Ductless Heating & Cooling Systems Market by Type(Split Systems, and Window Air Conditioning Systems), Application(Residential Buildings, Commercial Buildings,and Industrial Buildings) and Region - Global Forecast to 2026

Updated on : June 17, 2024

Ductless Heating & Cooling Systems Market

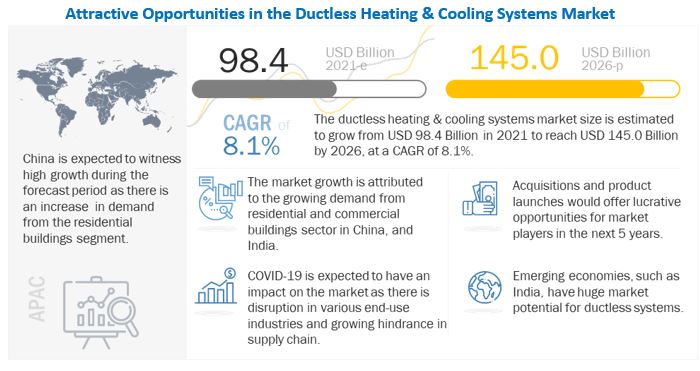

The global ductless heating & cooling systems market was valued at USD 98.4 billion in 2021 and is projected to reach USD 145.0 billion by 2026, growing at 8.1% cagr from 2021 to 2026. The implementation of IoT with ductless systems has fueled their demand in commercial and residential applications. Ductless heating & cooling systems are of different types, based on different technologies, and their functions are application-specific.

The global market includes major Tier I and II players like DAIKIN INDUSTRIES (Japan), Johnson Controls (US), Carrier (US), Trane Technologies plc, (US), LG Electronics (South Korea) and others.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on Ductless Heating & Cooling Systems Market

The pandemic was disruptive for every industry, and the ductless heating & cooling systems market was no exception. The beginning of the year 2020 saw the greatest hardships for nonresidential construction, according to data from Associated Builders and Contractors (ABC). In the first quarter of 2020, the US economy dipped by 4.8% due to the pandemic. In March 2020, the Air Conditioning Contractors of America (ACCA) conducted a survey to gain insights into how HVAC professionals felt about the market’s future amid the outbreak. A majority of those surveyed (70%) believed that the medical implications of the pandemic would last for a mere 3 months, while 65% anticipated a long-term impact on business viability, and 9% were worried that their businesses might not survive. In the process, it was expected that construction activities pertaining to hotels declined by more than 20%, while there would be a decline of 13% in recreational and amusement establishments, 11% in offices, 8% in retail, and 7% in education.

Ductless Heating & Cooling Systems Market Dynamics

Drivers: Growing trend of Smart Homes

According to the Comfy Living, the number of smart homes in the US was approximately 41.3 million units by 2020. The growth in smart homes is expected to create demand for ductless heating & cooling systems. Ductless systems are used in smart homes for controlling air temperature, humidity, and fresh air intake. Moreover, the energy consumption level of a ductless system can be optimized to a large extent by utilizing various components such as smart thermostats, sensors, control valves, heating and cooling coils, dampers, actuators, pumps, and fans. These smart devices save energy and control the working of ductless heating & cooling systems with the help of technologies such as wireless communication, Internet connectivity, handheld devices, and cloud computing. For example, ENERGY STAR certified ductless mini split systems use 60% less energy for heating and 30% less energy for cooling as compared to conventional room air conditioners. The energy-saving is possible as more sophisticated compressors and fans are used that can adjust speed to save energy. The continuous development in technology and rapid innovation in various devices has increased the interest of customers toward the use of ductless systems in smart homes. These factors, in turn, are expected to accelerate growth in the ductless heating & cooling systems market during the forecast period.

Restraints: Rising Environmental Concerns

According to the International Energy Agency, the sales of air conditioners witnessed a growth of around 15% during 2019-2020. An increase in the sales of air conditioners will also lead to an increase in air pollutants released during the functioning of the systems. Air conditioners release hydrofluorocarbons (HFCs) and hydrochlorofluorocarbons (HCFCs), which trap heat in the atmosphere, contributing to global warming. The increasing demand for ductless systems will consequently increase the amount of energy and power consumed during the operation. To avoid these, manufacturers of ductless heating & cooling systems and refrigerants are required to develop energy-efficient and low carbon-emitting systems, as well as eco-friendly refrigerants. For example, Daikin developed R-32, a next-generation refrigerant that has lower environmental impact and efficiently carries heat. R-32 can reduce electricity consumption by 10% compared to air conditioners using refrigerant R-22. This, in turn, is expected to result in an increased overall cost of ductless systems, along with the development of eco-friendly refrigerants, which is estimated to put pressure on ductless systems manufacturers.

Challenges: Lack of awareness about the benefits of ductless heating & cooling systems

With continuous technological developments, it is very important to make end users aware of the benefits of new products. In the case of ductless systems, the awareness regarding cost- and environment-related benefits of ductless systems is low; they are normally perceived to be expensive, which acts as a challenge for market penetration in the region. There also exists a lack of awareness regarding energy-efficient ductless systems.

Despite various innovations, such as the development of low GWP refrigerants for ductless systems, the adoption rate of ductless systems is not at par with the benefits they provide. Additionally, with respect to contractors of ductless systems, there is a lack of awareness regarding the standards for ductless systems. Recently, higher SEER standards such as 21 SEER units have been launched in North America, about which residential HVAC construction firms in the US, Canada, and Mexico are unaware, which ultimately hampers their business.

Opportunities: Rapid transformation of IoT in HVAC systems

The Internet of Things (IoT) represents a scenario where HVAC systems can be connected to the Internet to allow data sharing. It manages HVAC systems, collects data, stores it in the cloud; improves HVAC operations for better efficiency; and runs a predictive maintenance schedule. It also monitors, controls, and diagnoses units over the Internet in a cost-effective way. In addition, IoT enables low ongoing maintenance and repair costs of the HVAC system. IoT allows access to real-time performance data of HVAC systems and interprets it correctly. For instance, IoT-enabled buildings can alert facility managers with early warnings of any operational abnormalities and allow for the remote diagnosis and adjustment of units, which, in turn, could save costs by minimizing system failures.

