Propylene Glycol Market by Source (Petroleum-based, Bio-based), Grade (Industrial, Pharmaceutical), End-use Industry (Transportation, Building & Construction, Food & Beverage, Pharmaceuticals, Cosmetics & Personal Care), Region - Global Forecast to 2024

Updated on : April 11, 2024

Propylene Glycol Market

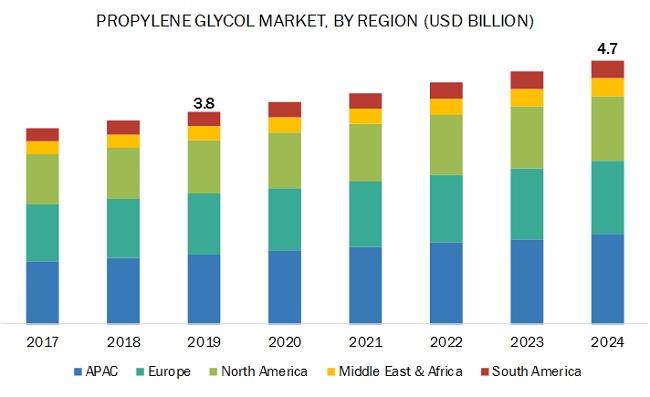

The global propylene glycol market was valued at USD 3.8 billion in 2019 and is projected to reach USD 4.7 billion by 2024, growing at 4.4% cagr from 2019 to 2024. The growing automotive industry in APAC and eco-friendly production process of bio-based propylene glycol are expected to drive the market during the forecast period.

Propylene Glycol Market Dynamics

“Bio-based propylene glycol to witness the fastest growth during the forecast period”

On basis of source, the global propylene glycol market is segented into petroleum-based and bio-based propylene glycol. Petroleum-based propylene glycol is expected to lead the global market during the forecast period, due to its growing use in the transportation and building & construction industries.

“Unsaturated polyester resin to be the largest application segment during the forecast period”

Unsaturated polyester resin is expected to dominate the global propylene glycol market during the forecast period, followed by antifreeze & functional fluids and pharmaceuticals. The growing building & construction industry, coupled with increasing investments in emerging economies for infrastructural development, is fostering the growth of the propylene glycol market in the unsaturated polyester resin application.

“Transportation to be the largest end-use industry during the forecast period”

On the basis of end-use industry, the global propylene glycol market is segmented into transportation, building & construction, food & beverage, pharmaceuticals, cosmetics & personal care, and others. Transportation is the fastest-growing end-use industry due to the growing automobile sales. The increase in the use of propylene glycols in applications, such as aircraft deicing fluid, automotive coolants, and hydraulic & brake fluids, is also driving the propylene glycol market.

“APAC to account for the largest share of the global propylene glycol market during the forecast period”

APAC is expected to account for the largest market share in the global propylene glycol market during the forecast period, in terms of both volume and value. The increasing population in the region, accompanied by increasing construction spending in the developing markets of China, India, and South Korea, is projected to make this region an ideal destination for the propylene glycol industry.

Propylene Glycol Market Players

The key market players profiled in the report include as The Dow Chemical Company (US), LyondellBasell Industries N.V. (Netherlands), BASF SE (Germany), Archer Daniels Midland Company (US), Global Bio-chem Technology Group Co., Ltd. (China), DuPont Tate & Lyle Bio Products, LLC (US), Huntsman Corporation (US), SKC Co., Ltd. (South Korea), Temix International S.R.L. (Italy), and Ineos Oxide (Switzerland).

The Dow Chemical Company (US) is one of the leading producers of propylene glycol. The company entered into an exclusive technology partnership with Evonik. They are plan to bring a unique method (HYPROSYN) for directly synthesizing propylene glycol from propylene and hydrogen peroxide. Over 100 Evonik employees worked for years to develop this method. The key element is a novel catalytic system developed by Evonik researchers, which allows direct synthesis of propylene glycol from propylene and hydrogen peroxide in a process offering high yield and comparatively low energy consumption.

LyondellBasell Industries N.V. (Netherlands) is ranked at the second position in the propylene glycol market. The company has undertaken expansion as its growth strategy in the propylene glycol market. For instance, in 2018, it announced to build the world’s largest propylene oxide (PO) and tertiary butyl alcohol (TBA) plant. The USD 2.4-billion project represents the single-largest capital investment in the company’s history. The facility will be able to produce 470,000 tpy of PO and 1 MMtpy of TBA annually.

Propylene Glycol Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2019 |

USD 3.8 billion |

|

Revenue Forecast in 2024 |

USD 4.7 billion |

|

CAGR |

4.4% |

|

Years considered for the study |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Units considered |

Value (USD Billion), Volume (Kiloton) |

|

Segments covered |

Source, Grade, End-use Industry, and Region |

|

Regions covered |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

The Dow Chemical Company (US), LyondellBasell Industries N.V. (Netherlands), BASF SE (Germany), Archer Daniels Midland Company (US), Global Bio-chem Technology Group Co., Ltd. (China), DuPont Tate & Lyle Bio Products, LLC (US), Huntsman Corporation (US), SKC Co., Ltd. (South Korea), Temix International S.R.L. (Italy), and Ineos Oxide (Switzerland), among others |

This report categorizes the global propylene glycol market based on source, grade, end-use industry, and region.

