Electrolyzers Market Size, Share, Growth, Analysis

Electrolyzers Market By Technology (ALK, AEM, PEM, SOEC), Power Rating (<500 kW, 500–2,000 kW, above 2,000 kW), Application (Energy, Mobility, Industrial, Grid Injection), Component (Stack, Balance of Plant), and Region - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global electrolyzers market is projected to reach USD 14.48 billion by 2031 from an estimated USD 2.08 billion in 2025, at a CAGR of 38.2%. The market growth is driven by the increasing adoption of green hydrogen across industrial, mobility, and energy sectors, as well as the rapid integration of renewable energy systems and supportive hydrogen policies. Rising efficiency, safety, and reliability requirements, along with stringent decarbonization targets, are encouraging industries and utilities to invest in advanced electrolyzer technologies. Additionally, technological advancements in high-efficiency stacks, modular electrolyzer designs, and digital monitoring platforms are improving system performance, reducing operational costs, and enhancing flexibility in grid-connected hydrogen production, further supporting market expansion across key applications.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific region accounted for a share of 40.5% in the electrolyzers market in 2024.

-

BY POWER RATINGBy power rating, the 500 kW segment is projected to witness the fastest growth rate from 2025 to 2031.

-

BY TECHNOLOGYBy technology, the anion exchange membrane electrolyzer (AEM) segment is expected to register the highest CAGR of 50.6% during the forecast period.

-

BY APPLICATIONBy application, the mobility segment is expected to record the highest CAGR during the forecast period.

-

COMPETITIVE LANDSCAPEthyssenkrupp nucera, Siemens Energy, John Cockerill, Nel, and Cummins Inc. were identified as Star players focused on a robust presence in the electrolyzers market.

-

COMPETITIVE LANDSCAPEiGas energy GmbH, Cipher Neutron, HydrogenPro, Ohmium, and PERIC Hydrogen Technologies Co., Ltd have distinguished themselves among SMEs and Startups due to their strong product portfolio and business strategy.

As utilities and industries modernize their energy systems, the potential for electrolyzers to be integrated into demand–response programs, smart energy management platforms, and time-of-use electricity strategies is rapidly increasing. Electrolyzers capable of flexible operation, including load shifting, ramping, and dynamic modulation, offer added value by optimizing power consumption, reducing grid stress during peak demand, and improving overall system efficiency. This operational flexibility not only lowers hydrogen production costs but also supports broader decarbonization goals by aligning hydrogen generation with periods of abundant renewable energy.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The electrolyzers market is witnessing a significant transformation driven by accelerating green hydrogen adoption, increasing renewable energy integration, and the rapid expansion of industrial decarbonization initiatives. Utilities, industrial users, and project developers are demanding advanced electrolyzers with higher efficiency, greater operational flexibility, and improved durability to support large-scale hydrogen production. Growing investments in hydrogen hubs, mobility applications, and green industrial processes are prompting electrolyzer manufacturers to innovate compact, modular, and cost-efficient system designs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Significant focus on expanding electrolyzer manufacturing capacity

-

Accelerating industrial transformation through Industry 4.0 and green hydrogen

Level

-

Limited availability and concentration of critical materials

-

Operational downsizing triggered by reduced electrolyzer uptake

Level

-

Integration of renewable energy and electrolysis for decarbonization and energy balancing

-

Government-led initiatives to boost green hydrogen development

Level

-

Delay in electrolyzer industry expansion due to slow market uptake and persistent cost barriers

-

Supply chain constraints

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Significant focus on expanding electrolyzer manufacturing capacity

Electrolyzer manufacturing capacity continues to expand rapidly worldwide, emerging as a critical driver of scale-up in the global green hydrogen economy. This expansion marks a transition from early-stage demonstration-scale deployment to industrial-level commercialization, reflecting increasing policy support, growing corporate commitment to decarbonization, and strategic investments from governments and private industry. The acceleration of manufacturing capability is reshaping cost trajectories, improving project confidence, and enabling competitive pathways for green hydrogen production across multiple sectors. According to the International Energy Agency (IEA), global electrolyzer manufacturing capacity increased further in 2024 to reach nearly 38 GW per year, based on nominal factory capacities announced by companies. This signifies a 40% increase in manufacturing capacity by the end of 2023, with China being the main contributor to this growth. The scale of capacity expansion indicates a significant shift from custom, engineering-focused project development to high-volume manufacturing, akin to the early days of photovoltaic solar gigafactories and offshore wind industrialization.