Moreover, HVAC systems in commercial or residential buildings consume maximum energy. Implementing IoT in these applications would offer cost-saving, predictive maintenance, comfort control, and healthy building performance. Thus, the increasing adoption of IoT in the HVAC industry offers growth opportunities for ductless heating & cooling systems.

Residential: Largest application of ductless heating & cooling systems market

The residential application segment is expected to hold the largest market share during the forecast period. The growth is attributed to the increasing adoption of ductless heating & cooling systems in residential buildings, growing demand for energy-efficient devices, and rising awareness regarding energy conservation in developing regions such as APAC and RoW. Moreover, increasing investments by governments for the construction of residential spaces are also expected to propel the growth of the ductless heating & cooling systems market for residential application.

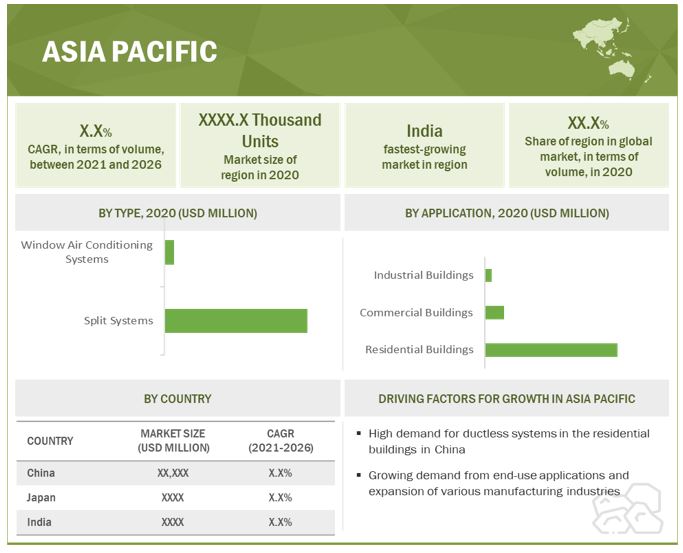

APAC is the fastest-growing market for ductless heating & cooling systems

APAC is projected to be the fastest-growing ductless heating & cooling systems market. The growth of the APAC ductless heating & cooling systems market can be attributed to the growing investment in building & construction in the region. Additionally, Ductless heating & cooling systems manufacturers are targeting this region, as it is the strongest regional market. China is the leading producer and consumer of ductless heating & cooling systems in the region. Other major markets in the region are emerging economies such as Japan, India, and Thailand.

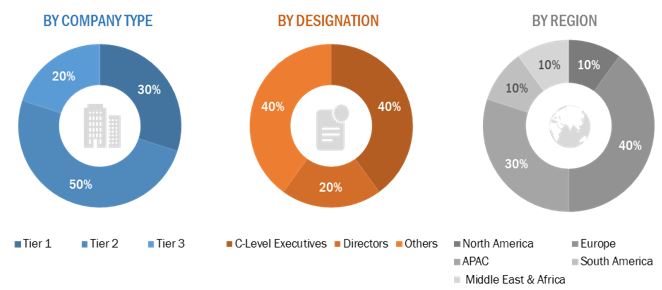

Extensive primary interviews were conducted in the process of determining and verifying sizes of the type, and application segments of the ductless heating & cooling systems market gathered through secondary research.

To know about the assumptions considered for the study, download the pdf brochure

Ductless Heating & Cooling Systems Market Players

DAIKIN Industries (Japan), Johnson Controls (US), Carrier (US), Trane Technologies plc, (US), LG Electronics (South Korea), Emerson Electric Co. (US), Honeywell International Inc. (US), Mitsubishi Electric Corporation (Japan), Nortek Air Management (US), Samsung Electronics (South Korea), FUJITSU (Japan), GREE (China), Hitachi (Japan), Midea (China), Panasonic (Japan), Haier Smart Home (China), Whirlpool (US), Electrolux (Sweden), and Lennox (US) are the leading players operating in the ductless heating & cooling systems market.

These companies have adopted various organic as well as inorganic growth strategies between 2018 and 2020 to strengthen their position in the market. New product development, merger & acquisition, and expansion were among the key growth strategies adopted by these leading players to enhance their product offering and regional presence and meet the growing demand for ductless heating & cooling systems in the emerging economies.

Ductless Heating & Cooling Systems Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million) |

|

Segments |

Type, Application, and Region |

|

Geographies covered |

North America, APAC, Europe, the Middle East & Africa, and South America |

|

Companies |

Daikin Industries (Japan), Johnson Controls (US), Carrier (US), Trane Technologies plc, (US), LG Electronics (South Korea), Emerson Electric Co. (US), Honeywell International Inc. (US), Mitsubishi Electric Corporation (Japan), Nortek Air Management (US), Samsung Electronics (South Korea), FUJITSU (Japan), GREE (China), Hitachi (Japan), Midea (China), Panasonic (Japan), Haier Smart Home (China), Whirlpool (US), Electrolux (Sweden), and Lennox (US). |

This research report categorizes the ductless heating & cooling systems market based on type, application, and region.

Ductless Heating & Cooling Systems Market by Type:

-

Split System

- Mini Split System

- Multi Split System

- VRF System

- Window Air Conditioning System

Ductless Heating & Cooling Systems Market by Application:

- Residential Buildings

- Commercial Buildings

- Industrial Buildings

Ductless Heating & Cooling Systems Market by Region

- North America

- APAC

- Europe

- Middle East & Africa

- South America

The ductless heating & cooling systems market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In 2021, Carrier launched a new Toshiba Carrier touchscreen controller in North America for VRF systems, capable of connecting up to 128 indoor units to one easy-to-use interface.

