Space DC-DC Converter Market by Type (Isolated, Non-Isolated), Form Factor (Chassis Mount, Enclosed, Brick, Discrete), Input Voltage (<12V, 12-40V, 40-75V, >75V), Output Voltage (3.3V, 5V, 12V, 15V, 28V), Output Power (<10W, 10-29W, 30-99W, 100-250W, 251-500W, 501-1000W, >1000W), Platform, Application, and Region – Global Forecast to 2027

Space DC-DC Converter Market Size and Growth

The Global Space DC-DC Converter Market Size was valued at USD 37 Million in 2022 and is estimated to reach USD 66 Million by 2027, growing at a CAGR of 12.4% during the forecast period.

Space DC-DC Converter Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Space DC-DC Converter Market Trends

Driver: Emergence of digital power management and control

As a result of the ongoing digital revolution, the digital power management and control system is introduced in order to improve the device's efficiency. This is one of the most important technologies for minimizing power consumption. The traditional analog system depends on circuits to control the DC-DC converters, which results in power loss at the time when the load is not connected to the converters. In comparison, the digital power management and control system is often used for power supply, which utilizes a digital method to control the on/off time of a particular device. This technology uses a digital interface to control the switching regulator. For instance, tasks such as switching frequencies, control of the output voltage, control and monitoring of individual power supplies, and management of switching frequencies are done using digital power management and control. Digital power-based DC-DC converters ensure accuracy and efficiency in power supply and optimize performance and minimize power consumption, which is expected to act as one of the major factors for driving the growth of space DC-DC converters.

Restrains: Functionality of DC-DC converters in no-load situation

The biggest challenge for space DC-DC converters manufacturers is developing a device that automatically turns off during a no-load situation. Conventional converters draw current even when the load is not connected to them. In this situation, the generated heat is wasted and contributes additional thermal stress. This, in turn, results in power loss and reduced system efficiency. The Space DC-DC Converter Industry manufacturers face a significant challenge to overcome this drawback of traditional space DC-DC converters. Therefore, system designers are trying to develop a system with an automatic switch-off option when the load is not connected to the converters. It will result in power saving to a great extent and improved device efficiency.

Opportunities: Miniaturization of space DC-DC converters

In the current scenario, satellite manufacturers are demanding compact-sized power converters. The compactness of converters benefits designers who need galvanically isolated output power or noise reduction in an analog circuit. The miniaturized DC-DC converters will offer low output noise with extended operating temperature, resulting in high switching frequencies. As a result, the converters will deliver increased efficiency. Therefore, market players have the opportunity to reduce the device size to make DC-DC converters more effective.

Challenges: Global shortage of semiconductors

The global manufacturing sector has been significantly impacted by the ongoing disruptions in global supply chains. International travel restrictions and seismic shifts in demand and supply due to COVID-19 have dented the worldwide distribution network. Global shortages in integrated circuits have decimated the supply chain of various key industries. This has also affected the space DC-DC converter market, as these converters are vital to IC boards. Hence, the global shortage faced by the power electronics industry has also affected the manufacturing and supply chain of space DC-DC converters.

Space DC-DC Converter Market Segments

Growing launch of mars rovers and small satellites is driving the command & data handling systems application segment.

Spacecraft, launch vehicles, and rovers consist of multiple systems that work together to achieve mission goals. The command and data management system processes all data sent and received by the spacecraft, launch vehicle, and rover, including scientific data and the operation of the spacecraft or payload. The system is connected to a radio transmitter, and the receiving device provides a communication channel between the spacecraft and ground operators. It manages all forms of data on the spacecraft, launch vehicles, and rovers; carries out commands sent from ground stations or command centers; prepares data for transmission to Earth; manages the collection of solar power and charging of the batteries; collects and processes information about all subsystems and payloads; keeps and distributes the spacecraft time; calculates the spacecraft, launch vehicle, and rover position in orbit around Mars; carries out commanded maneuvers; and autonomously monitors and responds to a wide range of onboard problems that might occur.

Over the last few years, there has been an explosion of activities in space exploration of Mars and Moon planers and the rapid launch of small satellites by SpaceX (US) and OneWeb (UK), driven by technology breakthroughs, industry commercialization, and private investments.

In 2020, NASA’s launched its Mars rover mission which includes rover perseverance and small robotic, coaxial helicopter ingenuity.

In March 2021, NASA (US) launched the Time-Resolved Observations of Precipitation Structure and Storm Intensity with a Constellation of Small Satellite (TROPICS) mission, a group of six CubeSats to be stationed into three orbital planes by 2022 to study tropical weather systems. NASA awarded a contract to Rocket Lab (US) to launch the four CubeSats of a constellation to monitor tropical weather systems.

Increasing demand from commercial and government sectors for nanosatellite services to drive the platform segment.

