Food & Beverage Processing Equipment Market by Type (Processing, Pre-Processing), Application (Bakery & Confectionery, Meat & Poultry, Dairy, Alcoholic & Non Alcoholic Beverages), Mode of Operation, End Product Form and Region - Global Forecast to 2028

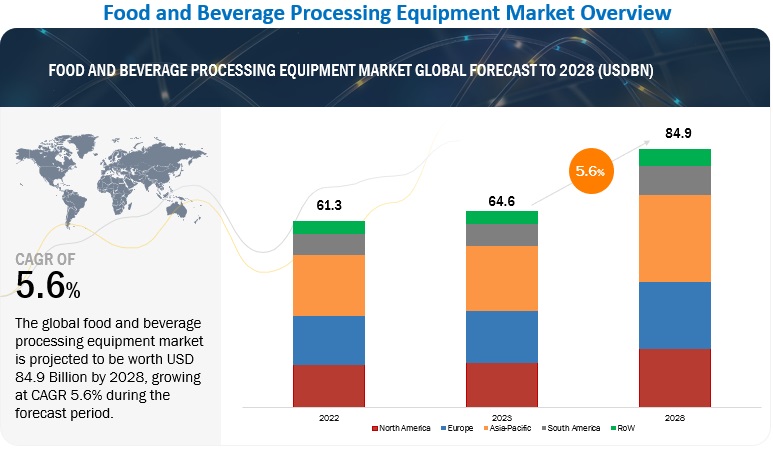

The global food and beverage processing equipment market size was valued at US$ 61.3 billion in 2022 and is poised to grow from US$ 64.6 billion in 2023 to US$ 84.9 billion by 2028, growing at a CAGR of 5.6% in the forecast period (2023-2028).

Food Processing and Preservation is an important aspect of food and beverage processing equipment. Equipment such as pasteurizers, sterilizers, vacuum heating, freezing and more operations helps to preserve the quality and shelf-life of food and beverage products. This allows manufacturers to produce products in bulk, store them for longer periods, and transport them over longer distances without compromising their quality. Processing also helps to reduce waste by extending the life of the product, making it more cost-effective for both manufacturers and consumers. The Food and beverage processing equipment are designed to comply with strict safety standards, ensuring that the products are safe for consumption, by the equipment manufacturers. Overall, these factors are expected to drive the growth of the food and beverage processing market in the future.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: Growth in demand for convenience foods

Over the upcoming years, the market is anticipated to be driven by advancements in food processing technology, an increase in consumer demand for processed foods, and more research and development into food processing equipment. Distribution, preservation, the convenience of preparation, and reduced susceptibility to deterioration compared to fresh food are all advantages of food processing. Additionally, it enhances food flavor while lowering the prevalence of foodborne illness. Food processing equipment is divided into depositors, extruding machines, mixers, refrigerators, slicers and dicers, and others based on type. Beverages, dairy, meat and poultry, bakery, convenience foods and snacks, fruits and vegetables, confectionery, and others are only a few food processing applications.

Reverse micellar, enzyme-assisted, and membrane ultrafiltration technologies are examples of innovations used in separating and functionalizing soy-based protein extraction and formulations that provide the finished products. Factors such as the expanding “health and wellness” movement, consumers’ increased interest in meat alternatives, and developments in ingredient technologies (such as microencapsulation) are supporting the growth of plant-based proteins. The US population’s 29% shift to flexitarians since 2017 presents the biggest growth opportunity for soy-based food and beverage products, according to PBFA. With this, introducing microencapsulation in industries allows food processing machine industries to curate machines to extract food from plant-based sources, which can later be processed and consumed by vegan consumers.

Due to the industry’s rapid growth, the outlook for growth of the food & beverage processing equipment market is anticipated to remain positive. Key players in the market offer a wide variety of premium food and beverage brands. Some examples of companies with premium brands include Danone, which sells Alpro and Activia; Cargill, which sells the Sterling Silver Premium Meats line; and Finsbury Food Group PLC, which sells Vogel’s Village Bakery, Cranks, and LivLife brands. Currently, consumers can choose from a wide variety of food products based on their preferences.

Restraints: Several rules and regulations implemented by governments globally

Due to the COVID-19 pandemic and the increased number of foodborne illnesses, numerous governments and food organizations worldwide have enacted rigorous laws and regulations on food processing and handling hygiene. To lessen the danger posed by convenience foods, governments are providing food processing and handling machinery operators with various safety training facilities. Due to the limited capital backing in some rising small and medium-sized businesses, implementing government regulations has become a complex process, which restrains the growth of the global market.

“All industry equipment and utensils shall be so designed, and of such material and workmanship as to be adequately cleanable, and shall be properly maintained,” according to the Current Good Manufacturing Practices (cGMPs) rule by US Public Health Service/US Food and Drug Administration (FDA) Food Code in 2021. Five fundamental principles are considered in the understanding of this statement:

- Under normal usage conditions, all equipment and utensils with food contact surfaces must be made of stainless steel or other non-toxic, smooth, impermeable, non-corrosive, non-absorbent materials.

- All surfaces that come into touch with food must be easily cleanable and free of breaks, open seams, cracks, and other problems.

- Surfaces that meet food must not provide any flavor, color, or other adulterants to the food.

- Except for food contact surfaces intended for clean-in-place (CIP) cleaning, all food contact surfaces must be easily accessible for manual cleaning.

- All joints and fittings must be made of hygienic materials.

The safety design specifications for equipment used in food processing are provided by the British Standards mentioned below. Since their initial release, most of these Standards have been revised (for instance, BSEN453:2000 was revised in 2009 to become BSEN453:2000 + A1:2009). The Standards are offered by the British Standards Institution and are founded on European CEN Standards.