- In 2021, Nortek Global HVAC (NGH), a manufacturer of the industry’s leading unit heaters, redesigned its entire Reznor brand of commercial/industrial/residential gas-fired unit heaters for the North American market.

- In 2021, Trane China launched a new suite of air cleaning systems that applies advanced technology to reduce containments, including particulates, gases, and viruses, in indoor environments. The system comprehensively improves indoor air quality (IAQ) and builds environmental safety under the new normal with the COVID-19 pandemic, and meets people’s added requirements for a safe, healthy, and comfortable indoor environment.

FAQs:

What are the major drivers influencing the growth of the ductless heating & cooling systems market?

The major drivers influencing the growth of the market are the growing residential and non-residential building constructions and stringent government regulations in the countries.

Who are the major manufacturers of ductless heating & cooling systems?

DAIKIN INDUSTRIES (Japan), Johnson Controls (US), Carrier (US), Trane Technologies plc, (US), LG Electronics (South Korea) are the major manufacturers of ductless heating & cooling systems.

What is the COVID-19 impact on the ductless heating & cooling systems market?

According to discussions with various primary respondents, the impact of COVID-19 on the ductless heating & cooling systems market has been considered to be for a short-to-medium term; hence, it has been assumed that COVID-19 prevailed from the first quarter of 2020 to its fourth quarter.

What are some of the technological advancements in the market?

With smart technology, completely automated homes are also becoming a reality. Now, HVAC units can be connected with other smart appliances in the home and behave automatically based on climate conditions, occupant’s preferences, and settings. For example, when it is sunny and hot outside, the blinds may turn halfway down, the AC may turn on a cool, low fan setting to preserve energy, while the ceiling fan can turn on to circulate air at low power. Moreover, users can also give voice commands to their air-conditioning units. All appliances can be interconnected and adjusted according to each other.

What are the major applications for the ductless heating & cooling systems market?

The major applications are Residential and Commercial Buildings.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 53)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 DUCTLESS HEATING & COOLING SYSTEMS MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATION

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 57)

2.1 RESEARCH DATA

FIGURE 2 DUCTLESS HEATING & COOLING SYSTEMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 3 PRIMARY INTERVIEWS

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 DUCTLESS HEATING & COOLING SYSTEMS MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 65)

FIGURE 7 SPLIT SYSTEMS TO DOMINATE DUCTLESS HEATING & COOLING SYSTEMS MARKET BETWEEN 2021 AND 2026

FIGURE 8 RESIDENTIAL BUILDINGS SEGMENT TO DOMINATE DUCTLESS HEATING & COOLING SYSTEMS MARKET

FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF DUCTLESS HEATING & COOLING SYSTEMS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 68)

4.1 ATTRACTIVE OPPORTUNITIES IN DUCTLESS HEATING & COOLING SYSTEMS MARKET

FIGURE 10 GROWING DEMAND FROM RESIDENTIAL BUILDINGS SEGMENT TO DRIVE DUCTLESS HEATING & COOLING SYSTEMS MARKET IN ASIA PACIFIC

4.2 DUCTLESS HEATING & COOLING SYSTEMS MARKET, BY TYPE AND COUNTRY, 2020

FIGURE 11 CHINA AND SPLIT SYSTEMS SEGMENT ACCOUNTED FOR LARGEST SHARES

5 MARKET OVERVIEW (Page No. - 69)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR DUCTLESS HEATING & COOLING SYSTEMS MARKET

5.2.1 DRIVERS

5.2.1.1 Growing trend of smart homes

5.2.1.2 Significant growth in the number of data centers

TABLE 1 COUNTRY MAPPING OF DATA CENTERS

5.2.1.3 Increase in residential construction

5.2.1.4 Lower operating cost of ductless heating & cooling systems

5.2.1.5 Growing demand for energy-efficient devices

5.2.2 RESTRAINTS

5.2.2.1 Rising environmental concerns

5.2.2.2 Higher initial cost of ductless system installation

5.2.2.3 Economic slowdown and impact of COVID-19 on the manufacturing sector

5.2.3 OPPORTUNITIES

5.2.3.1 Rapid transformation of IoT in HVAC systems

5.2.3.2 High penetration of VRF systems in residential and commercial applications

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness about the benefits of ductless heating & cooling systems

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 13 DUCTLESS HEATING & COOLING SYSTEMS MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 2 DUCTLESS HEATING & COOLING SYSTEMS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

FIGURE 14 VALUE CHAIN ANALYSIS: DUCTLESS HEATING & COOLING SYSTEMS MARKET

5.5 ECOSYSTEM MARKET MAP

FIGURE 15 ECOSYSTEM/ MARKET MAP

TABLE 3 SUPPLY CHAIN

5.6 TRADE ANALYSIS

5.6.1 EXPORT SCENARIO

TABLE 4 EXPORT SCENARIO FOR HS CODE: 841510, BY COUNTRY, 2016–2020 (USD THOUSAND)

5.6.2 IMPORT SCENARIO

TABLE 5 IMPORT SCENARIO FOR HS CODE 841510, BY COUNTRY, 2016–2020 (USD THOUSAND)

