Fluorosurfactant Market by Type (Nonionic, Anionic, Amphoteric, and Cationic), Application (Paints & Coatings, Specialty Detergents, Firefighting, and Oilfield & Mining), Region - Global Forecast to 2021

[141 Pages Report] The Fluorosurfactants Market was valued at USD 382.6 Million in 2015 and is projected to reach USD 667.4 Million by 2021, at a CAGR of 9.8%. The base year considered for the study is 2015, while the forecast period is from 2016 to 2021. Better properties and performance as compared to other surfactants drive the market for fluorosurfactants globally.

Objectives of the report are as follows:

- To define, describe, and forecast the global fluorosurfactants market based on type, application, and region

- To analyze the market segmentation and project the market size, in terms of volume and value, for key regions, such as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, and the key countries within these regions

- To strategically analyze the market segments with respect to type, application, and region

- To provide detailed information regarding the major factors influencing the growth of the fluorosurfactants market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for shareholders and draw a competitive landscape for the market leaders

- To strategically profile the key players and comprehensively analyze the key developments, such as new product launches, capacity expansions, mergers & acquisitions, and partnerships in the fluorosurfactants market

- To analyze in detail, the short-term, mid-term, and long-term outlook of the market and their respective impact on the fluorosurfactants market

- To identify key players and their core competencies in the fluorosurfactants market and provide their market positioning

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global market and to estimate the sizes of various other dependent submarkets in the overall fluorosurfactants market. The research study involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites, to identify and collect information useful for the technical, market-oriented, and commercial study of the global fluorosurfactants market.

To know about the assumptions considered for the study, download the pdf brochure

The value chain of the fluorosurfactants market includes sourcing of basic raw materials, manufacturing, and supplying to intermediate product manufacturers, and usage in various end-use applications. The raw materials in the fluorosurfactants market are perfluoroalkylsulfonyl fluoride, sulfonyl chlorides, olefins, methyl acrylates, thiols, and alcohols. Much of the fluorosurfactants manufacturers are backward integrated. Major players in the market include The Chemours Company (U.S.), The 3M Company (U.S.), and Asahi Glass Co. Ltd. (Japan).

Key Target Audience:

- Raw Material Suppliers

- Paint Manufacturers

- Traders, Distributors, and Suppliers of Paints

- Government & Regional Agencies, Research Organizations, and Investment Research Firms

Scope of the Report:

This research report categorizes the global fluorosurfactants market on the basis of type, application, and region.

On the basis of Type:

- Nonionic

- Anionic

- Amphoteric

- Cationic

On the basis of Application:

- Paints & coatings

- Specialty detergents

- Firefighting

- Oilfield & mining

- Others

On the basis of Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The market is further analyzed for the key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Geographic Analysis:

- Country-level analysis of fluorosurfactants market by type and application

Company Information:

- Detailed analysis and profiles of additional market players

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

The global fluorosurfactants market is projected to reach USD 667.4 Million by 2021, at a CAGR of 9.8% from 2016 to 2021. Fluorosurfactants are used in very low concentration to increase the wetting, leveling, and oil repellency in applications such as paints & coatings, waxes, polishes, cleaners, films, and adhesives. Better performance of fluorosurfactants in these applications as compared to other surfactants and the use of short-chain fluorosurfactants in developed economies are driving the fluorosurfactants market globally.

The paints & coatings segment is estimated to be the largest application segment of the fluorosurfactants market. The growing use of fluorosurfactants as wetting & leveling agents drives the market for fluorosurfactants in this application. Stringent regulations on VOC emissions by regulatory bodies, such as EPA (U.S.) and REACH (Europe), are driving the market for short-chain fluorosurfactants.

By type, the anionic segment of the fluorosurfactants market is estimated to be the largest and is also projected to grow at the highest CAGR during the forecast period. Anionic fluorosurfactants exhibit excellent wettability and permeability, besides providing better leveling. These fluorosurfactants are widely preferred in paints & coatings application. The growing demand for paints & coatings is expected to increase the demand for anionic fluorosurfactants globally.

Paints & coatings and specialty detergents are estimated to be the largest application segments of the fluorosurfactants market. The growing use of fluorosurfactants in paints & coatings as wetting and leveling agents is expected to drive the paints & coatings segment of the fluorosurfactants market. Fluorosurfactants are used in specialty detergents as they help improve the penetration of cleaners on surfaces.