Opportunities: Government initiatives toward meat & processed food industry

The growing demand for extruded snacks, dairy, meat, confections, and bakery products in developing markets such as China, India, Brazil, and the European region is driving up demand for automation in the food & beverage processing industry. Manufacturers are increasing production to reach these markets, driving up demand for food extruders in the area. Manufacturers of snack pellets are being inspired by this to upgrade and expand their facilities. Industry automation has steadily increased since 2017, says Invest India (National Investment Promotion and Facilitation Agency), and investments have increased. According to the Minister of State for Food Processing Industries, FDI in the food processing industry totaled USD 44.3 billion in 2018–2019.

In 2019, through training, food safety audits, certification of animal feed, and pressuring merchants to make health and safety improvements, the Food Safety and Standards Authority of India (FSSAI) undertook a hygiene and cleanliness crusade in the Indian meat business. Within the next three months, it intended to conduct a food safety audit of meat processing facilities, slaughterhouses, distribution centers, and retail establishments throughout 40 cities. Additionally, by December 2019, the FDA had held 50 training sessions for meat handlers throughout India. The FSSAI stated that it was considering updating formal animal feed requirements as well as financing initiatives offering small meat businesses government support to enhance their sanitary methods, collaborating with other government organizations, including the Bureau of Indian Requirements.

The cost of labor per hour increased by 4.2% in the Euro region and 4.1% in the European Union (EU) in the second quarter of 2020, the quarter that saw the widespread implementation of the COVID-19 containment measures in the European Union. Hourly labor costs climbed by 3.7% and 3.9%, respectively, in the first quarter of 2020. Automation now has more room to grow in all economies. To address the labor shortage, because of the increasing labor wages, European manufacturers are concentrating on robotic interventions because of the rising labor wages.

The working and living circumstances of the posted and temporary workers employed by the German meat processing sector had been the subject of heated discussion for years. The government attempted to address the issue by reaching agreements with the sector that would ensure moral behavior and better working conditions. However, the pandemic exposed occupational health and safety gaps, infection prevention, and health protection standards. The large number of infections that resulted from these gaps, as well as the new regulations on labor inspection in general and the working conditions in the meat sector, are the results. New rules went into effect on January 1, 2021. They must be vigorously enforced by the appropriate authorities.

Brazil is transforming into an economic powerhouse in promoting domestic industry development and foreign investment. For processed bakery and snack goods, there is a significant market in Europe. By bringing together various stakeholders in the snacks industry, the European Snacks Association (ESA) has supported the markets for snacks and snack pellets. To advance trade through knowledge sharing, the association organizes various trade shows, conferences, and publications of technical insights. The ESA accepts responsibility for informing members of the association’s current and future trends. The North American Association of Food Equipment Manufacturers also offers all the assistance needed to start, grow, or improve a business in terms of technical know-how and other guidance. Via all these government initiatives, the region-wise government is trying to increase employment opportunities and promote better quality meat for export purposes.

Challenges: Infrastructural challenges in emerging economies

The saturated markets of developed regions such as Europe and North America compel food processing equipment manufacturers to search for untapped markets and expand their consumer base. This requires substantial investments in many aspects of business expansion, especially in establishing new facilities in developing countries. Apart from internal investments in facilities, manufacturers also need to spend heavily on developing efficient supply chain management and storing raw materials and finished goods. Although low raw material prices and labor costs benefit processing companies entering developing countries, the investment costs for infrastructural development are a significant challenge. Many developing countries still lack proper infrastructure facilities, such as cold storage facilities, non-availability of refrigerated transport, and non-availability of electric supply and road and rail connectivity. These challenges need to be addressed by the respective governments and manufacturers to support the growth of the food & beverage processing equipment market in developing regions.

Based on mode of operations, automatic segment is estimated to account for the largest market share of the food and beverage processing equipment market.

Automatic machines offer several advantages over manual machines, which is why food manufacturers prefer them. Firstly, automatic machines can produce food products at a faster rate than manual machines, leading to increased efficiency and higher production capacity. This allows food manufacturers to meet demand while reducing production costs and increasing profits. Further, the use of automatic machines reduces labor costs, as they require fewer workers to operate. This is especially important in the food industry, where labor costs can be high. By reducing the number of workers required, food manufacturers can save money and increase their profits. The use of automatic machines offers several advantages to food manufacturers, including increased efficiency, consistency in production, reduced labor costs, and improved food safety. These advantages make them a preferred choice for food manufacturers, leading to increased adoption of automatic machines in the food industry.

Based on end product form, The solid segment are anticipated to dominate the market.

Solid foods tend to be more filling than semi-solid or liquid foods. They take longer to chew and digest, which helps to create a feeling of fullness and satisfaction. The process of chewing food helps to break it down into smaller pieces, which makes it easier for our bodies to digest and absorb the nutrients. Additionally, solid foods tend to take longer to digest in our stomachs, which can also contribute to feelings of fullness and satisfaction. Thus, consumers prefer more of solid food products over semi-solid and liquid food products.

Non-alcoholic segment of the food and beverage processing equipment market by application is projected to witness the highest CAGR during the forecast period.

Non-alcoholic beverages offer a wider variety of flavors and options than alcoholic beverages. There are many different types of non-alcoholic beverages available, including sparkling waters, iced teas, coffees, and mocktails, which can appeal to a broad range of tastes and preferences. Also, Non-alcoholic beverages are becoming more socially acceptable and are being offered in more settings, such as bars and cafes. Thus, the increase in consumer preference and consumption had led to the highest CAGR during the forecast period.

