Electrical Insulation Materials Market by Type (Thermoplastics, Epoxy Resins, Ceramics), Application (Power Systems, Electronic Systems, Cables & Transmission Lines, Domestic Portable Appliances), and Region - Global Forecast to 2027

Updated on : April 03, 2024

Electrical Insulation Materials Market

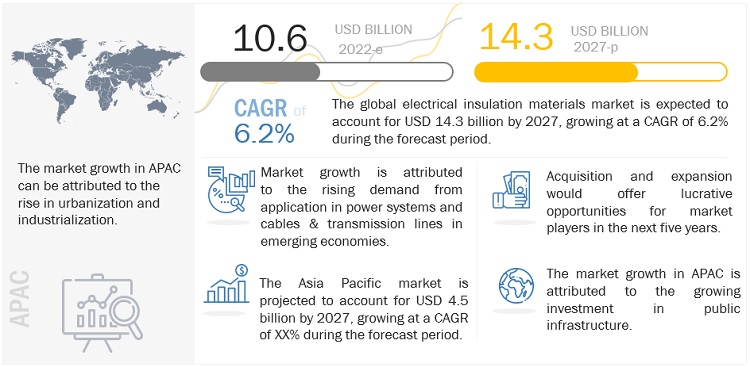

The global electrical insulation materials market size was valued at USD 10.6 billion in 2022 and is projected to reach USD 14.3 billion by 2027, growing at 6.2% cagr from 2022 to 2027. Increasing demand for electrical insulation materials from emerging markets and growth in production of electric vehicles (EVs) are driving the market.

Attractive Opportunities in the Electrical Insulation Materials Market

Note: e-estimated p-projected.

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Electrical Insulation Materials Market Dynamics

Driver: Growing demand for electric vehicles (EVs)

Electrical insulation materials are used in EVs to provide protection to electronic components and decrease conductivity. Due to the increasing drive for fuel economy, emission targets, and changing consumer behavior toward the adaptability of EVs, their sales are increasing. Total EV sales are expected to grow from 6.6 million in 2021 to 11.2 million in 2025 and reach 31.1 million by 2030. This segment is expected to account for an approximately 32% market share in new car sales by 2030. In the US, EV sales accounted for 2% of the total car sales in 2020. Sales increased to 5% in 2021 for light-duty vehicles and 20% for all passenger vehicles, as per Climatewire. Ford Motor Co. and SK Innovation announced investments worth USD 11.4 billion on new production sites for EVs and batteries in Tennessee and Kentucky. Ford F-150s, launched in May 2021, recorded bookings of 130,000 units. It is expected that by the end of 2022, 40 new models of EV vehicles will be available in the US market. The US government is expected to pass a USD 3.5 trillion reconciliation package which includes the provision of offering USD 7,500 EV tax credit and a further USD 4,500 incentive if the union made EVs are assembled in the country. This is expected to significantly boost the market for EVs in the US. These trends forecast the growing demand for electrical insulation materials in the country.

Restraint: Rising number of low-quality grey market products

The electric insulator market comprises organized as well as unorganized players/sectors. The organized sector mainly targets industrial buyers and maintains high product quality, while players in the unorganized sector provide cheaper alternatives to increase their market presence and penetrate local markets. Leading market players are facing significant competition from unorganized market players who supply cheap and low-quality products. These market players from the unorganized sector can overpower the large players with price competitiveness and the local supply networks maintained by them. Growth in the sales of electric insulators in the grey market degrades the names of the market leaders as cheap-quality goods are sold under their brand names.

Opportunity: HVDC transmission for long distance transmission lines

Often, the sources of renewable energy are located at large distances from populated areas. HVDC cables are used in such scenarios. These transmission lines require constant and steady monitoring of the entire systems to ensure minimum losses and protection against faults. They are the most efficient means of transporting electricity over long distances. The use of insulation materials for HVDC cables can also be used underground or under seabed. Projects such as NordLink in Europe are expected to connect southern Norway and Germany. The HVDC cable projects form a significant part of Germany’s energiewende (plan for environmentally sustainable energy supply.

Challenge: Volatile raw material prices

Price and availability of raw materials is a key factor for determining the cost structures of their products for electrical insulation material manufacturers. Recently, oil prices witnessed highly volatile fluctuations on either side. Prices of different resins are at an all-time high. In North America, according to Plastics Today, there is a strong demand for the export of resins from the US, but freight constraints limit sales. Therefore, Mexico is the most viable option for exports. This also leads to fluctuations in pricing. In 2019, Rubber News stated that the prices of synthetic rubber and petrochemical feedstocks are expected to remain volatile.