On the basis of Source, the propylene glycol market has been segmented as follows:

- Petroleum-based PG

- Bio-based PG

On the basis of Grade, the propylene glycol market has been segmented as follows:

-

Industrial Grade

- Unsaturated Polyester Resin

- Antifreeze & Functional Fluids

- Liquid Detergents

- Plasticizers

- Paints & Coatings

-

Pharmaceutical Grade

- Food & Beverage

- Pharmaceuticals

- Cosmetics

-

Other Applications

- Animal Feed

- Tobacco humectants

- Inks

- Lacquers

- Varnishes

On the basis of End-Use Industry, the propylene glycol market has been segmented as follows:

- Transportation

- Building & Construction

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

-

Others

- Paints & Coatings

- Consumer Goods

- Electronics

- Tobacco

- Textile industry

On the basis of Region, the propylene glycol market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Key Questions addressed by the report

- What are the major developments impacting the market?

- Where will all the developments take the industry in the mid to long term?

- What are the emerging end-use industries of propylene glycol?

- What are the major factors impacting the market growth during the forecast period?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 SCOPE OF THE STUDY

1.3.1 PROPYLENE GLYCOL: MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 BASE NUMBER CALCULATION

2.1.1 PRIMARY AND SECONDARY RESEARCH

2.1.2 MARKET SIZE CALCULATION BY END-USE INDUSTRY

2.1.3 MARKET SIZE CALCULATION BY SOURCE

2.2 FORECAST NUMBER CALCULATION

2.3 MARKET ENGINEERING PROCESS

2.3.1 BOTTOM-UP APPROACH

FIGURE 1 PROPYLENE GLYCOL MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 2 PROPYLENE GLYCOL MARKET: TOP-DOWN APPROACH

