Enterprise Asset Management Market

Enterprise Asset Management Market by Asset Class (Linear Assets, Production Equipment, Fleet & Mobile Assets, Fixed Assets), Application (Asset Lifecycle Management, Operations, Maintenance, Compliance & Safety, Reporting & Analytics) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The enterprise asset management (EAM) market is projected to grow from USD 5.87 billion in 2025 to USD 9.02 billion by 2030, featuring a CAGR of 9.0%. Organizations are increasingly prioritizing asset optimization to reduce costs, boost productivity, and extend asset lifecycles. Effective asset management is crucial for minimizing financial losses and addressing cash flow challenges. This trend offers EAM providers a chance to deliver advanced solutions, and investing in scalable, AI-powered platforms can help them lead in this dynamic market.

KEY TAKEAWAYS

-

BY SERVICE MODELGrowing adoption of integrated EAM solutions that provide predictive maintenance, asset lifecycle management, and real-time monitoring to optimize operational efficiency and reduce downtime. Expansion of managed EAM services, as organizations prefer OpEx models with outsourced maintenance, cloud-based asset monitoring, and streamlined workflow orchestration to simplify asset management and improve regulatory compliance.

-

BY APPLICATIONOperation management streamlines enterprise workflows by integrating automation, IoT, and analytics, enabling organizations to minimize downtime and improve overall asset efficiency. Maintenance management fuels growth with predictive and preventive strategies, leveraging AI, machine learning, and sensor-based monitoring to extend asset lifespan and reduce unplanned failures.

-

BY DEPLOYMENT TYPETraditional on-premises EAM deployments remain preferred by large enterprises with strict data security, regulatory compliance, and legacy system integration requirements. Cloud-based EAM is rapidly growing as organizations seek scalability, lower upfront costs, and remote accessibility.

-

BY ORGANIZATION SIZELarge enterprises leverage comprehensive EAM systems to scale asset-intensive operations, implement predictive maintenance, and integrate digital twins across complex infrastructure. Small enterprises are increasingly adopting EAM solutions to drive digital transformation and optimize asset performance without heavy upfront capital investments.

-

BY ASSET CLASSLinear assets, such as pipelines, railways, and roads, drive demand for EAM solutions that enable real-time monitoring, preventive maintenance, and lifecycle optimization. Production and manufacturing equipment adoption of EAM solutions is growing to enhance operational efficiency, track performance, and predict failures.

-

BY VERTICALManufacturing companies are adopting EAM solutions to enhance operational efficiency, optimize asset uptime, and reduce maintenance costs. Predictive maintenance, IoT integration, and real-time asset monitoring help manufacturers improve production reliability and overall equipment effectiveness (OEE). Healthcare and life sciences organizations leverage EAM systems to manage critical medical equipment, laboratory instruments, and facility assets. These solutions ensure regulatory compliance, minimize equipment downtime, and enhance patient safety and operational continuity.

-

BY REGIONAsia Pacific is expected to register the highest CAGR of 14.3%, driven by rapid industrialization, expanding manufacturing sectors, and increasing adoption of IoT and predictive maintenance solutions. Rising investments in smart factories, digital infrastructure, and cloud-based EAM systems are accelerating asset optimization and operational efficiency across the region.

-

COMPETITIVE LANDSCAPEThe major players in the EAM market have adopted both organic and inorganic strategies, including partnerships and investments. For instance, IFS, IBM, and Hexagon are entering into a number of agreements and partnerships to cater to the growing demand for EAM solutions across diverse enterprise applications.

Integrating advanced technologies such as IoT, AI, and predictive analytics further enhances EAM solutions. Growing demand for cloud-based solutions driven by scalability, cost efficiency, and seamless integration underscores the shift toward sustainability and digital transformation . These trends fuel sustained market growth as enterprises adapt to evolving challenges, focusing on maximizing asset value while minimizing disruptions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The section highlights the major trends and disruptions influencing customer businesses, focusing on how revenue models are shifting toward predictive maintenance, IoT-enabled tracking, and cloud-based platforms. It emphasizes the changing priorities of key client segments such as manufacturing, energy & utilities, and oil & gas, and connects their strategic imperatives to measurable client outcomes such as improved asset uptime, regulatory compliance, cost optimization, sustainability, and enhanced service reliability.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rsing uptime demand