5.7 PRICING ANALYSIS

TABLE 6 DUCTLESS HEATING & COOLING SYSTEM INSTALLATION COST, BY REGION

TABLE 7 SPLIT SYSTEM INSTALLATION COST, BY REGION

TABLE 8 DUCTLESS HEATING & COOLING SYSTEM INSTALLATION COST, BY TYPE

TABLE 9 DUCTLESS SPLIT SYSTEM COST, BY BRAND, 2020

5.8 MACROECONOMIC INDICATORS

5.8.1 GLOBAL GDP OUTLOOK

TABLE 10 WORLD GDP GROWTH PROJECTION

5.9 TARIFF POLICIES & REGULATIONS

5.9.1 HVAC EFFICIENCY STANDARDS

5.9.2 HVAC TECH CERTIFICATIONS

5.9.2.1 OSHA applicable standards and regulations on IAQ

5.9.2.2 OSHA Standards

5.10 COVID-19 IMPACT ON DUCTLESS HEATING & COOLING SYSTEMS MARKET

5.10.1 IMPACT OF COVID-19 ON HVAC INDUSTRY

5.10.2 IMPACT OF COVID-19 ON BUILDING & CONSTRUCTION INDUSTRY

5.10.2.1 Disruption in commercial construction sectors

5.10.3 IMPACT OF COVID-19 ON INDUSTRIAL SECTOR

5.10.4 IMPACT ON CUSTOMER SPENDING PATTERNS

5.10.5 STIMULUS PACKAGE BY G-20 COUNTRIES

TABLE 11 RELIEF PACKAGES ANNOUNCED BY G-20 COUNTRIES

5.10.6 EFFECTS ON GDP OF COUNTRIES

FIGURE 16 EFFECTS ON GDP OF COUNTRIES

5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 17 TRENDS IN END-USE INDUSTRIES IMPACTING STRATEGIES OF DUCTLESS HEATING & COOLING SYSTEM MANUFACTURERS

TABLE 12 YC AND YCC SHIFT FOR DUCTLESS HEATING & COOLING SYSTEMS MARKET

5.12 CASE STUDY

5.12.1 DAIKIN DEVELOPED A WATER-SOURCE VRV HEAT RECOVERY SYSTEM FOR DUKE ELLINGTON HIGH SCHOOL IN COLUMBIA

5.12.2 DAIKIN TECHNOLOGY MAKES GRADES AT FLORIDA MIDDLE SCHOOL TO OFFER IMPROVED COMFORT AND EXCEPTIONAL ENERGY SAVINGS

5.12.3 HVAC SYSTEMS BY TRANE TECHNOLOGIES OFFERED HIGH-END EXPERIENCE TO CORE FITNESS

5.13 TECHNOLOGY ANALYSIS

5.13.1 INVERTER TECHNOLOGY

5.13.2 SMART TECHNOLOGY

5.13.3 GEOTHERMAL TECHNOLOGY

5.13.4 ZONED HVAC SYSTEMS

5.14 PATENT ANALYSIS

5.14.1 INTRODUCTION

5.14.2 METHODOLOGY

5.14.3 DOCUMENT TYPE

TABLE 13 GRANTED PATENTS WERE 14 % OF TOTAL COUNT IN LAST 10 YEARS

FIGURE 18 NUMBER OF PATENTS PUBLISHED FROM 2010 TO 2020

FIGURE 19 NUMBER OF PATENTS PUBLISHED YEAR-WISE (2010-2020)

5.14.4 INSIGHTS

5.14.5 JURISDICTION ANALYSIS

FIGURE 20 PATENT ANALYSIS, BY TOP JURISDICTIONS

5.14.6 TOP COMPANIES/APPLICANTS

FIGURE 21 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 14 LIST OF PATENTS BY MIDEA GROUP CO LTD

TABLE 15 LIST OF PATENTS BY GM GLOBAL TECHNOLOGY OPERATIONS LLC.

TABLE 16 LIST OF PATENTS BY NINGBO AUX ELECTRIC CO LTD

TABLE 17 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6 DUCTLESS HEATING & COOLING SYSTEMS MARKET, BY TYPE (Page No. - 100)

6.1 INTRODUCTION

FIGURE 22 SPLIT SYSTEMS TO DRIVE DUCTLESS HEATING & COOLING SYSTEMS MARKET BETWEEN 2021 AND 2026

TABLE 18 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 19 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 20 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 21 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 22 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY SPLIT SYSTEM TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 23 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY SPLIT SYSTEM TYPE, 2016–2018 (USD MILLION)

TABLE 24 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY SPLIT SYSTEM TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 25 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY SPLIT SYSTEM TYPE, 2019–2026 (USD MILLION)

6.2 SPLIT SYSTEMS

6.2.1 GREATER ENERGY EFFICIENCY AND LOW NOISE LEVEL FEATURE OF SPLIT SYSTEMS TO DRIVE THE MARKET

TABLE 26 SPLIT SYSTEMS MARKET SIZE, BY REGION, 2016–2018 (THOUSAND UNIT)

TABLE 27 SPLIT SYSTEMS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 28 SPLIT SYSTEMS MARKET SIZE, BY REGION, 2019–2026 (THOUSAND UNIT)

TABLE 29 SPLIT SYSTEMS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2.2 MINI SPLIT SYSTEMS

6.2.2.1 Compact design and flexible zoning of mini split systems to drive the market

6.2.3 MULTI SPLIT SYSTEMS

6.2.3.1 Expanding real estate market and rebounding construction market to drive demand for multi split systems

6.2.4 VARIABLE REFRIGERANT FLOW (VRF)

6.2.4.1 Simultaneous heating & cooling, precise temperature control, and high efficiency driving demand for VRF systems

6.3 WINDOW AIR CONDITIONING SYSTEMS

6.3.1 STAGNANT GROWTH DUE TO NO FURTHER INNOVATION, LOW DEMAND, AND INCREASING TREND OF HIGH-RISE BUILDINGS

TABLE 30 WINDOW AIR CONDITIONING SYSTEMS MARKET SIZE, BY REGION, 2016–2018 (THOUSAND UNIT)

TABLE 31 WINDOW AIR CONDITIONING SYSTEMS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 32 WINDOW AIR CONDITIONING SYSTEMS MARKET SIZE, BY REGION, 2019–2026 (THOUSAND UNIT)

TABLE 33 WINDOW AIR CONDITIONING SYSTEMS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7 DUCTLESS HEATING & COOLING SYSTEMS MARKET, BY APPLICATION (Page No. - 109)

