Dicamba Herbicide Market by Crop Type (Cereals & Grains, Oilseeds & Pulses, and Pastures & Forage Crops), Formulation (Acid and Salt), Physical Form (Dry and Liquid), & Time of Application (Pre- and Post-Emergence) - Global Forecast to 2022

[140 Pages Report] The dicamba herbicide market is projected to grow from USD 341.6 million in 2016 to USD 521.2 million by 2022, at a CAGR of 7.3% from 2016 to 2022. Dicamba is a benzoic acid herbicide that is applied to soil, plants, or leaves. It is primarily applied to control broad-leaved weeds. The shrinking arable land, adoption of new technology, and the increasing willingness of farmers to spend more for higher productivity are some important factors that contribute to the increasing demand for dicamba herbicide. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2022.

Market Dynamics

Drivers

- Rising prices of agricultural commodities

- Increase in the use of herbicides and growth of dicamba-resistant GMO crops

- Advancement in farming practices and technology

Restraints

- Tendency of herbicide drift

- Growth of organic food industry

- Pesticide residue

- Increasing herbicide resistance of weeds

Opportunities

- Growth potential in emerging economies

Challenges

- Adverse effects of pesticides

- Stringent regulations

Increase in the use of herbicides and growth in adoption of dicamba-resistant GMO crops drives the global dicamba herbicide market

In 2012, as per the USDA report, more than 73% of all corn was genetically modified to resist chemicals formulated to kill competing weeds. Similarly, 93% of soy planted was also herbicide-tolerant, engineered to combat herbicides (provided by the same players who patented and sold the seeds).

The commercial success of herbicide-resistant (GMO) crops have been phenomenal in the US. One of the main reasons behind engineering these crops is to reduce herbicide use. However, according to USDA and EPA findings, over the last 10 years, the quick adoption of GMO crops by farmers has increased the use of broad-spectrum herbicides, including dicamba.

The following are the major objectives of the study.

- To define, segment, and measure the dicamba herbicide market based on its crop type, time of application, formulation, physical form, and region

- To project the size of the market, in terms of value (USD million) and volume (MT) in the four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the dicamba herbicides market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To analyze competitive developments such as new product launches, acquisitions, investments, expansions, partnerships, agreements, joint ventures, and collaborations in the dicamba herbicides market

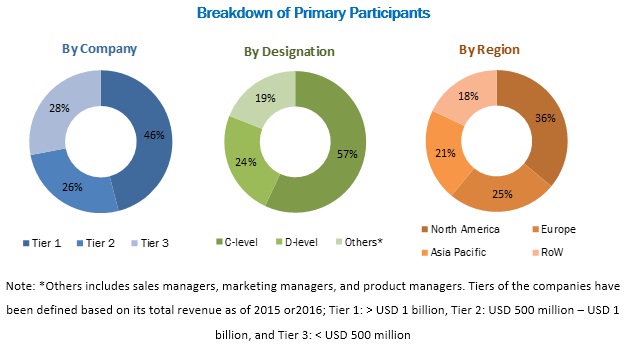

During this research study, major players operating in the dicamba herbicides market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The dicamba herbicides market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the agricultural disinfectants market are BASF (Germany), E.I. DuPont de Nemours and Company (US), The Dow Chemical Company (US), Syngenta (Switzerland), and Bayer CropScience (Germany).

Major Market Developments

- In September 2016, Monsanto invested USD 975 million to establish a manufacturing facility in Luling, Louisiana, US, to become a leading producer of the herbicide dicamba.

- In July 2016, DuPont and Monsanto (US) entered into an agreement for the supply of dicamba herbicides in the US and Canada. The new product was launched as DuPont FeXapan herbicide plus VaporGrip technology. The chemical would find its application with Monsanto's Roundup Ready 2 Xtend soybeans, that were grown on approximately 1 million acres in the US.

