Cosmetic Pigments Market by Composition (Organic, Inorganic), Type (Special Effect, Surface treated, Nano), Application (Facial Makeup, Eye Makeup, Lip Products, Nail Products, Hair Color Products), and Region - Global Forecast to 2026

Cosmetic Pigments Market

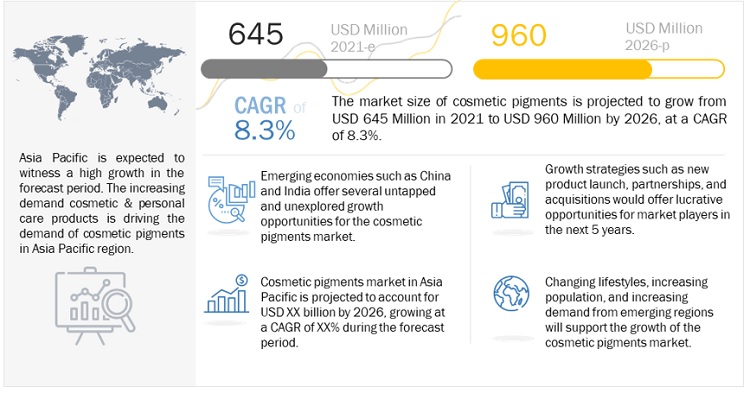

The global cosmetic pigments market was valued at USD 645 million in 2021 and is projected to reach USD 960 million by 2026, growing at a cagr 8.3% from 2021 to 2026. The high growth of niche applications consuming cosmetic pigments across the world, coupled with the efficient and superior properties of cosmetic pigments, is driving the market.

Attractive Opportunities in the Cosmetic Pigments Market

Note: e = estimated: p = projected

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Cosmetic Pigments Market Dynamics

Driver: Increasing demand for cosmetic pigments in cosmetic and personal care products

Cosmetic pigments are utilized in various cosmetic and personal care products such as facial makeup, lip products, nail products, and eye makeup. These products utilize cosmetic pigments due to their various characteristics including bright and brilliant luster, shine, and shimmer. The use of cosmetic pigments, especially pearlescent pigments, in facial makeup help in covering the blemishes and the uneven skin tone. This has increased the demand for cosmetic pigments that are used in root makeup products. The demand for cosmetic products which match the natural skin tone of the consumer is growing, owing to the rising product differentiation in the cosmetics & personal care industry. Further, cosmetic brands are emphasizing on developing new and unique colors to create vibrant effects in the beauty products such as lipsticks, and lip glosses. This factor drives the demand of bright colors including neon pink and blaze orange. The increasing demand of cosmetic and personal care products drives the cosmetic pigments market.

Restraint: Stringent regulations pertaining to the use of certain pigments

Cosmetic pigments manufacturers are required to follow stringent regulations regarding cosmetics products. There are several regulations pertaining to the specification of packaging, labeling, and the ingredients that are used in the production of color additives and pigments. These regulations are more stringent in the developed regions including North America and Europe. For instance, in the US, Federal Food, Drug, and Cosmetic Act (FD&C Act) mandates the prior approval system for the use of color pigments. The European Union (EU) has restriction on the use of lead and cadmium-based pigments owing to the environmental risks associated with their use. Various regulations pertaining to the use and manufacturing of cosmetic pigments restrains the growth of the cosmetic pigments market.

Opportunity: Consumer interest in environment-friendly and sustainably produced ingredients in cosmetic and personal care products

Several cosmetic pigments used in the makeup products utilize harmful chemicals which may have an adverse effect on human health. A combination of increased public interest and government regulations has led cosmetics manufacturers to develop more natural and sustainable cosmetic emulsifiers. Due to this, the demand for environment-friendly and sustainable organic pigments is growing rapidly. Manufacturing companies are investing to venture into the green market and are following sustainable technologies. The rising demand for organically produced cosmetic pigments is providing growth opportunity for the cosmetic pigments market players.

Challenge: Maintaining the quality of cosmetic pigments for mass-market products

The cosmetic pigments market is growing due to the increasing demand for color cosmetic products. Major challenge that cosmetic pigment manufacturers face is maintaining the quality of cosmetic pigments for mass-market products including lip colors, nail paints, and eye makeup products. These products are produced in large quantities, and sometimes the quality of the product does not meet the consumer expectations. The revenue generated by the mass-market products is high, and their demand is highly dependent on the quality of the cosmetic pigment used. Thus, the manufacturers of the cosmetic pigment must ensure that the high-quality pigment are manufactured.