-

Demand for real-time asset insights

Level

-

High upfront implementation cost

-

Managining compliance complexcity across borders

Level

-

Transforming EAM with edge-to-cloud innovation

-

Enabling predictive maintenance with IoT sensors

Level

-

Risk of cyberattacks and data privacy

-

Skilled workforce challenges in asset management

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising uptime demand

Enterprise asset management (EAM) adoption is driven by the need to maximize uptime, improve OEE, and unlock full asset lifecycle value across sectors like utilities, healthcare, and manufacturing. Despite implementation challenges, EAM delivers measurable benefits, including reduced downtime and lower maintenance costs. Scalable, flexible, next-generation EAM solutions enhance efficiency and reliability, enabling organizations to optimize ROI and gain a competitive advantage.

Restraint: High upfront implementation cost

High upfront costs limit EAM adoption among SMEs, with implementation for mid-sized businesses often ranging from USD 150–300K for software, hardware, and integrations. Cloud-based, cost-effective solutions can lower entry barriers, making EAM more accessible. Emphasizing long-term efficiency gains and transformative benefits of platforms like Microsoft Dynamics 365, SAP EAM, and IBM Maximo can help justify the investment and drive broader adoption.

Opportunity: Transforming EAM with edge-to-cloud innovation

Edge-to-cloud innovation, combined with 5G connectivity, is transforming EAM by enabling faster, decentralized data processing for real-time monitoring, predictive maintenance, and efficient asset management. This allows enterprises in energy, utilities, transportation, and manufacturing to improve uptime, optimize resource use, and enhance operational reliability. EAM providers investing in scalable edge-to-cloud solutions can deliver higher asset performance and drive industry-wide efficiency.

Challenge: Risk of cyberattacks and data privacy.

The rapid growth of the EAM market brings heightened risks of cyberattacks and data breaches, as platforms manage sensitive operational and financial information across interconnected systems. These threats can cause operational disruptions, regulatory penalties, and reputational damage, slowing adoption. EAM providers must prioritize robust cybersecurity and data privacy measures to build trust, protect assets, and enable sustainable market growth.

Enterprise Asset Management Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Hungrana Kft. modernized maintenance and safety with SAP EAM. | Hungrana achieved significant cost savings, improved technician productivity, and reduced paperwork through digitalized maintenance. The solutions also enhanced workplace safety, ensured regulatory compliance, and supported long-term sustainability goals. |

|

Riyadh Airports Company (RAC) transformed King Khalid International Airport’s maintenance operations by deploying IBM Maximo. | RAC achieved major efficiency gains with an 80% reduction in paperwork, a 50% improvement in real-time insights, and contractor onboarding cut from 10 days to just 2–3. Inspector productivity rose by over 40%, while automated workflows and preventive maintenance minimized errors, reduced downtime, and optimized asset lifecycle costs. |

|

Transdev Sweden rapidly deployed Hexagon’s HxGN EAM to take over the Mälartåg rail network. | Transdev Sweden ensured uninterrupted passenger services with improved maintenance efficiency and seamless asset tracking across rail and bus fleets. The future-ready HxGN EAM platform also supports proactive strategies, system integration, and readiness for electric bus adoption. |

|

L’Oréal implemented Maintenance Connection CMMS to enhance preventive maintenance, streamline workflows, and centralize asset data across its US facilities. | L’Oréal achieved lower maintenance costs and fewer equipment breakdowns through preventive maintenance. The company also improved mechanical productivity and real-time asset visibility, enabling proactive downtime management. |

|

Anderson Dahlen implemented Aptean EAM to centralize preventive maintenance, streamline work order tracking, and reduce reliance on costly outsourced contractors. | Anderson Dahlen cut maintenance costs by replacing outsourced services with an expanded in-house team and centralized preventive maintenance requests. This improved response speed, reduced downtime, and provided data-driven visibility for smarter decision-making. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

This section outlines the enterprise asset management (EAM) ecosystem, which encompasses a broad range of solutions designed to optimize the management, monitoring, and performance of physical assets across industries. The ecosystem consists of comprehensive platforms and specialized tools supporting key applications such as asset lifecycle management, operation management and maintenance management.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Enterprise Asset Management Market, By Offering

The solutions segment is estimated to lead the market, driven by the demand for comprehensive software platforms that enable asset monitoring, predictive maintenance, and lifecycle management. These solutions help organizations optimize performance, reduce downtime, and improve operational efficiency across industries, making them a critical investment for enterprises seeking long-term value from their assets.

