Automotive Cybersecurity Market by Form (In-Vehicle, External Cloud Services), Offering (Hardware & Software), Security, Vehicle Type, Application, Propulsion, Vehicle Autonomy, Approach, EV Application and Region - Global Forecast to 2028

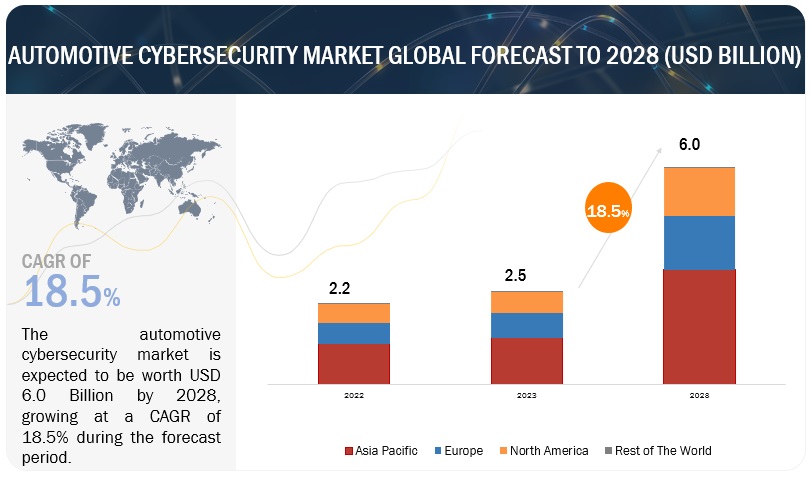

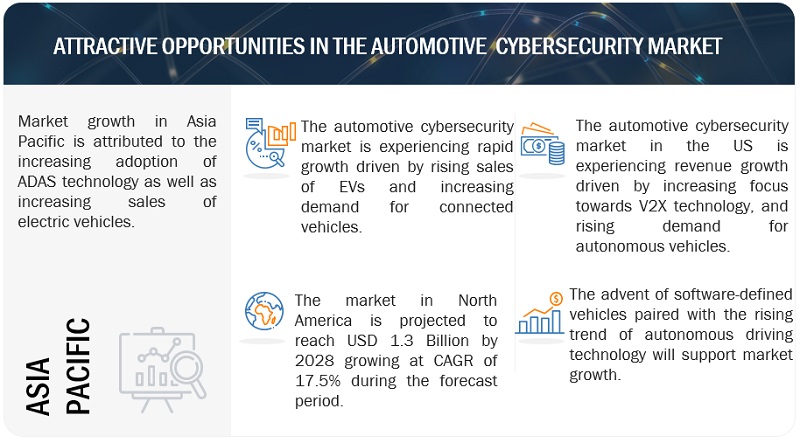

The global automotive cybersecurity market size is expected to grow from USD 2.5 billion in 2023 to USD 6.0 billion by 2028, at a CAGR of 18.5%. Increasing adoption of connected vehicles has in turn increased the electronic content per vehicle. This has eventually raised the vulnerability of a vehicle against a cyber-attack, which resulted in recall of vehicles by the reputaed automakers in the recent past. Thereby, the demand for automotive cybersecurity solutions are growing at a rapid pace all over the world. Moreover, advent of software-defined vehicles in conjunction with growing cloud-based applications in automotive sector are also expected to create lucrative opportunities for the automotive cybersecurity market in the coming years globally.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Automotive Cybersecurity Market Dynamics:

Driver: Electric vehicles more vulnerable to cyber attacks

Electric vehicles are equipped with advanced connected vehicle technology, which allows EVs to communicate with other vehicles, infrastructure, and various online services. This connectivity increases the vulnerability of vehicles to cyber threats. As EV sales rise, the need for robust cybersecurity solutions will become even more critical to protect these connected systems from potential attacks. As such, the global sales of EVs increased by 55% in 2022 to 10.5 million units from the previous year. China led the way with an 82% growth in new energy vehicle (NEV) sales, and BYD became the global sales leader.

The demand for automotive cybersecurity is likely to grow along with the growing demand for electric vehicles. Moreover, with reputed automakers such as BMW, General Motors, Volvo, Daimler, Stellantis, Toyota, and Volkswagen planning to either partially or completely phase out the production of ICE-powered vehicles by 2030, the demand for electric vehicles is expected to increase in turn, driving the demand for automotive cyber security solutions globally.

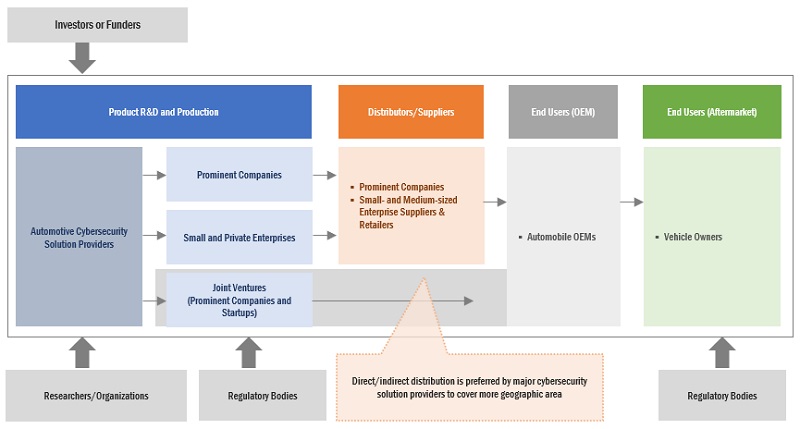

Restraint: Complex ecosystem with multiple stakeholders

The automotive sector has been a focus area for many non-automotive technology companies as the value chain is fragmented, and revenue distribution has become a challenge for stakeholders. The development of countermeasures is challenging because of the lack of standardization of cybersecurity solutions. The solutions for cybersecurity depend on the specifications given by the automotive OEMs. These solutions vary due to the use of different platforms in the same vehicle model, differences in the electronic architecture, and different features in the vehicle. As a result, automotive cybersecurity solution providers face integration risks in dealing with threats and vulnerabilities of a vehicle.

The inherited nature of OEMs to buy all the components for a vehicle from various suppliers and assemble them into one vehicle can make the car more vulnerable. Every supplier has its platform of electronic components, and it would be challenging to integrate all the electronic components of different suppliers. Poor integration of these components can lead to cyberattacks regardless of the strength of individual components. Hence, it is necessary to release standards for cybersecurity products and services throughout the stakeholders of the value chain to make vehicles less vulnerable to cyberattacks.

Opportunity: Advent of software-defined vehicles

The automotive sector has started shifting its focus toward software-centric vehicles. The features and functions of these vehicles are primarily enabled through automotive software. Today, most premium vehicles have up to 150 million lines of software codes, which are typically proportionate among hundreds of electronic control units (ECUs) and a rising number of cameras, RADAR, and light detection and ranging (LiDAR) devices, among others.

Software-defined vehicles have several advantages. For instance, software upgrades pertaining to vehicle infotainment systems, telematics, vehicle diagnostic systems, and others will require a trip to the dealership. However, with software-defined vehicles, customers will be able to receive over-the-air (OTA) updates that cover infotainment improvements, security patches, and the monitoring & tuning of core functionalities, such as powertrain and vehicle dynamics. This will increase the demand for software-defined vehicles, in turn creating growth opportunities for the automotive cyber security market during the forecast period.

Challenge: Time lag in delivery of cybersecurity updates

Most of the automobile manufacturers do not have any necessary software development capabilities. The automobile manufacturers are only responsible for integrating the cybersecurity solution with the hardware of the vehicle, while the rest is the responsibility of the cybersecurity providers. Hence, due to the absence of robust capabilities within automobile manufacturing plants and service centers, the time lag in rectifying the identified vulnerabilities increases. The security code update development is a time-taking process due to back-end system records, which hampers the whole process of delivering updates to the automotive security market without any delay.

