Renewable Energy Certificate (REC) Market

Renewable Energy Certificate (REC) Market by Energy Type (Solar Power, Wind Power, Hydropower, Biomass), Capacity (Up to 1000 KWH, 1001-5000 KWH, Above 5000 KWH), End Use (Compliance, Voluntary), and Region - Global Forecast & Trends to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global renewable energy certificate (REC) market was estimated at USD 27.99 billion in 2025 and is projected to reach USD 45.45 billion in 2030; it is estimated to grow at a CAGR of 10.2% from 2025 to 2030. The growth of the renewable energy certificate (REC) market is driven by the significant focus of organizations on minimizing their greenhouse gas emissions and increasing investments in renewable energy globally. Also, government policies mandating renewable energy targets are strongly propelling the renewable energy certificate (REC) market as they establish a formal framework to encourage power generation using renewable energy sources. The market exhibits promising growth, given the increasing demand from businesses and individuals seeking to neutralize their carbon footprint.

KEY TAKEAWAYS

-

BY ENERGY TYPESolar power segment dominates market, by energy type, due to wide adoption of renewable energy sources. The increasing demand for solar panels, micro hydropower plants, and micro wind turbines is creating an opportunity for the REC market to grow. Solar panels, micro hydropower plants, and micro wind turbines significantly drive the demand for RECs by increasing renewable energy supply. As the adoption of solar energy continues to rise, with solar installations accounting for a large share of new renewable energy capacity, each megawatt-hour of energy produced generates RECs, which utilities must purchase to meet Renewable Portfolio Standards (RPS) in many states. As the number of individuals, businesses, and organizations adopting these systems continues to grow propelled by state incentives, tax credits, and a strong commitment to sustainability the production of Renewable Energy Certificates (RECs) surges. This increasing generation fuels heightened demand in compliance and voluntary markets, significantly impacting the landscape of renewable energy. These technologies collectively support the transition to renewable energy while ensuring a steady market for RECs, as they fulfill both regulatory requirements and corporate carbon offset goals.

-

BY CAPACITYBased on capacity, the Renewable energy certificate market has been segmented into upto 1,000 KWh, 1,001 to 5,000 KWh, and above 5,000 KWh. The Above 5,000 KWh segment is expected to hold the largest market share during the forecast period because of the size and economic efficiencies of large-scale renewable energy projects, especially in solar and wind energy. Larger installations, like commercial-scale solar farms or wind turbines, can generate large quantities of renewable energy. Large-scale renewable energy projects benefit from economies of scale where the cost per unit of energy generated decreases as the system size gets larger making them generally more financially compelling and more competitive in the RECs market.

-

BY END USERThe compliance segment held a larger market share in 2024, and a similar trend is likely to be observed in the coming years. This dominance is primarily driven by government regulations and mandates requiring utilities, corporations, and energy suppliers to source a certain percentage of their electricity using renewable sources. Many countries and states have established Renewable Portfolio Standards (RPS) or similar regulatory frameworks, which obligate entities to purchase RECs to demonstrate compliance with clean energy goals. The demand for compliance-based RECs is particularly high in regions with strict renewable energy targets, such as the United States, the European Union, and parts of Asia. Utilities and corporations prefer compliance RECs to avoid financial penalties and maintain their legal standing. Additionally, governments often enforce increasing renewable energy quotas over time, further driving the demand for these certificates.

-

BY REGIONAsia Pacific segment is expected to be the fastest-growing region in the renewable energy certificate (REC) market. In the recent past, the countries in Asia-Pacific have significantly started increasing the generation of renewable energy with the most focus on solar and wind energy. To facilitate the transition, they have set up several mechanisms and incentives like feed-in tariffs, RECs (renewable energy certificate) programs, and Renewable Energy targets. Key developments responsible for REC market growth in the region are China, Japan, and Australia. As an International Renewable Energy Certificate (I-REC), the market is booming across the region as a global framework for certification of production and usage of renewable equipment.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including expansions, sales contracts, acquisitions, agreements, investments, product launches, partnerships, and collaborations. For instance, 3Degrees, Inc. collaborated with the International Organization for Migration (IOM) and Energy Peace Partners (EPP) to facilitate a second Peace Renewable Energy Credit (P-REC) transaction, funding the solar electrification of Malakal Teaching Hospital and Bor State Hospital in South Sudan.

