Grain Alcohol Market by Type (Ethanol, Polyols), Application (Food, Beverages, Pharmaceutical & Healthcare), Source (Sugarcane, Grains, Fruits), Functionality (Preservative, Coloring/Flavoring Agent, Coatings), and by Region - Global Forecast to 2026

Grain Alcohol Market Size

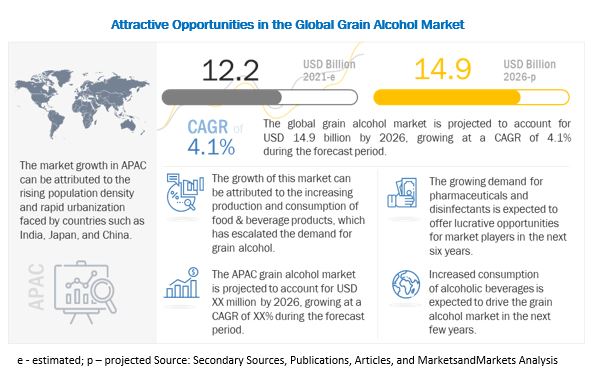

The global grain alcohol market is expected to grow from USD 12.2 billion in 2021 to USD 14.9 billion by 2026, at a compound annual growth rate (CAGR) of 4.1% during the forecast period.

Various factors have played a major role in driving the market growth across the globe. The effects of rapid westernization & urbanization have led to the rising demand for grain alcohol in countries other than Europe and the US. A sharp increase in consumer demand for food products containing grain alcohol and rising demand from the food processing industry is also propelling the market.

The market for grain alcohol is largely associated with the sale of beverage products. Increasing sales of a variety of beverage and health & personal care products in matured markets of developed economies in the last five years are responsible for the increased growth of the grain alcohol industry.

The key players in the industry are adopting growth strategies in emerging countries by enhancing their research capabilities to further develop their product portfolio and strengthen their distribution base. The key players of the grain alcohol industry are focusing on tapping the emerging markets in regions such as Asia Pacific, Latin America, the Middle East, and Africa. Growth in these developing regions over the next few years exhibits promising opportunities for business expansions. Hence, the players in this market can tap new markets to gain profits.

To know about the assumptions considered for the study, Request for Free Sample Report

Grain alcohol is used not only in manufacturing alcoholic beverages but also in food and healthcare & pharmaceutical products. Hence, as the demand for these consumables increases from end users, manufacturers use grain alcohol for making innovative food products. The food & beverage companies use grain alcohol in a variety of processed foods and healthcare & pharmaceutical products for advantages it offers. Grain alcohol is primarily used as a key ingredient in manufacturing alcoholic beverages. It is also used in a wide range of food applications as a preservative, colorant/flavorant, and coating agent. With rapid increase in convenience food consumption, the demand for processed foods is increasing. This consumer-driven demand for processed foods, coupled with increasing consumption of alcoholic beverages, would drive the market for grain alcohol, globally.

Europe has adopted the usage of grain alcohol in food, beverages, and pharmaceutical applications. The Asia Pacific region is estimated to drive the market with burgeoning demand for grain alcohol; in the Asia Pacific region, increasing consumption of alcoholic beverages and convenience food products are significantly impacting the growth of the market, with the growing food-processing industry.

Grain Alcohol Market Dynamics

Grain Alcohol Market Drivers: Increasing global beer production and popularity of craft beer

Beer is a widely consumed alcohol beverage, and the production of beer has increased significantly during the last decade. Increasing global demand for beer production is driving the breweries to source grain alcohol from barley. The usage of alcohol manufactured from barely in the beer industry is projected to account for a large share of the market. The growing popularity of craft beer and local beer is likely to further increase the demand for domestic malt over the next five years.

Restraints: Awareness about harmful effects of alcohol consumption

The Ministry of Health across various countries, namely, Australia, Brazil, the US, and India, has taken up initiatives on the harmful effects of alcohol consumption. The alcohol market is highly price sensitive; therefore, even a slight increase in its price by the government or any other regulatory bodies can have a significant impact on the consumption levels. This in turn may affect the grain alcohol market for beverage applications adversely, leading to a fall in demand.

Opportunities: Emerging markets such as Asia Pacific, South America, Middle East and Africa

Due to changing lifestyles, and the rising middle-class population and their disposable incomes, the market for grain alcohol applications have increased substantially in the emerging markets of Asia Pacific, South America, and the Middle East & Africa. These untapped markets have a wide availability of cost-effective labor, advanced technologies, and relatively relaxed regulations on the use of food grade alcohol. Natural sources of grain alcohol such as sugarcane, grains, corn, and other fruits & vegetables are abundantly available in the Asian, African, and Latin American countries. The leading market players have been expanding their facilities in China, India, and Brazil, considering the future potential demand in these markets.

Challenges: Fluctuating prices of raw materials

Fluctuations in the supply of raw materials and quality of the produce define the price of food grade alcohols. Increase in the price of raw materials has led to one of major challenges for the food grade alcohols market. Over the last few years, the prices of ingredients have been fluctuating and this trend is expected to continue over the next few years. The prices of crops such as corn, wheat, and barley for producing ethanol have been fluctuating, resulting in uncertainties in the volume produced.

