Thermoplastic Pipe Market by Product Type (TCP and RTP), Polymer Type (PE, PP, PVDF, PVC, Others), Application (Onshore & Offshore), End-user Industry (Oil & Gas, Water & Wastewater Treatment, Mining & Dredging) and Region - Global Forecast to 2026

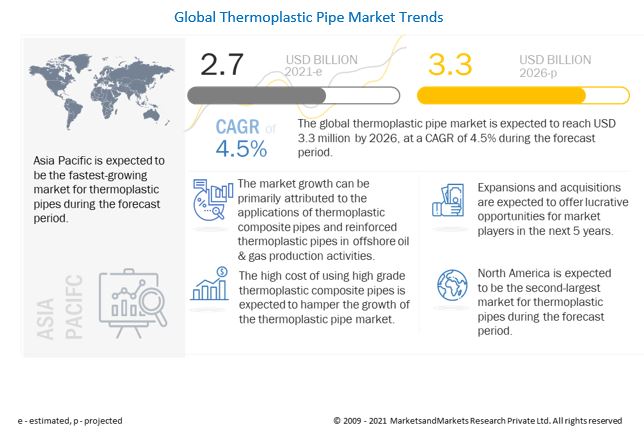

[303 Pages Report] The global thermoplastic pipe market size was valued at $2.7 billion in 2021 and to reach $3.3 billion by 2026, growing at a compound annual growth rate (CAGR) of 4.5% from 2021 to 2026. The increasing application of thermoplastic composite pipes and reinforced thermoplastic pipes in offshore and onshore production activities is the main driver for the thermoplastic pipe market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Thermoplastic pipe Market

The outbreak of the COVID-19 pandemic has had an adverse impact on the global economy as governments worldwide were forced to implement lockdowns to prevent the spread of the virus. As a result, the operations of oil & gas transportation were hampered. The immediate impact of the COVID-19 pandemic was the low demand for crude oil, leading to lower demand for thermoplastic pipes, which are used to transport oil & gas to the end user’s site. Moreover, the pandemic has interrupted the water treatment sector as well, of which thermoplastic pipes are an integral part.

The implementation of stringent lockdown measures—partial or full—led to a halt of industrial operations. Besides, due to the unavailability of the workforce and decline in logistical operations, the functioning of the thermoplastic piping system was affected. Additionally, due to the outbreak of COVID-19, one of the ongoing projects of Shell Chemical was suspended temporarily in Pennsylvania, which consequently hampered the growth of thermoplastic pipe manufacturers as the orders for these pipes had declined until the construction of projects resumed.

Market Trends

Thermoplastic pipe Market Dynamics

Driver: Increasing application of thermoplastic composite pipes and reinforced thermoplastic pipes in offshore and onshore production activities

The oil & gas industry uses steel as a key material in manufacturing a variety of tubes and pipes. In the onshore industry, steel continues to be used dominantly in products such as coiled tubing and flow lines. However, thermoplastic composites are primarily used for offshore applications, such as chemical injection pipes and risers. Its properties, such as wear and corrosion resistance, better stiffness, and strength with respect to changes in temperature and deformation due to stress, make it highly effective for underwater applications. Offshore drilling and production activities are expected to increase in the next five years at a greater pace than onshore activities, given the increasing importance of deep and ultra-deepwater oil & gas production and exploration activities, as demand for fossil fuels has intensified. Therefore, thermoplastic composites’ application in offshore products, such as flowlines, umbilical, and risers, is likely to drive the thermoplastic pipe market in the oil & gas industry.

On the other hand, reinforced thermoplastic pipes (RTP) are being used in the oil & gas industry, where it is used to replace medium-pressure steel pipes. Various significant companies, which are certified for international standards, design pipes with a pressure capacity of up to 450 bar or 6527 psi and can be used for onshore applications. Moreover, these wholly plastic pipes use thermoset-based composite parts that are ideal for onshore applications.

Restraints: High cost of using high-grade thermoplastic composite pipes

Thermoplastic pipes made from engineering thermoplastic grades such as polyethylene (PE) and polyvinyl chloride (PVC) have been used extensively due to their cost-effectiveness and excellent chemical resistance properties. Higher grades of thermoplastics, such as polyether ether ketone (PEEK), have limited applications in seals and wirelines as they are expensive. These pipes provide good abrasion resistance, low flammability, and reduced emission of smoke and toxic gases, but they also have high raw material and fabrication costs. Compared with steel, composite pipes made of PEEK or polyphenylene sulfide (PPS) cost 20–100 times more, making its application impossible for products such as pipes, thus becoming the most common obstacle for the thermoplastic pipe market.

Opportunities: Growing deep- and ultra-deepwater oil & gas exploration and production activities

As the oil & gas reserves in shallow waters are running dry, producers are turning to deep- and ultra-deepwater off the coasts of Brazil, Norway, Angola, and the US. For instance, in May 2019, Strohm collaborated with SÍMEROS TECHNOLOGIES, an engineering company, to deliver Thermoplastic Composite Pipe (TCP) risers in the deepwater region of Brazil. Bringing the fluids through 3,000 m of water to the surface poses various challenges for well operators. The temperature and pressure ratings are high in deep and ultra-deepwater and increased CO2 and H2S content scour and weaken steel. Also, in deepwaters, increased pressure and currents drag the pipes through the water. To overcome these problems, companies produce flexible pipes for the oil & gas industry by winding layers of thermoplastic composite reinforced with glass or carbon fibers around a polymer liner. Moreover, thermoplastic composite pipes are much lighter than flexible steel pipes, so operators can use simpler and less expensive equipment to install them. Additionally, the ease of handling and the potential use of “no-dig” technology for installing the flexible pipes, which can be delivered to the site in long coils, help reduce jointing and traffic disruption. Hence, the benefits of using flexible composite pipes in deep- and ultra-deepwater applications are expected to pose more opportunities for the thermoplastic pipe market.

Challenges: Difficulties in large-scale manufacturing of thermoplastic composite pipes

Thermoplastic composite pipe fabricators for the oil & gas industry usually have to procure raw materials (polymer) directly from the manufacturers because the fabricators have to work in sync with the operational requirements of oil companies and the quality of material provided by suppliers. Thermoplastic composite pipes are customized products that require modifications, depending on end-use conditions, such as pressure, temperature, and corrosion. Subsequently, the modifications are usually in polymer composition or processing conditions, which can be carried out only if there is close coordination between polymer manufacturers and the pipe fabricator. This constraint in standardization makes large-scale manufacturing of composite pipes a difficult prospect, contributing to the overall high cost of thermoplastic pipes.