Inorganic pigments are projected to be the largest segment amongst elemental compositions in the cosmetic pigments market

Based on elemental composition, the cosmetic pigments market has been categorized into inorganic and organic pigments. Inorganic pigments are projected to account for the highest share of the cosmetic pigments market during the forecast period. Inorganic pigments are metal compounds such as titanium oxide, iron oxide, chromium oxide, and mica. The demand for inorganic pigments is witnessing an increasing demand as they are increasingly being used in premium and luxury cosmetic products.

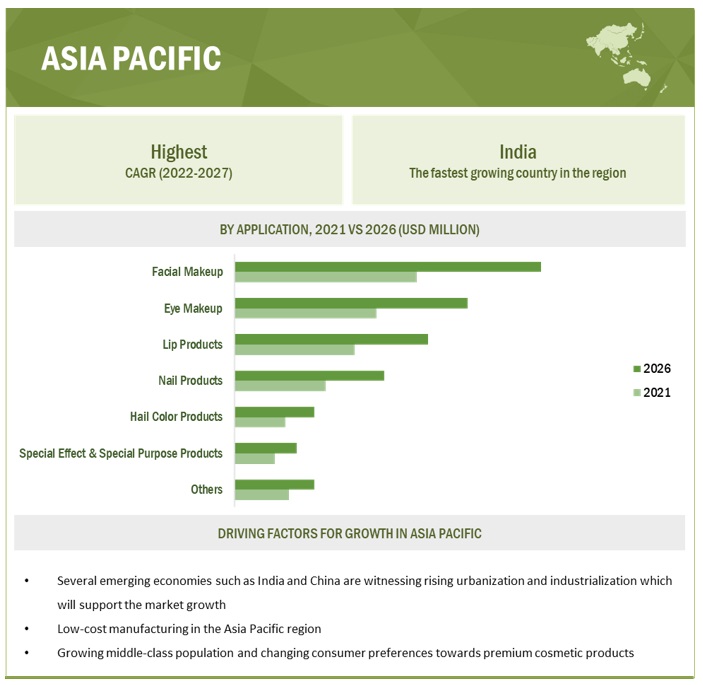

Facial makeup is estimated to be fastest-growing application during the forecast period

The applications of cosmetic pigments include facial makeup, nail products, eye makeup, lip products, hair color products, special effect & special purpose, and others. Facial makeup is projected to be the fastest growing segment amongst applications in the cosmetic pigments market. The growing demand root makeup products including face powders, foundations, and blushers is expected to drive the market for this application.

Surface treated pigments estimated to be largest segment amongst types in the cosmetic pigments market

Surface-treated pigments are treated to alter the shape and size of the particles and to achieve better absorption, chemical constitution, and dispersibility characteristics. These pigments are used in several cosmetic and personal care products. The rising demand for new colors and technological advancements are expected to drive the growth of the surface-treated pigments segment.

Asia Pacific is estimated to account for the largest share of the overall cosmetic pigments market

Asia Pacific is projected to be the largest market for cosmetic pigments. It also accounted for the largest share in 2020, in terms of value. Increasing demand from China, India, and Japan drives the cosmetic pigments market in this region. Further, various factors such as changing consumer lifestyle, increasing disposable income, and low-cost availability of labor supports the market growth in Asia Pacific region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players profiled in this market Sensient Cosmetic Technologies (France), Kobo Products (US), ECKART (UK), Sun Chemical (US), Sudarshan (India), Merck (Germany), Clariant (Switzerland), and Geotech (Netherlands).

These companies adopted various organic as well as inorganic growth strategies between 2014 and 2019 to strengthen their position in the market. Expansion was among the key growth strategies adopted by these leading players to enhance their regional presence and meet the growing demand for cosmetic pigments from emerging economies.

Cosmetic Pigments Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2016–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD million), Volume (Ton) |

|

Segments |

Elemental Composition, Type, Application, and Region |

|

Regions |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies profiled |

Total of 10 major players covered: |

This research report categorizes the cosmetic pigments market based on elemental composition, type, application, and region.

Based on elemental composition, the cosmetic pigments market has been segmented as follows:

- Inorganic Pigments

- Organic Pigments

Based on type, the cosmetic pigments market has been segmented as follows:

- Special Effect Pigments

- Surface-Treated Pigments

- Nano Pigments

- Natural Colorants

Based on application, the cosmetic pigments market has been segmented as follows:

- Facial Makeup

- Eye Makeup

- Lip Products

- Nail Products

- Hair Color Products

- Special effect & Special Purpose Products

- Others

Based on the region, the cosmetic pigments market has been segmented as follows:

- Europe

- North America

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In March 2020, Merck signed an agreement with Azelis to make Azelis a distributor of Merck’s products related to personal care, CASE (coatings, adhesives, sealants, and elastomers), food & health, and industrial chemicals in Vietnam.

