Glass Mat Market by Mat Type (Chopped Strand Mat, Continous Filament Mat), Binder Type (Emulsion, Powder), Manufacturing Process (Dry-Laid, Wet-Laid), End-Use Industry, Region (North America, APAC, Europe, Latin America, MEA) - Global Forecast to 2028

Updated on : November 27, 2025

Glass Mat Market

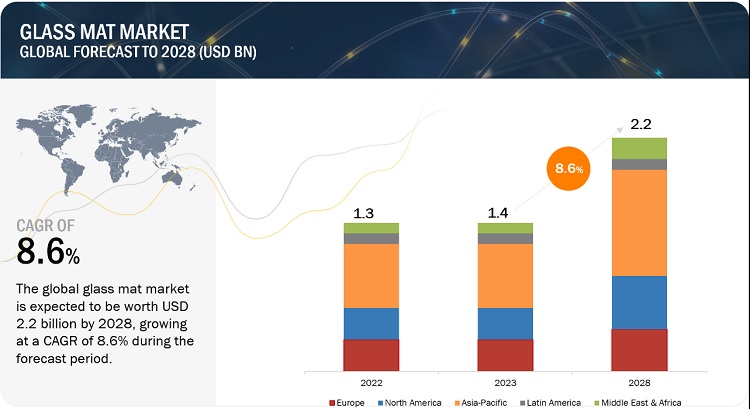

The global glass mat market size was valued at USD 1.3 billion in 2022 and is projected to reach USD 2.2 billion by 2028, growing at 8.6% cagr from 2023 to 2028. Significant growth of glass mats in construction & infrastructure, industrial applications, automotive & transportation, and many other industries is driving the growth of the market across the globe. Glass mat is inexpensive as compared to other composite forms, easy to use, and can quickly build thickness required for parts.

Glass Mat Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Glass Mat Market

Glass Mat Market Dynamics

Drivers: Increase in demand for lightweight and fuel-efficient vehicles

The construction & infrastructure industry is expected to show significant growth in Asia Pacific, Europe, North America and other regions of the world. The expansion of the construction industry around the world is a key factor driving the growth of the glass mat market. According to Oxford Economics, the global construction industry contributes approximately one-tenth to the global GDP and is expected to reach a size of about USD 8 trillion by 2030. The increasing population and the construction of commercial and residential buildings in growing economies, such as China and India are also supporting the growth of the construction industry as well as the growth of the glass mat market in the Asia Pacific region. According to the data provided by the International Trade Administration (ITA), China was reported.

Restraints: Rapid adoption of close molding method in developed countries

The close mold method reduces the wastage of raw material, provides better finish parts, enables faster production, and reduces efforts related to finishing and polishing. In addition, the method helps manufacturers to reduce emissions as curing takes place inside the mold. This less labor-dependent process also helps in reducing tool costs. The close molding processes allows the production of high-quality products along with minimal waste generation. Hence, many manufacturers are adopting these processes to manufacture various products of prepregs and composites.

Opportunities: Increased demand for glass mats in construction & infrastructure industry in the Middle East & Africa

The glass mat industry is mainly concentrated in Asia Pacific, North America, and Europe. However, over the last few years, there has been increasing use of glass mats in the construction & infrastructure and automotive & transportation industries in the Middle East & Africa region as well. The glass mat market in Saudi Arabia, Qatar, and the UAE is expected to be driven by government spending. Qatar hosted the 2022 FIFA World Cup, which resulted in increased construction and infrastructural activities in the country, thereby fueling the use of glass mats. In addition, the rising number of infrastructural developments in Saudi Arabia, Qatar, and the UAE are expected to provide opportunities for the growth of the market in the Middle East & Africa.

Challenges: Lack of major research and technical advancements

Fabric and roving forms are preferred over glass mats in several end-use industries, owing to the advanced technology used in the manufacturing of these forms. This shift is hindering the R&D for the development of innovative glass mat products. Aerospace, automotive, and wind energy are a few key industries that have been using glass fabric composites instead of glass mat in various applications, which is pushing manufacturers toward R&D on fabrics and roving.

Chopped strand glass mats to account for the largest market share in terms of both value and volume

Chopped strand mats are made from glass fiber strands that are randomly distributed but evenly spread and bonded together with a binder. These mats are used in various hand lay-up and closed mold applications to mold various types of composites products. This mat type is compatible with polyester and vinyl ester resin systems. The major applications of chopped glass mat include recreational, marine, transportation, industrial, and construction. The chopped length can vary depending on properties and application requirements.

Emulsion Bonded Glass Mat to be the fastest growing binder type of glass mat market

The emulsion bonded glass mat gives better handling properties, better surface bonding efficiency, and ease of processing, unlike the powder bonded glass mat. Emulsion bonded mat offers benefits such as easy air removal and rapid resin impregnation, good surface bonding and high strand integrity, better appearance of the composite parts, low resin consumption, and high strand integrity.