The global renewable energy certificate (REC) market was estimated at USD 27.99 billion in 2025 and is projected to reach USD 45.45 billion in 2030; it is estimated to grow at a CAGR of 10.2% from 2025 to 2030. The growth of the renewable energy certificate (REC) market is driven by the significant focus of organizations on minimizing their greenhouse gas emissions and increasing investments in renewable energy globally. Also, government policies mandating renewable energy targets are strongly propelling the renewable energy certificate (REC) market as they establish a formal framework to encourage power generation using renewable energy sources. The market exhibits promising growth, given the increasing demand from businesses and individuals seeking to neutralize their carbon footprint.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Renewable Energy Certificate (REC) market is undergoing major transformation due to emerging technologies like AI and IoT, which are revolutionizing how renewable energy is generated, traded, and tracked. AI boosts market efficiency by forecasting demand, optimizing generation patterns, and balancing power grids, while advanced data analytics ensure renewable energy alignment with consumption. IoT enables real-time monitoring of solar, wind, and hydropower assets, continuously collecting operational data and boosting system reliability. Innovations such as smart grids, energy-efficient solutions, and demand-response systems increase renewable energy usage and transparency. Blockchain and digital platforms are improving market liquidity and reducing transaction costs, driving wider REC adoption from both small and large participants. These advancements, alongside evolving regulations and carbon pricing, are shaping the global push toward a sustainable and energy-efficient future. Overall, REC market developments are enhancing credibility, efficiency, and accessibility, accelerating the energy transition worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Government policies and mandates regarding renewable energy targets

-

Corporate strategies and initiatives toward sustainability goals

Level

-

Fluctuating prices of renewable energy certificates

-

High transaction costs

Level

-

Increasing investments in clean energy projects

-

Government incentives and financial support programs

Level

-

Standardization gaps and duplicate counting issues

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Government policies and mandates regarding renewable energy targets

Government policies mandating renewable energy targets strongly expedite the growth of the market. These mandates establish a formal framework to encourage using renewable energy in power generation. These regulations often compel utilities and large firms to create a specific percentage of energy using renewable energy sources through direct purchase or by buying RECs. A renewable energy certificate proves that renewable sources such as wind, solar, or biomass have produced a specified quantity of electricity. As governments impose stringent renewable energy mandates and establish clear carbon reduction targets, the demand for RECs is poised to spike. Energy producers are incentivized to generate more renewable energy to meet requirements and earn RECs, which can be traded by organizations needing to comply with their renewable energy obligations. This establishes a market where RECs are an exchangeable commodity, offering economic incentives to renewable energy producers and encouraging additional capital inflow in clean energy ventures. Additionally, with governments continuing to strengthen climate-linked regulations and increasing renewable energy requirements, the REC market expanded in terms of volume and value, further propelling the shift toward cleaner energy sources and bringing economic incentives into balance with environmental objectives.

Restraints: Fluctuating prices of renewable energy certificates

The fluctuating prices of renewable energy certificates (RECs) pose a significant challenge, creating market instability and unpredictability for businesses. To meet renewable energy mandates and sustainability targets, RECs are essential for utilities and corporations. However, price volatility complicates budgeting, long-term planning, and regulatory compliance. REC price fluctuations primarily result from supply-demand imbalances. When renewable energy generation exceeds expectations or regulations loosen, surplus RECs drive prices down. Conversely, reduced renewable output or stricter regulations can increase demand, leading to price spikes. This uncertainty makes it difficult for businesses to predict future costs and assess the long-term feasibility of sustainability initiatives. Price instability also hinders budgeting strategies. Smaller companies with limited resources may struggle with unexpected price surges during peak demand, impacting financial stability. Likewise, large corporations committed to carbon neutrality may find it challenging to maintain consistent sustainability efforts if REC costs rise unpredictably. Addressing REC price volatility is crucial to ensuring a stable, predictable market that supports long-term renewable energy adoption

