Green & Bio-solvents Market by Type (Bioalcohols, Bio-Diols, Biogycols, Lactate Esters), Application (Industrial & Domestic Cleaners, Paints & Coatings, Adhesives, Printing Inks, Pharmaceuticals) and Region- Global Forecast to 2027

Updated on : September 02, 2025

Green & Bio-Solvents Market

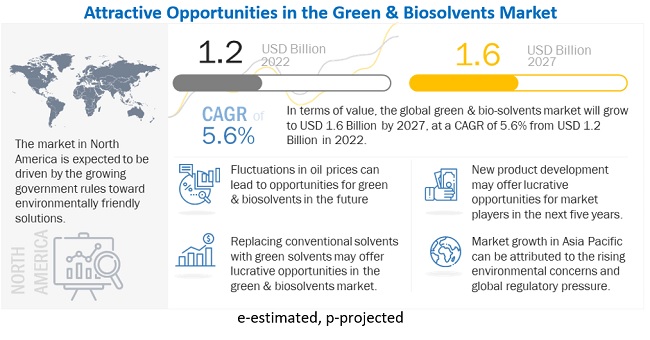

The global green & bio-solvents market was valued at USD 1.2 billion in 2022 and is projected to reach USD 1.6 billion by 2027, growing at 5.6% cagr from 2022 to 2027. Improved competitiveness from product differentiation and increasing penetration and need to decarbonize economy are the major factors driving the market growth. Most green & bio-solvents consume less energy and emit less carbon dioxide (CO2) than solvents derived from petrochemical resources. Vegetable-sourced solvents emit few or no VOCs. Green & bio-solvents also offer the potential for product differentiation in cosmetics and the development of new properties and functionalities.

Customers in North America and Europe value natural and green products. All these factors drive the demand for green & bio-solvents market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Green & Bio-solvents Market

The global pandemic has affected almost every sector in the world. The green & bio-solvents market was negatively affected due to disruptions in the global supply chain. The market is highly dependent on applications, such as paints & coatings, printing inks, industrial cleaners, pharmaceuticals, and others.

However, the impact of COVID-19 had a positive impact on bio-alcohol type of green & bio-solvents due to the increasing demand for sanitizers and other industrial cleaning products. During the outbreak of COVID-19, the demand for sanitizers and disinfectants shot up significantly to control the spread of the virus. On the other hand, due to significant growth in demand with limited supply, the price of green & bio-solvents increased in 2020, driving the market.

Green & Bio-solvents Market Dynamics

Driver: Increasing market penetration and need to decarbonize economy

The growth in demand for green & bio-solvents is higher compared to that for conventional solvents. This is because of the increased environmental regulations, especially in Europe and North America, and the increased supply of green & bio-solvents with enhanced properties at lower costs by existing as well as new production plants. Green & bio-solvents are used in applications, such as cleaning, plant-protection oil, wetting agents, and bio fluxing agents. The application areas for green & bio-solvents are increasing due to continuous product innovation, which acts as a key driver for the market.

Restraint: Uncertainty about the reliability and adequate supply of feedstocks

Raw material availability and its continuous supply are crucial to secure undisturbed green & bio-solvents production. Uniform quality of raw material is also essential for efficient production. The profitability of green & bio-solvents is often based on the availability of cheap renewable raw materials, and future increases/strong cyclicality in the raw material price can make production unprofitable. SMEs have smaller chances than large companies of establishing long-term fixed-price contracts, using price hedging tools and other similar instruments.

Opportunity: Extensive R&D on green & bio-solvents

Conventional solvents, such as diethanolamine, triethanolamine, and polyethylene glycols, are used in personal care products. These solvents can cause health problems, such as hormone disruptions, irritation of the eyes, skin, respiratory tracts, sore throat, asthma, and allergic contact dermatitis. Other conventional solvents, such as carbon tetrachloride and 1,2- Dicholoroethane are used in pharmaceutical applications which are toxic and carcinogenic. These factors have increased the scope for R&D in the field of green & bio-solvents.

Challenge: Securing profitability and competitiveness

The economics of the green & bio-solvents sector is very complex given the wide range of variables in the rather new value and production chains. Larger players have a better chance of understanding the value chain and positioning themselves than the Small & Medium-sized Enterprises (SMEs).

The competition for green & bio-solvents with petrochemical-based solvents can be very tight. Entering a well-structured industry with major key players can be challenging for a new player.

Green & Bio-solvents Market Ecosystem

“D-Limonene was the second-largest type of green & bio-solvents market, in terms of value, in 2021”

D-Limonene is a solvent that is produced from the citrus feedstock. The process involves squeezing the rind or peels of fruit (orange or lemon) in a steam extractor to produce oil. When the steam is condensed, a significant layer of oil (D-Limonene) floats to the surface of the water and can be collected. The ability of the solvent to replace high VOC solvents, such as mineral spirits, methyl ethyl ketone, acetone, toluene, glycol ethers, and halogenated solvents, drive its demand in various applications and sectors.

