Asia Pacific Smart Homes Market

Asia Pacific Smart Home Market by Product (Lighting Controls, Smart Speakers, Entertainment & Other Controls, Smart Kitchen, HVAC Controls, Security & Access Controls, Home Healthcare, Home Appliances), Offering (Behavioral, Proactive) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

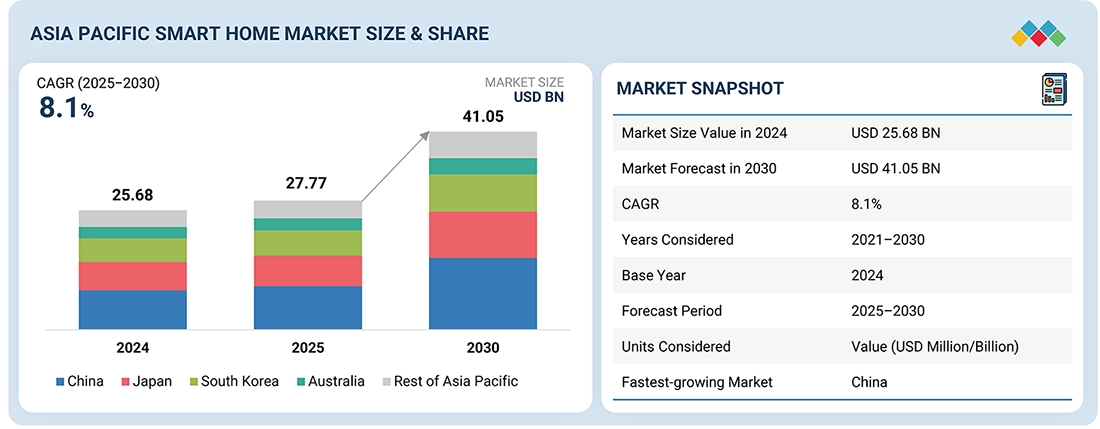

The Asia Pacific smart home market is projected to reach USD 41.05 billion by 2030 from USD 27.77 billion in 2025, at a CAGR of 8.1 % from 2025 to 2030. The market is primarily driven by rapid urbanization, rising disposable incomes, and a growing middle-class population, which is increasing the demand for connected comfort and lifestyle enhancement technologies. Additionally, strong government smart city initiatives, expanding broadband/5G infrastructure, and a heightened focus on energy efficiency and security are accelerating adoption of smart lighting, HVAC control, security systems, and IoT-enabled home automation across the region.

KEY TAKEAWAYS

-

BY COUNTRYChina is expected to dominate the market, growing at a CAGR of 9.7%, during the forecast period.

-

BY PRODUCTThe smart furniture segment is projected to register the highest CAGR of 13.8% during the forecast period.

