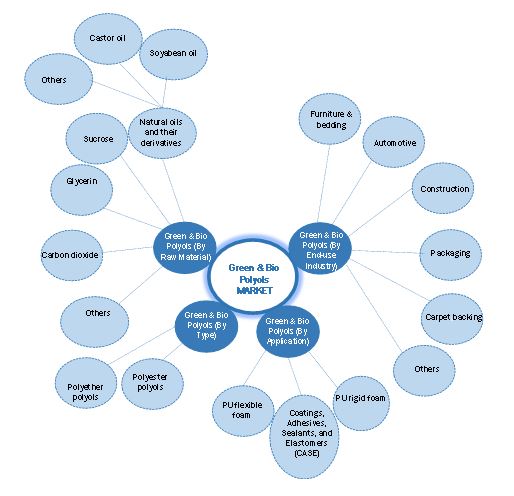

Green and Bio Polyols Market by Raw Material (Natural Oils and their Derivatives, Sucrose, Glycerin, Carbon Dioxide), Type, Application (PU Flexible Foam, CASE, PU Rigid Foam) End-use Industry and Region - Global Forecast to 2027

Green and Bio Polyols Market

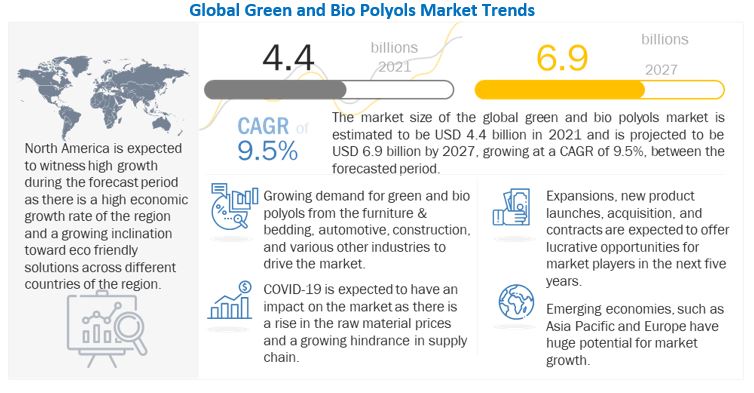

[253 Pages Report] The market size of the global green and bio polyols market is estimated to be USD 4.4 billion in 2021 and is projected to be USD 6.9 billion by 2027, growing at a CAGR of 9.5%, between the forecasted period. The global green and bio polyols market is experiencing a growth due to the stringent government regulation which aims to cut down the excessive use of polyols based on petroleum. The growing demand followed by the production of PU flexible or rigid foams as insulating material in buildings, and in the furniture & bedding industry is expected to drive the growth of the green and bio polyols market forward globally. There is an extensive use of green and bio based polyols in CASE applications which is a major reason for the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Green and bio polyols Market

COVID-19 is an infectious disease caused by a newly discovered strain of the coronavirus. This disease is impacting the growth of economies across the globe. The virus was first identified in Wuhan (China) in December 2019. The COVID-19 pandemic has wreaked havoc on the world. COVID-19 significantly impacted the global GDP in 2020, and estimates, so far, indicate the virus had impacted the global economic growth by at least 0.5%- 1.5% in FY 2020-2021, but the economies are recovering with reduction in restrictions imposed by major countries. Owing to the swift spread of the disease, both lives and livelihoods are at risk. It is a global problem that calls for a global response. There cannot be estimates on how quickly this disease is going to retreat. This situation is somewhat unusual, as it affects both supply and demand, thus, also affecting the supply of green and bio polyols, globally.

Various rigid plastic packaging suppliers are finding solutions and ways to communicate with their end users to help assure them by providing information on their websites and social media on how they are tackling the global challenges.

Green and bio polyols Market: Market Dynamics

Driver: Use of bio-based polyols in polyurethane used in automotive, furniture, and construction industries

Polyurethanes are among the most versatile polymers, with applications ranging from rigid and flexible foams to coatings, films, and other products. Isocyanates, polyols, and other additives are important raw materials used in the production of polyurethane. Polyols make up most polyurethanes. The automotive industry is one of the most significant users of bio-based polyols. Bio-based polyols can improve load-bearing or hardness properties in molded foams, such as automotive seating and headrests, when compared to conventional polyols. Raw materials can be poured and reacted into molds to achieve a specific, consistent shape for the foam. Molded foam is used to improve the aesthetics and ergonomics of seating and other components in automobiles, trucks, boats, buses, and aircraft. In North America, transportation accounts for approximately 85 percent of all molded foam. Other uses include office furniture and bedding (pillows). The rebound in the furniture, interiors, and construction industries in North America and Europe, as well as rapid economic growth in Asia Pacific, are expected to continue to be the primary driving forces in the polyurethane market, implying the growth of the green and bio polyols market.

Members of the Polyurethane Foam Association account for most of this production in North America. Polyurethanes are most used in the form of flexible polyurethane foam. Flexible foam is used in a wide range of industrial and consumer markets.

Restraint: Developments in different regions to be a restraint for market

The high recycling of foam-based waste for the production of bio polyols has contributed to lower raw material prices for conventional polyols. North America's high unconventional hydrocarbon production has aided in lowering petroleum-related raw material prices for conventional polyols. Iran has recently begun exporting its oil reserves, which is expected to lower overall petrochemical prices in the near future. All of the aforementioned recent activities in various regions may emerge as a major source of concern for bio-based polyol producers. Since bio polyol products are new to the bio polyols market, the cost of producing these polyols is still extremely high. This could stifle market growth in general.

Opportunity: Concerns over depletion of non-renewable resources and environment along with innovations

Most polyols are currently petroleum-based, but growing concerns about the depletion of petroleum resources, the environment, and sustainability have resulted in significant efforts to develop bio-based polyols and PUs from renewable resources.

Governments and regulatory organizations, such as the Environmental Protection Agency (EPA) and REACH, have implemented several guidelines encouraging the use of bio-based polyols. Hazardous volatile organic compounds (VOCs) are used in the production of conventional polyols. In their manufacturing process, sustainable bio-based polyols emit zero to minimal VOCs. Hence, interventions to promote the use of bio polyols are expected to drive the overall market.