By Product Type, the reinforced thermoplastic pipes segment is expected to make the largest contribution to the thermoplastic pipe market during the forecast period.

RTPs are different from TCPs as they are used in applications with lower pressure ratings (up to 70 bar) and less demanding temperatures. RTPs are mainly used in onshore applications—sometimes offshore in very shallow water of about 30 m depth. The increasing usage of RTPs in the water & wastewater treatment industry is likely to fuel their demand globally.

By Polymer Type, the polyethylene (PE) segment is expected to be the largest and fastest-growing segment during 2021-2026.

There are two variants of PE pipes available in the market, i.e., HDPE (high-density polyethylene pipes) and PEX (cross-linked polyethylene). The crosslinked structure of polyethylene enhances the toughness and temperature resistance of the material. This enables the content to be specified for use in more harsh environments both at lower and higher temperatures. Lightweight, flexible, and easy to weld properties of polyethylene (PE) is expected to foster its demand in the thermoplastic pipe market.

By End-user Industry, the utilities segment is expected to dominate to the thermoplastic pipe market during the forecast period.

The oil & gas segment uses thermoplastic pipes for various applications, such as high-pressure water injection pipelines, water transport & distribution, effluent water disposal, temporary surface lines, well intervention, and seawater intake & discharge lines. Countries such as US, China, Russia, and some of the countries have started installing thermoplastic composite pipe (TCP) because of its cost, durability, and light weight advantages over steel pipes which is likely to foster its demand.

By Application, the onshore segment is expected to dominate to the thermoplastic pipe market during the forecast period.

The asset performance management segment is expected to dominate the global thermoplastic pipe market owing to its use in the onshore industry for various applications including high-pressure water injection pipelines and transportation, among others

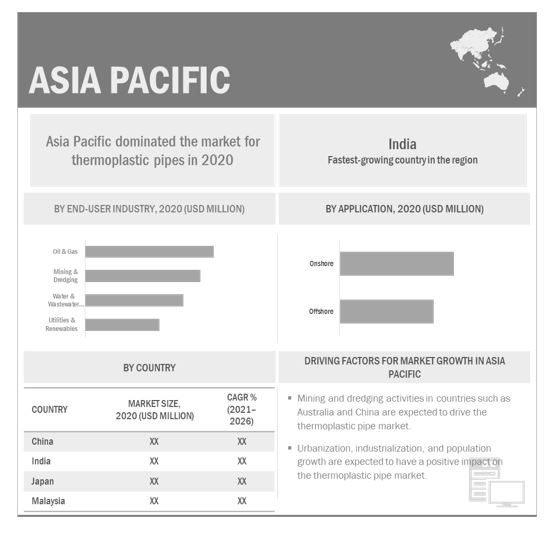

Asia Pacific is expected to be the largest market during the forecast period.

North America, Europe, South America, Asia Pacific, and Middle East & Africa are the major regions considered for the study of the thermoplastic pipe market. The growth of the Asia Pacific market is driven by urbanization and industrialization growth along with increasing mining activities in China, Australia, and India.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the global thermoplastic pipe market are NOV (US), Wienerberger (Austria), TechnipFMC (UK), Georg Fischer (Switzerland), Advanced Drainage Systems (US), Chevron Philips Chemical Company (US), Prysmian Group (Italy), Strohm (Netherlands), and Baker Hughes Company (US).

Scope of the report

|

Report Metric |

Details |

|

Market Size available for years |

2018–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD) and Volume (Thousand-meters) |

|

Segments covered |

Product Type, Polymer Type, End-User Industries, and Application |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

Advanced Drainage Systems (US), TechnipFMC (UK), NOV (US), Strohm (Netherlands), Baker Hughes Company (US), Wienerberger (Austria) Chevron Philips Chemical Company (US), Prysmian Group (Italy), Georg Fischer (Switzerland), Shawcor (Canada), IPEX (US), PES.TEC (Germany) Saudi Arabian Amiantit (Saudi Arabia), Simtech Process Systems (US), and Uponor Corporation (Finland) |

This research report categorizes the thermoplastic pipe market based on Product Type, Polymer Type, End-User Industries, Application, and geography.

Based on Product Type, the thermoplastic pipe market has been segmented as follows:

- Reinforced Thermoplastic Pipes (RTP)

- Thermoplastic Composite Pipes (TCP)

Based on Polymer Type, the thermoplastic pipe market has been segmented as follows:

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinylidene Fluoride (PVDF)

- Polyvinyl Chloride (PVC)

- Others

Based on End-User Industry, the thermoplastic pipe market has been segmented as follows:

- Oil & Gas

- Water & Wastewater

- Mining & Dredging

- Utilities & Renewables

Based on Application, the thermoplastic pipe market has been segmented as follows:

- Onshore

- Offshore

Based on the Geography, the thermoplastic pipe market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In October 2021, TechnipFMC acquired the outstanding shares of Magma Global; the company will use Magma Global's technology to manufacture Thermoplastic Composite Pipes (TCPs) using PEEK polymer. TechnipFMC will combine Magma Global’s expertise with its flexible pipe technology to create a Hybrid Flexible Pipe (HFP) that will be deployed in the pre-salt fields of Brazil.

- In July 2021, Wienerberger acquired 100% of the shares of FloPlast and Cork Plastics. The product portfolios of both companies are focused on rainwater, roofline, and drainage products. Therefore, the acquisition is expected to help Wienerberger become a complete system provider for managed grey and stormwater solutions in the residential sector.

- In December 2020, GF Piping Systems, a division of Georg Fischer, acquired FGS Brasil Indústria e Comércio (FGS), Cajamar (Brazil), a manufacturer of polyethylene piping systems. The acquisition enabled GF Piping Systems to expand its presence in Brazil and South America.

- In July 2020, NOV was awarded a contract by Subsea 7 to provide a flexible pipeline system including flexible pipes and associated ancillary components for the Sangomar, Phase 1 project offshore Senegal, West Africa, Woodside, headquartered in Australia. The overall scope of the contract includes the installation of up to eight dynamic risers in a lazy wave configuration and up to 47 associated jumpers and flowlines.

- In January 2020, Advanced Drainage Systems acquired the assets of Plastic Tubing Industries (PTI), a manufacturer of HDPE pipes and related accessories. The acquisition increased the company’s customer base and capacity in Southeast US. With this step, it is expected to increase its manufacturing footprint in Georgia and Texas and add production capacity to the existing manufacturing facilities in Florida.

