Firefighting Foam Market by Type (AFFF, AR-AFFF, PF, Synthetic Detergent Foam), End-Use Industry (Oil & Gas, Aviation, Marine, Mining), Expansion, Material Type (Surfactant, Fluorosurfactant, Perfluorooctanoic Acid (PFOA)) & Region - Global Forecast to 2026

Updated on : August 25, 2025

Firefighting Foam Market

The global firefighting foam market was valued at USD 756 million in 2021 and is projected to reach USD 913 million by 2026, growing at 3.8% cagr from 2021 to 2026. The major driver for the market includes the increasing use of environmentally friendly products and increasing fire-related accidents leading to casualties and loss of property.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the global firefighting foam market

The pandemic is estimated to have an impact on various factors of the value chain of the firefighting foam market, which is expected to reflect during the forecast period, especially in the year 2020. The impact of COVID-19 is as follows:

The COVID-19 pandemic has caused severe impacts on the global economy at various levels, and which can be seen on the oil & gas industry as well. The sector of the oil & gas industry faced a steep decline in their revenues during the lockdown period owing to the shutdown of the manufacturing units, acute shortage in the supply of raw materials and absence of potential manpower. It can be deduced from the current situations brought about by the pandemic that the production, and supply chain activities have experienced hurdles.

Firefighting Foam Market Dynamics

Driver: Increased fire-related accidents leading to casualties and loss of property

The rise in investment by the globally operating firms in the fire protection of their facilities has increased the installation of fire protection systems, which utilize automatic suppression systems due to the presence of stringent regulations. The NFPA is extending the use of its standards well beyond the US and is expected to be applicable, globally. It helps educate facility managers, business leaders, and fire professionals on the NFPA standards and other best practices in diverse locations, such as the Middle East, China, and countries in the European Union (EU), and South America.

Opportunity: Upcoming technologies to mitigate current issues related to firefighting foam

Since 2002, most of the perfluorinated surfactants contained in firefighting foams have been produced using the telomerization process. Over the years, these perfluorinated surfactants have contained perfluorinated carbon chains ranging from C4 to C24 in length. The US Environmental Protection Agency (EPA) has revealed findings that suggest some of the higher homologues can break down in the environment to produce PFOA or other PFCAs. Traditional AFFF foam concentrates and older fluoro-protein foams are being replaced with SOLBERG RE-HEALING foam concentrates, which are created utilizing a tested and authorized high-performance synthetic foam technology. Moreover, ACAF Systems have partnered with the LASTFIRE group to further understand new generation foams and demonstrate their efficiency in CAF applications.

Challenge: Existing lawsuits and litigations against major manufacturers

In January 2019, the Ohio, US, filed a lawsuit in state court against a number of manufacturers, including affiliates of the 3M company, over PFOS and PFOA contamination allegedly caused by the use of firefighting foams at various specified and unspecified locations throughout Ohio. The action aims to recover money and damages to natural resources caused by the contamination. This case has been transferred to the multi-district litigation (MDL) from the United States District Court for the Northern District of Ohio.

On the basis of type, the market is classified into AFFF, AR-AFFF, PF, synthetic detergent foam, and others. As AFFF is widely used by the oil & gas industry, the demand for AFFF was the highest in 2020. The demand for AFFF is high in the oil & gas industry due to the high risk of fires from flammable liquids.

On the basis of end-use industry, the market is classified into oil & gas, aviation, marine, mining, and others. As oil & gas industry is a major consumer of firefighting foam, it was the largest market in 2020. The high demand can be attributed to the high risk of fire accidents and the efficiency of firefighting foam in combatting such fires.

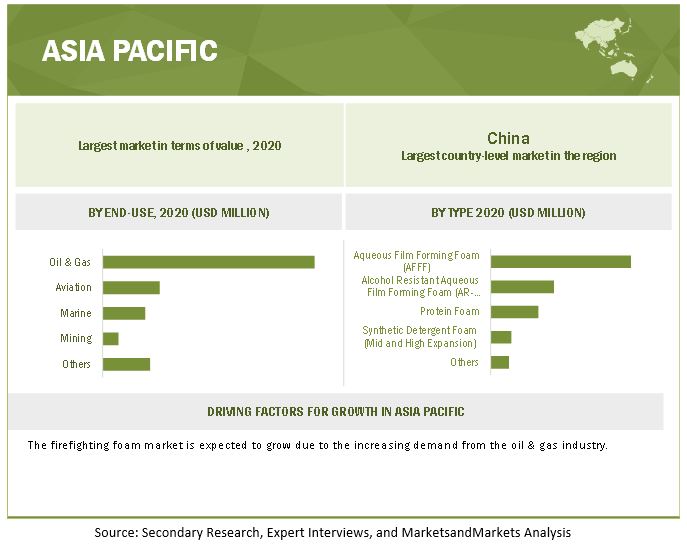

By region, the market is segregated into APAC, Europe, North America, South America, and Middle East & Africa. APAC was the largest market for firefighting foam in 2020. Various countries in the APAC are undertaking downstream activities, such as refining and processing due to the rising demand for oil & gas in the region. Various national oil companies in the region are investing in the growth of the oil & gas industry. Hence, these factors are driving the demand for firefighting foam in the APAC.