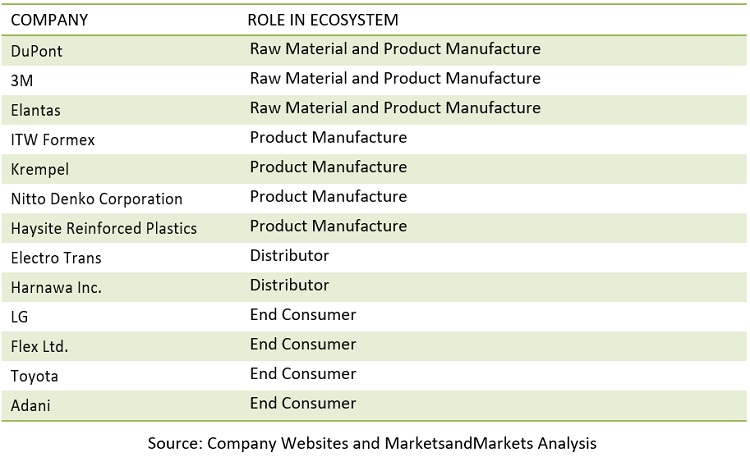

Electrical Insulation Materials Market Ecosystem

In terms of value, the cables & transmission lines segment is projected to account for the second largest share of the electrical insulation materials market, by application, during the forecast period.

The cables & transmission lines segment accounted for a share of 23.2% in terms of value, of the overall electrical insulation materials market in 2021. Electricity generated in plants is transferred from one place to another with the help of cables & transmission lines. Developing countries such as India, Brazil, and Indonesia are expanding their grid structure to provide electricity to rural areas. Demand is expected to be fulfilled by new generation capacity additions, which are expected to require new transmission and distribution infrastructure. This will directly increase the demand for electrical insulation materials to be used in the cables and transmission lines segment.

In terms of value, ceramic type is projected to account for one of the fastest growth of the electrical insulation materials market, by type, during the forecast period.

Based on type, the ceramics segment accounted for the fastest growth along with thermoplastics at a CAGR of 6.3% in terms of value, during the forecast period. Ceramics are an inorganic, non-metallic solid that is made of both metal and non-metal components. A ceramic insulator is a non-conductive insulator with high dielectric strength. These are made from red, brown, and white porous clay. Ceramic products used as electrical insulators include spark plugs, hermetic packaging, ceramic arc tubes, and protective parts for bare wires and power lines.

APAC is expected to be the fastest-growing market during the forecast period.

Based on region, Asia Pacific is a key market for the production of electrical insulation materials and is projected to grow at a CAGR of 6.8% in terms of value during the forecasted period. The availability of low-cost raw materials and labour, coupled with increasing domestic demand in the power generation sector, makes the region an attractive investment destination for electrical insulation material manufacturers. The rising population, urbanization, and industrialization are some of the factors that will drive the electrical insulation materials market in this region

To know about the assumptions considered for the study, download the pdf brochure

Electrical Insulation Materials Market Players

Major players operating in the global electrical insulation materials market include DuPont (US), Elantas (Germany), Krempel GMBH (Germany), Nitto (Japan), Von Roll (Switzerland), ITW Formex (US), 3M (US), Haysite Reinforced Plastics (US), Vitar (China), Tesa SE (Germany), Teijin DuPont Films (Japan), and NGK Insulator (Japan).

Electrical Insulation Materials Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018-2027 |

|

Base year |

2021 |

|

Forecast period |

2022-2027 |

|

Units considered |

Value (USD Million/Billion), Volume (Kiloton) |

|

Segments |

Type, Application, and Region |

|

Regions |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies |

DuPont (US), Elantas (Germany), Krempel GMBH (Germany), Nitto Denko (Japan), Von Roll (Switzerland), ITW Formex (US), 3M (US), Haysite Reinforced Plastics (US), Vitar (China), Tesa SE (Germany), Teijin DuPont Films (Japan), and NGK Insulator (Japan). |

This research report categorizes the electrical insulation materials market based on type, application, and region.