To know about the assumptions considered for the study, download the pdf brochure

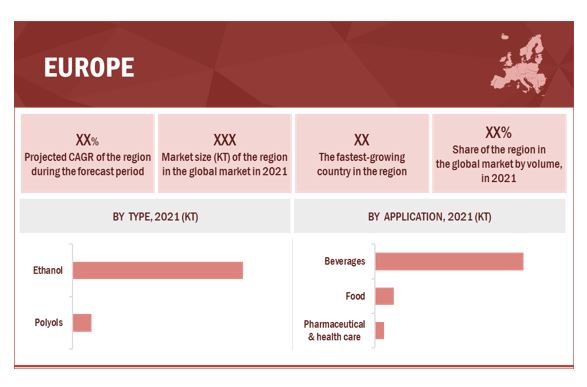

Europe is projected to account for the largest market during the forecast period

The European grain alcohol market is the largest in the world, and despite very high per capita consumption levels, market growth has remained attractive and stable. The presence of a large food & beverage industry offers the European grain alcohol market a prominent consumer base with opportunistic growth prospects. The market in this region is estimated to be driven by development in the Eastern & Southeastern European countries. Europe is the one of the largest markets for sugar polyols. As consumers’ demand for low-calorie food is high, the food industry prefers the use of sugar polyols, which are similar to sugar but with low-calorie value. These sugar polyols act as bulking agents, which provide the mass required and sweeten the product without adding any additional calories.

Grain Alcohol Market Trends:

- Increasing Demand for Ethanol Fuel: Ethanol, a type of grain alcohol primarily derived from corn, has seen growing demand due to its use as a biofuel additive. Governments worldwide have been implementing policies to promote the use of ethanol-blended fuels as a more environmentally friendly alternative to traditional gasoline.

- Alcohol Industry Trends: The broader alcohol industry, including spirits, has also influenced the grain alcohol market. Consumers have shown interest in craft and artisanal spirits, including those made from grains such as wheat, barley, and rye. This trend has created opportunities for small distilleries and craft producers to enter the market.

- Health and Wellness Considerations: Health-conscious consumers have been increasingly seeking alternatives to traditional alcoholic beverages with lower calorie and sugar content. Grain alcohol, when consumed in moderation, can be perceived as a purer form of alcohol without added sugars or flavors, appealing to those looking for cleaner drinking options.

- Regulatory Changes: Regulatory changes, particularly regarding alcohol production and distribution, can significantly impact the grain alcohol market. Changes in tax policies, licensing requirements, and trade agreements can affect production costs and market accessibility for producers.

- Sustainability Initiatives: With increasing concerns about environmental sustainability, consumers and businesses alike are paying more attention to the sustainability practices of alcohol producers. This includes efforts to reduce water usage, minimize waste, and adopt renewable energy sources in the production process.

Top Companies in Grain Alcohol Market:

ADM (US), Cargill (US), Merck Group (Germany), Roquette Frères (France), MGP Ingredients (US), Cristalco (France), Grain Processing Corporation (US), Wilmar Group (Singapore), Manildra Group (Australia), Glacial Grain Spirits (US)

Scope of the Report

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 12.2 billion |

|

Revenue Forecast in 2026 |

USD 14.9 billion |

|

Growth Rate |

CAGR of 4.1% from 2021 to 2026 |

|

Research Duration Considered |

2019-2026 |

|

Historical Base Year |

2020 |

|

Segmentation |

|

|

Growing Market Geographies |

|

|

Key companies profiled |

|

This research report categorizes the grain alcohol market based on type, application, source, functionality, and region.

Based on type, the market has been segmented as follows:

- Ethanol

- Polyols

Based on application, the market has been segmented as follows:

- Beverages

- Food

- Pharmaceutical & health care

Based on source, the market has been segmented as follows:

- Sugarcane

- Grains

- Fruits

- Other sources (corn and rice)

Based on functionality, the market has been segmented as follows:

- Preservative

- Coloring/flavoring agent

- Coatings

- Other functionalities (solubility, antifreeze, flammability, and volatility)

Based on the region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW

Grain Alcohol Market Recent Developments

- In January 2021, MGP Ingredients entered into a definitive agreement to acquire Luxco (US) and its affiliated companies. Luxco is a leading branded beverage alcohol company across various categories. As a result of the Luxco acquisition, MGP Ingredients expects to increase its scale and market position in the branded-spirits sector.

- In February 2021, Grain Processing Corporation opened a large, high-quality, efficient distillery in Muscatine, Iowa for the production of alcohol.

FAQs:

What is grain alcohol?

Grain alcohol, also known as ethanol or ethyl alcohol, is a type of alcohol that is produced by fermenting and distilling grains such as corn, wheat, barley, or rye. It is commonly used as a solvent, fuel, or as a base ingredient in the production of alcoholic beverages, pharmaceuticals, and personal care products.

What are the different grades of grain alcohol?

Grain alcohol is commonly categorized into several grades based on its purity:

- Denatured alcohol: Ethanol that has been rendered undrinkable by the addition of chemicals called denaturants. It is used in industrial applications and as a solvent.

- Food-grade alcohol: High-purity ethanol that is safe for consumption and is used in the production of food and beverages.

