Brewery Equipment Market Size, Share, Industry Growth, Trends and Analysis Report by Equipment Type, Brewery Type (Macrobrewery, Craft brewery), Mode of Application (Manual, Automatic and Semi-automatic), and Region (North America, Asia Pacific, Europe and RoW) - Global Forecast to 2027

Brewery Equipment Market Overview

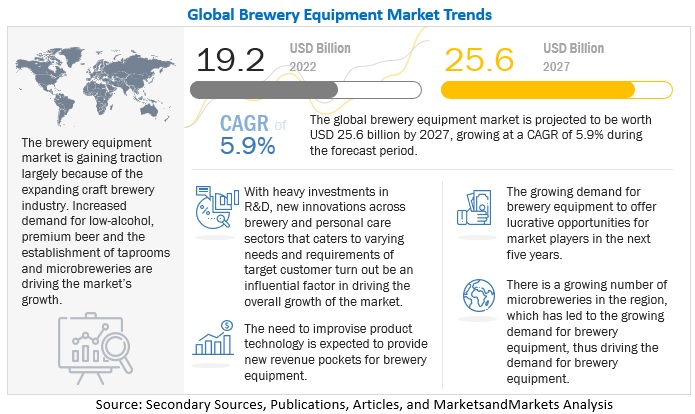

The global brewery equipment market size is expanding at a CAGR of 5.9% to reach USD 25.6 billion by 2027 from USD 19.2 billion in 2022.

To know about the assumptions considered for the study, Request for Free Sample Report

Brewery Equipment Market Dynamics

Drivers: Increase in beer consumption in developing countries

Beer is one of the world's most traded and consumed alcoholic beverages. Most Asian and South American countries are experiencing increased urbanization and improved financial conditions. The improved financial conditions and rising GDP have resulted in an increase in consumer disposable income in these countries, which is one of the key factors driving the growth of the brewery industry.

This has resulted in a shift in consumer preferences and the adoption of the beer culture among the younger generation. Beer consumption in North America has increased, while beer consumption in developing countries such as Brazil, Russia, and Argentina have increased significantly. Brewers have invested because of the growing demand for beer in developing economies, allowing them to increase their production to keep up with demand from consumers. The brewery equipment market is driven by this trend, which has a positive impact on it and leads to proportional growth to meet the rising demand.

Restraints: The constant rise in Energy and Power Costs

The brewing industry is expanding rapidly, creating a high demand for brewing equipment around the world. In addition to refrigeration, lighting, and other processes, the brewery processing requires electricity and natural gas to run the brewhouse. Refrigeration generates the most electrical load, while brewing consumes the most natural gas. The cost of energy is approximately 8% of the cost of producing beer.

Brewers' profitability is generally being impacted by the rising cost of energy, particularly small brewers whose scalability is lower than that of large brewers. Boilers, cooling and refrigeration systems, compressed air motors, and packaging systems are just a few of the systems in breweries that have significant energy-saving potential. Because of this, breweries can greatly profit from a number of simple, low-cost strategies, minimizing the barrier to the growth of the market over the forecast period.

Opportunities: Beer manufacturers’ demand for after-sales service to enhance operational efficiencies

Brewery equipment necessitates extensive maintenance and services, which may be required during installation and/or after sales. Brewery equipment manufacturers can provide after-sales services such as annual maintenance contracts in addition to installation. After-sales services strengthen the bond between equipment manufacturers and beer manufacturers. Operator training, preventive maintenance by knowledgeable technicians, factory acceptance testing (FAT), and timely service are the leading services that beer manufacturers require from manufacturers to contribute to their operational efficiencies. This would assist beer manufacturers in better understanding their machinery and improving its performance. Beer manufacturers are looking for a higher level of operator training services from brewery equipment market manufacturers due to a persistent shortage of skilled labor.

Challenges: The rise in demand for Non-alcoholic and Functional Beverages

The market for non-alcoholic beverages is expanding as consumer preferences shift toward healthier beverages. People prefer low-calorie, nutritious beverages over alcoholic beverages. Functional beverages, such as fortified drinks, are increasingly popular among consumers. People prefer nutritious drinks on the go due to their hectic lifestyles. Beer consumption is being reduced by consumers seeking weight loss options. Large brands are developing functional and shaped drinks.

Furthermore, as the beverage industry evolves, many brewery equipment manufacturers are experimenting with new combinations to attract customers. Arla (UK) introduced a carbonated dairy beverage in 2018, which is anticipated to boost the company's revenue from milk-based drinks by 300% by 2020. after the Middle Eastern nations' craze for carbonated dairy beverages. For the anticipated period, such innovations in the European region are anticipated to present a challenge to the brewery equipment manufacturer.

Key Trends in the Global Brewery Equipment Market

- Rising Craft Beer Movement: The craft beer industry has been experiencing significant growth worldwide, driven by consumer demand for unique flavors and high-quality brews. This trend has led to an increased demand for brewery equipment, particularly smaller-scale and specialized equipment suited for craft breweries.

-

Automation and Efficiency: Brewery operators are increasingly investing in automation technology to improve production efficiency, reduce labor costs, and maintain consistency in product quality. Advanced brewery equipment with features such as automated brewing systems, fermentation controls, and real-time monitoring capabilities are in high demand.

-

Expansion of Microbreweries and Brewpubs: The proliferation of microbreweries and brewpubs, particularly in emerging markets, has been fueling the demand for brewery equipment. These smaller-scale establishments require flexible and cost-effective equipment solutions tailored to their production needs, driving innovation in the market.

-

Focus on Sustainability: Sustainability has become a priority for brewery operators, leading to the adoption of eco-friendly brewing practices and equipment. Energy-efficient brewing systems, water recycling technologies, and waste reduction measures are gaining traction as breweries seek to minimize their environmental footprint and appeal to environmentally-conscious consumers.

-

Demand for Modular and Scalable Solutions: Brewery operators are increasingly opting for modular and scalable equipment solutions that can easily adapt to changing production requirements and accommodate future expansion. Modular brewhouse systems, fermenters, and packaging lines offer flexibility and cost-effectiveness, allowing breweries to scale up or down as needed.

-

Emergence of Homebrewing Equipment Market: The growing popularity of homebrewing as a hobby has led to a surge in demand for homebrewing equipment and supplies. Manufacturers are catering to this niche market segment by offering a wide range of homebrewing kits, fermenters, kegs, and accessories tailored to amateur brewers.