2.4 ASSUMPTIONS

2.5 SECONDARY DATA

2.6 PRIMARY DATA

2.6.1 BREAKDOWN OF PRIMARY INTERVIEWS

2.6.2 KEY INDUSTRY INSIGHTS

3 EXECUTIVE SUMMARY (Page No. - 28)

FIGURE 3 PETROLEUM-BASED PROPYLENE GLYCOL TO DOMINATE THE PROPYLENE GLYCOL MARKET BETWEEN 2019 AND 2024

FIGURE 4 UNSATURATED POLYESTER RESIN TO REMAIN THE LARGEST APPLICATION SEGMENT DURING THE FORECAST PERIOD

FIGURE 5 TRANSPORTATION SEGMENT TO LEAD THE PROPYLENE GLYCOL MARKET BETWEEN 2019 AND 2024

FIGURE 6 APAC TO REGISTER THE HIGHEST CAGR IN THE PROPYLENE GLYCOL MARKET

4 PREMIUM INSIGHTS (Page No. - 32)

4.1 ATTRACTIVE OPPORTUNITIES IN THE PROPYLENE GLYCOL MARKET

FIGURE 7 THE GLOBAL PROPYLENE GLYCOL MARKET TO WITNESS MODERATE GROWTH BETWEEN 2019 AND 2024

4.2 APAC PROPYLENE GLYCOL MARKET, BY SOURCE AND COUNTRY, 2018

FIGURE 8 CHINA ACCOUNTED FOR THE LARGEST MARKET SHARE

4.3 PROPYLENE GLYCOL MARKET, BY REGION

FIGURE 9 APAC TO BE THE KEY MARKET FOR PROPYLENE GLYCOL BETWEEN 2019 AND 2024

4.4 PROPYLENE GLYCOL MARKET ATTRACTIVENESS

FIGURE 10 CHINA TO BE THE FASTEST-GROWING MARKET, GLOBALLY

5 MARKET OVERVIEW (Page No. - 35)

5.1 INTRODUCTION

TABLE 1 PROPYLENE GLYCOL: PHYSICAL AND CHEMICAL PROPERTIES

5.1.1 PHARMACEUTICAL (USP/EP) GRADE

5.1.2 INDUSTRIAL GRADE

5.2 EVOLUTION

FIGURE 11 DEVELOPMENT STAGES OF PROPYLENE GLYCOL

5.3 MARKET DYNAMICS

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE PROPYLENE GLYCOL MARKET

5.3.1 DRIVERS

5.3.1.1 Growing automotive industry in APAC and the Middle East & Africa

TABLE 2 INCREASED VEHICLE SALES AND HIGHER MOTORIZATION RATE

5.3.1.2 Increasing demand for petroleum-based propylene glycol in APAC & the Middle East & Africa

TABLE 3 INDUSTRIAL GROWTH RATE OF COUNTRIES IN APAC, 2018

5.3.1.3 Rising demand for processed food in APAC

5.3.1.4 Eco-friendly production process of propylene glycol

5.3.2 RESTRAINTS

5.3.2.1 Less product differentiation of petroleum-based propylene glycols

5.3.2.2 Growth in demand for hybrid vehicles and increasing battery price parity

5.3.2.3 Huge investment requirement in R&D for bio-based propylene glycol

5.3.3 OPPORTUNITIES

5.3.3.1 Growing domestic income and rising population in emerging economies of APAC

TABLE 4 TOP 10 ECONOMIES BY GDP IN PPP TERMS, 2018

5.3.3.2 Rising demand for bio-based propylene glycol in pharmaceutical (USP/EP) grade applications

5.3.4 CHALLENGES

5.3.4.1 Volatile crude oil prices

6 INDUSTRY TRENDS (Page No. - 42)

6.1 INTRODUCTION

6.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 13 PORTER’S FIVE FORCES ANALYSIS

6.2.1 THREAT OF NEW ENTRANTS

6.2.2 THREAT OF SUBSTITUTES

6.2.3 BARGAINING POWER OF SUPPLIERS

6.2.4 BARGAINING POWER OF BUYERS

6.2.5 INTENSITY OF COMPETITIVE RIVALRY

7 PROPYLENE GLYCOL MARKET, BY SOURCE (Page No. - 45)

7.1 INTRODUCTION

FIGURE 14 PETROLEUM-BASED PROPYLENE GLYCOL TO DOMINATE THE GLOBAL MARKET

TABLE 5 PROPYLENE GLYCOL MARKET SIZE, BY SOURCE, 2017–2024 (KILOTON)

TABLE 6 PROPYLENE GLYCOL MARKET SIZE, BY SOURCE, 2017–2024 (USD MILLION)

7.2 PETROLEUM-BASED PROPYLENE GLYCOL

FIGURE 15 APAC TO BE THE LARGEST PETROLEUM-BASED PROPYLENE GLYCOL MARKET BETWEEN 2019 AND 2024

TABLE 7 PETROLEUM-BASED PROPYLENE GLYCOL MARKET SIZE, BY REGION, 2017–2024 (KILOTON)

TABLE 8 PETROLEUM-BASED PROPYLENE GLYCOL MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

7.2.1 PROPYLENE OXIDE

7.3 BIO-BASED PROPYLENE GLYCOL

FIGURE 16 NORTH AMERICA TO BE THE LARGEST BIO-BASED PROPYLENE GLYCOL MARKET

TABLE 9 BIO-BASED PROPYLENE GLYCOL MARKET SIZE, BY REGION, 2017–2024 (KILOTON)

TABLE 10 BIO-BASED PROPYLENE GLYCOL MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

7.3.1 GLYCERIN

7.3.2 SORBITOL

8 PROPYLENE GLYCOL MARKET, BY GRADE (Page No. - 51)

8.1 INTRODUCTION

TABLE 11 PROPYLENE GLYCOL: APPLICATION AND SUBSEGMENT

FIGURE 17 UNSATURATED POLYESTER RESIN APPLICATION TO LEAD THE PROPYLENE GLYCOL MARKET

TABLE 12 PROPYLENE GLYCOL MARKET SIZE, BY GRADE, 2017–2024 (KILOTON)

TABLE 13 PROPYLENE GLYCOL MARKET SIZE, BY GRADE, 2017–2024 (USD MILLION)

8.2 UNSATURATED POLYESTER RESIN

FIGURE 18 APAC TO LEAD THE PROPYLENE GLYCOL MARKET FOR UNSATURATED POLYESTER RESIN APPLICATION

TABLE 14 PROPYLENE GLYCOL MARKET SIZE IN UNSATURATED POLYESTER RESIN APPLICATION, BY REGION, 2017–2024 (KILOTON)

TABLE 15 PROPYLENE GLYCOL MARKET SIZE IN UNSATURATED POLYESTER RESIN APPLICATION, BY REGION, 2017–2024 (USD MILLION)

8.2.1 REINFORCED THERMOSET

8.2.1.1 Reinforced plastic laminates

8.2.1.2 Sheet molding compounds

8.2.1.3 Electronic components

8.2.2 NON-REINFORCED THERMOSET

8.2.2.1 Synthetic marble casting

8.2.2.2 Gel coats

8.3 ANTIFREEZE & FUNCTIONAL FLUIDS

FIGURE 19 EUROPE TO LEAD THE PROPYLENE GLYCOL MARKET IN ANTIFREEZE & FUNCTIONAL FLUIDS APPLICATION

TABLE 16 PROPYLENE GLYCOL MARKET SIZE IN ANTIFREEZE & FUNCTIONAL FLUIDS APPLICATION, BY REGION, 2017–2024 (KILOTON)