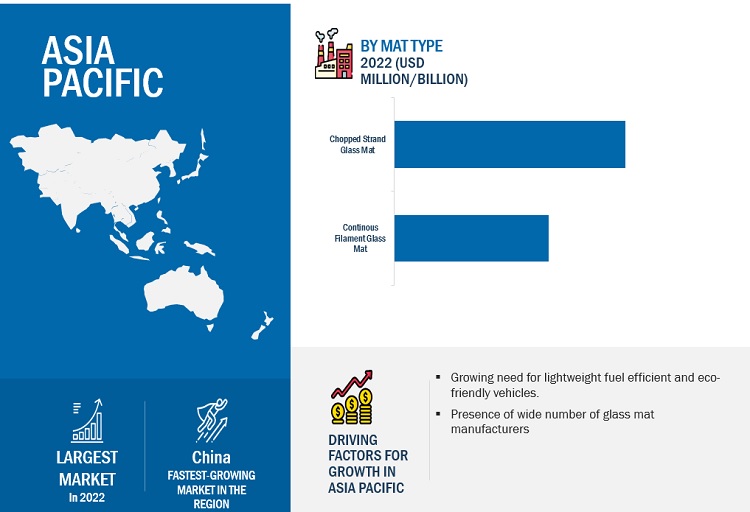

Asia Pacific held the largest market share and is expected to witness the highest CAGR in the glass mat market

Asia Pacific is the dominating region in the glass mats market and it is expected to witness high growth in the next five years. Growing demand, emission control policies, environment-friendly products, among other factors, have led to innovation and development in the industry, making the region a strong global composites hub. High growth and innovation, along with industry consolidation, are expected to ascertain a bright future for the regional industry. The replacement of traditional materials such as steel and aluminum with glass mat owing to the latter’s superior mechanical and physical properties is contributing to growth of the region’s glass mat market. Construction & infrastructure, automotive & transportation, and industrial applications are expected to be the largest and the most profitable industries, which are expected to increase the use of glass mat in the next five years.

To know about the assumptions considered for the study, download the pdf brochure

Glass Mat Market Players

The key players in the global glass mat market are:

- Owens Corning, (US)

- Chongqing Polycomp International Corporation (CPIC), (China)

- China Jushi Co., Ltd., (China)

- Saint-Gobain, (France)

- Nippon Electric Glass Co., Ltd., (Japan)

- China Beihai Fiberglass Co., Ltd, (China)

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the glass mat industry. The study includes an in-depth competitive analysis of these key players in the glass mat industry, with their company profiles, recent developments, and key market strategies.

Glass Mat Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 1.3 billion |

|

Revenue Forecast in 2028 |

USD 2.2 billion |

|

CAGR |

8.6% |

|

Years considered for the study |

2018–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million/Billion), Volume (Kiloton) |

|

Segments |

Mat Type, Binder Type, Manufacturing Process, End-use Industry, and Region |

|

Regions |

Asia Pacific, North America, Europe, Latin America, and Middle East & Africa |

|

Companies |

are Owens Corning, (US), Chongqing Polycomp International Corporation (CPIC), (China), China Jushi Co., Ltd., (China), 3B-the Fibreglass Company, (Belgium), Saint-Gobain, (France), Nippon Electric Glass Co., Ltd., (Japan), China Beihai Fiberglass Co., Ltd, (China), and Taiwan Glass Ind. Corp. (Taiwan). |

This research report categorizes the glass mat market based on mat type, binder type, manufacturing process, end-use industry, and region.

Glass Mat Market by Mat Type:

- Chopped Strand Glass Mat

- Continuous Filament Glass Mat

Glass Mat Market by Binder Type:

- Powder Bonded Glass Mat

- Emulsion Bonded Glass Mat

Glass Mat Market by Manufacturing Process:

- Wet-laid

- Dry-laid

- Others

Glass Mat Market by End-use Industry:

- Construction & Infrastructure

- Industrial Applications

- Automotive & Transportation

- Marine

- Sports & Leisure Goods

- Others

Glass Mat Market by Region:

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

Recent Developments

- In December 2022, Owens Corning announced that it has completed the sale of its operations in the country to Umatex, a Russia-based producer of carbon fiber and fiber-based items. The transaction includes two manufacturing operations: a Composites manufacturing plant in Gous-Khroustalny and an Insulation manufacturing plant in Tver/Izoplit.

- In August 2021, Owens Corning introduced PINK Next Gen Fiberglass insulation, a new product developed by the company that offers higher fire resistance performance, improved stiffness, superior texture, and a smooth finish. It enables faster installation compared to other existing products.

- In April 2021, In 2021, CPIC announced a partnership with Jushi Group, another leading Chinese manufacturer of fiberglass products, to jointly invest in a new production line for high-end E-glass fiber products.

- In December 2022, China Jushi Co., Ltd., a leading fiberglass maker, intends to invest CNY 5.7 billion (USD 812 million) to build the world's first zero-carbon glass fiber plant in the Chinese city of Huai'an. Jushi will spend CNY 4.7 billion (USD 0.68 billion) to build a factory with an annual output of 400,000 tons of glass fiber.

Frequently Asked Questions (FAQ):

Which are the key players of glass mat market and what are their strategies to strengthen their market presence/shares?

Some of the key players of glass mat market Owens Corning (US), Chongqing Polycomp International Corporation (CPIC) (China), China Jushi Co., Ltd. (China), 3B-the Fibreglass Company (Belgium), Saint-Gobain (France), Nippon Electric Glass Co., Ltd. (Japan), China Beihai Fiberglass Co., Ltd (China), Taiwan Glass Ind. Corp. (Taiwan), among others, are the key manufacturers that secured contracts, deals in the last few years. Agreements, expansions, technological developments, contracts, and deals was the key strategies adopted by these companies to strengthen their glass mat market presence.

What are the drivers for the glass mat market?

Increased use of glass mats in construction & infrastructure, automotive & transportation and industrial applications is expected to drive the market globally.

Which type of glass mat holds the largest market share?

Chopped strand glass mat holds the largest share in terms of both, value and volume in the glass mat market.

What is the major factor on which the final price of glass mat rely?

Price and availability of raw material along with the type of manufacturing process used plays an important role in determining the costs of the glass mats.