The timely delivery of the security package at the time of vehicle recalls becomes a big challenge for OEMs. Providers of cybersecurity solutions need to expedite the development processes such as risk management, progress monitoring and reporting, and incident management, followed by delivering them to the production and service centers of automobile manufacturers. The cybersecurity solution providers look for new ways to reduce the time lag for updates as it would give them a competitive edge over their competitors. Hence, product innovation and accuracy are crucial for the effective implementation of cybersecurity solutions.

Automotive Cybersecurity Market Ecosystem

The ecosystem analysis highlights various players in the automotive cybersecurity ecosystem, which is primarily represented by OEMs, tier 1 integrators/suppliers, tier 2 suppliers, and automotive cybersecurity solution providers. Prominent companies in this market include Continental AG (Germany), Robert Bosch GmbH (Germany), Harman International (US), DENSO Corporation (Japan), and Aptiv PLC (Ireland), among others.

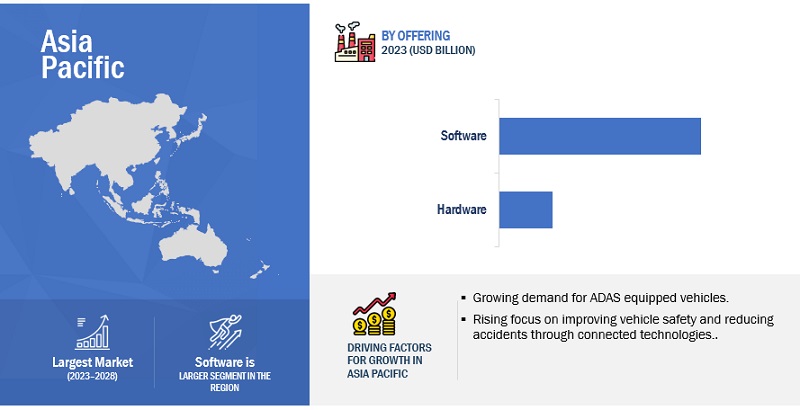

Software segment is expected to witness significant growth rate in the global automotive cybersecurity market during the forecast period

The software segment is expected to have a larger share in the market during the forecast period. This is owing to the increasing penetration of connected vehicles, and rising adoption of ADAS features in vehicles. Thus, increasing new features in vehicles is likely to support the software segment of the market during the forecast period.

Asia Pacific and North America dominate the software segment of the market. The software segment is projected to grow at the highest rate in Asia Pacific during the forecast period. Automotive OEMs in Japan and South Korea are launching new vehicle models that are equipped with modern connectivity technologies. These OEMs specify their requirements and designs to vendors for the cybersecurity of their vehicles. Vehicle cybersecurity providers and Tier I suppliers develop the actual software as well as functional components for various vehicles.

ICE vehicles segment is expected to be the largest in automotive cybersecurity market during the forecast period

Modern ICE vehicles are equipped with various connected features, such as infotainment systems, GPS navigation, and wireless connectivity. These features introduce potential vulnerabilities that can be exploited by hackers to gain unauthorized access to the vehicle’s systems. Cybersecurity measures are necessary to protect against unauthorized control or manipulation of critical functions, ensuring the safety and privacy of the occupants. This, in turn, is expected to bolster the ICE vehicles segment of the market during the forecast period.

Passenger vehicles segment is expected to be the largest in automotive cybersecurity market during the forecast period

The passenger cars segment accounts for the largest share of the market, owing to increased investments toward autonomous mobility, the advent of software-defined cars, and growing sales of L2 autonomous vehicles, among others.

The production and sales of luxury and mid-size vehicles are increasing in Asia Pacific, and OEMs are coming up with new models in the mid-size vehicle class that is equipped with connected and ADAS features. Hence, the increasing sales of luxury class vehicles in developing countries, such as China and India, are expected to drive the passenger cars segment of the market in Asia Pacific. In Europe, the passenger cars segment is expected to witness growth during the forecast period due to the increasing sales of Level 2 autonomy vehicles in the region.

“The Asia pacific automotive cybersecurity market is projected to hold the largest share by 2028.”

Asia Pacific is estimated to account for the largest market share in 2023, followed by Europe and North America. Countries such as China, India, Japan, South Korea, and the Rest of Asia Pacific are considered under Asia Pacific for market analysis. One of the key factors driving the market growth in this region is the large production of passenger vehicles, coupled with the increasing penetration of connected cars and other advanced technologies. China and India are considered manufacturing hubs for the automotive industry. . In addition, the increasing purchasing power of the population and rising concerns over vehicle pollution have triggered the demand for electric vehicles and semi-autonomous vehicles in Asia Pacific. This in turn would also drive the market growth for automotive cybersecurity.

Key Market Players

The global automotive cybersecurity market is dominated by major players such as Continental AG (Germany), Robert Bosch GmbH (Germany), Harman International (US), DENSO Corporation (Japan), Aptiv PLC (Ireland), and Karamba Security (Israel), among others. These companies have secure distribution networks at a global level and offer a wide range of cybersecurity products for traditional as well as electric vehicle. The key strategies adopted by these companies to sustain their market position are collaborations, new product developments, acquisitions, etc.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

Application, Offering, Form Type, Security Type, Approach, Vehicle Type, Propulsion Type, Vehicle Autonomy, EV Application, and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, and Rest of the World |

|

Companies Covered |

Continental AG (Germany), Robert Bosch GmbH (Germany), Harman International (US), DENSO Corporation (Japan), Aptiv PLC (Ireland), Karamba Security (Israel), Upstream Security Ltd. (Israel). |

This research report categorizes the automotive cybersecurity market based on application type, offering, form type, security type, vehicle type, propulsion type, vehicle autonomy, electric vehicle application type, and region

Based on Offering:

- Software

- Hardware

Based on Application:

- ADAS & safety

- Body control & comfort

- Infotainment

- Telematics

- Powertrain systems

- Communication systems

Based on Form Type

- In-vehicle

- External cloud services

Based on Security Type

- Application

- Wireless

- Endpoint

Based on Approach

- Intrusion Detection System

- Security Operations Centre

Based on Vehicle Type:

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Based on Propulsion Type:

- ICE Vehicles

- Electric Vehicles

Based on Vehicle Autonomy:

- Non-autonomous Vehicles

- Semi-autonomous Vehicles

- Autonomous Vehicles

Based on EV Application:

- ADAS & safety

- Body control & comfort

- Infotainment

- Telematics

- BMS & powertrain systems

- Communication systems

- Charging management

Based on the Region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Russia

- Turkey

- UK

- Rest of Europe

-

Rest of the World

- Brazil

- South Africa

- Others in RoW

Recent Developments

- In February 2023, ETAS (a subsidiary of Robert Bosch GmbH) offered ESCRYPT C_ycurRISK, a software tool for threat analysis and risk assessment. It allows the automotive OEMs and suppliers to identify security vulnerabilities during vehicle development and reduce cyber risks systematically.

- In January 2023, HL Mando Corporation collaborated with Argus Cyber Security. Through this collaboration, the Argus CAN Intrusion Detection Systems (IDS) solution was applied to HL Mando’s electrification system products, such as brakes and steering, beginning in January 2023.

- In October 2022, NTT Communications Corporation, along with DENSO Corporation (DENSO), was supposed to develop the security operation center technology for vehicles (VSOC1) to respond to the threat of increasingly sophisticated cyber-attacks against vehicles.

- In November 2022, Garrett Motion Inc. developed multi-layered on-and-off board intrusion detection systems (IDS) to identify cyber threats, which support OEMs to enhance vehicle security.

- In November 2021, NXP Semiconductors collaborated with Ford Motor Company to deliver enhanced driver experiences, convenience, and services like over-the-air updates across its global fleet of vehicles, including the 2021 Ford F-150 pickup, Mustang Mach-E, and Bronco SUVs.