-

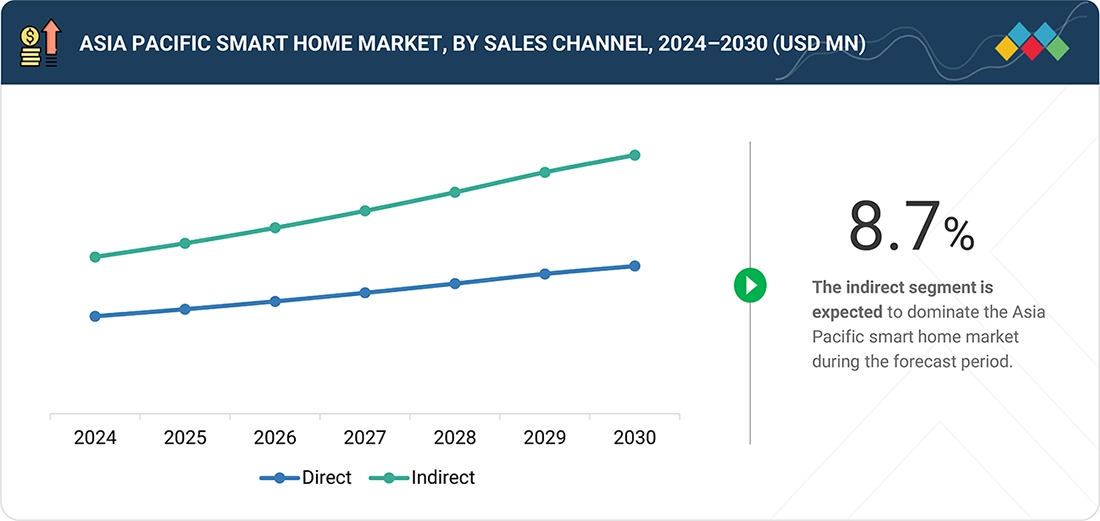

BY SALES CHANNELThe indirect segment is expected to dominate the market during the forecast period.

-

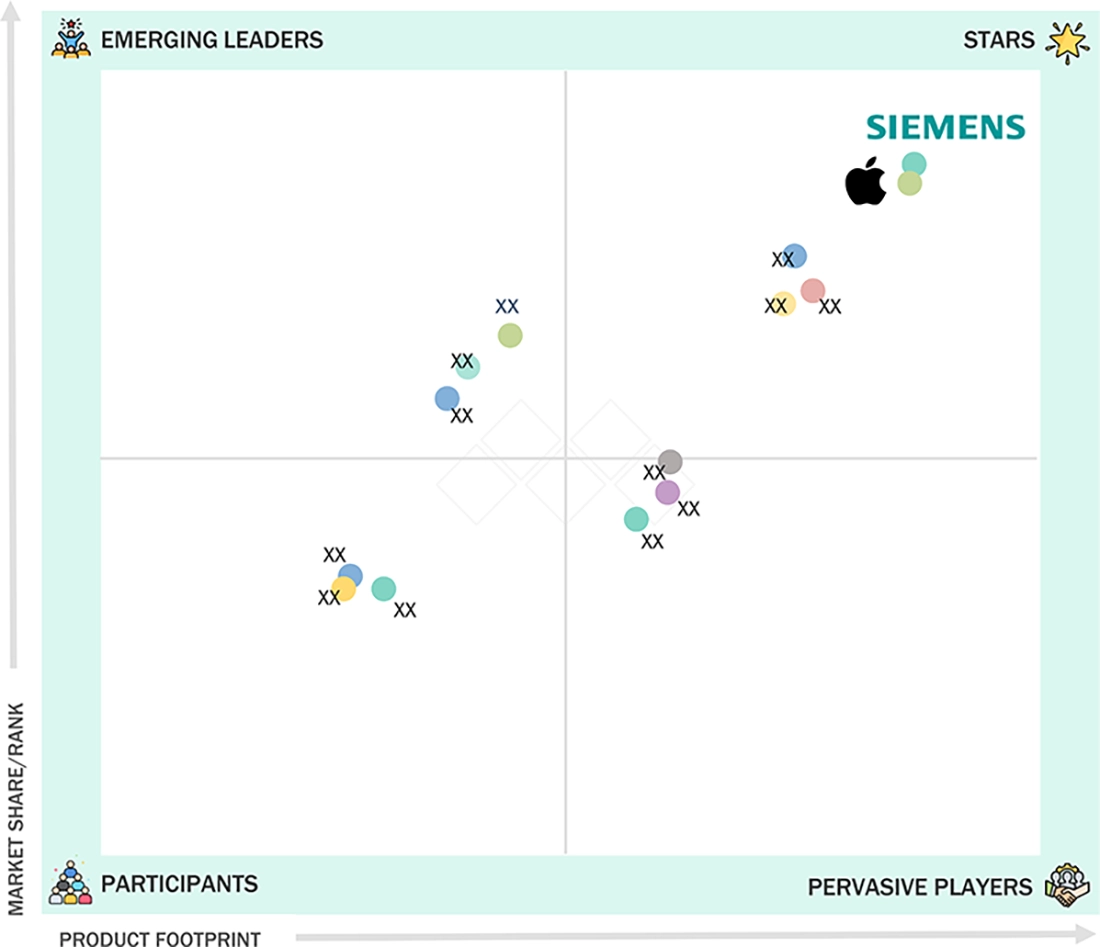

COMPETITIVE LANDSCAPE - KEY PLAYERSSiemens, Schneider Electric, and Apple Inc. were identified as some of the star players in the Asia Pacific smart home market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESLutron and Legrand have distinguished themselves among startups and SMEs due to their strong product portfolio and business strategies.