Which region is expected to hold the highest market share?

Asia Pacific will dominate the market share in forecasted period i.e between 2023 to 2028, due to the huge demand coming from the countries like China, India and South Korea. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTIONS

-

5.2 MARKET DYNAMICSDRIVERS- Increased use in construction and infrastructure industries- Rise in demand for lightweight products in automotive & transportation sector- Increased demand for open molding in emerging countriesRESTRAINTS- Increased automation resulting in reduced use across industries- Rapid adoption of close molding method in developed countriesOPPORTUNITIES- Penetration of composite materials in emerging economies- Rise in demand from emerging markets due to growth in end-use industries- Increased demand in construction and infrastructure industries in Middle East & AfricaCHALLENGES- Lack of major research and technical advancements- Competition from alternative substitutes

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICES IN END-USE INDUSTRIES, BY KEY PLAYERS

- 5.6 AVERAGE SELLING PRICES, BY MAT TYPE

- 5.7 AVERAGE SELLING PRICES, BY BINDER TYPE

- 5.8 AVERAGE SELLING PRICE TREND

-

5.9 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 TECHNOLOGY ANALYSIS

-

5.11 ECOSYSTEM: GLASS MAT MARKET

- 5.12 VALUE CHAIN ANALYSIS

- 5.13 CASE STUDY ANALYSIS

- 5.14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.15 KEY MARKETS FOR IMPORT/EXPORTJAPANCHINATAIWANUSINDIA

-

5.16 TARIFF AND REGULATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.17 GLASS MAT MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOSOPTIMISTIC SCENARIOPESSIMISTIC SCENARIOREALISTIC SCENARIOSTANDARDS FOR GLASS MAT MARKET

-

5.18 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISANALYSIS OF TOP APPLICANTSPATENTS BY JOHNS MANVILLEPATENTS BY BMIC LLCPATENTS BY NIPPO ELECTRIC CO., LTD.US: TOP 10 PATENT OWNERS IN LAST 10 YEARS

- 5.19 KEY CONFERENCES & EVENTS

- 6.1 INTRODUCTION

-

6.2 CHOPPED STRAND GLASS MATGROWTH IN AUTOMOTIVE AND CONSTRUCTION INDUSTRIES TO DRIVE SEGMENTCHOPPED STRAND GLASS MAT MARKET, BY REGION

-

6.3 CONTINUOUS FILAMENT GLASS MATINCREASED DEMAND IN INDUSTRIAL APPLICATIONS TO PROPEL SEGMENTCONTINUOUS FILAMENT GLASS MAT MARKET, BY REGION

- 7.1 INTRODUCTION

-

7.2 EMULSION BONDED GLASS MATSUPERIOR PROPERTIES COMPARED WITH POWDER BONDED GLASS MATS TO DRIVE SEGMENTEMULSION BONDED GLASS MAT MARKET, BY REGION

-

7.3 POWDER BONDED GLASS MATCOMPATIBILITY WITH EPOXY RESIN TO PROPEL SEGMENTPOWDER BONDED GLASS MAT MARKET, BY REGION

- 9.1 INTRODUCTION

-

9.2 CONSTRUCTION & INFRASTRUCTUREINCREASED USE FOR TENSILE STRENGTH AND STRENGTH-TO-WEIGHT RATIO TO DRIVE SEGMENTGLASS MAT MARKET IN CONSTRUCTION & INFRASTRUCTURE END-USE INDUSTRY, BY REGION

-

9.3 INDUSTRIAL APPLICATIONSEXTENSIVE USE IN CHEMICAL, OIL & GAS, AND PULP & PAPER INDUSTRIES TO PROPEL SEGMENTGLASS MAT MARKET IN INDUSTRIAL APPLICATIONS END-USE INDUSTRY, BY REGION

-

9.4 AUTOMOTIVE & TRANSPORTATIONINCREASED ADOPTION TO IMPROVE VEHICLE PERFORMANCE TO PROPEL SEGMENTGLASS MAT MARKET IN AUTOMOTIVE & TRANSPORTATION END-USE INDUSTRY, BY REGION

-

9.5 MARINELOW MAINTENANCE AND RESISTANCE TO CORROSION AND WATERLOGGING PROPERTIES TO BOOST SEGMENTGLASS MAT MARKET IN MARINE END-USE INDUSTRY, BY REGION

-

9.6 SPORTS & LEISURE GOODSINCREASED DEMAND FOR SPORTING GOODS FROM ASIA PACIFIC AND NORTH AMERICA TO DRIVE SEGMENTGLASS MAT MARKET IN SPORTS & LEISURE GOODS END-USE INDUSTRY, BY REGION

-

9.7 OTHER INDUSTRIESGLASS MAT MARKET IN OTHER END-USE INDUSTRIES, BY REGION

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAIMPACT OF RECESSIONNORTH AMERICA: GLASS MAT MARKET, BY MAT TYPENORTH AMERICA: GLASS MAT MARKET, BY BINDER TYPENORTH AMERICA: GLASS MAT MARKET, BY END-USE INDUSTRYNORTH AMERICA: GLASS MAT MARKET, BY COUNTRY- US- Canada

-

10.3 EUROPEIMPACT OF RECESSIONEUROPE: GLASS MAT MARKET, BY MAT TYPEEUROPE: GLASS MAT MARKET, BY BINDER TYPEEUROPE: GLASS MAT MARKET, BY END-USE INDUSTRYEUROPE: GLASS MAT MARKET, BY COUNTRY- Germany- Italy- France- UK- Spain- RussiaREST OF EUROPE- Rest of Europe: glass mat market, by end-use industry