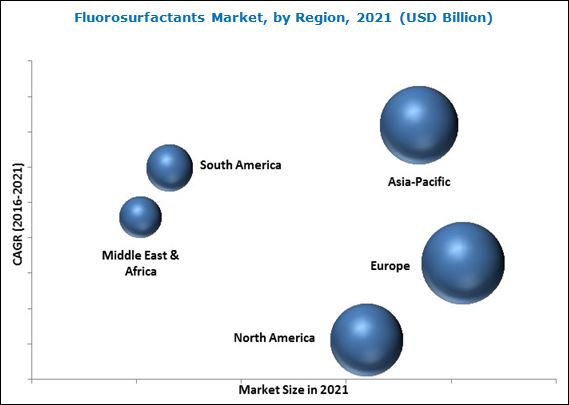

The growth of the building & construction industry has led to an increase in demand for fluorosurfactants. In 2015, North America accounted for the largest share of the global fluorosurfactants market, in terms of volume. Owing to the geographical shift of the fluorosurfactants market towards developing economies, Asia-Pacific is expected to outgrow the North American market, in terms of volume. In terms of value, Europe accounted for the largest share of the global fluorosurfactants market and the trend is estimated to continue throughout the forecast period.

Asia-Pacific is also projected to be the fastest-growing market for fluorosurfactants. The shift of the fluorosurfactants market towards emerging economies due to stringent regulations on VOC emissions in developed economies is driving the growth of the fluorosurfactants in Asia-Pacific region.

Short-chain fluorosurfactants are considered a potential eco-friendly alternative to the conventionally used long chain fluorosurfactants, which, in turn, leads to the growth of the fluorosurfactants market. However, the higher price of fluorosurfactants as compared to other surfactants, and stringent regulations over VOC emissions in developed economies are restraining the growth of the fluorosurfactants market.

The Chemours Company is one of the leading players in the fluorosurfactants market. The company mainly focuses on strengthening its global distribution channel. For this, the company had entered into an agreement with ChemPoint.com Inc. for the North American region, and with Alfa Chemicals Ltd. for the European region. The company also focuses on tapping the market through new product launches. It has a wide portfolio of products to cater to the demand of various applications of fluorosurfactants.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

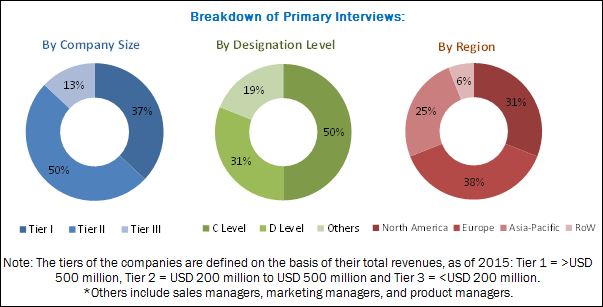

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Fluorosurfactants Market

4.2 Asia-Pacific Fluorosurfactants Market, By Country and Application, 2015

4.3 Fluorosurfactants Market, By Application

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Fluorosurfactants Market, By Type

5.2.2 Fluorosurfactants Market, By Application

5.2.3 Fluorosurfactants Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand for Short-Chain Fluorosurfactants

5.3.1.2 Better Performance of Fluorosurfactants Than Hydrocarbon Surfactants

5.3.2 Restraints

5.3.2.1 Higher Price of Fluorosurfactants Than Its Alternatives

5.3.2.2 Toxic Nature of Long-Chain Fluorosurfactants Hampering Their Market Growth in Developed Countries

5.3.3 Opportunities

5.3.3.1 Shift of Fluorosurfactants Market to Emerging Economies

5.3.3.2 Growing Demand for High-Performance Paints & Coatings From End-User Industries

5.3.4 Challenges

5.3.4.1 Development of Environment Friendly Products

5.4 Impact Analysis

6 Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Threat of New Entrants

6.3.3 Threat of Substitutes

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Patent Analysis

6.5 Macroeconomic Indicators

6.5.1 Introduction

6.6 Paints & Coatings Industry Trends

6.6.1 Overview of the Paints & Coatings Industry in North America

6.6.2 Overview of the Paints & Coatings Industry in Europe

6.6.3 Overview of the Paints & Coatings Industry in Asia-Pacific

7 Fluorosurfactants Market, By Type (Page No. - 51)

7.1 Introduction

7.2 Anionic Fluorosurfactants

7.3 Nonionic Fluorosurfactants

7.4 Amphoteric Fluorosurfactants

7.5 Cationic Fluorosurfactants

8 Fluorosurfactants Market, By Application (Page No. - 58)

8.1 Introduction

8.2 Paints & Coatings

8.3 Specialty Detergents

8.4 Firefighting

8.5 Oilfield & Mining

8.6 Others

9 Fluorosurfactants Market, By Region (Page No. - 66)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 Belgium

9.3.3 Italy

9.3.4 France

9.3.5 Russia

9.3.6 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 India

9.4.3 Japan

9.4.4 South Korea

9.4.5 Indonesia

9.4.6 Thailand

9.4.7 Rest of Asia-Pacific

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 South Africa

9.5.3 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 106)

