Thermoplastic Composites Market by Resin Type (Polypropylene, Polyamide, Polyetheretherketone, Hybrid), Fiber Type (Glass, Carbon, Mineral), Product Type (SFT, LFT, CFT, GMT), End-Use Industry, and Region - Global Forecast to 2025

Updated on : March 25, 2023

Thermoplastic Composites Market

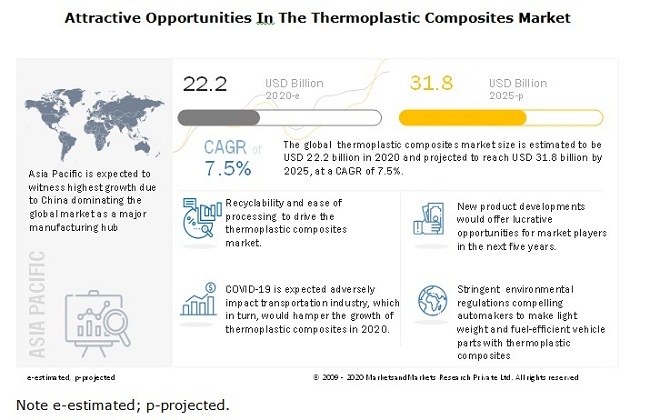

The global thermoplastic composites market size was valued at USD 22.2 billion in 2020 and is projected to reach USD 31.8 billion by 2025, growing at a cagr 7.5% from 2020 to 2025. The thermoplastic composites industry is growing due to its properties such as recyclability, fast processing, ability to mould and remould, survival at higher temperatures. However, the demand for thermoplastic composites is expected to decline in 2020 due to COVID-19. The removal of restriction on cross country travel and recovery in the end-use industries will stimulate the demand for thermoplastic composites during the forecast period.

Impact of COVID-19 on global thermoplastic composites market

COVID-19 has negatively affected the demand for thermoplastic composites across various end-use industries such as aerospace & defense, transportation, wind energy, construction, consumer & electronics goods, and others. The disruption in the supply chain resulting in delays or non-arrival of raw materials, disrupted financial flows, and growing absenteeism among production line workers have compelled OEMs to operate at zero or partial capacities, leading to reduced demand for thermoplastic composites.

Increasing demand from the transportation industry to drive the demand for composites

Thermoplastic composites are used to manufacture various automotive components, rail coaches, and heavy vehicles. These materials are lightweight and help reduce the weight of cars, which leads to reduced CO2 emissions better fuel efficiency of vehicles and helps the automotive manufacturers to meet the CAFÉ emission standards (54.5 mpg by 2025) and other fuel norms mandated by environmental agencies. Increase in the use of thermoplastic composites materials in racing and high-performance vehicle components, such as instrumental panel, front end module, door modules, roof components, appearance grade components, and under-hood components, is one of the driving factors driving the thermoplastic composites market in the transportation industry. The demand for thermoplastic composites is also growing in the rail sector. High-speed rail uses these materials for interior and exterior applications of rail carriers to reduce weight.

Lack of standardization in manufacturing technologies is a major restrain for the composites market

High cost of raw materials

Thermoplastic resins used in the production of thermoplastic composites are higher priced compared to thermoset resins. Raw materials constitute a large portion of the total cost of these composites. The raw material, processing, and manufacturing cost of thermoplastic composites is a costly affair, which results in high end-product price. This high cost is a major restraint for the OEMs in the supply chain to use thermoplastic composites. Furthermore, the machinery and tools required for the production of thermoplastic composites are capital intensive, resulting in high product cost. There are many applications for thermoplastic composites in various sectors. However, they are not commercially feasible currently. The use of thermoplastic composites in many applications is expected to be feasible if the cost of thermoplastic resins and the cost of production is reduced.

Growing market for electric vehicles

Electric vehicles (EV) are environment-friendly and are contributing to the reduction of carbon emission in the transportation industry. The demand for hybrid vehicles and electric vehicles is expected to see high growth in the coming years. Thermoplastic composites offer excellent strength and play a significant role in the weight reduction of vehicles. This makes them highly useful in the production of electric vehicle components. Hence, the increased demand for electric vehicles is augmenting the consumption of thermoplastic composites. Various companies are now engaged in the development of components made using thermoplastic composites. For instance, UNITI SWEDEN AB (Sweden) and KW Special Projects will exploit digital twin technology along with carbon fiber-reinforced thermoplastic composites to redefine automotive designs and production.

