Portable Generator Market by Application (Emergency, Prime/Continuous), Fuel (Gasoline, Diesel, Natural Gas, Others), Power Rating (Below 5 kW, 5 – 10 kW, 10 – 20 kW), Product type, End user and Region - Global Forecast to 2027

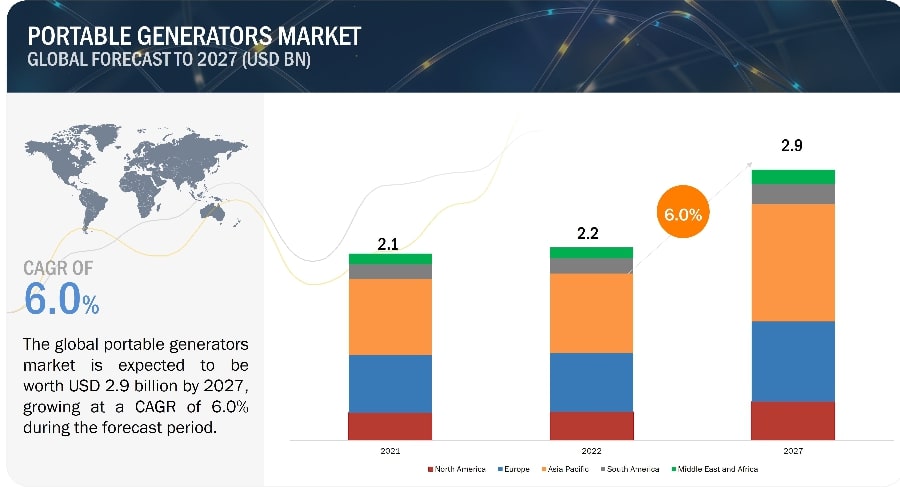

The global portable generator market size was valued at $2.2 billion in 2022 and to reach $2.9 billion by 2027, growing at a compound annual growth rate (CAGR) of 6.0% from 2022 to 2027.

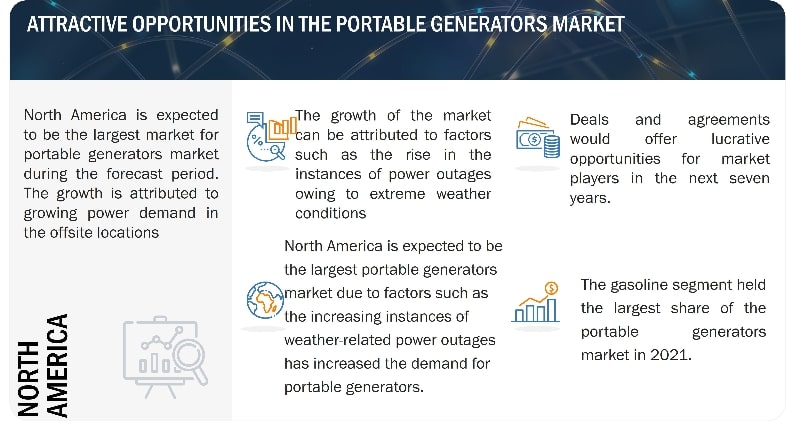

Severe weather conditions like heavy rains, heat waves, storms, hurricanes, and fog disrupt regular supply of electricity, thereby creating demand for backup power supply for different sectors. Portable generators find their applications for camping, tailgating as well as Recreational Vehicles. Long runtime and efficient fuel capacity are some of the features that have increased the demand for portable generators.

To know about the assumptions considered for the study, Request for Free Sample Report

Portable Generator Market Dynamics

Driver: Rise in the instances of power outages owing to extreme weather conditions

Electricity transmission and distribution is the backbone for the power infrastructure in the country. Transmission systems that are not properly upgraded cannot sustain additional power burden and, in some cases, can also lead to the failure of the system, causing power outage. Transmission and distribution networks in developed countries were laid out quite a while ago, and even with regular maintenance, after a certain age, the infrastructure is bound to weaken. According to the National Association of Regulatory Utility Commissioners US, coal, gas, and nuclear power plants can work efficiently for a span of approximately 40 years. The life span of these power generation sources is reaching the end of their life cycle due to which countries such as the US, the UK, and Germany have been focusing on replacing their aging power generation, transmission, and distribution infrastructure to reduce the power outages.

