Generator Market

Generator Market by Fuel Type (Diesel, Gas, LPG, Biofuel), Power Rating (Up to 50 kW, 51–280 kW, 281–500 kW, 501–2,000 kW, 2,001–3,500 kW, Above 3,500 kW), Application, End User, Design, Sales Channel, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The generator market is estimated to reach USD 25.31 billion in 2025 and USD 33.45 billion by 2030, registering a CAGR of 5.7% during the forecast period (2025–2030). The market is driven by the increasing demand for uninterrupted and reliable power supply, rapid industrialization, and the rapidly expanding manufacturing sector. A diverse commercial segment also augments the demand for generators, as they are essential for ensuring business continuity and risk mitigation. Industries such as IT & telecom, healthcare, data centers, hospitality, retail, and public infrastructure all recognize the critical need for a reliable power supply, further contributing to the overall market growth.

KEY TAKEAWAYS

-

BY FUEL TYPEBased on fule type, the generator market is segmented into diesel, gas, LPG, biofuels, coal gas, gasoline, producer gas, and fuel cells. Diesel generators are expected to hold the largest market share in 2025 share due to their high energy density and ease of fuel availability. However, the demand for gas and clean fuel types are growing rapidly owing to regulatory pressure and sustainability targets.

-

BY APPLICATIONSegmentation by application includes standby, peak shaving, prime, and continuous. Standby generators dominate the generator market during the forecast period. They are used for emergency backup in industrial, healthcare, and commercial settings, while prime and continuous applications are preferred for off-grid, remote, or critical processes.

-

BY POWER RATINGSegmentation by rating covers Up to 50 kW, 51–280 kW, 281–500 kW, 501–2,000 kW, 2,001–3,500 kW, and above 3,500 kW. Lower ratings serve residential and small commercial, mid-to-high ratings address industrial, data center, infrastructure, utilities, and heavy equipment needs.The generator market for the above 3,500 kW segment is driven primarily by rapid industrialization, expansion of manufacturing, and the ongoing boom in data centers and infrastructure investments—particularly in fast-growing economies, including India and China, within the Asia Pacific region.

-

BY DESIGNBy design, the generator market is segregated into stationary and portable generators. Stationary generators are widely used for permanent backup and large-scale industrial sites, whereas portable generators serve temporary, mobile, or remote use cases, such as construction, events, and residential backup.

-

BY SALES CHANNELThe generator market is segmented into direct and indirect sales channels. Direct sales cover manufacturers selling generators directly to large industrial, utility, or commercial clients, often providing custom solutions and after-sales service. Indirect sales involve distributors, dealers, OEMs, retailers, and equipment rental companies, which offer wider market reach, technical support, and customer service for short-term and long-term client needs. Indirect sales channels account for the largest share, driven by the need for rapid product availability, localized support, and turnkey installation/service offerings.

-

BY END USEREnd user segments include industrial, commercial, and residential. The industrial segment dominates, driven by factories, mining, oil & gas, chemicals, and manufacturing. Commercial adoption spans data centers, healthcare, hospitality, offices, and retail. The demand for backup power is strong in the residential sector, especially in regions with grid reliability issues or frequent outages.

-

BY REGIONThe regions considered are North America, Europe, Asia Pacific, South America, and the Middle East & Africa. The Asia Pacific leads due to rapid urbanization, large-scale grid expansion, and aggressive electrification efforts.

-

COMPETITIVE LANDSCAPEMajor market players use organic and inorganic strategies, such as partnerships and investments, to drive growth in wire and cable management applications. Companies such as Caterpillar and Cummins adopted various strategies, such as collaborations, partnerships, acquisitions, and enhanced product innovations, to meet the increasing demand for generators for innovative uses.

