Global Chocolate, Cocoa Beans, Lecithin, Sugar and Vanilla Market By Market Share, Trade, Prices, Geography Trend and Forecast (2011-2016)

The global chocolate industry has been in a moderate growth trajectory since the last five years. This growth is largely fueled by the increased global demand for premium chocolate. The major developing countries such as China and India are expected to offer great opportunities to the global chocolate industry; thanks to the use of chocolate as a functional food. Organic and fair trade chocolate is a rapidly growing segment of the industry. With consumers developing more awareness regarding environment-friendly products, this segment is expected to rise rapidly in the next five years. One of the major concerns for the chocolate industry is the rising number of counterfeit products. This is a great threat for the overall confectionery market and chocolate is no exception.

The global chocolate market is highly consumer driven and companies need to focus on their development and marketing strategies towards capturing a larger consumer base, and acquiring new markets. The major strategies used are consolidation of processes, and enhancement of brand image through corporate social responsibility.

Cocoa is the main raw material for chocolate production and has no other substitute. Moreover, it can only be grown within 10 degrees (latitudes) of the equator. Due to this constraint, global production of cocoa is highly concentrated in West African countries such as Ghana, Cote d'Ivoire, Cameroon, and Nigeria. The cocoa fruit is harvested twice a year in the form of a main crop and an intermediary crop (also termed as mid-crop). The main crop is larger than the mid-crop though the relative size varies according to the country where it is produced. Emulsifiers are basically used in food and pharmaceutical applications. The global emulsifier market was valued at around $1 billion in 2010. Lecithin has the highest share of around 30% of the global emulsifiers market.

Vanilla is the most preferred flavor in the chocolate industry. A number of other important flavors such as mint, coffee, strawberry, and orange are being increasingly used these days as the consumer is more open to experimenting; however, the traditional chocolate flavor is still the most sought-after. Almost 90% of the total vanilla used as a flavor is synthetic. The major demand for sugar is fueled by the manufacturing and food preparation sectors, including the beverages market. Developing economies such as India, China, and Indonesia are expected to account for more than 3.2 million tons (72%) of the overall sugar consumption by 2015. These are the same countries expected to witness high CAGR in the global chocolate market. The growth in the overall sugar market is attributed to India, a result of the expansion in the sugarcane area, and generally favorable weather.

In this report, under the raw materials section, an in-depth analysis of cocoa, sugar, emulsifiers, and flavors has been done with respect to their contribution to the chocolate industry. Competitive information includes market shares of leading producers, key developments, and strategies deployed to win. Major companies analyzed in the company profiles section include Nestlé (Switzerland), Barry Callebaut (Switzerland), Kraft Foods (U.S.), Mars (U.S.), Ferrero (Italy), and Hershey (U.S.). The purpose of the report is to highlight points that are actionable for its stakeholders. The report features more than 130 tables and figures, including market numbers, and also forecasts the chocolate market scenario till 2016.

The report analyzes global chocolate market by product, sales category, geography and raw materials; forecasting revenues and analyzing trends in each of the following submarkets:

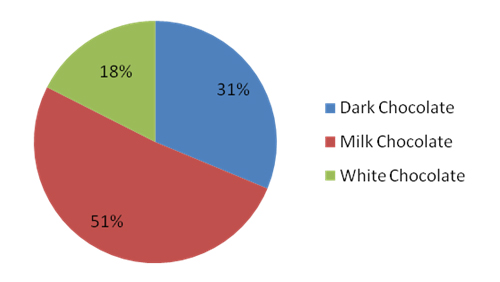

By product types:

- Dark chocolate

- Milk chocolate

- White chocolate

By sales category:

- Everyday chocolate

- Premium chocolate

- Seasonal chocolate

By geography:

- North America

- Europe

- Asia

- ROW (Rest of the World)

Each section will provide market drivers, trends and opportunities, top-selling products, key players, and competitive outlook. This report will also provide market tables for covering the sub-segments and micro-markets.

Please click here to get the relevant report of

Cocoa & Chocolate Market by Application (Confectionery, Food & Beverage, Cosmetics, & Pharmaceuticals), Cocoa Type (Cocoa Butter, Powder, & Liquor) & Chocolate Type (Dark, White, Milk, Filled) - Global Trends & Forecasts to 2019

Global Chocolate, Cocoa Beans, Lecithin, Sugar and Vanilla Market (2011-2016)

Cocoa is believed to have originated in Amazon in around 2000 B.C. Mayans consumed chocolate as drinks as early as the sixth century. Today chocolate is estimated to account for 55% of global confectionary sales; followed by candy with 31% and gum with 14% of sales in 2009.