Restraint: Limited availability and concentration of critical materials

Proton exchange membrane (PEM) electrolysis depends heavily on critical and scarce materials, such as platinum, titanium, and iridium, which are essential for maintaining performance under highly oxidative conditions (greater than 1.4 V) on the anode side. Due to the limited number of materials capable of withstanding such harsh environments, iridium a rare and costly element has become the preferred choice for PEM electrolyzers. Similarly, porous transport layers (PTL) require significant amounts of titanium-based materials coated with platinum, further adding to system costs. The reliance on these platinum group metals (PGMs) not only elevates production expenses but also constrains scalability due to their scarcity and geographically concentrated supply. Both platinum and iridium are among the most resource-intensive and emission-heavy metals to produce. As global demand for these materials grows across multiple industries, including fuel cells and industrial catalysts, the electrolyzers market faces price volatility and supply chain vulnerabilities. To mitigate these risks, researchers and manufacturers are actively developing alternative, earth-abundant catalyst materials that can reduce dependency on PGMs. This transition is vital to enhancing the economic viability, sustainability, and long-term competitiveness of electrolyzer technologies within the renewable energy landscape

Opportunity: Integration of renewable energy and electrolysis for decarbonization and energy balancing

The growing integration of renewable energy sources such as solar, wind, and hydropower with electrolyzer systems represents a transformative opportunity for the global electrolyzers market. High-purity hydrogen can be efficiently produced through the electrolysis of water (H2O), and the cost of electricity largely determines its production cost. As the share of renewables continues to rise, using these clean energy sources to power electrolysis becomes vital to reducing the levelized cost of hydrogen (LCOH) while supporting a sustainable energy transition. Electrolysis powered by renewable energy not only enables large-scale, carbon-free hydrogen generation but also provides a flexible solution for managing the intermittency of renewable power. Surplus electricity from renewables can be stored as hydrogen and later reconverted to electricity through re-electrification processes—using fuel cells, turbines, or internal combustion engines—to stabilize the grid and balance power supply and demand (power-to-power operations). This capability enhances energy system resilience and supports efficient renewable energy utilization. Moreover, hydrogen serves as a critical energy carrier that enables decarbonization across multiple sectors. In the industrial domain, hydrogen is already a key raw material in processes such as refining, chemical production, and steelmaking. Transitioning to low-carbon hydrogen in these applications can significantly reduce emissions, fostering cleaner production pathways. Together, these synergies between renewable energy and electrolysis are creating strong market opportunities for green hydrogen deployment, grid balancing, and industrial decarbonization on a global scale.

Challenge: Delay in electrolyzer industry expansion due to slow market uptake and persistent cost barriers

THigh electrolyzer capital costs and slow project deployment continue to impede the scale-up of hydrogen production, constraining opportunities to reduce equipment costs. Despite expectations of meaningful cost declines driven by technological advances, manufacturing innovation, and economies of scale, such reductions have largely been limited to China. Outside China, slow deployment has prevented scaling efficiencies, while global inflation in 2022–2023 reversed prior downward cost trends, contributing to elevated project expenses. The IEA’s 2024 assessment indicates that electrolyzer installation costs remain high—typically USD 2,000–2,600/kW in most international markets, compared with USD 600–1,200/kW in China. When deployed globally, additional EPC, logistics, customization, and contingency expenditures can raise total installed costs to USD 1,500–2,450/kW. These cost pressures are compounded by financing uncertainty, with only about 30% of announced projects progressing to Final Investment Decision (FID), reflecting capital risk, policy dependencies, and weak project pipelines. Collectively, high costs, limited economies of scale, and slow market uptake are delaying the expansion of electrolyzer manufacturing capacity. Although long-term demand remains favorable due to decarbonization and energy security priorities, the current landscape is likely to accelerate industry consolidation, favoring companies with strong financial resources and advanced technological capabilities.