Development of low-cost production technology

There are a number of applications of thermoplastic composites. However, the use of these composites in many of the applications are not commercially feasible because of the high cost. The production of low-cost thermoplastic composites can increase its consumption in different end-use applications. Development of low-cost technologies is the need of the hour for all research organizations and thermoplastic manufacturers. However, investment in R&D for the development of new technology for producing thermoplastic composites is a major challenge for the market players. Nonetheless, companies are heavily investing in R&D to reduce the overall cost of thermoplastic composites and the end-product manufactured. Some companies are offering thermoplastic composites which are made using recycled thermoplastics. For instance, Celanese Corporation (US) is offering ECOMID POLYAMIDE COMPOUNDS, which is made using recycled PA66 compounds. This product range offers economical solutions to the automotive, consumer goods, and construction industries.

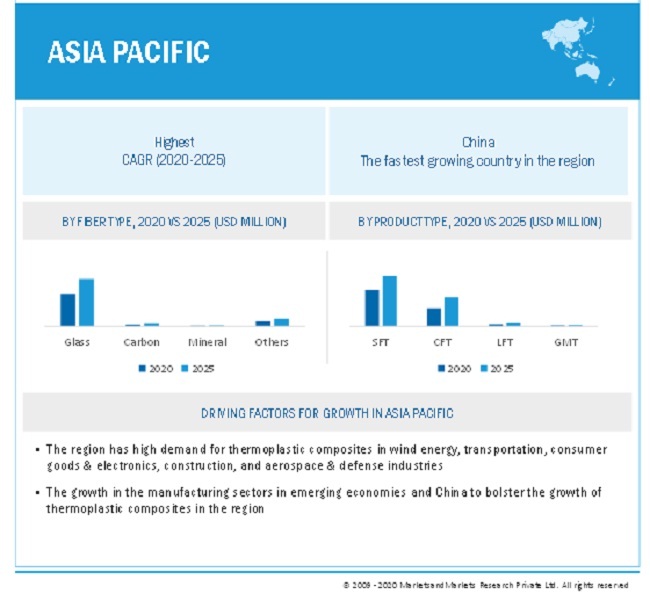

The glass fiber thermoplastic composites to account for the largest market share, in terms of value and volume, during the forecast period

Glass fiber dominated the global thermoplastic composites industry in terms of volume and value. Glass fibers are high in demand as they are low cost and ability to process with different resins. Glass fiber are used mostly in wind energy, consumer goods & electronics, and construction, transportation, and other industries. However, due to COVID-19, the industries mentioned above will see a decline in thermoplastic composites demand to decline in aircraft deliveries, reduction in the number of wind energy installations as well as automobile and electronics goods sales. The demand for thermoplastic composites will gain momentum with the recovery in end-use industries.

SFT process accounted for a major share of the thermoplastic composites market in terms of value and volume.

In terms of value and volume, the SFT composites segment is the most commonly used type of thermoplastic composites in consumer goods & electronics and transportation applications due to low cost. Transportation and aerospace & defense are the major consumers of LFT and CFT composites. The LFT segment is expected to witness the highest CAGR in terms of value, during the forecast period. Due to COVID-19, there is disruption in the supply chain across all industries resulting in decreased demand from all product types. The demand will be restored with the recovery in the supply chain during the forecast period.

The transportation end-use industry is expected to have the largest share in the thermoplastic composites market in terms of value and volume.

Transportation is the largest consumer of thermoplastic composites in terms of value and volume due to high demand for fuel-efficient vehicles. The automakers and heavy vehicle manufacturers are exploring the use of thermoplastic composites in various transportation applications due to its properties of lightweight, high strength, and ease-of-reforming, and reshaping. In addition, the thermoplastic composites also allow the automotive manufacturers to meet the stringent environmental regulations. Due to COVID-19, automobile manufacturers and suppliers across the world are struggling to continue production after the shutdown of manufacturing plants in most of the countries. With the production crisis, automakers also have to deal with decreased thermoplastic composites demand in markets, such as the US, China, and Japan, in 2020. However, the sentiments of the people to travel in private cars for safety reasons will drive automotive sales and demand for thermoplastic composites post the pandemic.

APAC held the largest market share in the thermoplastic composites market

APAC is the biggest thermoplastic composites market globally and is projected to witness the highest CAGR between 2020 and 2025. The high domestic demand for thermoplastic composites in transportation, aerospace & defence, and consumer goods & electronics applications drives the APAC region to occupy the top position in the thermoplastic composites market. Due to COVID-19, major thermoplastic composite manufactures such as Toray Industries, Inc. (Japan) are operating in adverse situations with all the stipulated COVID-19 regulations. Furthermore, with the recovery of all industries and high-performance properties of thermoplastic composites, the demand for thermoplastic composites will rise in the region after 2020.