Some of the major drivers of the industry identified in this report are health benefits, large variety of applications, and seasonal & festive sales. The major restraints identified in this report are raw material prices and the dependence of the industry over unstable economies for cocoa supply. Major threats the industry is facing are the rising counterfeit market and changing consumer preferences. There are some opportunities capable of changing the dynamics of this industry; such are lower penetration in developing economies, organic and fair trade chocolate, and use of chocolate as functional food.

The global chocolate market is estimated to reach $98.3 billion in 2016 from $83.2 billion in 2010, at a CAGR of 2.7% from 2011 to 2016. The market in Asia is driving the sales and is expected to hold 20% of the global market share in 2016. The Asian market is expected to have high growth of CAGR 4.7% due to lower penetration and sales of Asian region are expected to boost their share from $15 billion in 2010 to $19.7 billion in 2016. The U.S. leads the chocolate market in North America with around 86.3% market share while Japan leads the Asian market with 39.7% of market share. Within Europe, UK draws the largest demand with 16.4%; followed by Germany with 15.9 % market share.

Source: MarketsandMarkets

The dark chocolate segment is expected to have the highest CAGR of 5.2% in the next five years due to the health benefits resulting from its high cocoa content. A majority of consumers are opting for dark chocolate over white and milk chocolate. Milk chocolate constitutes the largest segment with a value of $42.6 billion and is expected to grow to $46.9 billion in 2016, at an estimated CAGR of 1.6% globally. While milk chocolate has the benefits of cocoa, it is not bitter in taste and provides a healthy alternative to the high cholesterol sweets.

