Smart Homes in Europe Market Size, Share & Trends

European Smart Home Market by Lighting Controls, Smart Speakers, Entertainment Controls, HVAC Controls, Security & Access Control, Smart Kitchen, Home Healthcare, Smart Furniture, Home Appliances, Wired, Behavioral, Proactive - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The European smart home market is projected to grow from USD 23.73 billion in 2025 to USD 32.67 billion by 2030 at a CAGR of 6.6% during the forecast period. Growth is driven by the rising adoption of connected home technologies, smart energy management systems, and home automation devices that enhance user comfort, convenience, and energy efficiency. Government-led initiatives promoting smart grids, renewable integration, and sustainable housing development across countries such as Germany, France, and the UK are fueling market demand. Furthermore, AI-based predictive control, IoT-enabled sensors, and cloud-integrated monitoring platforms are improving real-time energy optimization, reducing wastage, and supporting Europe’s long-term decarbonization and digital transformation goals in the residential sector.

KEY TAKEAWAYS

-

BY COUNTRYThe Rest of Europe is projected to register the fastest growth of CAGR of 8.7%

-

BY PRODUCTBy product, the entertainment & other controls segment dominates the market with share of ~33% in 2024.

-

BY SALES CHANNELBy sales channel, the market for indirect sales id projected to grow at a CAGR of 7.2%

-

BY PROTOCOLBy protocol, the wired segment dominates the market with share of ~55% in 2024.

-

BY INSTALLATION TYPEBy installation type, the new installations segment dominates the market with share of ~66% in 2024.

-

BY RESIDENCE TYPEBy residence type, the market for multi-family residence segment is projected to grow at a CAGR of 7.2%

-

BY SYSTEM TYPEBy system type, the behavioural segment dominates the market with share of ~95% in 2024.

-

COMPETITIVE LANDSCAPECompany ohnson Controls Inc., Schneider Electric, and ASSA ABLOY were identified as star players in the european smart home market (global) given their strong market share and product footprint. Companies tado GmbH, Withings, and Netatmo have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The European smart home market is projected to grow significantly over the next decade, driven by the rapid integration of smart building technologies, the expansion of sustainable urban infrastructure, and the increasing focus on energy-efficient and connected residential ecosystems. Ongoing government initiatives toward smart city development and renewable energy integration are further supporting market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The smart home and connected living vertical primarily includes residential property developers, home automation integrators, energy management service providers, and public utility agencies. Smart home systems are being widely adopted across these segments to enable centralized control, energy optimization, and enhanced occupant comfort. In addition, new opportunities are emerging with the integration of AI-driven analytics, IoT-based sensing networks, and cloud-enabled home management platforms for real-time monitoring and automation. These innovations are shaping the next generation of intelligent and sustainable home ecosystems, improving energy efficiency, security, and convenience while reducing operational costs for both homeowners and real estate developers across Europe.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising need for energy saving and low-carbon-emission-oriented solutions

-

Proliferation of smartphones and smart gadgets

Level

-

Expenses associated with smart gadgets

-

High cost of ownership of home automation systems

Level

-

Implementation of energy efficiency measures

-

Rising adoption of smart lighting systems

Level

-

Lack of developments in common standards and communication protocols

-

Increase in vulnerability to hacking

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising need for energy saving and low-carbon-emission-oriented solutions.

The European smart home market is being increasingly driven by the growing consumer focus on energy conservation, sustainability, and connected comfort. Rising implementation of EU energy directives and green building standards (such as EPBD and Fit for 55) is encouraging the adoption of IoT-enabled smart home devices for optimized energy use and carbon reduction. The integration of AI-driven home management platforms and predictive control systems is further enhancing automation, efficiency, and sustainability in residential spaces.

Restraint: Expenses associated with smart gadgets

Despite technological advances, high upfront costs for smart devices and integration across legacy infrastructure remain major barriers to adoption, particularly in older European homes. The lack of standardized communication protocols across various device ecosystems often leads to compatibility and interoperability challenges, slowing the pace of connected system deployment and long-term scalability.

Opportunity: Implementation of energy efficiency measures

Growing emphasis on renewable energy adoption, smart grid connectivity, and government-led sustainability programs is unlocking new opportunities for smart home providers. Public–private partnerships (PPPs) across the EU are fostering large-scale deployments of AI- and IoT-powered home automation systems, enabling energy sharing, demand response, and integration with rooftop solar and EV charging networks. Vendors offering cloud-connected analytics and interoperable home ecosystems are expected to gain a strong competitive edge.