-

Technological Advancements: Ongoing advancements in brewing technology, including equipment design, materials, and process automation, are driving innovation in the brewery equipment market. Manufacturers are continually developing new brewing equipment solutions that enhance efficiency, improve product quality, and reduce operational costs.

-

Regional Market Dynamics: The brewery equipment market is influenced by regional factors such as regulatory frameworks, consumer preferences, and the level of market maturity. Established beer markets in regions like North America and Europe continue to drive significant demand for brewery equipment, while emerging markets in Asia-Pacific and Latin America present opportunities for market expansion.

Type Insights:

By brewery type, the macrobrewery segment is projected to account for the largest market share in the brewery equipment market during the forecast period

In 2021, the market for brewery equipment worldwide was significantly dominated by the macrobrewery segment. A macro or large brewery is defined by the Brewers Association as "a brewery with an annual beer production of over 6,000,000 barrels." The largest contribution to the entire beer industry is made by macrobreweries. Every country has four to five macrobreweries on average. Anheuser-Busch InBev (Belgium), Heineken N.V. (Netherlands), China Resources Snow Breweries Limited (China), and Carlsberg Group are some of the most well-known macrobreweries.

Mode of Operation Insights:

By mode of operation, automated processing equipment ensures the quality and purity of beer

For consistent, high-quality beer, modern large-scale breweries use high-tech facilities with automated equipment. The automated machinery makes sure that the brewing meets strict hygienic standards. Brewhouse, filtration, cellar, and energy generation are just a few examples of the various areas and stages in brewery equipment market that can be managed simultaneously thanks to automatic systems. Process automation enables the brewer to regulate and efficiently operate the pumps, valves, measured values, and controllers as well as quickly identify and fix problems. In the case of craft breweries, the automated system also ensures recipe control with flexibility.

Equipment Type Insights:

By macrobrewery equipment type, milling equipment has the highest growth rate during the forecast period

Milling includes two conventional types of techniques such as dry milling and wet milling. The majority of modern microbreweries use dry milling as their primary milling method. Milling relies heavily on the roller mill in this process, which varies in complexity. Dry milling is simple and straightforward, but it produces dust, which poses an imminent risk of explosive ignition by sparks. When the grains are dry, they are more likely to shatter their husk. Wet milling preserves the grain husk and allows for a faster run-off time.

Furthermore, wet milling produces no dust and poses no risk of explosive ignition by sparks. Wet milling is preferred in the beer industry due to its advantages over dry milling, such as faster run-off time and reduced oxidation of grains. In the Asia Pacific region, the milling equipment segment of macrobrewery equipment is expected to grow the fastest. The milling system is critical in the production of high-quality beer as it maintains the consistency of the wort. The leading manufacturers of macrobrewery milling equipment are Paul Mueller (US), Czech Brewery System (Czech Republic), and Prodeb Brewery Technology (India).

Regional Insights:

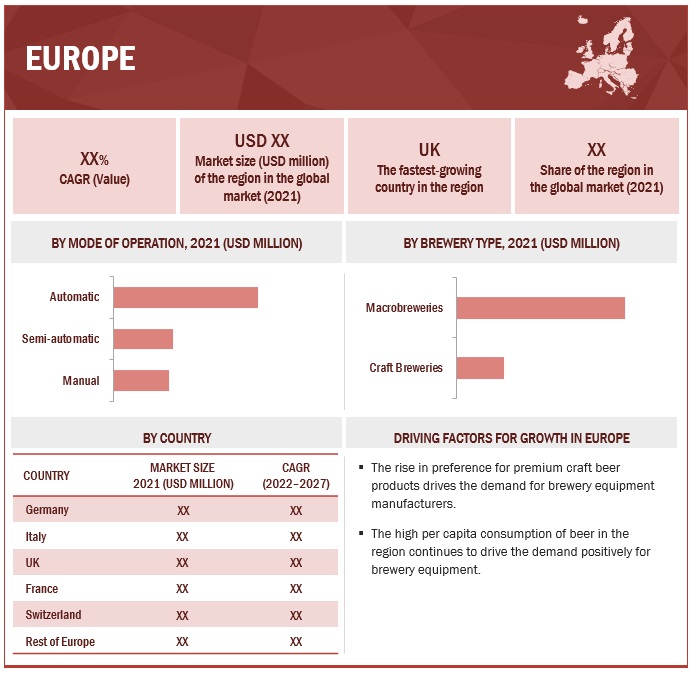

Europe dominates the brewery equipment market

The beer market in this country is highly established and is home to many big brands. However, the country is witnessing a change in consumer preferences. Consumers have shifted to craft beer from traditional beer sold by big brands. Consumers are more willing to try the premium beer brands sold by brewpubs and microbreweries. Also, France, once a wine-consuming country, is witnessing a shift in consumption patterns from wine to beer. Since the retail channels in the region are highly organized, the beer is easily available in supermarkets. Also, some craft beer brands have started taking shelf space in supermarkets, making it easily accessible for the population to choose and try new regional brands. All these factors together prove advantageous for brewery equipment manufacturers who are present or are planning to penetrate the European region.

The cost constraints of micro and mini-breweries that produce beer in small quantities sometimes results in the preference for manual brewing equipment, which involves handcrafting methods. Furthermore, some small beer manufacturers still prefer to use traditional brewing methods in order to produce small volumes of beer with intense flavors. Micro and mini-breweries have been using manual beer processing equipment to reduce equipment and energy costs while producing traditional beer using unique family recipes. Manual beer processing equipment is rarely used nowadays.