Based on Type:

- Thermoplastics

- Epoxy Resins

- Ceramics

- Others

Based on Application:

- Power Systems

- Electronics Systems

- Cables & Transmission Lines

- Domestic Portable Appliances

- Others

Based on Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments in Electrical Insulation Materials Market

- In May 2022, Krempel announced that Nomex 910, a unique insulating material comprised of high-quality electrical grade cellulose pulp developed by DuPont, would exclusively be produced, and sold through Krempel. This partnership is expected to strengthen Krempel’s market position in the electrical insulation materials market.

- In April 2022, Von Roll planned to expand its site in Italy for the growing potting resin business in the automotive and electronic industries. This will expand production and warehouse capacities as well as R&D resources and set up a customer experience centre.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the electrical insulation materials market?

The growth of this market can be attributed to growing requirement in APAC and increasing adaption of smart grid systems.

Which are the key applications driving the electrical insulation materials market?

Applications such as power systems, electronic systems, cables & transmission lines, and domestic portable appliances are driving the demand for electrical insulation materials market.

Who are the major manufacturers?

Major manufacturers include DuPont (US), Elantas (Germany), Krempel GMBH (Germany), Nitto (Japan), Von Roll (Switzerland), ITW Formex (US), 3M (US), Haysite Reinforced Plastics (US), Vitar (China), Tesa SE (Germany), Teijin DuPont Films (Japan), and NGK Insulator (Japan), among others.

What is the biggest restraint for electrical insulation materials?

The biggest restraint can be rising number of low-quality grey market products.

How is COVID-19 affecting the overall electrical insulation materials market?

The electrical insulation materials market saw a disruption in supply chain for supply of raw materials.

What will be the growth prospects of the electrical insulation materials market?

Growth in developing countries and technological advancements in end-use industries are driving the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 ELECTRICAL INSULATION MATERIALS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Primary interviews – Demand and supply sides

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 ELECTRICAL INSULATION MATERIALS MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 ELECTRICAL INSULATION MATERIALS MARKET: TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 FORECAST NUMBER CALCULATION

FIGURE 5 DEMAND-SIDE FORECAST PROJECTIONS

2.4 DATA TRIANGULATION

FIGURE 6 ELECTRICAL INSULATION MATERIALS MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS AND MARKET RISKS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 7 THERMOPLASTICS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 8 POWER SYSTEMS APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 OVERVIEW OF ELECTRICAL INSULATION MATERIALS MARKET

FIGURE 10 HIGH GROWTH POTENTIAL IN ASIA PACIFIC

4.2 ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET, BY APPLICATION AND COUNTRY, 2021

FIGURE 11 CABLES & TRANSMISSION LINES SEGMENT AND CHINA LED MARKET IN ASIA PACIFIC

4.3 ELECTRICAL INSULATION MATERIALS MARKET, BY TYPE

FIGURE 12 THERMOPLASTICS SEGMENT TO LEAD MARKET IN TERMS OF VOLUME

4.4 ELECTRICAL INSULATION MATERIALS MARKET, BY APPLICATION

FIGURE 13 POWER SYSTEMS SEGMENT TO GROW AT HIGHEST CAGR IN TERMS OF VOLUME

4.5 ELECTRICAL INSULATION MATERIALS MARKET, BY COUNTRY

FIGURE 14 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, CHALLENGES, AND OPPORTUNITIES IN ELECTRICAL INSULATION MATERIALS MARKET

5.2.1 DRIVERS

5.2.1.1 Refurbishment of existing grid networks

5.2.1.2 Increasing demand for electricity

5.2.1.3 Growth of renewable energy

5.2.1.4 Growing demand for electric vehicles

TABLE 1 KEY DEVELOPMENTS BY DIFFERENT COMPANIES IN EV SEGMENT

5.2.2 RESTRAINTS

5.2.2.1 Rising number of low-quality grey market products

5.2.3 OPPORTUNITIES

5.2.3.1 HVDC transmission for long-distance transmission lines

5.2.3.2 Adapting to smart grid technology

5.2.4 CHALLENGES

5.2.4.1 Volatile raw material prices

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 16 PORTER'S FIVE FORCES ANALYSIS OF ELECTRICAL INSULATION MATERIALS MARKET

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 2 ELECTRICAL INSULATION MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.4 VALUE CHAIN ANALYSIS