-

10.4 ASIA PACIFICIMPACT OF RECESSIONASIA PACIFIC: GLASS MAT MARKET, BY MAT TYPEASIA PACIFIC: GLASS MAT MARKET, BY BINDER TYPEASIA PACIFIC: GLASS MAT MARKET, BY END-USE INDUSTRYASIA PACIFIC: GLASS MAT MARKET, BY COUNTRY- China- Japan- India- South Korea- Indonesia- Rest of Asia Pacific

-

10.5 MIDDLE EAST & AFRICAIMPACT OF RECESSIONMIDDLE EAST & AFRICA: GLASS MAT MARKET, BY MAT TYPEMIDDLE EAST & AFRICA: GLASS MAT MARKET, BY BINDER TYPEMIDDLE EAST & AFRICA: GLASS MAT MARKET, BY END-USE INDUSTRYMIDDLE EAST & AFRICA: GLASS MAT MARKET, BY COUNTRY- Saudi Arabia- Qatar- UAE- South Africa- Rest of Middle East & Africa

-

10.6 LATIN AMERICAIMPACT OF RECESSIONLATIN AMERICA: GLASS MAT MARKET, BY MAT TYPELATIN AMERICA: GLASS MAT MARKET, BY BINDER TYPELATIN AMERICA: GLASS MAT MARKET, BY END-USE INDUSTRYLATIN AMERICA: GLASS MAT MARKET, BY COUNTRY- Brazil- Mexico- Rest of Latin America

- 11.1 INTRODUCTION

- 11.2 MARKET SHARE ANALYSIS

- 11.3 MARKET RANKING

- 11.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- 11.5 COMPETITIVE LANDSCAPE MAPPING

-

11.6 COMPANY EVALUATION MATRIXSTARSPERVASIVE PLAYERSPARTICIPANTSEMERGING LEADERSSTRENGTH OF PRODUCT PORTFOLIOBUSINESS STRATEGY EXCELLENCE

- 11.7 MARKET EVALUATION FRAMEWORK

- 11.8 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

-

11.9 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.1 KEY COMPANIESOWENS CORNING- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHINA JUSHI CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHONGQING POLYCOMP INTERNATIONAL CORP. (CPIC)- Business overview- Products/Solutions/Services offered- Recent developments- MnM view3B-THE FIBREGLASS COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAINT-GOBAIN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTAIWAN GLASS IND. CORP.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNIPPON ELECTRIC GLASS CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHINA BEIHAI FIBERGLASS CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewSUPERIOR HUNTINGDON COMPOSITES, LLC- Business overview- Products/Solutions/Services offered- MnM viewJIANGSU CHANGHAI COMPOSITE MATERIALS CO., LTD.- Business overview- Products/Solutions/Services offered- MnM view

-

12.2 OTHER COMPANIESJOHNS MANVILLE (A BERKSHIRE HATHAWAY COMPANY)CENTRAL GLASS CO., LTD.HANGZHOU MINGDA GLASS FIBRE CO., LTD.NITTO BOSEKI CO., LTD.KROSGLASS S.A.SISECAM A.S.EASTERN INDUSTRIAL COMPANY (EICO)JIANGSU JIUDING NEW MATERIAL CO., LTD.P-D GLASSEIDEN GMBHTEXAS FIBERGLASS GROUPTAISHAN FIBERGLASS INC. (CTG)SODA SANAYII ASKCC CORPORATIONCHONGQING DUJIANG COMPOSITES CO., LTD. (CQFIBERGLASS)

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 NUMBER OF FCEVS, BY MAJOR COUNTRY/REGION, 2021

- TABLE 2 NEW WIND POWER INSTALLATIONS (ONSHORE), BY REGION, 2022 & 2027

- TABLE 3 GLASS MAT MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 GLASS MAT MARKET: COMPANIES AND THEIR ROLE IN ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICES IN TOP 3 END-USE INDUSTRIES, BY KEY PLAYERS (USD/KG)

- TABLE 6 AVERAGE SELLING PRICE TREND IN GLASS MAT MARKET, BY REGION

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 9 GLASS MAT MANUFACTURING PROCESS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 GLASS MAT MARKET: CAGR (BY VALUE) IN OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

- TABLE 15 CURRENT STANDARD CODES FOR GLASS MAT MARKET

- TABLE 16 GLASS MAT MARKET: GLOBAL PATENTS

- TABLE 17 DETAILED LIST OF CONFERENCES & EVENTS RELATED TO GLASS MAT AND RELATED MARKETS, 2023 & 2024

- TABLE 18 GLASS MAT MARKET, BY MAT TYPE, 2018–2022 (KILOTON)

- TABLE 19 GLASS MAT MARKET, BY MAT TYPE, 2018–2022 (USD MILLION)

- TABLE 20 GLASS MAT MARKET, BY MAT TYPE, 2023–2028 (KILOTON)

- TABLE 21 GLASS MAT MARKET, BY MAT TYPE, 2023–2028 (USD MILLION)

- TABLE 22 CHOPPED STRAND GLASS MAT MARKET SIZE, BY REGION, 2018–2022 (KILOTON)

- TABLE 23 CHOPPED STRAND GLASS MAT MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 CHOPPED STRAND GLASS MAT MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 25 CHOPPED STRAND GLASS MAT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 CONTINUOUS FILAMENT GLASS MAT MARKET SIZE, BY REGION, 2018–2022 (KILOTON)