Enterprise Asset Management Market, By Deployment Type

The on-premises segment is estimated to hold the largest market share, as it offers organizations greater control over their data, security, and customization. Enterprises with stringent compliance requirements or complex asset management needs prefer on-premises deployments to ensure reliability, seamless integration, and tailored functionality, driving strong adoption across asset-intensive industries. Additionally, on-premises solutions provide robust performance for large-scale operations, reduce dependency on internet connectivity, and enable organizations to maintain critical operational continuity while safeguarding sensitive asset data.

Enterprise Asset Management Market, By Organization Size

The large enterprises segment is estimated to hold the largest market share, driven by their extensive asset portfolios and complex operational requirements. These organizations adopt EAM solutions to enhance asset performance, streamline maintenance processes, and improve overall efficiency. With greater budgets and strategic focus on long-term ROI, large enterprises can invest in comprehensive EAM platforms that deliver scalability, advanced analytics, and robust integration across business functions. Furthermore, their emphasis on regulatory compliance, risk mitigation, and digital transformation initiatives reinforces the adoption of sophisticated EAM solutions, driving sustained market growth.

Enterprise Asset Management Market, By Asset Class

The linear assets segment is estimated to hold the largest market share, as these assets, such as pipelines, rail networks, roads, and utility lines, require continuous monitoring and maintenance to ensure operational reliability and safety. EAM solutions help organizations track asset conditions, schedule preventive maintenance, and optimize lifecycle performance, reducing downtime and repair costs. Industries like energy, transportation, and utilities, which rely heavily on extensive linear infrastructure, drive strong demand for these solutions. By enabling real-time insights, predictive analytics, and efficient resource allocation, EAM platforms support the effective management of linear assets, ensuring long-term sustainability and operational efficiency.

Enterprise Asset Management Market, By Application

The operations management segment is estimated to dominate the EAM market, as it enables organizations to streamline asset utilization, optimize maintenance schedules, and enhance overall operational efficiency. By providing real-time insights and predictive capabilities, this application helps industries minimize downtime, reduce costs, and maximize asset performance across diverse sectors. Its critical role in ensuring compliance, safety, and resource optimization further reinforces its importance, driving widespread adoption across manufacturing, utilities, transportation, and healthcare industries.

Enterprise Asset Management Market, By Vertical

The manufacturing segment is estimated to hold the largest market share due to its reliance on complex machinery and extensive asset networks that require continuous monitoring and maintenance. EAM solutions enable manufacturers to optimize equipment performance, reduce unplanned downtime, and enhance overall operational efficiency. By leveraging predictive maintenance, real-time monitoring, and lifecycle management capabilities, these solutions help manufacturers minimize costs and improve productivity. Additionally, the focus on regulatory compliance, quality control, and digital transformation in the manufacturing sector further drives the adoption of advanced EAM platforms, supporting long-term sustainability and competitive advantage.

REGION

Asia Pacific to be fastest-growing region in global enterprise asset management market during forecast period

Asia Pacific is expected to be the fastest-growing region in the EAM market during the forecast period, driven by rapid industrialization, urbanization, and the expansion of asset-intensive sectors such as manufacturing, energy, and utilities. Increasing adoption of digital technologies, government initiatives promoting smart infrastructure , and rising investments in predictive maintenance and asset optimization are fueling market growth. Additionally, the growing focus on operational efficiency, cost reduction, and regulatory compliance encourages enterprises in the region to implement advanced EAM solutions, positioning Asia Pacific as a key growth hotspot in the global market.

Enterprise Asset Management Market: COMPANY EVALUATION MATRIX

In the enterprise asset management (EAM) market matrix, IFS (Star) lead with a strong market presence and comprehensive portfolio, enabling large-scale adoption across industries such as manufacturing, energy, and transportation. Trimble (Emerging Leader) is gaining traction with scalable, data-driven EAM solutions tailored for asset-intensive operations. While IFS dominates with scale and enterprise reach, other providers such as SAP and IBM show strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.87 Billion |

| Market Forecast in 2030 (Value) | USD 9.02 Billion |

| Growth Rate | CAGR of 9.0% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Enterprise Asset Management Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Aircraft OEM |

|

|

| Composite Material Manufacturer |

|

|

| Engine Manufacturer |

|

|

| Raw Material Supplier |

|

|

| Defense Contractor |

|

|

RECENT DEVELOPMENTS

- June 2025 : Hexagon’s Asset Lifecycle Intelligence division announced a strategic partnership with Prevas to expand digital asset management across Denmark, Finland, Norway, and Sweden. Prevas will establish an exclusive practice for HxGN EAM and HxGN APM, strengthening its role as a leading Hexagon partner in the Nordics. Building on nearly two decades of collaboration, the partnership aims to accelerate digital transformation, enhance asset performance, and expand into additional Hexagon solutions.