1 INTRODUCTION

1.1 KEY TAKEAWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 RESEARCH METHODOLOGY

1.5.1 MARKET SIZE

1.5.2 SECONDARY SOURCES OF KEY DATA POINTS

1.5.3 ASSUMPTIONS

2 EXECUTIVE SUMMARY

3 MARKET OVERVIEW

3.1 BUSINESS LANDSCAPE OF CHOCOLATE

3.2 CONFECTIONERY MARKET OVERVIEW

3.2.1 CHOCOLATE INDUSTRY ANALYSIS

3.2.2 SWOT ANALYSIS

3.2.2.1 Strengths

3.2.2.1.1 Well established brands

3.2.2.1.2 Broad products and brand portfolio

3.2.2.2 Weaknesses

3.2.2.2.1 Over dependency on West African Countries for cocoa supply

3.2.2.2.2 Lower growth rates in major markets

3.2.2.3 Opportunities

3.2.2.3.1 Lower penetration in developing countries

3.2.2.3.2 Use of chocolate as a functional food

3.2.2.3.3 Organic and fair trade

3.2.2.4 Threats

3.2.2.4.1 Rising counterfeit products

3.2.2.4.2 Changing consumer preferences

3.3 INDUSTRY INSIGHTS

3.3.1 PORTER’S FIVE FORCE ANALYSIS

3.3.1.1 Intensity of rivalry

3.3.1.2 Bargaining power of suppliers

3.3.1.3 Bargaining power of buyers

3.3.1.4 Threat of substitutes

3.3.1.5 Threat of new entrants

3.3.2 WINNING IMPERATIVES

3.3.2.1 Outsourcing non-core functions

3.3.2.2 Inorganic growth through agreements and mergers and acquisitions

3.4 MARKET DYNAMICS

3.4.1 DRIVERS

3.4.1.1 Health benefits of chocolate

3.4.1.2 Large variety of applications

3.4.1.3 Seasonal and festive related sales

3.4.2 RESTRAINTS

3.4.2.1 Highly unstable economies in cocoa producing countries

3.4.2.2 High raw material prices

3.5 PATENT ANALYSIS

3.6 KEY INDUSTRY EVENTS

3.6.1 KRAFT’S ACQUISITION OF CADBURY’S

3.7 ORGANIC CHOCOLATE – NEW AND FAST EMERGING TREND

3.8 CHOCOLATE INDUSTRY EVOLUTION

4 GLOBAL CHOCOLATE MARKET BY PRODUCT (2011-2016)

4.1 DARK CHOCOLATE

4.2 MILK CHOCOLATE

4.3 WHITE CHOCOLATE

5 GLOBAL CHOCOLATE MARKET BY SALES CATEGORY (2011-2016)

5.1 EVERYDAY CHOCOLATE

5.2 PREMIUM CHOCOLATE

5.3 GOURMET CHOCOLATE

5.4 SEASONAL CHOCOLATE

6 GLOBAL CHOCOLATE MARKET BY GEOGRAPHY (2011-2016)

6.1 NORTH AMERICA

6.1.1 MARKET SIZE AND FORECAST (2011-2016)

6.1.2 OPPORTUNITY ANALYSIS

6.1.3 KEY MARKET PARTICIPANTS

6.1.4 MARKET EVOLUTION

6.1.5 NORTH AMERICAN MARKET BY COUNTRY

6.1.5.1 U.S. Chocolate Market

6.2 EUROPE

6.2.1 MARKET SIZE AND FORECAST (2011-2016)

6.2.2 OPPORTUNITY ANALYSIS

6.2.3 KEY MARKET PARTICIPANTS

6.2.4 MARKET EVOLUTION

6.2.5 EUROPEAN CHOCOLATE MARKET BY COUNTRY

6.2.5.1 French Chocolate Market

6.2.5.2 German Chocolate Market

6.2.5.3 UK Chocolate Market

6.3 ASIA

6.3.1 MARKET SIZE AND FORECAST (2011-2016)

6.3.2 OPPORTUNITY ANALYSIS

6.3.3 KEY MARKET PARTICIPANTS

6.3.4 MARKET EVOLUTION

6.3.5 ASIAN CHOCOLATE MARKET BY COUNTRY

6.3.5.1 Japanese Chocolate Market

6.3.5.2 South Korean chocolate market

6.3.5.3 Chinese Chocolate Market

6.3.5.4 Indian Chocolate Market

7 RAW MATERIAL ANALYSIS

7.1 COCOA

7.1.1 DRIVERS

7.1.1.1 Growing demand for chocolate

7.1.2 PRICING TREND ANALYSIS

7.1.3 GLOBAL COCOA BEANS SUPPLY ANALYSIS (2010-2016)

