FRP/GRP/GRE Pipe Market

FRP/GRP/GRE Pipes Market Size by Type (GRP, GRE, Others), Glass Fiber Type (E-Glass, S-Glass, Others), Manufacturing Process (Filament Winding, Others), Diameter (<300 mm, 300-1200 mm, >1200 mm), End-Use Industry (Oil & Gas, Chemicals, Sewage Pipes, Irrigation, Others) and Region - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The FRP/GRP/GRE pipes market size was valued at USD 5.14 billion in 2025 and is expected to reach USD 6.72 billion by 2030 at a CAGR of 5.5%. The popularity of GRE/FRP/GRP pipes is increasing as an alternative to steel and concrete pipes, mainly because they are corrosion-resistant, lightweight, and have a long life expectancy when used as a pipeline for water, wastewater, chemicals, and energy. Investment in water supply, desalination plants, sewage treatment, and district cooling has been increasing in the Asia Pacific and Middle Eastern Regions, which has resulted in greater adoption of these types of pipes since they provide a longer usable lifespan, require minimal maintenance, and exhibit enhanced hydraulic performance when used as large diameter transmission pipeline systems. In addition, FRP/GRP/GRE materials are becoming increasingly popular for corrosive and multiple service applications (Flowlines, Firewater, Downhole Tubing, etc.) due to rapid urbanization and industrial growth within the oil & gas, petrochemical, and offshore industries.

KEY TAKEAWAYS

-

By TypeBy type, the GRE segment is projected to grow at a CAGR of 6.0% during the forecasted period in terms of value.

-

By Fiber TypeBy fiber type, the e-glass segment is projected to grow at a CAGR of 6.1% during the forecasted period in terms of value.

-

By DiameterBy diameter, the 300m-1200mm segment is projected to grow at a CAGR of 5.8% during the forecasted period in terms of value.

-

By Manufacturing TypeBy manufacturing type, the filament winding process is projected to be the fastest-growing segment in the forecast period.

-

By End-use IndustryBy end-use industry, the sewage pipe segment is projected to be the fastest-growing segment in the forecast period, in terms of value.

-

Competitive LandscapeNOV, Future Pipe Industries, Amiantiti Company are star players in the FRP/GRP/GRE market, given their broad industry coverage and strong operational & financial strength.

-

Competitive LandscapeAugusta Fiberglass, FIBREX, and Plasticon Composites have distinguished themselves among startups and SMEs due to their well-developed marketing channels and extensive funding to build their product portfolios.

The FRP/GRP/GRE pipe market will continue to grow as companies become focused on reliability, longevity, and efficiency of transport systems. Water treatment, chemical processing, marine transportation, and energy companies are replacing older types of pipes such as metal and concrete which tend to scale, corrode, need frequent replacement and had limited service life with composite piping products, which offered measurable performance advantages over traditional pipe products through their superior strength-to-weight ratios, reduced installation costs, decreased work stoppage, and broad compatibility with extreme fluid environments. In addition to these advantages, the need for composite piping is driven by global climate changes and the growing need for fresh water through the development of desalination, reuse, and wastewater treatment facilities, all of which require strong, durable piping materials able to perform under extreme conditions. The ongoing development of improved resin compositions and manufacturing technologies by manufacturers of composite pipes has also increased the versatility and cost-effectiveness of these products.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The FRP/GRP/GRE pipe market is expected to shift from a smaller revenue base today toward much higher future demand, driven by new applications and technologies. Key customer industries such as sewage, chemicals, oil and gas, and irrigation will require features like low maintenance, fire and pressure safety, lightweight strength, and weather resistance. These needs lead to outcomes that matter for end users, including longer service life, reliable supply, regulatory compliance, and reduced leakage, demonstrating why demand for composite pipes will grow significantly.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for non-corrosive pipes

-

Increased demand for oil & gas

Level

-

High raw material cost

-

Consolidated industry and high capital cost

Level

-

Increasing demand from emerging economies

-

Technological advancements in composites driving use in high-pressure oil & gas applications