- In October 2019, Merck expanded its pigment production facility situated in Gernsheim, Germany. The company is increasing the production capacity of silicon dioxide flakes, which is a special substrate for the complete range of unique effect pigments. These pigments offer a unique color shift depending on the angle of observation and help cosmetic and coating manufacturers to create eye-catching formulations.

- In February 2019, Sun Chemical introduced its new SpectraFlex illusion pigments for soft-focus effects. SpectraFlex Illusion soft-focus effect pigments are used in daily wear makeup primers to help optically blur fine lines and other imperfections. This launch helped the company in strengthening its product offering for personal care applications, such as face powders, body powders, foundation, and other skin care applications.

Frequently Asked Questions (FAQ):

What is the current size of the global cosmetic pigments market?

The cosmetic pigments market is projected to grow from USD 645 million in 2021 to USD 960 million by 2026, at a CAGR of 8.3% from 2021 to 2026.

What are the factors driving the demand of the cosmetic pigments?

Major factors driving the cosmetic pigments market are increasing income and changing lifestyle, increasing demand for cosmetic pigments in cosmetic and personal care products, and growing demand for new, differentiated, and premium products.

Who are the leading players in the global cosmetic pigments market?

The leading companies in the cosmetic pigments market include Sun Chemical (US), Sensient Cosmetic Technologies (France), Merck (Germany), ECKART (UK), Sudarshan (India), Kobo Products (US), Clariant (Switzerland), and Geotech (Netherlands). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVE OF STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.3.3 REGIONAL SCOPE

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 SCOPE-RELATED LIMITATIONS

1.7 STAKEHOLDERS

1.8 INCLUSIONS & EXCLUSIONS

1.8.1 COSMETIC PIGMENTS MARKET, BY ELEMENTAL COMPOSITION: INCLUSIONS & EXCLUSIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

FIGURE 1 COSMETIC PIGMENTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MATRIX CONSIDERED FOR DEMAND SIDE ANALYSIS

FIGURE 2 MAIN MATRIX CONSIDERED WHILE ASSESSING DEMAND FOR COSMETIC PIGMENTS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 COSMETIC PIGMENTS MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 COSMETIC PIGMENTS MARKET: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 5 COSMETIC PIGMENTS MARKET: DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 LIMITATIONS

FIGURE 6 METHODOLOGY FOR ASSESSING SUPPLY OF COSMETIC PIGMENTS

2.7 CALCULATIONS FOR SUPPLY SIDE ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 32)

FIGURE 7 INORGANIC PIGMENTS SEGMENT TO DOMINATE COSMETIC PIGMENTS MARKET BETWEEN 2021 AND 2026

FIGURE 8 SPECIAL EFFECT PIGMENTS SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2021 AND 2026

FIGURE 9 FACIAL MAKEUP APPLICATION SEGMENT TO BE LARGEST CONSUMER OF COSMETIC PIGMENTS BETWEEN 2021 AND 2026

FIGURE 10 ASIA PACIFIC TO BE FASTEST-GROWING COSMETIC PIGMENTS MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 ATTRACTIVE OPPORTUNITIES IN COSMETIC PIGMENTS MARKET

FIGURE 11 GROWING USE IN COSMETIC AND PERSONAL CARE INDUSTRY TO BOOST MARKET GROWTH

4.2 COSMETIC PIGMENTS MARKET, BY TYPE

FIGURE 12 SURFACE-TREATED PIGMENTS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2021

4.3 COSMETIC PIGMENTS MARKET, BY REGION

FIGURE 13 ASIA PACIFIC TO LEAD COSMETIC PIGMENTS MARKET DURING FORECAST PERIOD

4.4 ASIA PACIFIC COSMETIC PIGMENTS MARKET, BY APPLICATION AND COUNTRY

FIGURE 14 CHINA AND FACIAL MAKEUP SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARES IN ASIA PACIFIC IN 2021

5 MARKET OVERVIEW (Page No. - 38)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE COSMETIC PIGMENTS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for cosmetic pigments in cosmetic and personal care products