Frequently Asked Questions(FAQs):

What is the current size of the thermoplastic pipe market?

The current market size of global thermoplastic pipe market is USD 2.6 billion in 2020.

What are the major drivers for thermoplastic pipe market?

Increasing application of thermoplastic composite pipes and reinforced thermoplastic pipes in offshore and onshore production activities and the increasing use of engineered thermoplastic materials in manufacturing pipes are some of the major drivers driving the market of well intervention.

Which is the fastest-growing region during the forecasted period in thermoplastic pipe market?

The growth of the South American market is driven by the increasing investments in the oil & gas industries in Venezuela and Brazil by foreign countries.

Which is the largest segment, by polymer type during the forecasted period in thermoplastic pipe market?

The polyethylene segment held the largest share of the thermoplastic pipe market owing to its light weight, flexibility, and easy to weld properties. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 43)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.2.1 MARKET, BY POLYMER TYPE: INCLUSIONS & EXCLUSIONS

1.2.2 MARKET, BY PRODUCT TYPE: INCLUSIONS & EXCLUSIONS

1.2.3 MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

1.2.4 MARKET, BY END-USER INDUSTRIES: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 THERMOPLASTIC PIPE MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 49)

2.1 RESEARCH DATA

FIGURE 1 THERMOPLASTIC PIPE MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key insights from primary sources

2.2.2.2 Primary interviews with experts

2.2.2.3 List of key primary interview participants

2.2.2.4 Breakdown of primaries

2.3 MARKET SIZE ESTIMATION

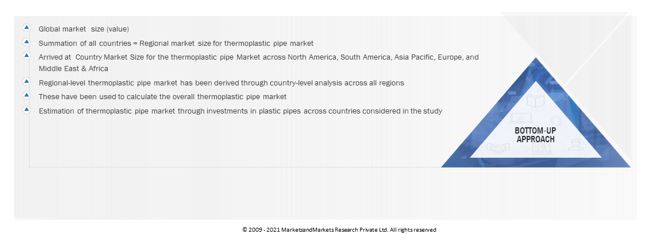

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE METRICS

FIGURE 5 MAIN METRICS CONSIDERED FOR ANALYSING AND ASSESSING DEMAND FOR THERMOPLASTIC PIPES

2.3.3.1 Assumptions for demand-side analysis

2.3.4 SUPPLY-SIDE ANALYSIS

FIGURE 6 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF THERMOPLASTIC PIPES

FIGURE 7 THERMOPLASTIC PIPE MARKET: SUPPLY-SIDE ANALYSIS

2.3.4.1 Supply-side calculations

2.3.4.2 Assumptions for supply-side analysis

2.3.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 60)

TABLE 1 THERMOPLASTIC PIPE MARKET SNAPSHOT

FIGURE 8 MARKET IN SOUTH AMERICA EXPECTED TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

FIGURE 9 REINFORCED THERMOPLASTIC PIPES (RTP) SEGMENT EXPECTED TO ACQUIRE LARGER SHARE OF MARKET DURING FORECAST PERIOD

FIGURE 10 POLYETHYLENE (PE) SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 11 OIL & GAS SEGMENT EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 12 ONSHORE SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 64)

4.1 ATTRACTIVE OPPORTUNITIES IN THERMOPLASTIC PIPE MARKET

FIGURE 13 RISING DEMAND FOR THERMOPLASTIC PIPES IN OIL & GAS END-USER INDUSTRY TO DRIVE MARKET FROM 2021 TO 2026

4.2 MARKET, BY REGION

FIGURE 14 MARKET IN SOUTH AMERICA EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 ASIA PACIFIC: MARKET, BY END-USER INDUSTRY AND COUNTRY

FIGURE 15 OIL & GAS SEGMENT AND CHINA HELD LARGEST SHARES OF MARKET IN ASIA PACIFIC IN 2020

4.4 MARKET, BY PRODUCT TYPE

FIGURE 16 REINFORCED THERMOPLASTIC PIPES (RTPS) SEGMENT IS EXPECTED TO DOMINATE THE MARKET IN 2026

4.5 MARKET, BY POLYMER TYPE

FIGURE 17 POLYETHYLENE (PE) SEGMENT IS EXPECTED TO DOMINATE THE MARKET IN 2026

4.6 ONSHORE SEGMENT IS EXPECTED TO DOMINATE MARKET IN 2026

4.7 MARKET, BY END-USER INDUSTRY

FIGURE 18 OIL & GAS SEGMENT IS EXPECTED TO DOMINATE MARKET IN 2026

5 MARKET OVERVIEW (Page No. - 68)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 19 COVID-19 GLOBAL PROPAGATION

FIGURE 20 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 21 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 22 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 23 THERMOPLASTIC PIPE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Increasing applications of thermoplastic composite pipes and reinforced thermoplastic pipes in offshore and onshore production activities

