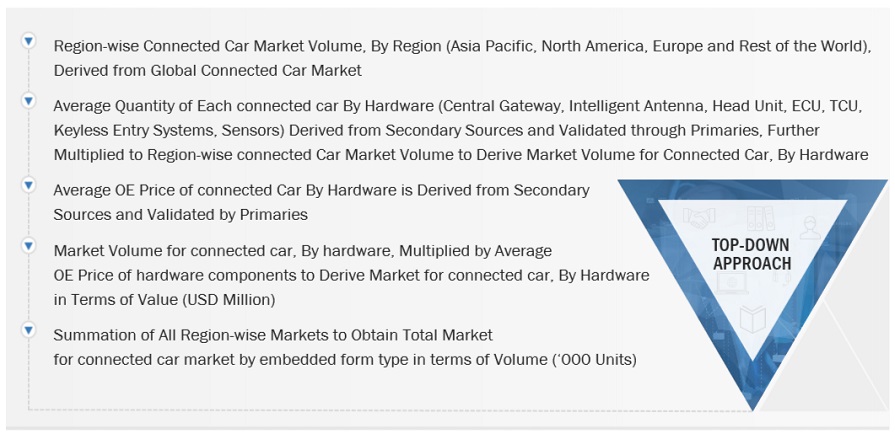

Various secondary sources, directories, and databases have been used to identify and collect information for an extensive connected car market study. The study involved four main activities in estimating the current size of the market: secondary research, validation through primary research, assumptions, and market analysis. Exhaustive secondary research was carried out to collect information on the market, such as the number of hardware used in cars, the number of on-board units installed in the vehicles, subscription cost from different service providers, annual renewal percentage of connected car service in bundles/subscriptions and upcoming technologies and trends. The next step was to validate these findings, assumptions, and market analysis with industry experts across the value chain through primary research. The top-down approach was employed to estimate the complete market size for different segments considered in this study.

Secondary Research

In the secondary research process, various secondary sources, such as company annual reports, presentations, and press releases; associations, such as Organisation Internationale des Constructeurs d'Automobiles (OICA), the International Energy Agency (IEA), European Automobile Manufacturers’ Association, Canadian Automobile Association (CAA), country-level automotive associations and trade organizations, and the US Department of Transportation (DOT); industry association publications, such as publications of OEMs’ vehicle sales; connected car magazine articles, directories, and technical handbooks; World Economic Outlook; trade websites, and technical articles, were used to identify and collect information useful for an extensive commercial study of the global connected car market.

Primary Research

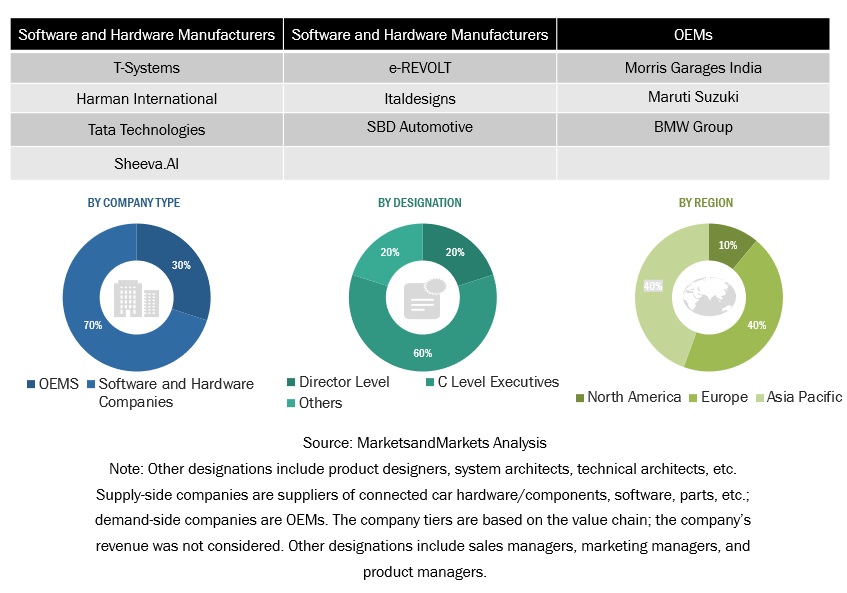

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Various sources from both the supply and demand sides were interviewed in the primary research process to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as research and development experts, CEOs, CTOs, COOS, vice presidents, marketing directors, technology and innovation directors, and related key executives from different vital companies operating in the connected car market.