Nanosatellites are satellites with a wet mass (including fuel) between 1 kg and 10 kg. They are also known as nanosats. These satellites typically have a dimension as small as 10 cubic centimeters. The launch of the first nanosatellite triggered a series of opportunities in various space-based projects, ranging from technological research to biological experimentation. Constant innovation and technological advances in sensors and actuators are expected to boost the launch of nanosatellites. The demand from commercial and government sectors for nanosatellite services is expected to increase significantly over the next few years.

Space DC-DC Converter Market Regions

North America likely to emerge as the largest space DC-DC converter market

There is strong political support in North America for the adoption of advanced satellites. Another key factor fueling the growth of the market in this region is that a large number of leading developers of space DC-DC converters are concentrated in North America, with clear policies laid out for dealing with government agencies on defense matters. The satellite industry in North America is the largest in the world. Major companies such as Advanced Energy, Vicor Corp., Texas Instruments, Crane Co., XP Power, and Astronics, and small-scale private companies such as VPT, SYNQOR, and AJ's Power Source are based in the US. These players continuously invest in the R&D of new & improved designs of space DC-DC converters.

Space DC-DC Converter Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Space DC-DC Converter Industry Companies: Top Key Market Players

The Space DC-DC Converter Companies are dominated by globally established players such as:

- Texas Instruments Incorporated (US)

- STMicroelectronics (Switzerland)

- Crane Co. (US)

- Infineon Technologies AG (Germany)

- Vicor Corporation (US)

These companies have well-equipped manufacturing and distribution networks across North America, Europe, Asia Pacific, Middle East, and Rest of the World.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 37 Million in 2022 |

|

Projected Market Size |

USD 66 Million by 2027 |

|

Space DC-DC Converter Market Growth Rate |

12.4% |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Platform, By Application, By Type, By Form Factor, By Output Power, By Output Voltage, By Input Voltage |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

Texas Instruments Incorporated (US), STMicroelectronics (Switzerland), Crane Co. (US), Infineon Technologies AG (Germany), and Vicor Corporation (US) are some of the major players of space DC-DC converter market. (25 Companies) |

Space DC-DC Converter Market Highlights

The study categorizes the space DC-DC converter market based on Platform, Application, Type, Form Factor, Output Power, Output Voltage, Input Voltage and Region

|

Segment |

Subsegment |

|

By Platform |

|

|

By Application |

|

|

By Input Voltage |

|

|

By Output Voltage |

|

|

By Type |

|

|

By Output Power |

|

|

By Form Factor |

|

Recent Developments

- In March 2021, Modular Devices Inc. launched model 3693 series of DC-DC power converters for CubeSats and micro-miniature orbiting platforms.

- In December 2020, Vicor Corporation entered into a global distribution agreement with Arrow Electronics to expand its presence in Europe, the Middle East, and Africa.

Frequently Asked Questions (FAQ):

Which are the major companies in the space DC-DC converter market? What are their major strategies to strengthen their market presence?

The major players are Texas Instruments Incorporated (US), STMicroelectronics (Switzerland), Crane Co. (US), Infineon Technologies AG (Germany), and Vicor Corporation (US). These companies have well-equipped manufacturing and distribution networks across North America, Europe, Asia Pacific, Middle East, and Rest of the World.

What are the drivers and opportunities for the space DC-DC converter market?

The market for space DC-DC converters has grown substantially across the globe, and especially in North America, where increase in developing new technologies and development of new space DC-DC converter in countries such as US, Canada will offer several opportunities for space DC-DC converter industry. The rising R&D activities to develop space DC-DC converters are also expected to boost the growth of the market around the world.

Which region is expected to grow at the highest rate in the next five years?

The market in North America is projected to grow at the highest CAGR of from 2022 to 2027, showcasing strong demand for use of space DC-DC converters in the region.

Which type of platform segment is expected to significantly lead in the coming years?

The satellites segment of the space DC-DC converter market is projected to witness the highest CAGR. The growth of the satellites space DC-DC converter market can be attributed to the increased demand in satellite internet, earth observation.

What are some of the technological advancements in the market?

Various research activities have been conducted by manufacturers across the globe to enhance space DC-DC converters. Technologies such as compact, high-density, and high-efficiency dc-dc converters for new space applications, low power devices, miniaturization of space dc-dc converters, use of gallium nitride technology for increased efficiency of dc-dc converters.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Investments by private firms in space exploration missions- Emergence of digital power management and control- Increased demand for high-performance and cost-effective systems- Development of thick-film hybrid DC-DC converters- Increasing number of space exploration missionsRESTRAINTS- Functionality of DC-DC converters in no-load situation- Product manufacturing challenges- Export restrictions for US manufacturers- Issues with commercially available DC-DC convertersOPPORTUNITIES- Miniaturization of space DC-DC converters- Development of DC-DC converters with high switching frequency- Increasing demand for radiation-hardened isolated DC-DC converters- Extending operating temperature of DC-DC converter componentsCHALLENGES- Global shortage of semiconductors- Maintaining high performance with compact size- Development of DC-DC converters with low-noise performance- Power density and efficiency