7.1 INTRODUCTION

FIGURE 23 RESIDENTIAL BUILDINGS SEGMENT TO DRIVE DUCTLESS HEATING & COOLING SYSTEMS MARKET, 2021 VS. 2026

TABLE 34 INDUSTRY-STANDARD RATING PARAMETERS RELATED TO HVAC SYSTEMS

TABLE 35 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 36 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 37 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 38 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.2 RESIDENTIAL BUILDINGS

7.2.1 GOVERNMENT REGULATIONS AND TAX CREDIT PROGRAMS TO PROMOTE THE USE OF HVAC SYSTEMS IN RESIDENTIAL APPLICATIONS

TABLE 39 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE IN RESIDENTIAL BUILDINGS, BY REGION, 2016–2018 (THOUSAND UNIT)

TABLE 40 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE IN RESIDENTIAL BUILDINGS, BY REGION, 2016–2018 (USD MILLION)

TABLE 41 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE IN RESIDENTIAL BUILDINGS, BY REGION, 2019–2026 (THOUSAND UNIT)

TABLE 42 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE IN RESIDENTIAL BUILDINGS, BY REGION, 2019–2026 (USD MILLION)

7.3 COMMERCIAL BUILDINGS

7.3.1 GROWING ADOPTION OF ENERGY-EFFICIENT EQUIPMENT TO BOOST THE DUCTLESS HEATING & COOLING SYSTEMS MARKET FOR COMMERCIAL SPACES

TABLE 43 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE IN COMMERCIAL BUILDINGS, BY REGION, 2016–2018 (THOUSAND UNIT)

TABLE 44 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE IN COMMERCIAL BUILDINGS, BY REGION, 2016–2018 (USD MILLION)

TABLE 45 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE IN COMMERCIAL BUILDINGS, BY REGION, 2019–2026 (THOUSAND UNIT)

TABLE 46 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE IN COMMERCIAL BUILDINGS, BY REGION, 2019–2026 (USD MILLION)

7.4 INDUSTRIAL BUILDINGS

7.4.1 GROWING USE OF ENERGY-EFFICIENT DUCTLESS SYSTEMS IN INDUSTRIAL SPACES TO REDUCE OPERATIONAL COST AND SAVE ENERGY

TABLE 47 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE IN INDUSTRIAL BUILDINGS, BY REGION, 2016–2018 (THOUSAND UNIT)

TABLE 48 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE IN INDUSTRIAL BUILDINGS, BY REGION, 2016–2018 (USD MILLION)

TABLE 49 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE IN INDUSTRIAL BUILDINGS, BY REGION, 2019–2026 (THOUSAND UNIT)

TABLE 50 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE IN INDUSTRIAL BUILDINGS, BY REGION, 2019–2026 (USD MILLION)

8 DUCTLESS HEATING & COOLING SYSTEMS MARKET, BY REGION (Page No. - 118)

8.1 INTRODUCTION

TABLE 51 DUCTLESS HEATING & COOLING SYSTEMS MARKET, BY REGION, 2016–2018 (THOUSAND UNIT)

TABLE 52 DUCTLESS HEATING & COOLING SYSTEMS MARKET, BY REGION, 2016–2018 (USD MILLION)

TABLE 53 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY REGION, 2019–2026 (THOUSAND UNIT)

TABLE 54 DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.2 ASIA PACIFIC

FIGURE 24 ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS: MARKET SNAPSHOT

TABLE 55 ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2016-2018 (THOUSAND UNIT)

TABLE 56 ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 57 ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND UNIT)

TABLE 58 ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 59 ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 60 ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 61 ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 62 ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 63 ASIA PACIFIC: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 64 ASIA PACIFIC: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 65 ASIA PACIFIC: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 66 ASIA PACIFIC: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 67 ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 68 ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 69 ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 70 ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.2.1 CHINA

8.2.1.1 Increasing investment in construction industry to drive market

TABLE 71 CHINA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 72 CHINA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 73 CHINA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 74 CHINA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 CHINA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 76 CHINA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 77 CHINA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 78 CHINA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 79 CHINA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 80 CHINA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 81 CHINA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 82 CHINA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.2.2 INDIA

8.2.2.1 Government initiatives and climatic factors to drive market

TABLE 83 INDIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 84 INDIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 85 INDIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 86 INDIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 INDIA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 88 INDIA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 89 INDIA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 90 INDIA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 INDIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 92 INDIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 93 INDIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 94 INDIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.2.3 JAPAN

8.2.3.1 Presence of leading ductless system manufacturers to support market growth

TABLE 95 JAPAN: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 96 JAPAN: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 97 JAPAN: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 98 JAPAN: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 99 JAPAN: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 100 JAPAN: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 101 JAPAN: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 102 JAPAN: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 JAPAN: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 104 JAPAN: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 105 JAPAN: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 106 JAPAN: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.2.4 SOUTH KOREA

8.2.4.1 Climatic conditions, along with rising demand for room ACs, to drive market

TABLE 107 SOUTH KOREA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 108 SOUTH KOREA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 109 SOUTH KOREA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 110 SOUTH KOREA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 111 SOUTH KOREA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 112 SOUTH KOREA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 113 SOUTH KOREA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 114 SOUTH KOREA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 SOUTH KOREA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 116 SOUTH KOREA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 117 SOUTH KOREA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 118 SOUTH KOREA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.2.5 ASEAN COUNTRIES

8.2.5.1 Increasing investment in construction sector to drive market

TABLE 119 ASEAN COUNTRIES: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 120 ASEAN COUNTRIES: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 121 ASEAN COUNTRIES: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 122 ASEAN COUNTRIES: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 ASEAN COUNTRIES: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 124 ASEAN COUNTRIES: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 125 ASEAN COUNTRIES: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 126 ASEAN COUNTRIES: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 ASEAN COUNTRIES: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 128 ASEAN COUNTRIES: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 129 ASEAN COUNTRIES: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 130 ASEAN COUNTRIES: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.2.6 REST OF ASIA PACIFIC

