Hermetic Packaging Market with COVID-19 impact by Configuration (Multilayer Ceramic Packages, Metal Can Packages, Pressed Ceramic Packages), Type (Ceramic-Metal Sealing, Glass-Metal Sealing), Application, Industry, and Region - Global Forecast to 2025

Updated on : October 17 , 2023

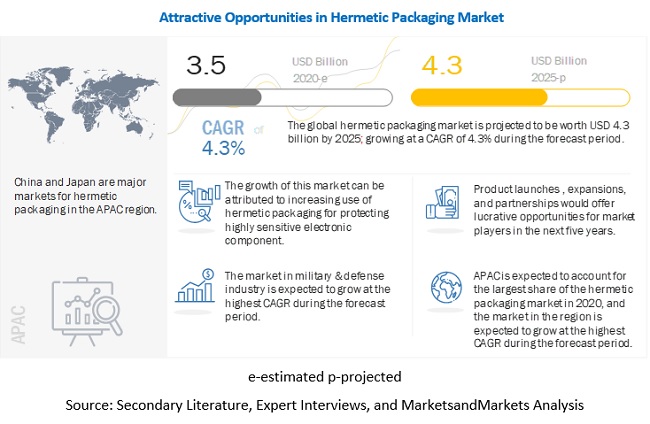

The Hermetic Packaging Market Size is expected to grow from USD 3.5 billion in 2020 to USD 4.3 billion by 2025 at a CAGR of 4.3%. The market growth is fueled by the increasing use of hermetic packaging industry for protecting highly sensitive electronic components and rising demand from industries such as aerospace and automotive electronics.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Hermetic Packaging Market

The recent outbreak of COVID-19 has affected the capacities and financial conditions of hermetic packaging providers. The pandemic has resulted in a widespread health crisis, which is adversely affecting the financial markets and economies of countries and the end-use industries for hermetic packaged products. This is expected to lead to an economic downturn and is expected to affect the demand for hermetically packaged electronic components negatively. The overall long-term impact of COVID-19 on the hermetic packaging market is expected to depend upon various factors such as global spread and duration of the pandemic, the actions taken by various government authorities worldwide in response to the pandemic, and the severity of the disease.

Hermetic Packaging Market Dynamics

Driver: Increasing use of hermetic packaging for protecting highly sensitive electronic components

Hermetic products protect against various environmental conditions such as soil/grime, humidity/moisture, changes in atmospheric pressure, and other natural hazards that could otherwise damage delicate electronics or disrupt electrical connections within hermetic products. Product applications whose disrupted functionality could result in catastrophic outcomes and are susceptible to harsh environmental conditions need to be hermetically packaged. Owing to this, the rate of adoption of hermetic packaging for protecting highly sensitive electronic components is significantly high and is expected to increase further during the forecast period. This is among the key factors driving the hermetic packaging market.

Restraint: Stringent leak rate requirements for hermetic packaging

Microelectronic components used in military, aerospace and medical devices are required to meet the toughest regulations for hermetic packaging primarily because of their harsh environments and critical applications. The tightening of standards compels companies to buy new leak test equipment as older equipment does not have the required sensitivity to test according to the new standards. Hermetic packaging providers need to adhere to such standards to increase their market share at the expense of increased expenditure. These stringent standards for hermetic packaging are expected to restrain the growth of the market.

Opportunity: Adoption of hermetic packaging for the protection of implantable medical devices

Modern microtechnology has led to the significant miniaturization of smart devices, despite an increasing level of complexity and integration. Therefore, reliable, compact packaging of microelectronics is increasingly becoming important. For life-critical devices such as implantable medical devices, the package must provide a high-quality hermetic environment to protect the device from the human body. The miniaturization of next-generation implantable medical devices is expected to create further opportunities to develop new packaging methods.

Challenge: Emergence of quasi-hermetic packaging

The near hermetic package is made from polymeric materials as opposed to metals, ceramics, and glasses. These are also known by other names such as quasi-hermetic or not quite hermetic or almost hermetic. These packaging methods hold the promise of reliable substitutes for hermetic packaging if manufactured, designed, and tested properly. Owing to the benefits of near-hermetic packaging such as lower cost, lighter weight, and size, coupled with the expected increase in production and the development of standardization, it is expected to be used in lieu of hermetic packaging during the forecast period, especially for products that do not have a high cost of system failure relative to the packaging costs.

The market for multilayer ceramic packages to grow at the highest CAGR from 2020 to 2025

Multilayer ceramic packages are most suitable for packaging complex electronic circuits, such as microelectromechanical systems (MEMS). They are also referred to as solder seal packages as they are designed by soldering a metal lid onto the metalized and plated seal ring. The ability of multilayer ceramic packages to offer better hermeticity compared with other configurations for high-frequency applications such as data communication, wireless communication, and optical communication is the key factor driving the multilayer ceramic packages market.

Hermetic packaging market for military & defense to exhibit high growth during the forecast period

The military & defense industry majorly requires customized solutions for air surveillance and underwater surveillance. Given the demand for high-quality standards and reliable performance of the electronic components used in this industry, the adoption of hermetically packaged components is critical. The hermetic packaging technology is highly trusted and dependable for users in the military & defense industry as it helps in addressing distinctive challenges related to safety and absolute reliability that are inherent in applications such as air surveillance and underwater surveillance.