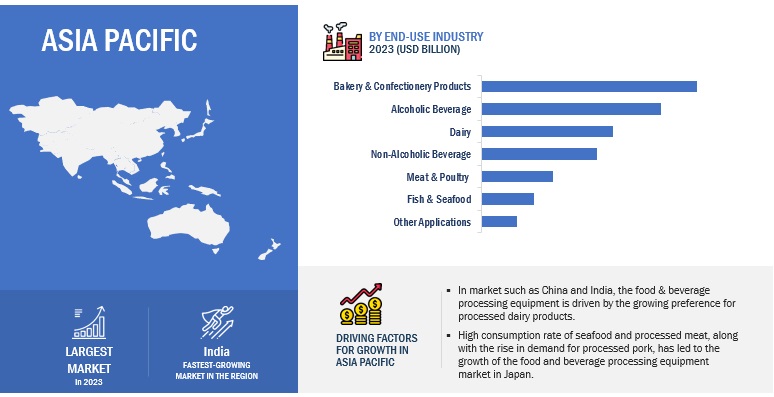

The Asia Pacific market is projected to contribute the largest share for the food and beverage processing equipment market.

The Asia Pacific region is the dominant market for food & beverages and is expected to be the largest for food & beverage processing equipment as well. The food industry in Asia Pacific is gigantic. In the region, product innovations and technological advances have increasingly pressured quality standards at all levels, with a growing emphasis on food safety, integrity, quality, and nutritional and health impacts. The growing consumer base and rising advanced technological developments in the processed food industry are expected to drive the growth of the food & beverage processing equipment market in emerging counties such as China, India, and Thailand, to name a few. Thus, creating a large market share in the food and beverage processing equipment market.

Key Market Players

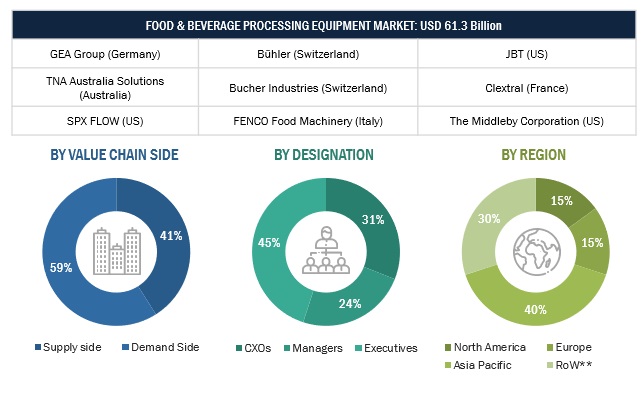

Marel (Iceland), GEA Group Aktiengesellschaft (Germany), Bühler (Switzerland), JBT (US), and Tetra Laval (Switzerland) are among the key players in the global food and beverage processing equipment market. Companies are focusing on expanding their production facilities by entering into partnerships and agreements as well as by launching new products to grow their businesses and their market shares. New product launches as a result of extensive research & development (R&D) initiatives, geographical expansion to tap the potential of emerging economies, and strategic acquisitions to gain a foothold over the large extent of the supply chain are the key strategies adopted by companies in the food & beverage processing equipment market.

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments covered |

By Type, By Application, By End-product form, By Mode of Operation, By Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America and RoW |

|

Companies studied |

|

Report Scope:

Food and Beverage Processing Equipment Market:

By Type

-

Pre-processing

- Sorting & grading

- Cutting, peeling, grinding, slicing, and washing

- Mixing & blending

-

Processing

- Forming

- Extruding

- Coating

- Drying, cooling, and freezing

- Thermal

- Homogenization

- Filtration

- Pressing

By Application

- Bakery & confectionery products

- Meat & poultry

- Dairy products

- Fish & seafood

- Alcoholic beverages

- Non-alcoholic beverages

- Other applications

By End Product form

- Solid

- Liquid

- Semi-solid

By Mode of Operation

- Semi-automatic

- Automatic

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)**

Recent Developments

- In February 2023, Marel launched the MS 2750 filleting machine, providing accurate and flexible salmon and trout filleting for secondary processors. The MS 2750 could process up to 25 fish per minute with minimal operator input, reducing labor dependency and improving yield. The MS 2750 would strengthen Marel's position in the food & beverage processing equipment market, particularly in the salmon and trout industry, by providing processors with durable and flexible equipment that maximizes yield and efficiency.

- In August 2021, new product launch of GEA Ariete Homogenizer 3160 was designed by GEA to be a high-pressure homogenizer to process a wide range of products, including those with high viscosity and solid content. The GEA TriplexPanda Lab Homogenizer, on the other hand, was a laboratory-scale homogenizer that could be used for product development and testing. By extending its range of homogenizers, GEA would be able to offer its customers a wider range of options to meet their specific processing needs. This would help strengthen the company’s position as a leading supplier of food & beverage processing equipment.

- In April 2021, SPX Flow acquired of Philadelphia Mixing Solutions, Ltd. from Thunder Basin Corporation. Philadelphia Mixing Solutions has more than six decades of industry experience in multi-industry mixing products and services, along with a reputation for world-class innovation, technical support, testing, analysis, and field service. This strategic acquisition would strengthen the company’s foothold in the food & beverage processing equipment market..

- In May 2022, Curio and Marel recently opened a demonstration and learning facility in Peterhead, Scotland, their first in the UK. The facility would offer live demonstrations of Curio’s heading and filleting machines, as well as other Marel solutions. The new demo and learning facility would help Marel strengthen its position in the food & beverage processing equipment market by showcasing its latest technology and expertise in fish processing.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the food and beverage processing equipment market?

The Asia Pacific region accounted for the largest share and fastest growing market, in terms of value, of USD 20.06 billion, of the global food & beverage processing equipment market in 2022 and is expected to grow at a CAGR of 6.2%. The growing consumer base and rising advanced technological developments in the processed food industry are expected to drive the growth of the food & beverage processing equipment market in emerging counties such as China, India, and Thailand, to name a few.

What is the current size of the global food and beverage processing equipment market?

The food and beverage processing equipment market is estimated at USD 64.6 billion in 2023 and is projected to reach USD 84.9 billion by 2028, at a CAGR of 5.6% from 2022 to 2028.

Which are the key players in the market?

