Flexible Pipe Market by Raw Material (HDPE, PA, and PVDF), Application (Offshore and Onshore), and Region (North America, Middle East & Africa, Central & South America, Asia-Pacific, and Europe) - Global Forecast to 2022

To get the latest information, inquire now!

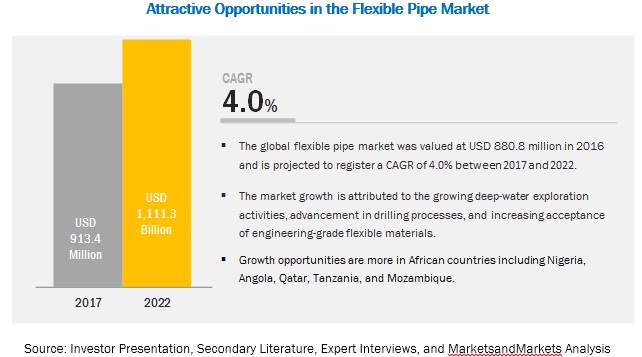

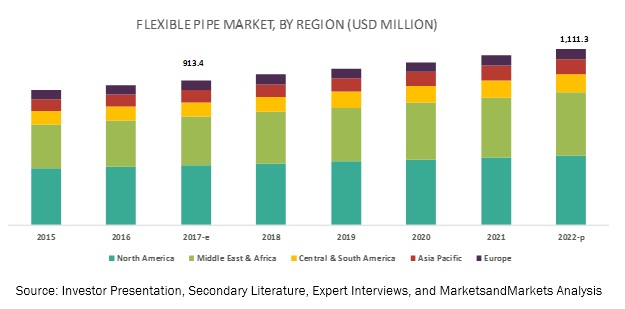

[118 Pages Report] MarketsandMarkets forecasts the flexible pipe market to grow from USD 880.8 million in 2016, and projected to reach USD 1,111.3 million by 2022, registering a CAGR of 4.0% from 2017 to 2022. The market growth is primarily attributed to the increase in oil & gas exploration activities, rise in demand for non-corrosive pipes, and acceptance of engineering-grade flexible materials. Moreover, rising growth of deep-water exploration coupled with technological advancement in drilling process are the key factors driving the global flexible pipe market.

By Raw material, High-density polyethylene (HDPE) to dominate the flexible pipe market between 2017-2022

HDPE is estimated to be the largest and fastest growing segment in the global flexible pipe market. HDPE-based flexible pipe is easy to install and also possess excellent physical properties that propels its demand in the global market. Moreover, it is more cost effective as compared to PA, PVDF, and other materials that further driving the market for HDPE in flexible pipe manufacturing.

By Application, offshore accounted for the largest share in the flexible pipe market in 2016

The demand for flexible pipe is higher in offshore application due to growing deep water, ultra-deep water, and subsea exploration activities. Moreover, the price of offshore flexible pipe is much higher compared to the flexible pipe used in onshore applications, which in turn increases the value market for offshore application.

North America to lead the flexible pipe market during the forecast period

North America accounted for the largest market size for flexible pipe, in 2016 and would continue to lead the market throughout the forecast period. Presence of leading market players and large number of oil & gas drilling in U.S. and Canada are the key factors attributing the market growth of this region.