Challenges: Availability of raw materials and crude oil, higher cost of green and bio-based polyols, and imbalance between commercial and food crop

The primary problem with green and bio polyols is the cost, which is higher than the cost of paper and generic plastics such as PVC vinyl and polystyrene. As the green and bio polyols is made of plastic, it can be twice as expensive as fine offset paper. Therefore, it is only recommended for long-term applications such as menus, seasonal P-O-P displays, banners, and manuals that may be exposed to harsh environments. Green and bio polyols is used in applications where its properties allow it to last much longer than paper. Thus, the high cost of green and bio polyols limits its use to the long term rather than the short term.

Natural oils and their derivatives is the largest raw material segment of the green and bio polyols market

The green and bio polyols market is segmented into natural oils and their derivatives, sucrose, glycerin, carbon dioxide on the basis if raw materials. The natural oils and their derivatives segment led the raw material segment of the market with respect to both value and volume. Bio-polyols which are made from natural oils are known as natural oil polyols. These polyols can be prepared from soybean oil, rapeseed (canola) oil, palm oil, castor oil, and sunflower oil. All the natural oil polyols have similar sources and usage, but there exists a difference with respect to materials which depends on the way they are made.

Polyether polyols is the largest applications segment of the green and bio polyols market

On the basis of type, the green and bio polyols market is divided into polyether polyols and polyester polyols. The polyether polyols type segment accounted for the largest share amongst the two in the green and bio polyols market in 2021. The general production of polyether polyols is through catalysis reaction of epoxides. They are mostly used in PU flexible foam manufacturing. The content of polyether polyols is multiple ether linkages and hydroxyl groups within their molecular form..

PU flexible foams is the largest applications segment of the green and bio polyols market

On the basis of applications, the green and bio polyols market is segmented into PU Flexible Foam, CASE, PU Rigid Foam. The PU flexible foams application segment was the largest application in the green and bio polyols market in 2021. There is a vast usage if PU flexible foams in consumer and commercial products. These products include furniture, cushion, carpet transportation, bedding, packaging, textiles, and fibers. As cushion material, PU flexible foams provide support, comfort, durability, and energy absorption. PU flexible foam has many applications in the automotive industry, which include its usage in arms rests ventilating , seating, headrests; heating, and air conditioning (HVAC) components, car & truck fenders, interior panels & skins, headliners, and other interior systems.

Furniture & bedding is the largest end-use industry segment of the green and bio polyols market

On the basis of end-use industry, the green and bio polyols market is segmented into furniture & bedding, construction, automotive, packaging, carpet backing, and others. The furniture & bedding end-use industry segment accounted for the largest end-use industry of green and bio polyols. The rapid growth in the construction activities in the housing sector has driven the growth of the furniture & bedding products. Due to the growing up income levels of the population in the emerging economies, thre is an added expenditure on luxury commodities. The furniture & bedding industry creates a market with a rapid groeth potential for green and bio polyols because of their extensive usage in the manufacturing of cushions for sofas, recliners, and upholstered chairs for both household and commercial purposes.

North America is the largest market for green and bio polyols market

The North America region is the largest market, in terms of value, as per the projections. It is expected to grow at the fastest CAGR between 2022 and 2017. North America is a major market for polyurethane market concerning the demands and product innovations which are taking place to improve performance and quality. The presence of established players in the North American markets makes it a favouable market and hence, it is the biggest market of green and bio polyols.

The major players of the green and bio polyols maket are BASF SE (Germany), The Dow Chemical Company (US), Cargill, Incorporated (US), Covestro AG (Germany), and Emery Oleochemicals (US) .

To know about the assumptions considered for the study, download the pdf brochure

Market Interconnections

Key Market Players

BASF SE (Germany), The Dow Chemical Company (US), Cargill, Incorporated (US), Covestro AG (Germany), and Emery Oleochemicals (US) are key players in green and bio polyols market.. These companies have adopted several growth strategies to strengthen their position in the market. Expansion, new product development, merger & acquisition, and collaboration are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for to green and bio polyols from emerging economies.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million) |

|

Segments |

Rw Material, Type, Application, End-use Industry and Region |

|

Regions |

Asia Pacific, Europe, North America, South America, and Middle East & Africa |

|

Companies |

BASF SE (Germany), The Dow Chemical Company (US), Cargill, Incorporated (US), Covestro AG (Germany), and Emery Oleochemicals (US) |

This research report categorizes the green and bio polyols market based on application, end-use industry and region.

The Green and bio polyols Market, By Raw Material:

- Natural Oils and their Derivatives

- Sucrose

- Glycerin

- Carbon Dioxide

The Green and bio polyols Market, By Type:

- Polyether Polyols

- Polyester Polyols

The Green and bio polyols Market, By Application:

- PU Flexible Foam

- CASE

- PU Rigid Foam

The Green and bio polyols Market, By End-use Industry:

- Furniture and Bedding

- Construction

- Automotive

- Packaging

- Carpet Backing

- Others

The Green and bio polyols Market, By Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In December 2021, Cargill entered into an agreement to acquire the majority of Croda's performance technologies and industrial chemicals business cash-free and debt-free. Cargill's bio-industrial footprint would be significantly expanded as a result of the investment, allowing it to better serve industrial manufacturers looking for greener ingredient solutions.

- In September 2021, Dow Polyurethanes, a Dow business division, and Orrion Chemicals Orgaform, in collaboration with Eco-mobilier, H&S Anlagentechnik, and The Vita Group, opened a pioneering mattress recycling plant as part of the RENUVA programme..

- In June 2021, Cargill and HELM are partnering up to build the first commercial-scale, renewable BDO facility in the US to meet the rising customer demand. The new joint venture introduces QIRA, a bio-based 1,4-butanediol (BDO) that reduces greenhouse gas emissions by up to 93% compared to conventional BDO. QIRA can be used to make spandex and other polyester-based chemical fibers, as well as biodegradable plastics, polyurethane coatings, sealants, and synthetic leathers, reducing their environmental impact.

- In March 2021, Cargill invested heavily in its soy processing operations in the US, with modernization and expansion projects planned across its network of crush facilities in seven states. The company estimates that once completed, the investments will improve operational efficiencies while also increasing capacity by 10% in one location and doubling capacity in another to better meet the growing demand for US soy products.

- In July 2020, The Dow Chemical Company and Eco-mobilier, a French mattress and furniture EPR (Extended Producer Responsibility) organization, announced a new collaboration today for the collection and supply of post-consumer polyurethane foam for the RENUVA Mattress Recycling Program.