5.4.1 RAW MATERIAL SUPPLIERS

5.4.2 MANUFACTURERS

5.4.3 COMPONENT MANUFACTURERS

5.4.4 CONSUMERS

FIGURE 17 ELECTRICAL INSULATION MATERIALS MARKET: VALUE CHAIN

5.5 ECOSYSTEM MAPPING

FIGURE 18 ELECTRICAL INSULATION MATERIALS MARKET: ECOSYSTEM

TABLE 3 ELECTRICAL INSULATION MATERIALS MARKET: ECOSYSTEM

5.6 AVERAGE SELLING PRICE ANALYSIS

5.6.1 AVERAGE SELLING PRICE, BY REGION

FIGURE 19 AVERAGE SELLING PRICE, BY REGION (USD/KG)

5.6.2 AVERAGE SELLING PRICE, BY TYPE

TABLE 4 AVERAGE SELLING PRICES BASED ON TYPE (USD/KG)

5.6.3 AVERAGE SELLING PRICE BY TOP 3 MARKET PLAYERS

FIGURE 20 AVERAGE SELLING PRICE BASED BY TOP 3 MARKET PLAYERS (USD/KG)

5.7 TRADE ANALYSIS

TABLE 5 IMPORT TRADE DATA FOR ELECTRICAL INSULATORS FOR TOP 10 COUNTRIES, 2017–2021 (USD THOUSAND)

TABLE 6 EXPORT TRADE DATA FOR ELECTRICAL INSULATORS FOR TOP 10 COUNTRIES, 2017–2021 (USD THOUSAND)

TABLE 7 IMPORT TRADE DATA FOR ELECTRICAL INSULATORS OF CERAMICS FOR TOP 10 COUNTRIES, 2017–2021 (USD THOUSAND)

TABLE 8 EXPORT TRADE DATA FOR ELECTRICAL INSULATORS OF CERAMICS FOR TOP 10 COUNTRIES, 2017–2021 (USD THOUSAND)

5.8 TECHNOLOGY ANALYSIS

5.8.1 FLEXIBLE ELECTRICAL INSULATION

5.8.2 POLY (3-HEXYLTHIOPHENE) ADDITIVE

5.9 MACROECONOMIC DATA

5.9.1 ELECTRICITY GENERATION

TABLE 9 ELECTRICITY GENERATION, BY COUNTRY (2020)

5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 21 ELECTRIC VEHICLES AND BUILDING AUTOMATION TO INFLUENCE ELECTRICAL INSULATION MATERIALS MARKET

5.11 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 10 ELECTRICAL INSULATION MATERIALS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.12 KEY FACTORS AFFECTING BUYING DECISIONS

5.12.1 QUALITY

5.12.2 SERVICE

FIGURE 22 KEY BUYING CRITERIA

5.13 TARIFFS & REGULATIONS

5.13.1 ASIA PACIFIC

5.13.2 EUROPE

5.13.3 NORTH AMERICA

TABLE 11 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14 PATENT ANALYSIS

5.14.1 METHODOLOGY

5.14.2 DOCUMENT TYPE

TABLE 12 TOTAL NUMBER OF PATENTS

FIGURE 23 TOTAL NUMBER OF PATENTS

5.14.3 PUBLICATION TRENDS

FIGURE 24 NUMBER OF PATENTS YEAR-WISE, FROM 2011 TO 2021

5.14.4 INSIGHTS

5.14.5 LEGAL STATUS OF PATENTS

FIGURE 25 PATENT ANALYSIS, BY LEGAL STATUS

5.14.6 JURISDICTION ANALYSIS

FIGURE 26 TOP JURISDICTION

5.14.7 TOP PATENT APPLICANTS

FIGURE 27 TOP 10 PATENT APPLICANTS

5.14.7.1 Patents by Nitto Denko Corp.

TABLE 13 PATENTS BY NITTO DENKO CORP.

5.14.7.2 Patents by 3M Innovative Properties Co.

TABLE 14 PATENTS BY 3M INNOVATIVE PROPERTIES CO.