Market Dynamics

Driver: Technological advancement in drilling process

Technological advances in drilling process have revolutionized the oil & gas industry and enabled access to the most remote locations, unconventional formations, deepwater regions, and even the Arctic. Such developments have played a key role in driving the consumption of flexible pipes. Horizontal drilling along with hydraulic fracturing has unlocked the unconventional potential of several regions. For instance, the shale gas boom in North America and new offshore oilfield discoveries in Europe and Africa. In North America, the horizontal rigs accounted for the highest share of 78% of the overall rig count, whereas vertical and directional rigs accounted for a share of 11%, each, as of June 2015. The rig count in June 2015 for horizontal, directional, and vertical rigs were recorded to be 13%, 25%, and 62%, respectively. Horizontal drilling enables the operators to drill long and lateral wells to access the whole reservoir. The increasing adoption of lateral drilling techniques is anticipated to increase the demand for flexible pipes, as it encourages boring of new reservoirs. These new drilling techniques also incorporate hydraulic fracturing that includes pumping water into underground reservoir rocks at high pressure to make cracks in the formation. This causes the trapped petroleum reserves, which can be extracted later, to be released. Hydraulic fracturing when used in conjunction with horizontal drilling provides drilling access to unconventional resources. This technique is widely used in new drilling activities, particularly in regions such as North America, South America, Asia-Pacific, and Africa, thus fueling the growth of the global flexible pipe market.

Restraint: Stringent regulation in oil & gas industry

The environmental regulations in the oil & gas industry are becoming stringent due to the harmful potential of well-drilling activities. Drilling activity in subsurface reservoirs can make hydraulic channels between contaminated surface water and the relatively pure underground water, which in turn contaminates the drinking water supply eventually. Various judicial acts, for example, the Clean Water Act (1972), the New York’s State Environmental Quality Review Act (1975), and the Oil Pollution Act (1990) have been established to prevent such issues. These legislations apply to drilling activities within the U.S., while international conventions, such as the Baltic Sea Convention (1972), Barcelona Convention (1975), and Kuwait Convention (1978), are responsible for regulating the disposal of drilling discharges in other regions of the world. These regulations reduce the oil in water content by mandating limits such as 40 mg per liter (Kuwait Convention), 15 mg per liter (Baltic Sea Convention), and 29 mg per liter (U.S. Gulf of Mexico regulations). This translates to additional costs for treating the produced water during drilling activities, thus affecting the revenue of offshore and onshore drilling service companies, which in turn affects the revenue of flexible pipes companies.

Opportunity: Increasing exploration of horizontal wells

Flexible composite pipes are used as a part of shallow and long horizontal wells. These composite pipes are ideal, as they can be effectively withdrawn from these wells. Currently, the oil & gas industry is witnessing a shifting trend with respect to drilling type. Directional drilling is growing rapidly in comparison to vertical drilling. The production rate of horizontal wells is more than twofold in contrast with verticals wells. An increase in horizontal wells is a prospective growth opportunity for the flexible pipe market owing to their high application in these wells

Challenge: Decreasing crude oil prices

The decrease in oil price has constrained market players to actualize cost-cutting measures, for example, workforce layoffs and rig idling. The prices of Brent crude oil started declining after reaching a peak price of USD 111.6 per barrel in 2012 and were recorded to be USD 43.7 per barrel in 2016. Expensive activities within the oil & gas industry, including drilling and exploration, were curtailed, thus reducing the use of flexible pipes. The North American rig count was 984 rigs in May 2015, a year-on-year decline of 53%. Thus, the decline in oil prices is a major restraint for the global flexible pipe market. As a result of sustained lower crude oil prices, several offshore drilling players have started cutting expenses by reducing the size of their operation, which in turn has influenced the revenue of flexible pipes companies.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2015–2022 |

|

Base year considered |

2016 |

|

Forecast period |

2017–2022 |

|

Forecast units |

Million (USD) |

|

Segments covered |

By Raw Material (HDPE, PA, and PVDF), Application (Offshore and Onshore), and Region |

|

Geographies covered |

North America, Europe, APAC, South America, and Middle East & Africa |

|

Companies covered |

National Oilwell Varco (US), Technipfmc PLC (France), Prysmian Group (Italy), GE Oil & Gas Corporation (UK), Shawcor Ltd. (Canada), Pipelife Nederland B.V. (The Netherlands), Airborne Oil & Gas B.V. (The Netherland), Magma Global Ltd. (UK), Contitech AG (Germany), Flexsteel Pipeline Technologies Inc. (US), and others |

The research report categorizes the Flexible pipe to forecast the revenues and analyze the trends in each of the following sub-segments:

On the Basis of Raw material:

- High-Density Polyethylene

- Polyamides

- Polyvinylidene Fluoride

- Others

On the Basis of Ingredient:

-

Offshore

- Deepwater

- Ultra-deep water

- Subsea

- Onshore

On the Basis of Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Key Market Players

National Oilwell Varco (US), Technipfmc PLC (France), Prysmian Group (Italy), GE Oil & Gas Corporation (UK), Shawcor Ltd. (Canada), Pipelife Nederland B.V. (The Netherlands), Airborne Oil & Gas B.V. (The Netherland), Magma Global Ltd. (UK), Contitech AG (Germany), Flexsteel Pipeline Technologies Inc. (US), and others

National Oilwell Varco (US), Technipfmc PLC (France), and Airborne Oil & Gas B.V. (The Netherlands) are among the key players who are adopting several organic and inorganic growth strategies to strengthen their foothold in flexible pipe markets. These companies have adopted several strategies like technology & innovation, contract, joint venture and investment between 2015 and 2017.

Recent Developments

- In February 2017, Airborne Oil & Gas has been awarded a qualification program from Royal Dutch Shell plc (Netherlands) for a high-pressure, deepwater TCP jumper spool. Its first application is expected in the Gulf of Mexico region. The light weight and flexible nature of the polymer pipes could considerably help in reducing the operational cost for exploration in deep waters. Moreover, the high-pressure jumper spool represents a relevant step toward future deployment of Deepwater composite risers.

- In January 2017, National Oilwell Varco (NOV) has brought about innovation in oil and gas technology, recently. The company has developed an automated casing monitoring system, named cerT&D. This system has potential application in automated casing monitoring in several projects. Using the system has allowed 3ROC (Three Rivers Operating Company) to avoid the tensile limit capacity of the rig site/pipe equipment and reach total depth (TD) without any damage to the equipment or casing.

- In February 2016, Technip was awarded a contract by Deep Gulf Energy III, LLC (“DGE”) for the development of the South Santa Cruz and Barataria fields. Along with other requirements, the contract includes the fabrication and installation of approximately 23 km of pipe-in-pipe flow lines.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the flexible pipe market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Significant Opportunities in the Flexible Pipe Market

4.2 Flexible Pipe Market Share, By Application and Region

4.3 Flexible Pipe Market, By Raw Material, 2015–2022

4.4 Flexible Pipe Market Size, By Leading Countries, 2017–2022 (USD Million)

4.5 Flexible Pipe Market Share, By Region

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Growth of Deepwater Exploration