To know about the assumptions considered for the study, download the pdf brochure

Firefighting Foam Market Players

Some of the key players operating in the firefighting foam market are Johnson Controls (US), Perimeter Solutions (US), Dr. Sthamer (Germany), National Foam (US), Angus Fire (UK), Kerr Fire (UK), Eau&Feu (France), and SFFECO Global (UAE).

Firefighting Foam Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 756 Million |

|

Revenue Forecast in 2026 |

USD 913 Million |

|

CAGR |

3.8% |

|

Market Size Available for Years |

2019–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD Million ) |

|

Segments Covered |

Type, Material Type, End-Use, Expansion, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

Johnson Controls (US), Perimeter Solutions (US), Angus Fire (US), National Foam (US), Dr. Sthamer (Germany), NAFFCO (UAE), SFFECO global (UAE), Dafo Fometec AB (Sweden), Kerr Fire (England), Eau & Feu (France), Foamtech Antifire (India), Fireade Inc. (Georgia), BIOEX (France), J. F. Ahern Co. (US), Integrated Fire Protection Pvt Ltd. (India), Viking Group Inc. (US), Buckeye Fire Equipment Company (US), KV Fire Chemical Pvt Ltd. (India), 3F (UK), Profoam International (Italy), Oil technics (Firefighting Products) Ltd. (Scotland), Firechem (India), Vintex Fire Protection Pvt. Ltd. (India), COFFCO India (India), and Orchidee (Belgium) |

This research report categorizes the firefighting foam market based on type, end-use, material type, expansion, and region.

Based on Type, the firefighting foam market has been segmented as follows:

- Aqueous Film Forming Foam (AFFF)

- Alcohol Resistant Aqueous Film Forming Foam (AR-AFFF)

- Protein Foam (PF)

- Synthetic Detergent Foam (Medium and High Expansion)

- Others (Class A foams, fluorine-free foams, and other environmentally safe foam)

Based on Material Type, the firefighting foam market has been segmented as follows:

- Surfactant

- Fluorosurfactant

- Perfluorooctanoic Acid (PFOA)

- Others (Fluorotelomers, Glycol And Gums)

Based on Expansion, the firefighting foam market has been segmented as follows:

- Low

- Medium

- High

Based on End-Use, the firefighting foam market has been segmented as follows:

- Oil & Gas

- Aviation

- Marine

- Mining

- Others (Heavy Industries, Pharmaceutical Industry, Utility Industry, Solvents & Coatings Industry, and Others)

Based on Region, the firefighting foam market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In May 2021, NAFFCO signed an agreement Bee Development Authority (BDA), to develop its first US manufacturing site at the Chase Field Industrial and Air Complex.

- In April 2021, Johnson Controls launched Chemguard NFF 3×3 UL201 Foam Concentrate. This new, patent-pending, non-fluorinated foam (NFF) technology provides fast, effective fire suppression on most class B hydrocarbon and polar solvent fuel fires.

FAQs

What is the current size of the global firefighting foam market?

The market size of firefighting foams is estimated to grow from USD 756 million in 2021 to USD 913 million by 2026, at a CAGR of 3.8% during the forecast period.

Who are the leading players in the global firefighting foam market?

Some of the key players operating in the firefighting foam market are Johnson Controls International Plc. (US), Perimeter Solutions (US), Dr. Sthamer (Germany), National Foam (US), Angus Fire (UK), Kerr Fire (UK), Eau&Feu (France), and SFFECO Global (UAE). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 FIREFIGHTING FOAM MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 RESEARCH LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 1 FIREFIGHTING FOAM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 MATRIX CONSIDERED FOR DEMAND-SIDE

FIGURE 2 MAIN MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR FIREFIGHTING FOAM

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF FIREFIGHTING FOAM MARKET (1/2)

FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF FIREFIGHTING FOAM MARKET (2/2)