- Fuel-grade alcohol: Ethanol that is used as a fuel additive, typically blended with gasoline.

- Pharmaceutical-grade alcohol: Extremely high-purity ethanol used in the production of pharmaceuticals and medical products.

What are some emerging trends in the grain alcohol market?

Emerging trends in the grain alcohol market may include:

- Growing demand for organic and craft spirits, leading to niche markets and specialty products

- Increasing use of grain alcohol as a biofuel or renewable energy source, driven by sustainability goals and regulatory incentives

- Innovation in production technologies and processes to improve efficiency, reduce environmental impacts, and enhance product quality

- Shifting consumer preferences towards healthier or more sustainable alcoholic beverages, such as low-alcohol or zero-alcohol options

- Expansion of the market into new regions or applications, driven by globalization and changing consumer demographics.

What is the current size of the global grain alcohol market?

The global grain alcohol market is projected to witness substantial growth, with an anticipated increase from USD 12.2 billion in 2021 to USD 14.9 billion by 2026, reflecting a compound annual growth rate (CAGR) of 4.1% over the forecast period.

Which are the major key players in the grain alcohol market?

The key players in this market include ADM (US), Cargill (US), Wilmar Group (Singapore), Merck Group (Germany), and Roquette Frères (France).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017-2020

1.7 VOLUME UNITS CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 2 GRAIN ALCOHOL MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key primary insights

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE – BOTTOM-UP

2.2.2 APPROACH TWO – TOP-DOWN

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS AND RISK ASSESSMENT OF THE STUDY

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 OPTIMISTIC SCENARIO

2.6.2 REALISTIC & PESSIMISTIC SCENARIO

2.6.3 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 4 COVID-19: THE GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 6 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 38)

TABLE 2 MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 9 IMPACT OF COVID-19 ON THE GRAIN ALCOHOL MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 10 MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 11 MARKET SIZE FOR GRAIN ALCOHOL, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 12 MARKET SIZE FOR GRAIN ALCOHOL, BY SOURCE, 2021 VS. 2026 (USD MILLION)

FIGURE 13 GRAIN ALCOHOL MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 BRIEF OVERVIEW OF THE GLOBAL MARKET

FIGURE 14 RAPID URBANIZATION AND INCREASED DEMAND FOR PHARMACEUTICALS AND DISINFECTANTS

4.2 NORTH AMERICA: MARKET FOR GRAIN ALCOHOL, BY APPLICATION AND COUNTRY

FIGURE 15 THE US IS ESTIMATED TO ACCOUNT FOR A SIGNIFICANT MARKET SHARE IN 2021

4.3 GRAIN ALCOHOL MARKET (VOLUME), BY TYPE, 2021 VS. 2026

FIGURE 16 ETHANOL SEGMENT EXPECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.4 GRAIN ALCOHOL MARKET (VOLUME), BY APPLICATION, 2021 VS. 2026

FIGURE 17 BEVERAGES SEGMENT EXPECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 MARKET SHARE (VOLUME), BY KEY REGION/COUNTRY

FIGURE 18 CHINA IS ESTIMATED TO DOMINATE THE MARKET IN 2021

FIGURE 19 COVID-19 IMPACT ON THE GRAIN ALCOHOL MARKET: COMPARISON OF THE PRE- AND POST-COVID-19 SCENARIOS

5 GRAIN ALCOHOL MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 GROWTH OPPORTUNITIES IN DEVELOPING REGIONS SUCH AS ASIA PACIFIC AND SOUTH AMERICA

FIGURE 20 GDP GROWTH RATE IN ASIAN COUNTRIES, 2020–2021

5.2.2 INCREASING POPULATION DENSITY

TABLE 3 GLOBAL POPULATION DENSITY, 2019

FIGURE 21 POPULATION GROWTH TREND, 1950–2050

5.2.3 EFFECTS OF RAPID URBANIZATION AND WESTERNIZATION

FIGURE 22 MOST URBANIZED COUNTRIES, 2020

5.3 MARKET DYNAMICS

FIGURE 23 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Increasing global beer production and popularity of craft beer

FIGURE 24 BEER PRODUCTION, 2018 (‘000 HECTOLITERS)

5.3.1.2 Increasing global trade in alcohol

FIGURE 25 BEER CONSUMPTION, 2018 (‘000 HECTOLITERS)

5.3.2 RESTRAINTS

5.3.2.1 Awareness about harmful effects of alcohol consumption

5.3.3 OPPORTUNITIES

5.3.3.1 Emerging markets such as Asia Pacific, South America, Middle East and Africa

5.3.3.2 Contribution of co-products of ethanol production in the feed industry

5.3.4 CHALLENGES

5.3.4.1 Fluctuating prices of raw materials

5.3.4.2 Stringent regulations on the use of alcohol in food & beverages and health & personal care products

5.4 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.4.1 COVID-19 IMPACT ON THE GRAIN ALCOHOL SUPPLY CHAIN

6 GRAIN ALCOHOL INDUSTRY TRENDS (Page No. - 54)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 26 PRODUCT DEVELOPMENT & PRODUCTION OF GRAIN ALCOHOL CONTRIBUTE THE MOST TO THE OVERALL VALUE CHAIN

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 27 MANUFACTURERS PLAY A VITAL ROLE IN THE SUPPLY CHAIN FOR GRAIN ALCOHOL