To know about the assumptions considered for the study, download the pdf brochure

The hermetic packaging market in APAC to grow at highest CAGR during the forecast period

Asia Pacific is the fastest-growing market for hermetic packaging across the world, led by China, Japan, South Korea, India, and Taiwan. Increasing energy needs, emerging economies, and increasing defense spending are some of the factors driving the growth of this market in the region. The rising military capabilities of emerging economies such as China, India, and South Korea are boosting the demand for hermetic packaging for sensitive electronic components. Increasing energy needs backed by high GDP growth rates in emerging countries such as China and India are creating opportunities for manufacturers of hermetically packaged components in the Asia Pacific.

Key Market Players

As of 2019, SCHOTT (Germany), AMETEK, Inc. (US), Amkor Technology, Inc. (US), Texas Instruments Incorporated (US), Teledyne Technologies (US), Kyocera Corporation (Japan), Materion Corporation (US), Egide (France), Micross Components Inc. (US), and Legacy Technologies Inc. (US) were the major players in the hermetic packaging market. The study includes an in-depth competitive analysis of these key players in market with their company profiles, recent developments, and key market strategies.

Hermetic Packaging Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 3.5 billion in 2020 |

| Projected Market Size | USD 4.3 billion by 2025 |

| Growth Rate | CAGR of 4.3% |

|

Years considered |

2016–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD million/billion) |

|

Segments covered |

Configuration, type, application, and industry |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

SCHOTT (Germany), AMETEK, Inc. (US), Amkor Technology, Inc. (US), Texas Instruments Incorporated (US), Teledyne Technologies (US), Kyocera Corporation (Japan), Materion Corporation (US), Egide (France), Micross Components Inc. (US), Legacy Technologies Inc. (US), Willow Technologies (UK), Renesas Electronics Corporation (US), SGA Technologies (UK), Complete Hermetics (US), Special Hermetic Products Inc. (US), Coat-X (Switzerland), Hermetics Solutions Group (US), StratEdge (US), Bel Fuse, Inc., ITT Inc. (US), Rosenberger (Germany), Mackin Technologies (US), Palomar Technologies (US), CeramTec (Germany), Aptiv PLC - Winchester Interconnect (Ireland). |

In this report, the overall hermetic packaging market has been segmented based on configuration, type, application, industry, and region.

By Configuration:

- Multilayer Ceramic Packages

- Pressed Ceramic Packages

- Metal Can Packages

By Type:

- Passivation Glass

- Reed Glass

- Transponder Glass

- Glass-Metal Sealing (GTMS)

- Ceramic-Metal Sealing (CERTM)

By Application:

- Transistors

- Sensors

- Lasers

- Airbag Ignitors

- Photo Diodes

- Oscillating Crystals

- MEMS Switch

- Others

By Industry:

- Military & Defense

- Aeronautics & Space

- Automotive

- Energy & Nuclear Safety

- Medical

- Telecommunication

- Consumer Electronics

- Others

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- South Korea

- Taiwan

- India

- Rest of APAC

-

Rest of the World (RoW)

- South America

- Middle East and Africa

Recent Developments

- In August 2019, KYOCERA Corporation inaugurated its new Minato Mirai Research Center in Yokohama, Kanagawa Prefecture, Japan. The center was created with the aim of promoting open innovation and the development of new business and technologies.

- In June 2019, SCHOTT launched new SCHOTT HEATAN feedthroughs to expand its hermetic sensor packaging portfolio. SCHOTT HEATAN feedthroughs can perform reliably in corrosive, high-heat environments beyond 1000°C.

- In February 2019, AMETEK Coining—a unit of AMETEK’s Electronic Components and Packaging division launched the Copper-Core Connect—a cost-effective, innovative alternative to thick solder preforms that are used in high-performance electronic packaging.

- In July 2018, SCHOTT signed an agreement to acquire Primoceler to expand the company’s hermetic packaging portfolio with glass micro bonding technology. This bonding technology offers excellent biocompatibility with new glass types. This technology creates new possibilities for wafer level chip scale packaging (WL-CSP) in a wide range of applications such as MEMS devices, medical implants, and other reliability-critical electronic and optical devices.

Frequently Asked Questions (FAQ):

Which region is expected to generate the highest revenues during the forecast period?

The APAC region is expected to generate the highest revenue during the forecast period

Does this report include the impact of COVID-19 on the hermetic packaging market?

Yes, the report includes the impact of COVID-19 on the hermetic packaging market. It llustrates the post- COVID-19 market scenario.

Who are the top five players in the hermetic packaging market?

The major vendors operating in the hermetic packaging market include SCHOTT (Germany), AMETEK. Inc. (US), Amkor Technology (US), Texas Instruments Incorporated (US), and KYOCERA Corporation (Japan).

Which major countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Italy, Spain, and the rest of European countries.

Which is the highest revenue-generating industry during the forecast period?