- June 2025 : IBM launched Maximo Application Suite 9.0, consolidating all applications, industry solutions, and add-ons under one version. The update adds IPv6 support, MongoDB 5.0/6.0 compatibility, enhanced user authentication (multiple IDPs, SCIM 2.0, self-registration), stronger security controls, and expanded UI customization. It also introduces the Data Reporter Operator for licensing metrics, replacing User Data Services. Meanwhile, some features were discontinued, including MRO Inventory Optimization, Watson Discovery in Maximo Assist, voice inspections, and search in Assist.

- August 2024 : Aptean announced the acquisition of SSG Insight, a UK-based EAM solutions provider with over 40 years of experience. The deal expands Aptean’s global EAM footprint across the UK, Europe, Australia, and North America while enhancing its cloud-based EAM offerings. SSG’s flagship Agility suite strengthens Aptean’s capabilities in asset lifecycle management, workflow automation, and advanced analytics for manufacturing, logistics, healthcare, and light rail industries.

- June 2024 : Trimble launched Trimble Unity, an end-to-end asset lifecycle management software suite for capital projects and public infrastructure. The cloud-first platform unifies Trimble’s existing solutions to help asset owners plan, build, operate, and maintain assets with centralized data and connected digital workflows. With capabilities such as Unity Construct, Maintain, Permit, Connect, and Field, the suite enables up to 40% reduction in total asset ownership costs, supporting transportation, utilities, healthcare, and education sectors.

Table of Contents

Methodology

This research used extensive secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information for a technical, market-oriented, and commercial study of the enterprise asset management market. Other market-related reports and analyses published by various industry associations and consortia, such as the National Security Agency (NSA) and SC Magazine, were considered while conducting extensive secondary research. The primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, and technologists from companies and organizations related to all segments of this industry’s value chain.

In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information and assess the prospects. The market was estimated by analyzing various driving factors, such as the need to improve compliance requirements within an organization, increasing emphasis on enhancing operational efficiency, and the requirement for simplified workflows to eliminate bottlenecks.

Secondary Research

The market size of companies offering enterprise asset management was determined based on secondary data available through paid and unpaid sources, analyzing the product portfolios of major companies in the ecosystem, and rating the companies based on their product capabilities and business strategies.

Various sources were used in the secondary research process to identify and collect information for the study. These sources included annual reports, press releases, investor presentations of companies, product data sheets, white papers, journals, certified publications, articles from recognized authors, government websites, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation based on industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the enterprise asset management market.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology-related trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as chief information officers (CIOs), chief technology officers (CTOs), chief security officers (CSOs), the installation teams of governments/end users using enterprise asset management platforms, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of services, which would affect the overall enterprise asset management market.

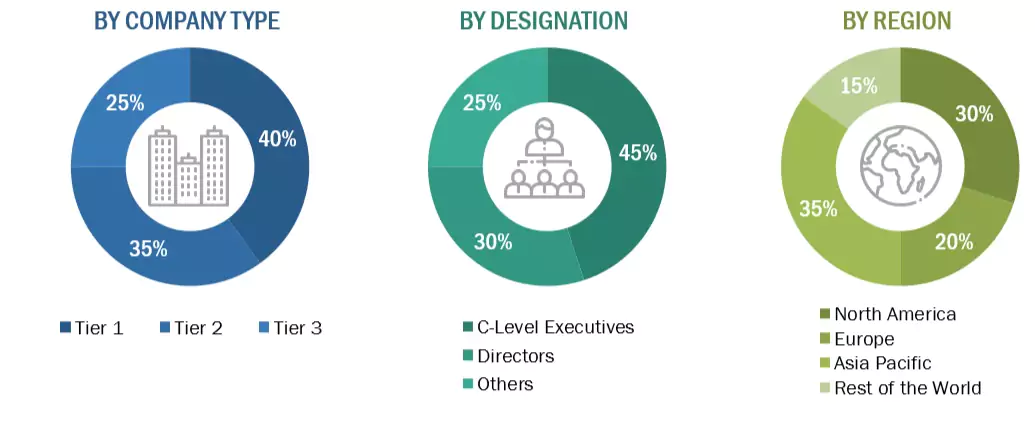

Note: Tier 1 companies have revenues greater than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10

billion; and tier 3 companies’ revenues range between USD 500 million and 1 billion.