FIGURE 28 GRAIN ALCOHOL (ETHANOL) PRODUCTION

6.4 GOVERNMENT REGULATIONS

6.4.1 INTRODUCTION

6.4.2 REGULATORY COMPLIANCES FOR ALCOHOLIC BEVERAGE MANUFACTURERS IN DIFFERENT COUNTRIES

TABLE 4 REGULATORY BODIES

6.4.3 REGULATORY PARAMETERS FOR ALCOHOL CONSUMPTION

6.4.3.1 Labeling

6.4.3.1.1 United States Pharmacopeia (USP)

7 GRAIN ALCOHOL MARKET, BY TYPE (Page No. - 58)

7.1 INTRODUCTION

FIGURE 29 MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021 VS. 2026 (KT)

TABLE 5 MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2017–2020 (USD MILLION)

TABLE 6 MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (USD MILLION)

TABLE 7 MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2017–2020 (KT)

TABLE 8 MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

7.1.1 COVID-19 IMPACT ON THE GRAIN ALCOHOL MARKET, BY TYPE

7.1.1.1 Realistic Scenario

TABLE 9 REALISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY TYPE, 2019–2022 (USD MILLION)

7.1.1.2 Pessimistic Scenario

TABLE 10 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY TYPE, 2019–2022 (USD MILLION)

7.1.1.3 Optimistic Scenario

TABLE 11 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE GRAIN ALCOHOL MARKET SIZE, BY TYPE, 2019–2022 (USD MILLION)

7.2 ETHANOL

TABLE 12 ETHANOL MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 13 ETHANOL MARKET SIZE, BY REGION, 2021–2026 (KT)

7.3 POLYOLS

TABLE 14 POLYOLS MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 15 POLYOLS MARKET SIZE, BY REGION, 2021–2026 (KT)

8 GRAIN ALCOHOL MARKET, BY SOURCE (Page No. - 64)

8.1 INTRODUCTION

FIGURE 30 MARKET SIZE FOR GRAIN ALCOHOL, BY SOURCE, 2021 VS. 2026 (KT)

TABLE 16 MARKET SIZE FOR GRAIN ALCOHOL, BY SOURCE, 2017–2020 (USD MILLION)

TABLE 17 MARKET SIZE FOR GRAIN ALCOHOL, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 18 MARKET SIZE FOR GRAIN ALCOHOL, BY SOURCE, 2017–2020 (KT)

TABLE 19 MARKET SIZE FOR GRAIN ALCOHOL, BY SOURCE, 2021–2026 (KT)

8.1.1 COVID-19 IMPACT ON GRAIN ALCOHOL MARKET, BY SOURCE

8.1.1.1 Realistic Scenario

TABLE 20 REALISTIC SCENARIO: COVID-19 IMPACT ON THE GRAIN ALCOHOL MARKET SIZE, BY SOURCE, 2019–2022 (USD MILLION)

8.1.1.2 Pessimistic Scenario

TABLE 21 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY SOURCE, 2019–2022 (USD MILLION)

8.1.1.3 Optimistic Scenario

TABLE 22 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY SOURCE, 2019–2022 (USD MILLION)

8.2 SUGARCANE

TABLE 23 SUGARCANE ALCOHOL MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 24 SUGARCANE ALCOHOL MARKET SIZE, BY REGION, 2021–2026 (KT)

8.3 GRAINS

TABLE 25 GRAIN SOURCES ALCOHOL MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 26 GRAIN SOURCES ALCOHOL MARKET SIZE, BY REGION, 2021–2026 (KT)

8.4 FRUITS

TABLE 27 FRUIT ALCOHOL MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 28 FRUIT ALCOHOL MARKET SIZE, BY REGION, 2021–2026 (KT)

8.5 OTHER SOURCES

TABLE 29 OTHER SOURCES MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 30 OTHER SOURCES MARKET SIZE, BY REGION, 2021–2026 (KT)

9 GRAIN ALCOHOL MARKET, BY APPLICATION (Page No. - 72)

9.1 INTRODUCTION

FIGURE 31 MARKET SIZE FOR GRAIN ALCOHOL, BY APPLICATION, 2021 VS. 2026 (KT)

TABLE 31 MARKET SIZE FOR GRAIN ALCOHOL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 32 MARKET SIZE FOR GRAIN ALCOHOL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 33 MARKET SIZE FOR GRAIN ALCOHOL, BY APPLICATION, 2017–2020 (KT)

TABLE 34 MARKET SIZE FOR GRAIN ALCOHOL, BY APPLICATION, 2021–2026 (KT)

9.1.1 COVID-19 IMPACT ON GRAIN ALCOHOL MARKET, BY APPLICATION

9.1.1.1 Realistic Scenario

TABLE 35 REALISTIC SCENARIO: COVID-19 IMPACT ON THE GRAIN ALCOHOL MARKET SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

9.1.1.2 Pessimistic Scenario

TABLE 36 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

9.1.1.3 Optimistic Scenario

TABLE 37 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE GLOBAL MARKET SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

9.2 BEVERAGES

TABLE 38 BEVERAGES: MARKET SIZE FOR GRAIN ALCOHOL, BY REGION, 2017–2020 (KT)