The global generator market is experiencing steady growth, due to the rising demand for reliable backup and prime power in industrial, commercial, and residential sectors. Key drivers include the rapid industrialization, expanding manufacturing, frequent power outages, infrastructure development, and the rise of data centers. Diverse fuel sources (diesel, gas, renewables), the adoption of smart generators with digital controls, and regulatory focus on clean energy and emissions reduction shape the technology trends. Asia Pacific and North America dominate due to strong demand from manufacturing, data center, and infrastructure projects, while sustainability initiatives and the growing renewable integration spur innovation and market expansion.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The generator market is driven by the increasing demand for uninterrupted and reliable power supply, rapid industrialization, and growth in manufacturing sectors. Multiple commercial segments, such as IT, telecom, healthcare, hospitality, retail, and public infrastructure, also recognize the critical need for backup power to ensure business continuity and risk mitigation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Mounting demand for uninterrupted and reliable power supply

-

Rising power outages

Level

-

High operational costs associated with diesel generators

-

Capital expenditure related to hydrogen energy storage

Level

-

Rising adoption of fuel cell generators

-

Growing demand for hybrid, bi-fuel, and inverter generators

Level

-

Imposition of strict emission standards

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising power outages

Aging infrastructure, the rising demand for electricity, and natural events create power outages to such an extent that have significantly driven the demand for backup generators. As urban populations increase and industries expand, the electrical grid comes under more pressure, which leads to outages and disrupts some critical operations. Such disruptions create a need for dependable sources of power, encouraging businesses and even households to invest in generators for continuity. Planned and unplanned outages and blackouts related to weather events or equipment failure have made generators the necessary choice for continued operations.

Restraint: High operational costs associated with diesel generators

The generator market has been under pressure due to the high operational expenses, which have been associated with diesel generators and which arise from the accelerating fuel price. Diesel-based generators normally relied as a means of backup power for various businesses and industries. However, the increasing price of fuel presents the industry facing the dilemma. The sharply increased fuel prices have created an atmosphere of concern over the viability of using diesel generator. Volatility in international crude oil prices, geopolitical factors, and an imbalance in supply and demand have led to the surge in fuel prices. The price range of diesel fuel varies significantly between regions and countries, causing a hindrance in operations. On average, the cost of operation in the case of the diesel generator is significantly influenced by the price of diesel fuel. In general, it is higher compared with other sources of power. The higher cost of diesel fuel therefore increases the cost of diesel generator operation directly, and they are less economical compared with other alternatives, such as natural gas or renewable power sources.

Opportunity: Growing demand for hybrid, bi-fuel, and inverter generators

There are various alternative fuels being developed to replace fossil fuels, resulting in innovations in the generator market. Hybrid gensets, which comprise a combination of an internal combustion engine and batteries, are manufactured by some OEMs. The hybrid genset provides power optimally by using the engine at times of high loads and the battery at lower loads. Hybrid generators benefit much more than conventional gensets. It reduced running times, fuel consumption, and noise. It finds applications in mobile gensets for rural or remote places, urban construction sites, residential and the mining sector. For example, the US-based company, Ecoflow, designed Delta Pro Ultra, the whole-house battery generator with up to one month's power backup. This system can work for plenty of scenarios with multiple energy sources as it has a single-unit capacity of 6 kWh, 7.2 kW output, and 5.6 kW solar input. The demand for bi-fuel generators is also expected to increase as they combine the attributes of both gas and diesel generators, making a reliable standby power. They mainly operate on gas but are made to switch to diesel in emergency situations. In dual-fuel natural gas is added to the intake system, which in turn, reduces the use of diesel while still retaining power density, torque, and transient response. Some generator manufacturers have incorporated the bi-fuel technology to cope with the rising high operation costs and to meet the emission standards of diesel engines.

Challenge: Imposition of strict emission standards

Diesel generators are used for a multitude of residential, commercial, and industrial uses. When diesel is burnt, it emits oxides of nitrogen, carbon monoxide, and particulate matter. These emissions find direct release in the atmosphere and deteriorate the environment and the inhabitants. Several regulations have been enforced worldwide to minimize air pollution caused by generator sets. Growing environmental concerns have led to the development of regulations and policies related to the reduction of air pollution in each country. This is why governments are employing stricter emission standards for fossil-fuelled generators, including diesel and gasoline. For instance, the US EPA has implemented regulations such as Tier 4 Final and Nonroad Spark-Ignition Engine Emission Standards for monitoring emission from non-road diesel engines, including generators. The standards force the manufacturers of generators to develop and sell more advanced technologies with emission-control features, which raises the production cost and decreases the availability of traditional fuel generators. The CARB's Low-NOx Regulation also limits NOx generation from a generator by 90%. It also created a price situation similar.