“Paints & Coatings was the second-largest green & bio-solvents application in 2021 in terms of value”

In paints & coatings, bio-solvents dissolve or disperse different components used in the paint formulation (like pigment and resin), making the paint of the desired consistency for application. The solvent evaporates once the paint or coating is applied, allowing resin and pigment to produce a film of paint (a coat) and dry rapidly. The use of solvents in paints provides a variety of effective choices among durable and decorative coatings and glossy paints for indoor and outdoor uses. Increasing production of green & bio-solvents in China and Japan and increasing regulatory requirements in the region are expected to drive the demand for green & bio-solvents in this application segment

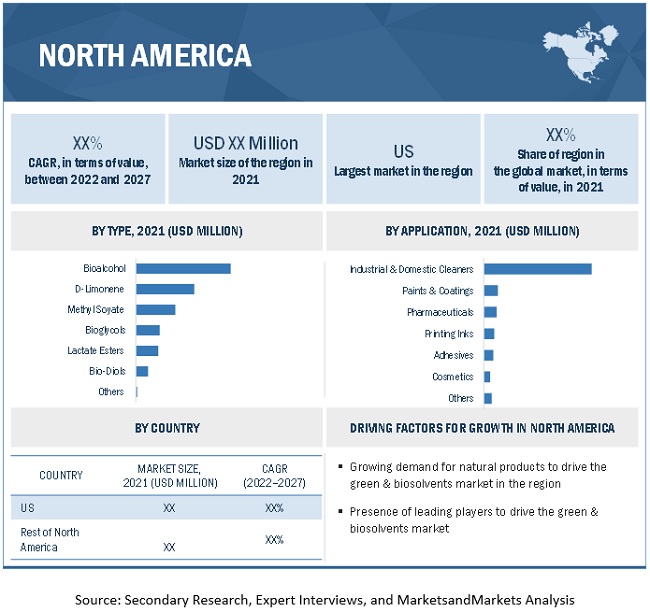

North America to account for the largest share of the global green & bio-solvents market, in terms of value, in 2021”

North America has been a strong market for green & bio-solvents. It has been a leader with respect to demand as well as product innovation in terms of quality and application development. The key countries in the North American market are the US (the most dominant market, accounting for a significant market share), Canada, and Mexico. Although a small market, Mexico has witnessed promising demand that is expected to continue in the near future. Consumer demand for greener solvents is driving the government policymakers and manufacturers to replace petrochemical-based solvents with bio-solvents in North America.

To know about the assumptions considered for the study, download the pdf brochure

Green & Bio-Solvents Market Players

The green & bio-solvents market is donimated by a few globally established players such as Archer Daniels Midland Company (US), BASF SE (Germany), Cremer Oleo GmbH & Co. KG (Germany), Solvay (Belgium), Stepan Company (US), The Dow Chemical Company (US), Corbion (Netherlands), Cargill Inc. (US), Astrobio (Italy), and GF Biochemicals (Netherlands).

Green & Bio-Solvents Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Billion), Volume (Kiloton) |

|

Segments covered |

Type, Application, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies profiled |

Archer Daniels Midland Company (US), BASF SE (Germany), Cremer Oleo (Germany), Solvay (Belgium), Stepan Company (US), Dow Inc. (US), and GF Biochemicals (Netherlands), among others Top 25 major players covered |

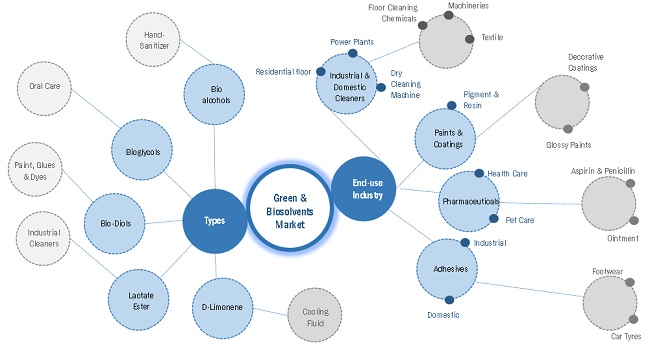

This report categorizes the global green & bio-solvents market based on type, application and region.

On the basis of type, the green & bio-solvents market has been segmented as follows

- Bio-Alcohol

- Bio-Diols

- Bio-Glycols

- Lactate Esters

- Methyl Soyate

- D-Limonene

- Others

On the basis of application, the green & bio-solvents market has been segmented as follows:

- Industrial & Domestic Cleaners

- Paints & Coatings

- Adhesives

- Printing Inks

- Pharmaceuticals

- Cosmetics

- Others

On the basis of region, the green & bio-solvents market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments:

- In November 2019, Archer Daniels Midland Company acquired Florida Chemical Company (FCC), a division of Flotek Industries (NYSE: FTK). The company produces D-Limonene, a biodegradable solvent, and degreaser extracted from the peel of oranges.

- In September 2019, Corbion extended its contract with Brenntag, a chemical and ingredients distributor in Europe and the Middle East region.

- In May 2019, DuPont Tate & Lyle Bio Products, Corbion, INOLEX, and ACT Solutions are partnering together on the production of a range of personal care product formulations with 100% bio-based content.

- In February 2020, the company announced a joint venture with Towell Engineering Group (Oman) to produce biochemicals derived from levulinic acid. The partnership called Nxtlevvel is expected to produce 30,000 metric tons per year of biodegradable solvents and plasticizers for cleaning, personal care, coatings, and agriculture markets.

Frequently Asked Questions (FAQ):

What are the high growth type of green & bio-solvents?

Bioalcohols is the largest type of green & bio-solvents in terms of both value and volume, in the global market in 2021.

Which is the largest application of green & bio-solvents?

Industrial & domestic cleaners holds the largest market share in green & bio-solvents market, in terms of both value and volume, in 2021,

What are the major factors impacting market growth during the forecast period?