TABLE 39 BEVERAGES: MARKET SIZE FOR GRAIN ALCOHOL, BY REGION, 2021–2026 (KT)

TABLE 40 GRAIN ALCOHOL MARKET SIZE IN BEVERAGES, BY SUBAPPLICATION, 2017–2020 (KT)

TABLE 41 MARKET SIZE IN BEVERAGES, BY SUBAPPLICATION, 2021–2026 (KT)

9.2.1 BEER

TABLE 42 MARKET SIZE IN BEER, BY REGION, 2017–2020 (KT)

TABLE 43 MARKET SIZE IN BEER, BY REGION, 2021–2026 (KT)

9.2.2 WINE

TABLE 44 GRAIN ALCOHOL MARKET SIZE IN WINE, BY REGION, 2017–2020 (KT)

TABLE 45 MARKET SIZE IN WINE, BY REGION, 2021–2026 (KT)

9.2.3 SPIRITS

TABLE 46 MARKET SIZE IN SPIRITS, BY REGION, 2017–2020 (KT)

TABLE 47 MARKET SIZE IN SPIRITS, BY REGION, 2021–2026 (KT)

9.2.4 OTHER BEVERAGES

TABLE 48 GRAIN ALCOHOL MARKET SIZE IN OTHER BEVERAGES, BY REGION, 2017–2020 (KT)

TABLE 49 MARKET SIZE IN OTHER BEVERAGES, BY REGION, 2021–2026 (KT)

9.3 FOOD

TABLE 50 MARKET SIZE IN FOOD, BY REGION, 2017–2020 (KT)

TABLE 51 MARKET SIZE IN FOOD, BY REGION, 2021–2026 (KT)

9.4 PHARMACEUTICAL & HEALTH CARE

TABLE 52 GRAIN ALCOHOL MARKET SIZE IN PHARMACEUTICAL & HEALTH CARE, BY REGION, 2017–2020 (KT)

TABLE 53 MARKET SIZE IN PHARMACEUTICAL & HEALTH CARE, BY REGION, 2021–2026 (KT)

10 GRAIN ALCOHOL MARKET, BY FUNCTIONALITY (Page No. - 83)

10.1 PRESERVATIVES

10.2 COLORING/FLAVORING AGENTS

10.3 COATINGS

10.4 OTHER FUNCTIONALITIES

11 GRAIN ALCOHOL MARKET, BY REGION (Page No. - 84)

11.1 INTRODUCTION

FIGURE 32 REGIONAL SNAPSHOT: NEW HOTSPOTS TO EMERGE IN THE ASIA PACIFIC, 2021–2026

TABLE 54 MARKET SIZE FOR GRAIN ALCOHOL, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 MARKET SIZE FOR GRAIN ALCOHOL, BY REGION, 2021–2026 (USD MILLION)

TABLE 56 MARKET SIZE FOR GRAIN ALCOHOL, BY REGION, 2017–2020 (KT)

TABLE 57 MARKET SIZE FOR GRAIN ALCOHOL, BY REGION, 2021–2026 (KT)

11.2 COVID-19 IMPACT ON THE GRAIN ALCOHOL MARKET, BY REGION

11.2.1 OPTIMISTIC SCENARIO

TABLE 58 OPTIMISTIC SCENARIO: MARKET SIZE FOR GRAIN ALCOHOL, BY REGION, 2019–2022 (USD MILLION)

11.2.2 REALISTIC SCENARIO

TABLE 59 REALISTIC SCENARIO: MARKET SIZE FOR GRAIN ALCOHOL, BY REGION, 2019–2022 (USD MILLION)

11.2.3 PESSIMISTIC SCENARIO

TABLE 60 PESSIMISTIC SCENARIO: MARKET SIZE FOR GRAIN ALCOHOL, BY REGION, 2019–2022 (USD MILLION)

11.3 NORTH AMERICA

TABLE 61 NORTH AMERICA: GRAIN ALCOHOL MARKET SIZE, BY COUNTRY, 2017–2020 (KT)

TABLE 62 NORTH AMERICA: MARKET SIZE FOR GRAIN ALCOHOL, BY COUNTRY, 2021–2026 (KT)

TABLE 63 NORTH AMERICA: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2017–2020 (KT)

TABLE 64 NORTH AMERICA: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

TABLE 65 NORTH AMERICA: MARKET SIZE FOR GRAIN ALCOHOL, BY APPLICATION, 2017–2020 (KT)

TABLE 66 NORTH AMERICA: MARKET SIZE FOR GRAIN ALCOHOL, BY APPLICATION, 2021–2026 (KT)

TABLE 67 NORTH AMERICA: MARKET SIZE FOR GRAIN ALCOHOL, BY BEVERAGE SUB-APPLICATION, 2017–2020 (KT)

TABLE 68 NORTH AMERICA: MARKET SIZE FOR GRAIN ALCOHOL, BY BEVERAGE SUB-APPLICATION, 2021–2026 (KT)

TABLE 69 NORTH AMERICA: MARKET SIZE FOR GRAIN ALCOHOL, BY SOURCE, 2017–2020 (KT)

TABLE 70 NORTH AMERICA: MARKET SIZE FOR GRAIN ALCOHOL, BY SOURCE, 2021–2026 (KT)