The Asia Pacific smart home industry is primarily driven by rapid urbanization, governments' smart city initiatives, expanding IoT connectivity, high demand for energy-efficient living, and the increasing consumer adoption of connected lifestyle technologies.

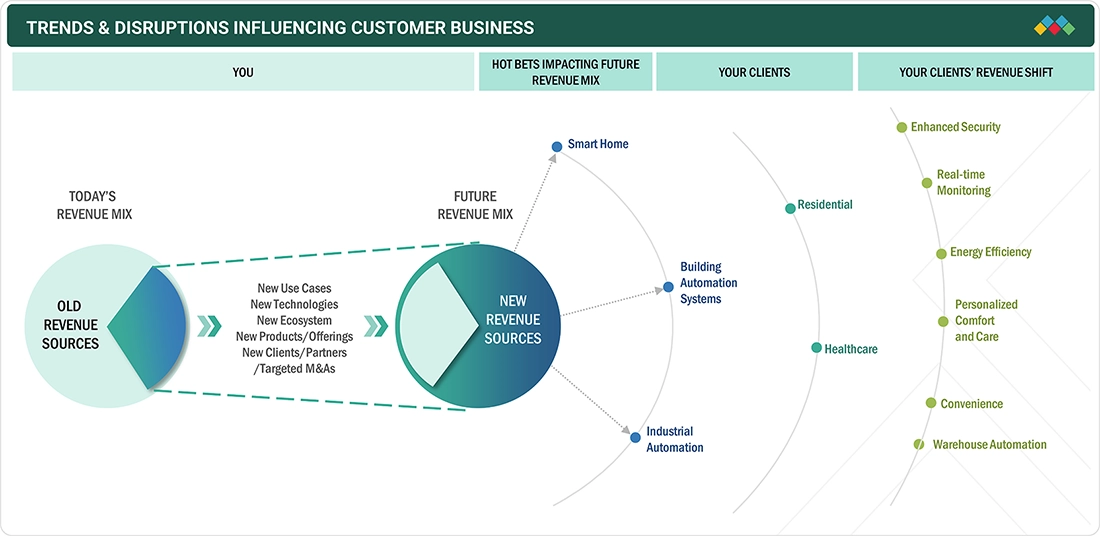

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Asia Pacific smart home market is witnessing rapid evolution driven by the increasing affordability of connected devices, strong regional manufacturing capabilities, rising integration of AI-powered voice assistants, and a growing focus on energy efficiency and sustainability across major economies, including China, Japan, India, South Korea, and Australia. The market is also shaped by heightened adoption of smart security and safety solutions, while major regional tech players such as Xiaomi, Huawei, Samsung, and Panasonic are disrupting the ecosystem with competitively priced, highly integrated platforms that challenge traditional Western dominance. At the same time, emerging standards like Matter are helping address interoperability challenges, cybersecurity, and data privacy regulations are becoming stricter, and the convergence of smart home technologies with telecom, utilities, and smart city infrastructures is fundamentally transforming how smart home solutions are deployed and monetized across the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid building automation adoption across China, Japan, and South Korea

-

Government-led digitalization initiatives

Level

-

High upfront cost versus price-sensitive consumers

-

Fragmented standards & interoperability issues

Level

-

Strong growth in affordable & localized smart devices

-

Rising demand for energy efficiency & sustainability

Level

-

Rising cybersecurity and data sovereignty concerns

-

Connectivity gaps and limited broadband penetration in rural areas

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid building automation adoption across China, Japan, and South Korea