7.1.4 COCOA PRODUCTS IMPORT AND EXPORT

7.2 SUGAR

7.2.1 MARKET SIZE AND FORECAST (2010-2015)

7.2.2 MARKET TRENDS

7.2.3 KEY INDUSTRY PARTICIPANTS

7.3 EMULSIFIERS

7.3.1 MARKET SIZE AND FORECAST (2010-2015)

7.3.2 MARKET TRENDS

7.3.3 KEY INDUSTRY PARTICIPANTS

7.4 FLAVORS

7.4.1 MARKET SIZE AND FORECAST (2011-2016)

7.4.2 KEY INDUSTRY PARTICIPANTS

8 COMPETITIVE LANDSCAPE

8.1 MARKET SHARE ANALYSIS

8.2 COMPETITIVE SCENARIO

9 COMPANY PROFILES

9.1 BARRY CALLEBAUT

9.1.1 OVERVIEW

9.1.2 PRODUCTS

9.1.3 FINANCIAL OVERVIEW

9.1.4 STRATEGY

9.1.5 RECENT DEVELOPMENTS

9.2 FERRERO

9.2.1 OVERVIEW

9.2.2 PRODUCTS

9.2.3 FINANCIAL OVERVIEW

9.2.4 STRATEGY

9.2.5 RECENT DEVELOPMENTS

9.3 HERSHEY COMPANY

9.3.1 OVERVIEW

9.3.2 PRODUCTS

9.3.3 FINANCIAL OVERVIEW

9.3.4 STRATEGY

9.3.5 RECENT DEVELOPMENTS

9.4 KRAFT FOODS

9.4.1 OVERVIEW

9.4.2 PRODUCTS

9.4.3 FINANCIAL OVERVIEW

9.4.4 STRATEGY

9.4.5 RECENT DEVELOPMENTS

9.5 LINDT & SPRÜNGLI

9.5.1 OVERVIEW

9.5.2 PRODUCTS

9.5.3 FINANCIAL OVERVIEW

9.5.4 STRATEGY

9.5.5 RECENT DEVELOPMENTS

9.6 LOTTE

9.6.1 OVERVIEW

9.6.2 PRODUCTS

9.6.3 FINANCIAL OVERVIEW

9.6.4 STRATEGY

9.6.5 RECENT DEVELOPMENTS

9.7 NESTLE

9.7.1 OVERVIEW

9.7.2 PRODUCTS

9.7.3 FINANCIAL OVERVIEW

9.7.4 STRATEGY

9.7.5 RECENT DEVELOPMENTS

9.8 CHOCOLATES GAROTO S/A

9.8.1 OVERVIEW

9.8.2 PRODUCTS

9.8.3 FINANCIAL OVERVIEW

9.8.4 STRATEGY

9.8.5 RECENT DEVELOPMENTS

9.9 LOTUS CHOCOLATE LTD

9.9.1 OVERVIEW

9.9.2 PRODUCTS

9.9.3 FINANCIAL OVERVIEW

9.9.4 STRATEGY

9.9.5 RECENT DEVELOPMENTS

9.1 MICHEL CLUIZEL

9.10.1 OVERVIEW

9.10.2 PRODUCTS

9.10.3 FINANCIAL OVERVIEW

9.10.4 STRATEGY

9.10.5 RECENT DEVELOPMENTS

9.11 CEMOI

9.11.1 OVERVIEW

9.11.2 PRODUCTS

9.11.3 FINANCIAL OVERVIEW

9.11.4 STRATEGY

9.11.5 RECENT DEVELOPMENTS

9.12 BELCOLADE

9.12.1 OVERVIEW

9.12.2 PRODUCTS

9.12.3 FINANCIAL OVERVIEW

9.12.4 STRATEGY

9.12.5 RECENT DEVELOPMENTS

9.13 SCHARFFEN BERGER

9.13.1 OVERVIEW

9.13.2 PRODUCTS

9.13.3 FINANCIAL OVERVIEW

9.13.4 STRATEGY

9.13.5 RECENT DEVELOPMENTS

9.14 MOONSTRUCK CHOCOLATIER CO.

9.14.1 OVERVIEW

9.14.2 PRODUCTS

9.14.3 FINANCIAL OVERVIEW

9.14.4 STRATEGY

9.14.5 RECENT DEVELOPMENTS

9.15 GHIRARDELLI CHOCOLATE CO.

9.15.1 OVERVIEW

9.15.2 PRODUCTS

9.15.3 FINANCIAL OVERVIEW

9.15.4 STRATEGY

9.15.5 RECENT DEVELOPMENTS

9.16 DIVINE CHOCOLATE LTD.

9.16.1 OVERVIEW

9.16.2 PRODUCTS

9.16.3 FINANCIAL OVERVIEW

9.16.4 STRATEGY

9.16.5 RECENT DEVELOPMENTS

9.17 MARS INC.

9.17.1 OVERVIEW

9.17.2 PRODUCTS

9.17.3 FINANCIAL OVERVIEW

9.17.4 STRATEGY

9.17.5 RECENT DEVELOPMENTS

9.18 ARCHER DANIELS MIDLAND COMPANY

9.18.1 OVERVIEW

9.18.2 PRODUCTS

9.18.3 FINANCIAL OVERVIEW

9.18.4 STRATEGY

9.18.5 RECENT DEVELOPMENTS

9.19 SEATTLE CHOCOLATE COMPANY

9.19.1 OVERVIEW

9.19.2 PRODUCTS

9.19.3 FINANCIAL OVERVIEW

9.19.4 STRATEGY

9.19.5 RECENT DEVELOPMENTS

9.2 GODIVA CHOCOLATIER

9.20.1 OVERVIEW

9.20.2 PRODUCTS

9.20.3 FINANCIAL OVERVIEW

9.20.4 STRATEGY

9.20.5 RECENT DEVELOPMENTS