Challenge: Lack of developments in common standards and communication protocols

As European consumers increasingly rely on connected and cloud-based smart home platforms, concerns regarding data protection and cybersecurity have grown significantly. Compliance with frameworks such as the General Data Protection Regulation (GDPR) and the upcoming Cyber Resilience Act is becoming crucial for vendors. Additionally, the lack of unified standards for AI-driven automation and IoT device interoperability continues to pose challenges for seamless communication between devices from different manufacturers.

SMART HOMES IN EUROPE MARKET SIZE, SHARE & TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of smart home energy management systems across residential projects in Sweden, integrating lighting, heating, and water management via IoT-enabled meters and sensors. | Improved household energy efficiency and water conservation, 20% reduction in energy usage, and enhanced sustainability compliance in line with Sweden’s green energy initiatives. |

|

Implementation of connected workplace automation across European office campuses, integrating smart lighting, HVAC scheduling, and occupancy-based energy control. | Achieved 25–30% reduction in facility energy costs, improved indoor comfort for employees, and enhanced operational transparency through real-time data insights. |

|

Integration of AI-driven smart home devices across residential and hospitality facilities for automated lighting, climate, and security control through mobile and voice-enabled interfaces. | 18% improvement in energy efficiency, lower maintenance costs, and elevated guest experience through intelligent and customizable automation features. |

|

Deployment of community-wide smart home ecosystems in residential neighborhoods and educational facilities, connecting IoT sensors for lighting, ventilation, and energy analytics. | 25% improvement in energy efficiency, optimized living and learning conditions, and reduced energy waste through predictive automation and analytics. |

|

Implementation of IoT-enabled smart home and building systems across student dormitories and classrooms, automating lighting, HVAC, and appliance control through smart devices. | 15–20% reduction in overall utility costs, improved occupant safety, and enhanced environmental comfort supporting digital campus sustainability goals. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The European smart home ecosystem comprises established providers such as Siemens, ABB, Honeywell, Schneider Electric, Bosch, Legrand, and NXP. The synergy among these players is unlocking new opportunities across areas such as AI-driven home energy optimization, IoT-enabled sensor networks, cloud-based automation platforms, and predictive maintenance analytics. These companies are continuously enhancing their portfolios with interoperable solutions, open-protocol architectures, and integrated home energy management systems, driving efficiency, sustainability, and digital transformation across the European residential and commercial smart living segments

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

European smart home market, By Product

The entertainment and other controls segment accounted for a significant market share in 2024, driven by the growing demand for real-time energy monitoring, HVAC optimization, and intelligent lighting control. The shift toward AI- and IoT-enabled analytics is enhancing interoperability and enabling predictive maintenance and sustainability-focused energy management across residential and commercial spaces.

European smart home market, By Sales Channel

The indirect sales segment held a significant market share in 2024, supported by widespread deployment across retail stores, offices, and hospitality facilities. Increasing integration of BAS-based HVAC, lighting, and security systems is driving energy savings, reducing operational costs, and enhancing occupant comfort. Additionally, the industrial segment is witnessing growing adoption of automation technologies for energy optimization, safety monitoring, and compliance.

European smart home market, By Protocol

The wired segment accounted for the largest share in 2024 due to its reliability, data security, and suitability for large residential complexes and mixed-use developments. However, the wireless segment is projected to grow rapidly owing to the increasing adoption of IoT-connected sensors, Wi-Fi, and Bluetooth-based systems that enable flexible installation and seamless connectivity. Service providers are focusing on cloud interoperability, AI-based fault detection, and remote management platforms to enhance efficiency and user experience.

European smart home market, By Installation type

The new installation segment held the largest market share in 2024, driven by the rapid construction of energy-efficient residential complexes and smart city projects integrating AI-based control systems for energy, lighting, and home security management.

European smart home market, By Residence Type

The multi-family residence segment accounted for a significant market share in 2024, supported by increasing demand for shared energy optimization systems, centralized HVAC management, and security automation solutions across apartment complexes and housing communities.

European smart home market, By System Type

The behavioral segment held a significant share in 2024, driven by growing consumer adoption of connected devices and mobile applications that provide real-time energy tracking and personalized comfort control. Meanwhile, the proactive segment is gaining momentum through AI-enabled automation platforms capable of predicting usage patterns, reducing energy waste, and improving sustainability performance.