Opportunities: Increasing investments in clean energy projects

The increasing investment in clean energy projects creates significant opportunities for the players in the renewable energy certificate (REC) market, as it directly contributes to the growth and expansion of renewable energy capacity. As governments, corporations, and private investors prioritize sustainability and decarbonization, there is a surge in the development of renewable energy infrastructure, including wind, solar, and hydroelectric power. These projects generate renewable energy that qualifies for issuing RECs, which are then traded in the market. More cleaner energy projects lead to increased REC generation, which boosts supply and demand in the REC market. Firstly, with the expansion of renewable energy generation, the number of RECs issued increases, which opens up more opportunities for businesses, utilities, and organizations to meet their regulatory compliance requirements or sustainability goals. Many countries have Renewable Portfolio Standards (RPS) or other mandates requiring entities to produce renewable energy or purchase RECs to meet renewable energy targets. As investments in clean energy projects rise, RECs' availability also grows, providing companies with more options to buy and fulfill their obligations. This, in turn, increases market activity, liquidity, and efficiency, driving the broader adoption of renewable energy.

Challenges: Standardization gaps and duplicate counting issues

The lack of standardization in the renewable energy certificate (REC) market presents a significant challenge, as it creates inefficiencies and confusion across regions and countries. Different areas may have varying definitions of "renewable energy," different rules for issuing and certifying RECs, and inconsistent standards for trading and tracking them. This fragmentation complicates the market for businesses and investors, making it harder to accurately engage in cross-border REC transactions or assess a certificate's value. For example, one country may issue RECs only for energy produced by specific renewable sources, while another might include a broader range of renewable energy technologies. Furthermore, the verification process for certifying RECs may differ from region to region, leading to a lack of confidence in the authenticity of the certificates. This inconsistency creates a barrier for companies operating in multiple areas, as they may face different regulatory requirements and cannot rely on a single, unified REC system. It also limits the market’s liquidity, as it becomes more challenging to trade RECs across borders due to differing standards, reducing opportunities for companies to meet their renewable energy obligations efficiently.

Renewable Energy Certificate (REC) Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Indian companies are increasingly committed to RE100, a global initiative to transition to 100% renewable energy. However, meeting this target is often challenging due to limited access to renewable energy sources, high upfront capital investments, and geographical constraints that restrict the direct procurement of renewable energy. Moreover, fluctuating energy prices and the need to comply with the Renewable Purchase Obligations (RPOs) set by the government further complicate the situation. Many companies cannot establish in-house renewable energy infrastructure (e.g., solar panels or wind farms) due to the high capital cost and operational challenges. Without the ability to directly source renewable energy, these companies have limited options to meet their energy targets while ensuring cost efficiency and regulatory compliance. | The REC system offers a cost-effective and flexible solution for Indian companies aiming to meet their RE100 energy targets. REC traders allow businesses to purchase certificates representing renewable energy produced and injected into the grid, even if they do not generate it themselves. By buying RECs, companies can effectively offset their carbon emissions and achieve 100% renewable energy consumption without significant investment in renewable energy infrastructure. This solution provides compliance with Renewable Purchase Obligations (RPOs) and helps companies mitigate the challenges of fluctuating energy prices and geographical limitations. Additionally, RECs allow businesses to demonstrate their commitment to sustainability and corporate social responsibility, improving their brand image and attracting investors and consumers focused on sustainable practices. By incorporating RECs into their energy procurement strategy, companies can cost-effectively, flexibly, and scalably meet their renewable energy targets while supporting India’s broader transition to renewable energy. |

|

The Ocotillo Wind Farm, located in Big Spring, Texas, began operations in 2008. Over time, the facility's equipment aged, leading to considerations of decommissioning the 55 MW wind farm. Clearway Energy faced the challenge of either retiring the wind farm or investing in significant upgrades to extend its operational life. | Clearway Energy opted for a comprehensive refurbishment of the Ocotillo Wind Farm. This initiative involved upgrading generators and turbine drive trains across the farm's 26 turbines. These enhancements nearly doubled the farm's generation capacity and extended its operational lifespan by 10-12 years. The refurbishment also emphasized sustainability by reusing existing materials, including towers, nacelles, and blades |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The REC ecosystem is changing rapidly as part of the broader transition to digital infrastructure. Key stakeholders in this ecosystem include renewable energy generators, regulatory bodies/certification authorities, REC traders, utilities & power distributors, third-party auditors and verifiers, and end users.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Renewable energy certificate market, By Energy Type

The Renewable Energy Certificate (REC) market is segmented by energy type, including solar, wind, hydropower, biomass, and others. Solar energy is expected to hold the largest share due to declining costs, technological advancements, and widespread adoption in residential and commercial sectors. Wind energy follows closely, supported by large-scale installations and favorable government policies. Hydropower remains significant due to its reliability, while biomass and other renewables contribute to diversification. Rising carbon reduction targets, tax incentives, and corporate renewable commitments further boost REC demand.