In the Asia Pacific, particularly in China, Japan, and South Korea, the adoption of building automation and smart living technologies is accelerating due to strong government initiatives, advanced digital infrastructure, and high technology acceptance among consumers. Rapid urbanization, rising smart city deployments, and increasing integration of IoT into residential developments are driving demand for smart lighting, automated climate control, security systems, and voice-enabled home automation. These markets also benefit from strong local manufacturing capabilities, technological innovation, and collaborations between real estate developers and technology providers, significantly boosting the growth of the smart home ecosystem.

Restraint: High upfront cost versus price-sensitive consumers

Despite the increasing awareness and technological advancement in smart home solutions, the Asia Pacific smart home market still faces a major restraint in the form of high upfront installation and device costs, especially in emerging economies such as India, Indonesia, Vietnam, and the Philippines. Many households in these countries remain highly price-sensitive, prioritizing essential household spending over premium automation technologies. Additionally, the requirement for supporting infrastructure, maintenance, and ecosystem upgrades increases total ownership cost, which slows down mass adoption outside premium urban residential segments.

Opportunity: Strong growth in affordable & localized smart devices

A significant opportunity in the Asia Pacific smart home market arises from the strong presence of regional OEMs and technology brands in China, Taiwan, South Korea, and other manufacturing hubs that are enabling the production of cost-efficient, localized, and user-friendly smart home devices. Companies are increasingly launching smart lighting, security cameras, switches, plugs, and energy monitoring devices tailored to regional consumer needs and budgets. This price accessibility, coupled with easy availability through online retail platforms and telecom bundles, is enabling broader penetration beyond high-income households and encouraging mass adoption across emerging and developed markets in the region.

Challenge: Rising cybersecurity and data-sovereignty concerns

One of the key challenges impacting the Asia Pacific smart home market is the growing concern regarding data privacy, cybersecurity threats, and compliance with country-specific data sovereignty regulations. As smart home devices collect and transmit large volumes of user data, governments and consumers are becoming increasingly cautious about risks related to hacking, unauthorized access, identity breaches, and surveillance misuse. Countries like China, Japan, Singapore, and South Korea are tightening regulatory frameworks, requiring manufacturers and service providers to strengthen security encryption, local data storage, and privacy safeguards. While essential, these regulatory pressures add complexity and cost to smart home deployments across the region.

ASIA PACIFIC SMART HOMES MARKET SIZE, SHARE & GROWTH, 2030: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of integrated smart home automation systems supporting smart lighting, security, HVAC control, and energy management in urban residential developments and multi-dwelling units across Asia through IoT and building automation platforms | Enhanced home convenience, energy efficiency suited to high-density urban living, seamless connectivity with building infrastructure, and better comfort management in varying climate zones across the region |

|

Secure smart home automation platform enabling lighting, climate control, locks, and cameras with strong privacy controls across premium residential segments | High data security, reliable device performance, and unified user experience across Apple devices |

|

Implementation of smart energy management, connected switches, smart panels, smart HVAC, and home power monitoring solutions in residential and light commercial smart buildings across India, China, Australia, Japan, and ASEAN nations | Improved energy savings, sustainability compliance aligned with regional green initiatives, better air quality and comfort, predictive maintenance, and reduced electricity costs in energy-sensitive markets in the region |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific smart home ecosystem comprises established providers such as Siemens, Sony, Apple, and Schneider Electric, among others. The synergy among these players is unlocking new opportunities across areas such as AI-driven home energy optimization, IoT-enabled sensor networks, cloud-based automation platforms, and predictive maintenance analytics. These companies are continuously enhancing their portfolios with interoperable solutions, open-protocol architectures, and integrated home energy management systems, driving efficiency, sustainability, and digital transformation across the Asia Pacific residential and commercial smart living segments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Smart Home Market, By Product