REGION

Germany in Europe is expected to register the highest CAGR in the global European smart home market during the forecast period.

Germany in the Europe region held the fastest growth, driven by strong government focus on carbon-neutral housing, renewable energy adoption, and sustainable urban infrastructure development. The country’s leadership in green building certifications, smart grid expansion, and IoT-enabled home automation programs is fueling large-scale smart home deployment across residential and mixed-use spaces. Government incentives promoting energy-efficient retrofitting, combined with advancements in AI-based home energy management, smart lighting, and HVAC control systems, are accelerating adoption across both single-family and multi-family residences. Additionally, the integration of renewable energy sources and cloud-connected platforms is enhancing home efficiency and user comfort, positioning Germany as a frontrunner in sustainable smart living innovation within the European market

The Asia Pacific smart home market is projected to reach USD 41.05 billion by 2030 from USD 27.77 billion in 2025, at a CAGR of 8.1 % from 2025 to 2030. The market is primarily driven by rapid urbanization, rising disposable incomes, and a growing middle-class population, which is increasing the demand for connected comfort and lifestyle enhancement technologies. Additionally, strong government smart city initiatives, expanding broadband/5G infrastructure, and a heightened focus on energy efficiency and security are accelerating adoption of smart lighting, HVAC control, security systems, and IoT-enabled home automation across the region.

The North America smart home market is projected to reach USD 45.68 billion by 2030 from USD 32.58 billion in 2025, at a CAGR of 7.0% from 2025 to 2030. Growth is due to the high disposable income and strong consumer spending support early adoption of smart home technologies. Homeowners are increasingly investing in smart security, energy management, and convenience solutions. Widespread availability of high-speed internet and strong penetration of smartphones and voice assistants make smart home systems easy to deploy and use

SMART HOMES IN EUROPE MARKET SIZE, SHARE & TRENDS: COMPANY EVALUATION MATRIX

In the European smart home market, Johnson Controls (Star) holds a leading position with a strong global presence, comprehensive product portfolio, and proven expertise in integrated home automation systems, HVAC optimization, and smart energy management solutions. The company’s continued focus on system interoperability, digital twin integration, and AI-enabled analytics has reinforced its position as a top-tier provider across residential and mixed-use buildings. SimpliSafe, Inc. (Emerging Leader) is demonstrating notable momentum through innovations in connected home security, IoT-enabled sensors, and scalable cloud-based monitoring platforms, gaining significant traction among energy-efficient and smart living projects across Europe

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Johnson Controls

- Schneider Electric

- Siemens

- Honeywell

- ASSA ABLOY

- Amazon.com, Inc.

- Apple Inc.

- Resideo Technologies Inc.

- Robert Bosch

- ABB

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 23.73 Billion |

| Market Forecast in 2030 (Value) | USD 32.67 Billion |

| Growth Rate | CAGR of 6.6% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | UK, Germany, France, Italy, Rest of Europe |

WHAT IS IN IT FOR YOU: SMART HOMES IN EUROPE MARKET SIZE, SHARE & TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Smart home device manufacturer | In-depth competitive profiling of leading European smart home vendors across lighting, HVAC, and energy management systems. Conducted strategic roadmap assessment for next-generation connected devices integrating AI, IoT, and cloud-based analytics. Included M&A and partnership landscape analysis for regional expansion and technology collaboration. | Identified emerging product innovation clusters in Western Europe |

| Property developer / facility operator | Detailed benchmarking of smart home and automation deployments across multi-residential and commercial complexes | Conducted cost–benefit evaluation of IoT-enabled HVAC, lighting, and security integration |

| Energy and housing ministry / smart city authority | Conducted policy and infrastructure readiness mapping for nationwide smart home deployments | Evaluated interoperability and data protection frameworks aligned with GDPR |

| Technology provider / IoT platform integrator | Performed market mapping of connected home platforms covering AI-based automation software, cloud-enabled data analytics, and mobile app interoperability | Conducted evaluation of cybersecurity frameworks and IoT data compliance mechanisms for European markets. |

RECENT DEVELOPMENTS

- March 2025 : Amazon India launched the Echo Spot, a smart alarm clock. The Echo Spot is designed as a smart alarm clock with a customizable display, available in Black and Blue

- March 2025 : Yale from ASSA ABLOY launched Yale Smart Lock with Matter, its next-generation smart lock designed specifically for Google Home and Matter-enabled smart home platforms. This new product represents a significant evolution from the popular Nest x Yale Lock, offering enhanced compatibility, improved features, and future-proof connectivity for smart home users