- TABLE 27 CONTINUOUS FILAMENT GLASS MAT MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 CONTINUOUS FILAMENT GLASS MAT MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 29 CONTINUOUS FILAMENT GLASS MAT MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 GLASS MAT MARKET, BY BINDER TYPE, 2018–2022 (KILOTON)

- TABLE 31 GLASS MAT MARKET, BY BINDER TYPE, 2018–2022 (USD MILLION)

- TABLE 32 GLASS MAT MARKET, BY BINDER TYPE, 2023–2028 (KILOTON)

- TABLE 33 GLASS MAT MARKET, BY BINDER TYPE, 2023–2028 (USD MILLION)

- TABLE 34 EMULSION BONDED GLASS MAT MARKET SIZE, BY REGION, 2018–2022 (KILOTON)

- TABLE 35 EMULSION BONDED GLASS MAT MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 EMULSION BONDED GLASS MAT MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 37 EMULSION BONDED GLASS MAT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 POWDER BONDED GLASS MAT MARKET SIZE, BY REGION, 2018–2022 (KILOTON)

- TABLE 39 POWDER BONDED GLASS MAT MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 POWDER BONDED GLASS MAT MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 41 POWDER BONDED GLASS MAT MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 GLASS MAT MARKET, BY MANUFACTURING PROCESS, 2018–2022 (KILOTON)

- TABLE 43 GLASS MAT MARKET, BY MANUFACTURING PROCESS, 2018–2022 (USD MILLION)

- TABLE 44 GLASS MAT MARKET, BY MANUFACTURING PROCESS, 2023–2028 (KILOTON)

- TABLE 45 GLASS MAT MARKET, BY MANUFACTURING PROCESS, 2023–2028 (USD MILLION)

- TABLE 46 GLASS MAT MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 47 GLASS MAT MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 48 GLASS MAT MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 49 GLASS MAT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 50 GLASS MAT MARKET SIZE IN CONSTRUCTION & INFRASTRUCTURE END-USE INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 51 GLASS MAT MARKET SIZE IN CONSTRUCTION & INFRASTRUCTURE END-USE INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 GLASS MAT MARKET SIZE IN CONSTRUCTION & INFRASTRUCTURE END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 53 GLASS MAT MARKET SIZE IN CONSTRUCTION & INFRASTRUCTURE END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 GLASS MAT MARKET SIZE IN INDUSTRIAL APPLICATIONS END-USE INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 55 GLASS MAT MARKET SIZE IN INDUSTRIAL APPLICATIONS END-USE INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 56 GLASS MAT MARKET SIZE IN INDUSTRIAL APPLICATIONS END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 57 GLASS MAT MARKET SIZE IN INDUSTRIAL APPLICATIONS END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 GLASS MAT MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION END-USE INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 59 GLASS MAT MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION END-USE INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 60 GLASS MAT MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 61 GLASS MAT MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 GLASS MAT MARKET SIZE IN MARINE END-USE INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 63 GLASS MAT MARKET SIZE IN MARINE END-USE INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 64 GLASS MAT MARKET SIZE IN MARINE END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 65 GLASS MAT MARKET SIZE IN MARINE END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 GLASS MAT MARKET SIZE IN SPORTS & LEISURE GOODS END-USE INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 67 GLASS MAT MARKET SIZE IN SPORTS & LEISURE GOODS END-USE INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 68 GLASS MAT MARKET SIZE IN SPORTS & LEISURE GOODS END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 69 GLASS MAT MARKET SIZE IN SPORTS & LEISURE GOODS END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 GLASS MAT MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2022 (KILOTON)

- TABLE 71 GLASS MAT MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 72 GLASS MAT MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (KILOTON)

- TABLE 73 GLASS MAT MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 GLASS MAT MARKET SIZE, BY REGION, 2018–2022 (KILOTON)

- TABLE 75 GLASS MAT MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 76 GLASS MAT MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 77 GLASS MAT MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: GLASS MAT MARKET SIZE, BY MAT TYPE, 2018–2022 (KILOTON)

- TABLE 79 NORTH AMERICA: GLASS MAT MARKET SIZE, BY MAT TYPE, 2018–2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: GLASS MAT MARKET SIZE, BY MAT TYPE, 2023–2028 (KILOTON)

- TABLE 81 NORTH AMERICA: GLASS MAT MARKET SIZE, BY MAT TYPE, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2018–2022 (KILOTON)

- TABLE 83 NORTH AMERICA: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2018–2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2023–2028 (KILOTON)

- TABLE 85 NORTH AMERICA: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 87 NORTH AMERICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 89 NORTH AMERICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: GLASS MAT MARKET SIZE, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 91 NORTH AMERICA: GLASS MAT MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: GLASS MAT MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 93 NORTH AMERICA: GLASS MAT MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 94 US: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 95 US: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 96 US: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 97 US: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 98 CANADA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 99 CANADA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 100 CANADA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 101 CANADA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: GLASS MAT MARKET SIZE, BY MAT TYPE, 2018–2022 (KILOTON)

- TABLE 103 EUROPE: GLASS MAT MARKET SIZE, BY MAT TYPE, 2018–2022 (USD MILLION)

- TABLE 104 EUROPE: GLASS MAT MARKET SIZE, BY MAT TYPE, 2023–2028 (KILOTON)

- TABLE 105 EUROPE: GLASS MAT MARKET SIZE, BY MAT TYPE, 2023–2028 (USD MILLION)

- TABLE 106 EUROPE: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2018–2022 (KILOTON)

- TABLE 107 EUROPE: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2018–2022 (USD MILLION)

- TABLE 108 EUROPE: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2023–2028 (KILOTON)