- In October 2021, Renesas Electronic Corporation acquired Celeno Communications (Israel) to develop more advanced Wi-Fi connectivity capabilities to deliver end-to-end connectivity solutions for clients and access points.

- In September 2021, Harman International collaborated with Renault (France) to provide the Harman Kardon sound system to the Renault Mégane E-TECH 100% electric that is expected to be launched in 2022.

- In July 2021, ETAS Korea, a subsidiary of Robert Bosch GmbH, signed a partnership agreement with Suresoft Tech Co., Ltd. (South Korea) to offer consulting services and solutions related to cybersecurity testing of in-vehicle systems to Korean automotive manufacturers and suppliers.

- In July 2021, NXP Semiconductors collaborated with Moter Technologies, Inc. (US) to combine its new S32G2 high-performance automotive processors with MOTER’s insurance data science expertise and software. This is expected to enable vehicle data monetization with new and improved automotive insurance services.

- In May 2021, ESCRYPT, a subsidiary of ETAS Inc, which is a subsidiary of Robert Bosch GmbH, partnered with Alyne GmbH and KPMG to offer joint expertise in developing the Product Security Organisation Framework (PROOF).

Frequently Asked Questions (FAQ):

What is the current size of the global automotive cybersecurity market?

The global automotive cybersecurity market is estimated to be USD 2.5 billion in 2023 and projected to reach USD 6.0 billion by 2028.

Who are the winners in the global automotive cybersecurity market?

The automotive cybersecurity market is dominated by global players such as Robert Bosch GmbH, Continental AG, Harman International, Aptiv PLC, and DENSO Corporation, among others. These companies develop new products, adopt expansion strategies, and undertake collaborations, partnerships, and mergers & acquisitions to gain traction in the automotive cybersecurity market.

What are the new market trends impacting the growth of the automotive cybersecurity market?

Increasing demand for cloud- based applications, rising demand for V2X equipped vehicles and growing sales of connected vehicles are some of the major trends affecting this market.

Which region is expected to be the largest market during the forecast period?

Asia Pacific is anticipated to be the largest market in the automotive cybersecurity market vehicles due to the increasing adoption of ADAS equipped vehicles in the region.

What is the total CAGR expected to be recorded for the automotive cybersecurity market during 2023-2028?

The CAGR is expected to record a CAGR of 18.5% from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased use of electronics per vehicle and growing number of connected cars- Electric vehicles more vulnerable to cyberattacks- Reinforcement of mandates by regulatory bodies for vehicle data protection- Rapidly growing automotive V2X marketRESTRAINTS- High cost of automotive cybersecurity solutions- Complex ecosystem with multiple stakeholders- Growing complexity in vehicle electronic systemsOPPORTUNITIES- Advent of software-defined vehicles- Growing cloud-based applications in automotive sector- Exceptional technological developments in autonomous vehicle space- Introduction of wireless battery management systemsCHALLENGES- Discrepancies related to pricing strategies among stakeholders- Time lag in delivery of cybersecurity updatesIMPACT OF MARKET DYNAMICS

-

5.3 ECOSYSTEM ANALYSIS

-

5.4 SUPPLY CHAIN ANALYSISAUTOMOTIVE CYBERSECURITY SOLUTION PROVIDERSTIER 2 SUPPLIERSTIER 1 SUPPLIERSOEMSEND USERS

- 5.5 TRENDS AND DISRUPTIONS IMPACTING MARKET

-

5.6 REGULATORY LANDSCAPEUNECE WP.29 REGULATIONISO/SAE DIS 21434 STANDARDAIS 140 STANDARDLIST OF KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.7 PATENT ANALYSISINTRODUCTIONLEGAL STATUS OF PATENTS (2012–2022)TOP PATENT APPLICANTS (2012–2022)

-

5.8 CASE STUDY ANALYSISGUARDKNOX DEMONSTRATED HOW HACKER COULD TAKE CONTROL OF VEHICLEMICROSAR EVALUATION PACKAGE HELPED RENESAS RUN SOFTWARE SAFELYVECTOR INFORMATIK GMBH DEVELOPED FIRMWARE FOR SECURED COMMUNICATIONVECTOR INFORMATIK GMBH'S OTA HELPED WM MOTOR FOR SOFTWARE UPDATESARGUS CYBER SECURITY COLLABORATED WITH ERICSSON TO DELIVER BIG DATA-ENABLED CYBERSECURITY SOLUTIONS FOR CONNECTED VEHICLESVECTOR INFORMATIK, ALONG WITH INFINEON TECHNOLOGIES, PROVIDED SOLUTIONS FOR CYBERATTACKSINCREASING SECURITY AND EFFICIENCY OF TRUST FRAMEWORK FOR V2X OF SAVARI

-

5.9 MARKET, SCENARIOS (2023–2028)MOST LIKELY SCENARIOOPTIMISTIC SCENARIOPESSIMISTIC SCENARIO

- 5.10 KEY CONFERENCES AND EVENTS IN 2023–2024

- 6.1 INTRODUCTION

- 6.2 AUTOMOTIVE CYBERSECURITY THREATS AND SOLUTIONS

-

6.3 CYBERSECURITY FOR INTELLIGENT TRANSPORTATION SYSTEMSCOOPERATIVE INTELLIGENT TRANSPORT SYSTEMS- Stakeholders- Standards- Services- Security policies- Data protection policies- Recent developmentsEUROPEAN NETWORK AND INFORMATION SECURITY AGENCYEUROPEAN TELECOMMUNICATIONS STANDARDS INSTITUTE

-

6.4 SYSTEM-ON-CHIP AND AUTOMOTIVE CYBERSECURITYAUTOMOTIVE SYSTEM-ON-CHIP: USE CASES- Integrated platform for integrated solutions- Advanced connectivity technologies- CVSoC with cognitive computing capabilities- Cryptography for V2X communicationsKEY FOCUS AREAS, CURRENT CONCERNS, AND FUTURE OUTLOOK

-

7.1 INTRODUCTIONOPERATIONAL DATA

-

7.2 TELEMATICSGROWING DEMAND FROM COMMERCIAL VEHICLES TO DRIVE MARKET

-

7.3 COMMUNICATION SYSTEMSINCREASING DEMAND FOR HIGH-END COMMUNICATION PLATFORMS TO CONTRIBUTE TO MARKET GROWTH

-

7.4 ADAS & SAFETYGOVERNMENT FOCUS ON VEHICLE SAFETY TO DRIVE MARKET

-

7.5 INFOTAINMENTGROWING DEMAND FROM PASSENGER AND COMMERCIAL VEHICLES TO DRIVE MARKET

-

7.6 BODY CONTROL & COMFORTRISING DEMAND FOR PREMIUM AND LUXURY CARS TO DRIVE DEMAND

-

7.7 POWERTRAIN SYSTEMSRISING DEMAND FOR BETTER FUEL ECONOMY AND LESS VEHICLE EMISSION TO DRIVE MARKET

- 7.8 KEY PRIMARY INSIGHTS

-

8.1 INTRODUCTIONOPERATIONAL DATA

-

8.2 APPLICATION SECURITYGROWING PENETRATION OF ADAS FEATURES AND IN-CAR ELECTRONICS TO SUPPORT MARKET

-

8.3 WIRELESS NETWORK SECURITYADVANCEMENTS IN INFORMATION TECHNOLOGY TO DRIVE MARKET

-

8.4 ENDPOINT SECURITYDEPLOYMENT OF SOFTWARE IN VEHICLES AND INCREASING SAFETY CONCERNS AMONG OEMS TO INCREASE DEMAND

- 8.5 KEY PRIMARY INSIGHTS

-

9.1 INTRODUCTIONOPERATIONAL DATA

-

9.2 NON-AUTONOMOUS VEHICLESRISING FOCUS ON DEVELOPING HARDWARE SECURITY MODULES AND NETWORK SECURITY TO DRIVE MARKET

-

9.3 SEMI-AUTONOMOUS VEHICLESINCREASING ADOPTION OF ADAS, V2P, AND V2V TECHNOLOGIES TO RESULT IN SOARING DEMAND FOR CYBERSECURITY SOLUTIONS AMONG OEMS