TABLE 131 REST OF ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 132 REST OF ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 133 REST OF ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 134 REST OF ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 135 REST OF ASIA PACIFIC: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 136 REST OF ASIA PACIFIC: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 137 REST OF ASIA PACIFIC: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 138 REST OF ASIA PACIFIC: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 139 REST OF ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 140 REST OF ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 141 REST OF ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 142 REST OF ASIA PACIFIC: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.3 NORTH AMERICA

FIGURE 25 NORTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SNAPSHOT

TABLE 143 NORTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2016–2018 (THOUSAND UNIT)

TABLE 144 NORTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 145 NORTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 146 NORTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND UNIT)

TABLE 147 NORTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 148 NORTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 149 NORTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 150 NORTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 151 NORTH AMERICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 152 NORTH AMERICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 153 NORTH AMERICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 154 NORTH AMERICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 155 NORTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 156 NORTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 157 NORTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 158 NORTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.3.1 US

8.3.1.1 Increased growth of construction industry to drive market

TABLE 159 US CONSTRUCTION SPENDING (USD BILLION), BY TYPE, 2015-2020

TABLE 160 US: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 161 US: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 162 US: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 163 US: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 164 US: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 165 US: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 166 US: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 167 US: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 168 US: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 169 US: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 170 US: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 171 US: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

8.3.2 CANADA

8.3.2.1 Government initiatives for construction sector to be the driving factor

TABLE 172 PROVINCIAL SUMMARY ON CONSTRUCTION SECTOR

TABLE 173 CANADA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 174 CANADA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 175 CANADA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 176 CANADA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 177 CANADA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 178 CANADA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 179 CANADA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 180 CANADA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 181 CANADA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 182 CANADA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 183 CANADA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 184 CANADA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

8.3.3 MEXICO

8.3.3.1 Government initiatives to support ductless heating and cooling system adoption to drive market

TABLE 185 MEXICO: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 186 MEXICO: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 187 MEXICO: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 188 MEXICO DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 189 MEXICO: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 190 MEXICO: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 191 MEXICO: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 192 MEXICO: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 193 MEXICO: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 194 MEXICO: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 195 MEXICO: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 196 MEXICO: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

8.4 EUROPE

TABLE 197 EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2016–2018 (THOUSAND UNIT)

TABLE 198 EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 199 EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND UNIT)

TABLE 200 EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 201 EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 202 EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 203 EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 204 EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 205 EUROPE: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 206 EUROPE: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 207 EUROPE: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 208 EUROPE: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 209 EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 210 EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 211 EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 212 EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.4.1 GERMANY

8.4.1.1 Increasing innovations in software solutions for ductless systems to support growth

TABLE 213 GERMANY: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 214 GERMANY: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 215 GERMANY: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 216 GERMANY: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 217 GERMANY: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 218 GERMANY: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 219 GERMANY: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 220 GERMANY: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 221 GERMANY: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 222 GERMANY: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 223 GERMANY: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 224 GERMANY: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.4.2 UK

8.4.2.1 Government subsidies to influence market growth

TABLE 225 UK: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 226 UK: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 227 UK: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 228 UK: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 229 UK: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 230 UK: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 231 UK: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 232 UK: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 233 UK: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 234 UK: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 235 UK: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 236 UK: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.4.3 FRANCE

8.4.3.1 Housing plans, along with government initiatives, to drive market

TABLE 237 FRANCE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 238 FRANCE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 239 FRANCE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 240 FRANCE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 241 FRANCE: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 242 FRANCE: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 243 FRANCE: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 244 FRANCE: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 245 FRANCE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 246 FRANCE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 247 FRANCE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 248 FRANCE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.4.4 SPAIN

8.4.4.1 Increased foreign investment in end-use industries to drive market

TABLE 249 SPAIN: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 250 SPAIN: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 251 SPAIN: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 252 SPAIN: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 253 SPAIN: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 254 SPAIN: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 255 SPAIN: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 256 SPAIN: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 257 SPAIN: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 258 SPAIN: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 259 SPAIN: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 260 SPAIN: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.4.5 ITALY

8.4.5.1 Strong construction industry to boost market

TABLE 261 ITALY: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 262 ITALY: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 263 ITALY: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 264 ITALY: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 265 ITALY: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 266 ITALY: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 267 ITALY: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 268 ITALY: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 269 ITALY: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 270 ITALY: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 271 ITALY: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 272 ITALY: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.4.6 RUSSIA

8.4.6.1 Commercial buildings segment to lead the consumption of ductless heating & cooling systems

TABLE 273 RUSSIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 274 RUSSIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 275 RUSSIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 276 RUSSIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 277 RUSSIA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 278 RUSSIA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 279 RUSSIA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 280 RUSSIA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 281 RUSSIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 282 RUSSIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 283 RUSSIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 284 RUSSIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.4.7 POLAND

8.4.7.1 Investment by Polish government in construction sector to drive market

TABLE 285 POLAND: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 286 POLAND: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 287 POLAND: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 288 POLAND: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 289 POLAND: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 290 POLAND: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 291 POLAND: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 292 POLAND: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 293 POLAND: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 294 POLAND: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 295 POLAND: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 296 POLAND: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.4.8 REST OF EUROPE

TABLE 297 REST OF EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 298 REST OF EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 299 REST OF EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 300 REST OF EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 301 REST OF EUROPE: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 302 REST OF EUROPE: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 303 REST OF EUROPE: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 304 REST OF EUROPE: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 305 REST OF EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 306 REST OF EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 307 REST OF EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 308 REST OF EUROPE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.5 MIDDLE EAST & AFRICA

TABLE 309 MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 310 MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2016–2018 (THOUSAND UNIT)

TABLE 311 MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND UNIT)

TABLE 312 MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 313 MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 314 MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 315 MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 316 MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 317 MIDDLE EAST & AFRICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 318 MIDDLE EAST & AFRICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 319 MIDDLE EAST & AFRICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 320 MIDDLE EAST & AFRICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 321 MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 322 MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 323 MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 324 MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.5.1 SAUDI ARABIA