electrolyzers-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Shell’s Holland Hydrogen I project required the precise installation of 200 MW electrolyzer modules within a highly congested industrial zone. The project faced challenges related to oversized component handling, restricted workspace, and coordination with offshore wind infrastructure. These conditions created risks around safety, sequencing, and timely execution. | Mammoet used advanced simulations, modular lifting plans, and engineered transport routes to streamline installation | Their precision-controlled assembly minimized congestion, improved safety, and aligned delivery with the offshore wind schedule | This optimized approach reduced project risks, accelerated deployment, and enhanced the reliability of installing the 200 MW electrolyzer system |

|

Air Liquide aimed to produce high-purity green hydrogen at a commercial scale in Québec to meet the rising industrial demand, requiring a PEM electrolyzer that could perform reliably in extreme weather conditions. The project needed consistent hydrogen purity, cost-efficient operations, and seamless integration with existing hydrogen infrastructure. Deploying a system larger than typical pilots added technical and operational complexity. | Cummins’ HyLYZER 20 MW PEM electrolyzer delivered stable, high-purity hydrogen output while maintaining strong year-round performance in Québec’s harsh climate | The system reduced regional carbon intensity, improved operational reliability, and demonstrated the scalability of PEM technology | This installation set a proven reference model for future 100 MW-class commercial green-hydrogen projects across North America |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The electrolyzers market ecosystem represents an integrated value chain connecting material suppliers, stack manufacturers, system integrators, power electronics providers, and end-use industries to support reliable and efficient green hydrogen production. Raw material providers such as Umicore (Belgium), Johnson Matthey (UK) supply critical inputs including catalysts, membranes, coatings, and advanced materials required for PEM, alkaline, and SOEC systems. Component and electrolzyer manufacturers such as Nel (Norway), thyssenkrupp nucera (Germany), John Cockerill (Belgium), Cummins Inc. (US), produce high-performance electrolyzer stacks optimized for industrial, mobility, and energy applications. The ecosystem further extends to major end users such as TotalEnergies and ArcelorMittal, who are deploying large-scale electrolyzer systems to decarbonize refining, chemicals, and green steel production, driving strong demand for high-capacity, efficient green hydrogen solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electrolyzers Market, By Application

Based on application, the electrolyzers market is segmented into energy (CHP/power), mobility, industrial (chemicals, refining, steel, fertilizers), and grid injection/power-to-gas. Energy applications include integration with renewables for on-site power and energy storage. Mobility applications are growing rapidly due to demand for hydrogen refueling for heavy-duty vehicles. Industrial uses dominate the market, especially in ammonia, methanol, and green steel production. Grid injection (hydrogen blending) and power-to-gas systems support renewable balancing, enabling large-scale seasonal storage and grid flexibility.

Electrolyzers Market, By Power Rating

The electrolyzers market, by power rating, is segmented into <500 kW, 500 kW–2,000 kW, and above 2,000 kW. <500 kW electrolyzers are used in pilot projects, research setups, and small distributed systems. Units in the 500–2,000 kW range are widely used for commercial hydrogen refueling stations and industrial operations that require moderate hydrogen volumes. The above 2,000 kW segment caters to the fastest-growing segment, driven by large green hydrogen plants, renewable energy integration projects, and utility-scale power-to-X applications.

Electrolyzers Market, By Technology

The market is segmented into Alkaline, Proton Exchange Membrane (PEM), Solid Oxide Electrolyzers (SOEC), and Anion Exchange Membrane (AEM). Alkaline technology holds the largest share due to maturity, lower CAPEX, and suitability for industrial-scale production. PEM electrolyzers are expanding rapidly due to their fast response capabilities and compatibility with intermittent renewable energy sources. Solid oxide electrolyzers deliver high efficiency and are gaining traction for waste-heat integration and high-temperature industrial sites. AEM technology is emerging as a cost-efficient alternative for small-to-medium-scale hydrogen production.