9.21 RUSSELL STOVER CANDIES INC.

9.21.1 OVERVIEW

9.21.2 PRODUCTS

9.21.3 FINANCIAL OVERVIEW

9.21.4 STRATEGY

9.21.5 RECENT DEVELOPMENTS

9.22 ENDANGERED SPECIES CHOCOLATE COMPANY

9.22.1 OVERVIEW

9.22.2 PRODUCTS

9.22.3 FINANCIAL OVERVIEW

9.22.4 STRATEGY

9.22.5 RECENT DEVELOPMENTS

9.23 LAKE CHAMPLAIN CHOCOLATES

9.23.1 OVERVIEW

9.23.2 PRODUCT

9.23.3 FINANCIAL OVERVIEW

9.23.4 STRATEGY

9.23.5 RECENT DEVELOPMENTS

9.24 MEIJI SEIKA KAISHA LTD.

9.24.1 OVERVIEW

9.24.2 PRODUCTS

9.24.3 FINANCIAL OVERVIEW

9.24.4 STRATEGY

9.24.5 RECENT DEVELOPMENTS

9.25 CHUAO CHOCOLATIER

9.25.1 OVERVIEW

9.25.2 PRODUCTS

9.25.3 STRATEGY

9.25.4 RECENT DEVELOPMENTS

9.26 FRAN’S CHOCOLATES

9.26.1 OVERVIEW

9.26.2 PRODUCTS

9.26.3 STRATEGY

9.26.4 RECENT DEVELOPMENTS

9.27 EZAKI GLICO CO LTD

9.27.1 OVERVIEW

9.27.2 PRODUCTS

9.27.3 FINANCIAL OVERVIEW

9.27.4 STRATEGY

9.27.5 RECENT DEVELOPMENTS

9.28 FUJI OIL CO., LTD

9.28.1 OVERVIEW

9.28.2 PRODUCTS

9.28.3 FINANCIAL OVERVIEW

9.28.4 STRATEGY

9.28.5 RECENT DEVELOPMENTS

LIST OF TABLES

GLOBAL CHOCOLATE MARKET, BY PRODUCTS 2009-2016 ($ BILLION)

TABLE 1 TOP 10 GLOBAL CONFECTIONERY COMPANIES, BY REVENUE (2009)

TABLE 2 CONFECTIONERY COMPANIES IN ICA MEMBER ASSOCIATION AROUND THE WORLD

TABLE 3 NUTRIENT CONTENT OF DIFFERENT CHOCOLATE FORMS PER SERVINGS

TABLE 4 GROWTH RATE OF CHOCOLATE APPLICATION MARKETS

TABLE 5 IMPACT ANALYSIS: MAJOR DRIVERS

TABLE 6 IMPACT ANALYSIS: MAJOR RESTRAINTS

TABLE 7 MARKET SHARE (%) COMPARISON IN MAJOR COUNTRIES, BY COMPANIES BEFORE AND AFTER CADBURY’S ACQUISITION

TABLE 8 DARK CHOCOLATE MARKET REVENUE, BY REVENUE 2009-2016 ($ BILLION)

TABLE 9 DARK CHOCOLATE MARKET BY VOLUME 2009-2016 (THOUSAND TONNES)

TABLE 10 MILK CHOCOLATE MARKET, BY REVENUE 2009-2016 ($ BILLION)

TABLE 11 MILK CHOCOLATE MARKET BY VOLUME 2009-2016 (THOUSAND TONNES)

TABLE 12 WHITE CHOCOLATE MARKET, BY REVENUE 2009-2016 ($ BILLION)

TABLE 13 WHITE CHOCOLATE MARKET, BY VOLUME 2009-2016 (THOUSAND TONNES)

TABLE 14 GLOBAL CHOCOLATE MARKET, BY SALES CATEGORY 2009-2016 ($ BILLION)

TABLE 15 GLOBAL CHOCOLATE MARKET, BY SALES CATEGORY 2009-2016 (THOUSAND TONNES)

TABLE 16 EVERYDAY CHOCOLATE MARKET, BY REVENUE 2009-2016 ($ BILLION)

TABLE 17 EVERYDAY CHOCOLATE MARKET, BY VOLUME 2009-2016 (THOUSAND TONNES)

TABLE 18 PREMIUM CHOCOLATE MARKET, BY REVENUE 2009-2016 ($ BILLION)

TABLE 19 PREMIUM CHOCOLATE MARKET, BY VOLUME 2009-2016 (THOUSAND TONNES)

TABLE 20 SEASONAL CHOCOLATE MARKET, BY REVENUE 2009-2016 ($ BILLION)

TABLE 21 SEASONAL CHOCOLATE MARKET, BY VOLUME 2009-2016 (THOUSAND TONNES)

TABLE 22 NORTH AMERICAN CHOCOLATE MARKET, BY CATEGORY 2009-2016 ($ BILLION)

TABLE 23 NORTH AMERICAN CHOCOLATE MARKET, BY CATEGORY 2009-2016 (THOUSAND TONNES)

TABLE 24 NORTH AMERICAN CHOCOLATE MARKET, BY PRODUCT 2009-2016 ($ BILLION)

TABLE 25 NORTH AMERICAN CHOCOLATE MARKET, BY PRODUCTS 2009-2016 (THOUSAND TONNES)

TABLE 26 NORTH AMERICAN CHOCOLATE MARKET, BY COUNTRY 2009-2016 ($ BILLION)