Frequently Asked Questions (FAQ):

What are the upcoming hot bets for the green and bio polyols market?

The growth of the global green and bio polyols market is directly related to the strict government regulation against use of petrochemical polyols which results in high demand for conventional resources.

What are the market dynamics for the different raw materials of green and bio polyols?

Based on raw materials, the green and bio polyols market includes natural oils and their derivatives, sucrose, glycerin, carbon dioxide. The natural oils and their derivatives raw material segment led the application segment of the market in terms of both value and volume. Bio-polyols made from natural oils are also known as natural oil polyols. These polyols can be made from soybean oil, rapeseed (canola) oil, palm oil, castor oil, and sunflower oil. The usage of a specific natural oil can be dependent on the region. All the natural oil polyols have similar sources and applications, but the materials are quite different, depending on how they are made. These polyols are colorless to light yellow. The viscosity of these polyols can vary based on the raw materials; it is determined by their molecular weight and the average number of hydroxyl groups present per molecule. The odor of these polyols varies based on the oil from which they are derived. Most natural oil polyols are quite similar chemically to their parent vegetable oils and are prone to rancidity.

What are the market dynamics for the different types of green and bio polyols?

Based on type, the green and bio polyols market is divided into polyether polyols and polyester polyols. The polyether polyols type segment accounted for the largest share in the green and bio polyols market in 2021. Polyether polyols are generally produced by the catalysis reaction of epoxides. They are mainly used in the manufacturing of PU flexible foam. Polyether polyols contain multiple ether linkages and hydroxyl groups in their molecular form. Most of these polyols are used for manufacturing urethanes, surface-active agents, functional fluids, and synthetic lubricants. The physical properties of polyether polyols depend on the length of the polymer chain. These polyols have a molecular weight of more than 3,000.

What are the market dynamics for the different applications of green and bio polyols?

Based on applications, the green and bio polyols market is divides into PU Flexible Foam, CASE, PU Rigid Foam. The PU flexible foams application segment accounted for the largest share in the green and bio polyols market in 2021. PU flexible foams are used in different consumer and commercial products, including furniture, carpet cushion, transportation, bedding, packaging, textiles, and fibers. These foams consist of slab stock, which is primarily used for carpet cushions and furniture. They are also used for office chairs, stadium seating, and auditorium seating. As a cushioning material, these foams provide support, comfort, durability, and energy absorption. PU flexible foams have a wide range of applications in the automotive industry, such as in seating, headrests, arms rests; heating, ventilating, and air conditioning (HVAC) components, interior panels & skins, car & truck fenders, headliners, and other interior systems. The use of polyurethane for automotive design results in weight reduction, passenger comfort, and compressive strength in vehicles, thus driving the need for polyurethane flexible foams in the automotive industry.

What are the market dynamics for the different end-use industries of green and bio polyols?

Based on end-use industry, the green and bio polyols market is divides into furniture & bedding, construction, automotive, packaging, carpet backing, others. The furniture & bedding end-use industry segment is the largest end-user of green and bio polyols. Increased construction activities in the housing sector, especially in emerging economies, have fueled the demand for furniture & bedding products. Growing income levels in the emerging markets have led to added expenditure on luxury commodities. The furniture & bedding industry is a rapidly growing market for green and bio polyols, which are being increasingly used to manufacture cushions for sofas, recliners, and upholstered chairs for both household and commercial purposes.

Who are the major manufacturers of the green and bio polyols market?

BASF SE (Germany), The Dow Chemical Company (US), Cargill, Incorporated (US), Covestro AG (Germany), and Emery Oleochemicals (US) are the key players operating in the green and bio polyols market.

What are the major factors which will impact market growth during the forecast period?

The price fluctuations in basic raw materials may limit the green and bio polyols market. Green and bio polyols prices are also influenced by crude oil, which is a major restraint. Crude oil price fluctuations are expected to raise the price.

What are the effects of COVID-19 on the green and bio polyols market?

The COVID-19 pandemic has significantly impacted the pigments industry worldwide, and it is difficult to ascertain the extent and severity of the impact in the long term. COVID-19 has had three major effects on the global economy: direct effects on production and demand, supply chain and market disruption, and financial impact on enterprises and financial markets. The market's expansion was hampered by disruptions in supply chain management and products and service transportation. ? Globally, the building materials market faced significant revenue losses due to international trade restrictions and stoppage in construction activities across the world. Regionally, Europe and North America observed a declined growth rate in the green and bio polyols market in 2020. The Construction Product Association stated that construction output in the UK dropped by around 25% and commercial construction output by 36% in 2020. Such trends are poised to slow down the market growth rate during the forecast period. The furniture, carpet, and automotive industries were drastically hit due to the immediate shutdowns. However, the world has started recovering from the COVID-19 pandemic .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 40)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 GREEN AND BIO POLYOLS MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 46)

2.1 RESEARCH DATA

FIGURE 2 GREEN AND BIO POLYOLS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 3 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 GREEN AND BIO POLYOLS MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 7 POLYETHER POLYOLS SEGMENT TO LEAD GREEN AND BIO POLYOLS MARKET DURING FORECAST PERIOD

FIGURE 8 PU FLEXIBLE FOAM SEGMENT TO BE LARGEST APPLICATION OF GREEN AND BIO POLYOLS

FIGURE 9 FURNITURE & BEDDING END-USE INDUSTRY TO LEAD GREEN AND BIO POLYOLS MARKET

FIGURE 10 NORTH AMERICA LED GREEN AND BIO POLYOLS MARKET

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN GREEN AND BIO POLYOLS MARKET

FIGURE 11 GROWING DEMAND FROM FURNITURE & BEDDING, CONSTRUCTION, AND AUTOMOTIVE TO BOOST MARKET

4.2 GREEN AND BIO POLYOLS MARKET, BY REGION

FIGURE 12 NORTH AMERICA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4.3 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET, BY TYPE AND COUNTRY

FIGURE 13 US ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN GREEN AND BIO POLYOLS MARKET

4.4 GREEN AND BIO POLYOLS MARKET: MAJOR COUNTRIES

FIGURE 14 MARKET IN US PROJECTED TO WITNESS HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 60)

5.1 OVERVIEW

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN GREEN AND BIO POLYOLS MARKET