2.3.2.1 Calculations for supply-side analysis

2.3.3 FORECAST

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.5 DATA TRIANGULATION

FIGURE 7 FIREFIGHTING FOAM MARKET: DATA TRIANGULATION

2.6 KEY ASSUMPTIONS WHILE CALCULATING DEMAND-SIDE MARKET SIZE

2.7 LIMITATIONS

2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 37)

TABLE 2 FIREFIGHTING FOAM MARKET

FIGURE 8 AQUEOUS FILM-FORMING FOAM SEGMENT EXPECTED TO ACCOUNT FOR LARGEST SHARE

FIGURE 9 OIL & GAS TO BE LARGEST END USE OF FIREFIGHTING FOAM

FIGURE 10 ASIA PACIFIC ACCOUNTS FOR LARGEST SHARE OF FIREFIGHTING FOAM MARKET, BY VALUE

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE OPPORTUNITIES IN FIREFIGHTING FOAM MARKET

FIGURE 11 FIREFIGHTING FOAM MARKET PROJECTED TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

4.2 FIREFIGHTING FOAM MARKET, BY REGION

FIGURE 12 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF FIREFIGHTING FOAM DURING FORECAST PERIOD

4.3 FIREFIGHTING FOAM MARKET, BY TYPE

FIGURE 13 SYNTHETIC DETERGENT FOAM TO BE FASTEST-GROWING SEGMENT

4.4 FIREFIGHTING FOAM MARKET, BY END USE

FIGURE 14 OIL & GAS ACCOUNTED FOR LARGEST SHARE OF OVERALL MARKET

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FIREFIGHTING FOAM MARKET

5.2.1 DRIVERS

5.2.1.1 Increased fire-related accidents leading to casualties and loss of property

FIGURE 16 IMPACT OF DRIVERS ON FIREFIGHTING FOAM MARKET

5.2.2 RESTRAINTS

5.2.2.1 Absence of a standardized regulatory body globally for approval of firefighting foam

FIGURE 17 IMPACT OF RESTRAINTS ON FIREFIGHTING FOAM MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Upcoming technologies to mitigate current issues related to firefighting foam

5.2.3.2 Development of fluorine-free foams

FIGURE 18 IMPACT OF OPPORTUNITIES ON FIREFIGHTING FOAM MARKET

5.2.4 CHALLENGES

5.2.4.1 Existing lawsuits and litigations against major manufacturers

5.2.4.2 Stringent regulations for production of firefighting foams

FIGURE 19 IMPACT OF CHALLENGES ON FIREFIGHTING FOAM MARKET

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 FIREFIGHTING FOAM MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 3 FIREFIGHTING FOAM MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 ECOSYSTEM/MARKET MAP

FIGURE 21 FIREFIGHTING FOAM MARKET: ECOSYSTEM/MARKET MAP

5.5 VALUE CHAIN

FIGURE 22 FIREFIGHTING FOAM MARKET: VALUE CHAIN

5.6 CASE STUDY ANALYSIS

5.6.1 PER- AND POLYFLUOROALKYL SUBSTANCES FOAM CONTAMINATION AND THE TRANSITION TO FLUORINE-FREE FOAMS

5.7 TECHNOLOGY ANALYSIS

5.8 REGULATORY LANDSCAPE

TABLE 4 REPRESENTATIVE STATE AQUEOUS FILM-FORMING FOAM REGULATORY AND LEGISLATIVE ACTIVITY

TABLE 5 REPRESENTATIVE INTERNATIONAL AQUEOUS FILM-FORMING FOAM REGULATORY AND GUIDANCE ACTIVITY

5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.9 PRICE ANALYSIS

FIGURE 23 AVERAGE PRICE ANALYSIS BY PRODUCT TYPE, 2018, 2019, AND 2020

5.10 PATENT ANALYSIS

FIGURE 24 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

FIGURE 25 PUBLICATION TRENDS - LAST 10 YEARS

5.10.1 INSIGHT

FIGURE 26 LEGAL STATUS OF PATENTS

FIGURE 27 TOP JURISDICTION, BY DOCUMENT

FIGURE 28 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 10 LIST OF PATENTS BY TYCO FIRE PRODUCTS, LP

TABLE 11 LIST OF PATENTS BY JIANGSU SUOLONG FIRE SCIENCE AND TECHNOLOGY CO., LTD

TABLE 12 LIST OF PATENTS BY DUPONT

TABLE 13 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.11 IMPACT OF COVID-19 ON FIREFIGHTING FOAM MARKET

5.11.1 INTRODUCTION

5.11.2 IMPACT OF COVID-19 ON LIVES AND LIVELIHOOD

5.11.3 ECONOMIC OUTLOOK

TABLE 14 THE TABLE BELOW REPRESENTS THE ECONOMIC OUTLOOK PROJECTED BY THE IMF FOR 2021 AND 2022

5.11.4 IMPACT OF COVID-19: CUSTOMER ANALYSIS

5.11.5 IMPACT ON END USE

5.11.5.1 Oil & Gas

5.11.5.2 Aviation

5.11.5.3 Marine

5.11.5.4 Mining

5.12 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 15 FIREFIGHTING FOAM MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6 FIREFIGHTING FOAM MARKET, BY TYPE (Page No. - 72)