5.2.1.2 Increasing income and changing lifestyle

5.2.1.3 Growing demand for new, differentiated, and premium products

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulations pertaining to use of certain pigments

5.2.3 OPPORTUNITIES

5.2.3.1 Consumer interest in environment-friendly and sustainably produced ingredients in cosmetic and personal care products

5.2.4 CHALLENGES

5.2.4.1 Maintaining quality of cosmetic pigments for mass market products

5.2.4.2 Impact of COVID-19 on cosmetic pigments market

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 PORTER’S FIVE FORCES ANALYSIS: COSMETIC PIGMENTS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 ADJACENT AND INTERCONNECTED MARKETS

TABLE 1 ADJACENT AND INTERCONNECTED MARKETS (USD MILLION)

6 IMPACT OF COVID-19 ON COSMETIC PIGMENTS MARKET (Page No. - 44)

6.1 IMPACT OF COVID-19 ON LIVES AND LIVELIHOOD

6.1.1 ECONOMIC OUTLOOK BY INTERNATIONAL MONETARY FUND (IMF)

TABLE 2 COVID-19 IMPACT: ECONOMIC OUTLOOK, 2020–2021

6.2 IMPACT OF COVID-19: CUSTOMER ANALYSIS

6.3 IMPACT OF COVID-19 ON REGIONS

6.3.1 ASIA PACIFIC

6.3.2 NORTH AMERICA

6.3.3 EUROPE

6.3.4 MIDDLE EAST & AFRICA

6.3.5 SOUTH AMERICA

7 COSMETIC PIGMENTS, BY ELEMENTAL COMPOSITION (Page No. - 47)

7.1 INTRODUCTION

FIGURE 17 INORGANIC PIGMENTS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE BETWEEN 2021 AND 2026

TABLE 3 COSMETIC PIGMENTS MARKET SIZE, BY ELEMENTAL COMPOSITION, 2016–2019 (USD MILLION)

TABLE 4 COSMETIC PIGMENTS MARKET SIZE, BY ELEMENTAL COMPOSITION, 2020–2026 (USD MILLION)

TABLE 5 COSMETIC PIGMENTS MARKET SIZE, BY ELEMENTAL COMPOSITION, 2016–2019 (TONS)

TABLE 6 COSMETIC PIGMENTS MARKET SIZE, BY ELEMENTAL COMPOSITION, 2020–2026 (TONS)

7.2 ORGANIC PIGMENTS

7.2.1 LAKES

7.2.1.1 Demand for natural colorants in lip products and facial makeup is driving the market

7.2.2 TONERS

7.2.2.1 Toners used in talc due to their heat and light resistant properties

7.2.3 TRUE PIGMENTS

7.2.3.1 Higher cost of true pigments resulting in comparatively slower growth

7.3 INORGANIC PIGMENTS

7.3.1 TITANIUM DIOXIDE

7.3.1.1 Increasing use of TiO2 to impart white color in cosmetic products is fueling the market

7.3.2 IRON OXIDE

7.3.2.1 Use of bright color shades in lip products and nail products is boosting the demand for iron oxide

7.3.3 CHROMIUM DIOXIDE

7.3.3.1 Stringent regulations regarding use of chromium dioxide restricting market growth

7.3.4 ZINC OXIDE

7.3.4.1 Zinc oxide offers excellent covering and spreading ability

7.3.5 MICA

7.3.5.1 Mica used in face powders and blushers due to its natural translucency

7.3.6 ULTRAMARINES

7.3.6.1 Demand for deep blue color shades in lip, nail, and hair products is driving the demand for ultramarines

7.3.7 OTHER METAL OXIDES

8 COSMETIC PIGMENTS MARKET, BY TYPE (Page No. - 53)

8.1 INTRODUCTION

FIGURE 18 SURFACE-TREATED PIGMENTS SEGMENT TO DOMINATE COSMETIC PIGMENTS MARKET BETWEEN 2021 AND 2026

TABLE 7 COSMETIC PIGMENTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 8 COSMETIC PIGMENTS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 9 COSMETIC PIGMENTS MARKET SIZE, BY TYPE, 2016–2019 (TONS)

TABLE 10 COSMETIC PIGMENTS MARKET SIZE, BY TYPE, 2020–2026 (TONS)