Electrolyzers Market, By Component

The electrolyzers market, by component, is categorized into stack and balance of plant (BoP). The stack is the core of the electrolyzer, responsible for the electrochemical reaction and representing a major portion of system cost. Advancements in membrane durability, catalyst optimization, and cell efficiency are driving improvements in this segment. The balance of plant, including power electronics, gas purification, cooling systems, and hydrogen compression, plays a critical role in overall system performance and operational reliability. Increasing demand for modular, integrated, and digitally monitored BoP systems is supporting market expansion across both components.

REGION

Europe to exhibit highest CAGR during forecast period

Europe is expected to experience strong growth in the global electrolyzers market during the forecast period, supported by ambitious decarbonization goals, large-scale renewable energy expansion, and comprehensive hydrogen policy frameworks. The region’s rapid deployment of offshore wind, solar, and hybrid renewable projects across Germany, the Netherlands, Spain, Denmark, and France is accelerating demand for electrolyzers for green hydrogen production. Growing industrial decarbonization needs in steel, ammonia, refining, and chemicals further strengthen momentum. Additionally, government incentives, EU Hydrogen Bank mechanisms, and hydrogen mobility initiatives are shaping a robust market outlook. Key players including Nel, Siemens Energy, and thyssenkrupp nucera are expanding their European presence.

electrolyzers-market: COMPANY EVALUATION MATRIX

Nel is a leading player in the global electrolyzers market, recognized for its advanced technology, extensive product portfolio, and strong international footprint. The company provides alkaline and PEM electrolyzers for industrial, mobility, utility, and renewable energy applications, ensuring high efficiency and reliable large-scale hydrogen production. Nel’s continuous focus on innovation, system modularity, and cost-optimized stack designs enhances performance, safety, and long-term operational reliability. Strategic partnerships with utilities, governments, and major hydrogen developers further strengthen its position, driving widespread adoption of Nel’s electrolyzer solutions across green hydrogen hubs, energy storage projects, and industrial decarbonization initiatives worldwide. In Emerging Leaders, the Envision Group is emerging as a notable player in electrolyzers, focusing on scalable PEM and alkaline solutions for renewable and industrial applications. Its innovation-driven approach and strategic partnerships are accelerating green hydrogen adoption globally.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- thyssenkrupp nucera (Germany)

- Siemens Energy (Germany)

- John Cockerill,

- Nel (Norway)

- Cummins Inc.(US)

- Plug Power Inc. (US)

- LONGi (China)

- Asahi Kasei Corporation (Japan)

- Envision Group (China)

- ITM Power plc (UK)

- Sunfire GmbH (Germany)

- Enapter (Italy)

- Bloom Energy (US)

- SUNGROW (China)

- Next Hydrogen (Canada)

- Shandong AUYAN New Energy Technology Co., Ltd. (China)

- Quest One GmbH (Germany)

- TOPSOE (Denmark)

- Erre Due s.p.a. (Italy)

- Hygreen Energy (China)

- iGas energy GmbH (Germany)

- Cipher Neutron (Canada)

- HydrogenPro (Norway)

- Ohmium (US)

- PERIC Hydrogen Technologies Co., Ltd (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 0.88 Billion |

| Revenue Forecast in 2031 | USD 14.48 Billion |

| Growth Rate | CAGR of 38.2% from 2025–2031 |

| Actual Data | 2020–2031 |

| Base Year | 2024 |

| Forecast Period | 2031 |

| Units Considered | Value (USD Billion) and Volume (Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Power Rating, Technology, Component, and Application. |

| Regional Scope | North America, Europe, Asia Pacific, RoW |

WHAT IS IN IT FOR YOU: electrolyzers-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Client requested inclusion of detailed product specifications for electrolyzer systems offered by key market players. | The study was customized to compile and present detailed technical specifications of electrolyzer products offered by leading OEMs. This included information on technology type, power rating, efficiency, hydrogen output, stack materials, system configuration, operating parameters, and integrated balance-of-plant features. | Enabled the client to benchmark key OEM |

RECENT DEVELOPMENTS

- September 2025: : thyssenkrupp nucera completed the acquisition of key technology assets (including IP and a test facility) from Green Hydrogen Systems, strengthening its capabilities in pressurised alkaline water electrolysis (up to ~35 bar).