6.1 INTRODUCTION

FIGURE 29 AQUEOUS FILM-FORMING FOAM TO BE LARGEST SEGMENT OF FIREFIGHTING FOAM MARKET

TABLE 16 FIREFIGHTING FOAM MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 17 FIREFIGHTING FOAM MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

6.2 AQUEOUS FILM-FORMING FOAM

6.2.1 RAPID EXTINGUISHMENT PROPERTY OF AQUEOUS FILM-FORMING FOAM IS EXPECTED TO ENHANCE DEMAND

TABLE 18 AQUEOUS FILM-FORMING FOAM MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 19 AQUEOUS FILM-FORMING FOAM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 ALCOHOL-RESISTANT AQUEOUS FILM-FORMING FOAM

6.3.1 PROPERTY OF ALCOHOL-RESISTANT AQUEOUS FILM-FORMING FOAM TO EXTINGUISH FLAMMABLE LIQUID FIRE IS EXPECTED TO PROPEL DEMAND

TABLE 20 ALCOHOL-RESISTANT AQUEOUS FILM-FORMING FOAM MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 21 ALCOHOL-RESISTANT AQUEOUS FILM-FORMING FOAM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4 PROTEIN FOAM

6.4.1 HIGH STABILITY OF PROTEIN FOAM WILL DRIVE THE DEMAND OF THIS SEGMENT

TABLE 22 PROTEIN FOAM MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 23 PROTEIN FOAM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.5 SYNTHETIC DETERGENT FOAM (MEDIUM AND HIGH EXPANSION)

6.5.1 GROWTH IN MARINE INDUSTRY IS EXPECTED TO INCREASE DEMAND OF THIS SEGMENT

TABLE 24 SYNTHETIC DETERGENT FOAM MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 25 SYNTHETIC DETERGENT FOAM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.6 OTHERS

TABLE 26 OTHERS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 27 OTHERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 FIREFIGHTING FOAM MARKET, BY EXPANSION (Page No. - 81)

7.1 INTRODUCTION

7.2 LOW EXPANSION FIREFIGHTING FOAM CONCENTRATES

7.2.1 DURABILITY OF LOW EXPANSION FOAM WILL DRIVE DEMAND OF THIS SEGMENT

7.3 MEDIUM EXPANSION FIREFIGHTING FOAM CONCENTRATES

7.3.1 MEDIUM EXPANSION FOAM USED FOR MUNICIPAL FIRE DEPARTMENTS IS EXPECTED TO BOLSTER THIS SEGMENT

7.4 HIGH EXPANSION FIREFIGHTING FOAM CONCENTRATES

7.4.1 LARGE COVERAGE PROPERTY OF HIGH EXPANSION FOAM TO PROPEL DEMAND

8 FIREFIGHTING FOAM MARKET, BY MATERIAL (Page No. - 83)

8.1 INTRODUCTION

8.2 SURFACTANT

8.2.1 GOOD WETTING AND PENETRATION PROPERTIES OF SURFACTANT IS EXPECTED TO INCREASE DEMAND IN THIS SEGMENT

8.3 FLUOROSURFACTANT

8.3.1 INCREASE EFFECTIVENESS OF FLUOROSURFACTANTS TO CONTROL FIRE WILL PROPEL GROWTH IN THIS SEGMENT

8.4 PERFLUOROOCTANOIC ACID

8.4.1 PERFLUOROOCTANOIC ACID BASED FOAMS USED IN DEFENSE INDUSTRY IS EXPECTED TO DRIVE THE GROWTH IN THIS SEGMENT

8.5 OTHERS

9 FIREFIGHTING FOAM MARKET, BY END USE (Page No. - 85)

9.1 INTRODUCTION

FIGURE 30 OIL & GAS TO BE LARGEST END USE IN FIREFIGHTING FOAM MARKET

TABLE 28 FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 29 FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