11.3.1 US

11.3.1.1 High demand for alcoholic beverages to fuel the global market

TABLE 71 US: GRAIN ALCOHOL MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 72 US: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

11.3.2 CANADA

11.3.2.1 Prominence of alcoholic beverages and food products in Canadian lifestyle to drive the market

TABLE 73 CANADA: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2017–2020 (KT)

TABLE 74 CANADA: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

11.3.3 MEXICO

11.3.3.1 Drug and alcohol use is highly prevalent among Mexican consumers

TABLE 75 MEXICO: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2017–2020 (KT)

TABLE 76 MEXICO: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

11.4 EUROPE

FIGURE 33 EUROPE: GRAIN ALCOHOL MARKET SNAPSHOT

TABLE 77 EUROPE: MARKET SIZE FOR GRAIN ALCOHOL, BY COUNTRY, 2017–2020 (KT)

TABLE 78 EUROPE: MARKET SIZE FOR GRAIN ALCOHOL, BY COUNTRY, 2021–2026 (KT)

TABLE 79 EUROPE: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2017–2020 (KT)

TABLE 80 EUROPE: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

TABLE 81 EUROPE: MARKET SIZE FOR GRAIN ALCOHOL, BY APPLICATION, 2017–2020 (KT)

TABLE 82 EUROPE: MARKET SIZE FOR GRAIN ALCOHOL, BY APPLICATION, 2021–2026 (KT)

TABLE 83 EUROPE: MARKET SIZE FOR GRAIN ALCOHOL, BY BEVERAGE SUB-APPLICATION, 2017–2020 (KT)

TABLE 84 EUROPE: MARKET SIZE FOR GRAIN ALCOHOL, BY BEVERAGE SUB-APPLICATION, 2021–2026 (KT)

TABLE 85 EUROPE: MARKET SIZE FOR GRAIN ALCOHOL, BY SOURCE, 2017–2020 (KT)

TABLE 86 EUROPE: MARKET SIZE FOR GRAIN ALCOHOL, BY SOURCE, 2021–2026 (KT)

11.4.1 GERMANY

11.4.1.1 Presence of major players to uplift the global market

TABLE 87 GERMANY: GRAIN ALCOHOL MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 88 GERMANY: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

11.4.2 UK

11.4.2.1 Extensive application of polyols in food to spur this market in the UK

TABLE 89 UK: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2017–2020 (KT)

TABLE 90 UK: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

11.4.3 FRANCE

11.4.3.1 Well-established food & beverage sector to uphold the market for grain alcohol

TABLE 91 FRANCE: GRAIN ALCOHOL MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 92 FRANCE: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

11.4.4 ITALY

11.4.4.1 Hefty import-export activities to drive the market

TABLE 93 ITALY: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2017–2020 (KT)

TABLE 94 ITALY: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

11.4.5 REST OF EUROPE

11.4.5.1 Liqueur-infused food & beverage items to augment the demand for grain alcohol

TABLE 95 REST OF EUROPE: GRAIN ALCOHOL MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 96 REST OF EUROPE: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

11.5 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: GRAIN ALCOHOL MARKET SNAPSHOT

TABLE 97 ASIA PACIFIC: MARKET SIZE FOR GRAIN ALCOHOL, BY COUNTRY, 2017–2020 (KT)

TABLE 98 ASIA PACIFIC: MARKET SIZE FOR GRAIN ALCOHOL, BY COUNTRY, 2021–2026 (KT)

TABLE 99 ASIA PACIFIC: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2017–2020 (KT)

TABLE 100 ASIA PACIFIC: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

TABLE 101 ASIA PACIFIC: MARKET SIZE FOR GRAIN ALCOHOL, BY APPLICATION, 2017–2020 (KT)

TABLE 102 ASIA PACIFIC: MARKET SIZE FOR GRAIN ALCOHOL, BY APPLICATION, 2021–2026 (KT)

TABLE 103 ASIA PACIFIC: MARKET SIZE FOR GRAIN ALCOHOL, BY BEVERAGE SUB-APPLICATION, 2017–2020 (KT)

TABLE 104 ASIA PACIFIC: MARKET SIZE FOR GRAIN ALCOHOL, BY BEVERAGE SUB-APPLICATION, 2021–2026 (KT)

TABLE 105 ASIA PACIFIC: MARKET SIZE FOR GRAIN ALCOHOL, BY SOURCE, 2017–2020 (KT)

TABLE 106 ASIA PACIFIC: MARKET SIZE FOR GRAIN ALCOHOL, BY SOURCE, 2021–2026 (KT)

11.5.1 CHINA

11.5.1.1 Ingrained Chinese culture to benefit the global market

TABLE 107 CHINA: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2017–2020 (KT)

TABLE 108 CHINA: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

11.5.2 INDIA

11.5.2.1 Growing millennial population to drive the demand for grain alcohol

TABLE 109 INDIA: GRAIN ALCOHOL MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 110 INDIA: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

11.5.3 JAPAN

11.5.3.1 Augmented demand for Japanese whiskey to influence the grain alcohol market

TABLE 111 JAPAN: GRAIN ALCOHOL MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 112 JAPAN: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