TABLE 27 NORTH AMERICAN CHOCOLATE MARKET, BY COUNTRY 2009-2016 (THOUSAND TONNES)

TABLE 28 U.S. CHOCOLATE MARKET, BY SEGMENT 2009-2016 ($ BILLION)

TABLE 29 U.S. CHOCOLATE MARKET, BY CATEGORY 2009-2016 (THOUSAND TONNES)

TABLE 30 EUROPEAN CHOCOLATE MARKET, BY CATEGORY 2009-2016 ($ BILLION)

TABLE 31 EUROPEAN CHOCLATE MARKET BY CATEGORY 2009-2016 (THOUSAND TONNES)

TABLE 32 EUROPEAN CHOCOLATE MARKET, BY PRODUCT 2009-2016 ($ BILLION)

TABLE 33 EUROPEAN CHOCOLATE MARKET, BY PRODUCT 2009-2016 (THOUSAND TONNES)

TABLE 34 EUROPEAN CHCOLATE MARKET BY COUNTRY 2009-2016 ($ BILLION)

TABLE 35 EUROPE CHOCOLATE MARKET, BY COUNTRY 2009-2016 (THOUSAND TONNES)

TABLE 36 FRENCH CHCOLATE MARKET, BY CATEGORY 2009-2016 ($ BILLION)

TABLE 37 GERMAN CHOCOLATE MARKET, BY CATEGORY 2009-2016 ($ BILLION)

TABLE 38 GERMAN CHOCOLATE MARKET, BY CATEGORY 2009-2016 (THOUSAND TONNES)

TABLE 39 UK CHOCOLATE MARKET, BY CATEGORY 2009-2016 ($ BILLION)

TABLE 40 UK CHOCLATE MARKET, BY CATEGORY 2009-2016 (THOUSAND TONNES)

TABLE 41 ASIAN CHOCOLATE MARKET, BY SALES CATEGORY 2009-2016 ($ BILLION)

TABLE 42 ASIAN CHOCOLATE MARKET, BY SALES CATEGORY 2009-2016 (THOUSAND TONNES)

TABLE 43 ASIAN CHOCOLATE MARKET, BY PRODUCT 2009-2016 ($ BILLION)

TABLE 44 ASIAN CHOCOLATE MARKET, BY PRODUCT 2009-2016 (THOUSAND TONNES)

TABLE 45 ASIAN CHOCOLATE MARKET, BY COUNTRY 2009-2016 ($ BILLION)

TABLE 46 ASIAN CHOCOLATE MARKET, BY COUNTRY 2009-2016 (THOUSAND TONNES)

TABLE 47 JAPANESE CHOCOLATE MARKET, BY CATEGORY 2009-2016 ($ BILLION)

TABLE 48 JAPANESE CHOCLATE MARKET, BY CATEGORY 2009-2016 (THOUSAND TONNES)

TABLE 49 SOUTH KOREAN CHOCOLATE MARKET, BY CATEGORY 2009-2016 ($ BILLION)

TABLE 50 SOUTH KOREAN CHOCOLATE MARKET, BY CATEGORY 2009-2016 (THOUSAND TONNES)

TABLE 51 CHINESE CHOCOLATE MARKET, BY CATEGORY 2009-2016 ($ BILLION)

TABLE 52 CHINESE CHOCOLATE MARKET, BY CATEGORY 2009-2016 (THOUSAND TONNES)

TABLE 53 MAJOR COMPANIES AND THEIR BRANDS IN INDIAN CHOCOLATE MARKET

TABLE 54 INDIAN CHOCOLATE MARKET, BY CATEGORY 2009-2016 ($ BILLION)

TABLE 55 INDIAN CHOCOLATE MARKET, BY CATEGORY 2009-2016 (THOUSAND TONNES)

TABLE 56 HARVEST TIME FOR COCOA CROP IN MAJOR COUNTRIES

TABLE 57 MAJOR COCOA PRODUCING AND CONSUMING NATIONS (2009)

TABLE 58 GLOBAL COCOA BEANS PRODUCTION, BY GEOGRAPHY 2006-2015 (THOUSAND TONNES)

TABLE 59 AFRICAN COCOA BEANS PRODUCTION, BY COUNTRY 2006-2015 (THOUSAND TONNES)

TABLE 60 ASIA OCEANIA COCOA BEANS PRODUCTION, BY COUNTRIES 2006-2015 (THOUSAND TONNES)