8.5.1.1 Growth in residential construction sector to drive market

TABLE 325 SAUDI ARABIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 326 SAUDI ARABIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 327 SAUDI ARABIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 328 SAUDI ARABIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 329 SAUDI ARABIA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 330 SAUDI ARABIA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 331 SAUDI ARABIA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 332 SAUDI ARABIA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 333 SAUDI ARABIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 334 SAUDI ARABIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 335 SAUDI ARABIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 336 SAUDI ARABIA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.5.2 UAE

8.5.2.1 Presence of leading ductless system manufacturers to support market growth

TABLE 337 UAE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 338 UAE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 339 UAE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 340 UAE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 341 UAE: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 342 UAE: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 343 UAE: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 344 UAE: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 345 UAE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 346 UAE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 347 UAE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 348 UAE: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.5.3 SOUTH AFRICA

8.5.3.1 Government’s investment plan for construction industry to drive market

TABLE 349 SOUTH AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 350 SOUTH AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 351 SOUTH AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 352 SOUTH AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 353 SOUTH AFRICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 354 SOUTH AFRICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 355 SOUTH AFRICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 356 SOUTH AFRICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 357 SOUTH AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 358 SOUTH AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 359 SOUTH AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 360 SOUTH AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 361 REST OF MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 362 REST OF MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 363 REST OF MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 364 REST OF MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 365 REST OF MIDDLE EAST & AFRICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 366 REST OF MIDDLE EAST & AFRICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 367 REST OF MIDDLE EAST & AFRICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 368 REST OF MIDDLE EAST & AFRICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 369 REST OF MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 370 REST OF MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 371 REST OF MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 372 REST OF MIDDLE EAST & AFRICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.6 SOUTH AMERICA

TABLE 373 SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2016–2018 (THOUSAND UNIT)

TABLE 374 SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 375 SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND UNIT)

TABLE 376 SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 377 SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 378 SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 379 SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 380 SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 381 SOUTH AMERICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 382 SOUTH AMERICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 383 SOUTH AMERICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 384 SOUTH AMERICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 385 SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 386 SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 387 SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 388 SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.6.1 BRAZIL

8.6.1.1 Infrastructure and rapid industrial growth to drive market

TABLE 389 BRAZIL: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 390 BRAZIL: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 391 BRAZIL: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 392 BRAZIL: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 393 BRAZIL: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 394 BRAZIL: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 395 BRAZIL: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 396 BRAZIL: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 397 BRAZIL: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 398 BRAZIL: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 399 BRAZIL: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 400 BRAZIL: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.6.2 ARGENTINA

8.6.2.1 Housing projects to propel market

TABLE 401 ARGENTINA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 402 ARGENTINA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 403 ARGENTINA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 404 ARGENTINA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 405 ARGENTINA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 406 ARGENTINA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 407 ARGENTINA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 408 ARGENTINA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 409 ARGENTINA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 410 ARGENTINA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 411 ARGENTINA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 412 ARGENTINA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.6.3 REST OF SOUTH AMERICA

TABLE 413 REST OF SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 414 REST OF SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 415 REST OF SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 416 REST OF SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 417 REST OF SOUTH AMERICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (THOUSAND UNIT)

TABLE 418 REST OF SOUTH AMERICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 419 REST OF SOUTH AMERICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND UNIT)

TABLE 420 REST OF SOUTH AMERICA: SPLIT DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 421 REST OF SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (THOUSAND UNIT)

TABLE 422 REST OF SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 423 REST OF SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (THOUSAND UNIT)

TABLE 424 REST OF SOUTH AMERICA: DUCTLESS HEATING & COOLING SYSTEMS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 232)

9.1 OVERVIEW

FIGURE 26 COMPANIES ADOPTED NEW PRODUCT LAUNCH AS THE KEY GROWTH STRATEGY, 2018–2021

9.2 MARKET SHARE ANALYSIS

FIGURE 27 DUCTLESS HEATING & COOLING SYSTEMS MARKET SHARE ANALYSIS

TABLE 425 DUCTLESS HEATING & COOLING SYSTEMS MARKET: DEGREE OF COMPETITION

9.3 REVENUE ANALYSIS OF LEADING PLAYERS (2016–2020)

FIGURE 28 5-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN DUCTLESS HEATING & COOLING SYSTEMS MARKET

9.4 MARKET EVALUATION FRAMEWORK

TABLE 426 OVERVIEW OF STRATEGIES DEPLOYED BY KEY DUCTLESS HEATING & COOLING SYSTEM MANUFACTURERS

9.5 COMPANY EVALUATION MATRIX

9.5.1 STAR

9.5.2 EMERGING LEADER

9.5.3 PERVASIVE

9.5.4 PARTICIPANT

FIGURE 29 COMPANY EVALUATION MATRIX, 2020

9.6 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

9.6.1 RESPONSIVE COMPANIES

9.6.2 DYNAMIC COMPANIES

9.6.3 STARTING BLOCKS

FIGURE 30 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2020

9.7 COMPANY FOOTPRINT

TABLE 427 FOOTPRINT OF DIFFERENT TYPES OF DUCTLESS HEATING & COOLING SYSTEMS OFFERED BY DIFFERENT COMPANIES

TABLE 428 FOOTPRINT OF DIFFERENT COMPANIES ACROSS DIFFERENT VERTICALS

TABLE 429 REGIONAL FOOTPRINT OF DIFFERENT COMPANIES

9.8 COMPETITIVE SITUATIONS AND TRENDS

9.8.1 PRODUCT LAUNCHES

TABLE 430 PRODUCT LAUNCHES, 2018–2021

9.8.2 DEALS

TABLE 431 DEALS, 2020–2021

10 COMPANY PROFILES (Page No. - 246)

10.1 MAJOR PLAYERS

(Business Overview, Products/solutions/services offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