-

9.4 AUTONOMOUS VEHICLESGROWING AUTONOMY LEVELS TO INCREASE VEHICLE VULNERABILITY

- 9.5 KEY PRIMARY INSIGHTS

- 10.1 INTRODUCTION

-

10.2 PASSENGER VEHICLESGROWING FOCUS ON ADAS, V2V, AND V2I TECHNOLOGIES TO ACCELERATE MARKET GROWTH

-

10.3 LIGHT COMMERCIAL VEHICLESGROWING SALES OF HIGH-END LIGHT COMMERCIAL VEHICLES TO DRIVE MARKET

-

10.4 HEAVY COMMERCIAL VEHICLESGROWING PENETRATION OF V2X TECHNOLOGY TO DRIVE DEMAND FOR AUTOMOTIVE CYBERSECURITY SOLUTIONS

- 10.5 KEY PRIMARY INSIGHTS

-

11.1 INTRODUCTIONOPERATIONAL DATA

-

11.2 ICE VEHICLESINCREASING ADOPTION OF ADAS AND OTHER CONNECTED FEATURES TO PROPEL DEMAND FOR AUTOMOTIVE CYBERSECURITY SOLUTIONS IN CONVENTIONAL VEHICLES

-

11.3 ELECTRIC VEHICLESINCREASING SALES OF ELECTRIC VEHICLES TO DRIVE MARKET

- 11.4 KEY PRIMARY INSIGHTS

-

12.1 INTRODUCTIONOPERATIONAL DATA

-

12.2 IN-VEHICLEGROWING PENETRATION OF CONNECTED VEHICLES AND AUTONOMOUS MOBILITY TO DRIVE MARKET

-

12.3 EXTERNAL CLOUD SERVICESINCREASING CLOUD CONNECTIVITY FEATURES TO DRIVE DEMAND

- 12.4 KEY PRIMARY INSIGHTS

-

13.1 INTRODUCTIONOPERATIONAL DATA

-

13.2 HARDWARECAPABILITY TO PROTECT VEHICLES FROM UNAUTHORIZED ACCESS TO DRIVE MARKET

-

13.3 SOFTWAREGROWING COMPLEXITY OF IN-VEHICLE ARCHITECTURE TO INCREASE VEHICLE’S VULNERABILITY AGAINST CYBERATTACKS

- 13.4 KEY PRIMARY INSIGHTS

- 14.1 INTRODUCTION

- 14.2 CHARGING MANAGEMENT

- 14.3 TELEMATICS

- 14.4 COMMUNICATION SYSTEMS

- 14.5 BATTERY MANAGEMENT & POWERTRAIN SYSTEMS

- 14.6 INFOTAINMENT

- 14.7 ADAS & SAFETY

- 14.8 BODY CONTROL & COMFORT

- 14.9 KEY PRIMARY INSIGHTS

- 15.1 INTRUSION DETECTION SYSTEM

-

15.2 SECURITY OPERATION CENTERKEY FUNCTIONS OF SECURITY OPERATION CENTERUSE CASES OF SECURITY OPERATION CENTER

- 15.3 KEY PRIMARY INSIGHTS

- 16.1 INTRODUCTION

-

16.2 ASIA PACIFICRECESSION IMPACT ANALYSISCHINA- Developed V2X networking to drive marketINDIA- Government initiatives regarding intelligent transport systems and electric mobility to drive demand for cybersecurity solutionsJAPAN- Introduction of cybersecurity supply-chain risk management and mandate on Cyber-Physical Security Framework to propel marketSOUTH KOREA- Stepwise approach to implement UNECE WP.29 regulations to propel marketREST OF ASIA PACIFIC

-

16.3 EUROPERECESSION IMPACT ANALYSISGERMANY- High demand for premium cars to drive marketFRANCE- Focus on deployment of ADAS features by OEMs to drive marketUK- Rising demand for connected vehicles to catalyze demand for automotive cybersecurity solutionsRUSSIA- Investments in automotive sector by major manufacturers to drive marketTURKEY- Implementation of UN regulations to boost marketREST OF EUROPE

-

16.4 NORTH AMERICARECESSION IMPACT ANALYSISUS- Increasing adoption of connected cars to support marketCANADA- Focus on autonomous driving to favor market growthMEXICO- Growth in export sales of LCVs with connectivity features to boost market

-

16.5 REST OF THE WORLD (ROW)RECESSION IMPACT ANALYSISBRAZIL- Adoption of advanced technologies to drive marketSOUTH AFRICA- Government initiatives for increasing electric vehicle sales to propel marketOTHERS

- 17.1 OVERVIEW

- 17.2 MARKET RANKING ANALYSIS

- 17.3 REVENUE ANALYSIS OF TOP 5 PLAYERS

- 17.4 MARKET SHARE ANALYSIS

-

17.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

17.6 START-UP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 17.7 START-UP/SME FOOTPRINT

-

17.8 COMPETITIVE SCENARIODEALSEXPANSIONS

-

18.1 KEY PLAYERSCONTINENTAL AG- Business overview- Products offered- Recent developments- MnM viewROBERT BOSCH GMBH- Business overview- Products offered- Recent developments- MnM viewHARMAN INTERNATIONAL- Business overview- Products offered- Recent developments- MnM viewDENSO CORPORATION- Business overview- Products offered- Recent developments- MnM viewAPTIV PLC- Business overview- Products offered- Recent developments- MnM viewGARRETT MOTION INC.- Business overview- Products offeredRENESAS ELECTRONICS CORPORATION- Business overview- Products offeredNXP SEMICONDUCTORS- Business overview- Products offered- Recent developmentsLEAR CORPORATION- Business overview- Products offered- Recent developmentsVECTOR INFORMATIK GMBH- Business overview- Recent developments

-

18.2 OTHER KEY PLAYERSKARAMBA SECURITYSHEELDSSAFERIDE TECHNOLOGIESGUARDKNOX CYBER TECHNOLOGIES LTD.UPSTREAM SECURITY LTD.BROADCOM INC.AIRBIQUITY INC.GREEN HILLS SOFTWAREBLACKBERRY CERTICOMREAL-TIME INNOVATIONSIRDETOSTMICROELECTRONICS N.V.ID QUANTIQUEATOS SEAVL SOFTWARE AND FUNCTIONS GMBHCOMBITECH ABAUTOCRYPT CO., LTD.AUTOTALKSCYBELLUMC2A-SEC LTDCYMOTIVE TECHNOLOGIESTHALES GROUP

- 19.1 ASIA PACIFIC TO BE MAJOR MARKET FOR AUTOMOTIVE CYBERSECURITY SOLUTIONS

- 19.2 INCREASING FOCUS ON SEMI-AUTONOMOUS VEHICLES TO DRIVE DEMAND FOR AUTOMOTIVE CYBERSECURITY SOLUTIONS

- 19.3 ADAS AND SAFETY DRIVING TO EMERGE AS KEY APPLICATION SEGMENT

- 19.4 CONCLUSION

- 20.1 KEY INSIGHTS OF INDUSTRY EXPERTS

- 20.2 DISCUSSION GUIDE

- 20.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 20.4 CUSTOMIZATION OPTIONS

- 20.5 RELATED REPORTS

- 20.6 AUTHOR DETAILS

- TABLE 1 AUTOMOTIVE CYBERSECURITY MARKET DEFINITION, BY ICE AND EV APPLICATIONS

- TABLE 2 MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 3 MARKET DEFINITION, BY SECURITY TYPE

- TABLE 4 MARKET DEFINITION, BY VEHICLE AUTONOMY

- TABLE 5 MARKET DEFINITION, BY OFFERING

- TABLE 6 MARKET DEFINITION, BY FORM TYPE

- TABLE 7 MARKET DEFINITION, BY PROPULSION TYPE

- TABLE 8 MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 9 USD EXCHANGE RATES