The market growth is primarily impacted due to high production cost and performance issue. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 GREEN & BIOSOLVENTS MARKET: INCLUSIONS & EXCLUSIONS

1.2.2 GREEN & BIOSOLVENTS: MARKET DEFINITION AND INCLUSIONS, BY TYPE

1.2.3 GREEN & BIOSOLVENTS: MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 GREEN & BIOSOLVENTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews: Demand and supply sides

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION - APPROACH 1 (SUPPLY-SIDE): COMBINED MARKET SHARE OF MAJOR PLAYERS

FIGURE 3 MARKET SIZE ESTIMATION - BOTTOM-UP (SUPPLY SIDE): REVENUE FROM SALE OF GREEN & BIOSOLVENTS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND SIDE): PRODUCTS SOLD AND THEIR AVERAGE SELLING PRICE

2.3 DATA TRIANGULATION

FIGURE 5 GREEN & BIOSOLVENTS MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.4.1 SUPPLY SIDE

FIGURE 6 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

2.4.2 DEMAND SIDE

FIGURE 7 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 1 GREEN & BIOSOLVENTS MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 8 INDUSTRIAL & DOMESTIC CLEANERS TO DOMINATE GREEN & BIOSOLVENTS MARKET DURING FORECAST PERIOD

FIGURE 9 BIOALCOHOLS TO BE LARGEST TYPE IN OVERALL GREEN & BIOSOLVENTS MARKET

FIGURE 10 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF GREEN & BIOSOLVENTS MARKET

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN GREEN & BIOSOLVENTS MARKET

FIGURE 11 GREEN & BIOSOLVENTS MARKET TO REGISTER MODERATE GROWTH DURING FORECAST PERIOD

4.2 NORTH AMERICAN GREEN & BIOSOLVENTS MARKET, BY APPLICATION AND COUNTRY

FIGURE 12 US LED NORTH AMERICAN GREEN & BIOSOLVENTS MARKET IN 2021

4.3 GREEN & BIOSOLVENTS MARKET, BY REGION

FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING MARKET BETWEEN 2022 AND 2027

4.4 GREEN & BIOSOLVENTS MARKET, REGION VS APPLICATION

FIGURE 14 INDUSTRIAL & DOMESTIC CLEANERS ACCOUNT FOR LARGEST SHARE ACROSS REGIONS

4.5 GREEN & BIOSOLVENTS MARKET: MAJOR COUNTRIES

FIGURE 15 UK TO BE FASTEST-GROWING MARKET

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN GREEN & BIOSOLVENTS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing market penetration and need to decarbonize economy

5.2.1.2 Environmental regulations to reduce VOC emissions

5.2.1.3 Improved competitiveness from product differentiation

5.2.1.4 Uncertainty about developments in oil price

FIGURE 17 FLUCTUATIONS IN PRICE OF CRUDE OIL, 2016–2020

5.2.2 RESTRAINTS

5.2.2.1 Uncertainty about reliability and adequate supply of feedstocks

5.2.2.2 High production cost and performance issues

5.2.2.3 Availability, reliability, and cost of new technologies

5.2.3 OPPORTUNITIES

5.2.3.1 Focus of governments on bio-based products

5.2.3.2 Stringent regulations to offer high growth potential

5.2.3.3 Extensive R&D on green & biosolvents

5.2.4 CHALLENGES

5.2.4.1 Limitations of ionic solvents, deep eutectic solvents (DESs), and supercritical fluids

5.2.4.2 Securing profitability and competitiveness

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS: GREEN & BIOSOLVENTS MARKET

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 2 GREEN & BIOSOLVENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 MACROECONOMIC INDICATORS

5.4.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

TABLE 3 GDP TRENDS AND FORECAST, BY MAJOR ECONOMY, 2019–2027 (USD BILLION)

5.5 IMPACT OF COVID-19

5.5.1 INTRODUCTION

5.5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 19 COUNTRY-WISE SPREAD OF COVID-19

5.5.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 20 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2022

5.6 IMPACT OF COVID-19: CUSTOMER ANALYSIS

6 INDUSTRY TRENDS (Page No. - 62)

6.1 SUPPLY CHAIN ANALYSIS

FIGURE 21 GREEN & BIOSOLVENTS: SUPPLY CHAIN

6.1.1 RAW MATERIALS

6.1.2 MANUFACTURING OF GREEN & BIOSOLVENTS

6.1.3 DISTRIBUTION TO END USER

6.2 GREEN & BIOSOLVENTS MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

FIGURE 22 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

6.2.1 NON-COVID-19 SCENARIO

6.2.2 OPTIMISTIC SCENARIO

6.2.3 PESSIMISTIC SCENARIO

6.2.4 REALISTIC SCENARIO

6.3 SHIFT IN REVENUE STREAMS DUE TO MEGATRENDS IN END-USE INDUSTRIES

FIGURE 23 GREEN & BIOSOLVENTS MARKET: CHANGING REVENUE MIX

6.4 CONNECTED MARKETS: ECOSYSTEM

FIGURE 24 GREEN & BIOSOLVENTS MARKET: ECOSYSTEM

TABLE 4 GREEN & BIOSOLVENTS MARKET: ECOSYSTEM

6.5 CASE STUDIES

6.6 TECHNOLOGY OVERVIEW

6.7 TRADE DATA STATISTICS

FIGURE 25 GREEN & BIOSOLVENTS IMPORT, BY KEY COUNTRY (2012-2019)

FIGURE 26 GREEN & BIOSOLVENTS EXPORT, BY KEY COUNTRY (2012-2019)