TABLE 61 AMERICAS COCOA BEANS PRODUCTION, BY COUNTRIES 2006-2015 (THOUSAND TONNES)

TABLE 62 GLOBAL GRINDING OF COCOA BEANS, BY GEOGRAPHY 2007-2009 (THOUSAND TONNES)

TABLE 63 AFRICAN GRINDING OF COCOA BEANS, BY COUNTRY 2007-2009 (THOUSAND TONNES)

TABLE 64 ASIAN GRINDING OF COCOA BEANS, BY COUNTRY 2007-2009 (THOUSAND TONNES)

TABLE 65 AMERICAS GRINDING OF COCOA BEANS, BY COUNTRY 2007-2009 (THOUSAND TONNES)

TABLE 66 TOP 10 COCOA BEANS IMPORTING COUNTRIES (2008)

TABLE 67 TOP 10 EXPORTERS OF COCOA BEANS (2008)

TABLE 68 TOP 10 COCOA BUTTER IMPORTING COUNTRIES (2008)

TABLE 69 TOP 10 COCOA BUTTER EXPORTING COUNTRIES (2008)

TABLE 70 TOP 10 COCOA PASTE IMPORTING COUNTRIES (2008)

TABLE 71 TOP 10 COCOA PASTE EXPORTING COUNTRIES (2008)

TABLE 72 GLOBAL SUGAR BALANCE (2009-10 – 2010-11)

TABLE 73 GLOBAL SUGAR MARKET IN CHOCOLATE APPLICATION, BY GEOGRAPHY 2009-2016 ($ MILLION)

TABLE 74 GLOBAL SUGAR MARKET IN CHOCOLATE APPLICATION, BY GEOGRAPHY 2009-2016 (THOUSAND TONNES)

TABLE 75 TOP 10 REFINED SUGAR IMPORTERS (2008)

TABLE 76 TOP 10 REFINED SUGAR EXPORTERS (2008)

TABLE 77 GLOBAL EMULSIFIERS MARKET IN CHOCOLATE APPLICATION BY GEOGRAPHY 2009-2016 ($ MILLION)

TABLE 78 GLOBAL EMULSIFIERS MARKET IN CHOCOLATE APPLICATION BY GEOGRAPHY 2009-2016 (TONNES)

TABLE 79 GLOBAL EMULSIFIERS MARKET IN CHOCOLATE APPLICATION, BY PRODUCT 2009-2016 ($ MILLION)

TABLE 80 GLOBAL EMULSIFIERS MARKET IN CHOCOLATE APPLICATION BY PRODUCT 2009-2016 (TONNES)

TABLE 81 SOME OF EMULSIFIER SUPPLIERS IN CHOCOLATE MARKET

TABLE 82 GLOBAL VANILLA FLAVOR MARKET IN CHOCOLATE APPLICATION, BY GEOGRAPHY 2009-2016 ($ MILLION)

TABLE 83 GLOBAL VANILLA FLAVOR MARKET IN CHOCOLATE APPLICATION, BY GEOGRAPHY 2009-2016 (TONNES)

TABLE 84 LEADING FLAVOR SUPPLIERS FOR THE CHOCOLATE

TABLE 85 NEW PRODUCT LAUNCHES (AUGUST 2008 TO FEBRUARY 2011)

TABLE 86 MERGERS AND ACQUISITIONS (APRIL 2008 TO OCTOBER 2010)

TABLE 87 JOINT VENTURES AND AGREEMENTS (JANUARY 2008 TO DECEMBER 2010)

LIST OF FIGURES

FIGURE 1 BUSINESS LANDSCAPE : CHOCOLATE MARKET

FIGURE 2 GLOBAL CHOCOLATE MARKET: SWOT ANALYSIS

FIGURE 3 PER CAPITA CHOCOLATE CONSUMPTION IN MAJOR ASIAN AND EUROPEAN COUNTRIES (2008)

FIGURE 4 IMPORTS OF FAIR TRADE CERTIFIED COCOA INTO THE U.S. (2003-2008)

FIGURE 5 CHOCOLATE MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 6 OUTSOURCING TREND IN COCOA INDUSTRY

FIGURE 7 ORAC VALUE OF HIGH-FLAVANOL CONTAINING FOODS

FIGURE 8 GLOBAL SUGAR AND COCOA PRICES ($/TONNE) 2007-2010

FIGURE 9 PATENT ANALYSIS BY COMPANY (JANUARY 2006- JANUARY 2011)