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 RECESSION IMPACT ANALYSIS

- 5.5 OPERATIONAL DATA

- 5.6 TRADE ANALYSIS

-

5.7 DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR SPACE DC-DC CONVERTER MARKET

-

5.8 MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.9 PRICING ANALYSISAVERAGE SELLING PRICE

-

5.10 TECHNOLOGY ANALYSISSATELLITES FOR EARTH OBSERVATION IMAGERY AND ANALYTICS

-

5.11 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.12 TARIFF AND REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA PACIFICMIDDLE EAST

- 5.13 KEY CONFERENCES & EVENTS IN 2023

-

5.14 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSKEY BUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSCOMPACT, HIGH-DENSITY, AND HIGH-EFFICIENCY DC-DC CONVERTERS FOR NEW SPACE APPLICATIONSLOW POWER DEVICESMINIATURIZATION OF SPACE DC-DC CONVERTERSNEW ARCHITECTURES IN SPACE DC-DC CONVERTERSUSE OF GALLIUM NITRIDE TECHNOLOGY FOR INCREASED EFFICIENCY OF DC-DC CONVERTERSEMERGENCE OF NEW POWER ARCHITECTURES

-

6.3 USE CASES: SPACE DC-DC CONVERTERSDC-DC CONVERTERS FOR SPACE STATIONS AND ORION PROGRAM PLATFORMS

-

6.4 SPACE DC-DC CONVERTER MARKET: PATENT ANALYSIS, 2012−2021

-

6.5 IMPACT OF MEGATRENDUPPER-STAGE AND SPACECRAFT ORBIT-RAISING TECHNOLOGIESDEVELOPMENT OF SMALL SATELLITES USING ADDITIVE MANUFACTURING PROCESSDEPLOYMENT OF EARTH OBSERVATION SATELLITES

- 7.1 INTRODUCTION

-

7.2 SATELLITESCUBESATS- Increasing launch of CubeSats for Earth observationSMALL SATELLITES- Nanosatellites- Microsatellites- MinisatellitesMEDIUM SATELLITES- Used in climate & environment monitoring, Earth observation, and meteorologyLARGE SATELLITES- Commonly launched in GEO and for scientific missions in deep-space exploration