To know about the assumptions considered for the study, download the pdf brochure

Brewery Equipment Market Key Companies & Market Share Insights:

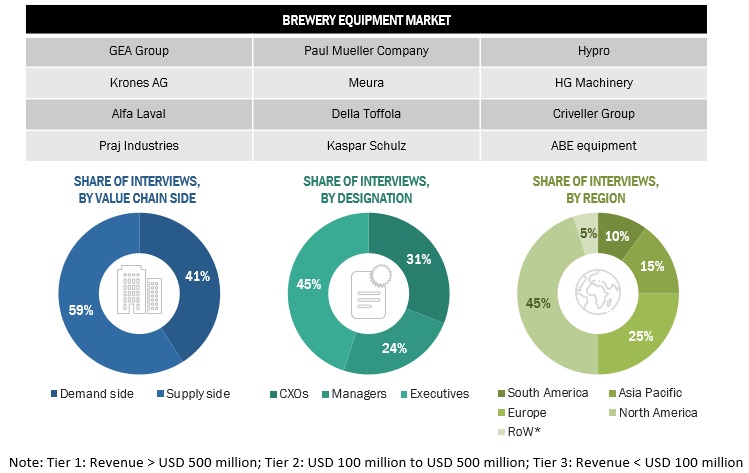

The key brewery equipment manufacturers in market include Alfa Laval (Sweden), GEA Group Aktiengesellschaft (Germany), Krones AG (Germany), Paul Mueller Company (US), Praj Industries (India), Meura (Belgium), Della Toffola SpA (Italy), Criveller Group (US), KASPAR SCHULZ Brauereimaschinenfabrik & Apparatebauanstalt GmbH (Germany), LEHUI (China), Hypro (India), HG Machinery (China), Interpump Group S.p.A (INOXPA) (Spain), and ABE Equipment (US).

Brewery Equipment Market Report Scope

|

Report Metric |

Details |

|

Market Size Valuation in 2022 |

USD 19.2 billion |

|

Revenue Forecast in 2027 |

USD 25.6 billion |

|

Progress Rate |

5.9% CAGR for 2022 - 2027 |

|

Key Companies Studied |

|

|

Market Driver |

Increase in beer consumption in developing countries |

|

Largest Growing Regions |

Europe |

|

Market Opportunities |

Growing demand for after-sales service by beer manufacturers to enhance operational efficiencies |

Target Audience for Brewery Equipment Market:

- Supply side: Brewery equipment producers, suppliers, distributors, importers, and exporters

- Demand side: Macrobreweries, craft breweries

- Regulatory bodies Government agencies and non-governmental organizations (NGO)

- Commercial R&D institutions and financial institutions

-

Associations, regulatory bodies, and other industry-related bodies:

- Food and Drug Administration (FDA)

- United States Department of Agriculture (USDA)

- The Brewers Association (BA)

- The Brewers of Europe

- Craft Brewers Association of India

Brewery Equipment Market Report Segmentation:

This research report categorizes the market, based on equipment type, brewery type, mode of operation, and region.

|

Aspect |

Details |

|

By Equipment Type |

|

|

By Mode Of Operation |

|

|

By Source |

|

|

By Region |

|

Brewery Equipment Market: Recent Developments & Industry News

- In August 2022, Alfa Laval acquired Scanjet (Sweden), a top provider of tank cleaning equipment and solutions for beverage, pharmaceutical, food, energy, pulp & paper, and transportation applications. Alfa Laval’s extensive tanker offering would be expanded by the acquisition, further expanding its portfolio of cargo tanks. Additionally, Scanjet would promote customer effectiveness throughout the entire cargo handling process.

- In January 2022, Alfa Laval collaborated with BenLink to further expand its service offerings in food and energy application. Alfa Laval’s service business would benefit as BenLink’s had a network of service technicians that can provide real-time maintenance and support while overseen by technical experts.

- In February 2021, Alfa Laval introduced its cleanest decanters, Foodec Hygiene Plus. It comprised several features intended to increase levels of hygiene. Its built-in cleaning-in-place (CIP) bar made it simpler to clean every component of the frame’s interior and exterior. The

- In April 2019, KASPAR SCHULZ Brauereimaschinenfabrik & Apparatebauanstalt GmbH and GE Additive (US) partnered to identify additive manufacturing 3D printing applications in the beverage industry, which would make improvements to both the time and yield anticipated for the brewing equipment.

Frequently Asked Questions (FAQ):

How big is the brewery equipment market?

The global brewery equipment market as per revenue was estimated to be worth USD 19.2 billion by 2022 and is poised to reach USD 25.6 billion by 2027, at a compound annual growth rate (CAGR) of 5.9% from 2022 to 2027.

Which players are involved in manufacturing of brewery equipments?

The key players in market include Alfa Laval (Sweden), GEA Group Aktiengesellschaft (Germany), Krones AG (Germany), Paul Mueller Company (US), Praj Industries (India), Meura (Belgium), Della Toffola SpA (Italy), Criveller Group (US), KASPAR SCHULZ Brauereimaschinenfabrik & Apparatebauanstalt GmbH (Germany), LEHUI (China), Hypro (India), HG Machinery (China), Interpump Group S.p.A (INOXPA) (Spain), and ABE Equipment (US).

Which region accounted for the largest brewery equipment market share?

Europe is currently dominating the market for brewery equipment. This is due to the fact that the beer industry in this region is well-established and is home to many prominent beer brands. However, there has been a shift in consumer preferences towards craft beer, which is offered by brewpubs and microbreweries, rather than the traditional beer sold by big brands.

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for brewery equipment market?

On request, We will provide details on market size, key players, and growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 BREWERY EQUIPMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 BREWERY EQUIPMENT MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

FIGURE 5 MARKET SIZE ESTIMATION (DEMAND SIDE)

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 RESEARCH LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 2 BREWERY EQUIPMENT MARKET SHARE SNAPSHOT, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET, BY BREWERY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MACROBREWERY: MARKET, BY EQUIPMENT TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 11 CRAFT BREWERY: MARKET, BY EQUIPMENT TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY MODE OF OPERATION, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET SHARE AND GROWTH RATE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN GLOBAL MARKET

FIGURE 14 GROWTH IN NUMBER OF MICROBREWERIES & BREWPUBS AND CONTINUOUS INNOVATION TO DRIVE GLOBAL MARKET

4.2 BREWERY EQUIPMENT MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 15 EUROPE WAS LARGEST MARKET GLOBALLY IN 2021

4.3 EUROPE: MARKET, BY MODE OF OPERATION & COUNTRY

FIGURE 16 GERMANY TO ACCOUNT FOR LARGEST SHARE IN EUROPEAN MARKET IN 2021

4.4 MARKET, BY BREWERY TYPE

FIGURE 17 MACROBREWERIES PROJECTED TO BE LARGER BREWERY TYPE MARKET DURING FORECAST PERIOD

4.5 MARKET, BY MODE OF OPERATION

FIGURE 18 AUTOMATIC EQUIPMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.6 MARKET, BY BREWERY TYPE & REGION

FIGURE 19 EUROPE TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 CULTIVATION OF CROPS ASSOCIATED WITH BEER PRODUCTION