Key players operating in this market include Tetra Laval (Switzerland), Marel (Iceland), GEA Group Aktiengesellschaft (Germany), JBT (US), Bühler (Switzerland), Alfa Laval (Sweden), Bucher Industries AG (Switzerland), SPX Flow Inc.( US), The Middleby Corporation (US), Krones AG (Germany), Bigtem Makine A.S (Turkey), Equipamientos Cárnicos, S.L (Spain), Tna Australia Pty Limited (Australia), Fenco Food Machinery S.R.L (Italy) And Khs Group (Germany).

What are the factors driving the food and beverage processing equipment market?

Growth in demand for convenience foods and Restaurants generate profits through automation in food & beverage industry.

Which segment by application accounted for the largest food and beverage processing equipment market share?

The bakery & confectionery segment dominated the market for food & beverage processing equipment and was valued the largest at USD 14.7 billion in 2022. This can be attributed to extended shelf life, improved flavor and texture and improved texture of the bakery & confectionery products that are processed using different processing equipment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSRISE IN DEMAND FOR MEAT, POULTRY, AND BAKERY PRODUCTSINCREASE IN CONSUMPTION OF SAFE AND HYGIENIC PROCESSED FOODS

-

5.3 MARKET DYNAMICSDRIVERS- Growth in demand for convenience foods- Restaurants generate profits through automation in food & beverage industryRESTRAINTS- Several rules and regulations implemented by governments globallyOPPORTUNITIES- Government initiatives toward meat & processed food industry- New technological trends in food processingCHALLENGES- Infrastructural challenges in emerging economies

- 6.1 INTRODUCTION

-

6.2 REGULATORY FRAMEWORKREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY FRAMEWORKCOUNTRY-WISE REGULATORY AUTHORITIES FOR FOOD & BEVERAGE PROCESSING EQUIPMENT- North America- Europe- Asia Pacific

-

6.3 PATENT ANALYSIS

-

6.4 VALUE CHAIN ANALYSISRESEARCH & PRODUCT DEVELOPMENTINPUTSFOOD & BEVERAGE PROCESSING EQUIPMENT MANUFACTURINGDISTRIBUTION & SALES MANAGEMENTEND-USER INDUSTRY

-

6.5 TRENDS/DISRUPTIONS IMPACTING BUYERS OF FOOD & BEVERAGE PROCESSING EQUIPMENTPELLET FRYING LINEROBOT GRIPPERS

-

6.6 MARKET ECOSYSTEMUPSTREAM- Equipment manufacturers- Technology providers- End usersDOWNSTREAM- Startups/Emerging companies

- 6.7 TRADE ANALYSIS

- 6.8 KEY CONFERENCES & EVENTS

-

6.9 CASE STUDY ANALYSISINSTALLATION OF FASTER PACKAGING LINE AT MEAT PRODUCTION FACILITIESPRODUCTION LINE AUTOMATION NEEDED AT FROZEN FOOD AND MEAT PRODUCT FACILITIES IN CHINABISCUIT MANUFACTURING WITH EFFICIENT, COMPACT PACKAGING EQUIPMENT

-

6.10 TECHNOLOGY ANALYSISISOCHORIC FREEZINGHIGH-VOLTAGE ATMOSPHERIC COLD PLASMAELECTROHYDRODYNAMIC DRYING

-

6.11 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.12 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 6.13 BUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 SEMI-AUTOMATICLOWER INSTALLATION AND MAINTENANCE COSTS FUEL MARKET IN EMERGING ECONOMIES

-

7.3 AUTOMATICACCURACY, TIME-SAVING, AND EFFICIENCY OFFERED BY AUTOMATION

- 8.1 INTRODUCTION

-

8.2 SOLIDINCREASING CONSUMPTION OF ULTRA-PROCESSED SOLID FOOD PRODUCTS

-

8.3 LIQUIDGROWTH IN HEALTH AWARENESS AND DEMAND FOR FRUIT & VEGETABLE JUICES

-

8.4 SEMI-SOLIDWIDE RANGE OF APPLICATIONS IN DIPS, SAUCES, SPREADS, AND DRESSINGS

- 9.1 INTRODUCTION

-

9.2 BAKERY & CONFECTIONERY PRODUCTSHIGH DEMAND FOR PROCESSED AND PREMIUM BAKERY PRODUCTS IN DEVELOPED COUNTRIES

-

9.3 MEAT & POULTRYINCREASED CONSUMPTION OF PROCESSED AND FROZEN MEAL PRODUCTS

-

9.4 DAIRY PRODUCTSAUTOMATED PROCESSING LINES CURATED BY MANY DAIRY PRODUCT MANUFACTURERS TO INCREASE PRODUCTION

-

9.5 FISH & SEAFOODUSAGE OF AUTOMATION PROCESSING EQUIPMENT FOR FISH & SEAFOOD TO INCREASE SHELF LIFE

-

9.6 ALCOHOLIC BEVERAGESINCREASE IN NUMBER OF BREWERIES

-

9.7 NON-ALCOHOLIC BEVERAGESRISE IN AWARENESS TOWARD HEALTHY AND FUNCTIONAL DRINKS

- 9.8 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 PRE-PROCESSINGSORTING & GRADING- Reduced wastage, food safety assurance, and improved quality of sorted food productsCUTTING, PEELING, GRINDING, SLICING, AND WASHING- Improved hygiene and consistency of cut fruits and vegetablesMIXING & BLENDING- Easy and consistent mixing of ingredients in bakery & confectionery, beverage, and dairy industries