-

7.3 CAPSULES/CARGOSABILITY TO SURVIVE REENTRY AND RETURN PAYLOAD TO SURFACE OF EARTH FROM ORBIT

-

7.4 INTERPLANETARY SPACECRAFT & PROBESCOUNTRIES LIKE INDIA AND CHINA LAUNCHING MISSIONS TO SUN

-

7.5 ROVERS/SPACECRAFT LANDERSGROWING NUMBER OF COMMERCIAL LUNAR MISSIONS

-

7.6 LAUNCH VEHICLESINCREASING USE OF REUSABLE LAUNCH VEHICLES

- 8.1 INTRODUCTION

-

8.2 ALTITUDE & ORBITAL CONTROL SYSTEMSREQUIRED FOR SPACE MISSIONS AND CONTAINS TESTED DC-DC CONVERTERS

-

8.3 SURFACE MOBILITY AND NAVIGATION SYSTEMSINCREASING USE OF SPACECRAFT/ROVERS FOR DEEP SPACE EXPLORATION

-

8.4 COMMAND & DATA HANDLING SYSTEMSGROWING LAUNCH OF MARS ROVERS AND SMALL SATELLITES

-

8.5 ENVIRONMENTAL MONITORING SYSTEMSNEED TO TRACK QUALITY OF ENVIRONMENT

-

8.6 SATELLITE THERMAL POWER BOXNEED TO MAINTAIN TEMPERATURE WITHIN RANGE IN SPACECRAFT AND INSTRUMENTS

-

8.7 ELECTRIC POWER SUBSYSTEMSNEED TO PROVIDE REQUIRED SECONDARY VOLTAGES FOR PAYLOADS AND BUS SUBSYSTEMS

-

8.8 POWER CONDITIONING UNIT (PCU)MANAGING ENERGY COMING FROM SEVERAL POWER SOURCES

- 8.9 OTHERS

- 9.1 INTRODUCTION

-

9.2 ISOLATEDDESIGNED FOR HIGH-POWER RUGGED SCENARIOS

-

9.3 NON-ISOLATEDSMALLER AND CAN FIT IN COMPACT SPACES

- 10.1 INTRODUCTION

-

10.2 CHASSIS MOUNTBETTER THERMAL EFFICIENCY THAN FORM FACTORS

-

10.3 ENCLOSEDDESIGNED TO OPERATE AT HIGHER TEMPERATURES

-

10.4 BRICKHIGH POWER DENSITY WITH LOWER OPERATIONAL NOISE

-

10.5 DISCRETEPROVIDE HIGHER ISOLATION VOLTAGE, RELIABILITY, AND EFFICIENCY THAN INTEGRATED MODULES

- 11.1 INTRODUCTION

-

11.2 <12VCOMPACT AND PROVIDE SINGLE OUTPUT

-

11.3 12−40VUSED FOR TRACKING SUBSYSTEMS AND MEMORY OF SATELLITES

-

11.4 42−75VEMPLOYED BY BUS IN SATELLITES AND SPACECRAFT

-

11.5 >75GENERATED BY SOLAR PANELS OF LARGER SATELLITES SUCH AS GEOSTATIONARY SATELLITES

- 12.1 INTRODUCTION

-

12.2 3.3VMULTI-OUTPUT CONVERTERS WITH VARIOUS OUTPUT LEVELS

-

12.3 5VREQUIRED IN VARIOUS SATELLITE SUBSYSTEMS

-

12.4 12VUSED BETWEEN CUBESAT POWER DISTRIBUTION AND 12 VOLTS BUS

-

12.5 15VREQUIRED IN ACTIVE CONTROL DRIVER CIRCUIT OF SATELLITES

-

12.6 28VUSED IN POWER DISTRIBUTION UNITS (PDUS) OF LARGER SATELLITES

- 13.1 INTRODUCTION

-

13.2 10WSUITABLE FOR CONVERTING POWER IN COMPACT BOARD SPACE

-

13.3 10−29WSUITABLE FOR SPACE APPLICATIONS

-

13.4 30−99WWORKS EFFICIENTLY UNDER INTERRUPTED POWER SUPPLY

-

13.5 100−250WSUITABLE FOR MILITARY AND AEROSPACE APPLICATIONS

-

13.6 251−500WUSED IN WIDE RANGE OF SPACE APPLICATIONS

-

13.7 501−1000WAVAILABLE IN BRICK AND ENCAPSULATED FORMS

-

13.8 >1000WSUITABLE FOR WORKING IN HIGHER TEMPERATURES

- 14.1 INTRODUCTION

- 14.2 REGIONAL RECESSION IMPACT ANALYSIS

-

14.3 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Increasing Starlink satellite launches by SpaceXCANADA- Ongoing developments in planetary exploration

-

14.4 EUROPEPESTLE ANALYSIS: EUROPERUSSIA- Growing reliability of indigenous space systemsUK- Development of small satellite configurations and component miniaturizationGERMANY- Increase in demand for CubeSatsFRANCE- Growing partnerships among local companiesITALY- Rising focus on CubeSats for Earth observation and science missionsREST OF EUROPE

-

14.5 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Rapid expansion of commercial space sectorINDIA- Increase in funding for space startupsJAPAN- High number of planned missions of private and public space playersSOUTH KOREA- Excavation of space minerals for future economic growthAUSTRALIA- Growing involvement in national and international space activities

-

14.6 REST OF WORLDMIDDLE EAST & AFRICALATIN AMERICA

- 15.1 INTRODUCTION

-

15.2 COMPETITIVE OVERVIEWKEY DEVELOPMENTS OF LEADING PLAYERS IN SPACE DC-DC CONVERTER MARKET (2018−2021)

- 15.3 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2021

- 15.4 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2021

- 15.5 REVENUE ANALYSIS 2019−2021

-

15.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE BENCHMARKING

-

15.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

15.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

- 16.1 INTRODUCTION

-

16.2 KEY PLAYERSTEXAS INSTRUMENTS INCORPORATED- Business overview- Products offered- Recent developments- MnM viewSTMICROELECTRONICS- Business overview- Products offered- Recent developments- MnM viewCRANE CO.- Business overview- Products offered- Recent developments- MnM viewASTRONICS CORPORATION- Business overview- Products offered- Recent developments- MnM viewINFINEON TECHNOLOGIES AG- Business overview- Products offered- Recent developments- MnM viewVICOR CORPORATION- Business overview- Products offered- Recent developments- MnM viewADVANCED ENERGY INDUSTRIES INC.- Business overview- Products offered- Recent developments- MnM viewMODULAR DEVICES INC.- Business overview- Products offered- Recent developmentsTHALES GROUP- Business overview- Products offered- Recent developments- MnM viewAIRBUS GROUP SE- Business overview- Products offered- Recent developments- MnM viewMICROSEMI CORPORATION- Business overview- Products offered- Recent developments- MnM ViewSYNQOR INC.- Business overview- Products offered- Recent developmentsVPT- Business overview- Products offered- Recent developmentsEPC SPACE- Business overview- Products offered- Recent developmentsRENESAS ELECTRONICS CORPORATION- Business overview- Products offered- Recent developments- MnM view