5.14.8 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

TABLE 15 TOP 10 PATENT OWNERS

5.15 CASE STUDY ANALYSIS

5.15.1 RETROFIT WITH DUPONT NOMEX BOOSTED ABB HALLE’S TRANSFORMER FLEXIBILITY, AND RELIABILITY AND LOWERED MAINTENANCE COSTS

5.15.2 UL-RECOGNIZED 600 VOLT CLASS ELECTRICAL INSULATION SYSTEMS BASED ON NOMEX

5.15.3 YUNNAN TRANSFORMER CO. INNOVATED HYBRID INSULATION IN TRANSFORMERS USING NOMEX TO MEET DEMAND SAFELY AND RELIABLY

6 ELECTRICAL INSULATION MATERIALS MARKET, BY TYPE (Page No. - 74)

6.1 INTRODUCTION

FIGURE 28 THERMOPLASTICS SEGMENT TO LEAD ELECTRICAL INSULATION MATERIALS MARKET

TABLE 16 ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2018–2021 (KILOTON)

TABLE 17 ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 18 ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 19 ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

6.2 THERMOPLASTICS

TABLE 20 THERMOPLASTICS: ELECTRICAL INSULATION MATERIALS, BY TYPE, 2021 (% SHARE)

6.3 EPOXY RESINS

6.4 CERAMICS

6.5 OTHERS

TABLE 21 OTHERS: ELECTRICAL INSULATION MATERIALS, BY TYPE, 2021 (% SHARE)

7 ELECTRICAL INSULATION MATERIALS MARKET, BY APPLICATION (Page No. - 79)

7.1 INTRODUCTION

FIGURE 29 POWER SYSTEMS APPLICATION TO LEAD ELECTRICAL INSULATION MATERIALS MARKET

TABLE 22 ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 23 ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 24 ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 25 ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 POWER SYSTEMS

7.3 ELECTRONIC SYSTEMS

7.4 CABLES & TRANSMISSION LINES

7.5 PORTABLE DOMESTIC APPLIANCES

7.6 OTHERS

8 ELECTRICAL INSULATION MATERIALS MARKET, BY REGION (Page No. - 84)

8.1 INTRODUCTION

FIGURE 30 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

TABLE 26 ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 27 ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

TABLE 28 ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.2 ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SNAPSHOT

TABLE 30 ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 31 ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 32 ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 33 ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 34 ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2018–2021 (KILOTON)

TABLE 35 ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 36 ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 37 ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 38 ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 39 ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 40 ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 41 ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.2.1 CHINA

8.2.1.1 Availability of low-cost labor and cheap raw materials to drive market

TABLE 42 CHINA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 43 CHINA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 44 CHINA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 45 CHINA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.2.2 JAPAN

8.2.2.1 Large electronics industry to generate demand for electrical insulation materials

TABLE 46 JAPAN: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 47 JAPAN: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 48 JAPAN: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 49 JAPAN: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.2.3 INDIA

8.2.3.1 Urbanization and Industrialization to impact growth

TABLE 50 INDIA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 51 INDIA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 52 INDIA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 53 INDIA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.2.4 SOUTH KOREA

8.2.4.1 Digitalization boom to drive market

TABLE 54 SOUTH KOREA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 55 SOUTH KOREA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 56 SOUTH KOREA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 57 SOUTH KOREA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.2.5 INDONESIA

8.2.5.1 Expanding electricity supply to boost market

TABLE 58 INDONESIA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 59 INDONESIA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 60 INDONESIA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 61 INDONESIA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.2.6 REST OF ASIA PACIFIC

TABLE 62 REST OF ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 63 REST OF ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 64 REST OF ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 65 REST OF ASIA PACIFIC: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3 EUROPE

FIGURE 32 EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SNAPSHOT

TABLE 66 EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 67 EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 68 EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 69 EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 70 EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2018–2021 (KILOTON)

TABLE 71 EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 72 EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 73 EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 74 EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 75 EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 76 EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 77 EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Energy transition to drive market

TABLE 78 GERMANY: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 79 GERMANY: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 80 GERMANY: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 81 GERMANY: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.2 UK

8.3.2.1 Advancement in digital sector to propel market

TABLE 82 UK: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 83 UK: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 84 UK: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 85 UK: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.3 FRANCE

8.3.3.1 Increasing renewable share in energy mix to support market growth

TABLE 86 FRANCE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 87 FRANCE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 88 FRANCE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 89 FRANCE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.4 ITALY

8.3.4.1 Government plans of increasing renewable sources to drive market

TABLE 90 ITALY: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 91 ITALY: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 92 ITALY: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 93 ITALY: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 New wind and solar PV capacity installations to favor market growth

TABLE 94 SPAIN: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 95 SPAIN: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 96 SPAIN: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 97 SPAIN: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.3.6 REST OF EUROPE

TABLE 98 REST OF EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 99 REST OF EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 100 REST OF EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 101 REST OF EUROPE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4 NORTH AMERICA

FIGURE 33 NORTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SNAPSHOT

TABLE 102 NORTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 103 NORTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 104 NORTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 105 NORTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 106 NORTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2018–2021 (KILOTON)