After the complete market engineering, which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation, extensive primary research has been conducted to gather information and verify and validate the critical numbers arrived at. Primary research has also been undertaken to identify and validate the segmentation, industry trends, key players, competitive landscape, and market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. Extensive qualitative and quantitative analysis has been performed on the complete market engineering process to list key information/insights throughout the report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter expert's opinions have led us to the conclusions described in this report's remainder.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value and volume of the connected car market and other dependent submarkets, as mentioned below:

-

The market size, by volume, of the market has been derived by studying various vehicle models equipped with connected car services at the country level.

-

In terms of volume, the regional-level market by vehicle type has been multiplied by the regional-level average selling price (ASP) for each service type to get the market for each service in terms of value.

-

All vehicle level penetration rates, percentage shares, splits, and breakdowns for the market were determined using secondary sources and verified through primary sources.

-

The summation of the regional-level market would give the global market by vehicle type. The total value of each region was then summed up to derive the total value of the market by service type.

-

All key macro indicators affecting the revenue growth of the market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

-

The gathered market data has been consolidated and added with detailed inputs, analyzed, and presented in this report.

-

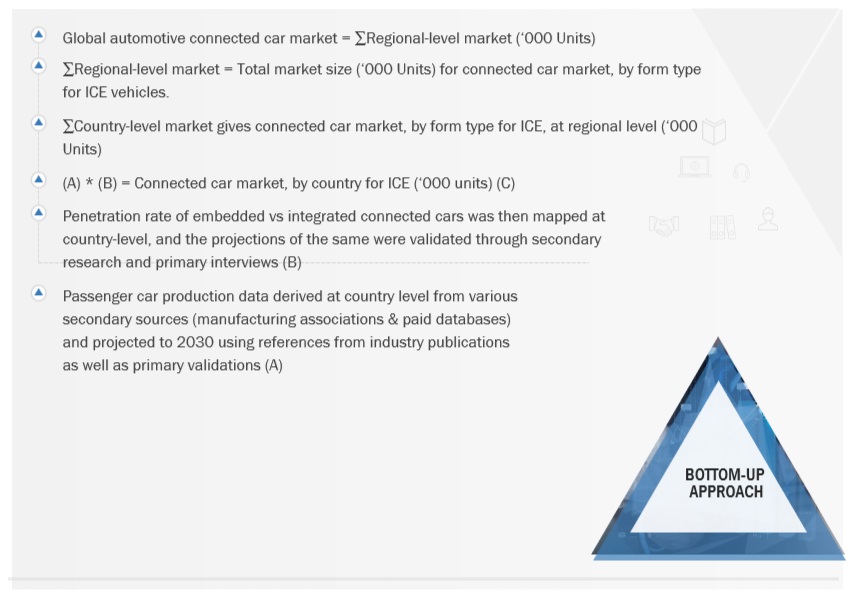

The bottom-up approach has been used to estimate and validate the size of the global market. The market size, by volume, of the connected car market has been derived by studying various vehicles.

Connected Car Market Size: Bottom-Up Approach (Form Type And Region)

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed input and analysis and presented in the report. The following figure illustrates this study's overall market size estimation process.

Market Definition

Definition: According to Geotab, a connected car is a vehicle that is equipped with mobile technology and, therefore, “connected” via the internet. Telematics is also used to connect cars using a small device that plugs into the vehicle or through embedded technology. The telematics device acts as an Internet of Things (IoT) hub that sends vehicle data to a cloud service, which can be processed and accessed by the vehicle owner or fleet manager.

According to Bosch, a connected vehicle is defined as one that has devices that use sensors and wireless connectivity to connect with other components within the vehicle and with networks outside it to provide an enhanced driving experience. It also supports vehicle-to-vehicle and vehicle-to-infrastructure communication.

Stakeholders

-

Connected car manufacturers.

-

Automotive electronic component and software suppliers

-

Automotive original equipment manufacturers (OEMs)

-

Government regulatory bodies

-

Telecommunication companies

-

Automotive testing and certification services

-

Automotive aftermarket suppliers

-

Fleet management companies.