- TABLE 10 MAJOR ANNOUNCEMENTS ON ELECTRIFICATION, 2021–2022

- TABLE 11 BASE STANDARDS FOR SECURITY AND PRIVACY DEVELOPED BY EUROPEAN TELECOMMUNICATIONS STANDARDS INSTITUTE

- TABLE 12 THREATS AND COUNTERMEASURES FOR DIFFERENT OSI LAYERS FOR V2X COMMUNICATION

- TABLE 13 MAJOR VEHICLE RECALLS, BY OEM, 2015-2021

- TABLE 14 VEHICLES WITH LEVEL-2 AND LEVEL-3 AUTONOMY (2019–2022)

- TABLE 15 MARKET: IMPACT OF MARKET DYNAMICS

- TABLE 16 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 17 AUTOMOTIVE CYBERSECURITY STANDARDS

- TABLE 18 WP.29 REGULATION APPROVAL PARTS

- TABLE 19 IMPORTANT REQUIREMENTS OF AIS 140 STANDARD

- TABLE 20 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 AUTOMOTIVE CYBERSECURITY MARKET: PATENT ANALYSIS (COMPLETED PATENTS)

- TABLE 24 MARKET SCENARIO, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 MOST LIKELY SCENARIO, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 OPTIMISTIC SCENARIO, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 PESSIMISTIC SCENARIO, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 MARKET: KEY CONFERENCES AND EVENTS

- TABLE 29 AUTOMOTIVE CYBERSECURITY THREATS AND SOLUTIONS ACROSS APPLICATIONS UNDER STRIDE MODEL

- TABLE 30 COMPARISON OF AUTOMOTIVE SECURITY MODELS

- TABLE 31 ROLE OF STAKEHOLDERS IN COOPERATIVE INTELLIGENT TRANSPORT SYSTEMS

- TABLE 32 STANDARDS OF COOPERATIVE INTELLIGENT TRANSPORT SYSTEMS

- TABLE 33 TEST SPECIFICATION FOR COOPERATIVE INTELLIGENT TRANSPORT SYSTEMS

- TABLE 34 SERVICES UNDER COOPERATIVE INTELLIGENT TRANSPORT SYSTEMS

- TABLE 35 RECENT DEVELOPMENTS IN COOPERATIVE INTELLIGENT TRANSPORT SYSTEMS (2017–2021)

- TABLE 36 EUROPEAN NETWORK AND INFORMATION SECURITY AGENCY STANDARDS

- TABLE 37 EUROPEAN TELECOMMUNICATIONS STANDARDS

- TABLE 38 MARKET: KEY FOCUS AREAS, CURRENT CONCERNS, AND FUTURE OUTLOOK, 2019 AND BEYOND

- TABLE 39 MARKET, BY APPLICATION TYPE, 2018–2022 (USD MILLION)

- TABLE 40 MARKET, BY APPLICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 41 TELEMATICS CYBERSECURITY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 TELEMATICS CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 DIFFERENT IN-VEHICLE AND EXTERNAL NETWORKS

- TABLE 44 COMMUNICATION SYSTEMS CYBERSECURITY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 COMMUNICATION SYSTEMS CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 VEHICLES WITH ADAS FEATURES IN INDIA

- TABLE 47 ADAS & SAFETY CYBERSECURITY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 ADAS & SAFETY CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 INFOTAINMENT CYBERSECURITY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 INFOTAINMENT CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 BODY CONTROL & COMFORT CYBERSECURITY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 BODY CONTROL & COMFORT CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 TOP 25 COUNTRIES WITH HIGHEST LUXURY CAR DENSITY

- TABLE 54 TOP 20 LUXURY CARS IN INDIA

- TABLE 55 POWERTRAIN SYSTEM CYBERSECURITY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 56 POWERTRAIN SYSTEM CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 MARKET, BY SECURITY TYPE, 2018–2022 (USD MILLION)

- TABLE 58 MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 59 ATTACK VECTORS AND SECURITY TYPE REQUIREMENTS

- TABLE 60 AUTOMOTIVE APPLICATION CYBERSECURITY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 AUTOMOTIVE APPLICATION CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 ATTACK FEASIBILITY RATING BASED ON INTERFACE

- TABLE 63 AUTOMOTIVE WIRELESS NETWORK CYBERSECURITY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 64 AUTOMOTIVE WIRELESS NETWORK CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 AUTOMOTIVE ENDPOINT CYBERSECURITY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 AUTOMOTIVE ENDPOINT CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 DIFFERENT LEVELS OF VEHICLE AUTONOMY

- TABLE 68 ATTACK SURFACES AND POSSIBLE THREATS

- TABLE 69 MARKET, BY VEHICLE AUTONOMY, 2018–2022 (USD MILLION)

- TABLE 70 MARKET, BY VEHICLE AUTONOMY, 2023–2028 (USD MILLION)

- TABLE 71 ACCIDENTAL ASSISTANCE PROVIDED BY ADAS FEATURES

- TABLE 72 LIST OF SOME POPULAR SELF-DRIVING VEHICLES BY GLOBAL COMPANIES

- TABLE 73 EXPECTED TECHNOLOGY VS. CURRENT TECHNOLOGY READINESS LEVEL OF AUTONOMOUS VEHICLES

- TABLE 74 AUTOMOTIVE SYSTEM ARCHITECTURE VS. SECURITY OF EACH LEVEL

- TABLE 75 L2: LAUNCH OF NEW SELF-DRIVING CARS, 2021–2022

- TABLE 76 MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 77 MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 78 POPULAR PASSENGER CAR MODELS EQUIPPED WITH V2X

- TABLE 79 SYSTEMATIC DERIVATION AND COMPARISON OF CYBERSECURITY RISKS FOR PASSENGER VEHICLES

- TABLE 80 MARKET IN PASSENGER VEHICLES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 81 MARKET IN PASSENGER VEHICLES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 MARKET IN LIGHT COMMERCIAL VEHICLES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 83 AUTOMOTIVE CYBERSECURITY MARKET IN LIGHT COMMERCIAL VEHICLES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 SYSTEMATIC DERIVATION AND COMPARISON OF CYBERSECURITY RISKS FOR HEAVY-DUTY VEHICLES

- TABLE 85 MARKET IN HEAVY COMMERCIAL VEHICLES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 86 MARKET IN HEAVY COMMERCIAL VEHICLES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 CARS EQUIPPED WITH V2X (BY PROPULSION)

- TABLE 88 MARKET, BY PROPULSION TYPE, 2018–2022 (USD MILLION)

- TABLE 89 MARKET, BY PROPULSION TYPE, 2023–2028 (USD MILLION)

- TABLE 90 MARKET, BY FORM TYPE, 2018–2022 (USD MILLION)

- TABLE 91 MARKET, BY FORM TYPE, 2023–2028 (USD MILLION)

- TABLE 92 ATTACKER PROFILE VS. SERIOUSNESS OF THREATS

- TABLE 93 AUTOMOTIVE IN-VEHICLE CYBERSECURITY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 94 AUTOMOTIVE IN-VEHICLE CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 AUTOMOTIVE EXTERNAL CLOUD SERVICE CYBERSECURITY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 96 AUTOMOTIVE EXTERNAL CLOUD SERVICE CYBERSECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 SUPPLIERS OF HARDWARE AND SOFTWARE

- TABLE 98 MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 99 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 100 AUTOMOTIVE CYBERSECURITY HARDWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 101 AUTOMOTIVE CYBERSECURITY HARDWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 102 AUTOMOTIVE CYBERSECURITY SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 103 AUTOMOTIVE CYBERSECURITY SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 104 MARKET, BY EV APPLICATION, 2018–2022 (USD MILLION)