TABLE 107 NORTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 108 NORTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 109 NORTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 110 NORTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 111 NORTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 112 NORTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 113 NORTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4.1 US

8.4.1.1 Government laws for energy policy to drive market

TABLE 114 US: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 115 US: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 116 US: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 117 US: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4.2 CANADA

8.4.2.1 Government investments in power industry to contribute to market growth

TABLE 118 CANADA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 119 CANADA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 120 CANADA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 121 CANADA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.4.3 MEXICO

8.4.3.1 Rising population to drive demand for electricity

TABLE 122 MEXICO: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 123 MEXICO: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 124 MEXICO: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 125 MEXICO: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.5 SOUTH AMERICA

TABLE 126 SOUTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 127 SOUTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 128 SOUTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 129 SOUTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 130 SOUTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2018–2021 (KILOTON)

TABLE 131 SOUTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 132 SOUTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 133 SOUTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 134 SOUTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 135 SOUTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 136 SOUTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 137 SOUTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.5.1 BRAZIL

8.5.1.1 Energy transition due to natural calamity to influence market growth

TABLE 138 BRAZIL: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 139 BRAZIL: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 140 BRAZIL: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 141 BRAZIL: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.5.2 ARGENTINA

8.5.2.1 Focus on non-hydro renewable sources to boost demand

TABLE 142 ARGENTINA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 143 ARGENTINA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 144 ARGENTINA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 145 ARGENTINA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.5.3 REST OF SOUTH AMERICA

TABLE 146 REST OF SOUTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 147 REST OF SOUTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 148 REST OF SOUTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 149 REST OF SOUTH AMERICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.6 MIDDLE EAST & AFRICA

TABLE 150 MIDDLE EAST & AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 151 MIDDLE EAST & AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 152 MIDDLE EAST & AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 153 MIDDLE EAST & AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 154 MIDDLE EAST & AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2018–2021 (KILOTON)

TABLE 155 MIDDLE EAST & AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 156 MIDDLE EAST & AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 157 MIDDLE EAST & AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 158 MIDDLE EAST & AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 159 MIDDLE EAST & AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 160 MIDDLE EAST & AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 161 MIDDLE EAST & AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.6.1 SAUDI ARABIA

8.6.1.1 New pipeline projects to influence market growth

TABLE 162 SAUDI ARABIA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 163 SAUDI ARABIA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 164 SAUDI ARABIA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 165 SAUDI ARABIA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.6.2 UAE

8.6.2.1 Changing energy mix to drive market

TABLE 166 UAE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 167 UAE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 168 UAE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 169 UAE: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.6.3 SOUTH AFRICA

8.6.3.1 Projects to fulfill capacity shortages to create market growth opportunities

TABLE 170 SOUTH AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 171 SOUTH AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 172 SOUTH AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 173 SOUTH AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

8.6.4 REST OF MIDDLE EAST & AFRICA

TABLE 174 REST OF MIDDLE EAST & AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 175 REST OF MIDDLE EAST & AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 176 REST OF MIDDLE EAST & AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 177 REST OF MIDDLE EAST & AFRICA: ELECTRICAL INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 146)

9.1 OVERVIEW

FIGURE 34 COMPANIES ADOPTED ACQUISITION AND EXPANSION AS KEY GROWTH STRATEGIES BETWEEN 2018 AND 2022

9.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

FIGURE 35 RANKING OF TOP 5 PLAYERS IN ELECTRICAL INSULATION MATERIALS MARKET, 2022

9.3 MARKET SHARE ANALYSIS

FIGURE 36 ELECTRICAL INSULATION MATERIALS MARKET SHARE, BY COMPANY (2022)

TABLE 178 ELECTRICAL INSULATION MATERIALS MARKET: DEGREE OF COMPETITION

9.4 REVENUE ANALYSIS OF TOP PLAYERS

TABLE 179 ELECTRICAL INSULATION MATERIALS MARKET: REVENUE ANALYSIS (USD)