The military & defense industry is expected to generate the highest revenue during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF STUDY

1.2 DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKETS COVERED

1.4 YEARS CONSIDERED FOR STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 2 PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 3 HERMETIC PACKAGING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary source s

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing the market share by bottom-up analysis (demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing the market share by top-down analysis (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 7 POST-COVID-19 IMPACT ANALYSIS OF HERMETIC PACKAGING MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 8 MULTILAYER CERAMIC PACKAGES EXPECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 9 CERAMIC–METAL SEALING PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 10 MARKET FOR TRANSISTORS PROJECTED TO LEAD DURING THE FORECAST PERIOD

FIGURE 11 MARKET FOR MILITARY & DEFENSE EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 12 ASIA PACIFIC ACCOUNTED FOR THE LARGEST SHARE OF THE HERMETIC PACKAGING MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 13 HERMETIC PACKAGING MARKET PROJECTED TO GROW AT A SIGNIFICANT CAGR DURING THE FORECAST PERIOD OWING TO INCREASING DEMAND FROM THE ASIA PACIFIC

4.2 MARKET, BY CONFIGURATION

FIGURE 14 MULTILAYER CERAMIC PACKAGES EXPECTED TO LEAD THE MARKET BY 2025

4.3 MARKET, BY TYPE

FIGURE 15 MARKET FOR CERAMIC-METAL SEALING PROJECTED TO GROW AT THE HIGHEST CAGR

4.4 MARKET, BY INDUSTRY

FIGURE 16 MILITARY & DEFENSE INDUSTRY PROJECTED TO LEAD BY 2025

4.5 MARKET, BY APPLICATION AND COUNTRY

FIGURE 17 TRANSISTORS APPLICATION PROJECTED TO LEAD THE HERMETIC PACKAGING MARKET

4.6 MARKET, BY COUNTRY

FIGURE 18 MARKET IN THE US PROJECTED TO GROW AT THE HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 MARKET DYNAMICS: OVERVIEW

5.2.1 DRIVERS

5.2.1.1 Increasing use of hermetic packaging for protecting highly sensitive electronic components

5.2.1.2 Increasing demand from industries such as aerospace and automobile electronics

5.2.2 RESTRAINTS

5.2.2.1 Stringent leak rate requirements for hermetic packaging

5.2.3 OPPORTUNITIES

5.2.3.1 Adoption of hermetic packaging for the protection of implantable medical devices

5.2.3.2 Increasing demand in the Asia Pacific for hermetically packaged ICs and components for various applications

5.2.4 CHALLENGES

5.2.4.1 High infrastructure cost incurred due to the controlled and regulated packaging environment

5.2.4.2 Emergence of quasi-hermetic packaging

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS: HERMETIC PACKAGING MARKET

5.4 IMPACT OF COVID-19 ON THE MARKET

5.5 TRENDS IN HERMETIC PACKAGING APPLICATIONS

5.5.1 INCREASING FOCUS ON DATA AND HIGHER TRANSMISSION RATES ARE LEADING TO THE NEED FOR HIGH-PERFORMANCE CHIPS

5.5.2 USE OF A WIDE RANGE OF MATERIALS IN HERMETIC PACKAGING

5.5.3 HERMETIC PACKAGING ADDRESSING THE NEED FOR MINIATURIZATION IN MODERN-DAY ELECTRONICS

5.6 PRICING OF HERMETIC PACKAGES

6 HERMETIC PACKAGING MARKET, BY CONFIGURATION (Page No. - 53)

6.1 INTRODUCTION

FIGURE 21 THE MULTILAYER CERAMIC PACKAGES SEGMENT PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 1 MARKET, BY CONFIGURATION, 2015–2019 (USD MILLION)

TABLE 2 MARKET, BY CONFIGURATION, 2020–2025 (USD MILLION)

6.2 MULTILAYER CERAMIC PACKAGES

6.2.1 SUITABILITY OF MULTILAYER PACKAGING FOR HIGH-FREQUENCY APPLICATIONS IS EXPECTED TO DRIVE ADOPTION IN THE MILITARY & DEFENSE INDUSTRY

TABLE 3 MARKET FOR MULTILAYER CERAMIC PACKAGES, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 4 MARKET FOR MULTILAYER CERAMIC PACKAGES, BY INDUSTRY, 2020–2025 (USD MILLION)

6.3 PRESSED CERAMIC PACKAGES

6.3.1 COST-EFFECTIVENESS OF PRESSED CERAMIC PACKAGES DRIVING THE MARKET

TABLE 5 MARKET FOR PRESSED CERAMIC PACKAGES, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 6 HERMETIC PACKAGING MARKET FOR PRESSED CERAMIC PACKAGES, BY INDUSTRY, 2020–2025 (USD MILLION)

6.4 METAL CAN PACKAGES

6.4.1 INCREASING FOCUS OF THE AUTOMOTIVE INDUSTRY ON COMPLETE AUTOMATIZATION AND PASSENGER SAFETY DRIVING DEMAND FOR METAL CAN PACKAGED SENSORS

TABLE 7 MARKET FOR METAL CAN PACKAGES, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 8 MARKET FOR METAL CAN PACKAGES, BY INDUSTRY, 2020–2025 (USD MILLION)

7 HERMETIC PACKAGING MARKET, BY TYPE (Page No. - 60)

7.1 INTRODUCTION

FIGURE 22 CERAMIC–METAL SEALING PROJECTED TO DOMINATE THE HERMETIC PACKAGING MARKET DURING THE FORECAST PERIOD

TABLE 9 MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 10 MARKET, BY TYPE, 2020–2025 (USD MILLION)