Level

-

Large-scale manufacturing

-

Competition from cheaper alternatives like ductile iron

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased demand for oil & gas

The rising demand for durable and corrosion-resistant piping materials in the oil and gas industry is propelling the market for FRP/GRP/GRE pipes. Oil and gas exploration and production activities are increasing in the offshore, onshore, and deepwater regions, where metal pipes experience corrosion, scaling, and rupture under high pressure or chemical attack. GRE pipes are predominantly used in flowlines, seawater injection, generated water handling, and chemical transport lines due to their superior strength-weight ratio and longer lifespan with minimal maintenance. The rising global investments in the oil and gas Industry, especially in the Middle East and Asian regions, are fueling the demand for composite pipes, which is a major driving force for this market.

Restraint: High raw material cost

The high price of raw materials like glass fiber, resins, and various additives is a strong deterrent to the FRP/GRP/GRE pipe industry. The prices of these materials are higher compared to traditional ductile iron or steel pipes, thereby adding to manufacturing and purchase costs. Although the maintenance and life cycle costs of composite pipes are lower, their price of entry might be prohibitively expensive for budget-conscious buyers, especially in the case of municipal projects or countries with developing economies. The price of resins and glass fibers affects the bottom line of manufacturers.

Opportunity: Increasing demand from emerging economies

The growth potential in emerging countries like the Asia Pacific, the Middle East, Africa, and Latin America is tremendous for FRP/GRP/GRE pipes. The investment being made in these regions for water supply infrastructure, waste and sewage treatment, irrigation, desalination plants, and industrial projects is substantial. Such projects require pipes that are corrosion-resistant, lightweight, easy to install, and capable of operating for extended periods of time. As these countries are working towards improving their infrastructure and addressing the effects of urbanization, FRP/GRP/GRE pipes offer a promising solution. Government expenditures in emerging nations on sanitation, energy, water security, and industrial development are fueling a massive demand, making these countries important drivers for the industry.

Challenge: Competition from cheaper alternatives like ductile iron

Despite their technical superiority, FRP/GRP/GRE pipes face competition from less-expensive substitutes like ductile iron, PVC, and steel, particularly in markets where buying decisions are based on upfront costs over the total cost of ownership. Many municipalities and contractors are familiar with traditional piping systems and may be reluctant to switch to composite materials due to their cost. Ductile iron also persists in water and sewage works due to its lower cost and established market. The cost-based competition may hinder the adoption of composite pipes, despite their better corrosion resistance and longer lifespan.

FRP/GRP/GRE PIPE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses GRP/FRP pipelines for drinking water distribution and sewage/wastewater collection networks in cities globally | Reliable leak-free delivery, lower maintenance costs, improved water quality, and longer asset life |

|

Applies composite (RTP / GRP / FRP) piping for chemical transfer, process lines and industrial effluent handling in its chemical plants | High chemical and corrosion resistance, long-term durability, lower maintenance, safe handling of aggressive media |

|

Employs abrasion-resistant composite or thermoplastic pipelines for slurry transport, tailings, and effluent disposal in mining operations | Lightweight transport systems, high abrasion and corrosion resistance, easier installation, and lower maintenance overhead |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

This ecosystem illustrates how different companies in the industry deliver value to consumers in a broad ecosystem. At one end, companies such as Owens Corning, Jushi, and Nippon Electric Glass, which supply raw materials such as glass fibers, are important players in this ecosystem. These raw materials are processed by other companies such as Solvay, Arkema, and SABIC to make specialized products such as resins, additives, and composite mix designs, which are used in making composite pipes. Companies such as NOV, Amiantit, and Future Pipe Industries are engaged in making composite pipes using different methods such as filament winding and molding. At the end of the ecosystem, companies such as Veolia, Saudi Aramco, and ACWA Power install these composite pipes in different applications such as water treatment plants, oil & gas production stations, and desalination stations, further completing the ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