Entertainment and other control systems are expected to dominate the Asia Pacific smart home market primarily due to strong consumer preference for convenience, lifestyle enhancement, and immersive digital experiences across key markets such as China, Japan, South Korea, India, and Southeast Asia. Smart TVs, streaming devices, multi-room audio, gaming systems, and voice-controlled home assistants are widely adopted because they offer immediate value, easy installation, and seamless integration with smartphones—unlike more complex automation systems that require higher investment. Additionally, the region’s young tech-savvy population, increasing broadband and 5G penetration, and rising popularity of OTT content consumption further accelerate adoption. As entertainment systems increasingly integrate with lighting, climate control, and voice assistants, they also act as entry points to broader smart home ecosystems, reinforcing their dominant position in the Asia Pacific market.

Asia Pacific Smart Home Market, By Sales Channel

The indirect sales channel is expected to dominate the Asia Pacific smart home market because consumers in the region largely rely on retail distributors, online e-commerce platforms, telecom operators, and system integrators to access smart home products. These channels provide wider product availability, competitive pricing, bundled offerings, and easy financing options, making adoption more attractive to price-sensitive and first-time users. Additionally, strong retail presence, marketplace dominance of platforms like Amazon, Alibaba, and regional e-tailers, along with strategic partnerships, significantly accelerate market penetration and consumer reach.

Asia Pacific Smart Home Market, By Installation Type

New installations are expected to dominate the Asia Pacific smart home market because rapid urbanization, increasing residential construction, and large-scale smart city developments are driving the integration of connected technologies directly into newly built homes. Real estate developers across China, Japan, South Korea, India, and Southeast Asia are increasingly offering pre-installed automation systems as value-added features to attract buyers. This approach ensures better system integration, lower incremental installation effort, and enhanced user appeal compared to retrofitting older homes, thereby significantly boosting new installation demand across the region.

Asia Pacific Smart Home Market, By Offering

Behavioral offerings are expected to dominate the Asia Pacific smart home market as consumers increasingly prefer solutions that provide real-time insights, personalized recommendations, and adaptive control to optimize comfort, energy usage, and lifestyle convenience. With growing awareness of energy efficiency, sustainability, and safety, smart devices that analyze user behavior, such as smart lighting, HVAC, security, and energy management systems, deliver tangible value by reducing utility costs and enhancing living experiences. Advancements in AI, data analytics, and IoT connectivity further strengthen adoption across both developed and emerging Asia Pacific economies.

REGION

China to be fastest-growing country across Asia Pacific smart home market during forecast period

China is expected to be the fastest-growing country in the Asia Pacific smart home market due to its massive consumer base, strong technological ecosystem, and rapid digital transformation. The country benefits from widespread urbanization, rising disposable incomes, and increasing consumer inclination toward connected lifestyles. China is home to leading smart home and IoT manufacturers such as Xiaomi, Huawei, Alibaba, and Haier, which offer highly affordable, integrated, and user-friendly smart devices, accelerating large-scale adoption across different income segments. Government initiatives supporting smart city development, 5G expansion, and digital infrastructure further strengthen the ecosystem

The North America smart home market is projected to reach USD 45.68 billion by 2030 from USD 32.58 billion in 2025, at a CAGR of 7.0% from 2025 to 2030. Growth is due to the high disposable income and strong consumer spending support early adoption of smart home technologies. Homeowners are increasingly investing in smart security, energy management, and convenience solutions. Widespread availability of high-speed internet and strong penetration of smartphones and voice assistants make smart home systems easy to deploy and use

The European smart home market is projected to grow from USD 23.73 billion in 2025 to USD 32.67 billion by 2030 at a CAGR of 6.6% during the forecast period. Growth is driven by the rising adoption of connected home technologies, smart energy management systems, and home automation devices that enhance user comfort, convenience, and energy efficiency. Government-led initiatives promoting smart grids, renewable integration, and sustainable housing development across countries such as Germany, France, and the UK are fueling market demand. Furthermore, AI-based predictive control, IoT-enabled sensors, and cloud-integrated monitoring platforms are improving real-time energy optimization, reducing wastage, and supporting Europe’s long-term decarbonization and digital transformation goals in the residential sector.