- TABLE 109 EUROPE: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2023–2028 (USD MILLION)

- TABLE 110 EUROPE: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 111 EUROPE: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 112 EUROPE: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 113 EUROPE: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 114 EUROPE: GLASS MAT MARKET SIZE, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 115 EUROPE: GLASS MAT MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 116 EUROPE: GLASS MAT MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 117 EUROPE: GLASS MAT MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 118 GERMANY: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 119 GERMANY: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 120 GERMANY: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 121 GERMANY: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 122 ITALY: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 123 ITALY: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 124 ITALY: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 125 ITALY: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 126 FRANCE: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 127 FRANCE: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 128 FRANCE: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 129 FRANCE: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 130 UK: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 131 UK: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 132 UK: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 133 UK: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 134 SPAIN: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 135 SPAIN: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 136 SPAIN: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 137 SPAIN: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 138 RUSSIA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 139 RUSSIA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 140 RUSSIA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 141 RUSSIA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 142 REST OF EUROPE: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 143 REST OF EUROPE: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 144 REST OF EUROPE: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 145 REST OF EUROPE: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: GLASS MAT MARKET SIZE, BY MAT TYPE, 2018–2022 (KILOTON)

- TABLE 147 ASIA PACIFIC: GLASS MAT MARKET SIZE, BY MAT TYPE, 2018–2022 (USD MILLION)

- TABLE 148 ASIA PACIFIC: GLASS MAT MARKET SIZE, BY MAT TYPE, 2023–2028 (KILOTON)

- TABLE 149 ASIA PACIFIC: GLASS MAT MARKET SIZE, BY MAT TYPE, 2023–2028 (USD MILLION)

- TABLE 150 ASIA PACIFIC: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2018–2022 (KILOTON)

- TABLE 151 ASIA PACIFIC: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2018–2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2023–2028 (KILOTON)

- TABLE 153 ASIA PACIFIC: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2023–2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 155 ASIA PACIFIC: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 156 ASIA PACIFIC: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 157 ASIA PACIFIC: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 158 ASIA PACIFIC: GLASS MAT MARKET SIZE, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 159 ASIA PACIFIC: GLASS MAT MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 160 ASIA PACIFIC: GLASS MAT MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 161 ASIA PACIFIC: GLASS MAT MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 162 CHINA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 163 CHINA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 164 CHINA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 165 CHINA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 166 JAPAN: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 167 JAPAN: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 168 JAPAN: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 169 JAPAN: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 170 INDIA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 171 INDIA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 172 INDIA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 173 INDIA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 174 SOUTH KOREA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 175 SOUTH KOREA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 176 SOUTH KOREA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 177 SOUTH KOREA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 178 INDONESIA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 179 INDONESIA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 180 INDONESIA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 181 INDONESIA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 183 REST OF ASIA PACIFIC: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 185 REST OF ASIA PACIFIC: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY MAT TYPE, 2018–2022 (KILOTON)

- TABLE 187 MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY MAT TYPE, 2018–2022 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY MAT TYPE, 2023–2028 (KILOTON)

- TABLE 189 MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY MAT TYPE, 2023–2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2018–2022 (KILOTON)

- TABLE 191 MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2018–2022 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2023–2028 (KILOTON)

- TABLE 193 MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2023–2028 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 195 MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 197 MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 199 MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 201 MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 202 SAUDI ARABIA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 203 SAUDI ARABIA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 204 SAUDI ARABIA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 205 SAUDI ARABIA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 206 QATAR: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 207 QATAR: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 208 QATAR: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 209 QATAR: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 210 UAE: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 211 UAE: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 212 UAE: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 213 UAE: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 214 SOUTH AFRICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 215 SOUTH AFRICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 216 SOUTH AFRICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 217 SOUTH AFRICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 218 REST OF MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 219 REST OF MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 220 REST OF MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 221 REST OF MIDDLE EAST & AFRICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: GLASS MAT MARKET SIZE, BY MAT TYPE, 2018–2022 (KILOTON)

- TABLE 223 LATIN AMERICA: GLASS MAT MARKET SIZE, BY MAT TYPE, 2018–2022 (USD MILLION)

- TABLE 224 LATIN AMERICA: GLASS MAT MARKET SIZE, BY MAT TYPE, 2023–2028 (KILOTON)

- TABLE 225 LATIN AMERICA: GLASS MAT MARKET SIZE, BY MAT TYPE, 2023–2028 (USD MILLION)

- TABLE 226 LATIN AMERICA: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2018–2022 (KILOTON)

- TABLE 227 LATIN AMERICA: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2018–2022 (USD MILLION)

- TABLE 228 LATIN AMERICA: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2023–2028 (KILOTON)

- TABLE 229 LATIN AMERICA: GLASS MAT MARKET SIZE, BY BINDER TYPE, 2023–2028 (USD MILLION)

- TABLE 230 LATIN AMERICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 231 LATIN AMERICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 232 LATIN AMERICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 233 LATIN AMERICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 234 LATIN AMERICA: GLASS MAT MARKET SIZE, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 235 LATIN AMERICA: GLASS MAT MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 236 LATIN AMERICA: GLASS MAT MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 237 LATIN AMERICA: GLASS MAT MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 238 BRAZIL: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 239 BRAZIL: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 240 BRAZIL: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 241 BRAZIL: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 242 MEXICO: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 243 MEXICO: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 244 MEXICO: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 245 MEXICO: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028(USD MILLION)