8.2 SPECIAL EFFECT PIGMENTS

8.2.1 INCREASING USE OF SPECIAL EFFECT PIGMENTS TO ADD SHINE AND SHIMMER IN COSMETIC PRODUCTS IS DRIVING THE DEMAND

8.2.2 PEARLESCENT PIGMENTS

8.2.2.1 Organic pearls

8.2.2.2 Inorganic pearls

8.2.2.3 Silver pearls

8.2.2.4 Colored interference pearls

8.2.3 METALLIC PIGMENTS

8.3 SURFACE-TREATED PIGMENTS

8.3.1 EASY AVAILABILITY AND BRIGHTER SHADES OF SURFACE-TREATED PIGMENTS ENABLE THEIR USE IN THE COSMETIC INDUSTRY

8.3.2 METHICONE- & DIMETHICONE-TREATED PIGMENTS

8.3.3 ALKYL SILANE-TREATED PIGMENTS

8.3.4 ORGANO TITRANATE-TREATED PIGMENTS

8.3.5 CROSS POLYMER-TREATED PIGMENTS

8.4 NANO PIGMENTS

8.4.1 NANO PIGMENTS MAINLY USED IN SUNSCREENS AS THEY HAVE THE CAPABILITY TO REFLECT AND SCATTER UV LIGHT

8.4.2 TITANIUM DIOXIDE

8.4.3 ZINC OXIDE

8.4.4 CARBON BLACK

8.5 NATURAL COLORANTS

8.5.1 ALKANET ROOT

8.5.2 HENNA

8.5.3 PHYCOBILIPROTEINS

9 COSMETIC PIGMENTS MARKET, BY APPLICATION (Page No. - 60)

9.1 INTRODUCTION

FIGURE 19 FACIAL MAKEUP TO BE LARGEST APPLICATION SEGMENT OF COSMETIC PIGMENTS MARKET BETWEEN 2021 AND 2026

TABLE 11 COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 12 COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 13 COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 14 COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

9.2 FACIAL MAKEUP

9.2.1 POWDER

9.2.1.1 Use of TiO2 in powder for whitening effect and sun protection is expected to boost the demand

9.2.2 FOUNDATION

9.2.2.1 Inorganic pigments widely used in foundation

9.2.3 BLUSHERS

9.2.3.1 Desire for natural glow and radiant look is fueling the demand for cosmetic pigments in blushers

9.3 EYE MAKEUP

9.3.1 EYE LINER

9.3.1.1 Overall growth in adoption of eye makeup products boosting the growth

9.3.2 EYE SHADOW

9.3.2.1 Increasing trend of smoky eye looks in fashion industry is driving the demand for eye shadow

9.3.3 MASCARA

9.3.3.1 The introduction of new and innovative eye products is driving the demand

9.4 LIP PRODUCTS

9.4.1 LIPSTICK

9.4.1.1 High demand for lipsticks from working women population is fueling the growth

9.4.2 LIP GLOSS

9.4.2.1 Change in lifestyle and rising appearance consciousness among women is fueling the demand

9.4.3 LIP LINER

9.4.3.1 Pearls and colorants are commonly used pigments in lip liner

9.4.4 LIP STAINS

9.4.4.1 Increasing younger consumers of lip products is expected to boost the demand significantly

9.5 NAIL PRODUCTS

9.5.1 NAIL POLISH

9.5.1.1 Mineral pigments including titanium dioxide and iron oxides are commonly used for nail polish

9.5.2 NAIL TREATMENT

9.5.2.1 Nail treatment is increasingly used for nail restoration and repair damaged nail

9.6 HAIR COLOR PRODUCTS

9.7 SPECIAL EFFECT & SPECIAL PURPOSE PRODUCTS

9.8 OTHERS

9.8.1 TOOTHPASTE

9.8.2 HAIR SHAMPOO & CONDITIONER

9.8.3 SUNLESS TANNING PRODUCTS

10 COSMETIC PIGMENTS MARKET, BY REGION (Page No. - 68)

10.1 INTRODUCTION

FIGURE 20 ASIA PACIFIC TO LEAD COSMETIC PIGMENTS MARKET

FIGURE 21 COSMETIC PIGMENTS MARKET IN INDIA TO REGISTER THE HIGHEST CAGR

TABLE 15 COSMETIC PIGMENTS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 COSMETIC PIGMENTS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 17 COSMETIC PIGMENTS MARKET SIZE, BY REGION, 2016–2019 (TONS)

TABLE 18 COSMETIC PIGMENTS MARKET SIZE, BY REGION, 2020–2026 (TONS)

10.2 NORTH AMERICA

FIGURE 22 NORTH AMERICA: COSMETIC PIGMENTS MARKET SNAPSHOT

TABLE 19 NORTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 20 NORTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 21 NORTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2016–2019 (TONS)