-

16.3 OTHER PLAYERSASP-EQUIPMENT GMBH- Business overview- Products offered- Recent developmentsANALOG DEVICES, INC.- Business overview- Products offered- Recent developmentsTTM TECHNOLOGIES INC.- Business overview- Products offered- Recent developmentsISOCOM LIMITED- Business overview- Products offered- Recent developmentsCISSOID- Business overview- Products offered- Recent developmentsNIPPON AVIONICS CO., LTD.- Business overview- Products offered- Recent developments3D PLUS- Business overview- Products offered- Recent developmentsSITAEL S.P.A.- Business overview- Products offered- Recent developmentsTAME POWER- Business overview- Products offered- Recent developmentsAJ'S POWER SOURCE- Business overview- Products offered- Recent developments

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATIONS OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 INCLUSIONS AND EXCLUSIONS

- TABLE 3 SPACE MISSIONS FROM 2022 TO 2026

- TABLE 4 OPERATING TEMPERATURE OF DC-DC CONVERTERS OFFERED BY MARKET PLAYERS

- TABLE 5 GLOBAL SATELLITE LAUNCH VOLUME, BY SATELLITE TYPE, 2018–2021

- TABLE 6 IMPORT VALUE OF SPACECRAFT, INCLUDING SATELLITES AND SUBORBITAL AND SPACECRAFT LAUNCH VEHICLES (PRODUCT HARMONIZED SYSTEM CODE: 880260, USD MILLION (2017–2021)

- TABLE 7 EXPORTED VALUE OF SPACECRAFT, INCLUDING SATELLITES AND SUBORBITAL AND SPACECRAFT LAUNCH VEHICLES (PRODUCT HARMONIZED SYSTEM CODE: 880260, USD MILLION (2017–2021)

- TABLE 8 MARKET ECOSYSTEM

- TABLE 9 AVERAGE SELLING PRICE: SPACE DC-DC CONVERTER (USD)

- TABLE 10 MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 MARKET: CONFERENCES & EVENTS, 2023

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PLATFORMS (%)

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE PLATFORM

- TABLE 14 PATENT ANALYSIS

- TABLE 15 MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 16 MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 17 SATELLITES: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 18 SATELLITES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 19 SMALL SATELLITES: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 20 SMALL SATELLITES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 21 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 22 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 23 MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 24 MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 25 MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

- TABLE 26 MARKET, BY FORM FACTOR, 2022–2027 (USD MILLION)

- TABLE 27 MARKET, BY INPUT VOLTAGE, 2018–2021 (USD MILLION)

- TABLE 28 MARKET, BY INPUT VOLTAGE, 2022–2027 (USD MILLION)

- TABLE 29 MARKET, BY OUTPUT VOLTAGE, 2018–2021 (USD MILLION)

- TABLE 30 MARKET, BY OUTPUT VOLTAGE, 2022–2027 (USD MILLION)

- TABLE 31 MARKET, BY OUTPUT POWER, 2018–2021 (USD MILLION)

- TABLE 32 MARKET, BY OUTPUT POWER, 2022–2027 (USD MILLION)

- TABLE 33 MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 34 MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 35 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 36 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 37 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 38 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 39 NORTH AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 40 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 41 NORTH AMERICA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 42 NORTH AMERICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 43 NORTH AMERICA: MARKET IN SATELLITES, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 44 NORTH AMERICA: MARKET IN SATELLITES, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 45 NORTH AMERICA: MARKET IN SMALL SATELLITES, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 46 NORTH AMERICA: MARKET IN SMALL SATELLITES, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 47 US: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 48 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 49 US: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 50 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 51 US: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 52 US: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 53 CANADA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 54 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 55 CANADA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 56 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 57 CANADA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 58 CANADA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 59 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 60 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 61 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 62 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 63 EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 64 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 65 EUROPE: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 66 EUROPE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 67 EUROPE: MARKET IN SATELLITES, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 68 EUROPE: MARKET IN SATELLITES, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 69 EUROPE: MARKET IN SMALL SATELLITES, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 70 EUROPE: MARKET IN SMALL SATELLITES, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 71 RUSSIA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 72 RUSSIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 73 RUSSIA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 74 RUSSIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 75 RUSSIA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 76 RUSSIA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 77 UK: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 78 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 79 UK: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 80 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 81 UK: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 82 UK: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 83 GERMANY: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 84 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 85 GERMANY: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 86 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 87 GERMANY: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 88 GERMANY: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 89 FRANCE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 90 FRANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 91 FRANCE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 92 FRANCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 93 FRANCE: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 94 FRANCE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 95 ITALY: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 96 ITALY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 97 ITALY: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 98 ITALY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 99 ITALY: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 100 ITALY: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 101 REST OF EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 102 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 103 REST OF EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 104 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 105 REST OF EUROPE: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 106 REST OF EUROPE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET IN SATELLITES, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARKET IN SATELLITES, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MARKET IN SMALL SATELLITES, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MARKET IN SMALL SATELLITES, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 119 CHINA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 120 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 121 CHINA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 122 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 123 CHINA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 124 CHINA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 125 INDIA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 126 INDIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 127 INDIA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 128 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 129 INDIA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 130 INDIA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 131 JAPAN: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 132 JAPAN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 133 JAPAN: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 134 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 135 JAPAN: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 136 JAPAN: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 137 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 138 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 139 SOUTH KOREA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 140 SOUTH KOREA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 141 SOUTH KOREA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 142 SOUTH KOREA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 143 AUSTRALIA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 144 AUSTRALIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 145 AUSTRALIA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 146 AUSTRALIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 147 AUSTRALIA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 148 AUSTRALIA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 149 REST OF WORLD: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 150 REST OF WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 151 REST OF WORLD: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 152 REST OF WORLD: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 153 REST OF WORLD: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 154 REST OF WORLD: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 155 REST OF WORLD: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 156 REST OF WORLD: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 157 REST OF WORLD: MARKET IN SATELLITES, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 158 REST OF WORLD: MARKET IN SATELLITES, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 159 REST OF WORLD: MARKET IN SMALL SATELLITES, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 160 REST OF WORLD: MARKET IN SMALL SATELLITES, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 167 LATIN AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 168 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 169 LATIN AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 170 LATIN AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 171 LATIN AMERICA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