- TABLE 246 REST OF LATIN AMERICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 247 REST OF LATIN AMERICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 248 REST OF LATIN AMERICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 249 REST OF LATIN AMERICA: GLASS MAT MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 250 DEGREE OF COMPETITION: GLASS MAT MARKET

- TABLE 251 COMPANY FOOTPRINT: PRODUCT

- TABLE 252 COMPANY FOOTPRINT: END-USE INDUSTRY

- TABLE 253 COMPANY FOOTPRINT: REGION

- TABLE 254 GLASS MAT MARKET: NEW PRODUCT LAUNCHES/DEVELOPMENTS, 2018-2023

- TABLE 255 GLASS MAT MARKET: DEALS, 2018-2023

- TABLE 256 GLASS MAT MARKET: OTHER DEVELOPMENTS, 2018-2023

- TABLE 257 GLASS MAT MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 258 GLASS MAT MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 259 OWENS CORNING: COMPANY OVERVIEW

- TABLE 260 CHINA JUSHI CO., LTD.: COMPANY OVERVIEW

- TABLE 261 CHONGQING POLYCOMP INTERNATIONAL CORP. (CPIC): COMPANY OVERVIEW

- TABLE 262 3B-THE FIBREGLASS COMPANY: COMPANY OVERVIEW

- TABLE 263 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 264 TAIWAN GLASS IND. CORP.: COMPANY OVERVIEW

- TABLE 265 NIPPON ELECTRIC GLASS CO., LTD.: COMPANY OVERVIEW

- TABLE 266 CHINA BEIHAI FIBERGLASS CO., LTD.: COMPANY OVERVIEW

- TABLE 267 SUPERIOR HUNTINGDON COMPOSITES, LLC.: COMPANY OVERVIEW

- TABLE 268 JIANGSU CHANGHAI COMPOSITE MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 269 JOHNS MANVILLE: COMPANY OVERVIEW

- TABLE 270 CENTRAL GLASS CO., LTD.: COMPANY OVERVIEW

- TABLE 271 HANGZHOU MINGDA GLASS FIBER CO., LTD.: COMPANY OVERVIEW

- TABLE 272 NITTO BOSEKI CO., LTD.: COMPANY OVERVIEW

- TABLE 273 KROSGLASS S.A.: COMPANY OVERVIEW

- TABLE 274 SISECAM A.S.: COMPANY OVERVIEW

- TABLE 275 EASTERN INDUSTRIAL COMPANY: COMPANY OVERVIEW

- TABLE 276 JIANGSU JIUDING NEW MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 277 P-D GLASSEIDEN GMBH: COMPANY OVERVIEW

- TABLE 278 TEXAS FIBERGLASS GROUP: COMPANY OVERVIEW

- TABLE 279 TAISHAN FIBERGLASS INC. (CTG): COMPANY OVERVIEW

- TABLE 280 SODA SANAYII AS.: COMPANY OVERVIEW

- TABLE 281 KCC CORPORATION: COMPANY OVERVIEW

- TABLE 282 CHONGQING DUJIANG COMPOSITES CO., LTD. (CQFIBERGLASS): COMPANY OVERVIEW

- FIGURE 1 GLASS MAT MARKET SEGMENTATION

- FIGURE 2 GLASS MAT MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 GLASS MAT MARKET: DATA TRIANGULATION

- FIGURE 6 CHOPPED STRAND GLASS MAT SEGMENT DOMINATED GLOBAL GLASS MAT MARKET IN 2022

- FIGURE 7 EMULSION BONDED GLASS MAT SEGMENT ACCOUNTED FOR LARGER MARKET SHARE BASED ON BINDER TYPE IN 2022

- FIGURE 8 WET-LAID MANUFACTURING PROCESS TO BE LARGEST SEGMENT IN 2023

- FIGURE 9 CONSTRUCTION & INFRASTRUCTURE INDUSTRY ACCOUNTED FOR LARGEST SHARE OF GLASS MAT MARKET IN 2022

- FIGURE 10 ASIA PACIFIC LED GLASS MAT MARKET IN 2022

- FIGURE 11 SIGNIFICANT GROWTH EXPECTED IN GLASS MAT MARKET BETWEEN 2023 AND 2028

- FIGURE 12 CHOPPED STRAND MAT AND ASIA PACIFIC DOMINATED MARKET IN 2022

- FIGURE 13 EMULSION BONDED GLASS MAT SEGMENT CONTRIBUTED LARGER SHARE TO MARKET IN 2022

- FIGURE 14 WET-LAID MANUFACTURING PROCESS SEGMENT CONTRIBUTED LARGEST SHARE TO MARKET IN 2022

- FIGURE 15 CONSTRUCTION & INFRASTRUCTURE LARGEST SEGMENT OF MARKET IN 2022

- FIGURE 16 SAUDI ARABIA TO BE FASTEST-GROWING GLASS MAT MARKET DURING FORECAST PERIOD

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN GLASS MAT MARKET

- FIGURE 18 GLASS MAT MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 19 AVERAGE SELLING PRICES IN TOP 3 END-USE INDUSTRIES, BY KEY PLAYERS (USD/KG)

- FIGURE 20 AVERAGE SELLING PRICES OF DIFFERENT MAT TYPES (USD/KG)

- FIGURE 21 AVERAGE SELLING PRICES OF DIFFERENT BINDER TYPES (USD/KG)

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- FIGURE 23 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- FIGURE 24 VALUE CHAIN ANALYSIS: GLASS MAT MARKET

- FIGURE 25 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 26 GLOBAL PATENT PUBLICATION TREND, 2012-2022