5.5.1.2 Increasing use of engineered thermoplastic materials in manufacturing pipes

TABLE 2 PROPERTIES OF VARIOUS POLYMER TYPES

5.5.2 RESTRAINTS

5.5.2.1 High cost of using high-grade thermoplastic composite pipes

5.5.3 OPPORTUNITIES

5.5.3.1 Growing deep- and ultra-deepwater oil & gas exploration and production activities

5.5.4 CHALLENGES

5.5.4.1 Absence of global design and qualification standards

5.5.4.2 Difficulties in large-scale manufacturing of thermoplastic composite pipes

5.6 COVID-19 IMPACT

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

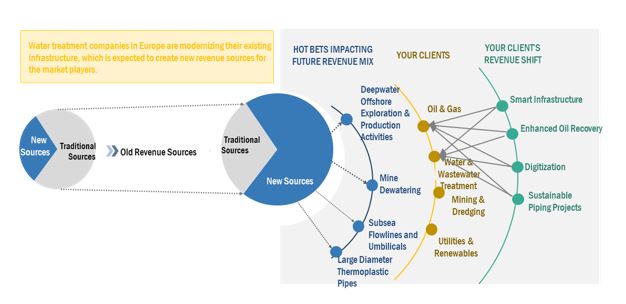

5.7.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN MARKET

FIGURE 24 REVENUE SHIFT OF THERMOPLASTIC PIPE PROVIDERS

5.8 PRICING ANALYSIS

TABLE 3 AVERAGE COST OF THERMOPLASTIC PIPE (USD/METER) ACROSS REGIONS

5.9 SUPPLY CHAIN ANALYSIS

FIGURE 25 MARKET: SUPPLY CHAIN ANALYSIS

TABLE 4 MARKET: VALUE/SUPPLY CHAIN

5.9.1 RAW MATERIAL SUPPLIERS

5.9.2 THERMOPLASTIC PIPE MANUFACTURERS

5.9.3 ENGINEERING, PROCUREMENT, AND CONSTRUCTION PROVIDERS AND THERMOPLASTIC PIPE SYSTEM MANUFACTURERS

5.9.4 DISTRIBUTORS

5.9.5 END USERS

5.10 MARKET MAP

FIGURE 26 THERMOPLASTIC PIPE: MARKET MAP

5.11 INNOVATIONS AND PATENT REGISTRATION

5.12 TECHNOLOGY ANALYSIS

5.13 MARKET: REGULATIONS

5.14 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.14.1 THREAT OF NEW ENTRANTS

5.14.2 BARGAINING POWER OF SUPPLIERS

5.14.3 BARGAINING POWER OF BUYERS

5.14.4 THREAT OF SUBSTITUTES

5.14.5 INTENSITY OF COMPETITIVE RIVALRY

5.15 CASE STUDY ANALYSIS

5.15.1 TECHNIPFMC TO ACCELERATE DEVELOPMENT OF COMPOSITE PIPE TECHNOLOGIES FOR CONVENTIONAL ENERGY AND CO2 APPLICATIONS

5.16 KEY PLAYERS IN RUSSIA RTP MARKET

TABLE 6 KEY PLAYERS IN RUSSIA RTP MARKET

6 THERMOPLASTIC PIPE MARKET, BY PRODUCT TYPE (Page No. - 86)

6.1 INTRODUCTION

FIGURE 28 REINFORCED THERMOPLASTIC PIPES (RTPS) SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2020

TABLE 7 MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 8 MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

6.2 THERMOPLASTIC COMPOSITE PIPES (TCP)

6.2.1 DEEP- AND ULTRA-DEEPWATER APPLICATIONS OF TCPS IN OIL & GAS INDUSTRY EXPECTED TO FOSTER DEMAND FOR THESE PIPES

TABLE 9 THERMOPLASTIC COMPOSITE PIPES (TCPS): MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 10 THERMOPLASTIC COMPOSITE PIPES (TCPS): MARKET VOLUME, BY REGION, 2018–2026 (THOUSAND-METER)

6.3 REINFORCED THERMOPLASTIC PIPE (RTP)

6.3.1 RISE IN USE OF REINFORCED THERMOPLASTIC PIPES IN WATER & WASTEWATER APPLICATIONS LIKELY TO FUEL THEIR DEMAND

TABLE 11 REINFORCED THERMOPLASTIC PIPES (RTPS): MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 12 REINFORCED THERMOPLASTIC PIPES (RTPS): MARKET VOLUME, BY REGION, 2018–2026 (THOUSAND-METER)

7 THERMOPLASTIC PIPE MARKET, BY POLYMER TYPE (Page No. - 91)

7.1 INTRODUCTION

FIGURE 29 POLYETHYLENE (PE) SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2020

TABLE 13 MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 14 MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

7.2 POLYETHYLENE (PE)

7.2.1 LIGHT WEIGHT, FLEXIBLE, AND EASY TO WELD PROPERTIES OF POLYETHYLENE (PE) ARE EXPECTED TO FOSTER ITS DEMAND

TABLE 15 POLYETHYLENE (PE): MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 16 POLYETHYLENE (PE): MARKET VOLUME, BY REGION, 2018–2026 (THOUSAND-METER)

7.3 POLYPROPYLENE (PP)

7.3.1 HIGH CHEMICAL RESISTANCE AND LIGHT WEIGHT OF PP LIKELY TO FOSTER ITS DEMAND GLOBALLY

TABLE 17 POLYPROPYLENE (PP): MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 18 POLYPROPYLENE (PP): MARKET VOLUME, BY REGION, 2018–2026 (THOUSAND-METER)

7.4 POLYVINYLIDENE FLUORIDE (PVDF)

7.4.1 HIGH TEMPERATURE AND CHEMICAL RESISTANCE OF PVDF THERMOPLASTIC PIPES ARE LIKELY TO FOSTER THEIR DEMAND GLOBALLY

TABLE 19 POLYVINYLIDENE FLUORIDE (PVDF): MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 20 POLYVINYLIDENE FLUORIDE (PVDF): MARKET VOLUME, BY REGION, 2018–2026 (THOUSAND-METER)

7.5 POLYVINYL CHLORIDE (PVC)

7.5.1 HIGH CORROSION RESISTANCE OF PVC THERMOPLASTIC PIPES TO FUEL THEIR DEMAND

TABLE 21 POLYVINYL CHLORIDE (PVC): MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 22 POLYVINYL CHLORIDE (PVC): MARKET VOLUME, BY REGION, 2018–2026 (THOUSAND-METER)

7.6 OTHERS

TABLE 23 OTHERS: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 24 OTHERS: MARKET VOLUME, BY REGION, 2018–2026 (THOUSAND-METER)

TABLE 25 OTHERS: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 26 OTHERS: MARKET VOLUME, BY OTHER POLYMER TYPE, 2018–2026 (THOUSAND METER)

8 THERMOPLASTIC PIPE MARKET, BY APPLICATION (Page No. - 100)

8.1 INTRODUCTION

FIGURE 30 ONSHORE SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2020

TABLE 27 THERMOPLASTIC PIPES MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 28 MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

8.2 ONSHORE

8.2.1 INCREASING USE OF THERMOPLASTIC PIPES FOR HIGH-PRESSURE WATER INJECTION PIPELINES AND TRANSPORTATION IN OIL & GAS INDUSTRY IS EXPECTED TO FOSTER DEMAND FOR ONSHORE APPLICATIONS

TABLE 29 ONSHORE THERMOPLASTIC PIPES MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 30 ONSHORE MARKET VOLUME, BY REGION, 2018–2026 (THOUSAND-METER)

8.3 OFFSHORE

8.3.1 INCREASING USE OF THERMOPLASTIC PIPES IN OFFSHORE APPLICATIONS LIKELY TO FUEL THEIR DEMAND

TABLE 31 OFFSHORE MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 32 OFFSHORE THERMOPLASTIC PIPES MARKET VOLUME, BY REGION, 2018–2026 (THOUSAND-METER)