- In February 2016, Albaugh, LLCs subsidiary, Agri-Estrella S de RL de CV (Mexico), and SipcamAdvan (US), signed a distribution agreement, allowing Agri-Estrella to have access to SipcamAdvans portfolio of crop protection products for distribution in Mexico. This is to strengthen the presence in the Mexican market, allowing both companies to offer competitive prices, quality products, and optimal care.

- In May 2015, BASF set up an agricultural research center in Pune, India. This center would emphasize on herbicides, insecticides, and fungicides.

- In November 2015, Monsanto Company acquired The Climate Corporation (US) for providing technology-based solutions and agricultural products that would improve farm productivity and food quality.

Target Audience

- Dicamba manufacturers

- Dicamba importers and exporters

- Dicamba traders, distributors, and suppliers

- Government and research organizations

- Associations and industry bodies such as the United States Department of Agriculture (USDA), Food and Agriculture Organization (FAO), Department of Environment, Food, and Rural Affairs (DEFRA), Environmental Protection Agency (EPA), and European Crop Protection Association (ECPA)

Scope of the Dicamba Herbicide Market Report

By Physical form

- Liquid

- Dry

By Time of Application

- Post-emergence

- Pre-emergence

By Crop Type:

- Cereal & grains

- Oilseeds & pulses

- Pastures & forage crops

By Formulation:

- Salt

- Acid

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Critical questions which the report answers

- Which seed companies are investing in the development of dicamba tolerant seeds?

- Which companies are developing low volatility formulations to reduce the problem that arises from drift reduction of dicamba?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the clients specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional analysis

- Further breakdown of European dicamba herbicides market

- Further breakdown of Asia Pacific dicamba herbicides market

- Further breakdown of the Rest of World dicamba herbicides market

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global dicamba herbicide market is projected to grow exponentially due to factors such as increasing demand for food security by the growing population and advancements in farming practices & techniques.

Dicamba herbicides are effective against annual and perennial broad-leaved weeds and brushed species around cultivations of corn, sorghum, sugarcane, turf, pastures, and non-crop areas. It can be used in combination with many other herbicides. Cotton, corn, soybean, wheat, and rice are the major field crops for the dicamba herbicides market.

The cereals & grains segment is estimated to dominate for the largest share in the dicamba herbicides market in 2016 as corn, wheat, and rice are some of the crops which hold the largest crop harvested area, globally. Also, the global cereals production volume is projected to reach 1,321 million tons by 2020, 18% more than in 2016, with significant growth projected in Argentina, Brazil, China, Russia, Ukraine, and the US.

The salt-based herbicides segment dominated the global dicamba herbicide market, by formulation. This is due to the water solubility property of salts, which reduces the need for emulsifiers. Also, salts are less volatile than esters. Dicamba herbicide formulations include dicamba acid, dimethylamine salt (DMA), sodium salt, diglycoamine salt (DGA), isopropylamine salts (IPA), and potassium salt. These formulations of dicamba have different properties in the environment.

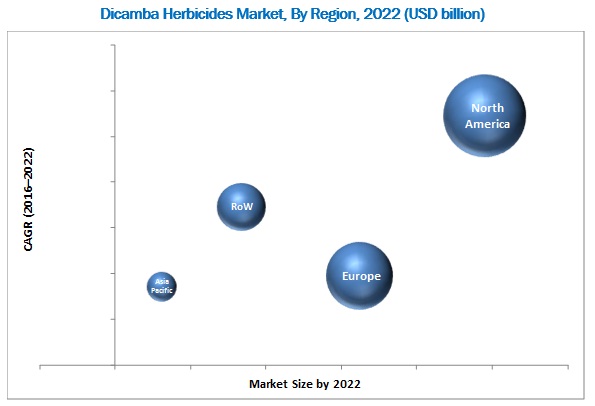

In the global dicamba herbicides market, the North American region is projected to be the fastest-growing market at a CAGR of 10.9% during the forecast period due to the advancement in agricultural practices and wider acceptance of technologies such as GMO crops and herbicide-tolerant crops in the North American region.