FIGURE 20 WORLD BARLEY PRODUCTION, 2016–2022 (MILLION TONS)

FIGURE 21 US: HOPS HARVESTED, BY KEY STATE, 2021–2022 (ACRE)

5.2.2 BEER MARKET BENEFITS FROM LARGE YOUNG DEMOGRAPHIC

FIGURE 22 NIGERIA: POPULATION, BY AGE GROUP, 2003–2021 (MILLION)

5.3 MARKET DYNAMICS

FIGURE 23 BREWERY EQUIPMENT MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Mushrooming Craft Breweries drive Brewery Equipment Demand

FIGURE 24 US: INCREASING NUMBER OF CRAFT BREWERIES, 2015–2021

FIGURE 25 US: GROWTH IN TAPROOMS AND BREWPUBS, 2018–2021

5.3.1.2 Rise in consumption of beer, predominantly in developing countries

FIGURE 26 BEER CONSUMPTION GROWTH, 2020 (KILOLITER)

5.3.1.3 Filling equipment gains demand by increased preference for canned beer

5.3.2 RESTRAINTS

5.3.2.1 Increase in Energy and Power Costs

5.3.2.2 Advertising Restrictions for Alcoholic Beverages

5.3.3 OPPORTUNITIES

5.3.3.1 High Demand for Energy-efficient Technology

5.3.3.2 Beer manufacturers’ demand for after-sales service to enhance operational efficiencies

5.3.3.3 Process Automation: Key to Modern Brewing

5.3.4 CHALLENGES

5.3.4.1 Rise in demand for Non-alcoholic and Functional Beverages

5.3.4.2 High equipment maintenance & startup cost

6 INDUSTRY TRENDS (Page No. - 66)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RESEARCH & DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING

6.2.3 MANUFACTURING

6.2.4 DISTRIBUTION

6.2.5 END USERS

6.2.6 POST-SALES SERVICES

FIGURE 27 BREWERY EQUIPMENT MARKET: VALUE CHAIN

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 28 MARKET: SUPPLY CHAIN

6.4 MARKET MAP AND ECOSYSTEM OF MARKET

6.4.1 DEMAND SIDE

6.4.2 SUPPLY SIDE

FIGURE 29 MARKET: ECOSYSTEM MAP

6.4.3 ECOSYSTEM MAP

TABLE 3 MARKET: ECOSYSTEM

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN MARKET

FIGURE 30 REVENUE SHIFT IMPACTING TRENDS/DISRUPTIONS IN BREWERY EQUIPMENT MARKET

6.6 TECHNOLOGY ANALYSIS

6.6.1 AUTOMATION

6.6.2 WORT OXYGENATOR

6.6.3 HYBRID MASH FILTER

6.7 PRICING ANALYSIS

6.7.1 SELLING PRICES CHARGED BY KEY PLAYERS IN TERMS OF BREWERY TYPE

FIGURE 31 SELLING PRICES OF KEY PLAYERS FOR BREWERY TYPE (USD/UNIT/L)

TABLE 4 SELLING PRICE OF BREWERY EQUIPMENT MANUFACTURERS FOR EQUIPMENT TYPE, 2021 (USD/UNIT)

6.7.2 AVERAGE SELLING PRICE TRENDS

FIGURE 32 AVERAGE SELLING PRICE TRENDS FOR MACROBREWERIES, 2019–2021 (USD/UNIT)

FIGURE 33 AVERAGE SELLING PRICE TRENDS FOR CRAFT BREWERIES, 2019–2021 (USD/UNIT)

6.8 BREWERY EQUIPMENT MARKET: PATENT ANALYSIS

FIGURE 34 NUMBER OF PATENTS GRANTED FOR BREWERY EQUIPMENT, 2011–2021

FIGURE 35 REGIONAL ANALYSIS OF PATENTS GRANTED, 2019–2022

6.8.1 LIST OF MAJOR PATENTS

TABLE 5 LIST OF PATENTS, 2019–2022

6.9 TRADE ANALYSIS

6.9.1 EXPORT SCENARIO

FIGURE 36 BREWERY EQUIPMENT EXPORTS, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 6 EXPORT DATA FOR KEY COUNTRIES, 2021 (USD THOUSAND)

6.9.2 IMPORT SCENARIO

FIGURE 37 BREWERY EQUIPMENT IMPORTS, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 7 IMPORT DATA FOR KEY COUNTRIES, 2021 (USD THOUSAND)

6.10 KEY CONFERENCES AND EVENTS

TABLE 8 KEY CONFERENCES AND EVENTS IN BREWERY EQUIPMENT MARKET, 2022–2023

6.11 CASE STUDIES

6.11.1 MEURA: INCREASED ENERGY EFFICIENCY & PRODUCTION

6.11.2 SMART MACHINE TECHNOLOGIES, INC. (SMT): ADOPTED AUTOMATION

6.12 TARIFF AND REGULATORY LANDSCAPE

6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.12.2 REGULATORY FRAMEWORK

6.12.2.1 International Organization for Standardization (ISO)

6.12.2.2 North America

6.12.2.2.1 USFDA

6.12.2.3 Europe

6.12.2.4 Asia Pacific

6.12.2.4.1 India

6.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 13 BREWERY EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

6.13.1 DEGREE OF COMPETITION

6.13.2 BARGAINING POWER OF SUPPLIERS

6.13.3 BARGAINING POWER OF BUYERS

6.13.4 THREAT FROM SUBSTITUTES

6.13.5 THREAT FROM NEW ENTRANTS

6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

6.14.2 BUYING CRITERIA

FIGURE 39 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

TABLE 15 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

7 BREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE (Page No. - 91)

7.1 INTRODUCTION

FIGURE 40 BASIC BREWING PROCESS

TABLE 16 MARKET, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 17 MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

7.2 MACROBREWERY EQUIPMENT

TABLE 18 MACROBREWERY: MARKET, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 19 MARKET FOR MACROBREWERY EQUIPMENT, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

7.2.1 MILLING EQUIPMENT

7.2.1.1 Increased usage of dry milling to increase efficiency

TABLE 20 MILLING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 21 MILLING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.2 BREWHOUSE EQUIPMENT

7.2.2.1 Economical advantage of single unit brewhouse equipment to drive growth

TABLE 22 BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 23 BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 24 BREWHOUSE EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 25 BREWHOUSE EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.2.2 Mash kettles IN BREWERY EQUIPMENT MARKET