5.2.1 DRIVERS

5.2.1.1 Use of bio-based polyols in polyurethane used in automotive, furniture, and construction industries

5.2.2 RESTRAINTS

5.2.2.1 Developments in different regions to be a restraint for market

5.2.3 OPPORTUNITIES

5.2.3.1 Concerns over depletion of non-renewable resources and environment along with innovations

5.2.3.2 Increasing usage of bio-based polyols in construction and other industries

5.2.4 CHALLENGES

5.2.4.1 Availability of raw materials and crude oil, higher cost of green and bio-based polyols, and imbalance between commercial and food crop

6 INDUSTRY TRENDS (Page No. - 63)

6.1 PORTER'S FIVE FORCES ANALYSIS

FIGURE 16 GREEN AND BIO POLYOLS MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 2 GREEN AND BIO POLYOLS MARKET: PORTER'S FIVE FORCE ANALYSIS

6.1.1 THREAT OF NEW ENTRANTS

6.1.2 BARGAINING POWER OF SUPPLIERS

6.1.3 THREAT OF SUBSTITUTES

6.1.4 BARGAINING POWER OF BUYERS

6.1.5 INTENSITY OF COMPETITIVE RIVALRY

6.2 MACROECONOMIC OVERVIEW AND TRENDS

6.2.1 INTRODUCTION

6.2.2 WORLD POPULATION GROWTH TRENDS

TABLE 3 WORLD POPULATION, BY COUNTRY, 2022 (LIVE)

6.3 VALUE CHAIN

FIGURE 17 GREEN AND BIO POLYOLS MARKET, VALUE CHAIN

6.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

6.4.1 TRADE ANALYSIS

TABLE 4 IMPORT OF POLYMER OF ETHYLENE IN PRIMARY FORM, 2020

TABLE 5 EXPORT OF POLYMER OF ETHYLENE IN PRIMARY FORM, 2020

FIGURE 18 ECOSYSTEM MAPPING: GREEN AND BIO POLYOLS MARKET

6.4.2 PRICING ANALYSIS

TABLE 6 AVERAGE PRICES OF GREEN AND BIO POLYOLS, BY REGION (USD/KILOGRAM)

6.4.3 TECHNOLOGY ANALYSIS

6.4.3.1 Bio-based polyurethane advancements for automotive interior coatings-Stahl

6.4.4 CASE STUDY ANALYSIS

6.4.4.1 LANXESS introduces a bio-based prepolymer line - Green Adiprene

6.4.4.1.1 Objective

6.4.4.1.2 Approach: Optical modeling for paper analysis

6.4.4.1.3 Result: Efficient development and optimization

6.5 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 7 GREEN AND BIO POLYOLS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.6 TARIFF AND REGULATIONS ANALYSIS

6.6.1 OSHA (OCCUPATIONAL SAFETY AND HEALTH ADMINISTRATION) STANDARDS FOR CEMENT AND CONCRETE

6.6.2 EUROPEAN UNION STANDARDS FOR SILICA DUST

6.6.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.6.4 PATENT ANALYSIS

6.6.4.1 Introduction

6.6.4.2 Methodology

6.6.4.3 Document Type

TABLE 9 TOTAL NUMBER OF PATENTS, 2011-2021

FIGURE 19 GREEN AND BIO POLYOLS MARKET: GRANTED PATENTS, LIMITED PATENTS, AND PATENT APPLICATIONS

FIGURE 20 PATENT PUBLICATION TRENDS (2011-2021)

6.6.4.4 Insight

6.6.4.5 Legal Status of Patents

FIGURE 21 PATENT ANALYSIS: LEGAL STATUS

FIGURE 22 JURISDICTION ANALYSIS

6.6.4.6 Top Companies/Applicants

FIGURE 23 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

6.6.4.7 List of Patents by Covestro Deutschland Ag

6.6.4.8 List of Patents by Dow Global Technologies Llc

6.6.4.9 List of Patents by BASF Se

6.6.4.10 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

7 GREEN AND BIO POLYOLS MARKET, BY RAW MATERIAL (Page No. - 83)

7.1 INTRODUCTION

FIGURE 24 GLYCERINE TO LEAD GREEN AND BIO POLYOLS MARKET DURING FORECAST PERIOD

TABLE 10 GREEN AND BIO POLYOLS MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD MILLION)

TABLE 11 GREEN AND BIO POLYOLS MARKET SIZE, BY RAW MATERIAL, 2020–2027 (KILOTON)

TABLE 12 GREEN AND BIO POLYOLS MARKET SIZE, BY NATURAL OILS AND THEIR DERIVATIVES, 2020–2027 (USD MILLION)

TABLE 13 GREEN AND BIO POLYOLS MARKET SIZE, BY NATURAL OILS AND THEIR DERIVATIVES, 2020–2027 (KILOTON)

7.2 NATURAL OILS AND THEIR DERIVATIVES

7.3 SUCROSE

7.4 CARBON DIOXIDE

8 GREEN AND BIO POLYOLS MARKET, BY TYPE (Page No. - 88)

8.1 INTRODUCTION

FIGURE 25 POLYETHER POLYOLS TO LEAD GREEN AND BIO POLYOLS MARKET DURING FORECAST PERIOD

TABLE 14 GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 15 GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 16 GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 17 GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

8.2 POLYETHER POLYOLS

8.2.1 FLEXIBLE FOAM APPLICATION, ESPECIALLY IN AUTOMOTIVE INDUSTRY, DRIVING DEMAND

TABLE 18 POLYETHER POLYOLS: GREEN AND BIO POLYOLS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 POLYETHER POLYOLS: GREEN AND BIO POLYOLS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 20 GREEN AND BIO POLYOLS MARKET SIZE IN POLYETHER POLYOLS, BY REGION, 2016–2019 (KILOTON)

TABLE 21 POLYETHER POLYOLS: GREEN AND BIO POLYOLS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

8.3 POLYESTER POLYOLS

8.3.1 CASE APPLICATIONS FUELING DEMAND

TABLE 22 POLYESTER POLYOLS: GREEN AND BIO POLYOLS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 POLYESTER POLYOLS: GREEN AND BIO POLYOLS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 24 POLYESTER POLYOLS: GREEN AND BIO POLYOLS MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 25 POLYESTER POLYOLS: GREEN AND BIO POLYOLS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