FIGURE 10 PATENT ANALYSIS BY GEOGRAPHY (JANUARY 2006-JANUARY 2011)

FIGURE 11 PATENT GROWTH COMPARISON (JANUARY 2006- JANUARY 2011)

FIGURE 12 PATENT ANALYSIS BY SEGMENT (JANUARY 2006-JANUARY 2011)

FIGURE 13 INCREASING MARKET PENETRATION OF ORGANIC CHOCOLATE 2009-2016

FIGURE 14 PRODUCT LIFE CYCLE FOR DIFFERENT CHOCOLATE SEGMENTS

FIGURE 15 CHOCOLATE CONSUMPTION IN MAJOR COUNTRIES 1999-2008 (000’S TONNES)

FIGURE 16 NORTH AMERICAN CHOCOLATE MARKET SHARE: BY COMPANY (2010)

FIGURE 17 CHOCOLATE LIFE CYCLE IN NORTH AMERICA

FIGURE 18 EUROPEAN CHOCOLATE MARKET SHARE, BY COMPANY (2009)

FIGURE 19 CHOCOLATE LIFE CYCLE IN EUROPE

FIGURE 20 FRENCH CHOCOLATE MARKET SHARE, BY COMPANIES (2009)

FIGURE 21 GERMAN CHOCOLATE MARKET SHARE, BY COMPANY (2009)

FIGURE 22 UK CHOCOLATE MARKET SHARE, BY COMPANIES (2009)

FIGURE 23 CHOCOLATE LIFE CYCLE IN ASIA

FIGURE 24 JAPANESE CHOCOLATE MARKET SHARE, BY COMPANIES (2009)

FIGURE 25 CHINESE CHOCOLATE MARKET SHARE, BY COMPANIES (2009)

FIGURE 26 GLOBA COCOA BEANS PRODUCTION SHARE: BY COUNTRIES (2009)

FIGURE 27 GLOBAL COCOA BEANS CONSUMPTION SHARE, BY COUNTRY (2009)

FIGURE 28 INCREASING CHOCOLATE MARKET (2009-2016)

FIGURE 29 AVERAGE COCOA PRICES TREND JANUARY 2005-JANUARY 2011 ($ PER TONNE)

FIGURE 30 TOP 10 COCOA BEANS IMPORTING COUNTRIES (2008-2009)

FIGURE 31 AVERAGE SUGAR PRICE TREND 2006-2011 ($/KG)

FIGURE 32 GLOBAL SUGAR PRODUCTION SHARE, BY COUNTRY (2009)

FIGURE 33 GLOBAL VANILLA PRODUCTION SHARE, BY COUNTRY (2009)

FIGURE 34 GLOBAL CHOCOLATE MARKET SHARE, BY COMPANY (2010)

FIGURE 35 MAJOR GROWTH STRATEGIES IN THE GLOBAL CHOCOLATE MARKET (JANUARY 2008 – FEBRUARY 2011)

FIGURE 36 GLOBAL CHOCOLATE MARKET: GROWTH STRATEGIES BY COMPANIES (JANUARY 2008-FEBRUARY 2011)

FIGURE 37 GLOBAL CHOCOLATE MARKET: GROWTH STRATEGIES BY GEOGRAPHY (JANUARY 2008 - FEBRUARY 2011)

FIGURE 38 BARRY CALLEBAUT REVENUE SHARE:BY GEOGRAPHY (2010)

FIGURE 39 BARRY CALLEBAUT: REVENUE GROWTH, 2006-2010 ($ MILLION)

FIGURE 40 HERSHEY’S REVENUE SHARE: BY GEOGRAPHY (2009)

FIGURE 41 HERSHEY’S REVENUE GROWTH, 2005-2009 ($ MILLION)

FIGURE 42 LINDT & SPRUENGLI AG REVENUE SHARE: BY GEOGRAPHY (2010)

FIGURE 43 LINDT & SPRUENGLI AG REVENUE GROWTH, 2006-2009 ($ MILLION)

FIGURE 44 NESTLE REVENUE SHARE:BY GEOGRAPHY (2009)

FIGURE 45 LOTUS CHOCOLATE REVENUE GROWTH (2007-2010) $ MILLION

FIGURE 46 DIVINE CHOCOLATE REVENUE GROWTH, 2005-2009 ($ MILLION)

Growth opportunities and latent adjacency in Global Chocolate, Cocoa Beans, Lecithin, Sugar and Vanilla Market