FRP/GRP/GRE Pipe Market, By Manufacturing Process

The filament winding process is projected to have the highest growth rate in the FRP/GRP/GRE pipe market because this process can offer improved mechanical properties, material usage, and consistency compared to other methods. This process enables precise control over orientation, resulting in an extremely high strength-to-weight ratio and superior resistance to pressure, corrosion, and fatigue, which are essential in harsh environments such as oil and gas extraction, water transmission, chemical plants, and desalination plants. The automated winding process enables faster production, consistent wall thickness, and reduced waste, thereby making the process more cost-effective on a mass production scale. With large-diameter and high-pressure applications continuing to increase in the global market, especially in infrastructure and energy development, the filament winding process is perceived to offer the optimal blend of quality, repeatability, and price competitiveness.

REGION

Asia Pacific to be fastest-growing region during forecast period

The Asia Pacific region is expected to be the most rapidly growing market for FRP/GRP/GRE pipes, owing to the region's infrastructural development. China, India, Indonesia, and Southeast Asia are investing heavily in water supply, sewage treatment, desalination plants, irrigation, and industrial projects, all of which have a huge demand for resistant and long-lasting pipelines. The Asia Pacific region has many oil & gas extraction, chemical processing, and power plants that require high-quality composite pipelines. Government outlays on modernization, stricter environmental regulations, and efforts to reduce leakage and maintenance costs are all factors that promote the adoption of composite pipes. The increased ability to manufacture composite pipes within this region makes them cheaper and more widely available, thus fueling the growth of this market.

FRP/GRP/GRE PIPE MARKET: COMPANY EVALUATION MATRIX

In the FRP/GRP/GRE pipe matrix, NOV stands out as the star player due to its extensive product portfolio, global presence, and proven performance in critical applications such as oil and gas, marine, desalination, and industrial infrastructure. Smithline Composites (Emerging Leader) is gaining recognition for its increasingly competitive range of composite pipes and fittings, supported by regional manufacturing capability and growing penetration in industrial, water, and utility projects. While NOV continues to dominate through scale, technology, and reputation, Smithline Composites shows promising potential to move toward the leaders’ quadrant as investment in infrastructure, water management, and corrosion-resistant piping accelerates across global markets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- NOV (US)

- Amiantit Company (Saudi Arabia)

- Future Pipe Industries (UAE)

- Amiblu Holding GmbH (Austria)

- Graphite India Limited (India)

- Abu Dhabi Pipe Factory (UAE)

- Hengrun Group Co., Ltd. (China)

- Hill & Smith PLC (UK)

- GRE COMPOSITES (Thailand)

- Advanced Piping Solutions (Saudi Arabia)

- Smithline Composites (UAE)

- Kuzeyboru (Turkey)

- Krah Group (Germany)

- Gruppo Sarplast (Italy)

- Lianyungang Zhongfu Lianzhong Composites Group Co., Ltd. (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 5.14 Billion |

| Market Forecast in 2030 (Value) | USD 6.72 Billion |

| Growth Rate | CAGR of 5.5% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Type: GRP, GRE, Others I By Glass Fiber Type: E-Glass, S-Glass, Others I By Manufacturing Process: Filament Winding, Others I By Diameter: <300 mm, 300-1200 mm, >1200 mm I By End-Use Industry: Oil & Gas, Chemicals, Sewage Pipes, Irrigation, Others |

| Region Covered | North America, Asia Pacific, Europe, Middle East & Africa, South America |

WHAT IS IN IT FOR YOU: FRP/GRP/GRE PIPE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Municipal Water & Sewage Boards | Assessment of corrosion-resistant pipeline alternatives for large-diameter networks I comparison of lifecycle cost vs. ductile iron and steel I maintenance benchmarking. | Enabled long-term investment planning I reduced leakage I improved network reliability with clear ROI justification. |

| Oil & Gas Operators (Onshore & Offshore) | Evaluation of GRE pipe performance under pressure I temperature and chemical exposure I project-specific design studies for flowlines and produced water systems. | Reduced downtime and maintenance cost I enhanced pipeline safety in harsh environments I longer service life vs. metallic pipes. |

| Chemical & Industrial Plant Owners | Material compatibility studies for chemicals, effluents and cooling-water lines I recommendations for installation I jointing and fire-rated specifications. | Improved operational safety, reduced corrosion failures I Ensured regulatory compliance for hazardous fluids. |

| Desalination, Marine & Utility Developers | Feasibility analysis for seawater intake I brine discharge and cooling systems I performance evaluation in saline and marine environments. | Demonstrated lower lifecycle cost I extended durability I ensured continuous operation in corrosive marine conditions. |