7.2 CERAMIC–METAL (CERTM) SEALING

7.2.1 HIGH ADOPTION OF CERTM HERMETICALLY SEALED TRANSISTORS BY THE AERONAUTICS & SPACE INDUSTRY

FIGURE 23 CERAMIC–METAL (CERTM) SEALING MARKET FOR PHOTO DIODES PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 11 MARKET FOR CERAMIC–METAL (CERTM) SEALING, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 12 MARKET FOR CERAMIC–METAL (CERTM) SEALING, BY APPLICATION, 2020–2025 (USD MILLION)

7.3 GLASS–METAL SEALING (GTMS)

7.3.1 GTMS PROVIDES SOLUTION FOR MEMS SWITCHES USED IN THE AUTOMOTIVE INDUSTRY FOR DESIGNING AUTOMATIZED CARS

FIGURE 24 GLASS–METAL SEALING (GTMS) FOR MEMS SWITCHES PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 13 MARKET FOR GLASS–METAL SEALING (GTMS), BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 14 MARKET FOR GLASS–METAL SEALING (GTMS), BY APPLICATION, 2020–2025 (USD MILLION)

7.4 PASSIVATION GLASS

7.4.1 ADOPTION OF PASSIVATION GLASS FOR HERMETIC SEALING OF TRANSISTORS IS EXPECTED TO INCREASE SIGNIFICANTLY DURING THE FORECAST PERIOD

TABLE 15 HERMETIC PACKAGING MARKET FOR PASSIVATION GLASS, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 16 MARKET FOR PASSIVATION GLASS, BY APPLICATION, 2020–2025 (USD MILLION)

7.5 TRANSPONDER GLASS

7.5.1 EXCELLENT BIOCOMPATIBILITY PROVIDED BY TRANSPONDER GLASS FOR VETERINARY APPLICATIONS EXPECTED TO DRIVE ADOPTION IN MEMS SWITCHES FOR LIVESTOCK FARMING

TABLE 17 MARKET FOR TRANSPONDER GLASS, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 18 MARKET FOR TRANSPONDER GLASS, BY APPLICATION, 2020–2025 (USD MILLION)

7.6 REED GLASS

7.6.1 REED GLASS HIGHEST SUITED HERMETIC SEALING FOR REED SWITCHES AND MEMS SWITCHES

TABLE 19 MARKET FOR REED GLASS, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 20 MARKET FOR REED GLASS, BY APPLICATION, 2020–2025 (USD MILLION)

8 HERMETIC PACKAGING MARKET, BY APPLICATION (Page No. - 72)

8.1 INTRODUCTION

FIGURE 25 MARKET FOR MEMS SWITCHES PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 21 MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 22 HERMETIC PACKAGING MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

8.2 TRANSISTORS

8.2.1 INCREASING DEMAND FOR HERMETICALLY PACKAGED TRANSISTORS FOR HIGH-FREQUENCY TELECOMMUNICATION DEVICES DRIVING THE MARKET

TABLE 23 MARKET FOR TRANSISTORS, BY CONFIGURATION, 2016–2019 (USD MILLION)

TABLE 24 MARKET FOR TRANSISTORS, BY CONFIGURATION, 2020–2025 (USD MILLION)

8.3 SENSORS

8.3.1 MAJORITY OF THE SENSORS ARE MULTILAYER CERAMIC PACKAGED

TABLE 25 MARKET FOR SENSORS, BY CONFIGURATION, 2016–2019 (USD MILLION)

TABLE 26 MARKET FOR SENSORS, BY CONFIGURATION, 2020–2025 (USD MILLION)

8.4 LASERS

8.4.1 MULTILAYER CERAMIC PACKAGES BEST SUITED FOR LASERS IN MEDICAL AND CUTTING & WELDING APPLICATIONS

TABLE 27 MARKET FOR LASERS, BY CONFIGURATION, 2016–2019 (USD MILLION)

TABLE 28 MARKET FOR LASERS, BY CONFIGURATION, 2020–2025 (USD MILLION)

8.5 AIRBAG IGNITORS

8.5.1 INCREASING FOCUS ON PASSENGER SAFETY DRIVING ADOPTION OF HERMETICALLY PACKAGED AIRBAG IGNITERS

TABLE 29 MARKET FOR AIRBAG IGNITORS, BY CONFIGURATION, 2016–2019 (USD MILLION)

TABLE 30 MARKET FOR AIRBAG IGNITORS, BY CONFIGURATION, 2020–2025 (USD MILLION)

8.6 PHOTODIODES

8.6.1 HERMETICALLY PACKAGED PHOTODIODES MAJORLY USED IN FIBER-OPTIC COMMUNICATION, INSTRUMENTATION, AND DATA TRANSMISSION

FIGURE 26 MULTILAYER CERAMIC PACKAGED PHOTODIODES PROJECTED TO LEAD THE HERMETIC PACKAGING MARKET DURING THE FORECAST PERIOD

TABLE 31 MARKET FOR PHOTODIODES, BY CONFIGURATION, 2016–2019 (USD MILLION)