9 GREEN AND BIO POLYOLS MARKET, BY APPLICATION (Page No. - 94)

9.1 INTRODUCTION

FIGURE 26 PU FLEXIBLE FOAM SEGMENT TO LEAD GREEN AND BIO POLYOLS MARKET DURING FORECAST PERIOD

TABLE 26 GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 27 GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 28 GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 29 GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

9.2 PU FLEXIBLE FOAM

9.2.1 GROWING AUTOMOTIVE AND FURNITURE INDUSTRIES FUELING THE MARKET FOR POLYOLS IN FLEXIBLE POLYURETHANE FOAM APPLICATION

TABLE 30 GREEN AND BIO POLYOLS MARKET SIZE IN PU FLEXIBLE FOAMS, BY REGION, “ 2016–2019 (USD MILLION)

TABLE 31 GREEN AND BIO POLYOLS MARKET SIZE IN PU FLEXIBLE FOAMS, BY REGION, 2020–2027 (USD MILLION)

TABLE 32 GREEN AND BIO POLYOLS MARKET SIZE IN PU FLEXIBLE FOAMS, BY REGION, 2016–2019 (KILOTON)

TABLE 33 GREEN AND BIO POLYOLS MARKET SIZE IN PU FLEXIBLE FOAMS, BY REGION, 2020–2027 (KILOTON)

9.3 COATINGS, ADHESIVES, SEALANTS, AND ELASTOMERS (CASE)

9.3.1 INCREASING DEMAND FROM CONSTRUCTION, PACKAGING, AND MANUFACTURING OF AUTOMOTIVE PARTS DRIVING THE MARKET IN THIS SEGMENT

TABLE 34 GREEN AND BIO POLYOLS MARKET SIZE IN CASE, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 GREEN AND BIO POLYOLS MARKET SIZE IN CASE, BY REGION, 2020–2027 (USD MILLION)

TABLE 36 GREEN AND BIO POLYOLS MARKET SIZE IN CASE, BY REGION, 2016–2019 (KILOTON)

TABLE 37 GREEN AND BIO POLYOLS MARKET SIZE IN CASE, BY REGION, 2020–2027 (KILOTON)

9.4 PU RIGID FOAM

9.4.1 GROWING REFRIGERATION INDUSTRY AND INCREASING ENERGY-SAVING STANDARDS ARE DRIVING MARKET

TABLE 38 GREEN AND BIO POLYOLS MARKET SIZE IN PU RIGID FOAM, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 GREEN AND BIO POLYOLS MARKET SIZE IN PU RIGID FOAM, BY REGION, 2020–2027 (USD MILLION)

TABLE 40 GREEN AND BIO POLYOLS MARKET SIZE IN PU RIGID FOAM, BY REGION, 2016–2019 (KILOTON)

TABLE 41 GREEN AND BIO POLYOLS MARKET SIZE IN PU RIGID FOAM, BY REGION, 2020–2027 (KILOTON)

10 GREEN AND BIO POLYOLS MARKET, BY END-USE INDUSTRY (Page No. - 102)

10.1 INTRODUCTION

FIGURE 27 FURNITURE & BEDDING TO LEAD GREEN AND BIO POLYOLS MARKET DURING FORECAST PERIOD

TABLE 42 GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 43 GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 44 GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 45 GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10.2 FURNITURE & BEDDING

10.2.1 INCREASING CONSTRUCTION ACTIVITIES IN EMERGING ECONOMIES TO BOOST SEGMENT

TABLE 46 GREEN AND BIO POLYOLS MARKET SIZE IN FURNITURE & BEDDING, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 GREEN AND BIO POLYOLS MARKET SIZE IN FURNITURE & BEDDING, BY REGION, 2020–2027 (USD MILLION)

TABLE 48 GREEN AND BIO POLYOLS MARKET SIZE IN FURNITURE & BEDDING, BY REGION, 2016–2019 (KILOTON)

TABLE 49 GREEN AND BIO POLYOLS MARKET SIZE IN FURNITURE & BEDDING, BY REGION, 2020–2027 (KILOTON)

10.3 AUTOMOTIVE

10.3.1 USE OF GREEN AND BIO POLYOLS IN SEATS, CUSHIONS, AND BACKRESTS TO BOOST SEGMENT

TABLE 50 GREEN AND BIO POLYOLS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 GREEN AND BIO POLYOLS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2020–2027 (USD MILLION)

TABLE 52 GREEN AND BIO POLYOLS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2016–2019 (KILOTON)

TABLE 53 GREEN AND BIO POLYOLS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2020–2027 (KILOTON)

10.4 CONSTRUCTION

10.4.1 BEING ECOFRIENDLY AND PROVIDING EFFICIENT SEALING AND INSULATING TO BOOST SEGMENT

TABLE 54 GREEN AND BIO POLYOLS MARKET SIZE IN CONSTRUCTION, BY REGION, 2016–2019 (USD MILLION)

TABLE 55 GREEN AND BIO POLYOLS MARKET SIZE IN CONSTRUCTION, BY REGION, 2020–2027(USD MILLION)

TABLE 56 GREEN AND BIO POLYOLS MARKET SIZE IN CONSTRUCTION, BY REGION, 2016–2019(KILOTON)

TABLE 57 GREEN AND BIO POLYOLS MARKET SIZE IN CONSTRUCTION, BY REGION, 2020–2027 (KILOTON)

10.5 PACKAGING

10.5.1 DEMAND FROM HEALTHCARE, MILITARY, REFRIGERATION, AND PALLET INDUSTRY TO BOOST SEGMENT

TABLE 58 GREEN AND BIO POLYOLS MARKET SIZE IN PACKAGING, BY REGION, 2016–2019 (USD MILLION)

TABLE 59 GREEN AND BIO POLYOLS MARKET SIZE IN PACKAGING, BY REGION, 2020–2027 (USD MILLION)

TABLE 60 GREEN AND BIO POLYOLS MARKET SIZE IN PACKAGING, BY REGION, 2016–2019 (KILOTON)

TABLE 61 GREEN AND BIO POLYOLS MARKET SIZE IN PACKAGING, BY REGION, 2020–2027 (KILOTON)

10.6 CARPET BACKING

10.6.1 USE IN CARPET PADS AND CARPET BINDERS TO BOOST SEGMENT

TABLE 62 GREEN AND BIO POLYOLS MARKET SIZE IN CARPET BACKING, BY REGION, 2016–2019 (USD MILLION)