ASIA PACIFIC SMART HOMES MARKET SIZE, SHARE & GROWTH, 2030: COMPANY EVALUATION MATRIX

In the Asia Pacific smart home company evaluation matrix, Siemens, Schneider Electric, and Apple Inc. (Star) lead with a strong market presence and a wide product portfolio. The continued focus of these companies on system interoperability, digital twin integration, and AI-enabled analytics has reinforced their position as top-tier providers across residential and mixed-use buildings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Apple Inc. (US)

- Schneider Electric (France)

- Siemens (Germany)

- Honeywell International Inc. (US)

- ASSA ABLOY (Sweden)

- Johnson Controls (Ireland)

- Amazon.com, Inc. (US)

- Sony Corporation (Japan)

- ADT (US)

- Robert Bosch (Germany)

- ABB (Switzerland)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 25.68 Billion |

| Market Forecast in 2030 (Value) | USD 41.05 Billion |

| Growth Rate | CAGR of 8.1% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion/Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Country Scope | China, Japan, South Korea, Australia, and Rest of Asia Pacific |

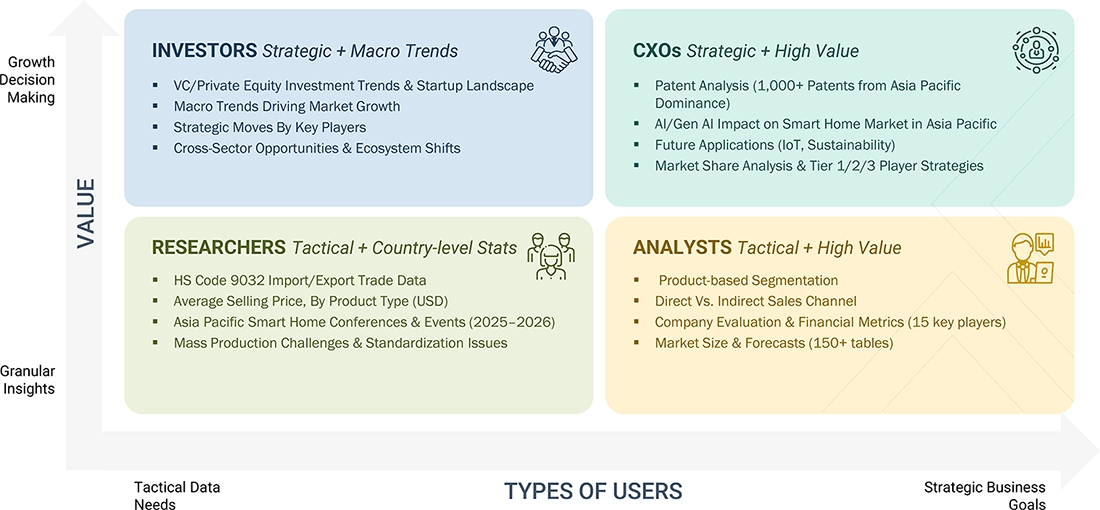

WHAT IS IN IT FOR YOU: ASIA PACIFIC SMART HOMES MARKET SIZE, SHARE & GROWTH, 2030 REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Property developer / facility operator | Conducted detailed benchmarking of smart home and building automation deployments across residential communities, luxury apartments, multi-dwelling units, and mixed-use developments in China, Japan, South Korea, India, and Southeast Asia | Delivered cost–benefit analysis of integrating smart HVAC, lighting, access control, and security systems to improve energy efficiency, sustainability compliance, occupant comfort, and property value appeal in high-density Asia Pacific cities |