TABLE 32 MARKET FOR PHOTODIODES, BY CONFIGURATION, 2020–2025 (USD MILLION)

8.7 OSCILLATING CRYSTALS

8.7.1 INCREASING DEMAND FOR CONSUMER ELECTRONIC DEVICES DRIVING THE MARKET FOR OSCILLATING CRYSTALS

TABLE 33 HERMETIC PACKAGING MARKET FOR OSCILLATING CRYSTALS, BY CONFIGURATION, 2016–2019 (USD MILLION)

TABLE 34 MARKET FOR OSCILLATING CRYSTALS, BY CONFIGURATION, 2020–2025 (USD MILLION)

8.8 MEMS SWITCHES

8.8.1 INCREASE IN DEMAND FOR COMPLETE AUTOMATIZATION OF AUTOMOBILES DRIVING MARKET FOR MEMS SWITCHES

FIGURE 27 MULTILAYER CERAMIC PACKAGES PROJECTED TO LEAD THE MARKET FOR MEMS SWITCHES DURING THE FORECAST PERIOD

TABLE 35 MARKET FOR MEMS SWITCHES, BY CONFIGURATION, 2016–2019 (USD MILLION)

TABLE 36 MARKET FOR MEMS SWITCHES, BY CONFIGURATION, 2020–2025 (USD MILLION)

8.9 OTHERS

TABLE 37 MARKET FOR OTHER APPLICATIONS, BY CONFIGURATION, 2016–2019 (USD MILLION)

TABLE 38 MARKET FOR OTHER APPLICATIONS, BY CONFIGURATION, 2020–2025 (USD MILLION)

9 HERMETIC PACKAGING MARKET, BY INDUSTRY (Page No. - 84)

9.1 INTRODUCTION

FIGURE 28 MILITARY & DEFENSE INDUSTRY PROJECTED TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 39 MARKET, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 40 HERMETIC PACKAGING MARKET, BY INDUSTRY, 2020–2025 (USD MILLION)

9.2 MILITARY & DEFENSE

9.2.1 INCREASED DEFENSE SPENDING TO MODERNIZE ARMIES DRIVING THE NEED FOR RELIABLE AND HIGH-QUALITY HERMETICALLY PACKAGED ELECTRONIC COMPONENTS

FIGURE 29 MARKET FOR THE MILITARY & DEFENSE INDUSTRY IN THE ASIA PACIFIC PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 41 MARKET FOR THE MILITARY & DEFENSE INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 MARKET FOR THE MILITARY & DEFENSE INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 43 MARKET FOR THE MILITARY & DEFENSE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 44 MARKET FOR THE MILITARY & DEFENSE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 45 MARKET FOR THE MILITARY & DEFENSE INDUSTRY IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 46 MARKET FOR THE MILITARY & DEFENSE INDUSTRY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 47 HERMETIC PACKAGING MARKET FOR THE MILITARY & DEFENSE INDUSTRY IN THE ASIA PACIFIC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 48 MARKET FOR THE MILITARY & DEFENSE INDUSTRY IN THE ASIA PACIFIC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 49 MARKET FOR THE MILITARY & DEFENSE INDUSTRY IN THE REST OF THE WORLD, BY REGION, 2016–2019 (USD MILLION)

TABLE 50 MARKET FOR THE MILITARY & DEFENSE INDUSTRY IN THE REST OF THE WORLD, BY REGION, 2020–2025 (USD MILLION)

9.3 AERONAUTICS & SPACE

9.3.1 COVID-19 PANDEMIC HAS DISRUPTED AIRCRAFT MANUFACTURING AND SPACE LAUNCHES AFFECTING THE DEMAND FOR HERMETICALLY PACKAGED PRODUCTS

FIGURE 30 ASIA PACIFIC PROJECTED TO LEAD THE MARKET FOR THE AERONAUTICS & SPACE INDUSTRY DURING THE FORECAST PERIOD

TABLE 51 MARKET FOR THE AERONAUTICS & SPACE INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 52 MARKET FOR THE AERONAUTICS & SPACE INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 53 MARKET FOR THE AERONAUTICS & SPACE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 54 HERMETIC PACKAGING MARKET FOR THE AERONAUTICS & SPACE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 55 MARKET FOR THE AERONAUTICS & SPACE INDUSTRY IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 56 MARKET FOR THE AERONAUTICS & SPACE INDUSTRY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 57 MARKET FOR THE AERONAUTICS & SPACE INDUSTRY IN THE ASIA PACIFIC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 58 MARKET FOR THE AERONAUTICS & SPACE INDUSTRY IN THE ASIA PACIFIC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 59 MARKET FOR THE AERONAUTICS & SPACE INDUSTRY IN THE REST OF THE WORLD, BY REGION, 2016–2019 (USD MILLION)

TABLE 60 MARKET FOR THE AERONAUTICS & SPACE INDUSTRY IN THE REST OF THE WORLD, BY REGION, 2020–2025 (USD MILLION)