9.2 OIL & GAS

9.2.1 HIGH RISK OF FIRE INCIDENTS WILL DRIVE FIREFIGHTING FOAM IN THIS SEGMENT

TABLE 30 OIL & GAS FIREFIGHTING FOAM MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 31 OIL & GAS FIREFIGHTING FOAM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 AVIATION

9.3.1 GROWING AVIATION INDUSTRY IN REGIONS, SUCH AS ASIA PACIFIC, IS EXPECTED TO DRIVE DEMAND FOR FIREFIGHTING FOAM

TABLE 32 AVIATION FIREFIGHTING FOAM MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 33 AVIATION FIREFIGHTING FOAM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 MARINE

9.4.1 FIREFIGHTING FOAM USED FOR VARIOUS APPLICATIONS IN MARINE INDUSTRY IS EXPECTED TO DRIVE DEMAND

TABLE 34 MARINE FIREFIGHTING FOAM MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 35 MARINE FIREFIGHTING FOAM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 MINING

9.5.1 GROWING DEMAND FOR FIREFIGHTING FOAM TO CONTROL MINE FIRE IS EXPECTED TO ENHANCE DEMAND FOR THIS SEGMENT

TABLE 36 MINING FIREFIGHTING FOAM MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 37 MINING FIREFIGHTING FOAM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.6 OTHERS

TABLE 38 OTHERS FIREFIGHTING FOAM MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 39 OTHERS FIREFIGHTING FOAM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 FIREFIGHTING FOAM MARKET, BY REGION (Page No. - 93)

10.1 INTRODUCTION

FIGURE 31 ASIA PACIFIC TO BE LARGEST FIREFIGHTING FOAM MARKET DURING FORECAST PERIOD

TABLE 40 FIREFIGHTING FOAM MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 41 FIREFIGHTING FOAM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 42 FIREFIGHTING FOAM MARKET SIZE, BY REGION, 2016–2020 (MILLION GALLON)

TABLE 43 FIREFIGHTING FOAM MARKET SIZE, BY REGION, 2021–2026 (MILLION GALLON)

10.2 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: FIREFIGHTING FOAM MARKET SNAPSHOT

TABLE 44 ASIA PACIFIC: FIREFIGHTING FOAM MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 45 ASIA PACIFIC: FIREFIGHTING FOAM MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 46 ASIA PACIFIC: FIREFIGHTING FOAM MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 47 ASIA PACIFIC: FIREFIGHTING FOAM MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 48 ASIA PACIFIC: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 49 ASIA PACIFIC: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.2.1 CHINA

10.2.1.1 Expanding oil & gas industry to drive demand for firefighting foams

TABLE 50 CHINA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 51 CHINA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.2.2 JAPAN

10.2.2.1 Aviation and marine industries to enhance demand for firefighting foams

TABLE 52 JAPAN: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 53 JAPAN: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.2.3 SOUTH KOREA

10.2.3.1 Downstream processing industries to drive market growth

TABLE 54 SOUTH KOREA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 55 SOUTH KOREA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.2.4 INDIA

10.2.4.1 Government investments in oil & gas industry to increase demand for firefighting foams

TABLE 56 INDIA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 57 INDIA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.2.5 INDONESIA

10.2.5.1 Foreign investments to fuel demand for firefighting foams

TABLE 58 INDONESIA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 59 INDONESIA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.2.6 REST OF ASIA PACIFIC

TABLE 60 REST OF ASIA PACIFIC: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 61 REST OF ASIA PACIFIC: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.3 EUROPE

FIGURE 33 EUROPE: FIREFIGHTING FOAM MARKET SNAPSHOT

TABLE 63 EUROPE: FIREFIGHTING FOAM MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 64 EUROPE: FIREFIGHTING FOAM MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 65 EUROPE: FIREFIGHTING FOAM MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 66 EUROPE: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 67 EUROPE: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.3.1 RUSSIA

10.3.1.1 Increased oil production activities to enhance demand for firefighting foams

TABLE 68 RUSSIA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 69 RUSSIA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 Growth of oil & gas industry to propel market

TABLE 70 GERMANY: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 71 GERMANY: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.3.3 UK

10.3.3.1 Stringent regulations to increase demand for firefighting foams

TABLE 72 UK: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 73 UK: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.3.4 FRANCE

10.3.4.1 Oil & gas industry to be largest end use segment

TABLE 74 FRANCE: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 75 FRANCE: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Developing downstream industry to drive market growth

TABLE 76 SPAIN: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 77 SPAIN: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.3.6 ITALY

10.3.6.1 Investment in oil & gas industry to enhance demand for firefighting foams

TABLE 78 ITALY: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 79 ITALY: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.3.7 REST OF EUROPE