The extreme weather conditions are also likely to drive demand for portable generators. The electrical infrastructure in the US is prone to unpredictable and frequent power failures. Thus, increasing investments in backup power solutions, apart from growing awareness among consumers toward emergency preparedness, will favor market growth. According to the Department of Energy (DoE) and the North American Electric Reliability Corp. (NERC), a system capable of handling sudden power shots and drops can help in uninterrupted power. The US endures more blackouts than any other developed country as the duration of US power outages lasts more than an hour, and the number has increased steadily over the past few years. These blackouts cost American businesses about USD 150 billion per year.

Restraint: Stringent government regulations pertaining to emissions on generators

Portable generators are used in residential, commercial, and industrial applications. When diesel is burnt in generator, it emits oxides of nitrogen, carbon monoxide, and particulate matter. These emissions are directly released into the atmosphere, and they deteriorate the environment as well as inhabitants. Several regulations have been implemented worldwide to reduce air and noise pollution by generator sets. Consumer Product Safety Commission (CPSC) is a key step toward regulating gas-powered generators, which emit as much as carbon monoxide. Countries focussing on reducing the emissions from the types of fuels used in portable generators. For instance, California has laid down a regulation to ban portable generators in the state.

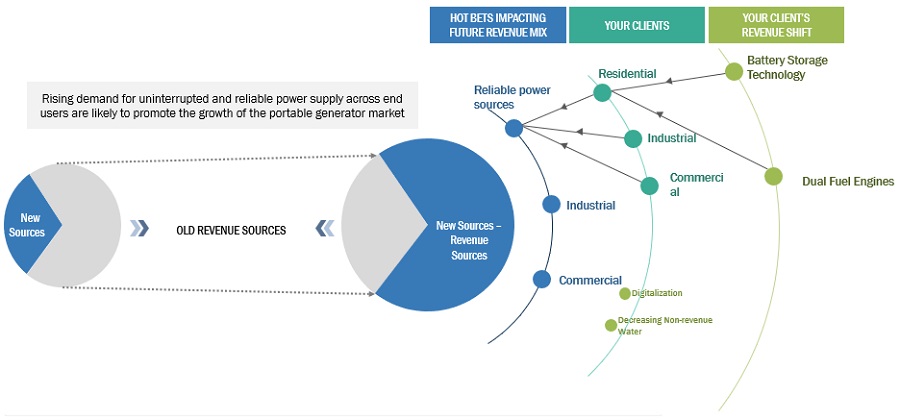

Opportunities: Technological advancements such as dual fuels and inverter portable generators

In general, the hybrid generators are internal combustion engines coupled with batteries, which are offered by many OEMs. When the load is high, these hybrid gensets directly power the engine; when the load is low, the battery powers the engine. They have a number of advantages over traditional gensets, including a reduction in running time, fuel consumption, and noise. They are also likely to penetrate the market for mobile gensets, which are primarily employed in residential settings and building sites.

The reliability for the dual fuel generator improves for the standby power applications by combining favorable aspects of both gas and diesel generators. The portable generators which can operate on either gas or diesel are able to run completely on diesel during an emergency. Dual fuel technology has now been used by a number of generator manufacturers for solving different problems appearing in diesel engines.

Challenges: Increasing adoption of renewable energy technologies and energy storage solutions

Over the past several years, the energy storage business has experienced exponential growth. The primary drivers of the energy storage market are the increasing focus on lowering greenhouse gases and the stringent emission reduction targets. These limitations also limit the expansion of the market for portable generators. Prices for solar and batteries have been falling each year and are anticipated to fall even further during the projection period. More people are drawn to renewable energy options because they want to control and lower their electricity bills. In residential applications, battery energy storage systems are utilized to power residential structures. Thus, the rise of fuel-based power generation machinery, such as portable generators, is being constrained by the rising usage of energy storage technology.

Market Trends

To know about the assumptions considered for the study, download the pdf brochure

5 – 10 kW segment, by power rating, is expected to be the largest market during the forecast period

The 5–10 kW portable generators are used for powering appliances used in households so, majorly used in applications such as residential and camping activities. The rise in the camping activities which require backup portable generators is pushing the demand for this segment. The major camping activities are seen in North American countries such as US, Canada, and Mexico which is boosting the market. The portable generators market is dominated by a few major market players that have a wide regional presence. The key players in the portable generators market are Honda (Japan), Generac (US), Yamaha (Japan), Cummins (US), Atlas Copco (Sweden). In the last few years, the companies have adopted growth strategies such as sales contracts to capture a larger share of the portable generators market. The increase in camping activities, especially in North America-United States, Canada, and Mexico-has driven the portable generators market development considerably. Accompanied by outdoor adventure tourism, the growth of demand in these countries is for 5–10 kW generators for dependable power supplies in unattended sites. This is further mired with the rise in the number of people going for RV camping, to which these generators generally operate to provide power to the electrical systems of the vehicle and other camping equipment. Major players dominate the market for portable generators with considerable regional presence.