- TABLE 105 MARKET, BY EV APPLICATION, 2023–2028 (USD MILLION)

- TABLE 106 COMPANIES AND THEIR IDS SOLUTIONS

- TABLE 107 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 108 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 111 C-V2X-EQUIPPED VEHICLES LAUNCHED IN CHINA

- TABLE 112 CHINA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 113 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 114 NEW L2 LAUNCHES IN CHINA, 2021–2022

- TABLE 115 VEHICLE LAUNCHES WITH ADAS FEATURES IN CHINA, 2021–2022

- TABLE 116 INDIA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 117 INDIA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 118 NEW L2 LAUNCHES IN JAPAN, 2021–2022

- TABLE 119 JAPAN: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 120 JAPAN: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 121 SOUTH KOREA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 122 SOUTH KOREA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 123 VEHICLE LAUNCHES WITH ADAS FEATURES IN SOUTH KOREA, 2021–2022

- TABLE 124 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 126 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 127 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 128 SEMI-AUTONOMOUS CARS LAUNCHED/UNDER DEVELOPMENT IN EUROPE, 2021–2022

- TABLE 129 VEHICLE LAUNCHES WITH ADAS FEATURES IN GERMANY, 2021–2022

- TABLE 130 GERMANY: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 131 GERMANY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 132 SEMI-AUTONOMOUS CARS LAUNCHED/UNDER DEVELOPMENT IN FRANCE, 2021–2023

- TABLE 133 VEHICLE LAUNCHES WITH ADAS FEATURES IN FRANCE, 2021–2022

- TABLE 134 FRANCE: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 135 FRANCE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 136 VEHICLE LAUNCHES WITH ADAS FEATURES IN UK, 2020–2022

- TABLE 137 UK: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 138 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 139 RUSSIA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 140 RUSSIA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 141 TURKEY: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 142 TURKEY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 143 REST OF EUROPE: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 144 REST OF EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 145 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 146 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 147 US: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 148 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 149 LAUNCH OF SEMI-AUTONOMOUS CARS IN US, 2021–2023

- TABLE 150 CANADA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 151 CANADA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 152 MEXICO: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 153 MEXICO: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 154 ROW: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 155 ROW: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 156 BRAZIL: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 157 BRAZIL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 158 SOUTH AFRICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 159 SOUTH AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 160 OTHERS: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 161 OTHERS: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 162 MARKET: COMPANY FOOTPRINT, 2022

- TABLE 163 MARKET: SOLUTION TYPE FOOTPRINT, 2022

- TABLE 164 MARKET: REGIONAL FOOTPRINT, 2022

- TABLE 165 START-UPS/SMES: REGIONAL FOOTPRINT

- TABLE 166 START-UPS/SMES: COMPANY SOLUTION TYPE FOOTPRINT

- TABLE 167 START-UPS/SMES: COMPANY FOOTPRINT

- TABLE 168 MARKET: PRODUCT LAUNCHES, 2021–2023

- TABLE 169 MARKET: DEALS, 2021–2023

- TABLE 170 MARKET: EXPANSIONS, 2021–2023

- TABLE 171 MARKET: LIST OF KEY START-UPS/SMES

- TABLE 172 MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 173 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 174 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 175 CONTINENTAL AG: MAJOR SUPPLY AGREEMENTS

- TABLE 176 CONTINENTAL AG: KEY CUSTOMERS

- TABLE 177 CONTINENTAL AG: PRODUCT DEVELOPMENTS

- TABLE 178 CONTINENTAL AG: DEALS

- TABLE 179 CONTINENTAL AG: OTHERS

- TABLE 180 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 181 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 182 ROBERT BOSCH GMBH: PRODUCT DEVELOPMENTS

- TABLE 183 ROBERT BOSCH GMBH: DEALS

- TABLE 184 ROBERT BOSCH GMBH: OTHERS

- TABLE 185 HARMAN INTERNATIONAL: COMPANY OVERVIEW

- TABLE 186 HARMAN INTERNATIONAL: MAJOR SUPPLY AGREEMENTS

- TABLE 187 HARMAN INTERNATIONAL: KEY CUSTOMERS

- TABLE 188 HARMAN INTERNATIONAL: PRODUCTS OFFERED

- TABLE 189 HARMAN INTERNATIONAL: PRODUCT DEVELOPMENTS

- TABLE 190 HARMAN INTERNATIONAL: DEALS

- TABLE 191 HARMAN INTERNATIONAL: OTHERS

- TABLE 192 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 193 DENSO CORPORATION: PRODUCTS OFFERED

- TABLE 194 DENSO CORPORATION: KEY CUSTOMERS

- TABLE 195 DENSO CORPORATION: SALES BREAKDOWN BY OEMS (AS OF MARCH 2022)

- TABLE 196 DENSO CORPORATION: MAJOR SUBSIDIARIES AND AFFILIATES

- TABLE 197 DENSO CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 198 DENSO CORPORATION: DEALS

- TABLE 199 DENSO CORPORATION: OTHERS

- TABLE 200 APTIV PLC: COMPANY OVERVIEW

- TABLE 201 APTIV PLC: KEY CUSTOMERS

- TABLE 202 APTIV PLC: SALES RATIO TO MAJOR CUSTOMER (AS OF DECEMBER 2022)

- TABLE 203 APTIV PLC: MAJOR SUPPLY AGREEMENTS

- TABLE 204 APTIV PLC: COMPETITORS IN OPERATING BUSINESS SEGMENTS

- TABLE 205 APTIV PLC: PRODUCTS OFFERED

- TABLE 206 APTIV PLC: PRODUCT DEVELOPMENTS

- TABLE 207 APTIV PLC: DEALS

- TABLE 208 APTIV PLC: OTHERS

- TABLE 209 GARRETT MOTION INC.: COMPANY OVERVIEW

- TABLE 210 GARRETT MOTION INC.: PRODUCTS OFFERED

- TABLE 211 GARRETT MOTION INC.: PRODUCT DEVELOPMENTS

- TABLE 212 GARRETT MOTION INC.: DEALS

- TABLE 213 GARRETT MOTION INC.: OTHERS

- TABLE 214 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 215 RENESAS ELECTRONICS CORPORATION: PRODUCTS OFFERED

- TABLE 216 RENESAS ELECTRONICS CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 217 RENESAS ELECTRONICS CORPORATION: DEALS

- TABLE 218 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 219 NXP SEMICONDUCTORS: MAJOR SUPPLY AGREEMENTS

- TABLE 220 NXP SEMICONDUCTORS: KEY CUSTOMERS

- TABLE 221 NXP SEMICONDUCTORS: PRODUCTS OFFERED

- TABLE 222 NXP SEMICONDUCTORS: PRODUCT DEVELOPMENTS

- TABLE 223 NXP SEMICONDUCTORS: DEALS

- TABLE 224 NXP SEMICONDUCTORS: OTHERS

- TABLE 225 LEAR CORPORATION: COMPANY OVERVIEW

- TABLE 226 LEAR CORPORATION: MAJOR SUPPLY AGREEMENTS

- TABLE 227 LEAR CORPORATION: KEY CUSTOMERS

- TABLE 228 LEAR CORPORATION: PRODUCTS OFFERED

- TABLE 229 LEAR CORPORATION: DEALS

- TABLE 230 VECTOR INFORMATIK GMBH: COMPANY OVERVIEW

- TABLE 231 VECTOR INFORMATIK GMBH: PRODUCTS OFFERED

- TABLE 232 VECTOR INFORMATIK GMBH: PRODUCT DEVELOPMENTS

- TABLE 233 VECTOR INFORMATIK GMBH: DEALS

- TABLE 234 VECTOR INFORMATIK GMBH: OTHERS

- TABLE 235 KARAMBA SECURITY: COMPANY OVERVIEW

- TABLE 236 SHEELDS: COMPANY OVERVIEW

- TABLE 237 SAFERIDE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 238 GUARDKNOX CYBER TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 239 UPSTREAM SECURITY LTD.: COMPANY OVERVIEW