- TABLE 172 LATIN AMERICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 173 KEY DEVELOPMENTS OF LEADING PLAYERS: SPACE DC-DC CONVERTER MARKET

- TABLE 174 DEGREE OF COMPETITION

- TABLE 175 COMPANY FOOTPRINT

- TABLE 176 COMPANY PLATFORM FOOTPRINT

- TABLE 177 COMPANY PRODUCT TYPE FOOTPRINT

- TABLE 178 COMPANY REGION FOOTPRINT

- TABLE 179 SPACE DC-DC CONVERTER MARKET: PRODUCT LAUNCHES, 2018–2021

- TABLE 180 SPACE DC-DC CONVERTER MARKET: DEALS, 2018–2021

- TABLE 181 TEXAS INSTRUMENTS INCORPORATED: BUSINESS OVERVIEW

- TABLE 182 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS OFFERED

- TABLE 183 STMICROELECTRONICS: BUSINESS OVERVIEW

- TABLE 184 STMICROELECTRONICS: PRODUCTS

- TABLE 185 CRANE CO.: BUSINESS OVERVIEW

- TABLE 186 CRANE CO.: PRODUCTS OFFERED

- TABLE 187 ASTRONICS CORPORATION: BUSINESS OVERVIEW

- TABLE 188 ASTRONICS CORPORATION: PRODUCTS

- TABLE 189 INFINEON TECHNOLOGIES AG: BUSINESS OVERVIEW

- TABLE 190 INFINEON TECHNOLOGIES AG: PRODUCTS OFFERED

- TABLE 191 VICOR CORPORATION: BUSINESS OVERVIEW

- TABLE 192 VICOR CORPORATION: PRODUCTS OFFERED

- TABLE 193 VICOR CORPORATION: DEALS

- TABLE 194 ADVANCED ENERGY INDUSTRIES INC.: BUSINESS OVERVIEW

- TABLE 195 ADVANCED ENERGY INDUSTRIES INC.: PRODUCTS OFFERED

- TABLE 196 MODULAR DEVICES INC.: BUSINESS OVERVIEW

- TABLE 197 MODULAR DEVICES INC.: PRODUCTS OFFERED

- TABLE 198 MODULAR DEVICES INC.: PRODUCT LAUNCHES

- TABLE 199 THALES GROUP: BUSINESS OVERVIEW

- TABLE 200 THALES GROUP: PRODUCTS OFFERED

- TABLE 201 AIRBUS GROUP SE: BUSINESS OVERVIEW

- TABLE 202 AIRBUS GROUP SE: PRODUCTS OFFERED

- TABLE 203 MICROSEMI CORPORATION: BUSINESS OVERVIEW

- TABLE 204 MICROSEMI CORPORATION: PRODUCTS OFFERED

- TABLE 205 MICROSEMI CORPORATION: ACQUISITIONS

- TABLE 206 SYNQOR INC.: BUSINESS OVERVIEW

- TABLE 207 SYNQOR INC.: PRODUCTS OFFERED

- TABLE 208 VPT: BUSINESS OVERVIEW

- TABLE 209 VPT: PRODUCTS OFFERED

- TABLE 210 EPC SPACE: BUSINESS OVERVIEW

- TABLE 211 EPC SPACE: PRODUCTS OFFERED

- TABLE 212 RENESAS ELECTRONICS CORPORATION: BUSINESS OVERVIEW

- TABLE 213 RENESAS ELECTRONICS CORPORATION: PRODUCTS OFFERED

- TABLE 214 ASP-EQUIPMENT GMBH: BUSINESS OVERVIEW

- TABLE 215 ASP-EQUIPMENT GMBH: PRODUCTS OFFERED

- TABLE 216 ANALOG DEVICES, INC.: BUSINESS OVERVIEW

- TABLE 217 ANALOG DEVICES, INC.: PRODUCTS OFFERED

- TABLE 218 TTM TECHNOLOGIES INC.: BUSINESS OVERVIEW