9.5 MARKET EVALUATION MATRIX

TABLE 180 MARKET EVALUATION MATRIX

9.6 COMPANY EVALUATION MATRIX (TIER 1), 2022

9.6.1 STAR PLAYERS

9.6.2 EMERGING LEADERS

FIGURE 37 ELECTRICAL INSULATION MATERIALS MARKET: COMPANY EVALUATION MATRIX OF TIER 1 PLAYERS, 2022

9.7 START-UP AND SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION MATRIX

9.7.1 RESPONSIVE COMPANIES

9.7.2 STARTING BLOCKS

9.7.3 DYNAMIC COMPANIES

FIGURE 38 ELECTRICAL INSULATION MATERIALS MARKET: START-UP AND SME MATRIX, 2022

9.8 COMPANY APPLICATION FOOTPRINT

9.9 COMPANY REGION FOOTPRINT

9.10 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 39 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN ELECTRICAL INSULATION MATERIALS MARKET

9.11 BUSINESS STRATEGY EXCELLENCE

FIGURE 40 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN ELECTRICAL INSULATION MATERIALS MARKET

9.12 COMPETITIVE SCENARIO

9.12.1 PRODUCT LAUNCHES

TABLE 181 PRODUCT LAUNCHES, 2018–2022

9.12.2 DEALS

TABLE 182 DEALS, 2018–2022

9.12.3 OTHERS

TABLE 183 OTHERS, 2018–2022

10 COMPANY PROFILES (Page No. - 160)

10.1 MAJOR PLAYERS

(Business overview, Products offered, Recent developments, Deals, MNM view, Key strategies/Right to win, Strategic choices, and Weaknesses and competitive threats)*