TABLE 80 REST OF EUROPE: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 81 REST OF EUROPE: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.4 NORTH AMERICA

FIGURE 34 NORTH AMERICA: FIREFIGHTING FOAM MARKET SNAPSHOT

TABLE 82 NORTH AMERICA: FIREFIGHTING FOAM MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 83 NORTH AMERICA: FIREFIGHTING FOAM MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: FIREFIGHTING FOAM MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 85 NORTH AMERICA: FIREFIGHTING FOAM MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 87 NORTH AMERICA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.4.1 US

10.4.1.1 Oil exploration activities to increase demand for firefighting foams

TABLE 88 US: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 89 US: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.4.2 CANADA

10.4.2.1 Increasing private investment to propel demand for firefighting foams

TABLE 90 CANADA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 91 CANADA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.4.3 MEXICO

10.4.3.1 Firefighting foams used for Class B fire to increase demand

TABLE 92 MEXICO: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 93 MEXICO: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.5 SOUTH AMERICA

TABLE 94 SOUTH AMERICA: FIREFIGHTING FOAM MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 95 SOUTH AMERICA: FIREFIGHTING FOAM MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 96 SOUTH AMERICA: FIREFIGHTING FOAM MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 97 SOUTH AMERICA: FIREFIGHTING FOAM MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 98 SOUTH AMERICA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 99 SOUTH AMERICA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Increasing oil consumption to drive market growth

TABLE 100 BRAZIL: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 101 BRAZIL: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.5.2 ARGENTINA

10.5.2.1 High energy requirement to increase demand for firefighting foam

TABLE 102 ARGENTINA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 103 ARGENTINA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.5.3 REST OF SOUTH AMERICA

TABLE 104 REST OF SOUTH AMERICA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 105 REST OF SOUTH AMERICA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

TABLE 106 MIDDLE EAST & AFRICA: FIREFIGHTING FOAM MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 107 MIDDLE EAST & AFRICA: FIREFIGHTING FOAM MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 108 MIDDLE EAST & AFRICA: FIREFIGHTING FOAM MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA: FIREFIGHTING FOAM MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 110 MIDDLE EAST & AFRICA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 111 MIDDLE EAST & AFRICA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.6.1 IRAN

10.6.1.1 Increasing natural gas consumption to drive market

TABLE 112 IRAN: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 113 IRAN: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.6.2 SAUDI ARABIA

10.6.2.1 High consumption of firefighting foams in oil & gas industry

TABLE 114 SAUDI ARABIA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 115 SAUDI ARABIA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.6.3 UAE

10.6.3.1 Presence of oil reserves to drive demand for firefighting foams

TABLE 116 UAE: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 117 UAE: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

10.6.4 REST OF THE MIDDLE EAST & AFRICA

TABLE 118 REST OF THE MIDDLE EAST & AFRICA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2016–2020 (USD MILLION)

TABLE 119 REST OF THE MIDDLE EAST & AFRICA: FIREFIGHTING FOAM MARKET SIZE, BY END USE, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 136)

11.1 STRATEGIES OF KEY PLAYERS

TABLE 120 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2021

11.2 MARKET SHARE ANALYSIS

FIGURE 35 FIREFIGHTING FOAM MARKET: MARKET SHARE ANALYSIS

11.2.1 JOHNSON CONTROLS

11.2.2 PERIMETER SOLUTIONS

11.2.3 NATIONAL FOAM

11.2.4 ANGUS FIRE

11.2.5 DR. STHAMER

11.2.6 NAFFCO

TABLE 121 FIREFIGHTING FOAM MARKET: BY TYPE

TABLE 122 FIREFIGHTING FOAM MARKET: END USE

TABLE 123 FIREFIGHTING FOAM MARKET: REGION FOOTPRINT

11.3 COMPANY EVALUATION QUADRANT

11.3.1 STARS

11.3.2 PERVASIVE

11.3.3 EMERGING LEADERS

11.3.4 PARTICIPANTS

FIGURE 36 FIREFIGHTING FOAM MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