9 THERMOPLASTIC PIPE MARKET, BY END-USER INDUSTRY (Page No. - 105)

9.1 INTRODUCTION

FIGURE 31 OIL & GAS SECTOR ACCOUNTED FOR LARGEST MARKET SHARE IN 2020

TABLE 33 MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 34 MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

9.2 OIL & GAS

9.2.1 BENEFITS OF USING THERMOPLASTIC PIPES IN HIGH-PRESSURE AND DEEPWATER APPLICATIONS EXPECTED TO PROPEL USE OF THERMOPLASTIC PIPES IN OIL & GAS INDUSTRY

TABLE 35 OIL & GAS: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 36 OIL & GAS: MARKET VOLUME, BY REGION, 2018–2026 (THOUSAND-METER)

9.3 WATER & WASTEWATER TREATMENT

9.3.1 LIGHT WEIGHT, HIGH DURABILITY, AND COST-EFFECTIVENESS OF THERMOPLASTIC PIPES ARE EXPECTED TO DRIVE THEIR DEMAND IN WATER & WASTEWATER TREATMENT AND TRANSPORT APPLICATIONS

TABLE 37 WATER & WASTEWATER TREATMENT: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 38 WATER & WASTEWATER TREATMENT: MARKET VOLUME, BY REGION, 2018–2026 (THOUSAND-METER)

9.4 MINING & DREDGING

9.4.1 LOW COST, EASE OF INSTALLATION, AND HIGH RESISTANCE PROPERTIES OF THERMOPLASTIC PIPES ARE LIKELY TO BOOST THEIR DEMAND IN MINING & DREDGING SECTOR

TABLE 39 MINING & DREDGING: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 40 MINING & DREDGING: MARKET VOLUME, BY REGION, 2018–2026 (THOUSAND-METER)

9.5 UTILITIES & RENEWABLES

9.5.1 ENERGY GENERATION THROUGH RENEWABLES ANTICIPATED TO PROPEL GROWTH OF UTILITIES & RENEWABLES INDUSTRY USING THERMOPLASTIC PIPES

TABLE 41 UTILITIES & RENEWABLES: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 42 UTILITIES & RENEWABLES: MARKET VOLUME, BY REGION, 2018–2026 (THOUSAND-METER)

10 THERMOPLASTIC PIPE MARKET, BY REGION (Page No. - 113)

10.1 INTRODUCTION

FIGURE 32 MARKET SHARE (VALUE), BY REGION, 2020 (%)

FIGURE 33 SOUTH AMERICA: MARKET TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

TABLE 43 MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 44 MARKET VOLUME, BY REGION, 2018–2026 (THOUSAND-METER)

10.2 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

10.2.1 EXPORT-IMPORT TRADE STATISTICS, 2017–2019

TABLE 45 EXPORT-IMPORT HISTORIC TRADE STATISTICS OF PLASTIC PIPES, 2017–2019 (USD BILLION)

10.2.2 AVERAGE SELLING PRICE TREND IN ASIA PACIFIC, USD, 2020

TABLE 46 AVERAGE SELLING PRICE IN ASIA PACIFIC, 2020

TABLE 47 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 48 ASIA PACIFIC: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 49 ASIA PACIFIC: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 50 ASIA PACIFIC: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 51 ASIA PACIFIC: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 52 ASIA PACIFIC: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 53 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 54 ASIA PACIFIC: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

TABLE 55 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 56 ASIA PACIFIC: MARKET VOLUME, BY COUNTRY, 2018–2026 (THOUSAND-METER)

10.2.3 INDIA

10.2.3.1 Government initiatives for wastewater treatment and modernization of existing thermal power plants expected to drive market in India

TABLE 57 INDIA: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 58 INDIA: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 59 INDIA: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 60 INDIA: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 61 INDIA: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 62 INDIA: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 63 INDIA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 64 INDIA: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.2.4 AUSTRALIA

10.2.4.1 Enhancement of existing mining infrastructure expected to propel growth of market in Australia

TABLE 65 AUSTRALIA: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 66 AUSTRALIA: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 67 AUSTRALIA: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 68 AUSTRALIA: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 69 AUSTRALIA: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 70 AUSTRALIA: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 71 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 72 AUSTRALIA: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.2.5 JAPAN

10.2.5.1 Rise in demand for thermoplastic pipes in chemicals industry to fuel growth of market in Japan

TABLE 73 JAPAN: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 74 JAPAN: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 75 JAPAN: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 76 JAPAN: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 77 JAPAN: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 78 JAPAN: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 79 JAPAN: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 80 JAPAN: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.2.6 CHINA

10.2.6.1 Energy production from unconventional resources expected to drive growth of thermoplastic pipe market in China

TABLE 81 CHINA: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 82 CHINA: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 83 CHINA: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 84 CHINA: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 85 CHINA: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 86 CHINA: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 87 CHINA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 88 CHINA: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.2.7 MALAYSIA

10.2.7.1 Enhancement of existing oil & gas fields and deepwater exploration plants to contribute to growth of market in Malaysia

TABLE 89 MALAYSIA: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 90 MALAYSIA: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 91 MALAYSIA: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 92 MALAYSIA: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 93 MALAYSIA: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 94 MALAYSIA: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 95 MALAYSIA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 96 MALAYSIA: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.2.8 REST OF ASIA PACIFIC

TABLE 97 REST OF ASIA PACIFIC: THERMOPLASTIC PIPES MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 98 REST OF ASIA PACIFIC: THERMOPLASTIC PIPES MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 99 REST OF ASIA PACIFIC: THERMOPLASTIC PIPES MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 100 REST OF ASIA PACIFIC: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 101 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 102 REST OF ASIA PACIFIC: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 103 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 104 REST OF ASIA PACIFIC: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.3 NORTH AMERICA

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

10.3.1 EXPORT-IMPORT TRADE STATISTICS, 2017–2019

TABLE 105 NORTH AMERICA: EXPORT-IMPORT HISTORIC TRADE STATISTICS OF PLASTIC PIPES, 2017–2019 (USD BILLION)

10.3.2 AVERAGE SELLING PRICE TREND IN NORTH AMERICA, USD, 2020

TABLE 106 AVERAGE SELLING PRICE IN NORTH AMERICA, 2020

TABLE 107 NORTH AMERICA: TARIFF AND REGULATORY LANDSCAPE OF PLASTIC PIPES

TABLE 108 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 112 NORTH AMERICA: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 114 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