10.1.1 DUPONT

TABLE 184 DUPONT: COMPANY OVERVIEW

FIGURE 41 DUPONT: COMPANY SNAPSHOT

TABLE 185 DUPONT: PRODUCTS OFFERED

TABLE 186 DUPONT: DEALS

TABLE 187 DUPONT: OTHERS

10.1.2 ELANTAS (ALTANA AG)

TABLE 188 ELANTAS (ALTANA AG): COMPANY OVERVIEW

FIGURE 42 ELANTAS: COMPANY SNAPSHOT

TABLE 189 ELANTAS: PRODUCTS OFFERED

TABLE 190 ELANTAS: DEALS

10.1.3 KREMPEL GMBH

TABLE 191 KREMPEL GMBH: COMPANY OVERVIEW

TABLE 192 KREMPEL GMBH: PRODUCTS OFFERED

TABLE 193 KREMPEL GMBH: DEALS

10.1.4 NITTO DENKO CORPORATION

TABLE 194 NITTO DENKO CORPORATION: COMPANY OVERVIEW

FIGURE 43 NITTO DENKO CORPORATION: COMPANY SNAPSHOT

TABLE 195 NITTO DENKO CORPORATION: PRODUCTS OFFERED

TABLE 196 NITTO DENKO CORPORATION: OTHERS

10.1.5 VON ROLL

TABLE 197 VON ROLL: COMPANY OVERVIEW

FIGURE 44 VON ROLL: COMPANY SNAPSHOT

TABLE 198 VON ROLL: PRODUCTS OFFERED

TABLE 199 VON ROLL: DEALS

TABLE 200 VON ROLL: OTHERS

10.1.6 ITW FORMEX

TABLE 201 ITW FORMEX: COMPANY OVERVIEW

TABLE 202 ITW FORMEX: PRODUCTS OFFERED

TABLE 203 ITW FORMEX: PRODUCT LAUNCHES

10.1.7 3M

TABLE 204 3M: COMPANY OVERVIEW

FIGURE 45 3M: COMPANY SNAPSHOT

TABLE 205 3M: PRODUCTS OFFERED

TABLE 206 3M: OTHERS

10.1.8 HAYSITE REINFORCED PLASTICS

TABLE 207 HAYSITE REINFORCED PLASTICS: COMPANY OVERVIEW

TABLE 208 HAYSITE REINFORCED PLASTICS: PRODUCTS OFFERED

10.1.9 VITAR INSULATION MANUFACTURERS LTD.

TABLE 209 VITAR INSULATION MANUFACTURERS LTD.: COMPANY OVERVIEW

TABLE 210 VITAR INSULATION MANUFACTURERS LTD.: PRODUCTS OFFERED

10.1.10 TESA SE

TABLE 211 TESA SE: COMPANY OVERVIEW

FIGURE 46 TESA SE: COMPANY SNAPSHOT

TABLE 212 TESA SE: PRODUCTS OFFERED

TABLE 213 TESA SE: DEALS

10.1.11 TEIJIN DUPONT FILMS JAPAN LTD.

TABLE 214 TEIJIN DUPONT FILMS JAPAN LTD.: COMPANY OVERVIEW

TABLE 215 TEIJIN DUPONT FILMS JAPAN LTD.: PRODUCTS OFFERED

TABLE 216 TEIJIN DUPONT FILMS JAPAN LTD.: PRODUCT LAUNCHES

10.1.12 NGK INSULATORS LTD.

TABLE 217 NGK INSULATORS LTD.: COMPANY OVERVIEW

FIGURE 47 NGK INSULATORS LTD: COMPANY SNAPSHOT

TABLE 218 NGK INSULATORS LTD.: PRODUCTS OFFERED

10.2 OTHER PLAYERS

10.2.1 NIKKAN INDUSTRIES CO., LTD

10.2.2 DR. DIETRICH MULLER GMBH

10.2.3 FRALOCK

10.2.4 WEIDMANN HOLDING AG

10.2.5 SICHUAN DONGFANG INSULATING MATERIALS CO., LTD

10.2.6 COVEME S.P.A.

10.2.7 MIKI TOKUSHU PAPER MFG CO., LTD

10.2.8 ADITYA BIRLA INSULATORS

10.2.9 HUBBELL POWER SYSTEMS

10.2.10 POWER TELECOM

10.2.11 SAINT-GOBAIN

10.2.12 VICTOR INSULATORS

10.2.13 WACKER CHEMIE AG

*Details on Business overview, Products offered, Recent developments, Deals, MNM view, Key strategies/Right to win, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 192)

11.1 INSIGHTS OF INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 CUSTOMIZATION OPTIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the electrical insulation materials market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Electrical Insulation Materials Market Secondary Research

This research report involves extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, BP statistics, and World Bank, to identify and collect information useful for the technical, market-oriented, and commercial study of the electrical insulation materials market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, and certified publications.

Electrical Insulation Materials Market Primary Research

The electrical insulation materials market comprises several stakeholders, such as raw material suppliers, manufacturers, distributors, buyers, and regulatory organizations. The demand side of this market is characterized by component manufacturers. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

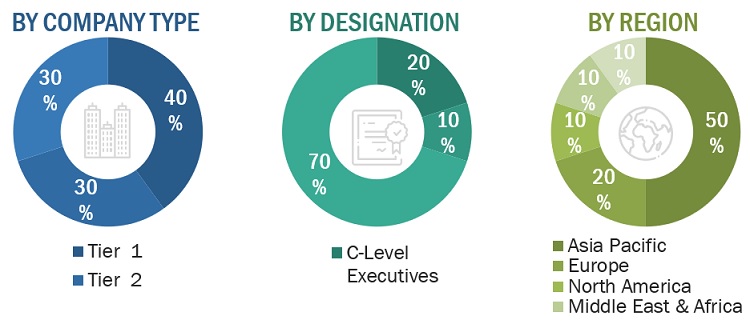

Following is the breakdown of primary respondents:

Notes: Companies are classified based on their revenue–Tier 1 = > USD 1 billion, Tier 2 = USD 500 million– USD 1 billion, and Tier 3 = < USD 500 million.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of the various submarkets for electrical insulation materials for each region. The research methodology used to estimate the market size included the following steps:

- Global electrical insulation materials market was identified, and the share for electrical insulation materials was determined through primary and secondary research.

- The global market was then segmented into five major regions and validated through industry experts.

- All percentage shares, splits, and breakdowns based on type, application, and country were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Electrical Insulation Materials Market Data Triangulation

After arriving at the overall market size—using the estimation processes explained above—the electrical insulation materials market was split into several segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment. The data was triangulated by studying several factors and trends from both the demand and supply sides.

Electrical Insulation Materials Market Report Objectives

- To define, describe, and forecast the size of the electrical insulation materials market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing market growth

- To estimate and forecast the market size based on type, application, and region

- To forecast the size of the market in the major regions, namely, Europe, North America, Asia Pacific (APAC), Middle East & Africa, and South America along with their key countries

- To strategically analyse micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyse opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To identify the impact of the COVID-19 pandemic on the market

- To track and analyse recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

Electrical Insulation Materials Market Report Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the electrical insulation materials market report:

Electrical Insulation Materials Market Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Electrical Insulation Materials Market Regional Analysis

- A further breakdown of the electrical insulation materials market, by segments

Electrical Insulation Materials Market Company Information

- Detailed analysis and profiling of additional market players (up to ten)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electrical Insulation Materials Market