TABLE 5 IMPORT OF GREEN & BIOSOLVENTS, BY REGION, 2012-2019 (USD MILLION)

TABLE 6 EXPORT OF GREEN & BIOSOLVENTS, BY REGION, 2012-2019 (USD MILLION)

6.8 KEY STAKEHOLDERS & BUYING CRITERIA

6.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP-THREE APPLICATIONS

TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

6.8.2 BUYING CRITERIA

FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 8 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

6.9 PRICING ANALYSIS

6.9.1 AVERAGE SELLING PRICES OF KEY PLAYERS, BY APPLICATION

FIGURE 29 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP-THREE APPLICATIONS

TABLE 9 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP-THREE APPLICATIONS(USD/KG)

6.9.2 AVERAGE SELLING PRICE, BY REGION

FIGURE 30 AVERAGE SELLING PRICE OF GREEN & BIOSOLVENTS, BY REGION (USD/KG)

TABLE 10 AVERAGE SELLING PRICE OF GREEN & BIOSOLVENTS, BY REGION (USD/KG)

6.1 REGULATORY LANDSCAPE

6.10.1 REGULATIONS RELATED TO GREEN & BIOSOLVENTS

6.11 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 11 GREEN & BIOSOLVENTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.12 PATENT ANALYSIS

6.12.1 APPROACH

6.12.2 DOCUMENT TYPE

TABLE 12 GRANTED PATENTS ARE 14% OF TOTAL COUNT IN LAST 11 YEARS

FIGURE 31 PATENTS REGISTERED FOR GREEN & BIOSOLVENTS MARKET 2011–2021

FIGURE 32 PATENT PUBLICATION TRENDS FOR GREEN & BIOSOLVENTS MARKET, 2011–2021

FIGURE 33 LEGAL STATUS OF PATENTS FILED FOR GREEN & BIOSOLVENTS MARKET

6.12.3 JURISDICTION ANALYSIS

FIGURE 34 MAXIMUM PATENTS FILED BY COMPANIES IN CHINA

6.12.4 TOP APPLICANTS

FIGURE 35 KALAMAZOO HOLDINGS INC. REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2011 AND 2021

TABLE 13 LIST OF PATENTS

TABLE 14 TOP 10 PATENT OWNERS IN US, 2011–2021

7 GREEN & BIOSOLVENTS MARKET, BY TYPE (Page No. - 79)

7.1 INTRODUCTION

FIGURE 36 BIOALCOHOLS SEGMENT TO LEAD GREEN & BIOSOLVENTS MARKET DURING FORECAST PERIOD

TABLE 15 GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 16 GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 17 GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 18 GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

7.2 BIOALCOHOLS

7.2.1 ENERGY SECURITY AND CONCERN OVER GREENHOUSE GAS EMISSIONS TO FUEL MARKET DEMAND

TABLE 19 BIOALCOHOLS SOLVENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 BIOALCOHOLS SOLVENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 21 BIOALCOHOLS SOLVENT MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 22 BIOALCOHOLS SOLVENT MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

TABLE 23 BIOALCOHOLS SOLVENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 24 BIOALCOHOLS SOLVENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 25 BIOALCOHOLS SOLVENT MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 26 BIOALCOHOLS SOLVENT MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

7.2.2 BIOETHANOL

7.2.2.1 Investment in R&D activities in Europe and US to drive market

TABLE 27 BIOETHANOL SOLVENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 BIOETHANOL SOLVENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 29 BIOETHANOL SOLVENT MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 30 BIOETHANOL SOLVENT MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

7.2.3 BIOMETHANOL

7.2.3.1 Reduced use of fossil fuels and reduction of greenhouse gas emissions to drive demand

TABLE 31 BIOMETHANOL SOLVENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 BIOMETHANOL SOLVENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 33 BIOMETHANOL SOLVENT MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 34 BIOMETHANOL SOLVENT MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

7.2.4 OTHER ALCOHOLS

7.2.4.1 Biopropanol

7.2.4.2 Biobutanol

TABLE 35 OTHER BIOALCOHOLS SOLVENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 OTHER BIOALCOHOLS SOLVENTS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 37 OTHER BIOALCOHOLS SOLVENTS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 38 OTHER BIOALCOHOLS SOLVENTS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

7.3 BIOGLYCOLS

7.3.1 INCREASING CONCERN OVER GREENHOUSE GAS EMISSIONS TO DRIVE MARKET

TABLE 39 BIOGLYCOLS SOLVENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 BIOGLYCOLS SOLVENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 41 BIOGLYCOLS SOLVENT MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 42 BIOGLYCOLS SOLVENT MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

7.3.2 BIOPROPYLENE GLYCOL

7.3.3 BIOETHYLENE GLYCOL

7.4 BIO-DIOLS

7.4.1 BIODEGRADABILITY IS MAJOR FACTOR DRIVING DEMAND FOR BIO-DIOLS AS SOLVENTS

TABLE 43 BIO-DIOLS SOLVENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 BIO-DIOLS SOLVENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 45 BIO-DIOLS SOLVENT MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 46 BIO-DIOLS SOLVENT MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

7.5 LACTATE ESTERS

7.5.1 ABILITY TO DISSOLVE A WIDE RANGE OF POLYURETHANE RESINS FUELS DEMAND

TABLE 47 LACTATE ESTERS SOLVENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 LACTATE ESTERS SOLVENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 49 LACTATE ESTERS SOLVENT MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 50 LACTATE ESTERS SOLVENT MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