Renewable energy certificate market, By Capacity

1,001-5,000 KWH, by capacity, is expected to grow at the second-highest CAGR during the forecast period. The renewable energy certificate (REC) market is witnessing consistent expansion across all capacity segments, fueled by the growing global emphasis on sustainable energy adoption. In this segment, above 5,000 KWh capacity continues to lead, reflecting uptake among industrial and commercial entities. The next growing segment is 1,001-5,000 KWh, since increasing businesses are taking advantage of the capacity while still pursuing their sustainability objectives. The segments having a capacity of less than 1,000 KWh are growing a bit faster because smaller consumers, which include residential and small commercial consumers, are also becoming aware of and taking up renewables. Thus, it is market growth driven by the combined support of income generation, corporate sustainability practices, and a change towards cleaner sources of energy.

Renewable energy certificate market, By End User

By end use, the Renewable energy certificate market has been segmented into complaince and voluntary segment. Voluntary is expected to be the second largest during the forecast period driven by the rising demand from corporations, business units, and individuals seeking to meet their sustainability targets and environmental goals.

REGION

North America to be largest region in global smart gas meter market during forecast period

North America dominated the Renewable Energy Certificate (REC) market. North America led the REC market due to stringent renewable energy policies, strong corporate sustainability commitments, and well-established trading platforms. The United States and Canada played a key role in the expansion of the market, supported by government incentives, Renewable Portfolio Standards (RPS), and voluntary corporate procurement of clean energy. The presence of robust compliance markets, such as the California Low Carbon Fuel Standard (LCFS) and state-specific RPS programs, further drove demand for RECs. Additionally, the growing emphasis on decarbonization, carbon neutrality goals, and the rising adoption of solar and wind energy contributed to market expansion.

Renewable Energy Certificate (REC) Market: COMPANY EVALUATION MATRIX

3Degrees Inc. (Star) in the Renewable Energy Certificate (REC) market matrix, reflecting its leadership in both market share and product footprint. The company stands out for its comprehensive REC portfolio, advanced digital solutions, and ability to serve diverse customer segments. 3Degrees’ robust trading infrastructure and commitment to sustainability have earned it a dominant presence among pervasive players, demonstrating innovation, high transaction volume, and trusted verification services. In contrast, Sterling Planet (Emerging Leader)" with a strong market presence and a broad technology portfolio, driving significant adoption and advancing best practices in the evolving REC landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 20.30 BN |

| Market Forecast in 2030 (Value) | USD 45.45 BN |

| Growth Rate | 10.2% |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, RoW |

WHAT IS IN IT FOR YOU: Renewable Energy Certificate (REC) Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| NA | Product matrix, which gives a detailed comparison of the product portfolio of each company | |

| NA | Further breakdown of the renewable energy certificates (REC) market, by country | |

| NA | Detailed analysis and profiling of additional market players (up to five).? |

RECENT DEVELOPMENTS

- February 2024 : Statkraft signed the VPPA with Air Liquide. Under the agreement, Air Liquide will purchase RECs from newly installed wind farms in Poland. This agreement is expected to reduce Air Liquide's carbon dioxide (CO2) emissions by 38,000 tonnes annually.

- December 2024 : NSCH, based in Massachusetts, entered into a two-year agreement with ENGIE Resources to match 100% of its energy consumption with RECs. This commitment supports NSCH's sustainability goals and ensures that its energy usage is offset by renewable generation. This agreement will help ENGIE Resources strengthen its position in the renewable energy market by expanding its customer base and showcasing its ability to provide sustainable energy solutions.

- May 2024 : Shell Energy Europe Limited and 3Degrees Group Inc. registered an agreement to participate in the auction for guarantees of origin at Croatia’s power exchange, CROPEX.