Thermoplastic Composites Market Players

The key players in the global composites market are SABIC (Saudi Arabia), Celenase Corporation (US), BASF SE (Germany), Lanxess AG (Germany), Solvay S.A. (Belgium), Mitsubishi Chemical Advanced Materials (Japan) SGL Group (Germany) DoWDuPont (US),Toray Industries, Inc. (Japan), Polyone Corporation (US), These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the composites industry. The study includes an in-depth competitive analysis of these key players in the thermoplastic composites market, with their company profiles, recent developments, and key market strategies.

Thermoplastic Composites Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2016–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Fiber Type, Resin Type, End-Use Industry, Product Type,and Region |

|

Regions |

Europe, North America, APAC, MEA, and Latin America |

|

Companies |

BASF SE (Germany), Celanese Corporation (US), SABIC (Saudi Arabia), DowDuPont Inc. (US), Koninklijke DSM N.V. (Netherlands), Toray Industries, Inc. (Japan), Solvay (Belgium), and Lanxess AG (Germany), among others |

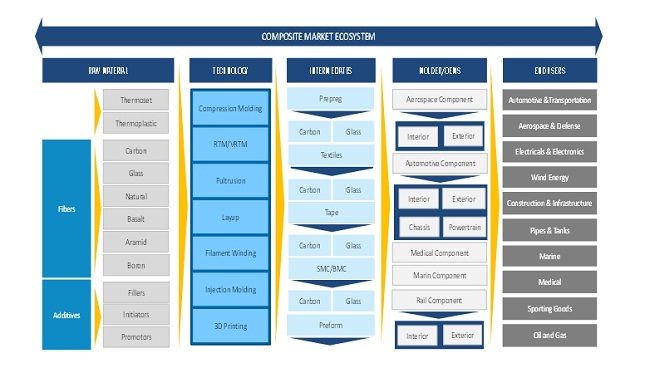

This research report categorizes the composites market based on fiber type, resin type, product type, end-use industry, and region.

By Fiber Type:

- Glass

- Carbon

- Mineral

- Others

By Resin Type:

- PA

- PP

- PEEK

- Hybrid

- Others

By End-use Industry:

- Transportation

- Consumer goods & electronics

- Wind Energy

- Sports & Leisure

- Construction

- Aersopace & Defense

- Others

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In June 2019, Mitsubishi Advanced Chemical Materials acquired Advanced Polymer Technologies (US) to enhance its technological advancement in the engineering plastics business. This acquisition will help the company to offer better solutions to aerospace & defense, medical, and electrical & electronics industries.

- In May 2019, Polyone Corporation launched new thermoplastic composite products at CHINAPLAS 2019. It introduced Complet LFT formulations, which is a thermoplastic composite with PEEK and PP as a base resin, to meet highly demanding design and performance requirements.

- In November 2018, DowDuPont announced plans to introduce two new grades, carbon fiber-reinforced polyamide and glass fiber-reinforced polyamide. These new grades are suitable to be used as a 3D-printing filament and cater to the demand from the high growing 3D printing market.

- In April 2018, BASEF SE inaugurated a new production facility in Yeosu, Korea. This production line will increase the production capacity of polyarylsulfone thermoplastic Ultrason to 24,000 tons per year.

- In March 2018. Lanxess AG announced a new thermoplastic specialty compounds facility in Krefeld-Uerdingen, Germany. This will increase the capacity of the facility by 10,000 metric tons per year. It will help the company to cater to the demand for polyamide-based compounds.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the thermoplastic composites market?

Recyclability and ease of processing are driving the growth of thermoplastic composites market.

Which is the largest country-level market for thermoplastic composites?

US is the largest thermoplastic composites market due to the presence of major thermoplastic composite manufacturers and high demand form transportation and consumer goods & electronics industries..

What are the factors contributing to the final price of thermoplastic composites?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of thermoplastic composites.

What are the challenges in the thermoplastic composites market?

Development of low-cost production technology is the major challenge in the thermoplastic composites market.

Which type of thermoplastic composites holds the largest market share?

Glass fiber thermoplastic composites hold the largest share due to low cost and ease of manufacturing.

How is the thermoplastic composites market aligned?

The market is growing at a significant pace. It is a potential market and many manufactures are planning business strategies to expand their business.

Who are the major manufacturers?