TABLE 116 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET VOLUME, BY COUNTRY, 2018–2026 (THOUSAND-METER)

10.3.3 US

10.3.3.1 Ongoing oil & gas production activities are major driving factors for growth of thermoplastic pipe market in US

TABLE 118 US: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 119 US: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 120 US: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 121 US: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 122 US: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 123 US: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 124 US: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 125 US: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.3.4 CANADA

10.3.4.1 Mining, quarrying, and extracting oil & gas are expected to fuel demand for thermoplastic pipes in Canada

TABLE 126 CANADA: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 127 CANADA: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 128 CANADA: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 129 CANADA: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 130 CANADA: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 131 CANADA: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 132 CANADA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 133 CANADA: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.3.5 MEXICO

10.3.5.1 Increasing investments to improve water & wastewater treatment infrastructure and oil & gas exploration activities expected to fuel growth of market in Mexico

TABLE 134 MEXICO: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 135 MEXICO: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 136 MEXICO: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 137 MEXICO: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 138 MEXICO: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 139 MEXICO: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 140 MEXICO: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 141 MEXICO: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.4 EUROPE

10.4.1 EXPORT-IMPORT TRADE STATISTICS, 2017–2019

TABLE 142 EUROPE: EXPORT-IMPORT HISTORIC TRADE STATISTICS OF PLASTIC PIPES, 2017–2019 (USD BILLION)

10.4.2 AVERAGE SELLING PRICE TREND IN EUROPE, USD, 2020

TABLE 143 AVERAGE SELLING PRICE IN EUROPE, 2020

TABLE 144 EUROPE: TARIFF AND REGULATORY LANDSCAPE OF PLASTIC PIPES

TABLE 145 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 146 EUROPE: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 147 EUROPE: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 148 EUROPE: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 149 EUROPE: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 150 EUROPE: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 151 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 152 EUROPE: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

TABLE 153 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 154 EUROPE: MARKET VOLUME, BY COUNTRY, 2018–2026 (THOUSAND-METER)

10.4.3 GERMANY

10.4.3.1 Stringent regulations on wastewater treatment to drive market growth in Germany

TABLE 155 GERMANY: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 156 GERMANY: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 157 GERMANY: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 158 GERMANY: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 159 GERMANY: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 160 GERMANY: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 161 GERMANY: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 162 GERMANY: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.4.4 ITALY

10.4.4.1 Need for installation of sewer pipelines likely to fuel growth of market in Italy

TABLE 163 ITALY: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 164 ITALY: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 165 ITALY: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 166 ITALY: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 167 ITALY: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 168 ITALY: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 169 ITALY: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 170 ITALY: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.4.5 FRANCE

10.4.5.1 Development of new wastewater treatment plants and pipeline networks driving growth of thermoplastic pipe market in France

TABLE 171 FRANCE: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 172 FRANCE: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 173 FRANCE: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 174 FRANCE: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 175 FRANCE: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 176 FRANCE: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 177 FRANCE: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 178 FRANCE: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.4.6 UK

10.4.6.1 Government policies and investments in wastewater treatment to drive growth of market in UK

TABLE 179 UK: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 180 UK: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 181 UK: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 182 UK: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 183 UK: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 184 UK: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 185 UK: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 186 UK: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.4.7 RUSSIA

10.4.7.1 Government initiatives to encourage investments in offshore oil & gas exploration and production activities to drive growth of thermoplastic pipes in Russia

TABLE 187 RUSSIA: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 188 RUSSIA: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 189 RUSSIA: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 190 RUSSIA: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 191 RUSSIA: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 192 RUSSIA: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 193 RUSSIA: MARKET SIZE VOLUME, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 194 RUSSIA: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.4.8 REST OF EUROPE

TABLE 195 REST OF EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 196 REST OF EUROPE: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 197 REST OF EUROPE: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 198 REST OF EUROPE: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 199 REST OF EUROPE: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 200 REST OF EUROPE: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 201 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 202 REST OF EUROPE: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.5 MIDDLE EAST & AFRICA

10.5.1 EXPORT-IMPORT TRADE STATISTICS, 2017–2019

TABLE 203 MIDDLE EAST & AFRICA: EXPORT-IMPORT HISTORIC TRADE STATISTICS OF PLASTIC PIPES, 2017–2019 (USD BILLION)

10.5.2 AVERAGE SELLING PRICE TREND IN MIDDLE EAST & AFRICA, USD, 2020

TABLE 204 AVERAGE SELLING PRICE IN MIDDLE EAST & AFRICA, 2020

TABLE 205 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 206 MIDDLE EAST & AFRICA: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 207 MIDDLE EAST & AFRICA: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 208 MIDDLE EAST & AFRICA: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 209 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 210 MIDDLE EAST & AFRICA: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 211 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 212 MIDDLE EAST & AFRICA: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

TABLE 213 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 214 MIDDLE EAST & AFRICA: MARKET VOLUME, BY COUNTRY, 2018–2026 (THOUSAND-METER)

10.5.3 SAUDI ARABIA

10.5.3.1 High demand for thermoplastic pipes in oil & gas and water & wastewater treatment industries likely to drive market in Saudi Arabia

TABLE 215 SAUDI ARABIA: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 216 SAUDI ARABIA: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 217 SAUDI ARABIA: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 218 SAUDI ARABIA: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 219 SAUDI ARABIA: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 220 SAUDI ARABIA: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 221 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 222 SAUDI ARABIA: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.5.4 QATAR

10.5.4.1 Growing number of wastewater treatment plants expected to drive thermoplastic pipe market in Qatar

TABLE 223 QATAR: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 224 QATAR: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 225 QATAR: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 226 QATAR: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 227 QATAR: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 228 QATAR: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 229 QATAR: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 230 QATAR: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.5.5 SOUTH AFRICA

10.5.5.1 Rising public infrastructure investments in water sectors to boost growth of thermoplastic pipe market in South Africa

TABLE 231 SOUTH AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 232 SOUTH AFRICA: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 233 SOUTH AFRICA: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 234 SOUTH AFRICA: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 235 SOUTH AFRICA: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 236 SOUTH AFRICA: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 237 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 238 SOUTH AFRICA: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.5.6 EGYPT

10.5.6.1 Increasing awareness for continuous water supply expected to drive growth of thermoplastic pipe market in Egypt

TABLE 239 EGYPT: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 240 EGYPT: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 241 EGYPT: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 242 EGYPT: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 243 EGYPT: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 244 EGYPT: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 245 EGYPT: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 246 EGYPT: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.5.7 TURKEY