TABLE 63 GREEN AND BIO POLYOLS MARKET SIZE IN CARPET BACKING, BY REGION, 2020–2027 (USD MILLION)

TABLE 64 GREEN AND BIO POLYOLS MARKET SIZE IN CARPET BACKING, BY REGION, 2016–2019 (KILOTON)

TABLE 65 GREEN AND BIO POLYOLS MARKET SIZE IN CARPET BACKING, BY REGION, 2020–2027 (KILOTON)

10.7 OTHERS

TABLE 66 GREEN AND BIO POLYOLS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 67 GREEN AND BIO POLYOLS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2020–2027 (USD MILLION)

TABLE 68 GREEN AND BIO POLYOLS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2016–2019 (KILOTON)

TABLE 69 GREEN AND BIO POLYOLS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2020–2027 (KILOTON)

11 GREEN AND BIO POLYOLS MARKET: REGIONAL ANALYSIS (Page No. - 116)

11.1 INTRODUCTION

FIGURE 28 NORTH AMERICA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

11.1.1 GREEN AND BIO POLYOLS MARKET, BY REGION

TABLE 70 GREEN AND BIO POLYOLS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 71 GREEN AND BIO POLYOLS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 72 GREEN AND BIO POLYOLS MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 73 GREEN AND BIO POLYOLS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

TABLE 74 GLOBAL GREEN AND BIO POLYOLS MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD MILLION)

TABLE 75 GLOBAL GREEN AND BIO POLYOLS MARKET SIZE, BY RAW MATERIAL, 2020–2027 (KILOTON)

TABLE 76 GLOBAL GREEN AND BIO POLYOLS MARKET SIZE, BY NATURAL OILS AND THEIR DERIVATIVES, 2020–2027 (USD MILLION)

TABLE 77 GLOBAL GREEN AND BIO POLYOLS MARKET SIZE, BY NATURAL OILS AND THEIR DERIVATIVES, 2020–2027 (KILOTON)

11.1.2 GREEN AND BIO POLYOLS MARKET, BY TYPE

TABLE 78 GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 79 GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 81 GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

11.1.3 GREEN AND BIO POLYOLS MARKET, BY APPLICATION

TABLE 82 GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 83 GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 84 GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 85 GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.1.4 GREEN AND BIO POLYOLS MARKET, BY END-USE INDUSTRY

TABLE 86 GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 87 GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 88 GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 89 GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

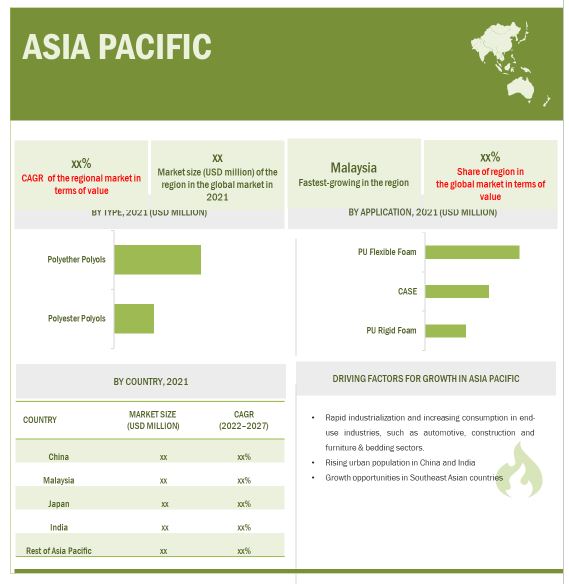

11.2 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SNAPSHOT

11.2.1 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET, BY COUNTRY

TABLE 90 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 91 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 92 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 93 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

11.2.2 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET, BY TYPE

TABLE 94 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 95 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 97 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

11.2.3 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET, BY APPLICATION

TABLE 98 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 99 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 100 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 101 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.2.4 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET, BY END-USE INDUSTRY

TABLE 102 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 103 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 104 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 105 ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

11.2.5 CHINA

11.2.5.1 PU foam demand from China to continue dominating in Asia Pacific market

TABLE 106 CHINA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 107 CHINA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 108 CHINA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 109 CHINA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 110 CHINA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 111 CHINA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 112 CHINA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 113 CHINA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.2.6 INDIA

11.2.6.1 Increasing demand in manufacturing, construction, and automotive segments to drive market

TABLE 114 INDIA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 115 INDIA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 116 INDIA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 117 INDIA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 118 INDIA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 119 INDIA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 120 INDIA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 121 INDIA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.2.7 JAPAN

11.2.7.1 Increasing government interventions due to environmental concerns to drive market

TABLE 122 JAPAN: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 123 JAPAN: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 124 JAPAN: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 125 JAPAN: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 126 JAPAN: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 127 JAPAN: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 128 JAPAN: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 129 JAPAN: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.2.8 MALAYSIA

11.2.8.1 Construction & automotive industries driving market

TABLE 130 MALAYSIA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 131 MALAYSIA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 132 MALAYSIA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 133 MALAYSIA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 134 MALAYSIA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 135 MALAYSIA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 136 MALAYSIA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 137 MALAYSIA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.2.9 REST OF ASIA PACIFIC

TABLE 138 REST OF ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 139 REST OF ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 140 REST OF ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 141 REST OF ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 142 REST OF ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 143 REST OF ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 144 REST OF ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 145 REST OF ASIA PACIFIC: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.3 EUROPE

11.3.1 EUROPE: GREEN AND BIO POLYOLS MARKET, BY COUNTRY

TABLE 146 EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 147 EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 148 EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 149 EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 150 EUROPE: GREEN AND BIO POLYOLS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 151 EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 152 EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 153 EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

11.3.2 EUROPE: GREEN AND BIO POLYOLS MARKET, BY APPLICATION

TABLE 154 EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 155 EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 156 EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 157 EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.3.3 EUROPE: GREEN AND BIO POLYOLS MARKET, BY END-USE INDUSTRY

TABLE 158 EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 159 EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 160 EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 161 EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

11.3.4 GERMANY

11.3.4.1 Increasing demand from automotive and packaging industries to be strong growth factor

TABLE 162 GERMANY: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 163 GERMANY: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 164 GERMANY: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 165 GERMANY: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 166 GERMANY: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 167 GERMANY: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 168 GERMANY: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 169 GERMANY: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.3.5 FRANCE