-

10.3 PROCESSINGFORMING- Consistent quality, quick processing, and errors associated with manual operations avoided by forming equipmentEXTRUDING- High efficiency of extrusion in production of breakfast cerealsCOATING- Increase in demand for healthier snack products and premium coated confectionery productsDRYING, COOLING, AND FREEZING- Freeze and spray drying find major applications in processing seasonal and perishable food productsTHERMAL- Prevention of food spoilage due to heat treatmentHOMOGENIZATION- High-volume processing, along with low energy costs of dairy productsFILTRATION- Demand for high quality and extended shelf life of filtered alcoholic and non-alcoholic beveragesPRESSING- High efficiency and ease of sap extraction in wine and fruit juice industries

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Strong presence of key market players and increasing use of automation in USCANADA- Increase in processed food & beverage consumption in CanadaMEXICO- Presence of established processed food manufacturers in Mexico

-

11.3 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- High preference for fortified food & beverage products in ChinaJAPAN- Westernized food consumption patterns, along with inclination toward balanced and healthy diets in JapanINDIA- Supportive government policies and growing consumer awareness regarding healthy diet in IndiaAUSTRALIA & NEW ZEALAND- Consumer preference to spend on nutritional food products in Australia & New ZealandREST OF ASIA PACIFIC

-

11.4 EUROPEEUROPE: RECESSION IMPACT ANALYSISUK- Increased preference for frozen convenience food & beverages in UKGERMANY- Small and medium-scale companies dominate food processing industry in GermanyITALY- Focus on food processing and export of food machinery in ItalySPAIN- Significantly large meat and seafood industry in SpainFRANCE- Investment by French companies in Asia Pacific to produce dairy, bakery & confectionery products, and beveragesREST OF EUROPE

-

11.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Rise in demand for bakery & confectionery and investments in processed food & beverages in BrazilARGENTINA- Increase in meat consumption to drive processing in ArgentinaREST OF SOUTH AMERICA

-

11.6 REST OF THE WORLD (ROW)ROW: RECESSION IMPACT ANALYSISMIDDLE EAST- Rise in demand for dairy products and increase in investments in Middle Eastern processed food & beverage industryAFRICA- Consumer preference to drive African bakery & confectionery industry

- 12.1 OVERVIEW

- 12.2 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- 12.3 MARKET SHARE ANALYSIS

- 12.4 KEY PLAYER STRATEGIES

-

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

12.6 COMPANY EVALUATION QUADRANT (STARTUPS/SMES)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

12.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY PLAYERSTETRA LAVAL- Business overview- Products offered- Recent developments- MnM viewMAREL- Business overview- Products offered- Recent developments- MnM viewGEA GROUP AKTIENGESELLSCHAFT- Business overview- Products offered- Recent developments- MnM viewJBT- Business overview- Products offered- Recent developments- MnM viewBÜHLER- Business overview- Products offered- Recent developments- MnM viewALFA LAVAL- Business overview- Products offered- Recent developments- MnM viewBUCHER INDUSTRIES AG- Business overview- Products offered- Recent developments- MnM viewSPX FLOW, INC.- Business overview- Products offered- Recent developments- MnM viewTHE MIDDLEBY CORPORATION- Business overview- Products offered- Recent developmentsKRONES AG- Business overview- Products offered- Recent developments- MnM viewBIGTEM MAKINE A.S.- Business overview- Products offered- Recent developments- MnM viewEQUIPAMIENTOS CÁRNICOS, S.L.- Business overview- Products offered- Recent developments- MnM viewTNA AUSTRALIA PTY LIMITED- Business overview- Products offered- Recent developments- MnM viewFENCO FOOD MACHINERY S.R.L.- Business overview- Products offered- Recent developments- MnM viewKHS GROUP- Business overview- Products offered- Recent developments- MnM view

-

13.2 OTHER PLAYERSCLEXTRAL- Business overview- Products offered- Recent developments- MnM viewGOMA- Business overview- Products offered- Recent developments- MnM viewNEOLOGIC ENGINEERS PVT. LTD- Business overview- Products offered- Recent developmentsFINIS FOOD PROCESSING EQUIPMENT B.V.- Business overview- Products offered- Recent developments- MnM viewANDERSON DAHLEN- Business overview- Products offered- Recent developments- MnM viewHEAT AND CONTROL, INC.ANKO FOOD MACHINE CO., LTDBAADERDOVER CORPORATIONBETTCHER INDUSTRIES, INC

- 14.1 INTRODUCTION

-

14.2 BEVERAGE PROCESSING EQUIPMENT MARKETLIMITATIONSMARKET DEFINITIONMARKET OVERVIEWBEVERAGE PROCESSING EQUIPMENT MARKET, BY BEVERAGE TYPEBEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION

-

14.3 BAKERY PROCESSING EQUIPMENT MARKETMARKET DEFINITIONMARKET OVERVIEWBAKERY PROCESSING EQUIPMENT MARKET, BY TYPEBAKERY PROCESSING EQUIPMENT MARKET, BY REGION

-

14.4 DAIRY PROCESSING EQUIPMENT MARKETLIMITATIONSMARKET DEFINITIONMARKET OVERVIEW

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 RESEARCH ASSUMPTIONS

- TABLE 3 LIMITATIONS AND RISK ASSESSMENT

- TABLE 4 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 LIST OF MAJOR PATENTS PERTAINING TO FOOD & BEVERAGE PROCESSING EQUIPMENT, 2012–2022

- TABLE 9 FOOD & BEVERAGE PROCESSING EQUIPMENT: ECOSYSTEM VIEW

- TABLE 10 IMPORT VALUE OF INDUSTRIAL FOOD PREPARATION MACHINERY FOR KEY COUNTRIES, 2021 (USD MILLION)

- TABLE 11 EXPORT VALUE OF INDUSTRIAL FOOD PREPARATION MACHINERY FOR KEY COUNTRIES, 2021 (USD MILLION)

- TABLE 12 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: CONFERENCES & EVENTS, 2023–2024

- TABLE 13 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY MODE OF OPERATION