10.1 Overview

10.2 Competitive Situation and Trends

10.3 Expansions & New Product Launches: Most Popular Growth Strategies Between 2012 and 2016

10.3.1 Expansions

10.3.2 New Product Launches

10.3.3 Mergers & Acquisitions

10.4 Market Share Analysis

10.4.1 The Chemours Company

10.4.2 The 3M Company

10.4.3 Merck KGaA

10.4.4 Asahi Glass Co. Ltd.

11 Company Profiles (Page No. - 112)

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View

11.1 The Chemours Company

11.2 The 3M Company

11.3 Tyco International PLC.

11.4 Merck KGaA.

11.5 Omnova Solution Inc.

11.6 Asahi Glass Co. Ltd.

11.7 DIC Corporation.

11.8 Advanced Polymer, Inc.

11.9 Innovative Chemical Technologies, Inc.

11.10 Pilot Chemical Company

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)

12 Appendix (Page No. - 134)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (104 Tables)

Table 1 Fluorosurfactants Market, By Type

Table 2 Fluorosurfactants Market, By Application

Table 3 Market Size, By Type, 20142021 (USD Million)

Table 4 Market Size, By Type, 20142021 (Ton)

Table 5 Market Size of Anionic Fluorosurfactants, By Region, 20142021 (USD Million)

Table 6 Market Size of Anionic Fluorosurfactants, By Region, 20142021 (Ton)

Table 7 Market Size of Nonionic Fluorosurfactants, By Region, 20142021 (USD Million)

Table 8 Market Size of Nonionic Fluorosurfactants, By Region, 20142021 (Ton)

Table 9 Market Size of Amphoteric Fluorosurfactants, By Region, 20142021 (USD Million)

Table 10 Market Size of Amphoteric Fluorosurfactants, By Region, 20142021 (Ton)

Table 11 Market Size Cationic Fluorosurfactants, By Region, 20142021 (USD Million)

Table 12 Market Size of Cationic Fluorosurfactants, By Region, 20142021 (Ton)

Table 13 Fluorosurfactants Market Size, By Application, 20142021 (USD Million)

Table 14 Market Size, By Application, 20142021 (Ton)

Table 15 Market Size in Paints & Coatings, By Region, 20142021 (USD Million)

Table 16 Market Size in Paints & Coatings, By Region, 20142021 (Ton)

Table 17 Market Size in Specialty Detergents, By Region, 20142021 (USD Million)

Table 18 Market Size in Specialty Detergents, By Region, 20142021 (Ton)

Table 19 Market Size in Firefighting, By Region, 20142021( USD Million)

Table 20 Fluorosurfactants Market Size in Firefighting, By Region, 20142021 (Ton)

Table 21 Market Size in Oilfield & Mining, By Region, 20142021 (USD Million)

Table 22 Market Size in Oilfield & Mining, By Region, 20142021 (Ton)

Table 23 Market Size in Other Applications, By Region, 20142021 (USD Million)

Table 24 Market Size in Other Applications, By Region, 20142021 (Ton)

Table 25 Asia-Pacific to Be the Fastest-Growing Market, 2016 vs 2021

Table 26 Market Size, By Region, 20142021 (USD Million)

Table 27 Market Size, By Region, 20142021 (Ton)

Table 28 North America: Fluorosurfactants Market Size, By Country, 20142021 (USD Million)

Table 29 North America: Market Size, By Country, 20142021(Ton)

Table 30 North America: Market Size, By Type, 20142021 (USD Million)

Table 31 North America: Market Size, By Type, 20142021 (Ton)

Table 32 North America: Market Size, By Application, 20142021 (USD Million)

Table 33 North America: Market Size, By Application, 20142021 (Ton)

Table 34 U.S.: Market Size, By Application, 20142021 (USD Million)

Table 35 U.S.: Market Size, By Application, 20142021 (Ton)

Table 36 Canada: Market Size, By Application, 20142021 (USD Million)

Table 37 Canada: Market Size, By Application, 20142021 (Ton)

Table 38 Mexic0: Market Size, By Application, 20142021 (USD Million)

Table 39 Mexico: Market Size, By Application, 20142021 (Ton)

Table 40 Europe: Fluorosurfactants Market Size, By Country, 20142021 (USD Million)

Table 41 Europe: Market Size, By Country, 20142021 (Ton)