TABLE 17 PROPYLENE GLYCOL MARKET SIZE IN ANTIFREEZE & FUNCTIONAL FLUIDS APPLICATION, BY REGION, 2017–2024 (USD MILLION)

8.3.1 AUTOMOTIVE COOLANTS

8.3.2 HYDRAULIC & BRAKE FLUID

8.3.3 AIRCRAFT DEICING FLUID

8.3.4 HEAT TRANSFER FLUID

8.4 LIQUID DETERGENTS

FIGURE 20 APAC TO DOMINATE THE MARKET IN THE LIQUID DETERGENTS APPLICATION

TABLE 18 PROPYLENE GLYCOL MARKET SIZE IN LIQUID DETERGENTS APPLICATION, BY REGION, 2017–2024 (KILOTON)

TABLE 19 PROPYLENE GLYCOL MARKET SIZE IN LIQUID DETERGENTS APPLICATION, BY REGION, 2017–2024 (USD MILLION)

8.4.1 HOUSEHOLD & DISHWASHING

8.4.2 INDUSTRIAL SOAPS & CLEANING FLUIDS

8.5 PLASTICIZERS

FIGURE 21 APAC TO BE THE LARGEST PROPYLENE GLYCOL MARKET IN THE PLASTICIZERS APPLICATION

TABLE 20 PROPYLENE GLYCOL MARKET SIZE IN PLASTICIZERS APPLICATION, BY REGION, 2017–2024 (KILOTON)

TABLE 21 PROPYLENE GLYCOL MARKET SIZE IN PLASTICIZERS APPLICATION, BY REGION, 2017–2024 (USD MILLION)

8.5.1 CELLOPHANE FILM

8.5.2 PHENOLIC RESIN

8.6 PAINTS & COATINGS

FIGURE 22 APAC TO BE THE LARGEST PROPYLENE GLYCOL MARKET IN THE PAINTS & COATINGS APPLICATION

TABLE 22 PROPYLENE GLYCOL MARKET SIZE IN PAINTS & COATINGS APPLICATION, BY REGION, 2017–2024 (KILOTON)

TABLE 23 PROPYLENE GLYCOL MARKET SIZE IN PAINTS & COATINGS APPLICATION, BY REGION, 2017–2024 (USD MILLION)

8.7 FOOD & BEVERAGE

FIGURE 23 APAC TO BE THE LARGEST PROPYLENE GLYCOL MARKET FOR FOOD & BEVERAGE APPLICATION

TABLE 24 PROPYLENE GLYCOL MARKET SIZE IN FOOD & BEVERAGE APPLICATION, BY REGION, 2017–2024 (KILOTON)

TABLE 25 PROPYLENE GLYCOL MARKET SIZE IN FOOD & BEVERAGE APPLICATION, BY REGION, 2017–2024 (USD MILLION)

8.7.1 DAIRIES

8.8 PHARMACEUTICALS

FIGURE 24 APAC TO BE THE LARGEST PROPYLENE GLYCOL MARKET IN PHARMACEUTICALS APPLICATION

TABLE 26 PROPYLENE GLYCOL MARKET SIZE IN PHARMACEUTICALS APPLICATION, BY REGION, 2017–2024 (KILOTON)

TABLE 27 PROPYLENE GLYCOL MARKET SIZE IN PHARMACEUTICALS APPLICATION, BY REGION, 2017–2024 (USD MILLION)

8.8.1 DENTAL CARE

8.8.2 THERAPEUTIC DRUGS AND MEDICINES

8.9 COSMETICS

FIGURE 25 APAC TO BE THE LARGEST PROPYLENE GLYCOL MARKET IN COSMETICS & PERSONAL CARE APPLICATION

TABLE 28 PROPYLENE GLYCOL MARKET SIZE IN COSMETICS & PERSONAL CARE APPLICATION, BY REGION, 2017–2024 (KILOTON)

TABLE 29 PROPYLENE GLYCOL MARKET SIZE IN COSMETICS & PERSONAL CARE APPLICATION, BY REGION, 2017–2024 (USD MILLION)

8.9.1 SKINCARE

8.10 OTHER APPLICATIONS

FIGURE 26 NORTH AMERICA TO LEAD THE PROPYLENE GLYCOL MARKET IN OTHER APPLICATIONS

TABLE 30 PROPYLENE GLYCOL MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2024 (KILOTON)

TABLE 31 PROPYLENE GLYCOL MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2024 (USD MILLION)

9 PROPYLENE GLYCOL MARKET, BY END-USE INDUSTRY (Page No. - 72)

9.1 INTRODUCTION

FIGURE 27 TRANSPORTATION INDUSTRY TO LEAD THE PROPYLENE GLYCOL MARKET DURING 2019–2024

TABLE 32 PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (KILOTON)

TABLE 33 PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD MILLION)