7.6 D-LIMONENE

7.6.1 INCREASING USE IN CLEANING PRODUCTS DRIVES DEMAND

TABLE 51 D-LIMONENE SOLVENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 52 D-LIMONENE SOLVENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 53 D-LIMONENE SOLVENT MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 54 D-LIMONENE SOLVENT MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

7.7 METHYL SOYATE

7.7.1 STRINGENT REGULATIONS REGARDING USE OF PETROCHEMICAL-BASED SOLVENTS DRIVE MARKET DEMAND

TABLE 55 METHYL SOYATE SOLVENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 METHYL SOYATE SOLVENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 57 METHYL SOYATE SOLVENT MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 58 METHYL SOYATE SOLVENT MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

7.8 OTHER GREEN & BIOSOLVENTS

7.8.1 2-METHYLTETRAHYDROFURAN

TABLE 59 OTHER GREEN & BIOSOLVENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 60 OTHER GREEN & BIOSOLVENTS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 61 OTHER GREEN & BIOSOLVENTS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 62 OTHER GREEN & BIOSOLVENTS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

8 GREEN & BIOSOLVENTS MARKET, BY APPLICATION (Page No. - 100)

8.1 INTRODUCTION

FIGURE 37 INDUSTRIAL & DOMESTIC CLEANERS APPLICATION TO LEAD GREEN & BIOSOLVENTS MARKET DURING FORECAST PERIOD

TABLE 63 GREEN & BIOSOLVENTS APPLICATIONS

TABLE 64 GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 65 GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 66 GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 67 GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.2 INDUSTRIAL & DOMESTIC CLEANERS

8.2.1 INCREASED AWARENESS RELATED TO HEALTH AND HYGIENE IS FUELING MARKET DEMAND

8.2.1.1 Primary green & biosolvents used in industrial & domestic cleaners

TABLE 68 GREEN & BIOSOLVENTS MARKET SIZE IN INDUSTRIAL & DOMESTIC CLEANERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 GREEN & BIOSOLVENTS MARKET SIZE IN INDUSTRIAL & DOMESTIC CLEANERS, BY REGION, 2021–2027 (USD MILLION)

TABLE 70 GREEN & BIOSOLVENTS MARKET SIZE IN INDUSTRIAL & DOMESTIC CLEANERS, BY REGION, 2017–2020 (KILOTON)

TABLE 71 GREEN & BIOSOLVENTS MARKET SIZE IN INDUSTRIAL & DOMESTIC CLEANERS, BY REGION, 2021–2027 (KILOTON)

8.3 PAINTS & COATINGS

8.3.1 ENVIRONMENTAL REGULATIONS FOR GREENER SOLUTIONS TO DRIVE MARKET DEMAND

8.3.1.1 Primary green & biosolvents used in paints & coatings

TABLE 72 GREEN & BIOSOLVENTS MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 GREEN & BIOSOLVENTS MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2021–2027 (USD MILLION)

TABLE 74 GREEN & BIOSOLVENTS MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2017–2020 (KILOTON)

TABLE 75 GREEN & BIOSOLVENTS MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2021–2027 (KILOTON)

8.4 ADHESIVES

8.4.1 ENVIRONMENTAL REGULATIONS FOR USE OF BIOSOLVENTS IN ADHESIVE APPLICATIONS FUELS MARKET DEMAND

8.4.1.1 Primary green & biosolvents used in adhesives

TABLE 76 GREEN & BIOSOLVENTS MARKET SIZE IN ADHESIVES, BY REGION, 2017–2020 (USD MILLION)

TABLE 77 GREEN & BIOSOLVENTS MARKET SIZE IN ADHESIVES, BY REGION, 2021–2027 (USD MILLION)

TABLE 78 GREEN & BIOSOLVENTS MARKET SIZE IN ADHESIVES, BY REGION, 2017–2020 (KILOTON)

TABLE 79 GREEN & BIOSOLVENTS MARKET SIZE IN ADHESIVES, BY REGION, 2021–2027 (KILOTON)

8.5 PRINTING INKS

8.5.1 VISCOSITY CONTROL PROPERTY DRIVES MARKET SEGMENT

8.5.1.1 Primary green & biosolvents used in printing inks

TABLE 80 GREEN & BIOSOLVENTS MARKET SIZE IN PRINTING INKS, BY REGION, 2017–2020 (USD MILLION)

TABLE 81 GREEN & BIOSOLVENTS MARKET SIZE IN PRINTING INKS, BY REGION, 2021–2027 (USD MILLION)

TABLE 82 GREEN & BIOSOLVENTS MARKET SIZE IN PRINTING INKS, BY REGION, 2017–2020 (KILOTON)

TABLE 83 GREEN & BIOSOLVENTS MARKET SIZE IN PRINTING INKS, BY REGION, 2021–2027 (KILOTON)

8.6 PHARMACEUTICALS

8.6.1 INCREASING GOVERNMENT EXPENDITURE ON HEALTHCARE & PHARMACEUTICAL INDUSTRY DRIVES USE OF BIOSOLVENTS

8.6.1.1 Primary green & biosolvents used in pharmaceuticals

TABLE 84 GREEN & BIOSOLVENTS MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 85 GREEN & BIOSOLVENTS MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2021–2027 (USD MILLION)

TABLE 86 GREEN & BIOSOLVENTS MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2017–2020 (KILOTON)

TABLE 87 GREEN & BIOSOLVENTS MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2021–2027 (KILOTON)