11.4 COMPETITIVE LEADERSHIP MAPPING OF SMALL & MEDIUM-SIZED ENTERPRISES (SMES), 2020

11.4.1 PROGRESSIVE COMPANIES

11.4.2 RESPONSIVE COMPANIES

11.4.3 STARTING BLOCKS

11.4.4 DYNAMIC COMPANIES

FIGURE 37 ADDITIONAL PLAYERS/SMES EVALUATION MATRIX FOR FIREFIGHTING FOAM MARKET

11.5 COMPETITIVE SCENARIO

TABLE 124 FIREFIGHTING FOAM MARKET: PRODUCT LAUNCHES, 2018–2021

TABLE 125 FIREFIGHTING FOAM MARKET: DEALS, 2018–2021

TABLE 126 FIREFIGHTING FOAM MARKET: OTHER DEVELOPMENTS, 2018–2021

12 COMPANY PROFILES (Page No. - 147)

(Business overview, Products/Solutions/Services offered, Recent developments & MnM View)*

12.1 KEY PLAYERS

12.1.1 JOHNSON CONTROLS

TABLE 127 JOHNSON CONTROLS: COMPANY OVERVIEW

FIGURE 38 JOHNSON CONTROLS: COMPANY SNAPSHOT

TABLE 128 JOHNSON CONTROLS: PRODUCT OFFERINGS

TABLE 129 JOHNSON CONTROLS: PRODUCT LAUNCH

12.1.2 PERIMETER SOLUTIONS

TABLE 130 PERIMETER SOLUTIONS: COMPANY OVERVIEW

TABLE 131 PERIMETER SOLUTIONS: PRODUCT OFFERINGS

TABLE 132 PERIMETER SOLUTIONS: DEALS

TABLE 133 PERIMETER SOLUTIONS: OTHERS

12.1.3 ANGUS FIRE

TABLE 134 ANGUS FIRE: COMPANY OVERVIEW

TABLE 135 ANGUS FIRE: PRODUCT OFFERINGS

12.1.4 NATIONAL FOAM

TABLE 136 NATIONAL FOAM: COMPANY OVERVIEW

TABLE 137 NATIONAL FOAM: PRODUCT OFFERINGS

TABLE 138 NATIONAL FOAM: PRODUCT LAUNCH

TABLE 139 NATIONAL FOAM: OTHERS

12.1.5 DR. STHAMER

TABLE 140 DR. STHAMER: COMPANY OVERVIEW

TABLE 141 DR. STHAMER: PRODUCT OFFERINGS

TABLE 142 DR. STHAMER: OTHERS

12.1.6 NAFFCO

TABLE 143 NAFFCO: COMPANY OVERVIEW

TABLE 144 NAFFCO: PRODUCT OFFERINGS

TABLE 145 NAFFCO: OTHERS

12.1.7 SFFECO GLOBAL

TABLE 146 SFFECO GLOBAL: COMPANY OVERVIEW

TABLE 147 SFFECO GLOBAL: PRODUCT OFFERINGS

12.1.8 DAFO FOMTEC AB

TABLE 148 DAFO FOMTEC AB: COMPANY OVERVIEW

TABLE 149 DAFO FOMTEC AB: PRODUCT OFFERINGS

12.1.9 KERR FIRE

TABLE 150 KERR FIRE: COMPANY OVERVIEW

TABLE 151 KERR FIRE: PRODUCT OFFERINGS

12.1.10 EAU&FEU

TABLE 152 EAU&FEU: COMPANY OVERVIEW

TABLE 153 EAU&FEU: PRODUCT OFFERINGS

12.1.11 FOAMTECH

TABLE 154 FOAMTECH: COMPANY OVERVIEW

TABLE 155 FOAMTECH: PRODUCT OFFERINGS

12.1.12 FIREADE INC.

TABLE 156 FIREADE INC.: COMPANY OVERVIEW

TABLE 157 FIREADE INC.: PRODUCT OFFERINGS

12.1.13 BIOEX

TABLE 158 BIOEX: COMPANY OVERVIEW

TABLE 159 BIOEX: PRODUCT OFFERINGS

12.1.14 J. F. AHERN CO.

TABLE 160 J. F. AHERN CO.: COMPANY OVERVIEW

TABLE 161 J. F. AHERN CO.: PRODUCT OFFERINGS

12.1.15 INTEGRATED FIRE PROTECTION PRIVATE LIMITED

TABLE 162 INTEGRATED FIRE PROTECTION PRIVATE LIMITED: COMPANY OVERVIEW

TABLE 163 INTEGRATED FIRE PROTECTION PRIVATE LIMITED: PRODUCT OFFERINGS

*Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 VIKING GROUP INC.