9.4 AUTOMOTIVE

9.4.1 INCREASING DEMAND FOR PASSENGER SAFETY IN THE AUTOMOTIVE SECTOR OFFERS SIGNIFICANT OPPORTUNITIES FOR THE MARKET

9.4.2 AIRBAG INITIATION

9.4.3 BATTERY PROTECTION

9.4.4 RADIO FREQUENCY IDENTIFICATION TRANSPONDER OPERATION

FIGURE 31 ASIA PACIFIC EXPECTED TO DOMINATE THE MARKET FOR THE AUTOMOTIVE INDUSTRY DURING THE FORECAST PERIOD

TABLE 61 HERMETIC PACKAGING MARKET FOR THE AUTOMOTIVE INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 62 MARKET FOR THE AUTOMOTIVE INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 63 MARKET FOR THE AUTOMOTIVE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 64 MARKET FOR THE AUTOMOTIVE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 65 MARKET FOR THE AUTOMOTIVE INDUSTRY IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 66 MARKET FOR THE AUTOMOTIVE INDUSTRY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 67 MARKET FOR THE AUTOMOTIVE INDUSTRY IN THE ASIA PACIFIC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 68 HERMETIC PACKAGING MARKET FOR THE AUTOMOTIVE INDUSTRY IN THE ASIA PACIFIC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 69 MARKET FOR THE AUTOMOTIVE INDUSTRY IN THE REST OF THE WORLD, BY REGION, 2016–2019 (USD MILLION)

TABLE 70 MARKET FOR THE AUTOMOTIVE INDUSTRY IN THE REST OF THE WORLD, BY REGION, 2020–2025 (USD MILLION)

9.5 ENERGY & NUCLEAR SAFETY

9.5.1 CHINA IS PROJECTED TO BE THE LARGEST MARKET FOR HERMETIC PACKAGING IN ENERGY & NUCLEAR SAFETY INDUSTRY DURING THE FORECAST PERIOD

9.5.2 ELECTRICAL PENETRATION CONTROL

9.5.3 OIL & GAS APPLICATIONS

9.5.4 FUEL CELL MANUFACTURING

FIGURE 32 ASIA PACIFIC PROJECTED TO LEAD THE HERMETIC PACKAGING MARKET IN THE ENERGY & NUCLEAR SAFETY INDUSTRY DURING THE FORECAST PERIOD

TABLE 71 MARKET FOR THE ENERGY & NUCLEAR SAFETY INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 72 MARKET FOR THE ENERGY & NUCLEAR SAFETY INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 73 MARKET FOR THE ENERGY & NUCLEAR SAFETY INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 74 MARKET FOR THE ENERGY & NUCLEAR SAFETY INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 75 MARKET FOR THE ENERGY & NUCLEAR SAFETY INDUSTRY IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 76 MARKET FOR THE ENERGY & NUCLEAR SAFETY INDUSTRY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 77 MARKET FOR THE ENERGY & NUCLEAR SAFETY INDUSTRY IN THE ASIA PACIFIC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 78 MARKET FOR THE ENERGY & NUCLEAR SAFETY INDUSTRY IN THE ASIA PACIFIC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 79 MARKET FOR THE ENERGY & NUCLEAR SAFETY INDUSTRY IN THE REST OF THE WORLD, BY REGION, 2016–2019 (USD MILLION)

TABLE 80 MARKET FOR THE ENERGY & NUCLEAR SAFETY INDUSTRY IN THE REST OF WORLD, BY REGION, 2020–2025 (USD MILLION)

9.6 MEDICAL

9.6.1 RISING AGING POPULATION DRIVING THE MARKET FOR THE MEDICAL INDUSTRY

9.6.2 DENTAL APPLICATIONS

9.6.3 VETERINARY APPLICATIONS

FIGURE 33 ASIA PACIFIC PROJECTED TO LEAD THE HERMETIC PACKAGING MARKET FOR THE MEDICAL INDUSTRY DURING THE FORECAST PERIOD

TABLE 81 MARKET FOR THE MEDICAL INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 82 MARKET FOR THE MEDICAL INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 83 MARKET FOR THE MEDICAL INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 84 MARKET FOR THE MEDICAL INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 85 MARKET FOR THE MEDICAL INDUSTRY IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 86 MARKET FOR THE MEDICAL INDUSTRY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 87 MARKET FOR THE MEDICAL INDUSTRY IN THE ASIA PACIFIC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 88 MARKET FOR THE MEDICAL INDUSTRY IN THE ASIA PACIFIC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 89 MARKET FOR THE MEDICAL INDUSTRY IN THE REST OF THE WORLD, BY REGION, 2016–2019 (USD MILLION)

TABLE 90 MARKET FOR THE MEDICAL INDUSTRY IN THE REST OF THE WORLD, BY REGION, 2020–2025 (USD MILLION)

9.7 TELECOMMUNICATIONS

9.7.1 DEMAND FOR HIGH SPEED DATA RATES DRIVING MARKET FOR HERMETICALLY PACKAGED OPTOELECTRONIC COMPONENTS

FIGURE 34 ASIA PACIFIC PROJECTED TO LEAD THE HERMETIC PACKAGING MARKET FOR THE TELECOMMUNICATIONS INDUSTRY DURING THE FORECAST PERIOD