10.5.7.1 Rising investments in oil & gas exploration activities to lead to rise in demand for thermoplastic pipes in Turkey

TABLE 247 TURKEY: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 248 TURKEY: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 249 TURKEY: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 250 TURKEY: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 251 TURKEY: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 252 TURKEY: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 253 TURKEY: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 254 TURKEY: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.5.8 REST OF MIDDLE EAST & AFRICA

TABLE 255 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 256 REST OF MIDDLE EAST & AFRICA: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 257 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 258 REST OF MIDDLE EAST & AFRICA: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 259 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 260 REST OF MIDDLE EAST & AFRICA: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 261 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 262 REST OF MIDDLE EAST & AFRICA: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.6 SOUTH AMERICA

10.6.1 EXPORT-IMPORT TRADE STATISTICS, 2017–2019

TABLE 263 SOUTH AMERICA: EXPORT-IMPORT HISTORIC TRADE STATISTICS OF PLASTIC PIPES, 2017–2019 (USD BILLION)

10.6.2 AVERAGE SELLING PRICE TREND IN SOUTH AMERICA, USD, 2020

TABLE 264 AVERAGE SELLING PRICE IN SOUTH AMERICA, 2020

TABLE 265 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 266 SOUTH AMERICA: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 267 SOUTH AMERICA: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 268 SOUTH AMERICA: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 269 SOUTH AMERICA: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 270 SOUTH AMERICA: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 271 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 272 SOUTH AMERICA: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

TABLE 273 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 274 SOUTH AMERICA: MARKET VOLUME, BY COUNTRY, 2018–2026 (THOUSAND-METER)

10.6.3 BRAZIL

10.6.3.1 Increasing foreign investments in oil & gas industry to drive growth of thermoplastic pipe market in Brazil

TABLE 275 BRAZIL: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 276 BRAZIL: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 277 BRAZIL: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 278 BRAZIL: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 279 BRAZIL: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 280 BRAZIL: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 281 BRAZIL: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 282 BRAZIL: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

10.6.4 REST OF SOUTH AMERICA

TABLE 283 REST OF SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2018–2026 (USD MILLION)

TABLE 284 REST OF SOUTH AMERICA: MARKET VOLUME, BY PRODUCT TYPE, 2018–2026 (THOUSAND-METER)

TABLE 285 REST OF SOUTH AMERICA: MARKET SIZE, BY POLYMER TYPE, 2018–2026 (USD MILLION)

TABLE 286 REST OF SOUTH AMERICA: MARKET VOLUME, BY POLYMER TYPE, 2018–2026 (THOUSAND-METER)

TABLE 287 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USER INDUSTRY, 2018–2026 (USD MILLION)

TABLE 288 REST OF SOUTH AMERICA: MARKET VOLUME, BY END-USER INDUSTRY, 2018–2026 (THOUSAND-METER)

TABLE 289 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 290 REST OF SOUTH AMERICA: MARKET VOLUME, BY APPLICATION, 2018–2026 (THOUSAND-METER)

11 COMPETITIVE LANDSCAPE (Page No. - 215)

11.1 KEY PLAYERS STRATEGIES

TABLE 291 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, AUGUST 2017–OCTOBER 2021

11.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 292 THERMOPLASTIC PIPE MARKET: DEGREE OF COMPETITION

FIGURE 36 MARKET SHARE ANALYSIS, 2020

11.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 37 TOP PLAYERS IN MARKET FROM 2016 TO 2020

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STAR

11.4.2 PERVASIVE

11.4.3 EMERGING LEADER

11.4.4 PARTICIPANT

FIGURE 38 COMPETITIVE LEADERSHIP MAPPING: MARKET, 2020

11.5 START-UP/SME EVALUATION QUADRANT, 2020

11.5.1 PROGRESSIVE COMPANY

11.5.2 RESPONSIVE COMPANY

11.5.3 DYNAMIC COMPANY

11.5.4 STARTING BLOCK

FIGURE 39 MARKET: START-UP/SME EVALUATION QUADRANT, 2020

11.6 THERMOPLASTIC PIPE MARKET: COMPANY PRODUCT FOOTPRINT

TABLE 293 BY END-USER INDUSTRY: COMPANY FOOTPRINT

TABLE 294 BY POLYMER TYPE: COMPANY FOOTPRINT

TABLE 295 BY REGION: COMPANY FOOTPRINT

TABLE 296 COMPANY FOOTPRINT

11.7 COMPETITIVE SCENARIO

TABLE 297 MARKET: DEALS, JANUARY 2020–OCTOBER 2021

TABLE 298 MARKET: OTHERS, AUGUST 2017–JULY 2020

12 COMPANY PROFILES (Page No. - 231)

12.1 KEY PLAYERS

(Business and financial overview, Products/solutions/services offered, Recent Developments, MNM view)*