BASF SE (Germany), Celanese Corporation (US), SABIC (Saudi Arabia), DowDuPont Inc. (US), Koninklijke DSM N.V. (Netherlands), Toray Industries, Inc. (Japan), and Lanxess AG (Germany)., among many others

What are the product types for thermoplastic composites?

Short fiber-reinforced, Long fiber-reinforced, continuous fiber-reinforced , Glass Mat thermoplastic are the major product types for thermoplastic composites

What are the major end-use industries for composites?

The major end-use industries for composites are aerospace & defense, wind energy, transportation, construction, consumer goods & electronics, spots & leisure..

What is the biggest restraint in thethermoplastic composites market?

Volatility in raw material prices and scarcity of raw materials coupled with global economic slowdown are restraining market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Content

1 Introduction

1.1 Objectives of the study

1.2 Scope of the study

2 Research Methodology

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

5.3 Industry Trends

5.4 Value Chain Analysis

5.5 Thermoplastic Composites Ecosystem Analysis

6 MACROECONOMIC OVERVIEW AND KEY TRENDS

6.1 Forecast of GDP Growth Rate

6.2 Per Capita Income

6.3 Aerospace Industry Trend

6.4 Automotive Industry Trend

6.5 COVID-19 Impact on the aerospace, wind energy, and automotive industries

7 Thermoplastic Composites Market, By Resin Type

7.1 Introduction

7.2 Impact of COVID-19on Resin Type

7.3 PA

7.4 PP

7.5 PEEK

7.6 Hybrid

7.7 Others

8 Thermoplastic Composites Market, By Fiber type

8.1 Introduction

8.2 Impact of COVID-19on Fiber Type

8.3 Glass

8.4 Carbon

8.5 Mineral

8.6 Others

9 Thermoplastic Composites Market, By End-Use Industry

9.1 Introduction

9.2 Impact of COVID-19on End-Use Industry

9.3 Transportation

9.4 Aersopace & Defesne

9.5 Consumer & Electronic Goods

9.6 Sports & leisure

9.7 Construction

9.8 Wind Energy

9.8 Others

10 Thermoplastic Composites Market, By Product Type

10.1 Impact of COVID-19on Product Type

10.2 SFT

10.3 LFT

10.4 CFT

10.5 GMT

11 Thermoplastic Composites Market, By Region

11.1 Introduction

11.2 Impact of COVID-19 on Region

11.2 North America

11.2.1 North America Thermoplastic Composites Market, By Product Type

11.2.2 North America Thermoplastic Composites Market, By Resin Type

11.2.3 North America Thermoplastic Composites Market, By Fiber Type

11.2.4 North America Thermoplastic Composites Market, By End-Use Industry

11.2.5 North America Thermoplastic Composites Market, By Country

11.2.5.1 US

11.2.5.2 Canada

11.3 Europe

11.3.1 Europe Thermoplastic Composites Market, By Product Type

11.3.2 Europe Thermoplastic Composites Market, By Resin Type

11.3.3 Europe Thermoplastic Composites Market, By Fiber Type

11.3.4 Europe Thermoplastic Composites Market, By End-Use Industry

11.3.5 Europe Thermoplastic Composites Market, By Country

11.3.5.1 Germany

11.3.5.2 France

11.3.5.3 UK

11.3.5.4 Italy

11.3.5.5 Rest of Europe

11.4 APAC

11.4.1 APAC Thermoplastic Composites Market, By Product Type

11.4.2 APAC Thermoplastic Composites Market, By Resin Type

11.4.3 APAC Thermoplastic Composites Market, By Fiber Type

11.4.4 APAC Thermoplastic Composites Market, By End-Use Industry

11.4.5 APAC Thermoplastic Composites Market, By Country

11.4.5.1 China

11.4.5.2 Japan

11.4.5.3 South Korea

11.4.5.4 India

11.3.5.5 Rest of APAC

11.5 MEA

11.5.1 MEA Thermoplastic Composites Market, By Product Type

11.5.2 MEA Thermoplastic Composites Market, By Resin Type

11.5.3 MEA Thermoplastic Composites Market, By Fiber Type

11.5.4 MEA Thermoplastic Composites Market, By End-Use Industry

11.5.5 MEA Thermoplastic Composites Market, By Country

11.5.5.1 Saudi Arabia

11.5.5.2 UAE

11.5.5.3 Rest of MEA

11.6 Latin America

11.6.1 MEA Thermoplastic Composites Market, By Product Type