*Details on Business Overview, Products/solutions/services offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

10.1.1 SAMSUNG ELECTRONICS CO., LTD

TABLE 432 SAMSUNG ELECTRONICS CO., LTD.: COMPANY OVERVIEW

FIGURE 31 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

FIGURE 32 SAMSUNG ELECTRONICS CO., LTD.’S CAPABILITY IN DUCTLESS HEATING & COOLING SYSTEMS MARKET

10.1.2 HITACHI LTD.

TABLE 433 HITACHI LTD.: COMPANY OVERVIEW

FIGURE 33 HITACHI LTD.: COMPANY SNAPSHOT

FIGURE 34 HITACHI LTD.’S CAPABILITIES IN DUCTLESS HEATING & COOLING SYSTEMS MARKET

10.1.3 LG ELECTRONICS

TABLE 434 LG ELECTRONICS: COMPANY OVERVIEW

FIGURE 35 LG ELECTRONICS: COMPANY SNAPSHOT

FIGURE 36 LG ELECTRONICS’ CAPABILITY IN DUCTLESS HEATING & COOLING SYSTEMS MARKET

10.1.4 MITSUBISHI ELECTRIC CORPORATION

TABLE 435 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

FIGURE 37 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

FIGURE 38 MITSUBISHI ELECTRIC CORPORATION’S CAPABILITY IN DUCTLESS HEATING & COOLING SYSTEMS MARKET

10.1.5 DAIKIN INDUSTRIES LTD

TABLE 436 DAIKIN INDUSTRIES LTD.: COMPANY OVERVIEW

FIGURE 39 DAIKIN INDUSTRIES LTD.: COMPANY SNAPSHOT

FIGURE 40 DAIKIN INDUSTRIES LTD.’S. CAPABILITY IN DUCTLESS HEATING & COOLING SYSTEMS MARKET

10.1.6 TRANE TECHNOLOGIES

TABLE 437 TRANE TECHNOLOGIES: COMPANY OVERVIEW

FIGURE 41 TRANE TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 42 TRANE TECHNOLOGIES’ CAPABILITY IN DUCTLESS HEATING & COOLING SYSTEMS MARKET

10.1.7 JOHNSON CONTROLS

TABLE 438 JOHNSON CONTROLS: COMPANY OVERVIEW

FIGURE 43 JOHNSON CONTROLS: COMPANY SNAPSHOT

FIGURE 44 JOHNSON CONTROLS’ CAPABILITY IN DUCTLESS HEATING & COOLING SYSTEMS MARKET

10.1.8 CARRIER GLOBAL CORPORATION

TABLE 439 CARRIER GLOBAL CORPORATION: COMPANY OVERVIEW

FIGURE 45 CARRIER GLOBAL CORPORATION: COMPANY SNAPSHOT

FIGURE 46 CARRIER GLOBAL CORPORATION'S CAPABILITIES IN DUCTLESS HEATING & COOLING SYSTEMS MARKET

10.1.9 LENNOX INTERNATIONAL INC.

TABLE 440 LENNOX INTERNATIONAL, INC.: COMPANY OVERVIEW

FIGURE 47 LENNOX INTERNATIONAL, INC.: COMPANY SNAPSHOT

FIGURE 48 LENNOX INTERNATIONAL INC.'S CAPABILITIES IN DUCTLESS HEATING & COOLING SYSTEMS MARKET

10.1.10 NORTEK

TABLE 441 NORTEK: COMPANY OVERVIEW

10.1.11 WHIRLPOOL CORPORATION

TABLE 442 WHIRLPOOL CORPORATION: COMPANY OVERVIEW

FIGURE 49 WHIRLPOOL CORPORATION: COMPANY SNAPSHOT

10.1.12 WATSCO INC.

TABLE 443 WATSCO, INC.: COMPANY OVERVIEW

FIGURE 50 WATSCO, INC.: COMPANY SNAPSHOT

10.1.13 PARKER DAVIS HVAC INTERNATIONAL INC.

TABLE 444 PARKER DAVIS HVAC INTERNATIONAL INC.: COMPANY OVERVIEW

10.1.14 RHEEM MANUFACTURING COMPANY INC

TABLE 445 RHEEM MANUFACTURING COMPANY INC: COMPANY OVERVIEW

10.1.15 GREE ELECTRIC APPLIANCES INC.

TABLE 446 GREE ELECTRIC APPLIANCES, INC.: COMPANY OVERVIEW

FIGURE 51 GREE ELECTRIC APPLIANCES, INC.: COMPANY SNAPSHOT

10.1.16 VOLTAS LTD.

TABLE 447 VOLTAS LTD.: COMPANY OVERVIEW

FIGURE 52 VOLTAS LTD.: COMPANY SNAPSHOT

10.1.17 BLUE STAR LTD.

TABLE 448 BLUE STAR LTD.: COMPANY OVERVIEW

FIGURE 53 BLUE STAR LTD.: COMPANY SNAPSHOT

10.2 OTHER PLAYERS

10.2.1 HAIER ELECTRONICS GROUP CO., LTD.

10.2.2 SHARP CORPORATION

10.2.3 MIDEA GROUP CO. LTD.

10.2.4 IFB INDUSTRIES LTD.

10.2.5 PANASONIC CORPORATION

10.2.6 GUANGDONG CHIGO AIR CONDITIONING CO., LTD.

10.2.7 GODREJ & BOYCE MFG. CO. LTD.

10.2.8 ONIDA

10.2.9 AUX GROUP CO., LTD.

10.2.10 FUJITSU GENERAL LTD.

11 APPENDIX (Page No. - 301)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for ductless heating & cooling systems. The exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

The ductless heating & cooling systems market comprises several stakeholders such as raw material suppliers, end product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the developments in end-use industry. The supply side is characterized by market consolidation activities undertaken by the raw material suppliers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the ductless heating & cooling systems market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study:

- To define, describe, and analyze the ductless heating & cooling systems market based on type, application, and region