The application time of pre- and post-emergent herbicides is critical. Applying them too early or too late may result in the wastage of the herbicide.

Post-emergence

Post-emergent herbicides are designed to control weeds that are already grown in the cultivated area. These are mostly applied later in the growing season. They can be applied as a spot treatment directly to a weed infestation. Dicamba herbicides are mostly used as post-emergent as it helps to control a broader spectrum of weed species as compared to pre-emergent herbicides.

Pre-emergence

Pre-emergent herbicides are applied to the crops or to the soil before the germination of weeds. This group of herbicides control weeds during the germination process but does not totally prevent germination. Pre-emergent herbicides provide season-long control of summer annual weeds such as crabgrass, goose grass, and sandbur. When applied in the early fall months, these group of herbicides can control many winter annual weeds such as annual bluegrass, common chickweed, and henbit. Pre-emergent herbicides can be applied in either liquid or granular form.

Critical questions the report answers:

- Which type of formulations would be able to create a major trend in the industry for the mid to long term?

- What are the upcoming country markets for dicamba herbicides?

Tendency of herbicide drift and increasing herbicide resistance of weeds are the factors restraining the growth of the market. One of the major disadvantages of dicamba, compared to glyphosate, is that it is much more volatile, meaning it becomes easily airborne and drifts from the area of application. Droplet size plays a major role in particle drift. Small droplets take longer to reach the ground, increasing their susceptibility to drift. The second cause of dicamba movement is the rate of volatilization of dicamba to a vapor. All dicamba formulations volatilize, but some volatilize more than others do.

Herbicide resistance is the ability of a weed population to survive the herbicide treatment which is used to control it. Globally, there are more than 249 herbicide-tolerant biotypes of weed, spread across 47 countries. Each year these numbers grow with new reports of resistant weeds. Experts such as weed scientists and agronomic & specialty crop growers believe that dicamba-resistant crops are a cause for concern as at higher application rates, it would accelerate herbicide-tolerance in weeds.

Key players in the market include BASF (Germany), E.I. DuPont de Nemours and Company (US), The Dow Chemical Company (US), Syngenta (Switzerland), and Bayer CropScience (Germany). Agreements, collaborations, joint ventures, and partnerships were their preferred growth strategies to maintain their position in the dicamba herbicides market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in this Market

4.2 Europe Dicamba Herbicide Market, By Country and Crop Type

4.3 Dicamba Herbicide Market: Major Countries

4.4 Dicamba Herbicide: Life Cycle Analysis, By Region

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Macro Indicators

5.2.1 Growing Population and Decreasing Arable Land

5.2.2 Increasing Farm Expenditure

5.3 Market Segmentation

5.3.1 By Crop Type

5.3.2 By Time of Application

5.3.3 By Formulation

5.3.4 By Physical Form

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Rising Prices of Agricultural Commodities