-

Satellite communication providers

-

Insurance companies

-

Cybersecurity firms

Report Objectives

-

To define, describe, segment, and forecast the connected car market in terms of volume (thousand units) and value (USD million)

-

To segment and forecast the market in terms of value and volume based on

-

By service (navigation, remote diagnostics, multimedia streaming, social media & other apps, OTA updates, on-road assistance, eCall & SOS assistance, remote operation, auto parking/connected parking, autopilot, home integration, and stolen vehicle recovery/warning) at the regional level, in terms of value at the regional level

-

By end market (OEM and aftermarket), in terms of value at the regional level

-

By form type (embedded and integrated), in terms of volume at the regional level

-

By hardware (head unit, central gateway, intelligent antenna, electronic control unit, telematics control unit, keyless entry system, and sensor), in terms of value at the regional level

-

By transponder (onboard unit and roadside unit), in terms of volume at the regional level

-

By network (DSRC and cellular) at the regional level, in terms of volume

-

By connecting the electric car market based on vehicle type (BEV, PHEV, and FCEV) in terms of value at the regional level

-

Region ((Asia Pacific, Europe, North America, and Rest of the World (RoW))

-

To understand the market dynamics (Drivers, Restraints, Opportunities, and Challenges) and conduct Patent Analysis, Pricing Analysis, Recession Impact, Key Buying Criteria, Trade Analysis, Technology Analysis, ASP Analysis, Trades and Conferences, Case Study Analysis, Supply Chain Analysis, Regulatory Analysis, critical conference and events, and Ecosystem Mapping

-

To understand the dynamics of the market players and distinguish them into stars, emerging leaders, pervasive players, and participants according to their product portfolio strength and business strategies.

-

To strategically analyze markets concerning individual growth trends, prospects, and contributions to the total market

-

To analyze recent developments, such as partnerships, supply agreements, joint ventures/mergers and acquisitions, geographic expansions, and product developments of key players in the market

Available Customizations

Connected Car Service Market By Vehicle Type

Connected Car Market, By Cellular Network

Connected Car Hardware Market, By Aftermarket

-

Head unit

-

Central gateway

-

Intelligent Antenna

-

Electronic Control Unit (ECU)

-

Telematic control unit (TCU)

-

Keyless entry system

-

Sensor

Detailed Analysis And Profiling Of Additional Market Players (Up To 3)

User

Aug, 2019

I am mainly interested in the way the autonomous vehicles will develop in the near future in terms of market size/value and technologies used. I am also interested in exploring the main players in the autonomous vehicle market now and in the near future. Hope that gives a better understanding..

User

Aug, 2019

Growth of the connected car market - Investments in entertainment software for connected cars, in particular new 3D sound systems.

User

Aug, 2019

Growth of the connected car market - Investments in entertainment software for connected cars, in particular new 3D sound systems.

Apoorv

Jun, 2019

As an SW consultant, I would like to present customers how the connected car market would be in the future and what should be prepared. .

Ajinkya

Jun, 2019

From reading the brief description, I get the sense that Connected Services are going to be the largest drivers of the annual growth rate of connected cars. As with any other new services, most of these new connected services need to break the "lack of adoption" barrier (as witnessed by mobile wallet industry). With high numbers of vehicles (in USA) on the road now (existing, non-connected cars), how do we expect the consumers to quickly adopt to the new connected services? Can we leverage some of the existing technologies and provide the "convenience" of driving to the existing consumers of non-connected cars? In a way, get them used to the newfound convenience which encourages them to adopt to new connected services after they buy a new "connected" cars. This is exactly what we are trying to address in our company. We would like to leverage the details in this report and make a case for an accelerated adoption roadmap for connected services.Thank you.

Akshit

Jun, 2019

Developing / selling end-to-end connected vehicles solution. Client (consumer and industrial) applications developed by ourselves or third parties on car sharing, taxi dispatching, bus dispatching, etc. .

Atul

Jun, 2019

Looking to understand what market sizing for digital engagement (advertising and personalization) in the connected car is projected for the next 5 or so years..

Akshit

Jun, 2019

Amply provides fleet charging as a service to connected cars / fleets. Need to understand the addressable market.

Akshit

Jun, 2019

Amply provides fleet charging as a service to connected cars / fleets. Need to understand the addressable market.

User

Apr, 2019

sdsaf.