Generator Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides emergency and standby generator solutions for commercial, industrial, and healthcare sectors, ensuring reliable power during grid failures or planned maintenance | Minimized operational downtime | Uninterrupted business continuity | Reduced risk of costly disruptions by ensuring rapid response and 24/7 availability |

|

Supplies generator sets for mining, manufacturing, data centers, and public infrastructure, featuring peak, prime, and standby load capabilities for diverse industry needs | Enhanced operational flexibility | Improved resilience to outages | Optimized maintenance cycles, supporting longer equipment life and lower noise levels |

|

Develops and integrates sustainable and hybrid generator systems for industrial and renewable energy projects, including hydrogen-based solutions for decarbonized power supply | Significantly reduced carbon footprint (98% CO2-free generation) | Improved energy efficiency | Scalable and reliable site power | Support for decarbonization initiatives |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The generator ecosystem provides a quick snapshot of key stakeholders, such as manufacturers, component providers, distributors, and end users. This list is not exhaustive and is meant to give an idea of the key market players.The generator value chain consists of several key segments, with prominent companies in each category. Manufacturers include Caterpillar, Rolls Royce, Cummins, and Generac, who are responsible for designing and assembling generator systems. Distributors such as General Power, Genesal Energy, and Adams handle the sales, logistics, and market reach of generator products to various regions and customer bases.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Generator Market, By Fuel Type

The global generator market by fuel type continues to be led by diesel generators, which account for the largest market share due to their outstanding reliability, high energy density, and widespread fuel availability. Diesel generators remain the preferred choice for backup and primary power across diverse sectors—ranging from manufacturing and construction to healthcare, telecom, mining, and data centers, especially where grid reliability is poor or mobile and off-grid applications are needed.

Generator Market, By Power Rating

The 281–500 kW power rating segment in the generator market serves critical mid-range demands between small commercial and large industrial systems. Generators with this power rating are widely utilized by large commercial buildings, mid-to-large manufacturing plants, hospitals, data centers, infrastructure projects, mining sites, and events requiring substantial but not utility-scale power.

Generator Market, By End User

The largest end user segment in the generator market is the industrial sector, which accounts for the largest share, owing to its significant need for reliable and uninterrupted power. This segment encompasses a wide range of industries including manufacturing, oil & gas, mining, construction, electric utilities, and transportation, where continuous power supply is critical to prevent operational disruptions and costly downtime.

Generator Market, By Application

The standby generator application holds the largest segment in the generator market, primarily driven by the need for reliable backup power across residential, commercial, and industrial sectors. Standby generators provide emergency power during grid outages, ensuring uninterrupted operations, safeguarding sensitive equipment, and supporting critical infrastructure like healthcare, data centers, and telecommunications

REGION

Asia Pacific to be the fastest-growing region in the global generator market during the forecast period

Asia Pacific is the fastest-growing region in the generator market, which can be attributed to the rapid industrialization, urbanization, and massive infrastructure development across emerging economies, including India, China, and Southeast Asian countries. The region experiences frequent grid constraints and power outages in urban and industrial areas, fueling high demand for reliable backup and prime power solutions, especially standby and prime generators.

Generator Market: COMPANY EVALUATION MATRIX

Caterpillar (Star) leads with a strong market presence and a wide product portfolio, driving large-scale adoption across end users. Everllence (Emerging Leader) is gaining traction with a higher product coverage among multiple end users. While Caterpillar dominates with scale, Everllence shows strong growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 25.31 Billion |

| Market Forecast in 2030 (Value) | USD 33.45 Billion |

| Growth Rate | CAGR 5.7% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Generator Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| End User & Application Segmentation | Comprehensive list of customers with segmentation by end user & type Benchmarking of adoption rates across utilities, industrial, and commercial. Analysis of barriers for customers | Insights on revenue shifts towards emerging end users Pinpoint cross-industry substitution risks and opportunities Enable targeting of high-margin products |

RECENT DEVELOPMENTS

- August 2025 : Caterpillar launched the Cat D1500 diesel generator set, delivering 1.5 MW of standby power with a compact, space-saving 32.1-liter Cat C32B engine. It offers up to 13% less floor space and 32% less weight, meeting ISO 8528-5, NFPA 110, and EPA Tier 2 standards for reliable standby performance.