TABLE 26 MASH KETTLES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 27 MASH KETTLES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.2.3 Lauter tuns

TABLE 28 LAUTER TUNS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 29 LAUTER TUNS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.2.4 Wort kettles

TABLE 30 WORT KETTLES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 31 WORT KETTLES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.2.5 Whirlpoolers

TABLE 32 WHIRLPOOLERS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 33 WHIRLPOOLERS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.2.6 Steam generators

TABLE 34 STEAM GENERATORS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 35 STEAM GENERATORS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.2.7 Aeration devices

TABLE 36 AERATION DEVICES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 37 AERATION DEVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.2.8 Other brewhouse equipment in brewery equipment market

TABLE 38 OTHER BREWHOUSE EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 39 OTHER BREWHOUSE EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.3 FERMENTATION EQUIPMENT

7.2.3.1 Rise in demand for low- and high-ABV beer positively impact segment

TABLE 40 FERMENTATION EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 41 FERMENTATION EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.4 COOLING EQUIPMENT

7.2.4.1 Demand for new beer flavors to enhance segment

TABLE 42 COOLING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 43 COOLING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.5 FILTRATION & FILLING EQUIPMENT

7.2.5.1 Effective removal of external effluents through filtration for producing top-quality beer to drive market

TABLE 44 FILTRATION & FILLING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 FILTRATION & FILLING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.6 OTHER MACROBREWERY EQUIPMENT

7.2.6.1 Cleaning systems

7.2.6.2 Grain silos

7.2.6.3 Generators

7.2.6.4 Pipes

TABLE 46 OTHER MACROBREWERY EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 47 MARKET FOR THER MACROBREWERY EQUIPMENT, BY REGION, 2022–2027 (USD MILLION)

7.3 CRAFT BREWERY EQUIPMENT

TABLE 48 CRAFT BREWERY EQUIPMENT: MARKET, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 49 MARKET FOR CRAFT BREWERY EQUIPMENT, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

7.3.1 MASHING EQUIPMENT

7.3.1.1 Enhanced saccharification due to consistent mashing increases production efficiency

TABLE 50 MASHING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 51 MASHING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3.2 STORAGE EQUIPMENT

7.3.2.1 Increased shelf life of beer with storage equipment to increase demand in breweries

TABLE 52 STORAGE EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 53 STORAGE EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3.3 COMPRESSORS

7.3.3.1 Multiutility of rotary air compressors to drive demand in craft breweries

TABLE 54 COMPRESSORS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 55 COMPRESSORS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3.4 FERMENTATION EQUIPMENT

7.3.4.1 Increase in demand for low- and no-alcohol craft beer to drive segment in craft breweries

TABLE 56 CRAFT BREWERY FERMENTATION EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 57 CRAFT BREWERY FERMENTATION EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3.5 COOLING EQUIPMENT

7.3.5.1 Increase in brewing efficiency due to constantly maintained ideal temperature to drive segment

TABLE 58 CRAFT BREWERY COOLING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 59 CRAFT BREWERY COOLING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3.6 OTHER CRAFT BREWERY EQUIPMENT

TABLE 60 OTHER CRAFT BREWERY EQUIPMENT: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 61 MARKET, BY REGION, 2022–2027 (USD MILLION)

8 BREWERY EQUIPMENT MARKET, BY MODE OF OPERATION (Page No. - 117)

8.1 INTRODUCTION

FIGURE 41 MARKET, BY MODE OF OPERATION, 2022 VS. 2027 (USD MILLION)

TABLE 62 MARKET, BY MODE OF OPERATION, 2017–2021 (USD MILLION)

TABLE 63 MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

8.2 MANUAL

8.2.1 HIGHER DEMAND FOR TRADITIONAL HANDCRAFTED BEER TO DRIVE MANUAL PROCESSING

TABLE 64 MANUAL BREWERY: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 65 MARKET FOR MANUAL BREWERY EQUIPMENT, BY REGION, 2022–2027 (USD MILLION)

8.3 AUTOMATIC

8.3.1 QUALITY, CONSISTENCY, AND FAST PRODUCTION OF BEER THROUGH AUTOMATION TO DRIVE MARKET

TABLE 66 AUTOMATIC BREWERY: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 67 MARKET FOR AUTOMATIC BREWERY EQUIPMENT, BY REGION, 2022–2027 (USD MILLION)

8.4 SEMI-AUTOMATIC

8.4.1 COST-EFFECTIVENESS OF SEMI-AUTOMATIC BREWERY PROCESSING SYSTEMS AID SMALL- AND MEDIUM-SCALE BREWERIES

TABLE 68 SEMI-AUTOMATIC BREWERY EQUIPMENT: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 69 MARKET FOR SEMI-AUTOMATIC BREWERY EQUIPMENT, BY REGION, 2022–2027 (USD MILLION)

9 BREWERY EQUIPMENT MARKET, BY BREWERY TYPE (Page No. - 123)

9.1 INTRODUCTION

FIGURE 42 MARKET, BY BREWERY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 70 MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 71 MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 72 MARKET FOR CRAFT BREWERY EQUIPMENT, BY TYPE, 2017–2021 (USD MILLION)

TABLE 73 MARKET FOR CRAFT BREWERY EQUIPMENT, BY TYPE, 2022–2027 (USD MILLION)

9.2 MACROBREWERIES

9.2.1 EXPANSION PLANS OF LARGE BEER MANUFACTURERS DRIVE DEMAND FOR MACROBREWERY EQUIPMENT

TABLE 74 MACROBREWERY EQUIPMENT: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 75 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 CRAFT BREWERIES

9.3.1 EMERGENCE OF PREMIUM CRAFT BEER TO DRIVE DEMAND FOR CRAFT EQUIPMENT

TABLE 76 MARKET FOR CRAFT BREWERY EQUIPMENT, BY REGION, 2017–2021 (USD MILLION)

TABLE 77 MARKET FOR CRAFT BREWERY EQUIPMENT, BY REGION, 2022–2027 (USD MILLION)

9.3.2 MICROBREWERIES

9.3.2.1 Rise in experimentation with beer flavors to drive microbrewery equipment

TABLE 78 MICROBREWERY EQUIPMENT: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 79 MARKET FOR MICROBREWERY EQUIPMENT, BY REGION, 2022–2027 (USD MILLION)

