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 63 REST OF APAC: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 64 REST OF APAC: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 65 EUROPE: INSULATED PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 66 EUROPE: INSULATED PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 67 EUROPE: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 68 EUROPE: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 69 EUROPE: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 70 EUROPE: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 71 EUROPE: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 72 EUROPE: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 73 EUROPE: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 74 EUROPE: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 75 GERMANY: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 76 GERMANY: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 77 GERMANY: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 78 GERMANY: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 79 GERMANY: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 80 GERMANY: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 81 GERMANY: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 82 GERMANY: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 83 UK: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 84 UK: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 85 UK: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 86 UK: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 87 UK: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 88 UK: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 89 UK: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 90 UK: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 91 FRANCE: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 92 FRANCE: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 93 FRANCE: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 94 FRANCE: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 95 FRANCE: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 96 FRANCE: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 97 FRANCE: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 98 FRANCE: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 99 RUSSIA: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 100 RUSSIA: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 101 RUSSIA: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 102 RUSSIA: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 103 RUSSIA: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 104 RUSSIA: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 105 RUSSIA: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 106 RUSSIA: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 107 ITALY: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 108 ITALY: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 109 ITALY: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 110 ITALY: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 111 ITALY: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 112 ITALY: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 113 ITALY: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 114 ITALY: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 115 REST OF EUROPE: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 116 REST OF EUROPE: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 117 REST OF EUROPE: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 118 REST OF EUROPE: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 119 REST OF EUROPE: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 120 REST OF EUROPE: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 121 REST OF EUROPE: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 122 REST OF EUROPE: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 123 NORTH AMERICA: INSULATED PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 124 NORTH AMERICA: INSULATED PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 125 NORTH AMERICA: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 126 NORTH AMERICA: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 127 NORTH AMERICA: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 128 NORTH AMERICA: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 129 NORTH AMERICA: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 130 NORTH AMERICA: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 131 NORTH AMERICA: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 132 NORTH AMERICA: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 133 US: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 134 US: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 135 US: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 136 US: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 137 US: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 138 US: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 139 US: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 140 US: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 141 CANADA: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 142 CANADA: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 143 CANADA: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 144 CANADA: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 145 CANADA: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 146 CANADA: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 147 CANADA: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 148 CANADA: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 149 MEXICO: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 150 MEXICO: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 151 MEXICO: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 152 MEXICO: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 153 MEXICO: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 154 MEXICO: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 155 MEXICO: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 156 MEXICO: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 157 ROW: INSULATED PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 158 ROW: INSULATED PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 159 ROW: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 160 ROW: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 161 ROW: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 162 ROW: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 163 ROW: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 164 ROW: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 165 ROW: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 166 ROW: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 167 BRAZIL: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 168 BRAZIL: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 169 BRAZIL: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 170 BRAZIL: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 171 BRAZIL: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 172 BRAZIL: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 173 BRAZIL: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 174 BRAZIL: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 175 ARGENTINA: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 176 ARGENTINA: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 177 ARGENTINA: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 178 ARGENTINA: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 179 ARGENTINA: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 180 ARGENTINA: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 181 ARGENTINA: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 182 ARGENTINA: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 183 SOUTH AFRICA: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 184 SOUTH AFRICA: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 185 SOUTH AFRICA: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 186 SOUTH AFRICA: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 187 SOUTH AFRICA: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 188 SOUTH AFRICA: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 189 SOUTH AFRICA: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 190 SOUTH AFRICA: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 191 OTHERS: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 192 OTHERS: INSULATED PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (KILOTONS)

TABLE 193 OTHERS: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 194 OTHERS: INSULATED PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTONS)

TABLE 195 OTHERS: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 196 OTHERS: INSULATED PACKAGING MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTONS)

TABLE 197 OTHERS: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 198 OTHERS: INSULATED PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (KILOTONS)

TABLE 199 MERGERS & ACQUISITIONS, 2017–2020

TABLE 200 EXPANSIONS, 2017–2020

LIST OF FIGURES (45 Figures)

FIGURE 1 INSULATED PACKAGING: MARKET SEGMENTATION

FIGURE 2 INSULATED PACKAGING MARKET: RESEARCH DESIGN

FIGURE 3 MARKET SIZE ESTIMATION

FIGURE 4 INSULATED PACKAGING MARKET: DATA TRIANGULATION

FIGURE 5 APAC WAS THE LARGEST MARKET FOR INSULATED PACKAGING IN 2019

FIGURE 6 BOXES & CONTAINERS TO BE THE LARGEST PACKAGING TYPE FOR INSULATED PACKAGING MARKET

FIGURE 7 FOOD & BEVERAGES TO BE THE LARGEST APPLICATION FOR INSULATED PACKAGING MARKET

FIGURE 8 INSULATED PACKAGING MARKET TO WITNESS RAPID GROWTH BETWEEN 2025 AND 2025

FIGURE 9 CORRUGATED CARDBOARD TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

FIGURE 10 RIGID IS EXPECTED TO BE THE LARGEST TYPE SEGMENT BY 2025

FIGURE 11 FOOD & BEVERAGES AND APAC WERE THE LARGEST MARKETS

FIGURE 12 INSULATED PACKAGING MARKET DYNAMICS

FIGURE 13 INSULATED PACKAGING MARKET DRIVERS: IMPACT ANALYSIS

FIGURE 14 INSULATED PACKAGING MARKET RESTRAINTS: IMPACT ANALYSIS

FIGURE 15 INSULATED PACKAGING MARKET OPPORTUNITIES: IMPACT ANALYSIS

FIGURE 16 INSULATED PACKAGING MARKET CHALLENGES: IMPACT ANALYSIS

FIGURE 17 VALUE CHAIN ANALYSIS OF INSULATED PACKAGING

FIGURE 18 SUPPLY CHAIN OF INSULATED PACKAGING INDUSTRY

FIGURE 19 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 TYPE ANALYSIS

FIGURE 21 PUBLICATION TRENDS - LAST 5 YEARS

FIGURE 22 JURISDICTION ANALYSIS.