TABLE 22 NORTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2020–2026 (TONS)

TABLE 23 NORTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 24 NORTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 25 NORTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 26 NORTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.2.1 US

10.2.1.1 High level of innovation and new product development is contributing to market growth

TABLE 27 US: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 28 US: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 29 US: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 30 US: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.2.2 CANADA

10.2.2.1 The rising demand for natural, herbal, and organic beauty products is creating potential opportunities

TABLE 31 CANADA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 32 CANADA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 33 CANADA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 34 CANADA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.2.3 MEXICO

10.2.3.1 Rapid economic expansion in Mexico is expected to drive the market

TABLE 35 MEXICO: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 36 MEXICO: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 37 MEXICO: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 38 MEXICO: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.3 EUROPE

FIGURE 23 EUROPE: COSMETIC PIGMENTS MARKET SNAPSHOT

TABLE 39 EUROPE: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 40 EUROPE: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 41 EUROPE: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2016–2019 (TONS)

TABLE 42 EUROPE: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2020–2026 (TONS)

TABLE 43 EUROPE: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 44 EUROPE: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 45 EUROPE: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 46 EUROPE: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.3.1 GERMANY

10.3.1.1 Increase in demand for natural cosmetics to drive the market

TABLE 47 GERMANY: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 48 GERMANY: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 49 GERMANY: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 50 GERMANY: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.3.2 UK

10.3.2.1 The demand for cosmetic products such as lipsticks, nail polish, facial makeup, and moisturizers is driving the market

TABLE 51 UK: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 52 UK: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 53 UK: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 54 UK: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.3.3 FRANCE

10.3.3.1 Companies adopting new product launches and establishing new distribution channels to boost growth

TABLE 55 FRANCE: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 56 FRANCE: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 57 FRANCE: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 58 FRANCE: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.3.4 ITALY

10.3.4.1 Increasing demand for mass cosmetic products drives the market

TABLE 59 ITALY: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 60 ITALY: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 61 ITALY: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 62 ITALY: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.3.5 SPAIN

10.3.5.1 Market witnessing shift from traditional inorganic pigments to organic pigments in Spain

TABLE 63 SPAIN: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 64 SPAIN: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 65 SPAIN: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 66 SPAIN: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.3.6 REST OF EUROPE

TABLE 67 REST OF EUROPE: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 68 REST OF EUROPE: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 69 REST OF EUROPE: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 70 REST OF EUROPE: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.4 ASIA PACIFIC

FIGURE 24 ASIA PACIFIC: COSMETIC PIGMENTS MARKET SNAPSHOT

TABLE 71 ASIA PACIFIC: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 72 ASIA PACIFIC: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 73 ASIA PACIFIC: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2016–2019 (TONS)

TABLE 74 ASIA PACIFIC: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2020–2026 (TONS)

TABLE 75 ASIA PACIFIC: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 76 ASIA PACIFIC: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 77 ASIA PACIFIC: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 78 ASIA PACIFIC: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.4.1 CHINA

10.4.1.1 Availability of low-cost raw material, labor, and land and presence of moderately stringent regulatory framework are expected to drive the market

TABLE 79 CHINA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 80 CHINA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 81 CHINA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 82 CHINA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.4.2 JAPAN

10.4.2.1 High demand for cosmetic products that help in achieving natural look

TABLE 83 JAPAN: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 84 JAPAN: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 85 JAPAN: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 86 JAPAN: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.4.3 INDIA

10.4.3.1 Increasing number of working female population in India is boosting the demand for cosmetic products

TABLE 87 INDIA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 88 INDIA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 89 INDIA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 90 INDIA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.4.4 SOUTH KOREA

10.4.4.1 Rising demand for high-quality cosmetic products with novel colors is driving the market

TABLE 91 SOUTH KOREA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 92 SOUTH KOREA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 93 SOUTH KOREA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 94 SOUTH KOREA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.4.5 REST OF ASIA PACIFIC

TABLE 95 REST OF ASIA PACIFIC: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 96 REST OF ASIA PACIFIC: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 97 REST OF ASIA PACIFIC: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 98 REST OF ASIA PACIFIC: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.5 MIDDLE EAST & AFRICA

TABLE 99 MIDDLE EAST & AFRICA: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 100 MIDDLE EAST & AFRICA: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 101 MIDDLE EAST & AFRICA: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2016–2019 (TONS)

TABLE 102 MIDDLE EAST & AFRICA: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2020–2026 (TONS)