- April 2025: : John Cockerill signed an agreement with The Green Solutions Group (TGS) in Vietnam to supply pressurized alkaline electrolyzers and jointly develop green hydrogen and ammonia projects, strengthening its regional presence in Asia.

- October 2024: : Nel, in collaboration with Saipem, launched IVHY 100, a modular 100 MW green hydrogen solution designed for scalability in hard-to-abate industries.

- November 2023: : Siemens Energy and Air Liquide inaugurated a new gigawatt electrolyzer factory in Berlin. Siemens Energy's establishment of the new factory is making electrolyzers widely available and setting the groundwork for the expansion of the hydrogen economy.

- January 2023: : Plug Power Inc. and Johnson Matthey (JM), a global leader in sustainable technologies, entered a long-term strategic partnership to accelerate the development of the green hydrogen economy.

Table of Contents

Methodology

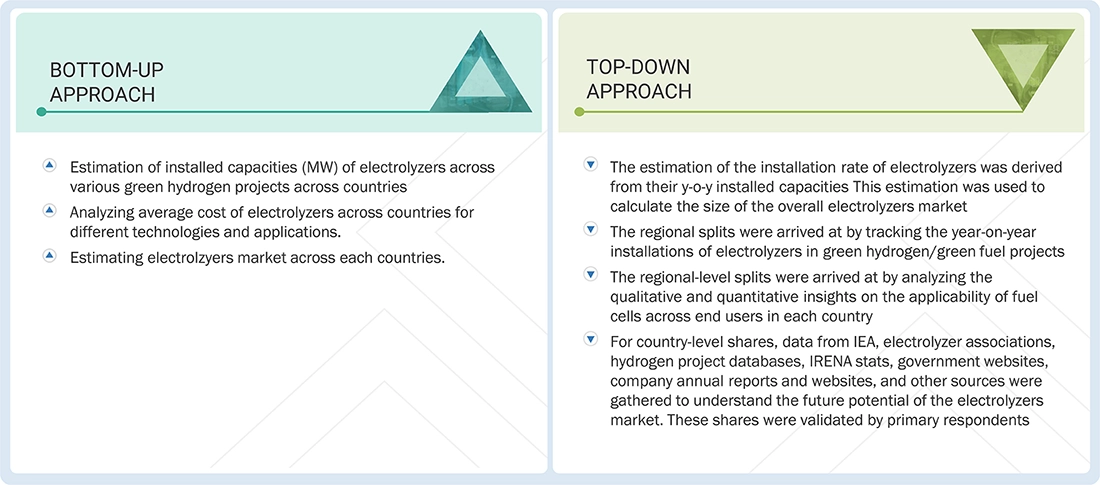

The study involved major activities in estimating the current size of the electrolyzers market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation techniques were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study utilized extensive secondary sources, including Hoover’s, Bloomberg, Factiva, IRENA, the International Energy Agency, and Statista Industry Journal, as well as directories and databases, to collect and identify valuable information for a technical, market-oriented, and commercial study of the electrolyzers. Other secondary sources included annual reports, press releases, and investor presentations from companies; white papers; certified publications; articles by recognized authors; and manufacturer associations, trade directories, and databases.