5.4.1.2 Increase in the Use of Herbicides and Growth of Dicamba-Resistant Gmo Crops

5.4.1.3 Advancement in Farming Practices and Technology

5.4.2 Restraints

5.4.2.1 Tendency of Herbicide Drift

5.4.2.2 Growth of Organic Food Industry

5.4.2.3 Pesticide Residue

5.4.2.4 Increasing Herbicide Resistance of Weeds

5.4.3 Opportunities

5.4.3.1 Growth Potential in Emerging Economies

5.4.4 Challenges

5.4.4.1 Adverse Effects of Pesticides

5.4.4.2 Stringent Regulations

5.5 Industry Trends

5.6 Value Chain Analysis

5.7 Supply Chain Analysis

5.7.1 Prominent Companies

5.7.2 Small & Medium Enterprises

6 Dicamba Herbicide Market, By Physical Form (Page No. - 45)

6.1 Introduction

6.2 Liquid

6.3 Dry

7 Dicamba Herbicide Market, By Time of Application (Page No. - 51)

7.1 Introduction

7.2 Post-Emergence

7.3 Pre-Emergence

8 Dicamba Herbicide Market, By Crop Type (Page No. - 55)

8.1 Introduction

8.2 Cereals & Grains

8.3 Oilseeds & Pulses

8.4 Pastures & Forage Crops

9 Dicamba Herbicide Market, By Formulation (Page No. - 62)

9.1 Introduction

9.2 Salt

9.3 Acid

10 Dicamba Herbicide Market, By Region (Page No. - 66)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Russia

10.3.2 France

10.3.3 Germany

10.3.4 Ukraine

10.3.5 Rest of Europe

10.4 Asia-Pacific

10.4.1 Australia

10.4.2 India

10.4.3 Japan

10.4.4 China

10.4.5 Rest of Asia-Pacific

10.5 Rest of the World

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Others in RoW

11 Competitive Landscape (Page No. - 94)

11.1 Overview

11.2 Market Share Analysis of Dicamba Herbicide Market

11.3 Competitive Situation & Trends

11.3.1 Agreements, Collaborations, Joint Ventures, and Partnerships

11.3.2 Expansions & Investments

11.3.3 Acquisitions

11.3.4 New Product Launches

12 Company Profiles (Page No. - 102)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.1.1 Geographic Revenue Mix

12.2 Monsanto Company

12.3 E.I. Dupont De Nemours and Company

12.4 BASF SE

12.5 The DOW Chemical Company

12.6 Bayer Cropscience AG

12.7 Syngenta AG

12.8 Nufarm Limited

12.9 Helena Chemical Company

12.10 The Andersons, Inc.

12.11 Albaugh, Inc.

12.12 Alligare, LLC

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 133)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (65 Tables)

Table 1 Degree of Usage of Herbicides on Crops

Table 2 Dicamba Herbicide Market Size, By Physical Form 20142022 (USD Million)

Table 3 Market Size, By Form 20142022 (MT)

Table 4 Liquid Dicamba Herbicide: Market, By Region 20142022 (USD Million)

Table 5 Liquid Dicamba Herbicide: Market, By Region 20142022 (MT)

Table 6 Dry Dicamba Herbicide Market, By Region, 20142022 (USD Million)

Table 7 Dry Dicamba Herbicide Market, By Region, 20142022 (MT)

Table 8 Dicamba Herbicide Market Size, By Time of Application, 20142022 (USD Million)

Table 9 Post-Emergence: Market, By Region 20142022 (USD Million)

Table 10 Pre-Emergence: Market, By Region 20142022 (USD Million)

Table 11 Dicamba Herbicide Market Size, By Crop Type, 20142022 (USD Million)

Table 12 Market Size for Cereals & Grains, By Subtype, 20142022 (USD Million)

Table 13 Market Size for Cereals & Grains, By Region, 20142022 (USD Million)

Table 14 Market Size for Oilseeds & Pulses, By Subtype, 20142022 (USD Million)

Table 15 Market for Oilseeds & Pulses, By Region, 20142022 (USD Million)

Table 16 Market for Pastures & Forage Crops, By Region, 20142022 (USD Million)

Table 17 Market Size, By Formulation, 20142022 (USD Million)

Table 18 Salt-Based Dicamba Herbicide Market, By Region, 20142022 (USD Million)

Table 19 Acid-Based Dicamba Herbicide Market, By Region, 20142022 (USD Million)

Table 20 Market Size, By Region, 20142022 (USD Million)

Table 21 Market Size, By Region, 20142022 (MT)

Table 22 North America: Dicamba Herbicide Market Size, By Crop Type, 20142022 (USD Million)

Table 23 North America: Market Size, By Formulation, 20142022 (USD Million)

Table 24 North America: Market Size, By Physical Form, 20142022 (USD Million)