9.2 TRANSPORTATION

FIGURE 28 APAC TO BE LARGEST PROPYLENE GLYCOL MARKET IN THE TRANSPORTATION SECTOR DURING THE FORECAST PERIOD

TABLE 34 PROPYLENE GLYCOL MARKET SIZE IN TRANSPORTATION INDUSTRY, BY REGION, 2017–2024 (KILOTON)

TABLE 35 PROPYLENE GLYCOL MARKET SIZE IN TRANSPORTATION INDUSTRY, BY REGION, 2017–2024 (USD MILLION)

9.2.1 AUTOMOTIVE

9.2.2 AEROSPACE

9.2.3 MARINE

9.3 BUILDING & CONSTRUCTION

FIGURE 29 APAC TO LEAD THE PROPYLENE GLYCOL MARKET IN BUILDING & CONSTRUCTION BETWEEN 2019 AND 2024

TABLE 36 PROPYLENE GLYCOL MARKET SIZE IN BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2017–2024 (KILOTON)

TABLE 37 PROPYLENE GLYCOL MARKET SIZE IN BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2017–2024 (USD MILLION)

9.4 FOOD & BEVERAGE

FIGURE 30 EUROPE TO BE LARGEST CONSUMER OF PROPYLENE GLYCOL MARKET IN FOOD & BEVERAGE APPLICATION

TABLE 38 PROPYLENE GLYCOL MARKET SIZE IN FOOD & BEVERAGE INDUSTRY, BY REGION, 2017–2024 (KILOTON)

TABLE 39 PROPYLENE GLYCOL MARKET SIZE IN FOOD & BEVERAGE INDUSTRY, BY REGION, 2017–2024 (USD MILLION)

9.5 PHARMACEUTICALS

FIGURE 31 NORTH AMERICA TO BE LARGEST PROPYLENE GLYCOL MARKET IN PHARMACEUTICALS INDUSTRY BETWEEN 2019 AND 2024

TABLE 40 PROPYLENE GLYCOL MARKET SIZE IN PHARMACEUTICALS INDUSTRY, BY REGION, 2017–2024 (KILOTON)

TABLE 41 PROPYLENE GLYCOL MARKET SIZE IN PHARMACEUTICALS INDUSTRY, BY REGION, 2017–2024 (USD MILLION)

9.6 COSMETICS & PERSONAL CARE

FIGURE 32 EUROPE TO BE LARGEST PROPYLENE GLYCOL MARKET IN COSMETICS & PERSONAL CARE INDUSTRY BETWEEN 2019 AND 2024

TABLE 42 PROPYLENE GLYCOL MARKET SIZE IN COSMETICS & PERSONAL CARE INDUSTRY, BY REGION, 2017–2024 (KILOTON)

TABLE 43 PROPYLENE GLYCOL MARKET SIZE IN COSMETICS & PERSONAL CARE INDUSTRY, BY REGION, 2017–2024 (USD MILLION)

9.7 OTHERS

FIGURE 33 APAC TO LEAD THE PROPYLENE GLYCOL MARKET IN OTHER END-USE INDUSTRIES DURING THE FORECAST PERIOD

TABLE 44 PROPYLENE GLYCOL MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017–2024 (KILOTON)

TABLE 45 PROPYLENE GLYCOL MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017–2024 (USD MILLION)

10 PROPYLENE GLYCOL MARKET, BY REGION (Page No. - 84)

10.1 INTRODUCTION

FIGURE 34 APAC TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 46 PROPYLENE GLYCOL MARKET SIZE, BY REGION, 2017–2024 (KILOTON)

TABLE 47 PROPYLENE GLYCOL MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

10.2 APAC

FIGURE 35 APAC: PROPYLENE GLYCOL MARKET SNAPSHOT

TABLE 48 APAC: PROPYLENE GLYCOL MARKET SIZE, BY COUNTRY, 2017–2024 (KILOTON)

TABLE 49 APAC: PROPYLENE GLYCOL MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 50 APAC: PROPYLENE GLYCOL MARKET SIZE, BY SOURCE, 2017–2024 (KILOTON)

TABLE 51 APAC: PROPYLENE GLYCOL MARKET SIZE, BY SOURCE, 2017–2024 (USD MILLION)

TABLE 52 APAC: PROPYLENE GLYCOL MARKET SIZE, BY GRADE, 2017–2024 (KILOTON)

TABLE 53 APAC: PROPYLENE GLYCOL MARKET SIZE, BY GRADE, 2017–2024 (USD MILLION)

TABLE 54 APAC: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (KILOTON)

TABLE 55 APAC: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD MILLION)

10.2.1 CHINA

10.2.1.1 Leading global companies are focusing on expanding their businesses in the country

TABLE 56 CHINA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 57 CHINA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.2.2 INDIA

10.2.2.1 The growing manufacturing sector is driving the demand for propylene glycol

TABLE 58 INDIA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 59 INDIA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.2.3 JAPAN