9.3.3 BREWPUBS

9.3.3.1 Change in socio-cultural dynamics to enhance brewpub equipment market

TABLE 80 BREWPUB EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 81 BREWPUB EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3.4 OTHER CRAFT BREWERIES

TABLE 82 OTHER CRAFT BREWERIES EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 83 OTHER CRAFT BREWERIES EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

10 BREWERY EQUIPMENT MARKET, BY REGION (Page No. - 132)

10.1 INTRODUCTION

FIGURE 43 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

FIGURE 44 REGIONAL SNAPSHOT OF MARKET SHARE (VALUE), 2021

10.2 NORTH AMERICA

TABLE 84 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: MACROBREWERY: MARKET, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET FOR MACROBREWERY EQUIPMENT, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET FOR CRAFT BREWERY EQUIPMENT, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 94 NORTH AMERICA: BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 95 NORTH AMERICA: BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 96 NORTH AMERICA: BREWERY EQUIPMENT MARKET, BY MODE OF OPERATION, 2017–2021 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Growth of craft breweries and craft beer exports to be major driving force

TABLE 98 US: BEER SALES VOLUME, BY BEER TYPE, 2021 (BBL)

TABLE 99 US BREWERY COUNT FROM 2019–2021 (UNITS)

TABLE 100 US: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 101 US: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 102 US: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 103 US: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Growth in microbreweries and importance of automation for consistent product quality to drive market

TABLE 104 CANADA: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 105 CANADA: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 106 CANADA: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 107 CANADA: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Higher export demand for beer from US to drive adoption of brewery equipment in Mexico

TABLE 108 MEXICO: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 109 MEXICO: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 110 MEXICO: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 111 MEXICO: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.3 EUROPE

FIGURE 45 EUROPE: MARKET SNAPSHOT

TABLE 112 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 116 EUROPE: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 118 EUROPE: MACROBREWERY: MARKET, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 119 EUROPE: MARKET FOR MACROBREWERY EQUIPMENT, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 120 BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 121 EUROPE: BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 122 EUROPE: MARKET FOR CRAFT BREWERY EQUIPMENT, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 123 EUROPE: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 124 EUROPE: BREWERY EQUIPMENT MARKET, BY MODE OF OPERATION, 2017–2021 (USD MILLION)

TABLE 125 EUROPE: MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 High export demand for locally manufactured brewery equipment to lead to growth

FIGURE 46 GERMANY: NUMBER OF ACTIVE BREWERIES, 2016–2020

TABLE 126 GERMANY: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 127 GERMANY: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 128 GERMANY: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 129 GERMANY: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Demand for premium beer to drive craft brewery equipment market

FIGURE 47 UK: NUMBER OF ACTIVE BREWERIES, 2016–2020

TABLE 130 UK: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 131 UK: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 132 UK: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 133 UK: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Change in consumption patterns from wine to beer to fuel demand for brewery equipment

FIGURE 48 FRANCE: BEER CONSUMPTION, 2016–2020 (‘000 HECTOLITERS)

FIGURE 49 FRANCE: NUMBER OF MICROBREWERIES, 2016–2020

TABLE 134 FRANCE: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 135 FRANCE: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 136 FRANCE: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 137 FRANCE: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Growing per capita consumption of artisanal beer to raise demand for craft brewery equipment

FIGURE 50 ITALY: BEER CONSUMPTION, 2016–2020 (‘000 HECTOLITERS)

TABLE 138 ITALY: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 139 ITALY: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 140 ITALY: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 141 ITALY: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.3.5 SWITZERLAND

10.3.5.1 Rise in demand for premium and artisanal beer to account for highest growth rate of craft brewery equipment

FIGURE 51 SWITZERLAND: NUMBER OF ACTIVE BREWERIES AND MICROBREWERIES, 2016–2020

TABLE 142 SWITZERLAND: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 143 SWITZERLAND: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 144 SWITZERLAND: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 145 SWITZERLAND: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

FIGURE 52 REST OF EUROPE: NUMBER OF ACTIVE BREWERIES, 2016–2020

TABLE 146 REST OF EUROPE: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 147 REST OF EUROPE: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 148 REST OF EUROPE: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 149 REST OF EUROPE: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 53 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 150 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 156 ASIA PACIFIC: MACROBREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET FOR MACROBREWERY EQUIPMENT, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET FOR CRAFT BREWERY EQUIPMENT, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 160 ASIA PACIFIC: BREWHOUSE BREWERY: MARKET, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 161 ASIA PACIFIC: BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET, BY MODE OF OPERATION, 2017–2021 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Investments by leading breweries and adoption of ‘mini-drinks production line’ to drive market

TABLE 164 CHINA: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 165 CHINA: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 166 CHINA: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 167 CHINA: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.4.2 INDIA

10.4.2.1 Presence of large beer manufacturers led the market for brewery equipment

TABLE 168 INDIA: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 169 INDIA: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 170 INDIA: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 171 INDIA: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Government intervention by tax revisions for increased sales to drive overall brewery industry

TABLE 172 JAPAN: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 173 JAPAN: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 174 JAPAN: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 175 JAPAN: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.4.4 AUSTRALIA

10.4.4.1 Innovations in production process and quality ingredients to enhance taste to drive market

TABLE 176 AUSTRALIA: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 177 AUSTRALIA: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 178 AUSTRALIA: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 179 AUSTRALIA: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.4.5 NEW ZEALAND

10.4.5.1 Tourism and innovations in low-alcohol and low-carb beer to drive market for craft brewery equipment

FIGURE 54 ALCOHOL AVAILABLE FOR CONSUMPTION, 2021

TABLE 180 NEW ZEALAND: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 181 NEW ZEALAND: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 182 NEW ZEALAND: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 183 NEW ZEALAND: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 184 REST OF ASIA PACIFIC: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 185 REST OF ASIA PACIFIC: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 186 REST OF ASIA PACIFIC: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 187 REST OF ASIA PACIFIC: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.5 REST OF THE WORLD (ROW)

TABLE 188 ROW: BREWERY EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 189 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 190 ROW: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 191 ROW: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 192 ROW: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 193 ROW: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 194 ROW: MARKET FOR MACROBREWERY EQUIPMENT, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 195 ROW: MACROBREWERY: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 196 ROW: MARKET FOR CRAFT BREWERY EQUIPMENT, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 197 ROW: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 198 ROW: BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 199 ROW: BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 200 ROW: MARKET EQUIPMENT MARKET, BY MODE OF OPERATION, 2017–2021 (USD MILLION)