11.3.5.1 Growing applications such as usage of polyurethane in automotive industry to boost market

TABLE 170 FRANCE: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 171 FRANCE: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 172 FRANCE: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 173 FRANCE: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 174 FRANCE: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 175 FRANCE: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 176 FRANCE: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 177 FRANCE: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.3.6 NETHERLANDS

11.3.6.1 Stringent government regulations to boost demand for green and bio polyols

TABLE 178 NETHERLANDS: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 179 NETHERLANDS: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 180 NETHERLANDS: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 181 NETHERLANDS: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 182 NETHERLANDS: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 183 NETHERLANDS: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 184 NETHERLANDS: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 185 NETHERLANDS: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.3.7 UK

11.3.7.1 Growth of construction to boost demand for green and bio polyols

TABLE 186 UK: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 187 UK: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 188 UK: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 189 UK: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 190 UK: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 191 UK: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 192 UK: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 193 UK: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.3.8 REST OF EUROPE

TABLE 194 REST OF EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 195 REST OF EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, “ 2020–2027 (USD MILLION)

TABLE 196 REST OF EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 197 REST OF EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 198 REST OF EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 199 REST OF EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 200 REST OF EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 201 REST OF EUROPE: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.4 NORTH AMERICA

FIGURE 30 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SNAPSHOT

11.4.1 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET, BY COUNTRY

TABLE 202 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 203 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 204 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 205 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

11.4.2 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET, BY RAW MATERIAL

TABLE 206 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY RAW MATERIAL, 2020–2027 (USD MILLION)

TABLE 207 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY RAW MATERIAL, 2020–2027 (KILOTON)

TABLE 208 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY NATURAL OILS AND THEIR DERIVATIVES, 2020–2027 (USD MILLION)

TABLE 209 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY NATURAL OILS AND THEIR DERIVATIVES, 2020–2027 (KILOTON)

11.4.3 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET, BY TYPE

TABLE 210 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 211 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 212 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 213 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

11.4.4 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET, BY APPLICATION

TABLE 214 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 215 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 216 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 217 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.4.5 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET, BY END-USE INDUSTRY

TABLE 218 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 219 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 220 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 221 NORTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

11.4.6 US

11.4.6.1 Government’s policy encourages automobile manufacturers to increase bio content of their products

TABLE 222 US: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 223 US: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 224 US: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 225 US: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 226 US: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 227 US: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 228 US: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 229 US: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.4.7 CANADA

11.4.7.1 Growing construction industry to drive market growth

TABLE 230 CANADA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 231 CANADA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 232 CANADA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 233 CANADA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 234 CANADA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 235 CANADA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 236 CANADA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 237 CANADA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.4.8 MEXICO

11.4.8.1 Stringent government regulations regarding petrochemical-based polyols industries to drive market growth

TABLE 238 MEXICO: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 239 MEXICO: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 240 MEXICO: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 241 MEXICO: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 242 MEXICO: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 243 MEXICO: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 244 MEXICO: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 245 MEXICO: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.5 SOUTH AMERICA

11.5.1 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET, BY COUNTRY

TABLE 246 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 247 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 248 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 249 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

11.5.2 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET, BY TYPE

TABLE 250 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 251 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 252 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 253 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

11.5.3 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET, BY APPLICATION

TABLE 254 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 255 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 256 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 257 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.5.4 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET, BY END-USE INDUSTRY

TABLE 258 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 259 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 260 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 261 SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

11.5.5 BRAZIL

11.5.5.1 Rapid industrialization to fuel market

TABLE 262 BRAZIL: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 263 BRAZIL: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 264 BRAZIL: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 265 BRAZIL: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 266 BRAZIL: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 267 BRAZIL: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 268 BRAZIL: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 269 BRAZIL: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.5.6 ARGENTINA

11.5.6.1 Substantial growth of infrastructure segment to fuel market

TABLE 270 ARGENTINA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 271 ARGENTINA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 272 ARGENTINA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 273 ARGENTINA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 274 ARGENTINA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 275 ARGENTINA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 276 ARGENTINA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 277 ARGENTINA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.5.7 REST OF SOUTH AMERICA

TABLE 278 REST OF SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 279 REST OF SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 280 REST OF SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 281 REST OF SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 282 REST OF SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 283 REST OF SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 284 REST OF SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 285 REST OF SOUTH AMERICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.6 MIDDLE EAST & AFRICA

11.6.1 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET, BY COUNTRY

TABLE 286 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 287 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 288 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 289 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

11.6.2 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET, BY TYPE

TABLE 290 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 291 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 292 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 293 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

11.6.3 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET, BY APPLICATION

TABLE 294 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 295 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 296 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 297 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.6.4 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET, BY END-USE INDUSTRY

TABLE 298 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 299 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 300 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 301 MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

11.6.5 SAUDI ARABIA

11.6.5.1 Increasing opportunities in end-use industries and availability of crude oil to fuel market

TABLE 302 SAUDI ARABIA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 303 SAUDI ARABIA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 304 SAUDI ARABIA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 305 SAUDI ARABIA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 306 SAUDI ARABIA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 307 SAUDI ARABIA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 308 SAUDI ARABIA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 309 SAUDI ARABIA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.6.6 UAE

11.6.6.1 Substantial growth of printing applications to fuel market

TABLE 310 UAE: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 311 UAE: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 312 UAE: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 313 UAE: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 314 UAE: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 315 UAE: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 316 UAE: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 317 UAE: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.6.7 REST OF MIDDLE EAST & AFRICA

TABLE 318 REST OF MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 319 REST OF MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 320 REST OF MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 321 REST OF MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

TABLE 322 REST OF MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 323 REST OF MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 324 REST OF MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 325 REST OF MIDDLE EAST & AFRICA: GREEN AND BIO POLYOLS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

12 IMPACT OF COVID-19 ON GREEN AND BIO POLYOLS MARKET (Page No. - 199)

12.1 COVID-19 IMPACT ANALYSIS

12.1.1 COVID-19 ECONOMIC ASSESSMENT

12.1.2 EFFECTS ON GDP OF COUNTRIES

FIGURE 31 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

12.1.3 CONFIRMED CASES AND DEATHS, BY GEOGRAPHY

TABLE 326 IMPACT OF COVID-19, BASED ON REGION

12.2 COVID-19 IMPACT ON GREEN AND BIO POLYOLS MARKET

12.2.1 IMPACT ON END-USE SECTORS

13 COMPETITIVE LANDSCAPE (Page No. - 201)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 32 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENT AND ACQUISITION AS KEY GROWTH STRATEGIES, 2017–202O