11.6.2 MEA Thermoplastic Composites Market, By Resin Type

11.6.3 MEA Thermoplastic Composites Market, By Fiber Type

11.6.4 MEA Thermoplastic Composites Market, By End-Use Industry

11.6.5 MEA Thermoplastic Composites Market, By Country

11.6.5.1 Brazil

11.6.5.2 Mexico

12 Competitive Landscape

12.1 Introduction

12.2 Competitive Leadrship Mapping

12.3 Strength of Product Portfolio

12.4 Business Strategy Excellence

12.5 Market Ranking

12.6 Market Share Analysis

12.7 Competitive Scenario

13 Company Profiles For Aramid Honeycomb Core Manufacturers

13.1 Introduction

13.2 Hexcel Corporation

13.2.1 Business Overview

13.2.2 Product Portfolio

13.2.3 Recent Developments

13.2.4 Swot Analysis

13.2.5 MnM view

13.3 Celenase Corporatio

13.3.1 Business Overview

13.3.2 Product Portfolio

13.3.3 Recent Developments

13.3.4 Swot Analysis

13.3.5 MnM view

13.4 DOWDUPONT INC

13.4.1 Business Overview

13.4.2 Product Portfolio

13.4.3 Recent Developments

13.4.4 Swot Analysis

13.4.5 MnM view

13.5 TENCATE

13.5.1 Business Overview

13.5.2 Product Portfolio

13.5.3 Recent Developments

13.5.4 Swot Analysis

13.5.5 MnM view

13.6 SOLVAY

13.6.1 Business Overview

13.6.2 Product Portfolio

13.6.3 Recent Developments

13.6.4 Swot Analysis

13.6.5 MnM view

13.7 Toray Industries, Inc.

13.7.1 Business Overview

13.7.2 Product Portfolio

13.7.3 Recent Developments

13.7.4 Swot Analysis

13.7.5 MnM view

13.8 SABIC

13.8.1 Business Overview

13.8.2 Product Portfolio

13.8.3 Recent Developments

13.8.4 Swot Analysis

13.8.5 MnM view

13.9 Lanxess A.G.

13.9.1 Business Overview

13.9.2 Product Portfolio

13.9.3 Recent Developments

13.9.4 Swot Analysis

13.9.5 MnM view

13.1 BASF SE

13.10.1 Business Overview

13.10.2 Product Portfolio

13.10.3 Recent Developments

13.10.4 Swot Analysis

13.10.5 MnM view

13.11 Polyone Corporation

13.11.1 Business Overview

13.11.2 Product Portfolio

13.11.3 Recent Developments

13.11.4 Swot Analysis

13.11.5 MnM view

13.12 Mitusbishi Chemical Advanced Materials

13.12.1 Business Overview

13.12.2 Product Portfolio

13.12.3 Recent Developments

13.12.4 Swot Analysis

13.12.5 MnM view

13.13 Others

13.13.1 Covestro AG

13.13.2 Victrex plc

13.13.3 SGL Group

13.13.4 technocompound gmbh

13.13.5 SUPREM SA

13.13.6 Kingfa SCI. & TECH. CO., LTD

13.13.7 SBHPP

13.13.8 DAICEL POLYMER LTD

13.13.9 RTP company

13.13.10 Ascend performance materials llc

14 Appendix

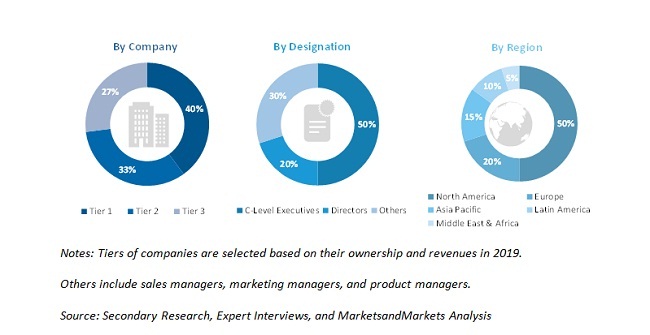

The study involves two major activities in estimating the current size of the thermoplastic composites market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The thermoplastic composites market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mainly the transportation, wind energy, aerospace & defense, and construction & infrastructure end-use industries. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total thermoplastic composites market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall thermoplastic composites market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the automotive & transportation, wind energy, aerospace & defense, and construction & infrastructure end-use industries.

Report Objectives

- To analyze and forecast the global thermoplastic composites market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on resin type, fiber type, product type, and end-use industry

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and Latin America

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC composites market

- Further breakdown of Rest of European composites market

- Further breakdown of Rest of North American composites market

- Further breakdown of Rest of MEA composites market

- Further breakdown of Rest of Latin American composites market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Growth opportunities and latent adjacency in Thermoplastic Composites Market