TABLE 164 VIKING GROUP INC.: COMPANY OVERVIEW

12.2.2 BUCKEYE FIRE EQUIPMENT

TABLE 165 BUCKEYE FIRE EQUIPMENT: COMPANY OVERVIEW

12.2.3 KV FIRE CHEMICALS PVT. LTD.

TABLE 166 KV FIRE CHEMICALS PVT. LTD.: COMPANY OVERVIEW

12.2.4 3F

TABLE 167 3F: COMPANY OVERVIEW

12.2.5 PROFOAM INTERNATIONAL

TABLE 168 PROFOAM INTERNATIONAL: COMPANY OVERVIEW

12.2.6 OIL TECHNICS (FIRE FIGHTING FOAM PRODUCTS) LIMITED

TABLE 169 OIL TECHNICS (FIRE FIGHTING FOAM PRODUCTS) LIMITED: COMPANY OVERVIEW

12.2.7 FIRECHEM

TABLE 170 FIRECHEM: COMPANY OVERVIEW

12.2.8 VINTEX FIRE PROTECTION PVT. LTD.

TABLE 171 VINTEX FIRE PROTECTION PVT. LTD.: COMPANY OVERVIEW

12.2.9 COFFCO

TABLE 172 COFFCO: COMPANY OVERVIEW

12.2.10 ORCHIDEE

TABLE 173 ORCHIDEE: COMPANY OVERVIEW

13 APPENDIX (Page No. - 187)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

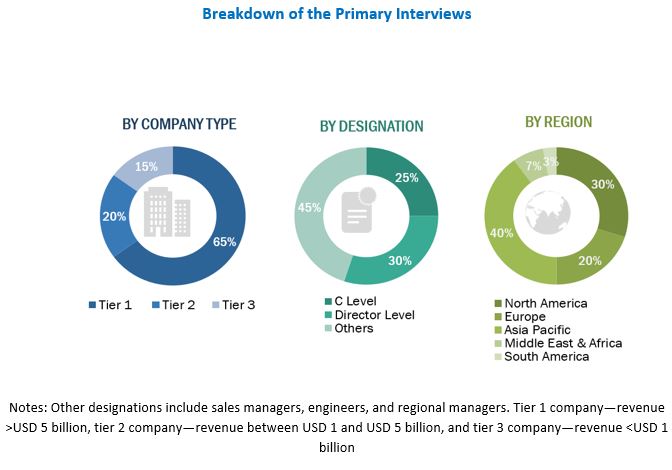

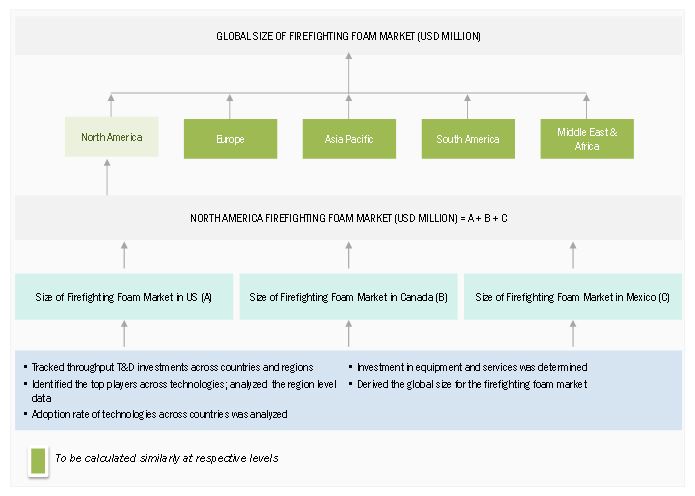

The study involved four major activities in estimating the current size of the firefighting foam market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the firefighting foam value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports; press releases and investor presentations of companies; white papers; certified publications; and articles by recognized authors, gold- and silver-standard websites, firefighting foam manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

The firefighting foam market comprises several stakeholders, such as raw material suppliers, processors, end-use industries, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of firefighting foam manufacturers, importers/exporters, and manufacturers engaged in the production of various products. The supply side is characterized by the presence of key technology providers for firefighting foam, end users, researchers, and service providers.

In the primary research process, various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders, executives, vice presidents, and CEOs of construction companies. The primary sources from the supply side included research institutions involved in R&D activities to introduce new technologies, key opinion leaders, distributors, and firefighting foam manufacturing companies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the firefighting foam market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through both primary and secondary research.

- The value chain and market size of the firefighting foam market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Firefighting foam Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

MARKET INTELLIGENCE

- To analyze and forecast the size of the firefighting foam market in terms of value

- To define, describe, and forecast the market size by type, material type, end use, expansion, and region

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market segments with respect to individual growth trends, prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as product launches, and expansions in the firefighting foam market

COMPETITIVE INTELLIGENCE

- To identify and profile the key players in the firefighting foam market

- To determine the top players offering various products in the firefighting foam market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify the key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Firefighting Foam Market