5.2.1.2 Growing Acceptance of Engineering Grade Flexible Materials

5.2.1.3 Rising Demand for Non-Corrosive Pipes in Oil & Gas Industry

5.2.1.4 Technological Advances in Drilling Process

5.2.2 Restraints

5.2.2.1 Stringent Regulations in Oil & Gas Industry

5.2.3 Opportunities

5.2.3.1 Increasing Exploration of Horizontal Wells

5.2.3.2 Discovery of New Oil Reserves

5.2.4 Challenges

5.2.4.1 Decreasing Crude Oil Prices

5.2.4.2 Large-Scale Manufacturing

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Bargaining Power of Buyers

5.3.3 Threat of Substitutes

5.3.4 Threat of New Entrants

5.3.5 Intensity of Competitive Rivalry

6 Flexible Pipes, By Raw Material (Page No. - 37)

6.1 Introduction

6.2 High-Density Polyethylene

6.3 Polyamides

6.4 Polyvinylidene Fluoride

6.5 Others

7 Flexible Pipes, By Type (Page No. - 40)

7.1 Introduction

7.2 Risers

7.3 Flow Lines

7.4 Jumpers

7.5 Fluid Transfer Lines

8 Flexible Pipes, By Application (Page No. - 41)

8.1 Introduction

8.2 Offshore

8.2.1 Deepwater

8.2.2 Ultra-Deep Water

8.2.3 Subsea

8.3 Onshore

9 Flexible Pipes, By Region (Page No. - 44)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.3 Middle East & Africa

9.3.1 Saudi Arabia

9.3.2 UAE

9.3.3 Qatar

9.3.4 Nigeria

9.3.5 Angola

9.3.6 Tanzania

9.3.7 Mozambique

9.3.8 Rest of Middle East & Africa

9.4 Central & South America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Rest of Central & South America

9.5 Asia-Pacific

9.5.1 China

9.5.2 Indonesia

9.5.3 Australia

9.5.4 Malaysia

9.5.5 India

9.5.6 Rest of Asia-Pacific

9.6 Europe

9.6.1 Russia

9.6.2 Norway

9.6.3 U.K.

9.6.4 Turkey

9.6.5 Denmark

9.6.6 Rest of Europe

10 Competitive Landscape (Page No. - 80)

10.1 Introduction

10.1.1 Dynamics

10.1.2 Innovators

10.1.3 Vanguards

10.1.4 Emerging

10.2 Competitive Benchmarking

10.3 Strength of Product Offerings

10.4 Business Strategy Excellence

10.5 Market Ranking

11 Company Profiles (Page No. - 84)

(Overview, Financials, Products & Services, Strategy, and Developments)*

11.1 National Oilwell Varco (Nov)

11.2 Technipfmc PLC

11.3 Prysmian Group

11.4 GE Oil & Gas Corporation

11.5 Shawcor Ltd.

11.6 Pipelife Nederland B.V.

11.7 Airborne Oil & Gas B.V.

11.8 Magma Global Ltd.

11.9 Contitech AG

11.1 Flexsteel Pipeline Technologies Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 110)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (74 Tables)

Table 1 Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 2 High-Density Polyethylene: Flexible Pipe Market Size, By Region, 2015–2022 (USD Million)

Table 3 Polyamides: Flexible Pipe Market Size, By Region, 2015–2022 (USD Million)

Table 4 Polyvinylidene Fluoride: Flexible Pipe Market Size, By Region, 2015–2022 (USD Million)

Table 5 Others: Flexible Pipe Market Size, By Region, 2015–2022 (USD Million)

Table 6 Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 7 Offshore: Flexible Pipe Market Size, By Region, 2015–2022 (USD Million)

Table 8 Onshore: Flexible Pipe Market Size, By Region, 2015–2022 (USD Million)

Table 9 Flexible Pipe Market Size, By Region, 2015–2022 (USD Million)

Table 10 North America: Flexible Pipe Market Size, By Country, 2015–2022 (USD Million)

Table 11 North America: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 12 North America: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 13 U.S.: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 14 U.S.: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 15 Canada: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 16 Canada: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 17 Middle East & Africa: Flexible Pipe Market Size, By Country, 2015–2022 (USD Million)

Table 18 Middle East & Africa: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 19 Middle East & Africa: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 20 Saudi Arabia: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 21 Saudi Arabia: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 22 UAE: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 23 UAE: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 24 Qatar: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 25 Qatar: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 26 Nigeria: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 27 Nigeria: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 28 Angola: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 29 Angola: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 30 Tanzania: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 31 Tanzania: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 32 Mozambique: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 33 Mozambique: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 34 Rest of Middle & Africa: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 35 Rest of Middle & Africa: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 36 Central & South America: Flexible Pipe Market Size, By Country, 2015–2022 (USD Million)

Table 37 Central & South America: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 38 Central & South America: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 39 Brazil: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 40 Brazil: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 41 Mexico: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 42 Mexico: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 43 Rest of Central & South America: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 44 Rest of Central & South America: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 45 Asia-Pacific: Flexible Pipe Market Size, By Country, 2015–2022 (USD Million)

Table 46 Asia-Pacific: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 47 Asia-Pacific: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 48 China: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 49 China: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 50 Indonesia: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 51 Indonesia: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 52 Australia: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 53 Australia: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 54 Malaysia: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 55 Malaysia: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 56 India: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 57 India: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 58 Rest of Asia-Pacific: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 59 Rest of Asia-Pacific: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 60 Europe: Flexible Pipe Market Size, By Country, 2015–2022 (USD Million)