TABLE 103 MIDDLE EAST & AFRICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 104 MIDDLE EAST & AFRICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 105 MIDDLE EAST & AFRICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 106 MIDDLE EAST & AFRICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.5.1 SAUDI ARABIA

10.5.1.1 Increasing disposable income, growing young population, and expansion of domestic and foreign cosmetics brands are expected to drive the market

TABLE 107 SAUDI ARABIA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 108 SAUDI ARABIA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 109 SAUDI ARABIA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 110 SAUDI ARABIA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.5.2 SOUTH AFRICA

10.5.2.1 Strong manufacturing base for cosmetic pigments is boosting the market growth

TABLE 111 SOUTH AFRICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 112 SOUTH AFRICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 113 SOUTH AFRICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 114 SOUTH AFRICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.5.3 REST OF THE MIDDLE EAST & AFRICA

TABLE 115 REST OF MIDDLE EAST & AFRICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 116 REST OF MIDDLE EAST & AFRICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 117 REST OF MIDDLE EAST & AFRICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 118 REST OF MIDDLE EAST & AFRICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.6 SOUTH AMERICA

TABLE 119 SOUTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 120 SOUTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 121 SOUTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2016–2019 (TONS)

TABLE 122 SOUTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY COUNTRY, 2020–2026 (TONS)

TABLE 123 SOUTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 124 SOUTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 125 SOUTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 126 SOUTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.6.1 BRAZIL

10.6.1.1 Rising disposable income among mid- and low-income consumers is driving the market

TABLE 127 BRAZIL: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 128 BRAZIL: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 129 BRAZIL: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 130 BRAZIL: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.6.2 ARGENTINA

10.6.2.1 Economic recovery and growing purchasing power is contributing to the increasing demand for cosmetic products

TABLE 131 ARGENTINA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 132 ARGENTINA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 133 ARGENTINA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 134 ARGENTINA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

10.6.3 REST OF SOUTH AMERICA

TABLE 135 REST OF SOUTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 136 REST OF SOUTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 137 REST OF SOUTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2016–2019 (TONS)

TABLE 138 REST OF SOUTH AMERICA: COSMETIC PIGMENTS MARKET SIZE, BY APPLICATION, 2020–2026 (TONS)

11 COMPETITIVE LANDSCAPE (Page No. - 127)

11.1 OVERVIEW

FIGURE 25 COMPANIES ADOPTED NEW PRODUCT LAUNCH AS KEY STRATEGY BETWEEN 2014 AND 2021

11.2 COMPETITIVE LEADERSHIP MAPPING, 2020

11.2.1 VISIONARY LEADER

11.2.2 INNOVATOR

11.2.3 DYNAMIC DIFFERENTIATOR

11.2.4 EMERGING COMPANY

FIGURE 26 COSMETIC PIGMENTS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

11.2.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 27 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN COSMETIC PIGMENTS MARKET

11.2.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 28 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN COSMETIC PIGMENTS MARKET

11.3 MARKET RANKING OF KEY PLAYERS, 2020

FIGURE 29 MARKET RANKING, 2020

11.4 COMPETITIVE SCENARIO

11.4.1 NEW PRODUCT LAUNCHES, 2014–2021

11.4.2 EXPANSIONS, 2014–2021

11.4.3 PARTNERSHIPS & ACQUISITIONS, 2014–2021

12 COMPANY PROFILES (Page No. - 138)

(Business Overview, Products, Key Insights, Recent Developments, SWOT Analysis, COVID-19 Developments, MnM View)*

12.1 SUN CHEMICAL

FIGURE 30 SUN CHEMICAL: SWOT ANALYSIS

12.2 SENSIENT COSMETIC TECHNOLOGIES

FIGURE 31 SENSIENT COSMETIC TECHNOLOGIES: SWOT ANALYSIS

12.3 MERCK

FIGURE 32 MERCK: COMPANY SNAPSHOT

FIGURE 33 MERCK: SWOT ANALYSIS

12.4 ECKART

FIGURE 34 ECKART: COMPANY SNAPSHOT

12.5 SUDARSHAN CHEMICAL

FIGURE 35 SUDARSHAN CHEMICAL: COMPANY SNAPSHOT

FIGURE 36 SUDARSHAN CHEMICAL: SWOT ANALYSIS

12.6 KOBO PRODUCTS

12.7 CLARIANT

FIGURE 37 CLARIANT: COMPANY SNAPSHOT

12.8 GEOTECH

12.9 VENATOR

FIGURE 38 VENATOR: COMPANY SNAPSHOT

12.10 LANXESS

FIGURE 39 LANXESS: COMPANY SNAPSHOT

*Details on Business Overview, Products, Key Insights, Recent Developments, SWOT Analysis, COVID-19 Developments, MnM View might not be captured in case of unlisted companies.