- TABLE 219 TTM TECHNOLOGIES INC.: PRODUCTS OFFERED

- TABLE 220 ISOCOM LIMITED: BUSINESS OVERVIEW

- TABLE 221 ISOCOM LIMITED: PRODUCTS OFFERED

- TABLE 222 CISSOID: BUSINESS OVERVIEW

- TABLE 223 CISSOID: PRODUCTS OFFERED

- TABLE 224 NIPPON AVIONICS CO., LTD.: BUSINESS OVERVIEW

- TABLE 225 NIPPON AVIONICS CO., LTD.: PRODUCTS OFFERED

- TABLE 226 3D PLUS: BUSINESS OVERVIEW

- TABLE 227 3D PLUS: PRODUCTS OFFERED

- TABLE 228 SITAEL S.P.A.: BUSINESS OVERVIEW

- TABLE 229 SITAEL S.P.A.: PRODUCTS OFFERED

- TABLE 230 TAME POWER: BUSINESS OVERVIEW

- TABLE 231 TAME POWER: PRODUCTS OFFERED

- TABLE 232 AJ'S POWER SOURCE: BUSINESS OVERVIEW

- TABLE 233 AJ'S POWER SOURCE: PRODUCTS OFFERED

- FIGURE 1 SPACE DC-DC CONVERTER MARKET SEGMENTATION

- FIGURE 2 SPACE DC-DC CONVERTER MARKET TO GROW AT HIGHER RATE THAN PREVIOUS ESTIMATES

- FIGURE 3 REPORT PROCESS FLOW

- FIGURE 4 SPACE DC-DC CONVERTER MARKET: RESEARCH DESIGN

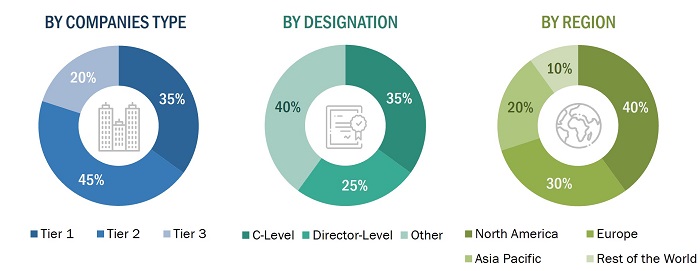

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 SATELLITE MANUFACTURERS QUARTERLY REVENUE

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 ASSUMPTIONS FOR RESEARCH STUDY ON SPACE DC-DC CONVERTER MARKET

- FIGURE 11 SATELLITES SEGMENT TO LEAD SPACE DC-DC CONVERTER MARKET DURING FORECAST PERIOD

- FIGURE 12 CHASSIS MOUNT SEGMENT TO LEAD SPACE DC-DC CONVERTER MARKET DURING FORECAST PERIOD

- FIGURE 13 NON-ISOLATED SEGMENT TO LEAD SPACE DC-DC CONVERTER MARKET DURING FORECAST PERIOD

- FIGURE 14 NORTH AMERICA ESTIMATED TO DOMINATE SPACE DC-DC CONVERTER MARKET IN 2022

- FIGURE 15 INCREASING MARS AND MOON EXPLORATION MISSIONS TO DRIVE MARKET FROM 2022 TO 2027

- FIGURE 16 12V SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

- FIGURE 17 COMMAND & DATA HANDLING SEGMENT TO DOMINATE MARKET FROM 2022 TO 2027

- FIGURE 18 SATELLITES SEGMENT TO LEAD MARKET FROM 2022 TO 2027

- FIGURE 19 CANADA PROJECTED TO BE FASTEST-GROWING MARKET FROM 2022 TO 2027

- FIGURE 20 SPACE DC-DC CONVERTER MARKET DYNAMICS

- FIGURE 21 VALUE CHAIN ANALYSIS: SPACE DC-DC CONVERTER MARKET

- FIGURE 22 RECESSION IMPACT ANALYSIS

- FIGURE 23 REVENUE SHIFT IN SPACE DC-DC CONVERTER MARKET

- FIGURE 24 SPACE DC-DC CONVERTERS ECOSYSTEM

- FIGURE 25 SPACE DC-DC CONVERTER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PLATFORMS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE PLATFORM