| Energy & housing ministry / smart city authority | Assessed policy readiness, digital infrastructure maturity, and deployment feasibility for large-scale connected home and community initiatives aligned with regional smart city programs. Evaluated integration with energy-efficiency frameworks and sustainability mandates. | Provided guidance on interoperability standards, data privacy policies, cybersecurity frameworks, and localized regulatory compliance tailored to Asian markets, including China, Japan, Singapore, South Korea, and India |

| Technology provider / IoT platform integrator | Mapped competitive landscape of smart home platforms and IoT ecosystems across Asia Pacific, covering AI-driven automation software, cloud analytics, device interoperability, and mobile ecosystem integration (Android, iOS, regional ecosystems) | Identified market entry strategies, partnership opportunities, integration feasibility, cybersecurity readiness, and monetization models across diverse Asia Pacific consumer and regulatory environments |

| Telecom operator / Internet service provider | Evaluated opportunities for smart home bundled services, including connected home devices, security subscriptions, and home automation offerings supported by broadband and 5G expansion in Asia Pacific | Enabled revenue diversification through bundled service offerings, improved customer retention, competitive positioning, and scalable subscription-based smart home business models |

RECENT DEVELOPMENTS

- March 2025 : Yale from ASSA ABLOY launched Yale Smart Lock with Matter, its next-generation smart lock designed specifically for Google Home and Matter-enabled smart home platforms. This product represents a significant evolution from the popular Nest x Yale Lock, offering enhanced compatibility, improved features, and future-proof connectivity for smart home users.

- March 2025 : Honeywell launched the Honeywell Home X2S smart thermostat during CES 2025. The thermostat is designed for easy installation and features a simple display with buttons, differentiating it from more high-tech models like the Google Nest Learning Thermostat, which typically utilize touchscreens.

- July 2023 : Schneider Electric signed a memorandum of understanding (MoU) with SAMRIDHI GROUP to offer sustainable and technologically advanced smart home solutions. Through this agreement, SAMRIDHI GROUP will create energy-efficient and environmentally positive residential spaces powered by Schneider Electric's products, including the Wiser Smart Home Solution, Unica Pure wiring devices, and low-voltage switchgear.

Table of Contents

Methodology

The study involved four major activities in estimating the size of the Asia Pacific smart home market . Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering data center accelerator systems have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the Asia Pacific smart home market share . Secondary sources considered for this research study include government sources, corporate filings, and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of data center accelerator systems to identify key players based on their products and prevailing industry trends in the Asia Pacific smart home market share by product, offering, sales channel, and installation type, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the Asia Pacific smart home market share through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across Asia Pacific. Approximately 25% of the primary interviews were conducted with the demand-side respondents, while approximately 75% were conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephone interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been employed to arrive at the overall size of the Asia Pacific smart home market share from the revenues of key players and their share. Calculations based on revenues of the key players identified in the market led to the estimation of the market’s overall size.

- Approach to arrive at market size using bottom-up analysis (demand side)

- Initially, over 25 companies offering Asia Pacific smart home solutions were identified. Their offerings were mapped based on products, software, and services.

- After understanding the different types of Asia Pacific smart homes offered by various manufacturers, the market was categorized into different segments based on the data gathered through primary and secondary sources.

- To derive the Asia Pacific smart home market share , global shipments of top players for each smart home device in Asia Pacific considered in the scope of the report were tracked.

- A suitable penetration rate was assigned for each product type to derive the shipments of Asia Pacific smart home market.

- Market share was derived the Asia Pacific smart home market based on different product types using the average selling price (ASP) at which a particular company offers its devices. The ASP of each device was identified based on secondary sources and validated from primaries.

- For the projected market values of each device type, the Y-o-Y projections showed a steep growth initially until 2023. The market is expected to witness a sharp ascent after that, considering the demand for Asia Pacific smart homes for different applications.

- For the CAGR, the market trend analysis was carried out by understanding the industry penetration rate and the demand and supply of Asia Pacific smart homes in different applications.

- The Asia Pacific smart home market share is also tracked through the data sanity method. The revenues of over 25 key providers were analyzed through annual reports and press releases and summed to derive the overall market.