- TABLE 240 BROADCOM INC.: COMPANY OVERVIEW

- TABLE 241 AIRBIQUITY INC.: COMPANY OVERVIEW

- TABLE 242 GREEN HILLS SOFTWARE: COMPANY OVERVIEW

- TABLE 243 BLACKBERRY CERTICOM: COMPANY OVERVIEW

- TABLE 244 REAL-TIME INNOVATIONS: COMPANY OVERVIEW

- TABLE 245 IRDETO: COMPANY OVERVIEW

- TABLE 246 STMICROELECTRONICS N.V.: COMPANY OVERVIEW

- TABLE 247 ID QUANTIQUE: COMPANY OVERVIEW

- TABLE 248 ATOS SE: COMPANY OVERVIEW

- TABLE 249 AVL SOFTWARE AND FUNCTIONS GMBH: COMPANY OVERVIEW

- TABLE 250 COMBITECH AB: COMPANY OVERVIEW

- TABLE 251 AUTOCRYPT CO., LTD.: COMPANY OVERVIEW

- TABLE 252 AUTOTALKS: COMPANY OVERVIEW

- TABLE 253 CYBELLUM: COMPANY OVERVIEW

- TABLE 254 C2A-SEC LTD: COMPANY OVERVIEW

- TABLE 255 CYMOTIVE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 256 THALES GROUP: COMPANY OVERVIEW

- FIGURE 1 AUTOMOTIVE CYBERSECURITY MARKET SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 MARKET: DEMAND-SIDE APPROACH

- FIGURE 7 AUTOMOTIVE CYBERSECURITY MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION APPROACH

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 10 MARKET: RESEARCH DESIGN AND METHODOLOGY

- FIGURE 11 MARKET: DATA TRIANGULATION

- FIGURE 12 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- FIGURE 13 MARKET OVERVIEW

- FIGURE 14 KEY PLAYERS OPERATING IN MARKET, BY REGION

- FIGURE 15 MARKET, BY REGION, 2023–2028

- FIGURE 16 MARKET, BY VEHICLE TYPE, 2023–2028

- FIGURE 17 MARKET, BY APPLICATION TYPE, 2023–2028

- FIGURE 18 INCREASING INCLINATION TOWARD ADAS TECHNOLOGY AND AUTONOMOUS MOBILITY TO DRIVE MARKET

- FIGURE 19 ASIA PACIFIC TO DOMINATE MARKET IN 2023

- FIGURE 20 ADAS & SAFETY SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 21 SOFTWARE SEGMENT TO DOMINATE AUTOMOTIVE CYBERSECURITY MARKET DURING FORECAST PERIOD

- FIGURE 22 IN-VEHICLE SEGMENT TO LEAD AUTOMOTIVE CYBERSECURITY MARKET DURING FORECAST PERIOD

- FIGURE 23 APPLICATION SECURITY SEGMENT TO LEAD AUTOMOTIVE CYBERSECURITY MARKET DURING FORECAST PERIOD

- FIGURE 24 PASSENGER VEHICLES SEGMENT TO DOMINATE AUTOMOTIVE CYBERSECURITY MARKET DURING FORECAST PERIOD

- FIGURE 25 SEMI-AUTONOMOUS VEHICLES SEGMENT TO DOMINATE AUTOMOTIVE CYBERSECURITY MARKET DURING FORECAST PERIOD

- FIGURE 26 ELECTRIC VEHICLES SEGMENT TO GROW AT HIGHER RATE THAN ICE VEHICLES SEGMENT DURING FORECAST PERIOD

- FIGURE 27 CHARGING MANAGEMENT SEGMENT TO GROW AT HIGHEST RATE FROM 2023 TO 2028

- FIGURE 28 AUTOMOTIVE CONNECTIVITY ECOSYSTEM

- FIGURE 29 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AUTOMOTIVE CYBERSECURITY MARKET

- FIGURE 30 DATA FROM AUTONOMOUS VEHICLES

- FIGURE 31 GLOBAL BEV AND PHEV SALES, 2018–2022

- FIGURE 32 MONETARY EV INCENTIVES IN WESTERN EUROPE

- FIGURE 33 CYBER VULNERABILITIES IN VEHICULAR ECOSYSTEM

- FIGURE 34 LEVEL OF COMMITMENT FOR CYBERSECURITY, BY COUNTRY (2022)

- FIGURE 35 KEY ELEMENTS OF V2X

- FIGURE 36 COMPARISON BETWEEN 4G AND 5G NETWORKS FOR CONNECTED CARS

- FIGURE 37 COMPLEXITY DRIVERS IN CAR ELECTRONIC SYSTEMS

- FIGURE 38 CONVENTIONAL VEHICLES VS. SOFTWARE-DEFINED VEHICLES

- FIGURE 39 LEVELS OF AUTONOMOUS DRIVING

- FIGURE 40 AUTOMOTIVE CYBERSECURITY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 41 MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 42 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 43 MARKET: SAFETY AND SECURITY STANDARDS

- FIGURE 44 UNECE’S 1958 AGREEMENT

- FIGURE 45 GUIDELINES AND BENEFITS OF AIS 140 STANDARD

- FIGURE 46 PUBLICATION TRENDS (2015–2022)

- FIGURE 47 LEGAL STATUS OF PATENTS FILED IN MARKET (2012–2022)

- FIGURE 48 MARKET: TOP 10 PATENT APPLICANTS

- FIGURE 49 MAJOR AUTOMOTIVE CYBERATTACKS, 2010–2025

- FIGURE 50 AUTOMOTIVE CYBERSECURITY DEFENSE FRAMEWORK

- FIGURE 51 ELEMENTS OF COOPERATIVE INTELLIGENT TRANSPORT SYSTEMS

- FIGURE 52 COOPERATIVE INTELLIGENT TRANSPORT SYSTEM SECURITY MODEL

- FIGURE 53 AUTOMOTIVE SYSTEM-ON-CHIP ARCHITECTURE FOR HUMAN-MACHINE INTERFACE

- FIGURE 54 CYBERSECURITY FROM ECU CONSOLIDATION PERSPECTIVE

- FIGURE 55 DOMAIN CENTRALIZATION ARCHITECTURE

- FIGURE 56 ADAS & SAFETY SEGMENT TO LEAD MARKET IN 2023–2028

- FIGURE 57 COMPARISON OF CODING REQUIRED FOR VARIOUS VEHICLES

- FIGURE 58 EXAMPLE OF REMOTE DIAGNOSTIC SERVICE

- FIGURE 59 APPLICATION SECURITY TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 60 SECURITY RISKS OF AUTOMOTIVE ELECTRONIC SYSTEMS

- FIGURE 61 AUTOMATION LEVELS OF AUTONOMOUS CARS

- FIGURE 62 VARIOUS ATTACK SURFACES OF CONNECTED VEHICLES

- FIGURE 63 SEMI-AUTONOMOUS VEHICLES TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 64 EVOLUTION OF AUTOMATED SAFETY TECHNOLOGIES

- FIGURE 65 AUTOMOTIVE SYSTEM AND HIERARCH ICAL CLASSIFICATION OF AUTONOMOUS VEHICLE FROM SECURITY VIEWPOINT

- FIGURE 66 PASSENGER VEHICLES TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 67 EXAMPLE OF ELEMENTS REQUIRED TO AUTOMATE TRUCK

- FIGURE 68 DEPLOYMENT ROAD MAP FOR AUTONOMOUS TRUCKS

- FIGURE 69 NEW PASSENGER CAR REGISTRATIONS IN EUROPE, BY FUEL TYPE

- FIGURE 70 ICE VEHICLES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 71 IN-VEHICLE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 72 CLOUD SERVICE IMPLICATIONS