8.7 COSMETICS

8.7.1 GROWING DEMAND FOR BIO-BASED COSMETIC PRODUCTS DRIVES DEMAND FOR GREEN & BIOSOLVENTS

8.7.1.1 Primary green & biosolvents used in cosmetics

TABLE 88 GREEN & BIOSOLVENTS MARKET SIZE IN COSMETICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 89 GREEN & BIOSOLVENTS MARKET SIZE IN COSMETICS, BY REGION, 2021–2027 (USD MILLION)

TABLE 90 GREEN & BIOSOLVENTS MARKET SIZE IN COSMETICS, BY REGION, 2017–2020 (KILOTON)

TABLE 91 GREEN & BIOSOLVENTS MARKET SIZE IN COSMETICS, BY REGION, 2021–2027 (KILOTON)

8.8 OTHERS

TABLE 92 GREEN & BIOSOLVENTS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 93 GREEN & BIOSOLVENTS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2027 (USD MILLION)

TABLE 94 GREEN & BIOSOLVENTS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (KILOTON)

TABLE 95 GREEN & BIOSOLVENTS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2027 (KILOTON)

9 GREEN & BIOSOLVENTS MARKET, BY REGION (Page No. - 117)

9.1 INTRODUCTION

FIGURE 39 ASIA PACIFIC PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 96 GREEN & BIOSOLVENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 97 GREEN & BIOSOLVENTS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 98 GREEN & BIOSOLVENTS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 99 GREEN & BIOSOLVENTS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

9.2 NORTH AMERICA

FIGURE 40 NORTH AMERICA: GREEN & BIOSOLVENTS MARKET SNAPSHOT

9.2.1 NORTH AMERICA GREEN & BIOSOLVENTS MARKET, BY TYPE

TABLE 100 NORTH AMERICA: GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 101 NORTH AMERICA: GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 102 NORTH AMERICA: GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 103 NORTH AMERICA: GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

9.2.2 NORTH AMERICA GREEN & BIOSOLVENTS MARKET, BY APPLICATION

TABLE 104 NORTH AMERICA: GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 105 NORTH AMERICA: GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 106 NORTH AMERICA: GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 107 NORTH AMERICA: GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

9.2.3 NORTH AMERICA GREEN & BIOSOLVENTS MARKET, BY COUNTRY

TABLE 108 NORTH AMERICA: GREEN & BIOSOLVENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 109 NORTH AMERICA: GREEN & BIOSOLVENTS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 110 NORTH AMERICA: GREEN & BIOSOLVENTS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 111 NORTH AMERICA: GREEN & BIOSOLVENTS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

9.2.3.1 US

9.2.3.2 Rest of North America

9.3 EUROPE

FIGURE 41 EUROPE: GREEN & BIOSOLVENTS MARKET SNAPSHOT

9.3.1 EUROPE GREEN & BIOSOLVENTS MARKET, BY TYPE

TABLE 112 EUROPE: GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 113 EUROPE: GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 114 EUROPE: GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 115 EUROPE: GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

9.3.2 EUROPE GREEN & BIOSOLVENTS MARKET, BY APPLICATION

TABLE 116 EUROPE: GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 117 EUROPE: GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 118 EUROPE: GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 119 EUROPE: GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

9.3.3 EUROPE GREEN & BIOSOLVENTS MARKET, BY COUNTRY

TABLE 120 EUROPE: GREEN & BIOSOLVENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 121 EUROPE: GREEN & BIOSOLVENTS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 122 EUROPE: GREEN & BIOSOLVENTS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 123 EUROPE: GREEN & BIOSOLVENTS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

9.3.3.1 Germany

9.3.3.2 France

9.3.3.3 Italy

9.3.3.4 Netherlands

9.3.3.5 UK

9.3.3.6 Rest of Europe

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC GREEN & BIOSOLVENTS MARKET, BY TYPE

TABLE 124 ASIA PACIFIC: GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 125 ASIA PACIFIC: GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 127 ASIA PACIFIC: GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

9.4.2 ASIA PACIFIC GREEN & BIOSOLVENTS MARKET, BY APPLICATION

TABLE 128 ASIA PACIFIC: GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 129 ASIA PACIFIC: GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 130 ASIA PACIFIC: GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 131 ASIA PACIFIC: GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

9.4.3 ASIA PACIFIC GREEN & BIOSOLVENTS MARKET, BY COUNTRY

TABLE 132 ASIA PACIFIC: GREEN & BIOSOLVENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 133 ASIA PACIFIC: GREEN & BIOSOLVENTS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 134 ASIA PACIFIC: GREEN & BIOSOLVENTS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 135 ASIA PACIFIC: GREEN & BIOSOLVENTS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

9.4.3.1 China

9.4.3.2 Japan

9.4.3.3 India

9.4.3.4 Rest of Asia Pacific

9.5 REST OF THE WORLD (ROW)

9.5.1 REST OF THE WORLD GREEN & BIOSOLVENTS MARKET, BY TYPE

TABLE 136 REST OF THE WORLD: GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 137 REST OF THE WORLD: GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 138 REST OF THE WORLD: GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 139 REST OF THE WORLD: GREEN & BIOSOLVENTS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

9.5.2 REST OF THE WORLD GREEN & BIOSOLVENTS MARKET, BY APPLICATION

TABLE 140 REST OF THE WORLD: GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 141 REST OF THE WORLD: GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 142 REST OF THE WORLD: GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 143 REST OF THE WORLD: GREEN & BIOSOLVENTS MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