11.5.4 AUSTRALIA & NEW ZEALAND

11.5.4.1 Countrywide consumption of alcoholic beverages to propel the global market

TABLE 113 AUSTRALIA & NEW ZEALAND: GRAIN ALCOHOL MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 114 AUSTRALIA & NEW ZEALAND: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

11.5.5 REST OF ASIA PACIFIC

11.5.5.1 Increasing preference for wine to fuel the global market

TABLE 115 REST OF ASIA PACIFIC: GRAIN ALCOHOL MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 116 REST OF ASIA PACIFIC: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

11.6 REST OF THE WORLD (ROW)

TABLE 117 ROW: GRAIN ALCOHOL MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 118 ROW: MARKET SIZE FOR GRAIN ALCOHOL, BY REGION, 2021–2026 (KT)

TABLE 119 ROW: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2017–2020 (KT)

TABLE 120 ROW: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

TABLE 121 ROW: MARKET SIZE FOR GRAIN ALCOHOL, BY APPLICATION, 2017–2020 (KT)

TABLE 122 ROW: MARKET SIZE FOR GRAIN ALCOHOL, BY APPLICATION, 2021–2026 (KT)

TABLE 123 ROW: MARKET SIZE FOR GRAIN ALCOHOL, BY BEVERAGE, 2017–2020 (KT)

TABLE 124 ROW: MARKET SIZE FOR GRAIN ALCOHOL, BY BEVERAGE, 2021–2026 (KT)

TABLE 125 ROW: MARKET SIZE FOR GRAIN ALCOHOL, BY SOURCE, 2017–2020 (KT)

TABLE 126 ROW: MARKET SIZE FOR GRAIN ALCOHOL, BY SOURCE, 2021–2026 (KT)

11.6.1 SOUTH AMERICA

11.6.1.1 Presence of vineyards fuels the production of alcohol

TABLE 127 SOUTH AMERICA: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2017–2020 (KT)

TABLE 128 SOUTH AMERICA: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

11.6.2 MIDDLE EAST & AFRICA

11.6.2.1 Young adult demographics augment the market

TABLE 129 MIDDLE EAST & AFRICA: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2017–2020 (KT)

TABLE 130 MIDDLE EAST & AFRICA: MARKET SIZE FOR GRAIN ALCOHOL, BY TYPE, 2021–2026 (KT)

12 COMPETITIVE LANDSCAPE (Page No. - 120)

12.1 OVERVIEW

12.2 REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 35 REVENUE ANALYSIS OF KEY PLAYERS IN THE GRAIN ALCOHOL MARKET, 2018-2020 (USD BILLION)

12.3 COVID-19-SPECIFIC COMPANY RESPONSE

12.4 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.4.1 STARS

12.4.2 PERVASIVE PLAYERS

12.4.3 EMERGING LEADERS

12.4.4 PARTICIPANTS

FIGURE 36 MARKET FOR GRAIN ALCOHOL, COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

12.4.5 PRODUCT FOOTPRINT

TABLE 131 COMPANY FOOTPRINT, BY APPLICATION

TABLE 132 COMPANY FOOTPRINT, BY PRODUCT TYPE

TABLE 133 COMPANY FOOTPRINT, BY REGION

TABLE 134 OVERALL COMPANY FOOTPRINT

12.5 GRAIN ALCOHOL MARKET, START-UP/SME EVALUATION QUADRANT, 2020

12.5.1 PROGRESSIVE COMPANIES

12.5.2 STARTING BLOCKS

12.5.3 RESPONSIVE COMPANIES

12.5.4 DYNAMIC COMPANIES

FIGURE 37 MARKET FOR GRAIN ALCOHOL: COMPANY EVALUATION QUADRANT, 2020 (START-UP/SMES)