RECENT DEVELOPMENTS

- November 2025 : A Memorandum of Understanding (MoU) was signed with Future Pipe Industries (FPI) in Saudi Arabia by one of the world's largest energy producers, Aramco.

- March 2025 : NOV’s Subsea Production Systems (SPS) business segment entered into a Pre-Commercial Agreement with Petrobras to develop flexible pipes intended for high CO2 deepwater environments.

- November 2023 : Hill & Smith Plc acquired United Fiberglass in Springfield, Ohio, a company specializing in composite pipes, conduits, and bridge drains for the utility, transport, and industrial sectors, offering corrosion-resistant solutions, for GBP 11.8 million (approximately USD 14 million).

Table of Contents

Methodology

The study involves two major activities in estimating the current market size for the FRP/GRP/GRE Pipe market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering FRP/GRP/GRE Pipe and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the FRP/GRP/GRE Pipe market, which was validated by primary respondents.

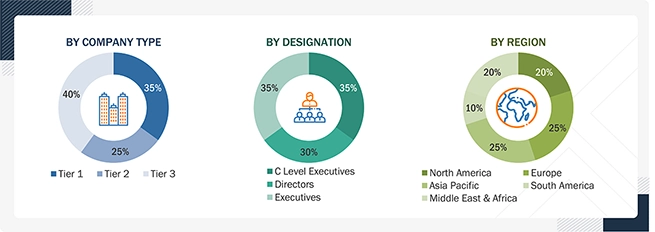

Primary Research

Extensive primary research was conducted after obtaining information regarding the FRP/GRP/GRE Pipe market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from FRP/GRP/GRE Pipe industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, form type, application, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using FRP/GRP/GRE Pipe were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of FRP/GRP/GRE Pipe products and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the FRP/GRP/GRE Pipe market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in FRP/GRP/GRE Pipe products in different applications at a regional level. Such procurements provide information on the demand aspects of the FRP/GRP/GRE Pipe industry for each application. For each end use industry, all possible segments of the FRP/GRP/GRE Pipe market were integrated and mapped.

FRP/GRP/GRE Pipes Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

FRP (fiber reinforced plastic) pipes are non-corrosive pipes having large diameters which are used for transporting fluids from one region to another. FRP pipes are being manufactured using resins, fiber (glass or carbon), silica sand and a few additives. FRP pipes are also referred to as GRP (glass reinforced plastic) pipes, since a majority of the manufactured products are reinforced with glass fibers. GRP is produced from glass fiber reinforcements surrounded by cured thermosetting resins. Generally, FRP pipes are classified on the basis of particular resin used to manufacture fiber glass pipes such as polyester (GRP), epoxy (GRE), and vinyl-ester (GRV) resins. The proper combination of resins, fibers, fillers, can create a product that provides a wide range of properties and characteristics such as high structural load capacity, high stiffness, UV resistance and so on. FRP/GRP pipes are widely employed in end-use industries such as oil & gas, sewage, chemicals, irrigation, desalination, power generation, potable water, among various other uses.

Key Stakeholders

- FRP/GRP/GRE Pipe manufacturers

- Senior Management

- End User

- FRP/GRP/GRE Pipe and composite associations and industrial bodies

- Research and consulting firms.

- R&D Department

Report Objectives

- To define, describe, and forecast the FRP/GRP/GRE Pipe market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global FRP/GRP/GRE Pipe market by fiber type, resin type, manufacturing process, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Available customizations:

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the FRP/GRP/GRE Pipe market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the FRP/GRP/GRE Pipes Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in FRP/GRP/GRE Pipes Market