- TABLE 15 KEY BUYING CRITERIA FOR MODE OF OPERATION

- TABLE 16 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 17 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 18 SEMI-AUTOMATIC FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 19 SEMI-AUTOMATIC FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 AUTOMATIC FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 AUTOMATIC FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION 2023–2028 (USD MILLION)

- TABLE 22 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2018–2022 (USD MILLION)

- TABLE 23 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2023–2028 (USD MILLION)

- TABLE 24 SOLID FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 SOLID FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION 2023–2028 (USD MILLION)

- TABLE 26 LIQUID FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 LIQUID FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION 2023–2028 (USD MILLION)

- TABLE 28 SEMI-SOLID FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 SEMI-SOLID FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 31 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 32 BAKERY & CONFECTIONERY PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 BAKERY & CONFECTIONERY PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 MEAT & POULTRY PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 MEAT & POULTRY PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 DAIRY PRODUCT PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 DAIRY PRODUCT PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 FISH & SEAFOOD PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 FISH & SEAFOOD PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 OTHER FOOD & BEVERAGE PROCESSING EQUIPMENT APPLICATIONS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 OTHER FOOD & BEVERAGE PROCESSING EQUIPMENT APPLICATIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 47 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 48 PRE-PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 PRE-PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 51 PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 52 SORTING & GRADING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 SORTING & GRADING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 CUTTING, PEELING, GRINDING, SLICING, AND WASHING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 55 CUTTING, PEELING, GRINDING, SLICING, AND WASHING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 MIXING & BLENDING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 MIXING & BLENDING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 61 PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 62 FORMING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 63 FORMING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 EXTRUDING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 65 EXTRUDING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 COATING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 67 COATING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 DRYING, COOLING, AND FREEZING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 69 DRYING, COOLING, AND FREEZING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 THERMAL EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 71 THERMAL EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 HOMOGENIZATION EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 73 HOMOGENIZATION EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 FILTRATION EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 75 FILTRATION EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 PRESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 77 PRESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 79 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2018–2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2023–2028 (USD MILLION)

- TABLE 94 US: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 95 US: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 CANADA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 97 CANADA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 98 MEXICO: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 99 MEXICO: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 101 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 105 ASIA PACIFIC: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC: PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2018–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2023–2028 (USD MILLION)

- TABLE 114 CHINA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 115 CHINA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 116 JAPAN: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 117 JAPAN: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 118 INDIA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 119 INDIA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 120 AUSTRALIA & NEW ZEALAND: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 121 AUSTRALIA & NEW ZEALAND: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 124 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 125 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 126 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 127 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 128 EUROPE: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 129 EUROPE: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 130 EUROPE: PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 131 EUROPE: PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 132 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 133 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 134 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 135 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 136 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2018–2022 (USD MILLION)

- TABLE 137 EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2023–2028 (USD MILLION)

- TABLE 138 UK: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 139 UK: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 140 GERMANY: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 141 GERMANY: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 142 ITALY: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 143 ITALY: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 144 SPAIN: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 145 SPAIN: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 146 FRANCE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 147 FRANCE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 148 REST OF EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 149 REST OF EUROPE: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 150 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 151 SOUTH AMERICA: FOOD & BEVERAGE PRODUCT PROCESSING EQUIPMENT MARKET, BY REGION 2023–2028 (USD MILLION)

- TABLE 152 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 153 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 154 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 155 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 156 SOUTH AMERICA: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 157 SOUTH AMERICA: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 158 SOUTH AMERICA: PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 159 SOUTH AMERICA: PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 160 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 161 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 162 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2018–2022 (USD MILLION)

- TABLE 163 SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2023–2028 (USD MILLION)

- TABLE 164 BRAZIL: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 165 BRAZIL: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 166 ARGENTINA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 167 ARGENTINA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 168 REST OF SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 169 REST OF SOUTH AMERICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 170 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 171 ROW: FOOD & BEVERAGE PRODUCT PROCESSING EQUIPMENT MARKET, BY REGION 2023–2028 (USD MILLION)

- TABLE 172 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 173 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 174 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 175 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 176 ROW: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 177 ROW: PRE-PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 178 ROW: PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 179 ROW: PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 180 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 181 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 182 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2018–2022 (USD MILLION)

- TABLE 183 ROW: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2023–2028 (USD MILLION)

- TABLE 184 MIDDLE EAST: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 185 MIDDLE EAST: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 186 AFRICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 187 AFRICA: FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 188 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- TABLE 189 COMPANY FOOTPRINT, BY PRODUCT TYPE

- TABLE 190 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 191 COMPANY FOOTPRINT, BY REGION

- TABLE 192 OVERALL COMPANY FOOTPRINT

- TABLE 193 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 194 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- TABLE 195 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: PRODUCT LAUNCHES, JUNE 2021–FEBRUARY 2023

- TABLE 196 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: DEALS, DECEMBER 2020–APRIL 2023

- TABLE 197 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: OTHERS, MAY 2020–JULY 2022