9.5.3 REST OF THE WORLD GREEN & BIOSOLVENTS MARKET, BY COUNTRY

TABLE 144 REST OF THE WORLD: GREEN & BIOSOLVENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 145 REST OF THE WORLD: GREEN & BIOSOLVENTS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 146 REST OF THE WORLD: GREEN & BIOSOLVENTS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 147 REST OF THE WORLD: GREEN & BIOSOLVENTS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

9.5.3.1 Brazil

9.5.3.2 Others

10 COMPETITIVE LANDSCAPE (Page No. - 148)

10.1 INTRODUCTION

10.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 148 OVERVIEW OF STRATEGIES ADOPTED BY KEY GREEN & BIOSOLVENT MANUFACTURERS

10.3 MARKET SHARE ANALYSIS

10.3.1 RANKING OF KEY MARKET PLAYERS, 2021

FIGURE 42 RANKING OF TOP FOUR PLAYERS IN GREEN & BIOSOVENTS MARKET, 2021

10.3.2 MARKET SHARE OF KEY PLAYERS

TABLE 149 GREEN & BIOSOLVENTS MARKET: DEGREE OF COMPETITION

FIGURE 43 ARCHER DANIELS MIDLAND COMPANY WAS LEADING PLAYER IN GREEN & BIOSOLVENTS MARKET IN 2021

10.3.2.1 Archer Daniels Midland Company

10.3.2.2 BASF SE

10.3.2.3 Cremer Oleo GmbH & Co. KG

10.3.3 REVENUE ANALYSIS OF TOP THREE PLAYERS

FIGURE 44 REVENUE ANALYSIS OF KEY COMPANIES IN PAST 5 YEARS

10.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

FIGURE 45 GREEN & BIOSOLVENTS MARKET: OVERALL COMPANY FOOTPRINT

TABLE 150 GREEN & BIOSOLVENTS MARKET: TYPE FOOTPRINT

TABLE 151 GREEN & BIOSOLVENTS MARKET: APPLICATION FOOTPRINT

TABLE 152 GREEN & BIOSOLVENTS MARKET: REGION FOOTPRINT

10.5 COMPANY EVALUATION MATRIX (TIER 1)

10.5.1 STAR

10.5.2 EMERGING LEADER

FIGURE 46 COMPANY EVALUATION QUADRANT FOR GREEN & BIOSOLVENTS MARKET (TIER 1)

10.6 COMPETITIVE BENCHMARKING

TABLE 153 GREEN & BIOSOLVENTS MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 154 GREEN & BIOSOLVENTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SME

10.7 START-UP/SMES EVALUATION QUADRANT

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 STARTING BLOCKS

FIGURE 47 START-UP/SME EVALUATION QUADRANT FOR GREEN & BIOSOLVENTS MARKET

10.8 COMPETITIVE SITUATION AND TRENDS

10.8.1 DEALS

TABLE 155 GREEN & BIOSOLVENTS MARKET: DEALS (2019-2021)

10.8.2 OTHER DEVELOPMENTS

TABLE 156 GREEN & BIOSOLVENTS MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (2019-2021)

11 COMPANY PROFILE (Page No. - 162)

11.1 MAJOR PLAYERS

11.1.1 ARCHER DANIELS MIDLAND COMPANY

(Business overview, Products offered, MnM view, Key strength/right to win, Strategic choices, and Weaknesses and competitive threats)*