13.3 MARKET RANKING

FIGURE 33 MARKET RANKING OF KEY PLAYERS, 2020

13.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 34 REVENUE ANALYSIS FOR KEY COMPANIES IN GREEN AND BIO POLYOLS MARKET

13.5 COMPANY EVALUATION QUADRANT

FIGURE 35 GREEN AND BIO POLYOLS MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

13.6 ARKEMA

13.6.1 STARS

13.6.2 PERVASIVE

13.6.3 EMERGING LEADERS

13.6.4 PARTICIPANTS

13.6.4.1 COMPETITIVE BENCHMARKING

TABLE 327 GREEN AND BIO POLYOLS MARKET: DETAILED LIST OF KEY PLAYERS

TABLE 328 GREEN AND BIO POLYOLS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

13.6.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 36 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN GREEN AND BIO POLYOLS MARKET

13.6.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 37 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN GREEN AND BIO POLYOLS MARKET

13.7 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES)

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPONSIVE COMPANIES

13.7.3 STARTING BLOCKS

13.7.4 DYNAMIC COMPANIES

FIGURE 38 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES), 2020

13.8 COMPETITIVE SCENARIO AND TRENDS

13.8.1 DEALS

TABLE 329 GREEN AND BIO POLYOLS MARKET: DEALS, JANUARY 2018–MARCH 2022

13.8.2 OTHERS

TABLE 330 GREEN AND BIO POLYOLS MARKET: NEW PRODUCT DEVELOPMENT, JANUARY 2018-MARCH 2022

14 COMPANY PROFILES (Page No. - 213)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

14.1 MAJOR PLAYERS

14.1.1 CARGILL, INCORPORATED

TABLE 331 CARGILL, INCORPORATED: COMPANY OVERVIEW

FIGURE 39 CARGILL, INCORPORATED: COMPANY SNAPSHOT

14.1.2 THE DOW CHEMICAL COMPANY

TABLE 332 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

FIGURE 40 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

14.1.3 BASF SE

TABLE 333 BASF SE: COMPANY OVERVIEW

FIGURE 41 BASF SE: COMPANY SNAPSHOT

14.1.4 EMERY OLEOCHEMICALS

TABLE 334 EMERY OLEOCHEMICALS: COMPANY OVERVIEW

TABLE 335 COVESTRO AG: COMPANY OVERVIEW

FIGURE 42 COVESTRO AG: COMPANY SNAPSHOT

14.1.6 STEPAN COMPANY

TABLE 336 STEPAN COMPANY: COMPANY OVERVIEW

FIGURE 43 STEPAN COMPANY: COMPANY SNAPSHOT

14.1.7 BIOBASED TECHNOLOGIES LLC

TABLE 337 BIOBASED TECHNOLOGIES LLC: COMPANY OVERVIEW

14.1.8 JAYANT AGRO-ORGANICS LIMITED

TABLE 338 JAYANT AGRO-ORGANICS LIMITED: COMPANY OVERVIEW

FIGURE 44 JAYANT AGRO-ORGANICS LIMITED: COMPANY SNAPSHOT

14.1.9 GLOBAL BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED

TABLE 339 GLOBAL BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED: COMPANY OVERVIEW

FIGURE 45 GLOBAL BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED: COMPANY SNAPSHOT

14.1.10 HUNTSMAN INTERNATIONAL LLC

TABLE 340 HUNTSMAN INTERNATIONAL LLC: COMPANY OVERVIEW

FIGURE 46 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

14.2 OTHER PLAYERS

14.2.1 NOVOMER INC.

14.2.2 ROQUETTE

14.2.3 MITSUI CHEMICALS

14.2.4 KOCH INDUSTRIES

14.2.5 ARKEMA

14.2.6 JOHNSON CONTROLS

14.2.7 CRODA INTERNATIONAL PLC

14.2.8 PIEDMONT CHEMICAL INDUSTRIES

14.2.9 POLYLABS

14.2.10 ITOH CHEMICALS

14.2.11 REPSOL S.A.

14.2.12 HUNTSMAN IFS

14.2.13 XUCHUAN CHEMICAL(SUZHOU) CO., LTD.

14.2.14 STAHL HOLDINGS BV

14.2.15 SHAKUN INDUSTRIES

14.2.16 OLEON NV

14.2.17 HUADA CHEMICAL GROUP CO., LTD.

14.2.18 SYNTHESIA TECHNOLOGY

14.2.19 EVONIK

14.2.20 ACME HARDESTY

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 246)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

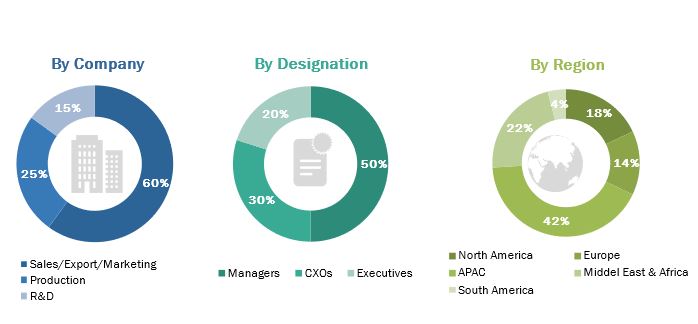

The study involved four major activities in estimating the current market size for the green and bio polyols market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding various trends related to process, end-use sector, and region. Stakeholders from the demand side, such as automotive, furniture, beddings, construction, and other companies of the customer/end users who are using green and bio polyols were interviewed to understand the buyers’ perspective on suppliers, products, service providers, and their current use of green and bio polyols and outlook of their business, which will affect the overall market.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the green and bio polyols market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, and forecast the global green and bio polyols market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the green and bio polyols market based on raw material, type, application and end-use industry

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific, Europe, North America, South America, and Middle East & Africa along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, merger & acquisitions, collaborations, and new product developments in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations:

- MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

- The following customization options are available for the report

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Green and Bio Polyols Market

Interested in bio-based polyether polyols for the production of flexible polyurethane foam

General Information on the Green Polyol & Bio Polyol Market

Report on bio-polyols market with European Prices, production and demand, individual producers and consumers, etc.

Green and Bio Polyols Market in India