Table 61 Europe: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 62 Europe: Flexiblepipe Market Size, By Application, 2015–2022 (USD Million)

Table 63 Russia: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 64 Russia: Flexiblepipe Market Size, By Application, 2015–2022 (USD Million)

Table 65 Norway: Flexiblepipe Market Size, By Raw Material, 2015-2022 (USD Million)

Table 66 Norway: Flexible Pipe Market Size, By Application, 2015-2022 (USD Million)

Table 67 U.K.: Flexiblepipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 68 U.K.: Flexiblepipe Market Size, By Application, 2015–2022 (USD Million)

Table 69 Turkey: Flexiblepipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 70 Turkey: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 71 Denmark: Flexiblepipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 72 Denmark: Flexible Pipe Market Size, By Application, 2015–2022 (USD Million)

Table 73 Rest of Europe: Flexible Pipe Market Size, By Raw Material, 2015–2022 (USD Million)

Table 74 Rest of Europe: Flexiblepipe Market Size, By Application, 2015–2022 (USD Million)

List of Figures (32 Figures)

Figure 1 Flexible Pipes: Market Segmentation

Figure 2 Flexible Pipe Market: Research Design

Figure 3 Key Industry Insights

Figure 4 Breakdown of Primary Interviews

Figure 5 Bottom-Up Approach

Figure 6 Top-Down Approach

Figure 7 Flexible Pipe Market: Data Triangulation

Figure 8 Hdpe Segment Dominates Overall Flexible Pipe Market

Figure 9 Offshore Application to Be the Faster-Growing Segment Between 2017 and 2022

Figure 10 Middle East & Africa to Be Fastest-Growing Market Between 2017 and 2022

Figure 11 Attractive Opportunities in the Flexible Pipe Market, 2017 vs. 2022 (USD Million)

Figure 12 Offshore Application Accounted for Larger Share Flexible Pipe Market, 2016

Figure 13 Hdpe Segment to Dominate Overall Flexible Pipe Market

Figure 14 U.S. is the Largest Market for Flexible Pipes, 2017–2022

Figure 15 North America Accounted for Largest Share of Flexible Pipe Market in 2016

Figure 16 Drivers, Restraints, Opportunities, and Challenges in Flexible Pipe Market

Figure 17 Regional Distribution of Undiscovered Arctic Oil Resources

Figure 18 Europe Brent Crude Oil Prices, 2011–2016 (USD Per Barrel)

Figure 19 Porter’s Five Forces Analysis

Figure 20 Hdpe to Be Fastest-Growing Segment for Flexible Pipe Market, Between 2017 and 2022

Figure 21 Offshore is Faster-Growing Application Segment of Flexible Pipe Market, Between 2017 and 2022

Figure 22 Nigeria, Tanzania, Mozambique, Malaysia, and Indonesia Emerging as the New Hotspots

Figure 23 The U.S. to Dominate the Flexible Pipe Market in North America Between 2017 and 2022

Figure 24 Hdpe Material Segment to Dominate Flexible Pipe Market in the U.S. Between 2017 and 2022

Figure 25 Hdpe Segment to Dominate the Flexible Pipe Market in the Middle East & Africa

Figure 26 China to Dominate the Flexible Pipe Market in Asia-Pacific Between 2017-2022

Figure 27 Dive Chart

Figure 28 Flexible Pipe Market Ranking

Figure 29 National Oilwell Varco (Nov): Company Snapshot

Figure 30 Prysmian Group: Company Snapshot

Figure 31 GE Oil & Gas Corporation: Company Snapshot

Figure 32 Shawcor Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Flexible Pipe Market

Market segmentation by raw materials for oil & gas application

Information on flexible piping for oil export operations

Information about the flexible pipeline laying market