FIGURE 23 TOP APPLICANTS ACCORDING TO NUMBER OF PATENTS

FIGURE 24 INSULATED PACKAGING MARKET, BY MATERIAL TYPE, 2020 & 2025 (USD MILLION)

FIGURE 25 INSULATED PACKAGING INDUSTRY MARKET, BY APPLICATION, 2020 & 2025 (USD MILLION)

FIGURE 26 INSULATED PACKAGING INDUSTRY MARKET, BY PACKAGING TYPE, 2020 & 2025 (USD MILLION)

FIGURE 27 INSULATED PACKAGING MARKET, BY TYPE, 2020 & 2025 (USD MILLION)

FIGURE 28 APAC TO RECORD THE HIGHEST GROWTH DURING THE FORECAST PERIOD

FIGURE 29 APAC: INSULATED PACKAGING MARKET SNAPSHOT

FIGURE 30 EUROPE INSULATED PACKAGING MARKET SNAPSHOT: GERMANY TO HOLD LARGEST SHARE DURING FORECAST PERIOD

FIGURE 31 NORTH AMERICA: INSULATED PACKAGING MARKET SNAPSHOT

FIGURE 32 ROW INSULATED PACKAGING MARKET SNAPSHOT: BRAZIL TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 33 COMPANIES PRIMARILY ADOPTED EXPANSION AS THE KEY GROWTH STRATEGY BETWEEN 2017 AND 2020

FIGURE 34 INSULATED PACKAGING MARKET, 2019

FIGURE 35 DEUTSCHE POST DHL: COMPANY SNAPSHOT

FIGURE 36 DEUTSCHE POST DHL: SWOT ANALYSIS

FIGURE 37 E. I. DU PONT DE NEMOURS AND CO: COMPANY SNAPSHOT

FIGURE 38 E. I. DU PONT DE NEMOURS AND CO: SWOT ANALYSIS

FIGURE 39 AMCOR LIMITED: COMPANY SNAPSHOT

FIGURE 40 AMCOR LIMITED: SWOT ANALYSIS

FIGURE 41 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

FIGURE 42 SONOCO PRODUCTS COMPANY: SWOT ANALYSIS

FIGURE 43 HUHTAMAKI OYJ: COMPANY SNAPSHOT

FIGURE 44 HUHTAMAKI OYJ: SWOT ANALYSIS

FIGURE 45 GREINER GROUP: COMPANY SNAPSHOT

The study involved four major activities in estimating the size of the Insulated Packaging Market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various sources such as Hoovers, Bloomberg Businessweek, Factiva, World Bank, and Industry Journals were used. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases.

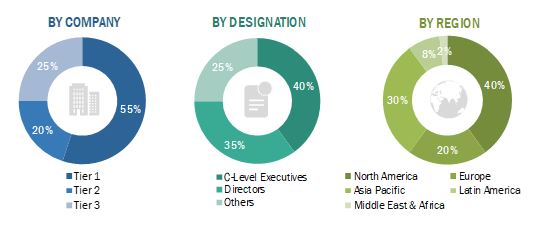

Primary Research

The insulated packaging market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Developments in the insulated packaging market characterize the demand side. Market consolidation activities undertaken by manufacturers characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

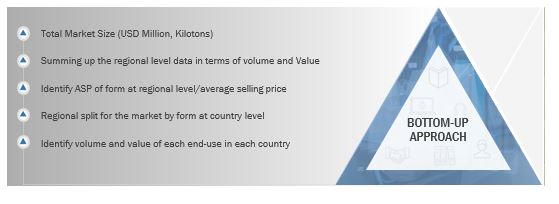

Both top-down and bottom-up approaches were used to estimate and validate the total size of the insulated packaging market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry and markets were identified through extensive secondary research.

The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Insulated packaging: Bottom-Up Approach

Insulated packaging: Top-Down Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above- the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the insulated packaging market.

Report Objectives

- To define, describe, and forecast the insulated packaging market in terms of value and volume

- To provide detailed information about the key factors influencing the market growth, such as drivers, restraints, opportunities, and challenges

- To analyze and forecast the market size based on material, type, packaging type, and applications

- To forecast the market size of five main regions, namely, North America, Europe, Asia Pacific (APAC), the and Rest of the World (along with the key countries in each region)

- To strategically analyze the micromarkets1 with respect to individual growth trends, growth prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders

- To analyze the competitive developments, such as expansion, mergers & acquisitions, new product developments, and agreement) in the insulated packaging market

- To strategically profile the key players and comprehensively analyze their core competencies2

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Insulated Packaging Market