10.2.3.1 The country is known for advanced technology and innovation-driven approach across all the sectors

TABLE 60 JAPAN: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 61 JAPAN: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.2.4 SOUTH KOREA

10.2.4.1 South Korea has one of the largest automotive industries in the world

TABLE 62 SOUTH KOREA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 63 SOUTH KOREA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.2.5 AUSTRALIA & NEW ZEALAND

10.2.5.1 The rapid development of the country, supported by viable economic policies, is helping in the market growth

TABLE 64 AUSTRALIA & NEW ZEALAND: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 65 AUSTRALIA & NEW ZEALAND: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.3 NORTH AMERICA

FIGURE 36 NORTH AMERICA: PROPYLENE GLYCOL MARKET SNAPSHOT

TABLE 66 NORTH AMERICA: PROPYLENE GLYCOL MARKET SIZE, BY COUNTRY, 2017–2024 (KILOTON)

TABLE 67 NORTH AMERICA: PROPYLENE GLYCOL MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 68 NORTH AMERICA: PROPYLENE GLYCOL MARKET SIZE, BY SOURCE, 2017–2024 (KILOTON)

TABLE 69 NORTH AMERICA: PROPYLENE GLYCOL MARKET SIZE, BY SOURCE, 2017–2024 (USD MILLION)

TABLE 70 NORTH AMERICA: PROPYLENE GLYCOL MARKET SIZE, BY GRADE, 2017–2024 (KILOTON)

TABLE 71 NORTH AMERICA: PROPYLENE GLYCOL MARKET SIZE, BY GRADE, 2017–2024 (USD MILLION)

TABLE 72 NORTH AMERICA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (KILOTON)

TABLE 73 NORTH AMERICA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD MILLION)

10.3.1 US

10.3.1.1 The presence of major oil & gas giants in the country are driving the market for propylene glycol

TABLE 74 US: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 75 US: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.3.2 CANADA

10.3.2.1 The market in the country is witnessing strong competition from that in the emerging economies of APAC and the Middle East

TABLE 76 CANADA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 77 CANADA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.3.3 MEXICO

10.3.3.1 Booming industrialization and rising population are expected to increase the demand for propylene glycol

TABLE 78 MEXICO: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 79 MEXICO: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.4 EUROPE

FIGURE 37 EUROPE: PROPYLENE GLYCOL MARKET SNAPSHOT

TABLE 80 EUROPE: PROPYLENE GLYCOL MARKET SIZE, BY COUNTRY, 2017–2024 (KILOTON)

TABLE 81 EUROPE: PROPYLENE GLYCOL MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 82 EUROPE: PROPYLENE GLYCOL MARKET SIZE, BY SOURCE, 2017–2024 (KILOTON)

TABLE 83 EUROPE: PROPYLENE GLYCOL MARKET SIZE, BY SOURCE, 2017–2024 (USD MILLION)

TABLE 84 EUROPE: PROPYLENE GLYCOL MARKET SIZE, BY GRADE, 2017–2024 (KILOTON)

TABLE 85 EUROPE: PROPYLENE GLYCOL MARKET SIZE, BY GRADE, 2017–2024 (USD MILLION)

TABLE 86 EUROPE: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (KILOTON)

TABLE 87 EUROPE: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD MILLION)

10.4.1 RUSSIA

10.4.1.1 Growing automobile industry is positively influencing the propylene glycol market in Russia

TABLE 88 RUSSIA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 89 RUSSIA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.4.2 GERMANY

10.4.2.1 The growing automotive industry is expected to drive the demand for propylene glycol

TABLE 90 GERMANY: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 91 GERMANY: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.4.3 UK

10.4.3.1 The government’s plans for infrastructure spending are expected to drive the propylene glycol market

TABLE 92 UK: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 93 UK: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.4.4 FRANCE

10.4.4.1 All the major end-use industries of propylene glycol are growing in the country

TABLE 94 FRANCE: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 95 FRANCE: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.4.5 ITALY

10.4.5.1 Complete economic recovery is expected to fuel the market in the future

TABLE 96 ITALY: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 97 ITALY: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.4.6 SPAIN

10.4.6.1 Spain exports a significant percentage of vehicles produced in the country

TABLE 98 SPAIN: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 99 SPAIN: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.4.7 ADDITIONAL CUSTOMIZATION (INCLUDING COVID-19 IMPACT ON SPECIFIC COUNTRIES)

10.4.7.1 Netherlands

TABLE 100 NETHERLANDS PROPYLENE GLYCOL MARKET SIZE, 2018–2025

10.4.7.2 Belgium

TABLE 101 BELGIUM PROPYLENE GLYCOL MARKET SIZE, 2018–2025

10.5 MIDDLE EAST & AFRICA

TABLE 102 MIDDLE EAST & AFRICA: PROPYLENE GLYCOL MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 103 MIDDLE EAST & AFRICA: PROPYLENE GLYCOL MARKET SIZE, BY COUNTRY, 2017–2024 (KILOTON)