TABLE 157 ARCHER DANIELS MIDLAND COMPANY: BUSINESS OVERVIEW

FIGURE 48 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

TABLE 158 ARCHER DANIELS MIDLAND COMPANY: DEALS

11.1.2 BASF SE

TABLE 159 BASF SE: BUSINESS OVERVIEW

FIGURE 49 BASF SE: COMPANY SNAPSHOT

TABLE 160 BASF SE: DEALS

TABLE 161 BASF SE: OTHER DEVELOPMENTS

11.1.3 CREMER OLEO GMBH & CO. KG.

TABLE 162 CREMER OLEO GMBH & CO. KG.: BUSINESS OVERVIEW

TABLE 163 CREMER OLEO GMBH & CO. KG: OTHER DEVELOPMENTS

11.1.4 STEPAN COMPANY

TABLE 164 STEPAN COMPANY: BUSINESS OVERVIEW

FIGURE 50 STEPAN COMPANY: COMPANY SNAPSHOT

11.1.5 SOLVAY

TABLE 165 SOLVAY: BUSINESS OVERVIEW

FIGURE 51 SOLVAY: COMPANY SNAPSHOT

TABLE 166 SOLVAY: OTHER DEVELOPMENTS

11.1.6 VERTEC BIOSOLVENTS INC.

TABLE 167 VERTEC BIOSOLVENTS INC.: BUSINESS OVERVIEW

TABLE 168 VERTEC BIOSOLVENTS INC.: DEALS

11.1.7 GALACTIC

TABLE 169 GALACTIC: BUSINESS OVERVIEW

TABLE 170 GALACTIC: OTHER DEVELOPMENTS

11.1.8 CORBION

TABLE 171 CORBION: BUSINESS OVERVIEW

FIGURE 52 CORBION: COMPANY SNAPSHOT

TABLE 172 CORBION: DEALS

TABLE 173 CORBION: OTHER DEVELOPMENTS

11.1.9 GFBIOCHEMICALS

TABLE 174 GFBIOCHEMICALS: BUSINESS OVERVIEW

TABLE 175 GFBIOCHEMICALS: DEALS

11.1.10 CARGILL, INC.

TABLE 176 CARGILL INC.: BUSINESS OVERVIEW

TABLE 177 CARGILL INC.: DEALS

11.1.11 ASTROBIO

TABLE 178 ASTROBIO: BUSINESS OVERVIEW

11.1.12 THE DOW CHEMICAL COMPANY

TABLE 179 THE DOW CHEMICAL COMPANY: BUSINESS OVERVIEW

FIGURE 53 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

11.1.13 INDIA GLYCOLS LIMITED

TABLE 180 INDIA GLYCOLS LIMITED: BUSINESS OVERVIEW

FIGURE 54 INDIA GLYCOLS LIMITED: BUSINESS OVERVIEW

11.2 OTHER KEY MARKET PLAYERS

11.2.1 INDORAMA VENTURES

TABLE 181 INDORAMA VENTURES: COMPANY OVERVIEW

11.2.2 BIOMCN

TABLE 182 BIOMCN: COMPANY OVERVIEW

11.2.3 BRASKEM

TABLE 183 BRASKEM: COMPANY OVERVIEW

11.2.4 CIRCA GROUP PTY LTD.

TABLE 184 CIRCA GROUP PTY LTD: COMPANY OVERVIEW

11.2.5 ELEVANCE RENEWABLE SCIENCES, INC.

TABLE 185 ELEVANCE RENEWABLE SCIENCES, INC.: COMPANY OVERVIEW

11.2.6 METABOLIC EXPLORER

TABLE 186 METABOLIC EXPLORER: COMPANY OVERVIEW

11.2.7 LAMBIOTTE & CIE

TABLE 187 LAMBIOTTE & CIE: COMPANY OVERVIEW

11.2.8 ROQUETTE FRERES

TABLE 188 ROQUETTE FRERES: COMPANY OVERVIEW

11.2.9 ZEA2 LLC

TABLE 189 ZEA2 LLC: COMPANY OVERVIEW

11.2.10 SOYSOLV BIOSOLVENTS, LLC

TABLE 190 SOYSOLV BIOSOLVENTS, LLC: COMPANY OVERVIEW

11.2.11 SOY TECHNOLOGIES

TABLE 191 SOY TECHNOLOGIES: COMPANY OVERVIEW

11.2.12 THE SEYDEL COMPANIES INC.

TABLE 192 THE SEYDEL COMPANIES INC.: COMPANY OVERVIEW

11.2.13 CELLULAC

TABLE 193 CELLULAC: COMPANY OVERVIEW

11.2.14 WILMAR INTERNATIONAL LIMITED

TABLE 194 WILMAR INTERNATIONAL LIMITED: COMPANY OVERVIEW

11.2.15 GODAVARI BIOREFINERIES LTD.

TABLE 195 GODAVARI BIOREFINERIES LTD.: COMPANY OVERVIEW

*Details on Business overview, Products offered, MnM view, Key strength/right to win, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 200)

12.1 INTRODUCTION

12.2 LIMITATION

12.3 SOLVENTS MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.4 SOLVENTS MARKET, BY REGION

TABLE 196 SOLVENTS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 197 SOLVENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12.4.1 ASIA PACIFIC

12.4.1.1 By country

TABLE 198 ASIA PACIFIC: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 199 ASIA PACIFIC: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.2 EUROPE

12.4.2.1 By country

TABLE 200 EUROPE: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 201 EUROPE: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.3 NORTH AMERICA

12.4.3.1 By country

TABLE 202 NORTH AMERICA: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 203 NORTH AMERICA: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.4 MIDDLE EAST & AFRICA

12.4.4.1 By country

TABLE 204 MIDDLE EAST & AFRICA: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 205 MIDDLE EAST & AFRICA: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.5 SOUTH AMERICA

12.4.5.1 By country

TABLE 206 SOUTH AMERICA: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 207 SOUTH AMERICA: SOLVENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

13 APPENDIX (Page No. - 207)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

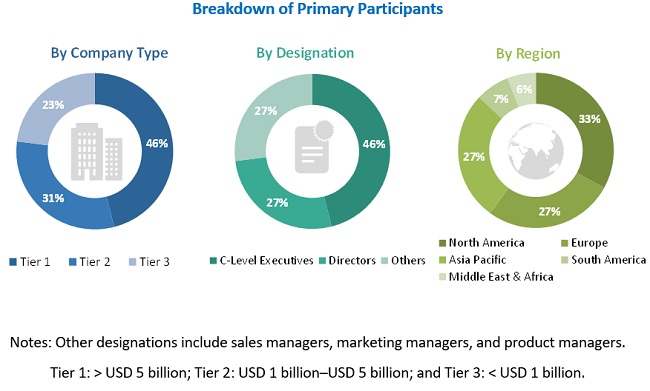

The study involved four major activities in estimating the market size for the green & bio-solvents market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The green & bio-solvents market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of paints & coatings, industrial & domestic cleaners, pharmaceutical and other industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the green & bio-solvents market.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various type of green & biosolvents.

- Several primary interviews have been conducted with key opinion leaders related to green & biosolvents manufacturing and development.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the food & beverages, pharmaceuticals & biotechnology industry among others.

Report Objectives

- To analyze and forecast the size of the green & bio-solvents market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define, describe, and segment the green & bio-solvents market based on type, and application.

- To forecast the size of the market segments for regions such as North America, Europe, Asia Pacific, and rest of the World.

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Green & Bio-solvents Market

General inquiry on pricing certeria

d-limonene market insights and its applications

Market trends for global d-limonene market