Table 42 Europe: Market Size, By Type, 20142021 (USD Million)

Table 43 Europe: Market Size, By Type, 20162021 (Ton)

Table 44 Europe: Market Size, By Application, 20142021 (USD Million)

Table 45 Europe: Market Size, By Application, 2014-2021 (Ton)

Table 46 Germany: Market Size, By Application, 20142021 (USD Million)

Table 47 Germany: Market Size, By Application, 20142021 (Ton)

Table 48 Belgium: Market Size, By Application, 20142021 (USD Million)

Table 49 Belgium: Market Size, By Application, 20142021 (Ton)

Table 50 Italy: Market Size, By Application, 20142021 (USD Million)

Table 51 Italy: Market Size, By Application, 20142021 (Ton)

Table 52 France: Market Size, By Application, 20142021 (USD Million)

Table 53 France: Market Size, By Application, 20142021 (Ton)

Table 54 Russia: Market Size, By Application, 20142021 (USD Million)

Table 55 Russia: Market Size, By Application, 20142021 (Ton)

Table 56 Rest of Europe: Market Size, By Application, 20142021 (USD Million)

Table 57 Rest of Europe: Market Size, By Application, 20142021 (Ton)

Table 58 Asia-Pacific: Fluorosurfactants Market Size, By Country, 20142021 (USD Million)

Table 59 Asia-Pacific: Market Size, By Country, 20142021 (Ton)

Table 60 Asia-Pacific: Market Size, By Type, 20142021 (USD Million)

Table 61 Asia-Pacific: Market Size, By Type, 20142021 (Ton)

Table 62 Asia-Pacific: Market Size, By Application, 20142021 (USD Million)

Table 63 Asia-Pacific: Market Size, By Application, 20142021 (Ton)

Table 64 China: Market Size, By Application, 20142021 (USD Million)

Table 65 China: Market Size, By Application, 20142021 (Ton)

Table 66 India: Market Size, By Application, 20142021 (USD Million)

Table 67 India: Market Size, By Application, 20142021 (Ton)

Table 68 Japan: Market Size, By Application, 20142021 (USD Million)

Table 69 Japan: Market Size, By Application, 20142021 (Ton)

Table 70 South Korea: Market Size, By Application, 20142021 (USD Million)

Table 71 South Korea: Market Size, By Application, 20142021 (Ton)

Table 72 Indonesia: Market Size, By Application, 20142021 (USD Million)

Table 73 Indonesia: Market Size, By Application, 20142021 (Ton)

Table 74 Thailand: Market Size, By Application, 20142021 (USD Million)

Table 75 Thailand: Market Size, By Application, 20142021 (Ton)

Table 76 Rest of Asia-Pacific: Market Size, By Application, 20142021 (USD Million)

Table 77 Rest of Asia-Pacific: Market Size, By Application, 20142021 (Ton)

Table 78 Middle East & Africa: Fluorosurfactants Market Size, By Country, 20142021 (USD Million)

Table 79 Middle East & Africa: Market Size, By Country, 20142021 (Ton)

Table 80 Middle East & Africa: Market Size, By Type, 20142021 (USD Million)

Table 81 Middle East & Africa: Market Size, By Type, 20142021 (Ton)

Table 82 Middle East & Africa: Market Size, By Application, 20142021 (USD Million)

Table 83 Middle East & Africa: Market Size, By Application, 20142021 (Ton)

Table 84 Saudi Arabia: Market Size, By Application, 20142021 (USD Million)

Table 85 Saudi Arabia: Market Size, By Application, 20142021 (Ton)

Table 86 South Africa: Market Size, By Application, 20142021 (USD Million)

Table 87 South Africa: Market Size, By Application, 20142021 (Ton)

Table 88 Rest of Middle East & Africa: Market Size, By Application, 20142021 (USD Million)

Table 89 Rest of Middle East & Africa: Market Size, By Application, 20142021 (Ton)

Table 90 South America: Fluorosurfactants Market Size, By Country, 20142021 (USD Million)

Table 91 South America: Market Size, By Country, 20142021 (Ton)

Table 92 South America: Market Size, By Type, 20142021 (USD Million)

Table 93 South America: Market Size, By Type, 20142021 (Ton)

Table 94 South America: Market Size, By Application, 20142021 (USD Million)

Table 95 South America: Market Size, By Application, 20142021 (Ton)

Table 96 Brazil: Market Size, By Application, 20142021 (USD Million)

Table 97 Brazil: Market Size, By Application, 20142021 (Ton)

Table 98 Argentina: Market Size, By Application, 20142021 (USD Million)