TABLE 91 MARKET FOR THE TELECOMMUNICATIONS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 92 MARKET FOR THE TELECOMMUNICATIONS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 93 MARKET FOR THE TELECOMMUNICATIONS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 94 MARKET FOR THE TELECOMMUNICATIONS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 95 MARKET FOR THE TELECOMMUNICATIONS INDUSTRY IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 96 MARKET FOR THE TELECOMMUNICATIONS INDUSTRY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 97 MARKET FOR THE TELECOMMUNICATIONS INDUSTRY IN THE ASIA PACIFIC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 98 MARKET FOR THE TELECOMMUNICATIONS INDUSTRY IN THE ASIA PACIFIC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 99 MARKET FOR THE TELECOMMUNICATIONS INDUSTRY IN THE REST OF THE WORLD, BY REGION, 2016–2019 (USD MILLION)

TABLE 100 MARKET FOR THE TELECOMMUNICATIONS INDUSTRY IN THE REST OF THE WORLD, BY REGION, 2020–2025 (USD MILLION)

9.8 CONSUMER ELECTRONICS

9.8.1 INCREASING ADOPTION OF HERMETICALLY PACKAGED ELECTRONIC COMPONENTS IN HOME APPLIANCES EXPECTED TO DRIVE THE MARKET

FIGURE 35 ASIA PACIFIC PROJECTED TO LEAD THE HERMETIC PACKAGING MARKET FOR THE CONSUMER ELECTRONICS INDUSTRY DURING THE FORECAST PERIOD

TABLE 101 MARKET FOR THE CONSUMER ELECTRONICS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 102 MARKET FOR THE CONSUMER ELECTRONICS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 103 MARKET FOR THE CONSUMER ELECTRONICS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 104 MARKET FOR THE CONSUMER ELECTRONICS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 105 MARKET FOR THE CONSUMER ELECTRONICS INDUSTRY IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 106 MARKET FOR THE CONSUMER ELECTRONICS INDUSTRY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 107 MARKET FOR THE CONSUMER ELECTRONICS INDUSTRY IN THE ASIA PACIFIC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 108 MARKET FOR THE CONSUMER ELECTRONICS INDUSTRY IN THE ASIA PACIFIC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 109 MARKET FOR THE CONSUMER ELECTRONICS INDUSTRY IN THE REST OF THE WORLD, BY REGION, 2016–2019 (USD MILLION)

TABLE 110 MARKET FOR THE CONSUMER ELECTRONICS INDUSTRY IN THE REST OF THE WORLD, BY REGION, 2020–2025 (USD MILLION)

9.9 OTHERS

FIGURE 36 ASIA PACIFIC PROJECTED TO LEAD THE HERMETIC PACKAGING MARKET FOR OTHER INDUSTRIES DURING THE FORECAST PERIOD

TABLE 111 MARKET FOR OTHER INDUSTRIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 112 MARKET FOR OTHER INDUSTRIES, BY REGION, 2020–2025 (USD MILLION)

TABLE 113 MARKET FOR OTHER INDUSTRIES IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 114 MARKET FOR OTHER INDUSTRIES IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 115 MARKET FOR OTHER INDUSTRIES IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 116 MARKET FOR OTHER INDUSTRIES IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 117 MARKET FOR OTHER INDUSTRIES IN THE ASIA PACIFIC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 118 MARKET FOR OTHER INDUSTRIES IN THE ASIA PACIFIC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 119 MARKET FOR OTHER INDUSTRIES IN THE REST OF THE WORLD, BY REGION, 2016–2019 (USD MILLION)

TABLE 120 MARKET FOR OTHER INDUSTRIES IN THE REST OF THE WORLD, BY REGION, 2020–2025 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 125)

10.1 INTRODUCTION

FIGURE 37 GEOGRAPHIC SNAPSHOT (2019): INDIA AND CHINA ARE EXPECTED TO WITNESS SIGNIFICANT GROWTH DURING THE FORECAST PERIOD

FIGURE 38 ASIA PACIFIC PROJECTED TO GROW AT THE HIGHEST CAGR IN THE HERMETIC PACKAGING MARKET DURING THE FORECAST PERIOD

TABLE 121 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 122 MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 39 NORTH AMERICA: SNAPSHOT OF HERMETIC PACKAGING MARKET

TABLE 123 MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 124 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

10.2.1 US

10.2.1.1 US to account for the largest market share in North America during forecast period

10.2.2 CANADA

10.2.2.1 Canadian market to be driven by growing military & defense, consumer electronics, and automotive industries

10.2.3 MEXICO

10.2.3.1 Mexican market to be driven by growing medical industry in the country

10.3 EUROPE

FIGURE 40 EUROPE: SNAPSHOT OF HERMETIC PACKAGING MARKET

TABLE 125 MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 126 MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Increasing number of passenger vehicles to drive market in Germany

10.3.2 FRANCE

10.3.2.1 Growing energy & nuclear safety industry in France to boost the adoption of hermetic packaging for electrical penetration control and fuel cell manufacturing

10.3.3 ITALY

10.3.3.1 Increased defense expenditure and modernization of defense forces expected to drive the market in Italy

10.3.4 UK

10.3.4.1 Growth in automotive electronics and consumer electronics expected to significantly drive the UK market

10.3.5 SPAIN

10.3.5.1 Advancements in medical industry expected to drive market in Spain

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 41 ASIA PACIFIC: SNAPSHOT OF MARKET