- April 2023 : 3Degrees, Inc. collaborated with the International Organization for Migration (IOM) and Energy Peace Partners (EPP) to facilitate a second Peace Renewable Energy Credit (P-REC) transaction, funding the solar electrification of Malakal Teaching Hospital and Bor State Hospital in South Sudan.

- April 2022 : Enel Green Power signed a 12-year PPA with BHP to supply 100% of Flat Rocks Wind Farm's output, totaling approximately 315 GWh per year of renewable energy and all Large-scale Generation Certificates (LGCs) from 2024.

Table of Contents

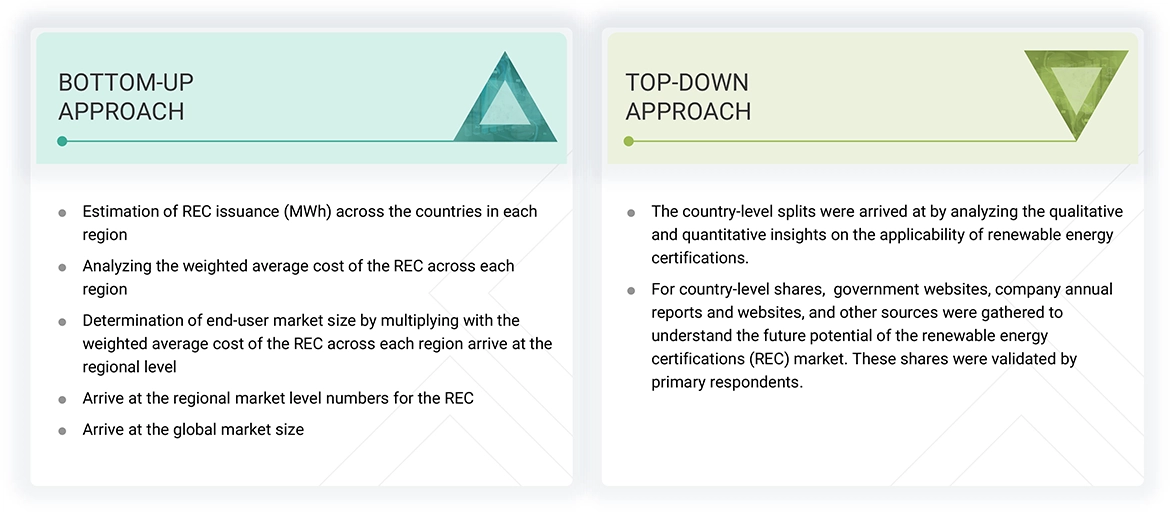

Methodology

The study involved major activities in estimating the current size of the renewable energy certificates (REC) market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the renewable energy certificates (REC) market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the global renewable energy certificates (REC) market. The other secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