- December 2024 : Caterpillar introduced the Cat G3500K series of gas generator sets, engineered for reliable, quick-response, and high-efficiency power in demanding environments. The first model, the G3520K HR, delivers 2.5 MW of continuous power and reaches full load in just 4.5 minutes—25% faster than the previous G3500H series.

- June 2025 : Cummins Inc. launched the S17 Centum generator set, a 17-liter engine platform delivering up to 1 MW of power in a compact design.Developed for space-constrained urban environments, it combines high performance with reliability across critical sectors.

- October 2025 : Rolls-Royce launched new fast-start mtu gas gensets, including the 20V4000 Series 4000 L64 engine, designed for data centers and grid stabilization. The 2.8 MW unit reaches full power in just 45 seconds for the US market, with global models offering 120-second start capability.

- October 2025 : Rolls-Royce launched the upgraded mtu Series 1600 generator sets for the 50 Hz market, delivering up to 40% more power than previous models. This release completes the rollout of the enhanced Series 1600 platform, following the 60 Hz version introduced in late 2023.

Table of Contents

Methodology

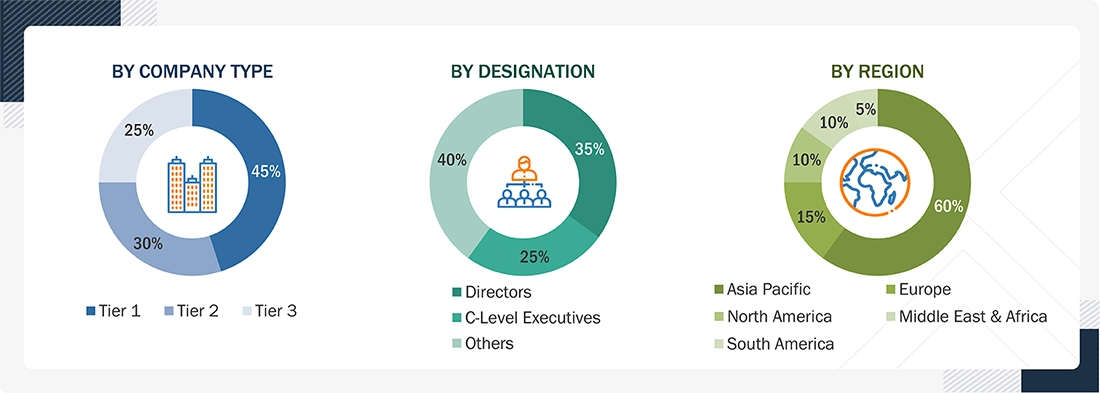

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, and ICIS, to identify and collect information useful for this technical, market-oriented, and commercial study of the global generator market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and assess market growth prospects.

Secondary Research

Secondary sources include annual reports, press releases, and investor presentations of companies; directories and databases, which include D&B, Bloomberg, and Factiva; white papers and articles from recognized authors; and publications and databases from associations, such as the Power Generators Air Coalition (PGen), the Energy Information Administration, the Portable Generator Manufacturers’ Association (PGMA), the American Public Power Association (APPA), and the Electric Generating Systems Association (EGSA). Secondary research has been used to obtain key information about key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders has also been prepared using secondary research.

Primary Research

In the primary research process, various sources from the supply and demand sides have been interviewed to obtain and verify qualitative and quantitative information for this report and analyze prospects. Primary sources from the supply side include industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various leading companies and organizations operating in the generator market. Primary sources from the demand side include experts and key persons.