- TABLE 198 TETRA LAVAL: BUSINESS OVERVIEW

- TABLE 199 TETRA LAVAL: PRODUCT OFFERINGS

- TABLE 200 TETRA LAVAL: OTHERS

- TABLE 201 MAREL: BUSINESS OVERVIEW

- TABLE 202 MAREL: PRODUCT OFFERINGS

- TABLE 203 MAREL: PRODUCT LAUNCHES

- TABLE 204 MAREL: DEALS

- TABLE 205 MAREL: OTHERS

- TABLE 206 GEA GROUP AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

- TABLE 207 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT OFFERINGS

- TABLE 208 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT LAUNCHES

- TABLE 209 GEA GROUP AKTIENGESELLSCHAFT: OTHERS

- TABLE 210 JBT: BUSINESS OVERVIEW

- TABLE 211 JBT: PRODUCT OFFERINGS

- TABLE 212 JBT: PRODUCT LAUNCHES

- TABLE 213 JBT: OTHERS

- TABLE 214 BÜHLER: BUSINESS OVERVIEW

- TABLE 215 BÜHLER: PRODUCT OFFERINGS

- TABLE 216 BÜHLER: PRODUCT LAUNCHES

- TABLE 217 BÜHLER: DEALS

- TABLE 218 BÜHLER: OTHERS

- TABLE 219 ALFA LAVAL: BUSINESS OVERVIEW

- TABLE 220 ALFA LAVAL: PRODUCT OFFERINGS

- TABLE 221 ALFA LAVAL: OTHERS

- TABLE 222 BUCHER INDUSTRIES AG: BUSINESS OVERVIEW

- TABLE 223 BUCHER INDUSTRIES AG: PRODUCT OFFERINGS

- TABLE 224 SPX FLOW INC.: BUSINESS OVERVIEW

- TABLE 225 SPX FLOW INC.: PRODUCT OFFERINGS

- TABLE 226 SPX FLOW INC.: PRODUCT LAUNCHES

- TABLE 227 SPX FLOW INC.: DEALS

- TABLE 228 SPX FLOW INC.: OTHERS

- TABLE 229 THE MIDDLEBY CORPORATION: BUSINESS OVERVIEW

- TABLE 230 THE MIDDLEBY CORPORATION: PRODUCT OFFERINGS

- TABLE 231 THE MIDDLEBY CORPORATION: DEALS

- TABLE 232 THE MIDDLEBY CORPORATION: OTHERS

- TABLE 233 KRONES AG: BUSINESS OVERVIEW

- TABLE 234 KRONES AG: PRODUCT OFFERINGS

- TABLE 235 KRONES AG: OTHERS

- TABLE 236 BIGTEM MAKINE A.S.: BUSINESS OVERVIEW

- TABLE 237 BIGTEM MAKINE A.S.: PRODUCT OFFERINGS

- TABLE 238 EQUIPAMIENTOS CÁRNICOS, S.L.: BUSINESS OVERVIEW

- TABLE 239 EQUIPAMIENTOS CÁRNICOS, S.L.: PRODUCT OFFERINGS

- TABLE 240 TNA AUSTRALIA PTY LIMITED: BUSINESS OVERVIEW

- TABLE 241 TNA AUSTRALIA PTY LIMITED: PRODUCT OFFERINGS

- TABLE 242 FENCO FOOD MACHINERY S.R.L.: BUSINESS OVERVIEW

- TABLE 243 FENCO FOOD MACHINERY S.R.L.: PRODUCT OFFERINGS

- TABLE 244 KHS GROUP: BUSINESS OVERVIEW

- TABLE 245 KHS GROUP: PRODUCT OFFERINGS

- TABLE 246 KHS GROUP: OTHERS

- TABLE 247 CLEXTRAL: BUSINESS OVERVIEW

- TABLE 248 CLEXTRAL: PRODUCT OFFERINGS

- TABLE 249 GOMA: BUSINESS OVERVIEW

- TABLE 250 GOMA: PRODUCT OFFERINGS

- TABLE 251 NEOLOGIC ENGINEERS PVT. LTD: BUSINESS OVERVIEW

- TABLE 252 NEOLOGIC ENGINEERS PVT. LTD: PRODUCT OFFERINGS

- TABLE 253 FINIS FOOD PROCESSING EQUIPMENT B.V.: BUSINESS OVERVIEW

- TABLE 254 FINIS FOOD PROCESSING EQUIPMENT B.V.: PRODUCT OFFERINGS

- TABLE 255 ANDERSON DAHLEN: BUSINESS OVERVIEW

- TABLE 256 ANDERSON DAHLEN: PRODUCT OFFERINGS

- TABLE 257 BEVERAGE PROCESSING EQUIPMENT MARKET, BY BEVERAGE TYPE, 2017–2020 (USD MILLION)

- TABLE 258 BEVERAGE PROCESSING EQUIPMENT MARKET, BY BEVERAGE TYPE, 2021–2026 (USD MILLION)

- TABLE 259 BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 260 BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 261 BAKERY PROCESSING EQUIPMENT MARKET, BY TYPE, 2020–2025 (USD MILLION)

- TABLE 262 BAKERY PROCESSING EQUIPMENT MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 263 DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

- TABLE 264 DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 FOOD & BEVERAGE EQUIPMENT PROCESSING MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 6 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 INDICATORS OF RECESSION

- FIGURE 10 WORLD INFLATION RATE, 2011–2021

- FIGURE 11 GLOBAL GDP, 2011–2021 (USD TRILLION)

- FIGURE 12 RECESSION INDICATORS AND THEIR IMPACT ON FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET

- FIGURE 13 GLOBAL FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: PREVIOUS FORECAST VS. RECESSION IMPACT FORECAST

- FIGURE 14 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 GLOBAL SHARE OF FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET IN 2023

- FIGURE 19 RISE IN FOOD DEMAND TO DRIVE MARKET GROWTH

- FIGURE 20 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE IN 2023 AND 2028

- FIGURE 21 AUTOMATIC SEGMENT AND CHINA TO ACCOUNT FOR SIGNIFICANT RESPECTIVE SHARES IN 2023

- FIGURE 22 INDIA ACCOUNTED FOR LARGEST SHARE IN 2023

- FIGURE 23 MEAT PRODUCTION, BY REGION, 2019–2021 (MILLION TONNES)

- FIGURE 24 POULTRY PRODUCTION, BY REGION, 2021 (MILLION TONNES)

- FIGURE 25 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET DYNAMICS

- FIGURE 26 NUMBER OF PATENTS APPROVED FOR FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, 2012–2022