TABLE 201 ROW: MARKET EQUIPMENT MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Establishment of large breweries and demand for premium and super premium beers to steer growth

TABLE 202 SOUTH AMERICA: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 203 SOUTH AMERICA: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 204 SOUTH AMERICA: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 205 SOUTH AMERICA: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.5.2 MIDDLE EAST

10.5.2.1 Tourism industry and relaxation in alcohol laws lead to surge in market growth

TABLE 206 MIDDLE EAST: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 207 MIDDLE EAST: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 208 MIDDLE EAST: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 209 MIDDLE EAST: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

10.5.3 AFRICA

10.5.3.1 Major investments for establishment of microbreweries in African countries to fuel growth

TABLE 210 AFRICA: MARKET, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 211 AFRICA: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

TABLE 212 AFRICA: MARKET FOR CRAFT BREWERY EQUIPMENT, BY BREWERY TYPE, 2017–2021 (USD MILLION)

TABLE 213 AFRICA: MARKET, BY BREWERY TYPE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 191)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS

TABLE 214 BREWERY EQUIPMENT MARKET: DEGREE OF COMPETITION (FRAGMENTED)

11.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 55 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD MILLION)

11.4 KEY PLAYER STRATEGIES

TABLE 215 STRATEGIES ADOPTED BY KEY BREWERY EQUIPMENT MANUFACTURERS

11.5 COMPANY EVALUATION QUADRANT (KEY BREWERY EQUIPMENT MANUFACTURERS)

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 56 MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

11.6 PRODUCT FOOTPRINT

TABLE 216 COMPANY FOOTPRINT, BY BREWERY TYPE

TABLE 217 COMPANY FOOTPRINT, BY EQUIPMENT TYPE

TABLE 218 COMPANY FOOTPRINT, BY REGION

TABLE 219 OVERALL COMPANY FOOTPRINT

11.7 EVALUATION QUADRANT (STARTUPS/SMES)

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

FIGURE 57 BREWERY EQUIPMENT MARKET: COMPANY EVALUATION QUADRANT, 2021 (STARTUPS/SMES)

11.7.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 220 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 221 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

11.8 COMPETITIVE SCENARIO

11.8.1 PRODUCT LAUNCHES

TABLE 222 MARKET: NEW PRODUCT LAUNCHES, 2021–2022

11.8.2 DEALS

TABLE 223 MARKET: DEALS, 2019–2022

12 COMPANY PROFILES (Page No. - 207)

12.1 INTRODUCTION

(Business overview, Products/Solutions/Services offered, Recent developments & MnM View)*