TABLE 104 MIDDLE EAST & AFRICA: PROPYLENE GLYCOL MARKET SIZE, BY SOURCE, 2017–2024 (KILOTON)

TABLE 105 MIDDLE EAST & AFRICA: PROPYLENE GLYCOL MARKET SIZE, BY SOURCE, 2017–2024 (USD MILLION)

TABLE 106 MIDDLE EAST & AFRICA: PROPYLENE GLYCOL MARKET SIZE, BY GRADE, 2017–2024 (KILOTON)

TABLE 107 MIDDLE EAST & AFRICA: PROPYLENE GLYCOL MARKET SIZE, BY GRADE, 2017–2024 (USD MILLION)

TABLE 108 MIDDLE EAST & AFRICA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (KILOTON)

TABLE 109 MIDDLE EAST & AFRICA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD MILLION)

10.5.1 SOUTH AFRICA

10.5.1.1 The country is witnessing increased demand for automobiles, which is aiding the propylene glycol market

TABLE 110 SOUTH AFRICA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 111 SOUTH AFRICA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.5.2 TURKEY

10.5.2.1 As one of the newly industrialized countries, Turkey has immense opportunities for market growth

TABLE 112 TURKEY: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 113 TURKEY: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.5.3 IRAN

10.5.3.1 Government expenditure on infrastructural growth is helpful for market growth

TABLE 114 IRAN: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 115 IRAN: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.6 SOUTH AMERICA

TABLE 116 SOUTH AMERICA: PROPYLENE GLYCOL MARKET SIZE, BY COUNTRY, 2017–2024 (KILOTON)

TABLE 117 SOUTH AMERICA: PROPYLENE GLYCOL MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 118 SOUTH AMERICA: PROPYLENE GLYCOL MARKET SIZE, BY SOURCE, 2017–2024 (KILOTON)

TABLE 119 SOUTH AMERICA: PROPYLENE GLYCOL MARKET SIZE, BY SOURCE, 2017–2024 (USD MILLION)

TABLE 120 SOUTH AMERICA: PROPYLENE GLYCOL MARKET SIZE, BY GRADE, 2017–2024 (KILOTON)

TABLE 121 SOUTH AMERICA: PROPYLENE GLYCOL MARKET SIZE, BY GRADE, 2017–2024 (USD MILLION)

TABLE 122 SOUTH AMERICA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (KILOTON)

TABLE 123 SOUTH AMERICA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD MILLION)

10.6.1 BRAZIL

10.6.1.1 Rapidly expanding economy stimulated by increasing investments is expected to drive the demand for propylene glycol

TABLE 124 BRAZIL: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 125 BRAZIL: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

10.6.2 ARGENTINA

10.6.2.1 The growing construction industry is expected to drive the demand for propylene glycol

TABLE 126 ARGENTINA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (TON)

TABLE 127 ARGENTINA: PROPYLENE GLYCOL MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD THOUSAND)

11 COMPETITIVE LANDSCAPE (Page No. - 132)

11.1 OVERVIEW

11.2 COMPETITIVE LEADERSHIP MAPPING (OVERALL MARKET)

11.2.1 INNOVATORS

11.2.2 VISIONARY LEADERS

FIGURE 38 PROPYLENE GLYCOL MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2018

11.3 STRENGTH OF PRODUCT PORTFOLIO (10 PLAYERS)

FIGURE 39 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN PROPYLENE GLYCOL MARKET (GLOBAL)

11.4 BUSINESS STRATEGY EXCELLENCE (10 PLAYERS)

FIGURE 40 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN PROPYLENE GLYCOL MARKET (GLOBAL)

11.5 COMPETITIVE LEADERSHIP MAPPING (SMSE)

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 DYNAMIC COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 41 PROPYLENE GLYCOL MARKET (SMSE) COMPETITIVE LEADERSHIP MAPPING, 2018

11.6 STRENGTH OF PRODUCT PORTFOLIO (16 PLAYERS)

FIGURE 42 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN PROPYLENE GLYCOL MARKET (SMSE)

11.7 BUSINESS STRATEGY EXCELLENCE (16 PLAYERS)

FIGURE 43 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN PROPYLENE GLYCOL MARKET (SMSE)

FIGURE 44 EXPANSION IS THE MOST PREFERRED GROWTH STRATEGY ADOPTED BY MAJOR PLAYERS BETWEEN 2017 AND 2019

11.8 MARKET SHARE OF KEY PLAYERS

FIGURE 45 PROPYLENE GLYCOL MARKET SHARE, BY COMPANY, 2018

11.8.1 THE DOW CHEMICAL COMPANY (US)

11.8.2 LYONDELLBASEDLL INDUSTRIES N.V. (NETHERLANDS)

11.8.3 GLOBAL BIO-CHEM TECHNOLOGY GROUP CO., LTD. (CHINA)

11.8.4 INEOS OXIDE (SWITZERLAND)

11.9 COMPETITIVE SITUATIONS AND TRENDS

11.9.1 EXPANSIONS

TABLE 128 EXPANSIONS, 2017–2018

11.9.2 PARTNERSHIPS

TABLE 129 PARTNERSHIPS, 2018–2019

11.9.3 CONTRACTS & AGREEMENTS

TABLE 130 CONTRACTS & AGREEMENTS, 2019

12 COMPANY PROFILES (Page No. - 143)

(Business Overview, Products, Key Insights, Recent Developments, Winning imperatives, MnM View)*