Table 25 North America: Market Size, By Physical Form, 20142022 (MT)

Table 26 North America: Market Size, By Time of Application, 20142022 (USD Million)

Table 27 North America: Market Size, By Country, 20142022 (USD Million)

Table 28 U.S.: Market Size, By Crop Type, 20142022 (USD Million)

Table 29 Canada: Market Size, By Crop Type, 20142022 (USD Million)

Table 30 Mexico: Market Size, By Crop Type, 20142022 (USD Million)

Table 31 Europe: Dicamba Herbicide Market Size, By Crop Type, 20142022 (USD Million)

Table 32 Europe: Market Size, By Formulation, 20142022 (USD Million)

Table 33 Europe: Market Size, By Physical Form, 20142022 (USD Million)

Table 34 Europe: Market Size, By Physical Form, 20142022 (MT)

Table 35 Europe: Market Size, By Time of Application, 20142022 (USD Million)

Table 36 Europe: Market Size, By Country, 20142022 (USD Million)

Table 37 Russia: Market Size, By Crop Type, 20142022 (USD Million)

Table 38 France: Market Size, By Crop Type, 20142022 (USD Million)

Table 39 Germany: Market Size, By Crop Type, 20142022 (USD Million)

Table 40 Ukraine: Dicamba Herbicide Market Size, By Crop Type, 20142022 (USD Million)

Table 41 Rest of Europe: Market Size, By Crop Type, 20142022 (USD Million)

Table 42 Asia-Pacific: Dicamba Herbicide Market Size, By Crop Type, 20142022 (USD Million)

Table 43 Asia-Pacific: Market Size, By Formulation, 20142022 (USD Million)

Table 44 Asia-Pacific: Market Size, By Physical Form, 20142022 (USD Million)

Table 45 Asia-Pacific: Market Size, By Physical Form, 20142022 (MT)

Table 46 Asia-Pacific: Market Size, By Time of Application, 20142022 (USD Million)

Table 47 Asia-Pacific: Market Size, By Country, 20142022 (USD Million)

Table 48 Australia: Market Size, By Crop Type, 20142022 (USD Million)

Table 49 India: Market Size, By Crop Type, 20142022 (USD Million)

Table 50 Japan: Market Size, By Crop Type, 20142022 (USD Million)

Table 51 China: Market Size, By Crop Type, 20142022 (USD Million)

Table 52 Rest of Asia-Pacific: Market Size, By Crop Type, 20142022 (USD Million)

Table 53 RoW: Dicamba Herbicide Market Size, By Crop Type, 20142022 (USD Million)

Table 54 RoW: Market Size, By Formulation, 20142022 (USD Million)

Table 55 RoW: Market Size, By Physical Form, 20142022 (USD Million)

Table 56 RoW: Market Size, By Physical Form, 20142022 (MT)

Table 57 RoW: Market Size, By Time of Application, 20142022 (USD Million)

Table 58 RoW: Market Size, By Country, 20142022 (USD Million)

Table 59 Brazil: Market Size, By Crop Type, 20142022 (USD Million)

Table 60 Argentina: Market Size, By Crop Type, 20142022 (USD Million)

Table 61 Others in RoW: Dicamba Herbicide Market Size, By Crop Type, 20142022 (USD Million)

Table 62 Agreements, Collaborations, Joint Ventures & Partnerships, 20112016

Table 63 Expansion and Investment, 20112016

Table 64 Acquisitions, 20112016

Table 65 New Product Launches, 20112016

List of Figures (60 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions of the Study