12.2 KEY PLAYERS

12.2.1 ALFA LAVAL

TABLE 224 ALFA LAVAL: BUSINESS OVERVIEW

FIGURE 58 ALFA LAVAL: COMPANY SNAPSHOT

TABLE 225 ALFA LAVAL: PRODUCTS OFFERED

TABLE 226 ALFA LAVAL: NEW PRODUCT LAUNCHES

TABLE 227 ALFA LAVAL: DEALS

12.2.2 GEA GROUP AKTIENGESELLSCHAFT

TABLE 228 GEA GROUP AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

FIGURE 59 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

TABLE 229 GEA GROUP AKTIENGESELLSCHAFT: PRODUCTS OFFERED

TABLE 230 GEA GROUP AKTIENGESELLSCHAFT: NEW PRODUCT LAUNCHES

12.2.3 KRONES AG

TABLE 231 KRONES AG: BREWERY EQUIPMENT MARKET BUSINESS OVERVIEW

FIGURE 60 KRONES AG: COMPANY SNAPSHOT

TABLE 232 KRONES AG: PRODUCTS OFFERED

TABLE 233 KRONES AG: NEW PRODUCT LAUNCHES

12.2.4 PAUL MUELLER COMPANY

TABLE 234 PAUL MUELLER COMPANY: BUSINESS OVERVIEW

FIGURE 61 PAUL MUELLER COMPANY: COMPANY SNAPSHOT

TABLE 235 PAUL MUELLER COMPANY: PRODUCTS OFFERED

12.2.5 PRAJ INDUSTRIES

TABLE 236 PRAJ INDUSTRIES: BUSINESS OVERVIEW

FIGURE 62 PRAJ INDUSTRIES: COMPANY SNAPSHOT

TABLE 237 PRAJ INDUSTRIES: PRODUCTS OFFERED

12.2.6 MEURA

TABLE 238 MEURA: BUSINESS OVERVIEW

TABLE 239 MEURA: PRODUCTS OFFERED

TABLE 240 MEURA: NEW PRODUCT LAUNCHES

12.2.7 CRIVELLER GROUP

TABLE 241 CRIVELLER GROUP: BUSINESS OVERVIEW

TABLE 242 CRIVELLER GROUP: PRODUCTS OFFERED

12.2.8 SHANGHAI HENGCHENG BEVERAGE EQUIPMENT CO, LTD

TABLE 243 SHANGHAI HENGCHENG BEVERAGE EQUIPMENT CO, LTD: BUSINESS OVERVIEW

TABLE 244 SHANGHAI HENGCHENG BEVERAGE EQUIPMENT CO, LTD: PRODUCTS OFFERED

TABLE 245 SHANGHAI HENGCHENG BEVERAGE EQUIPMENT CO, LTD: NEW PRODUCT LAUNCHES

12.2.9 LEHUI

TABLE 246 LEHUI: BUSINESS OVERVIEW

TABLE 247 LEHUI: PRODUCTS OFFERED

12.2.10 INTERPUMP GROUP S.P.A (INOXPA)

TABLE 248 INTERPUMP GROUP S.P.A (INOXPA): BUSINESS OVERVIEW

TABLE 249 INTERPUMP INOXPA (INOXPA): PRODUCTS OFFERED

12.2.11 DELLA TOFFOLA SPA

TABLE 250 DELLA TOFFOLA SPA: BREWERY EQUIPMENT MARKET BUSINESS OVERVIEW

TABLE 251 DELLA TOFFOLA SPA: PRODUCTS OFFERED

TABLE 252 DELLA TOFFOLA SPA: DEALS

12.2.12 KASPAR SCHULZ BRAUEREIMASCHINENFABRIK & APPARATEBAUANSTALT GMBH

TABLE 253 KASPAR SCHULZ BRAUEREIMASCHINENFABRIK & APPARATEBAUANSTALT GMBH: BUSINESS OVERVIEW

TABLE 254 KASPAR SCHULZ BRAUEREIMASCHINENFABRIK & APPARATEBAUANSTALT GMBH: PRODUCTS OFFERED

TABLE 255 KASPAR SCHULZ BRAUEREIMASCHINENFABRIK & APPARATEBAUANSTALT GMBH: DEALS

12.2.13 HYPRO

TABLE 256 HYPRO: BUSINESS OVERVIEW

TABLE 257 HYPRO: PRODUCTS OFFERED

12.2.14 HG MACHINERY

TABLE 258 HG MACHINERY: BUSINESS OVERVIEW

TABLE 259 HG MACHINERY: PRODUCTS OFFERED

12.2.15 ABE EQUIPMENT

TABLE 260 ABE EQUIPMENT: BUSINESS OVERVIEW

TABLE 261 ABE EQUIPMENT: PRODUCTS OFFERED

12.3 OTHER BREWERY EQUIPMENT MANUFACTURERS (SMES/STARTUPS)

12.3.1 CEDARSTONE INDUSTRY

12.3.1.1 Business overview

TABLE 262 CEDARSTONE INDUSTRY: BREWERY EQUIPMENT MARKET BUSINESS OVERVIEW

TABLE 263 CEDARSTONE INDUSTRY: PRODUCTS OFFERED

12.3.2 ALPHA BREWING OPERATIONS

TABLE 264 ALPHA BREWING OPERATIONS: BUSINESS OVERVIEW

TABLE 265 ALPHA BREWING OPERATIONS: PRODUCTS OFFERED

12.3.3 BRAUKON GMBH

TABLE 266 BRAUKON GMBH: BUSINESS OVERVIEW

TABLE 267 BRAUKON GMBH: PRODUCTS OFFERED

TABLE 268 BRAUKON GMBH: DEALS

12.3.4 CANADIAN CRYSTALLINE WATER INDIA LTD

TABLE 269 CANADIAN CRYSTALLINE WATER INDIA LTD: BUSINESS OVERVIEW

TABLE 270 CANADIAN CRYSTALLINE WATER INDIA LTD: PRODUCTS OFFERED

12.3.5 SPECIFIC MECHANICAL SYSTEM LTD

TABLE 271 SPECIFIC MECHANICAL SYSTEM LTD: BUSINESS OVERVIEW

TABLE 272 SPECIFIC MECHANICAL SYSTEM LTD: PRODUCTS OFFERED

12.3.6 BREWBILT MANUFACTURING INC

TABLE 273 BREWBILT MANUFACTURING INC: BUSINESS OVERVIEW

TABLE 274 BREWBILT MANUFACTURING INC: PRODUCTS OFFERED

12.3.7 SCHULZ BREWERY

12.3.8 SHANDONG ZUNHUANG BREWING EQUIPMENT CO., LTD.

12.3.9 CASPARY GMBH AND CO.KG

12.3.10 BREW-TEK AUSTRALIA

*Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS (Page No. - 260)

13.1 INTRODUCTION

TABLE 275 MARKETS ADJACENT TO BREWERY EQUIPMENT MARKET

13.2 LIMITATIONS

13.3 BEVERAGE PROCESSING EQUIPMENT MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.3 BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE

TABLE 276 BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 277 BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.3.4 BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION

13.3.4.1 North America

TABLE 278 NORTH AMERICA: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 279 NORTH AMERICA: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.3.4.2 Europe

TABLE 280 EUROPE: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 281 EUROPE: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.3.4.3 Asia Pacific

TABLE 282 ASIA PACIFIC: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 283 ASIA PACIFIC: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.3.4.4 Rest of the World (RoW)

TABLE 284 ROW: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 285 ROW: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.4 FOOD & BEVERAGE INDUSTRY PUMPS MARKET

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

13.4.3 FOOD & BEVERAGES INDUSTRY PUMPS, BY TYPE

13.4.3.1 Introduction

TABLE 286 FOOD & BEVERAGE INDUSTRY PUMPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 287 FOOD & BEVERAGE INDUSTRY PUMPS MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.4.4 FOOD & BEVERAGES INDUSTRY PUMPS, BY REGION

13.4.4.1 Introduction

TABLE 288 FOOD & BEVERAGES INDUSTRY PUMPS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 289 FOOD & BEVERAGES INDUSTRY PUMPS MARKET, BY REGION, 2022–2027 (USD MILLION)

14 APPENDIX (Page No. - 269)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This research involves the extensive use of secondary sources; directories; and the Food and Drug Administration (FDA), National Brewers Association, Homebrewers Association, The Brewers Association of Europe, All India Brewers Association, Bloomberg, and Factiva, to identify and collect information useful for a technical, market-oriented, and commercial study of the brewery equipment market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Drug Administration (FDA), National Brewers Association, Homebrewers Association, The Brewers Association of Europe, and All India Brewers Association, were referred to identify and collect information for this study. The secondary sources also include medical journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was conducted to obtain critical information about the industry’s supply chain, the total pool of brewery equipment manufacturers, and market classification and segmentation according to the industry trends to the bottom-most level and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The brewery equipment market comprises several stakeholders, including microbrewery equipment, craft brewery equipment manufacturers, suppliers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce technology, brewery equipment manufacturers, distributors, and technology providers. Primary sources from the demand side include key opinion leaders, executives, vice presidents, and CEOs of beer manufacturing companies through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Brewery Equipment Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the brewery equipment market. These approaches were extensively used to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

-

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry's supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The peer market—the beverage processing equipment market and food & beverage industry pumps and components market—were considered to validate further the market details of brewery equipment.

-

Bottom-up approach:

- The market size was analyzed based on the share of each type of brewery equipment and brewery type at regional and country levels. Thus, the global market was estimated with a bottom-up approach of the type at the country level.

- Other factors include the penetration rate of brewery equipment within pubs and brewhouses; consumer awareness; and function trends for beer; the adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the brewery equipment market were considered while estimating the market size.

- All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall brewery equipment market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying numerous factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Brewery Equipment Market Report Objectives

- To define, segment, and project the global market for brewery equipment market based on equipment type, mode of application, brewery type, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the brewery equipment manufacturers and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the brewery equipment market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the South America brewery equipment market, by key country

- Further breakdown of the Rest of Europe brewery equipment market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Brewery Equipment Market