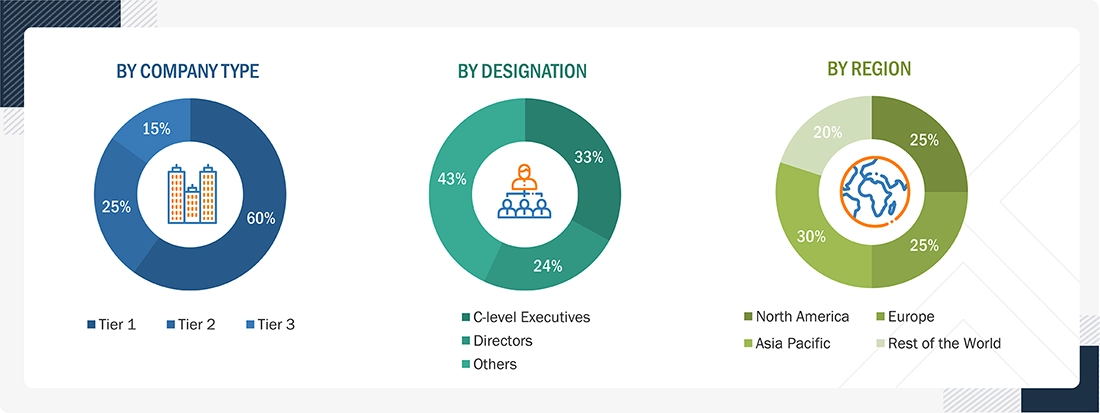

Primary Research

During the primary research process, various primary sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from various companies and organizations operating in the electrolyzers market.

In the comprehensive market engineering process, the top-down and bottom-up approaches, along with various data triangulation methods, were extensively employed to estimate market sizes and forecast demand for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report.

Note: The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: >USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: USD 500 million. Others include sales managers, engineers, and regional managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the electrolyzers market. These methods were also used extensively to estimate the size of various market segments. The research methodology used to estimate the market size comprises the following steps.

Electrolyzers Market : Top-Down and Bottom-Up Approach

Data Triangulation

The total market was divided into several segments and subsegments after determining the overall market size through the above estimation process. Data triangulation and market breakdown processes were employed to complete the overall market engineering process and determine the exact statistics for all segments and subsegments, as applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches.

Market Definition

An electrolyzer is a device that uses electrical energy to split water into hydrogen and oxygen. When powered by renewable or nuclear energy, it enables the production of low-emission hydrogen. The hydrogen generated can be utilized across various applications, while the oxygen produced can be released, stored, or used in industrial and medical sectors. Electrolyzers are available in multiple capacities: smaller units are used for on-site or localized hydrogen production, whereas larger systems can be paired with renewable or low-carbon power sources for large-scale hydrogen generation.

The electrolyzers market refers to the year-over-year installation of new electrolyzer capacities across different technologies. This market has been assessed across major regions, including North America, Europe, Asia Pacific, and Rest of the World (RoW).

Key Stakeholders

- Consulting companies in the energy & power sector

- Government and research organizations

- Investment banks

- Industrial gas companies

- Power and energy associations

- Hydrogen generation product and solutions providers

- Green hydrogen producers

- Engineering, procurement, and construction companies

- Renewable energy producers

- Manufacturers of electrolyzers

- Electrolyzer equipment manufacturers

Report Objectives

- To define, describe, segment, and forecast the size of the electrolyzers market, by power rating, technology, application, and region, in terms of value

- To segment and forecast the size of the electrolyzers market by region, application, and technology, in terms of volume

- To forecast the market sizes for four key regions: North America, Europe, Asia Pacific, and RoW

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the electrolyzers market

- To offer the supply chain analysis, trends/disruptions impacting customer business, ecosystem analysis, regulatory landscape, patent analysis, case study analysis, technology analysis, key conferences and events, impact of AI/Gen AI, macroeconomic outlook, pricing analysis, Porter’s five forces analysis, regulatory analysis, and impact of the 2025 US tariff on the market

- To analyze opportunities for stakeholders in the electrolyzers market and draw a competitive landscape of the market

- To benchmark market players using the company evaluation matrix, which analyzes market players on broad categories of business and product strategies adopted by them

- To compare key market players for the market share, product specifications, and end uses

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments, such as contracts, agreements, partnerships, and joint ventures, in the electrolyzers market

Available Customizations

MarketsandMarkets offers customizations tailored to the specific needs of companies using the provided market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the electrolyzers market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electrolyzers Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Electrolyzers Market