- FIGURE 27 JURISDICTIONS WITH HIGHEST PATENT APPROVALS FOR FOOD & BEVERAGE PROCESSING EQUIPMENT, 2012–2022

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY MODE OF OPERATION

- FIGURE 32 KEY BUYING CRITERIA FOR MODE OF OPERATION OF FOOD & BEVERAGE PROCESSING EQUIPMENT

- FIGURE 33 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023 VS. 2028 (USD BILLION)

- FIGURE 34 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY END-PRODUCT FORM, 2023 VS. 2028 (USD BILLION)

- FIGURE 35 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023 VS. 2028 (USD BILLION)

- FIGURE 36 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 37 GEOGRAPHICAL SNAPSHOT (2023–2028): ASIA PACIFIC EMERGING AS NEW HOTSPOT FOR FOOD & BEVERAGE PROCESSING EQUIPMENT

- FIGURE 38 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 39 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 41 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 43 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 44 EUROPE: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 45 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 46 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 47 SOUTH AMERICA: MARKET SNAPSHOT

- FIGURE 48 ROW: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 49 ROW: RECESSION IMPACT ANALYSIS, 2022–2023

- FIGURE 50 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2018–2022 (USD BILLION)

- FIGURE 51 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 52 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUP/SME)

- FIGURE 53 TETRA LAVAL: COMPANY SNAPSHOT

- FIGURE 54 MAREL: COMPANY SNAPSHOT

- FIGURE 55 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 56 JBT: COMPANY SNAPSHOT

- FIGURE 57 BÜHLER: COMPANY SNAPSHOT

- FIGURE 58 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 59 BUCHER INDUSTRIES AG: COMPANY SNAPSHOT

- FIGURE 60 SPX FLOW INC.: COMPANY SNAPSHOT

- FIGURE 61 THE MIDDLEBY CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 KRONES AG: COMPANY SNAPSHOT

This research study involved the extensive use of secondary sources directories and databases such as Bloomberg Businessweek and Factiva to identify and collect information useful for a technical, market-oriented, and commercial study of the food and beverage processing equipment market. In-depth interviews were conducted with various primary respondents such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

The secondary sources referred for this research study include government sources, such as Association for Packaging and Processing Technologies (PMMI), Food Processing Suppliers Association (FPSA), the Center for Innovative Food Technology (CIFT), Bakery Equipment Manufacturers & Allied (BEMA), and Food and Drug Administration (FDA) have been referred to, to identify and collect information for this study. The secondary sources also included food & beverage equipment manufacturers’ annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and paid databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The Food & Beverage processing equipment market comprises several stakeholders, including raw material suppliers, processed food suppliers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce technology, manufacturers, and importers & exporters of food and beverage processing equipment. Primary sources from the demand side include distributors, wholesalers, and key opinion leaders through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The following approaches represent the overall market size estimation process employed for the purpose of this study.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

Top-down approach:

- The key players in the industry and the market were identified through extensive secondary research.

- The revenues of major food & beverage processing equipment manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- Based on the market share analysis of key industry players from all regions, the final market size of the food & beverage processing equipment market has been arrived at.

Bottom-up approach:

- Based on the share of food & beverage processing equipment for each application at regional and country levels, the market sizes were analyzed. Thus, with a bottom-up approach to the application at the country level, the global market for food & beverage processing equipment was estimated.

- Based on the demand for applications, offerings of key players, and the region-wise market share of major players, the global market for applications was estimated.

- Other factors considered include the penetration rate of food & beverage processing equipment in the processed food & beverage industry, demand for health & wellness products, growth in immunity concerts, consumer awareness, functional trends, the adoption rate, patents registered, and organic & inorganic growth attempts.

- From this, market sizes for each region were derived.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the food & beverage processing equipment market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

The following sections (bottom-up & top-down) (supply-demand) depict the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the global market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the food & beverage equipment market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The food and beverage processing equipment market refers to the industry that produces machinery and equipment used in the processing, handling, and storing of food and beverages. This includes equipment used in food preparation, such as mixers & blenders, thermal processors, homogenizers, coolers, freezers, graders, sorters, size reduction machines and more. The food and beverage processing equipment market is an important industry that plays a vital role in ensuring the safety, quality, and efficiency of food and beverage production.

Stakeholders

- Government agricultural departments and regulatory bodies

- Manufacturers, dealers, and suppliers of food & beverage processing equipment

- Beverage product manufacturers

- Packaging equipment suppliers

- Intermediate suppliers, such as retailers, wholesalers, and distributors

- Raw material suppliers

- Technology providers

- Industry associations

-

Regulatory bodies and institutions:

- World Health Organization (WHO)

- Code of Federal Regulations (CFR)

- US Food and Drug Administration (FDA)

- Codex Alimentarius Commission (CAC)

- EUROPA

- United States Department of Agriculture (USDA)

- Food Processing Suppliers Association (FPSA)

- Logistics providers & transporters

- Research institutes and organizations

- Consulting companies/consultants in the agricultural technology sectors

Report Objectives

Market Intelligence

- Determining and projecting the size of the food & beverage processing equipment market, with respect to types, end-product forms, mode of operations, applications, and regions over a five-year period, ranging from 2023 to 2028

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework for significant countries related to the food & beverage processing equipment market

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- Impact of macro- and micro-economic factors on the market

- Shift in demand patterns across different subsegments and regions

Competitive Intelligence

- Identifying and profiling the key players in the global food & beverage processing equipment market

- Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products across the key regions and their impact on the prominent market players

- Providing insights on key product innovations and investments in the global food & beverage processing equipment market.

**Rest of the World (RoW) includes the Middle East and Africa.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for Food and beverage processing equipment into the Czech Republic, The Netherlands, Belgium, Hungary, Romania, and Ireland

- Further breakdown of the Rest of South America market for food and beverage processing equipment into Chile, Colombia, Paraguay, and Peru

- Further breakdown of other countries in the RoW market for food and beverage processing equipment into the Middle East & Africa

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Food & Beverage Processing Equipment Market