Figure 7 Limitations

Figure 8 Dicamba Herbicide Market Size, By Crop Type, 2016 vs 2022

Figure 9 Market Size, By Time of Application, 2016 vs 2022

Figure 10 Market Size, By Formulation, 2016 vs 2022

Figure 11 Market Size, By Physical Form, 2016 vs 2022

Figure 12 Market Share, By Region, 2015

Figure 13 Growing Demand for Herbicides to Drive the Global Market

Figure 14 Russia Dominated the Dicamba Herbicide Market in 2015

Figure 15 U.S. is Projected to Have the Highest CAGR

Figure 16 North America to Have the Highest CAGR During the Forecast Period

Figure 17 Global Population Projected to Reach ~9.5 Billion By 2050

Figure 18 Decrease in Per Capita Arable Land

Figure 19 Dicamba Herbicide Market, By Crop Type

Figure 20 Market, By Time of Application

Figure 21 Market, By Formulation

Figure 22 Market, By Physical Form

Figure 23 Dicamba Herbicides: Drivers, Restraints, Opportunities, and Challenges

Figure 24 Registration & Formulation Contributes Major Value Addition

Figure 25 Supply Chain for Dicamba Herbicide Market

Figure 26 Dicamba Herbicide Market Size, By Physical Form, 2016 vs 2022 (USD Million)

Figure 27 Liquid Dicamba Herbicide Market Size, By Region, 2016 vs 2022 (USD Million)

Figure 28 Dry Dicamba Herbicide Market Size, By Region, 2016 vs 2022 (USD Million)

Figure 29 Market Size, By Time of Application, 2016 vs 2022 (USD Million)

Figure 30 Post-Emergence: Dicamba Herbicide: Market Size, By Region, 2016 vs 2022 (USD Million)

Figure 31 Pre-Emergence: Dicamba Herbicide: Market Size, By Region, 2016 vs 2022 (USD Million)

Figure 32 Dicamba Herbicide Market Size, By Crop Type, 2016 vs 2022 (USD Million)

Figure 33 Market Size for Cereals & Grains, By Region, 2016 vs 2022 (USD Million)

Figure 34 Market Size for Oilseeds & Pulses, By Region, 2016 vs 2022 (USD Million)

Figure 35 Market Size for Pastures & Forage Crops, By Region, 2016 vs 2022 (USD Million)

Figure 36 Market Size, By Formulation, 2016 vs 2022 (USD Million)

Figure 37 Salt-Based Dicamba Herbicide Market Size, By Region, 2016 vs 2022 (USD Million)

Figure 38 Acid-Based Dicamba Herbicide Market Size, By Region, 2016 vs 2022 (USD Million)

Figure 39 Market Size, By Region, 2016 vs 2022 (USD Million)

Figure 40 North America Dicamba Herbicide Market: Snapshot

Figure 41 Europe: Dicamba Herbicide Market Snapshot

Figure 42 Asia-Pacific: Dicamba Herbicide Market Snapshot

Figure 43 Companies Adopted Agreements, Collaborations, Joint Ventures, and Partnerships as Their Key Growth Strategy From 2011 to 2016

Figure 44 Dicamba Herbicides Market Share, By Key Players, 2015

Figure 45 Total Developments in the Dicamba Herbicide Market, 20112016

Figure 46 Geographic Revenue Mix of Top Five Market Players

Figure 47 Monsanto Company: Company Snapshot

Figure 48 Monsanto Company: SWOT Analysis

Figure 49 E.I. Dupont De Nemours and Company: Company Snapshot

Figure 50 E. I. Du Pont De Nemours and Company: SWOT Analysis

Figure 51 BASF SE: Company Snapshot

Figure 52 BASF SE: SWOT Analysis

Figure 53 DOW Chemical Company: Company Snapshot

Figure 54 The DOW Chemical Company: SWOT Analysis

Figure 55 Bayer Cropscience AG: Company Snapshot

Figure 56 Bayer Cropscience AG: SWOT Analysis

Figure 57 Syngenta AG : Company Snapshot

Figure 58 Nufarm Limited : Company Snapshot

Figure 59 The Andersons, Inc.: Company Snapshot

Figure 60 Alligare, LLC: Company Snapshot

Growth opportunities and latent adjacency in Dicamba Herbicide Market