- For each company, a percentage is assigned to its overall revenue or, in a few cases, segmental revenue to derive its revenue for the Asia Pacific smart homes market. This percentage for each company is assigned based on its product portfolio and range of Asia Pacific smart homes offerings.

- The estimates at every level have been verified and cross-checked by discussing them with key opinion leaders, including CXOs, directors, and operation managers, and finally, with the domain experts at MarketsandMarkets.

Various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases, have been studied’

The top-down approach has been used to estimate and validate the total size of the Asia Pacific Smart Home Industry .

- The market size of Asia Pacific Smart Homes market was estimated through the data sanity of 25 major companies.

- The growth of the Asia Pacific smart homes industry witnessed an upward trend during the studied period, as it is currently in the initial stage of the product cycle, with major players beginning to expand their business into various application areas of the market.

- Types of smart homes, their features and properties, geographical presence, and key applications served by all players in the Asia Paciific smart home Industry were studied to estimate and arrive at the percentage split of the segments.

- Different types of smart homes and their penetration for products in Asia Pacific were also studied.

- Based on secondary research, the market split for Asia Pacific smart homes market by sales channel, offering, and installation type was estimated.

- Multiple discussions with key opinion leaders across major companies involved in developing the Asia Pacific smart home market and related components were conducted to validate the market split of sales channel, offering, and installation type.

- The regional splits were estimated using secondary sources based on factors such as the number of players in a specific country and region and the adoption and use cases of each implementation type with respect to products in the region.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the Asia Pacific smart home Industry growth.

Market Definition

A smart home is incorporated with advanced automation systems that enable inhabitants to monitor and control the functions of the house. Smart home systems enable owners to control lights, heating, ventilation, and air conditioning (HVAC), security alarms, and other household devices remotely through their smartphones, tablets, or computers. Smart homes are equipped with wired and wireless communication technologies such as Wi-Fi, Bluetooth, universal powerline bus (UPB), Insteon, Z-Wave, and Zigbee to offer intelligent insights and details to homeowners by continuously monitoring various aspects of the homes. As part of the Internet of Things (IoT), smart home systems and devices often operate together, sharing consumer usage data and automating actions based on homeowners’ preferences.

According to Smart Home Energy, an association in the UK, smart homes use home automation technologies to provide homeowners with intelligent feedback and information by monitoring many aspects of a home. For example, smart home refrigerators may be able to catalog its contents, suggest menus, recommend healthy alternatives, and order replacements as food is used up.

Key Stakeholders

- Raw Material and Manufacturing Equipment Suppliers

- Automation and Control Vendors

- Automation and Control Networking Technology Vendors

- Real Estate Builders

- System Integrators

- Homeowners

- Project Consultants

- Designers/Consultants (HVAC, Security, and Fire and Safety)

- Component Manufacturers (Sensors and Controls)

- Home Management System (Products and Servers) Providers

- Asia Pacific Smart Home-related Associations, Organizations, Forums, and Alliances

- Government Bodies Associated with Green Buildings

Report Objectives

- To define, describe, segment, and forecast the Asia Pacific smart home market, by product, offering, sales channel, and installation type, in terms of value

- To forecast the market for products, in terms of volume

- To describe the protocols and technologies used for Asia Pacific smart home market

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the Asia Pacific smart home industry

- To provide a detailed overview of the Asia Pacific smart home market supply chain, along with the ecosystem, technology trends, use cases, regulatory environment, and Porter’s five forces analysis

- To analyze industry trends, pricing data, patents and innovations, and trade data (export and import data) related to the Asia Pacific smart home market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

- To analyze opportunities for stakeholders and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as product launches/developments, collaborations, partnerships, acquisitions, and research & development (R&D) activities carried out by players in the Asia Pacific smart home Industry

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Smart Home Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Asia Pacific Smart Home Market

Shuyi

May, 2019

I am currently collecting customer data to enter Indonesian smart home market. The report could really help..