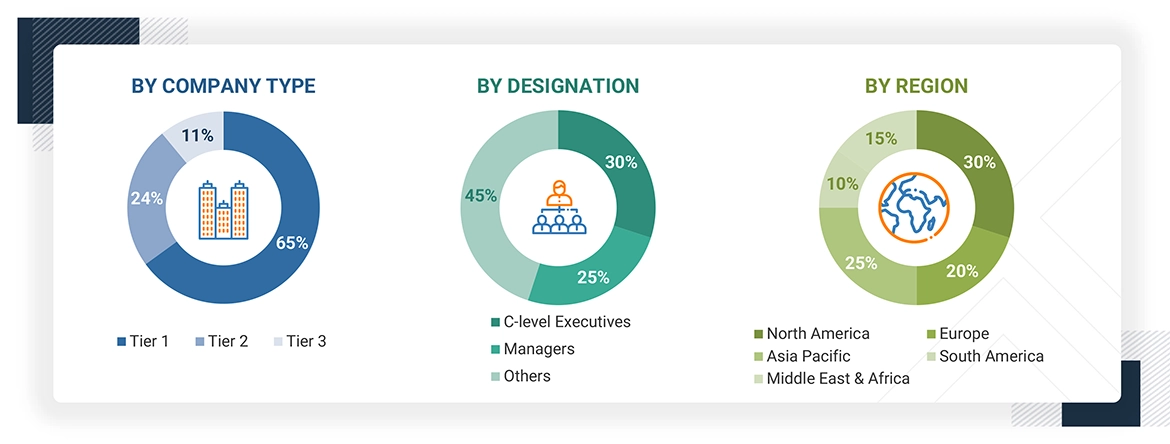

Primary Research

The renewable energy certificates (REC) market comprises several stakeholders such as Utilities & Retail Electricity Suppliers, REC Issuing Bodies, REC Traders & Brokers, Renewable Energy Generatorsin the supply chain. The demand side of this market is characterized by the rising demand for renewable energy and committment to net zero goals by 2050. The supply side is characterized by rising demand for contracts from the REC traders, and mergers and acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the renewable energy certificate market and its dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was obtained through primary and secondary research. The research methodology includes the study of the annual and financial reports of top market players and interviews with industry experts, such as chief executive officers, vice presidents, directors, sales managers, and marketing executives, for key quantitative and qualitative insights related to the renewable energy certificates (REC) market.

Renewable Energy Certificate (REC) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

A renewable energy certificate (REC) is a market-based instrument that represents the property rights to the environmental, social, and other non-power attributes of renewable electricity generation. Renewable energy certificates are issued when one megawatt-hour (MWh) of electricity is generated and delivered to the electricity grid from a renewable energy resource like wind energy, solar energy, hydro energy, biomass, biogas, and geothermal energy.

The growth of the renewable energy certificate (REC) market during the forecast period can be attributed to the organizations aiming to offset their greenhouse gas emissions coupled with government policies encouraging companies to meet renewable energy usage targets and increasing investments in the renewable energy across major countries in North America, Europe, Asia Pacific, and Rest of the World.

Stakeholders

- Government and research organizations

- Energy service providers (private/government)

- Utilities & Retail Electricity Suppliers

- REC Issuing Bodies

- REC Traders & Brokers

- Renewable Energy Generators

- Environmental organizations, and industry groups

- Auditors & Verification Bodies

- Consultants/consultancies/advisory firms

- Environmental research institutes

- Private or investor-owned utilities

- State and national regulatory authorities

- Investors/shareholders

- Investment banks

Report Objectives

- To define, describe, and forecast the renewable energy certificate (REC) market, by energy type, capacity, end use, and region, in terms of value

- To forecast the renewable energy certificate (REC) market, by region, in terms of volume

- To describe and forecast the renewable energy certificate (REC) market for various segments with respect to four main regions: North America, Europe, Asia Pacific, and Rest of the World, in terms of value

- To provide detailed information about the major drivers, restraints, opportunities, and challenges influencing the growth of the renewable energy certificate (REC) market

- To provide detailed information on the value chain, case studies, technologies, market ecosystem, regulatory landscape, Porter’s Five Forces, and trends/disruptions impacting customer business that are specific to the renewable energy certificate (REC) market

- To analyze market opportunities for stakeholders in the renewable energy certificate (REC) market and draw a competitive landscape for market players

- To benchmark players within the market using the company evaluation matrix, which analyzes market players on various parameters within the broad categories of business excellence and strength of product portfolio

- To compare key market players with respect to market share, product specifications, and end users

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market share and core competencies2

- To analyze competitive developments in the renewable energy certificate (REC) market, such as partnerships, acquisitions, contracts, agreements, product launches, investments, and expansions.

- To study the impact of AI/gen AI on the market under study, along with the macroeconomic outlook for each region.

Note: 1. Core competencies of companies are captured in terms of their key developments and product portfolios, as well as key strategies adopted to sustain their position in the renewable energy certificates (REC) market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the renewable energy certificates (REC) market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What was the size of the renewable energy certificate (REC) market in 2024?

The renewable energy certificate (REC) market size was USD 24.30 billion in 2024.

What are the major factors driving the renewable energy certificate (REC) market?

Stringent government regulations and policies promoting renewable energy are driving the demand for renewable energy certificates (RECs) in the renewable energy certificate (REC) market.

Which region will be the fastest-growing market during the forecast period?

Asia Pacific is expected to be the fastest-growing market between 2025 and 2030.

Which energy type will dominate the market in the coming years?

Solar power is expected to account for the largest market share throughout the forecast period.

Which segment is projected to account for a larger market, by end use, during the forecast period?

The compliance segment is expected to hold a prominent market share in the coming years.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Renewable Energy Certificate (REC) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Renewable Energy Certificate (REC) Market