12.1 THE DOW CHEMICAL COMPANY

FIGURE 46 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 47 THE DOW CHEMICAL COMPANY: WINNING IMPERATIVES

12.2 LYONDELLBASELL INDUSTRIES N.V.

FIGURE 48 LYONDELLBASELL INDUSTRIES N.V.: COMPANY SNAPSHOT

FIGURE 49 LYONDELLBASELL INDUSTRIES N.V.: WINNING IMPERATIVES

12.3 ARCHER DANIELS MIDLAND COMPANY (ADM)

FIGURE 50 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

FIGURE 51 ARCHER DANIELS MIDLAND COMPANY: WINNING IMPERATIVES

12.4 BASF SE

FIGURE 52 BASF SE: COMPANY SNAPSHOT

FIGURE 53 BASF SE: WINNING IMPERATIVES

12.5 HUNTSMAN CORPORATION

FIGURE 54 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

FIGURE 55 HUNTSMAN CORPORATION: WINNING IMPERATIVES

12.6 GLOBAL BIO-CHEM TECHNOLOGY GROUP CO., LTD.

FIGURE 56 GLOBAL BIO-CHEM TECHNOLOGY GROUP CO., LTD.: COMPANY SNAPSHOT

12.7 SKC CO., LTD.

FIGURE 57 SKC CO., LTD.: COMPANY SNAPSHOT

12.8 DUPONT TATE & LYLE BIO PRODUCTS, LLC

12.9 ROYAL DUTCH SHELL PLC.

FIGURE 58 ROYAL DUTCH SHELL PLC.: COMPANY SNAPSHOT

12.10 TEMIX OLEO S.R.L.

12.11 OTHER KEY MARKET PLAYERS

12.11.1 INEOS OXIDE (SWITZERLAND)

12.11.2 ASAHI GLASS CO., LTD. (JAPAN)

12.11.3 ADEKA CORPORATION (JAPAN)

12.11.4 MANALI PETROCHEMICALS LIMITED (INDIA)

12.11.5 QINGDAO SHIDA CHEMICAL CO., LTD. (CHINA)

12.11.6 TONGLING JINTAI CHEMICAL INDUSTRIAL CO., LTD. (CHINA)

12.11.7 DONGYING HI-TECH SPRING CHEMICAL INDUSTRIAL CO., LTD. (CHINA)

12.11.8 SHANDONG DEPU CHEMICAL INDUSTRY SCIENCE AND TECHNOLOGY CO., LTD (CHINA) 168

12.11.9 CHAOYANG CHEMICALS, INC. (U.S.)

12.11.10 OLEON NV (BELGIUM)

12.11.11 GOLDEN DYECHEM (INDIA)

12.11.12 HAIKE CHEMICAL GROUP (CHINA)

12.11.13 HELM AG (GERMANY)

12.11.14 OXYDE BELGIUM B.V. (BELGIUM)

12.11.15 ARROW CHEMICAL GROUP CORP. (CHINA)

12.11.16 TRINTERNATIONAL, INC. (US)

*Details on Business Overview, Products, Key Insights, Recent Developments, Winning imperatives, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 170)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

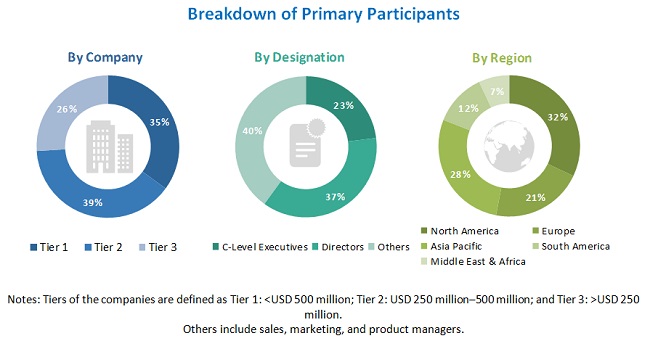

The study involved four major activities in estimating the market size for propylene glycol. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The propylene glycol market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by end-use industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the propylene glycol market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of propylene glycol.

Report Objectives

- To analyze and forecast the size of the propylene glycol market in terms of value and volume

- To provide detailed information regarding key factors—drivers, restraints, opportunities, and challenges—influencing the growth of the market

- To define, describe, and segment the propylene glycol market based on source, grade, and end-use industry

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country, additional end-use industry, and/or type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Propylene Glycol Market