- March 2025 : Honeywell launched Honeywell Home X2S smart thermostat during the CES 2025. The thermostat is designed for easy installation and features a simple display with buttons, differentiating it from more high-tech models like the Google Nest Learning Thermostat, which typically utilize touchscreens

Table of Contents

Methodology

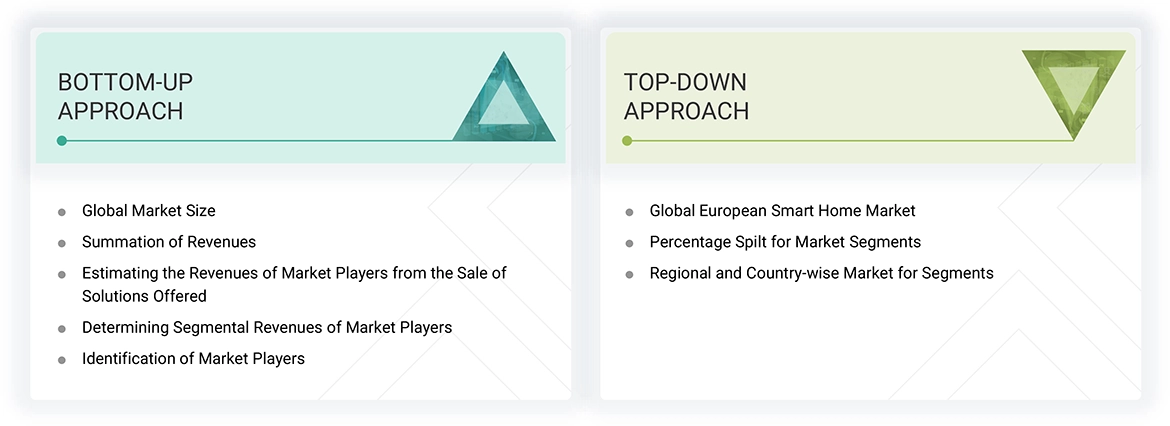

The research study involved four major steps in estimating the European smart home market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. After this, the market breakdown and data triangulation approaches have been adopted to estimate the market sizes of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market's value chain, the pool of key market players, market segmentation according to industry trends, country-level outlook, and developments from market and technology perspectives.

The European smart home report estimates the global market size using the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage splits and breakdowns have been determined using secondary sources and verified through primary sources.

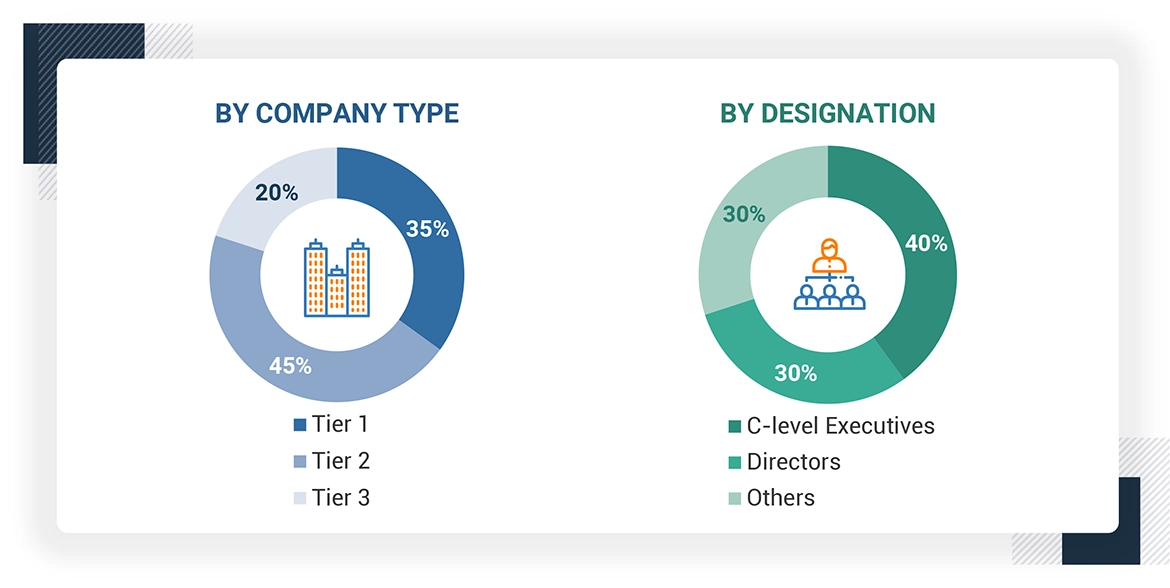

Primary Research

Extensive primary research has been conducted after understanding the European smart home market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across major countries— the UK, Germany, France, Italy, and the Rest of Europe. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data was collected mainly through telephonic interviews, which comprised 80% of the total primary interviews; questionnaires and emails were also used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce our primary research findings. This, along with the in-house subject matter experts' opinions, has led us to the findings as described in the report. The breakdown of primary respondents is as follows:

Note: Others include sales, marketing, and product managers.

About the assumptions considered for the study, To know download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the European smart home and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying top-line investments and spending in the ecosystem and considering segment-level splits and major market developments

- Identifying different stakeholders in the European smart home market that influence the entire market, along with participants across the supply chain

- Analyzing major manufacturers and service providers in the European smart home market and studying their solutions and service portfolios

- Analyzing trends related to the adoption of European smart home solutions and services

- Tracking recent and upcoming market developments, including R&D activities, product launches, collaborations, acquisitions, agreements, investments, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of European smart home devices

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

European Smart Home Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, using the market size estimation processes explained above, the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the entire market engineering process and arrive at each market segment's and subsegment's exact statistics. The data has been triangulated by studying various factors and trends from the demand and supply sides in the European smart home market.

Market Definition

A smart home is incorporated with advanced automation systems that enable inhabitants to monitor and control the functions of the house. Smart home systems enable owners to control lights remotely, such as heating, ventilation, air conditioning (HVAC), security alarms, and other household devices through smartphones, tablets, or computers. Smart homes are loaded with wired and wireless communication devices like Wi-Fi, Bluetooth, universal powerline bus (UPB), INSTEON, Z-Wave, and Zigbee to provide smart insights and information to residents by monitoring homes' different aspects on a real-time basis. As part of the Internet of Things (IoT), smart home systems and devices frequently collaborate, exchanging consumer usage data and automating behaviors according to homeowners' requirements.

According to Smart Home Energy, an association in the UK, smart homes use home automation technologies to provide homeowners with intelligent feedback and information by monitoring many aspects of a home. For instance, a smart home's refrigerator may be able to catalog its contents, suggest menus, recommend healthy alternatives, and order replacements as food is used up.

Key Stakeholders

- Raw material and manufacturing equipment suppliers

- Automation and control vendors

- Automation and control networking technology vendors

- Real estate builders

- System integrators

- Homeowners

- Project consultants

- Designers/consultants (HVAC, security, and fire and safety)

- Component manufacturers (sensors and controls)

- Home management system (products and servers) providers

- Smart home-related associations, organizations, forums, and alliances

- Government bodies associated with green buildings

Report Objectives

- To define, describe, segment, and forecast the European smart home market, by product, system type, sales channel, protocol, residence type, and installation type, in terms of value

- To forecast the market for products, in terms of volume

- To describe and forecast the market for various segments, with respect to one main region: Europe, along with their respective countries, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the European smart home market

- To provide a detailed overview of the European smart home market's supply chain, along with the ecosystem, technology trends, use cases, regulatory environment, and Porter's five forces analysis for the market

- To analyze industry trends, pricing data, patents and innovations, and trade data (export and import data) related to smart home

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To analyze competitive developments, such as product launches, collaborations, acquisitions, agreements, investments, partnerships, and research & development (R&D), carried out by players in the European smart home market

- To study the impact of AI/gen AI on the market under study, along with the macroeconomic outlook for each region considered in the scope

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the European Smart Home Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in European Smart Home Market

Albena

Aug, 2019

We are working on a feasibility study for the technological viability and commercial success of our energy management system for Bulgaria and Eastern Europe..

andres

Apr, 2022

In urgent need of European smart home report for an investment opportunity. .

Bernhard

Jul, 2014

We are a top technology leading producer for smart homes . How can we push our information in to your survey?.

Dimitris

Apr, 2019

Interested in having a thorough analysis of the European Smart Home market, as part of our strategic decision to expand our smart home product offering further to other countries..

Alessandra

Mar, 2015

I would like to buy the smart home report but would need to receive an invoice for payment in the UK or any other European country. Is that possible?.

Balazs

Feb, 2018

I would like to know what are the 5 most important smart home features and qualities the customers are ready to pay in Eastern Europe. .