- FIGURE 27 GLASS MAT MARKET: LEGAL STATUS OF PATENTS

- FIGURE 28 GLOBAL JURISDICTION ANALYSIS

- FIGURE 29 GLOBAL ANALYSIS OF TOP PATENT APPLICANTS

- FIGURE 30 CHOPPED STRAND MAT TO DOMINATE GLASS MAT MARKET

- FIGURE 31 CHOPPED STRAND GLASS MAT MARKET TO REGISTER HIGHEST GROWTH IN ASIA PACIFIC

- FIGURE 32 ASIA PACIFIC TO DOMINATE CONTINUOUS FILAMENT GLASS MAT MARKET

- FIGURE 33 EMULSION BONDED GLASS MAT TO DOMINATE GLASS MAT MARKET DURING FORECAST PERIOD

- FIGURE 34 ASIA PACIFIC TO REGISTER FASTEST GROWTH IN EMULSION BONDED GLASS MAT MARKET

- FIGURE 35 ASIA PACIFIC TO DOMINATE POWDER BONDED GLASS MAT MARKET

- FIGURE 36 WET-LAID MANUFACTURING PROCESS SEGMENT TO DOMINATE GLASS MAT MARKET DURING FORECAST PERIOD

- FIGURE 37 CONSTRUCTION & INFRASTRUCTURE END-USE INDUSTRY TO DOMINATE GLASS MAT MARKET

- FIGURE 38 ASIA PACIFIC TO REGISTER FASTEST GROWTH IN GLASS MAT MARKET IN CONSTRUCTION & INFRASTRUCTURE END-USE INDUSTRY

- FIGURE 39 ASIA PACIFIC EXPECTED TO DOMINATE GLASS MAT MARKET IN INDUSTRIAL APPLICATIONS END-USE INDUSTRY

- FIGURE 40 SAUDI ARABIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: GLASS MAT MARKET SNAPSHOT

- FIGURE 42 EUROPE: GLASS MAT MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: GLASS MAT MARKET SNAPSHOT

- FIGURE 44 SHARES OF TOP COMPANIES IN GLASS MAT MARKET

- FIGURE 45 RANKING OF TOP 5 PLAYERS IN GLASS MAT MARKET

- FIGURE 46 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 47 GLASS MAT MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 48 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN GLASS MAT MARKET

- FIGURE 49 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN GLASS MAT MARKET

- FIGURE 50 GLASS MAT MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2022

- FIGURE 51 OWENS CORNING: COMPANY SNAPSHOT

- FIGURE 52 CHINA JUSHI CO., LTD.: COMPANY SNAPSHOT

- FIGURE 53 SAINT-GOBAIN: COMPANY SNAPSHOT

- FIGURE 54 TAIWAN GLASS IND. CORP.: COMPANY SNAPSHOT

- FIGURE 55 NIPPON ELECTRIC GLASS CO., LTD.: COMPANY SNAPSHOT

The study involved two major activities in estimating the current size of the glass mat market. Exhaustive secondary research was performed to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The glass mat market comprises several stakeholders, such as material suppliers, manufacturers, end-product users, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mainly the construction & infrastructure, industrial applications, automotive & transportation, marine, sports & leisure goods and other end-use industries. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

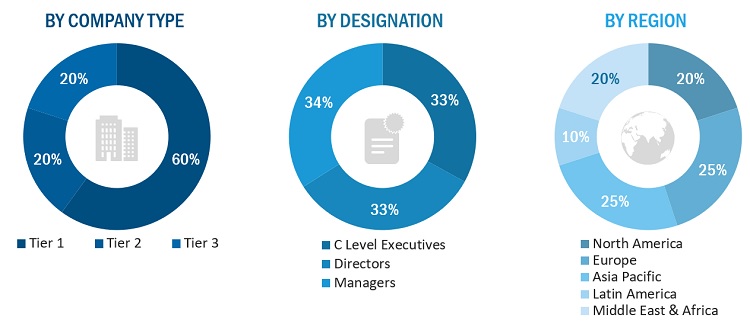

Following is the breakdown of primary respondents:

Notes: Tiers of companies are selected based on their ownership and revenues in 2022.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the glass mat industry. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall glass mat market size, using the market size estimation processes explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the construction & infrastructure, automotive & transportation, and industrial applications industries.

Market Definition

Glass mat is made of non-woven material, which can be randomly sized, chopped, or continuous glass fibers that are distributed uniformly and are bonded together with a binder material. These glass fibers can be E-glass or S-glass fiber, depending upon their applications. The glass mat is inexpensive, easy to use, and can quickly build the thickness required for composite parts. Glass mats find applications in various industries including marine, wind energy, electric & electronics, construction & infrastructure, automotive & transportation, sports & leisure goods, and industrial applications.

Key Stakeholders

- Glass fiber manufacturers

- Binder manufacturers

- Raw material suppliers

- Distributors and suppliers

- Industry associations

- Universities, governments & research organizations

- Associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environmental support agencies

- Investment banks and private equity firms

Objectives of the Report

- To define, describe, and forecast the size of the glass mat industry, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To provide detailed information about the technological advancements influencing the growth of the market

- To forecast the market based on the mat type, binder type, manufacturing process, and end-use industry

- To define, describe, and forecast the market based on five regions, namely, North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze recent developments such as expansions and joint ventures in the market

- To strategically profile the key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Europe glass mat market

- Further breakdown of Rest of North America glass mat market

- Further breakdown of Rest of Asia Pacific glass mat market

- Further breakdown of Rest of Middle East & Africa glass mat market

- Further breakdown of Rest of Latin America glass mat markets

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Glass Mat Market