12.1.1 ADVANCED DRAINAGE SYSTEMS

TABLE 299 ADVANCED DRAINAGE SYSTEMS: BUSINESS OVERVIEW

FIGURE 40 ADVANCED DRAINAGE SYSTEMS: COMPANY SNAPSHOT

TABLE 300 ADVANCED DRAINAGE SYSTEMS: PRODUCTS OFFERED

TABLE 301 ADVANCED DRAINAGE SYSTEMS: DEALS, JANUARY 2020

TABLE 302 ADVANCED DRAINAGE SYSTEMS: OTHERS, MARCH 2016–AUGUST 2017

12.1.2 TECHNIPFMC

TABLE 303 TECHNIPFMC: BUSINESS OVERVIEW

FIGURE 41 TECHNIPFMC: COMPANY SNAPSHOT

TABLE 304 TECHNIPFMC: PRODUCTS OFFERED

TABLE 305 TECHNIPFMC: DEALS, MARCH 2018–OCTOBER 2021

TABLE 306 TECHNIPFMC: OTHERS, DECEMBER 2017– FEBRUARY 2019

12.1.3 GEORG FISCHER

TABLE 307 GEORG FISCHER: BUSINESS OVERVIEW

FIGURE 42 GEORG FISCHER: COMPANY SNAPSHOT

TABLE 308 GEORG FISCHER: PRODUCTS OFFERED

TABLE 309 GEORG FISCHER: DEALS, MAY 2016–DECEMBER 2020

12.1.4 NOV

TABLE 310 NOV: BUSINESS OVERVIEW

FIGURE 43 NOV: COMPANY SNAPSHOT

TABLE 311 NOV: PRODUCTS OFFERED

TABLE 312 NOV: OTHERS, MAY 2017–JULY 2020

12.1.5 WIENERBERGER

TABLE 313 WIENERBERGER: BUSINESS OVERVIEW

FIGURE 44 WIENERBERGER: COMPANY SNAPSHOT

TABLE 314 WIENERBERGER: PRODUCTS OFFERED

TABLE 315 WIENERBERGER: DEALS, JULY 2018–JULY 2021

TABLE 316 WIENERBERGER: OTHERS, DECEMBER 2020

12.1.6 STROHM

TABLE 317 STROHM: BUSINESS OVERVIEW

TABLE 318 STROHM: PRODUCTS OFFERED

TABLE 319 STROHM: PRODUCT LAUNCHES, AUGUST 2018–JUNE 2019

TABLE 320 STROHM: DEALS, OCTOBER 2017–NOVEMBER 2020

TABLE 321 STROHM: OTHERS, JANUARY 2018–AUGUST 2021

12.1.7 BAKER HUGHES COMPANY

TABLE 322 BAKER HUGHES COMPANY: BUSINESS OVERVIEW

FIGURE 45 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

TABLE 323 BAKER HUGHES COMPANY: PRODUCTS OFFERED

TABLE 324 BAKER HUGHES COMPANY: PRODUCT LAUNCHES, JANUARY 2021

TABLE 325 BAKER HUGHES COMPANY: DEALS, DECEMBER 2020

TABLE 326 BAKER HUGHES COMPANY: OTHERS, JUNE 2021

12.1.8 PRYSMIAN GROUP

TABLE 327 PRYSMIAN GROUP: BUSINESS OVERVIEW

FIGURE 46 PRYSMIAN GROUP: COMPANY SNAPSHOT

TABLE 328 PRYSMIAN GROUP: PRODUCTS OFFERED

TABLE 329 PRYSMIAN GROUP: OTHERS, JULY 2021–AUGUST 2021

12.1.9 CHEVRON PHILIPS CHEMICAL COMPANY

TABLE 330 CHEVRON PHILIPS CHEMICAL COMPANY: BUSINESS OVERVIEW

FIGURE 47 CHEVRON PHILIPS CHEMICAL COMPANY: COMPANY SNAPSHOT

TABLE 331 CHEVRON PHILIPS CHEMICAL COMPANY: PRODUCTS OFFERED

TABLE 332 CHEVRON PHILIPS CHEMICAL COMPANY: OTHERS, AUGUST 2019

12.1.10 SHAWCOR

TABLE 333 SHAWCOR: BUSINESS OVERVIEW

FIGURE 48 SHAWCOR: COMPANY SNAPSHOT

TABLE 334 SHAWCOR: PRODUCTS OFFERED

TABLE 335 SHAWCOR: OTHERS, MAY 2018

12.1.11 IPEX

TABLE 336 IPEX: BUSINESS OVERVIEW

TABLE 337 IPEX: PRODUCTS OFFERED

TABLE 338 IPEX: PRODUCT LAUNCHES, JANUARY 2016

TABLE 339 IPEX: DEALS, NOVEMBER 2019

TABLE 340 IPEX: OTHERS, APRIL 2016–JUNE 2021

12.1.12 UPONOR CORPORATION

TABLE 341 UPONOR CORPORATION: BUSINESS OVERVIEW

FIGURE 49 UPONOR CORPORATION: COMPANY SNAPSHOT

TABLE 342 UPONOR CORPORATION: PRODUCTS OFFERED

TABLE 343 UPONOR CORPORATION: DEALS, SEPTEMBER 2019–NOVEMBER 2021

TABLE 344 UPONOR CORPORATION: OTHERS, JULY 2021

12.1.13 SAUDI ARABIAN AMIANTIT

TABLE 345 SAUDI ARABIAN AMIANTIT: BUSINESS OVERVIEW

FIGURE 50 SAUDI ARABIAN AMIANTIT: COMPANY SNAPSHOT

TABLE 346 SAUDI ARABIAN AMIANTIT: PRODUCTS OFFERED

12.1.14 SIMTECH PROCESS SYSTEMS

TABLE 347 SIMTECH: BUSINESS OVERVIEW

TABLE 348 SIMTECH: PRODUCTS OFFERED

12.1.15 PES.TEC

TABLE 349 PES.TEC: BUSINESS OVERVIEW

TABLE 350 PES.TEC: PRODUCTS OFFERED

12.2 OTHER PLAYERS

12.2.1 AETNA PLASTICS

12.2.2 TOPOLO

12.2.3 OILTECHPIPE

12.2.4 ROSTURPLAST

12.2.5 POLYPLASTIC GROUP

*Details on Business and financial overview, Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 295)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the thermoplastic pipe market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

The research study on the thermoplastic pipe market involved the extensive use of secondary sources, directories, and databases, such Hoovers, World Bank, Observatory of Economic Complexity (OEC), Ceicdata, Researchgate, Onepetro, Thermoplastic Industry Associations, UNESCO Institute for Statistics (UIS) Bloomberg, Businessweek, Factiva, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

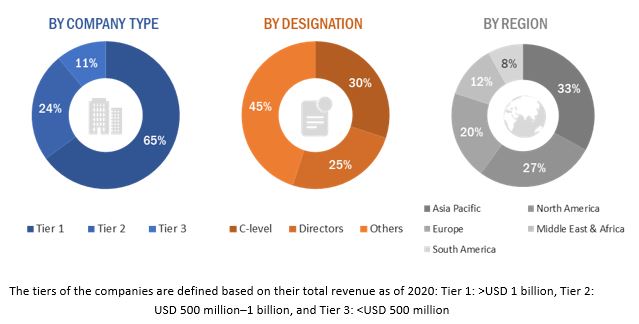

Primary sources included several industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, technology developers, standard and certification agencies of companies, and organizations related to all the segments of this industry’s value chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global thermoplastic pipe market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Thermoplastic pipe Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the thermoplastic pipe market by product type, polymer type, application, end user, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market with respect to individual growth trends, future expansions, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of the market with respect to five main regions, namely, North America, Europe, South America, Asia Pacific, and the Middle East & Africa

- To profile and rank key players and comprehensively analyze their respective market shares

- To analyze competitive developments, such as sales contracts, agreements, investments, expansions, new product launches, joint ventures, collaborations, and acquisitions, in the thermoplastic pipe market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Thermoplastic Pipe Market