12.6 COMPETITIVE SCENARIO

12.6.1 DEALS

TABLE 135 MARKET FOR GRAIN ALCOHOL: DEALS, 2021

12.6.2 OTHER DEVELOPMENTS

TABLE 136 MARKET FOR GRAIN ALCOHOL: OTHER DEVELOPMENTS, 2021

13 COMPANY PROFILES (Page No. - 128)

(Business overview, Products offered, Recent developments & MnM View)*

13.1 KEY PLAYERS

13.1.1 ADM

TABLE 137 ADM: BUSINESS OVERVIEW

FIGURE 38 ADM: COMPANY SNAPSHOT

TABLE 138 ADM: PRODUCTS OFFERED

13.1.2 CARGILL

TABLE 139 CARGILL: BUSINESS OVERVIEW

TABLE 140 CARGILL: PRODUCTS OFFERED

13.1.3 MERCK GROUP

TABLE 141 MERCK GROUP: BUSINESS OVERVIEW

FIGURE 39 MERCK GROUP: COMPANY SNAPSHOT

TABLE 142 MERCK GROUP: PRODUCTS OFFERED

13.1.4 ROQUETTE FRÈRES

TABLE 143 ROQUETTE FRÈRES: BUSINESS OVERVIEW

TABLE 144 ROQUETTE FRÈRES: PRODUCTS OFFERED

13.1.5 MGP INGREDIENTS

TABLE 145 MGP INGREDIENTS: BUSINESS OVERVIEW

FIGURE 40 MGP INGREDIENTS: COMPANY SNAPSHOT

TABLE 146 MGP INGREDIENTS: PRODUCTS OFFERED

TABLE 147 MGP INGREDIENTS: DEALS

13.1.6 CRISTALCO

TABLE 148 CRISTALCO: BUSINESS OVERVIEW

TABLE 149 CRISTALCO: PRODUCTS OFFERED

13.1.7 GRAIN PROCESSING CORPORATION

TABLE 150 GRAIN PROCESSING CORPORATION: BUSINESS OVERVIEW

TABLE 151 GRAIN PROCESSING CORPORATION: PRODUCTS OFFERED

TABLE 152 GRAIN PROCESSING CORPORATION: OTHER DEVELOPMENTS

13.1.8 WILMAR GROUP

TABLE 153 WILMAR GROUP: BUSINESS OVERVIEW

FIGURE 41 WILMAR GROUP: COMPANY SNAPSHOT

TABLE 154 WILMAR GROUP: PRODUCTS OFFERED

13.1.9 GLACIAL GRAIN SPIRITS

TABLE 155 GLACIAL GRAIN SPIRITS: BUSINESS OVERVIEW

TABLE 156 GLACIAL GRAIN SPIRITS: PRODUCTS OFFERED

13.1.10 MANILDRA GROUP

TABLE 157 MANILDRA GROUP: BUSINESS OVERVIEW

TABLE 158 MANILDRA GROUP: PRODUCTS OFFERED

13.1.11 GREENFIELD

TABLE 159 GREENFIELD: BUSINESS OVERVIEW

TABLE 160 GREENFIELD: PRODUCTS OFFERED

13.1.12 FONTERRA

TABLE 161 FONTERRA: BUSINESS OVERVIEW

FIGURE 42 FONTERRA: COMPANY SNAPSHOT

TABLE 162 FONTERRA: PRODUCTS OFFERED

13.1.13 ETHANOLSA

TABLE 163 ETHANOLSA: BUSINESS OVERVIEW

TABLE 164 ETHANOLSA: PRODUCTS OFFERED

13.1.14 BARTOW ETHANOL, LLC

TABLE 165 BARTOW ETHANOL, LLC: BUSINESS OVERVIEW

TABLE 166 BARTOW ETHANOL, LLC: PRODUCTS OFFERED

13.1.15 SHANKER INTERNATIONAL

TABLE 167 SHANKER INTERNATIONAL: BUSINESS OVERVIEW

TABLE 168 SHANKER INTERNATIONAL: PRODUCTS OFFERED

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 FAIRLY TRADED ORGANICS

13.2.2 ORGANIC ALCOHOL COMPANY

13.2.3 SME ALCOHOL

13.2.4 THE NORTHERN MAINE DISTILLING COMPANY

13.2.5 ETHANOLUS

14 ADJACENT & RELATED MARKETS (Page No. - 156)

14.1 INTRODUCTION

TABLE 169 ADJACENT MARKETS TO GRAIN ALCOHOL

14.2 LIMITATIONS

14.3 BREWING INGREDIENTS MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 170 BREWING INGREDIENTS MARKET SIZE, BY BREWERY SIZE, 2019–2026 (USD MILLION)

14.4 INDUSTRIAL ALCOHOL MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

TABLE 171 INDUSTRIAL ALCOHOL MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

15 APPENDIX (Page No. - 159)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

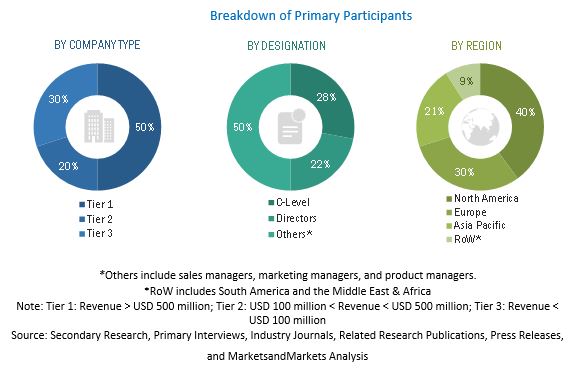

The study involved four major activities in estimating the grain alcohol market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of manufacturing companies and government organizations, service-providing company officials, government and research organizations, and research officers. The supply side is characterized by the presence of key CEOs and vice presidents, marketing directors, product innovation directors and related key executives from manufacturing companies and organizations operating in the market, and manufacturing and marketing companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Grain Alcohol Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through extensive secondary research.

- The COVID-19 impact on market size of grain alcohol was determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- Determining and projecting the size of the grain alcohol market, with respect to type, application, source, and regional markets, over a period, ranging from 2021 to 2026.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions.

- Providing detailed information about the impact of COVID-19 on grain alcohol supply chain and its impact on various stakeholders such as suppliers, manufacturers, and retailers across the supply chain.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro markets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the market and impact of COVID-19 on the key vendors.

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- Analyzing the value chain and products offered across key regions and their impact on the growth of the prominent market players

- Providing insights on key product innovations and investments in the market.

Available Customizations

Geographical Analysis

- Further breakdown of the Rest of Europe grain alcohol market, by key country

- Further breakdown of the Rest of Asia Pacific grain alcohol market, by key country

Company Information

- Analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Grain Alcohol Market