By fuel, the natural gas is expected to be the fastest growing market for the global portable generator market during the forecast period

By fuel , the portable generators market has been segmented into gasoline, diesel, natural gas, and others. Portable generators that run on natural gas are more affordable, easier to use, and better for the environment because natural gas is said to be the eco-friendly fuel. Additionally, noise pollution is reduced by portable generators that run on natural gas. Tanks make it simple to store natural gas for longer periods of time and use it as needed. Such portable generators are increasingly in demand in the worldwide portable generator market because they are utilized frequently during blackouts and in places vulnerable to natural disasters.

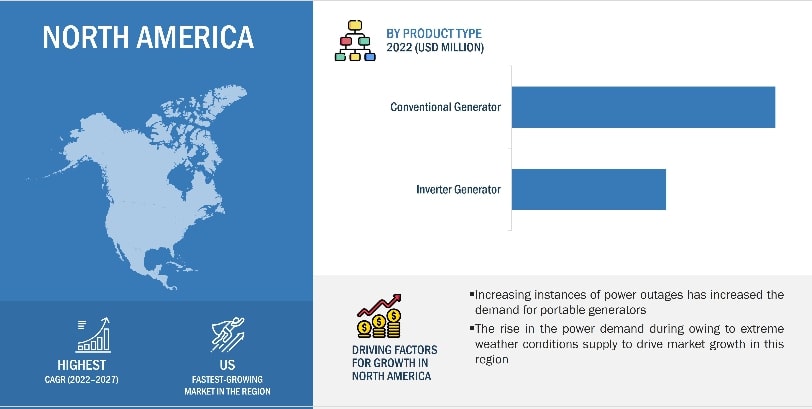

“North America: The second fastest portable generator market”

North America is expected to be the second fastest-growing region for the global portable generators market between 2022–2027. Increasing instances of power shortages in countries such as the US and Canada are likely to boost the demand for portable generators. North America is one of the leading manufacturers and consumer of electricity. Due to the massive industrial sector of North America in the countries such as US and Canada has increased the power demand. Environmental distress, power shortages, investments on the natural gas networks, and peak time electricity costs are expected to help the portable generator market grow in this region. The region has witnessed increasing frequency and intensity of various weather conditions, including hurricanes, wildfires, and winter storms. All such events are ascribable to longer power outages, which drive the residential generator market and commercial sectors to invest in portable generators for backup power.

Key Market Players

The portable generators market is dominated by a few major market players that have a wide regional presence. The key players in the portable generators market are Honda (Japan), Generac (US), Yamaha (Japan), Cummins (US), Atlas Copco (Sweden). In the last few years, the companies have adopted growth strategies such as sales contracts to capture a larger share of the portable generators market. The portable generators market is dominated by a few major players that have a wide regional presence.

Scope of the report

|

Report Metrics |

Details |

| Market size available for years | 2020–2027 |

| Base year considered | 2021 |

| Forecast period | 2022–2027 |

| Forecast units | Value (USD) |

| Segments covered | Fuel, Power rating, application, end user, product type and Region |

| Geographies covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

| Companies covered | Honda (Japan), Generac (US), Yamaha (Japan), Cummins (US), Atlas Copco (Sweden), Briggs and Stratton (US), Generac (US), Yamaha, Caterpillar Inc. (US), Honeywell International Inc. (US), Siemens (Germany), Waucker Neuson (Germany), Rato Europe (Italy), Kohler (US), Champion Power Equipment (US), Inmesol (Spain), Himoonsa (Spain), Duromax (California), Loncin (China), Wen portable generators (US), Pulsar products (US) |

This research report categorizes the portable generator market by fuel, applications, product type, power rating, end user, and region

Based on fuel:

- Gasoline

- Diesel

- Natural Gas

- Others

Based on application:

- Emergency

- Prime/ Continuous

Based on product type:

- Inverter generator

- Conevntional generator

Based on power rating:

- Below 5kW

- 5 – 10 kW

- 10 – 20 KW

Based on end user:

- Residential

- Commercial

- Industrial

Based on region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2021, Yamaha has updated its full line of inverter and conventional generators with Carbon Monoxide (CO) Sensor.