Table 99 Argentina: Market Size, By Application, 20142021 (Ton)

Table 100 Rest of South America: Market Size, By Application, 20142021 (USD Million)

Table 101 Rest of South America: Market Size, By Application, 20142021 (Ton)

Table 102 Expansions, 20122016

Table 103 New Product Launches, 20122016

Table 104 Mergers & Acquisitions, 20122016

List of Figures (49 Figures)

Figure 1 Fluorosurfactants: Market Segmentation

Figure 2 Fluorosurfactants Market: Research Design

Figure 3 Breakdown of Primary Interviews

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Fluorosurfactants Market: Data Triangulation

Figure 7 Anionic Fluorosurfactants to Remain the Dominant Type of Fluorosurfactants Until 2021

Figure 8 Paints & Coatings Application is Expected to Lead the Fluorosurfactants Market Between 2016 and 2021

Figure 9 Asia-Pacific to Witness the Fastest Market Growth in Fluorosurfactants

Figure 10 Increasing Demand From Different Applications Drives the Market Growth of Fluorosurfactants

Figure 11 Paints & Coatings Application Accounted for the Largest Market Share of Fluorosurfactants in the Asia-Pacific

Figure 12 Paints & Coatings Application to Account for the Largest Share in the Fluorosurfactants Market Between 2016 and 2021

Figure 13 Anionic Fluorosurfactants to Register the Highest CAGR Between 2016 and 2021

Figure 14 North America and Europe Dominated the Fluorosurfactants Market in 2015

Figure 15 Fluorosurfactants Market, By Region

Figure 16 Factors Governing the Fluorosurfactants Market

Figure 17 Fluorosurfactants Market: Supply Chain Analysis

Figure 18 Fluorosurfactants Market: Porters Five Forces Analysis

Figure 19 The U.S. Registered the Maximum Number of Patents in the Market of Fluorosurfactants Between 2010 and 2016

Figure 20 The U.S. Accounted for the Maximum Number of Patents Between 2010 and 2016

Figure 21 The U.S. Dominates the Paints & Coatings Industry in North America, 2016 vs 2021

Figure 22 Germany to Lead the European Paints & Coatings Industry, 2016 vs 2021

Figure 23 China to Dominate the Asia-Pacific Paints & Coatings Industry, 2016 vs 2021

Figure 24 Fluorosurfactants Market, By Type

Figure 25 Anionic Fluorosurfactants to Dominate the Fluorosurfactants Market, 2016 vs 2021

Figure 26 Fluorosurfactants Market, By Application

Figure 27 Paints & Coatings Application to Gain Significant Market Share

Figure 28 North American Market Snapshot: Market Growth Will Be Driven By the Demand From Mexico

Figure 29 The U.S. is Projected to Register Slow Growth Between 2016 and 2021

Figure 30 European Market Snapshot: Germany to Lead the Fluorosurfactants Market in Europe

Figure 31 Germany to Lead the European Fluorosurfactants Market Between 2016 and 2021

Figure 32 Asia-Pacific Market Snapshot: China and India are the Most Lucrative Markets

Figure 33 India to Grow the Fastest in the Asia-Pacific Market Between 2016 and 2021

Figure 34 Companies Adopted New Product Launches and Expansions as the Key Organic Growth Strategies Between 2012 and 2016

Figure 35 Market Evaluation Framework: Expansions and New Product Launches Fueled Growth Between 2012 and 2016

Figure 36 The Chemours Company Accounted for the Largest Share in 2015

Figure 37 The Chemours Company: Company Snapshot

Figure 38 The Chemours Company: SWOT Analysis

Figure 39 The 3M Company: Company Snapshot

Figure 40 The 3M Company: SWOT Analysis

Figure 41 Tyco International PLC.: Company Snapshot

Figure 42 Tyco International PLC: SWOT Analysis

Figure 43 Merck KGaA: Company Snapshot

Figure 44 Merck KGaA: SWOT Analysis

Figure 45 Omnova Solution Inc.: Company Snapshot

Figure 46 Omnova Solution Inc.: SWOT Analysis

Figure 47 Asahi Glass Co. Ltd.: Company Snapshot

Figure 48 Asahi Glass Co. Ltd.: SWOT Analysis

Figure 49 DIC Corporation: Company Snapshot

Growth opportunities and latent adjacency in Fluorosurfactant Market

Wetting agent for Masters Degree project

Market information on global Fluorosurfactants market

Market information on global Fluorosufactants specialty

Need customer intelligence for Maflon, other fluorinated chemicals in the surfactant industry.

Fluoro surfactant market and environment issues and comparison between C6 and C8