12.11 OTHER KEY PLAYERS

12.11.1 KOEL COLOURS

12.11.2 LI PIGMENTS

12.11.3 CHEM INDIA PIGMENTS

12.11.4 YIPIN PIGMENTS

12.11.5 NIHON KOKEN KOGYO

12.11.6 FERRO CORPORATION

12.11.7 DAYGLO COLOR

12.11.8 ELEMENTAL SRL

12.11.9 KOLORTEK

12.11.10 SANDREAM IMPACT

12.11.11 VIBFAST PIGMENTS

12.11.12 NEELIKON

12.11.13 MIYOSHI KASEI

12.11.14 TOYAL

12.11.15 KUNCAI EUROPE

12.11.16 MUSCLEROX

13 ADJACENT AND RELATED MARKETS (Page No. - 164)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 COSMETIC PIGMENTS INTERCONNECTED MARKETS

13.3.1 COSMETIC DYES MARKET

13.3.1.1 Market definition

13.3.1.2 Market overview

13.3.1.3 Cosmetic dyes market, By type

13.3.1.3.1 Natural Dyes

13.3.1.3.2 Synthetic Dyes

TABLE 139 COSMETIC DYES MARKET SIZE, BY TYPE, 2016–2023 (USD MILLION)

TABLE 140 COSMETIC DYES MARKET SIZE, BY TYPE, 2016–2023 (TON)

13.3.2 COSMETIC ANTIOXIDANTS MARKET

13.3.2.1 Market definition

13.3.2.2 Market overview

13.3.2.3 Cosmetic antioxidants market, By source

13.3.2.3.1 Natural

13.3.2.3.2 Chemically Derived

TABLE 141 COSMETIC ANTIOXIDANTS MARKET SIZE, BY SOURCE, 2016–2019 (USD MILLION)

TABLE 142 COSMETIC ANTIOXIDANTS MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

14 APPENDIX (Page No. - 168)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

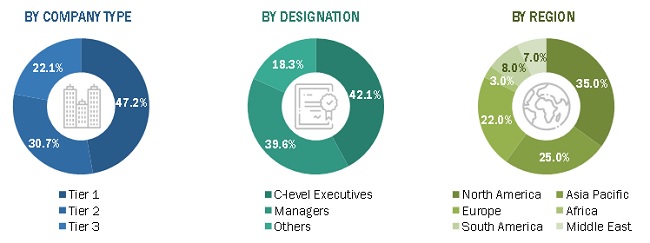

The study involves four major activities in estimating the current market size of cosmetic pigments. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers and Bloomberg BusinessWeek were referred to, for identifying and collecting information for this study. Secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, cosmetic pigments organizations, regulatory bodies, and databases were also referred.

Primary Research

The cosmetic pigments market comprises several stakeholders such as raw material suppliers, distributors of cosmetic pigments, cosmetic pigments associations, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market consists of color cosmetics and personal care industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary interviews—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cosmetic pigments market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the cosmetic pigments market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, in the facial makeup, eye makeup, nail products, lip products, and other applications.

Objectives of the Study:

- To define, describe, and forecast the cosmetic pigments market, in terms of value and volume

- To provide detailed information regarding the main factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To forecast the market size based on elemental composition, type, and application

- To forecast the size of the market with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze the competitive developments such as partnership & agreement, new product launch, and expansion, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

- Notes: Micromarkets1 are defined as the subsegments of the cosmetic pigments market included in the report.

- Core competencies of companies are determined in terms of the key developments, SWOT analysis, and key strategies adopted by them to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies along with the market data. The following customization options are available for this report:

Product Analysis

- A product matrix that provides a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Asia Pacific and Rest of Europe cosmetic pigments markets

Company Information

- Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cosmetic Pigments Market

Commodity Pigments, Special Effect Pigments, High Performance Pigments, Organic Pigments, Natural Colorants, and Pigment Dispersions market and insights

Market dynamics, growth trends, key manufacturers present in the market

General information required on cosmetic colarants

Interested in Pearlescent pigments market for cosmetic applications

Looking for market information

Report on cosmetic pigments market focussing on mineral and natural pigment markets