- FIGURE 73 SAMPLE ARCHITECTURE OF IN-VEHICLE NETWORK

- FIGURE 74 AUTOMOTIVE SOFTWARE AND E/E MARKET, 2020–2030 (USD BILLION)

- FIGURE 75 SOFTWARE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 76 ECU/DCU MARKET, BY DOMAIN REVENUE SHARE, 2020–2030 (USD BILLION)

- FIGURE 77 GLOBAL AUTOMOTIVE SOFTWARE MARKET, 2020–2030 (USD BILLION)

- FIGURE 78 MARKET, BY EV APPLICATION, 2023 VS. 2028

- FIGURE 79 SPOOFING MESSAGE INSERTED BY ATTACKER ELECTRONIC CONTROL UNIT

- FIGURE 80 INTRUSION DETECTION SYSTEM FOR AUTOMOTIVE CONTROLLER AREA NETWORK BUS SYSTEM

- FIGURE 81 STRUCTURE OF AUTOMOTIVE IDS

- FIGURE 82 ESCRYPT SECURITY OPERATION CENTER PLATFORM

- FIGURE 83 ASIA PACIFIC TO BE LARGEST AND FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 84 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 85 EUROPE: MARKET, 2023 VS. 2028 (USD MILLION)

- FIGURE 86 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 87 ROW: MARKET, 2023 VS. 2028

- FIGURE 88 MARKET: MARKET RANKING 2022

- FIGURE 89 MARKET: REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020–2022

- FIGURE 90 MARKET SHARE ANALYSIS, 2022

- FIGURE 91 MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 92 MARKET: START-UP/SME EVALUATION QUADRANT, 2022

- FIGURE 93 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 94 CONTINENTAL AG: BUSINESS LOCATIONS AND EMPLOYEES (AS OF DECEMBER 2022)

- FIGURE 95 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 96 HARMAN INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 97 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 98 APTIV PLC: COMPANY SNAPSHOT

- FIGURE 99 GARRETT MOTION INC.: EMPLOYEES PER COUNTRY (AS OF DECEMBER 2022)

- FIGURE 100 GARRETT MOTION INC.: COMPANY SNAPSHOT

- FIGURE 101 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 102 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 103 LEAR CORPORATION: COMPANY SNAPSHOT

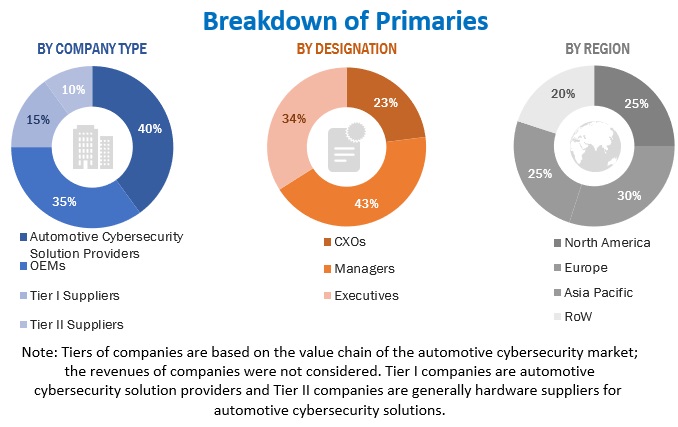

The study involved four major activities to estimate the current size of the automotive cybersecurity market. Exhaustive secondary research was done to collect information on the market, the peer market, and model mapping. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used for determining the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study included automotive cybersecurity industry organizations, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and industry associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the automotive cybersecurity market through secondary research. Several primary interviews were conducted with market experts from both the demand (OEMs) and supply (automotive cybersecurity solution providers, Tier I, and Tier II) sides across major regions, namely, North America, Europe, Asia Pacific, and RoW. Approximately 40% and 60% of primary interviews were conducted from the supply side & industry associations and dealers/distributors, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were considered to provide a holistic viewpoint in this report.

After interacting with industry experts, brief sessions with highly experienced independent consultants were conducted to reinforce the findings from primaries. This, along with the in-house subject matter experts’ opinions, led to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

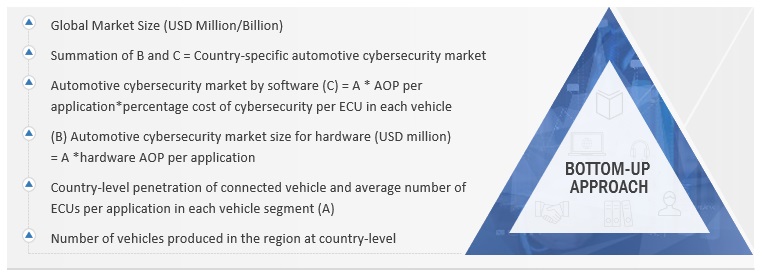

Market Size Estimation

The bottom-up approach was used to estimate and validate the size of the automotive cybersecurity market. The market size by application type, in terms of value, was derived by using the penetration rate (through model mapping) of connected vehicles at the country-level production of passenger cars and commercial vehicles, the average number of ECUs per application in each vehicle segment, hardware AOP per application, percentage cost of cybersecurity per ECU in each vehicle, and AOP per application. This gives the value of automotive cybersecurity by application type, by offering, by propulsion, and by vehicle type for all countries. Further summation of all countries leads to the regional-level market in terms of value.

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s future supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Automtive Cybersecurity Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size of the global market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedure were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Market Definition

Automotive Cybersecurity: The automotive cybersecurity market includes technologies, processes, and practices designed to protect networks, devices, programs, and data transferred within or outside a vehicle and prevent cyberattacks.

Key Stakeholders

- Automotive ADAS & Safety System Suppliers

- Automotive Component Manufacturers

- Automotive Cybersecurity Vendors

- Automotive Dealers and Distributors

- Automotive Engine Management & Powertrain System Manufacturers

- Automotive Infotainment System Manufacturers

- Automotive OEMs

- Automotive Semiconductor Manufacturers

- Automotive Telematics Components & Service Vendors

- Country-level Government Authorities and Organizations

- EV Manufacturers

- Electric Vehicle Component Manufacturers

- Investors

- Legal and Regulatory Authorities

- Raw Material Suppliers

- Transport Authorities

Report Objectives

- To define, segment, and forecast the global automotive cybersecurity market interms of value based on application, security type, form type, offering, vehicle type, propulsion type, vehicle autonomy, EV application, and region

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market, by value, based on application (telematics, communication systems, ADAS & safety, infotainment, body control & comfort, and powertrain systems)

- To segment and forecast the market, by value, based on offering (hardware and software)

- To segment and forecast the market, by value, based on form type (in-vehicle and external cloud services)

- To segment and forecast the market, by value, based on security type (application security, wireless network security, and endpoint security)

- To segment and forecast the market, by value, based on vehicle type (passenger vehicles, light commercial vehicles, and heavy commercial vehicles)

- To segment and forecast the market, by value, based on vehicle autonomy (non-autonomous vehicles, semi-autonomous vehicles, and autonomous vehicles)

- To segment and forecast the market, by value, based on propulsion type (ICE vehicles and electric vehicles)

- To segment and forecast the market, by value, based on EV application (charging management, telematics, battery management & powertrain systems, infotainment, ADAS & safety, communication systems, and body control & comfort)

- To define, segment, and analyze the approach (intrusion detection system and security operation center) segment

- To forecast the market size with respect to key regions, namely, North America, Europe, Asia Pacific, and RoW

- To provide critical analysis of the major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To analyze the competitive landscape of the market and the opportunities for stakeholders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To examine recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the automotive cybersecurity market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Automotive cybersecurity market, by propulsion type, at a regional level

- Automotive cybersecurity market, by vehicle autonomy, at a regional level

- Profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Cybersecurity Market

What are the forecast predictions for the Automotive cybersecurity market in Europe and the expected CAGR in 2022 to 2030

What are the most recent developments in the Global Automotive Cybersecurity Market?