- In October 2021, Generac launched its new products series Guardian 26kW generator provides 26 kilowatts of peak power, while taking up less space and offering thousands of dollars of savings on purchase and installation compared to competitive home standby generators.

- In September 2019, Honda has launched, Honda My Generator Bluetooth App which allows end users to start (electric start models only), stop, and monitor critical functions of Honda portable generators through a Bluetooth interface on a smartphone.

Frequently Asked Questions (FAQ):

What is the current size of the portable generators market?

The current market size of the global portable generators market is USD 2.1 Billion in 2021.

What are the major drivers?

Rise in the instances of power outages owing to extreme weather conditions

Which is the fastest-growing region during the forecasted period?

North America is expected to be the second fastest-growing region for the global portable generators market between 2022–2027. Increasing instances of power outages in countries such as the US and Canada are likely to boost the demand for portable generators for uninterrupted power supply in the region. The countries included are the US, Canada, and Mexico.

Which is the fastest-growing segment, by fuel during the forecasted period?

By fuel, the portable generators market has been segmented into gasoline, diesel, natural gas, and others. Natural gas-powered portable generators are cost effective, efficient to operate, and better for the environment as they are considered the cleanest burning fuel.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

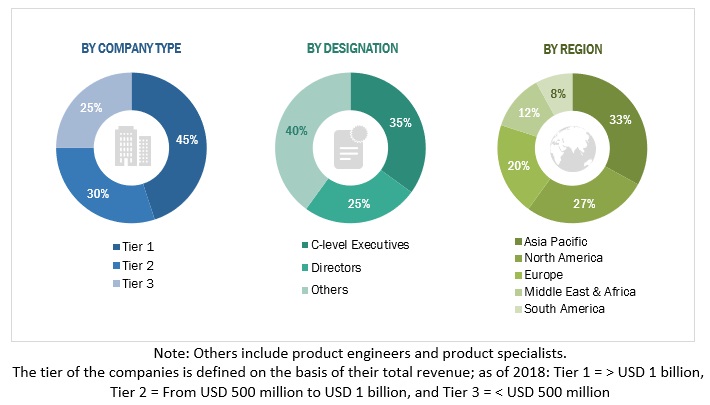

The study involved major activities in estimating the current size of the portable generator market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the portable generator market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the global portable generators market. The other secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The portable generators market comprises several stakeholders such as portable generators manufacturers, manufacturers of components of portable generators infrastructure, technology providers, and technology support providers in the supply chain. The demand side of this market is characterized by the rising demand for portable generators in the nations to reduce the non-revenue water losses. The supply side is characterized by rising demand for contracts from the residential users, commercial users and mergers and acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

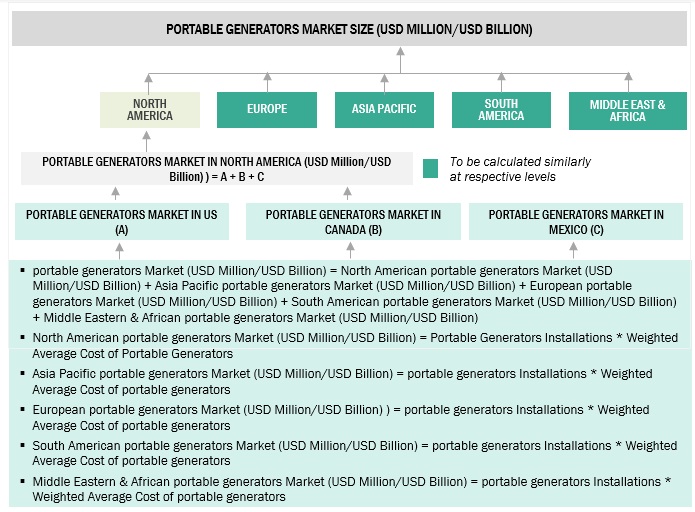

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the portable generators market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Portable generators Market Size: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the portable generators market size, by product type, fuel, power rating, end user, and application

- To provide detailed information on the major drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the portable generators market

- To strategically analyze the portable generators market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and provide a detailed competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five main regions (along with countries), namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments such as new product developments, contracts & agreements, investments & expansions, and mergers & acquisitions in the portable generators market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Portable Generator Market