After the complete market engineering process (including calculations of market statistics, market breakdown, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research has also been conducted to identify the segmentation, applications, Porter’s Five Forces, key players, competitive landscape, and key market dynamics, such as drivers, opportunities, challenges, trends, and strategies, adopted by key players.

To know about the assumptions considered for the study, download the pdf brochure

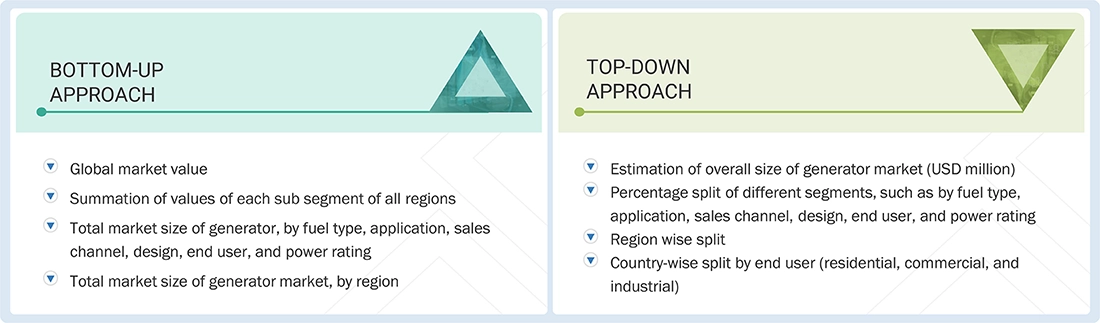

Market Size Estimation

In the complete market engineering process, the top-down and bottom-up approaches have been extensively used along with several data triangulation methods to estimate and forecast the overall market segments listed in this report.

Top-down and bottom-up approaches have been used to estimate and validate the market size of generators for various end users in each region. Key players in the generator market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of key market players and extensive interviews for insights from industry leaders, such as CEOs, vice presidents, directors, and marketing executives. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Generator Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. Data triangulation and market breakdown procedures have been used to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has been validated using the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources: the top-down approach, the bottom-up approach, and expert interviews. When the values arrived at from the three points matched, the data was assumed to be correct.

Market Definition

Generators are devices that can convert mechanical energy into electrical energy using diesel, gas, or other fuels. Internal combustion engines produce mechanical energy, which can be converted into electrical energy using generators. Generators considered in this study typically consist of an internal combustion engine, alternators, and various accessories, such as transfer switches, integrated power systems, paralleling systems, and remote monitoring systems. Generators supply electrical power in the absence of a regular power source and provide backup power during power outages, especially during peak hours and severe weather conditions in rural areas. They are also essential as backup or standby power for businesses, for temporary power supply in remote areas and off-grid locations, and to support the main power supply during peak demand.

Stakeholders

- Government organizations and regulatory agencies

- Investors/shareholders

- Shipping companies

- Organizations, forums, alliances,

- Generator manufacturing companies

- Manufacturers and equipment user associations and groups

- Environmental research institutes

- Consulting companies (energy and power domain)

- Manufacturing industry

- Investment banks

- State and national regulatory authorities

- Venture capital firms

- Financial organizations

- Research Institutes and organizations

- Environment associations

Report Objectives

- To describe and forecast the generator market, by fuel type, application, sales channel, design, end user, and power rating, in terms of value

- To describe and forecast the market size for five key regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with their key countries, in terms of value

- To describe and forecast the generator market, by region, in terms of volume

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the generator market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete supply chain and allied industry segments, and perform a supply chain analysis of the generator market landscape

- To study market trends, patent analysis, trade analysis, tariff and regulatory landscape, Porter’s five forces analysis, ecosystem analysis, technology analysis, investment and funding scenario, key stakeholders and buying criteria, the impact of AI/Gen AI, the 2025 US tariff impact, and case studies pertaining to the generator market

- To analyze the opportunities for various stakeholders by identifying the high-growth segments of the generator market

- To profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments, such as contracts, collaborations, product launches, and acquisitions, in the generator market

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies using the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the generator market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Generator Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Generator Market

Jeff

Jun, 2022

What factors are estimated to drive and restrain the generator sales market growth?.