- FIGURE 28 SATELLITES SEGMENT TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 29 COMMAND & DATA HANDLING SYSTEMS EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 30 ISOLATED SEGMENT TO COMMAND LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 31 ENCLOSED SEGMENT IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 12-40V SEGMENT TO COMMAND LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 33 3.3V SEGMENT TO COMMAND MARKET DURING FORECAST PERIOD

- FIGURE 34 >500W SEGMENT TO COMMAND LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 35 SPACE DC-DC CONVERTER MARKET IN NORTH AMERICA PROJECTED TO LEAD DURING FORECAST PERIOD

- FIGURE 36 GLOBAL PESSIMISTIC AND REALISTIC VIEW DUE TO RECESSION IMPACT

- FIGURE 37 REGIONAL RECESSION IMPACT ANALYSIS

- FIGURE 38 NORTH AMERICA: SPACE DC-DC CONVERTER MARKET SNAPSHOT

- FIGURE 39 EUROPE: SPACE DC-DC CONVERTER MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: SPACE DC-DC CONVERTER MARKET SNAPSHOT

- FIGURE 41 RANKING ANALYSIS OF TOP FIVE PLAYERS, 2021

- FIGURE 42 MARKET SHARE ANALYSIS OF KEY COMPANIES

- FIGURE 43 COLLECTIVE REVENUE SHARE OF TOP FIVE PLAYERS

- FIGURE 44 SPACE DC-DC CONVERTER MARKET: COMPANY EVALUATION MATRIX, 2021

- FIGURE 45 SPACE DC-DC CONVERTER MARKET (STARTUP/SME): COMPANY EVALUATION MATRIX, 2022

- FIGURE 46 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 47 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 48 CRANE CO.: COMPANY SNAPSHOT

- FIGURE 49 ASTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 51 VICOR CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 ADVANCED ENERGY INDUSTRIES INC.: COMPANY SNAPSHOT

- FIGURE 53 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 54 AIRBUS GROUP SE: COMPANY SNAPSHOT

- FIGURE 55 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 TTM TECHNOLOGIES INC.: COMPANY SNAPSHOT

The study involved various activities in estimating the current size of the Space DC-DC Converter market. Exhaustive secondary research was done to collect information on the Space DC-DC Converter market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments.

Secondary Research

The market ranking of companies was determined using the secondary data made available through paid and unpaid sources and by analyzing the service portfolios of major companies. These companies were rated on the basis of performance and quality of their services. These data points were further validated by primary sources.

Secondary sources referred to for this research study include financial statements of companies offering Space DC-DC Converter systems, services and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the Space DC-DC Converter market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the Space DC-DC Converter market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, and Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

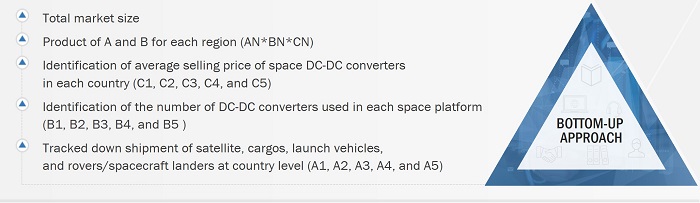

Both top-down and bottom-up approaches were used to estimate and validate the size of the Space DC-DC Converter market. The research methodology used to estimate the size of the market includes the following details:

The key players in the Space DC-DC Converter market were identified through secondary research, and their market shares were determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as CEOs, directors, and marketing executives of leading companies operating in the Space DC-DC Converter market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the Space DC-DC Converter market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Space DC-DC Converter Market Size: Bottom-Up Approach:

Data Triangulation

After arriving at the overall size of the Space DC-DC Converter market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the size of the space DC-DC converter market based on platform, input voltage, output voltage, output power, form factor, type, and region.

- To forecast the size of various segments of the market based on four regions: North America, Europe, Asia Pacific, and the Rest of the World, along with key countries in each of these regions.

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To identify industry trends, market trends, and technology trends prevailing in the market

- To analyze micromarkets with respect to individual technological trends, prospects, and their contribution to the overall market

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies, such as new product developments, contracts, deals, and collaborations, adopted by key players in the market.

- To identify the detailed financial position, key products, unique selling points, and key developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Space DC-DC Converter market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Space DC-DC Converter market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Space DC-DC Converter Market

Good evening. I am looking for a manufacturer of DC DC converters for space-resistant 100RAD. In particular, the DC DC converters must have an insulated input voltage of 29V and must generate outputs for different circuits: model A 5V 20W, model B 5V 60W, model C + -8V 30W, model D 12V 60W. My request is to evaluate any builders/solutions. Thank you.