Others include sales, marketing, and product managers.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the enterprise asset management market. The first approach involved estimating the market size by summating the companies’ revenue generated through the sale of services.

The research methodology used to estimate the market size included the following.

- Primary and secondary research were conducted to assess the revenue contributions of major market participants in each country, with secondary research identifying these participants.

- Critical insights were obtained by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

- Primary sources were used to verify all percentage splits and breakups, which we calculated using secondary sources.

Enterprise Asset Management Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall market size was determined, we divided the market into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from the government entities’ supply and demand sides.

Market Definition

According to IBM, “Enterprise asset management (EAM) is the combination of software, systems, and services that maintain and control operational assets and equipment. EAM aims to optimize the quality and utilization of assets throughout their lifecycle, increase productive uptime, and reduce operational costs.”

According to MarketsandMarkets, “Enterprise Asset Management (EAM) is the systematic process of managing an organization’s physical assets such as equipment, machinery, vehicles, infrastructure, and facilities throughout their entire lifecycle. It encompasses planning, acquiring, operating, maintaining, and disposing of assets, aiming to maximize performance, reduce costs, and ensure reliability, safety, and compliance.”

Stakeholders

- Maintenance Managers

- Asset Managers

- Facility Managers

- Operations Managers

- Engineers (Mechanical, Electrical, and Civil)

- IT/Technology Teams

- Procurement Teams

- Safety & Compliance Officers

- Plant/Production Managers

- Service Technicians

- Inventory & Warehouse Managers

- Energy & Utilities Managers

- Project Managers

Report Objectives

- To define, describe, and forecast the enterprise asset management market based on offering solutions and services, by applications, deployment type, asset class, organization size, vertical, and region

- To forecast the market size for North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information on the factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro markets concerning growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents, innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To analyze the impact of AI/generative AI on the market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments such as mergers & acquisitions, product launches, and partnerships & collaborations in the market

Available Customizations

MarketsandMarkets provides customizations based on the company’s unique requirements using market data. The following customization options are available for the report.

Product Analysis

- The product matrix provides a detailed comparison of each company’s portfolio.

Geographic Analysis as per Feasibility

- Further breakup of the enterprise asset management market

Company Information

- Detailed analysis and profiling of five additional market players

Key Questions Addressed by the Report

What is enterprise asset management?

Enterprise asset management (EAM) refers to the integrated software and processes used to manage the lifecycle of physical assets such as machinery, equipment, and infrastructure. It helps organizations optimize asset utilization, reduce downtime, and extend asset life.

What are the best strategies for EAM providers to optimize cloud-based solutions for scalability?

EAM providers should focus on developing cloud-based platforms with robust APIs, seamless integrations, and flexible architectures. This ensures scalability to handle growing asset portfolios, improves user adoption, and meets the demand for cost-effective, future-proof solutions across industries.

Which industries are the major adopters of EAM solutions?

Key industries adopting EAM include manufacturing, energy and utilities, transportation, healthcare, and government. These sectors rely heavily on asset-intensive operations where efficiency, safety, and compliance are critical.

What challenges do organizations face in implementing EAM?

Challenges include high upfront costs, complexity in integrating EAM with legacy systems, lack of skilled professionals, and organizational resistance to change. However, cloud-based solutions are helping reduce these barriers.

What steps can EAM providers take to reduce clients’ high upfront implementation costs?

Providers can offer subscription-based pricing, cloud-hosted solutions, and phased implementation plans. These strategies lower initial investment barriers, improve accessibility for SMEs, and drive wider market penetration.

Who are the key vendors in the enterprise asset management market?

The key vendors in the global enterprise asset management market include IBM, Oracle, SAP, Heaxgon, IFS, Aptean, Trimble, ServiceNow, Hitachi Energy, Ramco, Accruent, MaintainX, ABS Group, Central Square, KloudGin, Assetworks, Limble CMMS, Upkeep, Asset Panda, emaint, Asset Infinity, EZmaintain, Llumin, and IPS Intelligent Process Solutions.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Enterprise Asset Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Enterprise Asset Management Market