TABLE 127 MARKET IN THE ASIA PACIFIC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 128 MARKET IN THE ASIA PACIFIC, BY COUNTRY, 2020–2025 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Increasing space research activities expected to significantly drive the market in China

10.4.2 JAPAN

10.4.2.1 Hermetically packaged components are gaining traction in the manufacture of home appliances in Japan

10.4.3 SOUTH KOREA

10.4.3.1 Growing energy & nuclear safety industry to drive the hermetic packaging market in South Korea

10.4.4 TAIWAN

10.4.4.1 Favorable government initiatives expected to create opportunities for the market in Taiwan

10.4.5 INDIA

10.4.5.1 India to be fastest-growing market in the Asia Pacific

10.4.6 REST OF ASIA PACIFIC

TABLE 129 MARKET IN THE REST OF THE WORLD, BY REGION, 2016–2019 (USD MILLION)

TABLE 130 MARKET IN THE REST OF THE WORLD, BY REGION, 2020–2025 (USD MILLION)

10.5 REST OF THE WORLD

10.5.1 SOUTH AMERICA

10.5.1.1 Rising investments in oil & gas to drive market in Middle East & Africa

10.5.2 MIDDLE EAST & AFRICA

10.5.2.1 Market in Middle East & Africa to grow at highest CAGR during forecast period

11 COMPETITIVE LANDSCAPE (Page No. - 141)

11.1 OVERVIEW

FIGURE 42 KEY DEVELOPMENT LAUNCHES IN HERMETIC PACKAGING MARKET, 2018 TO MARCH 2020

11.2 MARKET SHARE OF PLAYERS, 2019

TABLE 131 MARKET SHARE ANALYSIS OF MARKET PLAYERS, 2019

11.3 COMPETITIVE LEADERSHIP MAPPING, 2019

11.3.1 VISIONARY LEADERS

11.3.2 INNOVATORS

11.3.3 DYNAMIC DIFFERENTIATORS

11.3.4 EMERGING COMPANIES

FIGURE 43 HERMETIC PACKAGING MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

11.4 COMPETITIVE SITUATIONS & TRENDS

FIGURE 44 MARKET EVOLUTION FRAMEWORK: PRODUCT LAUNCHES FUELLED GROWTH OF MARKET DURING 2018–MARCH 2020

FIGURE 45 PRODUCT LAUNCHES WERE KEY STRATEGIES ADOPTED BY PLAYERS IN MARKET FROM 2018 TO 2019

11.4.1 PRODUCT LAUNCHES

TABLE 132 PRODUCT LAUNCHES, 2018–2019

11.4.2 EXPANSIONS AND PARTNERSHIPS

TABLE 133 EXPANSIONS AND PARTNERSHIPS, 2019

11.4.3 ACQUISITIONS

TABLE 134 ACQUISITIONS, 2018

11.4.4 CONTRACTS AND AGREEMENTS

TABLE 135 CONTRACTS AND AGREEMENTS, 2019

12 COMPANY PROFILES (Page No. - 150)

(Business overview, Products offered, Recent developments, SWOT analysis & MnM View)*

12.1 KEY PLAYERS

12.1.1 SCHOTT

FIGURE 46 SCHOTT: COMPANY SNAPSHOT

12.1.2 AMETEK, INC.

FIGURE 47 AMETEK, INC.: COMPANY SNAPSHOT

12.1.3 AMKOR TECHNOLOGY, INC.

FIGURE 48 AMKOR TECHNOLOGY, INC.: COMPANY SNAPSHOT

12.1.4 TEXAS INSTRUMENTS INCORPORATED

FIGURE 49 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

12.1.5 TELEDYNE TECHNOLOGIES INCORPORATED

FIGURE 50 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

12.1.6 KYOCERA CORPORATION

FIGURE 51 KYOCERA CORPORATION: COMPANY SNAPSHOT

12.1.7 MATERION CORPORATION

FIGURE 52 MATERION CORPORATION: COMPANY SNAPSHOT

12.1.8 EGIDE

FIGURE 53 EGIDE: COMPANY SNAPSHOT

12.1.9 MICROSS COMPONENTS INC.

12.1.10 LEGACY TECHNOLOGIES INC.

*Details on Business overview, Products offered, Recent developments, SWOT analysis & MnM View might not be captured in case of unlisted companies.

12.2 RIGHT TO WIN

12.3 OTHER COMPANIES

12.3.1 WILLOW TECHNOLOGIES

12.3.2 RENESAS ELECTRONICS CORPORATION (INTERSIL CORPORATION)

12.3.3 SGA TECHNOLOGIES LTD

12.3.4 COMPLETE HERMETICS

12.3.5 SPECIAL HERMETIC PRODUCTS INC.

12.3.6 COAT-X

12.3.7 HERMETIC SOLUTIONS GROUP

12.3.8 STRATEDGE

12.3.9 BEL FUSE INC.

12.3.10 ITT, INC.

12.3.11 ROSENBERGER

12.3.12 MACKIN TECHNOLOGIES

12.3.13 PALOMAR TECHNOLOGIES

12.3.14 CERAMTEC

12.3.15 APTIV PLC (WINCHESTER INTERCONNECT)

13 APPENDIX (Page No. - 194)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

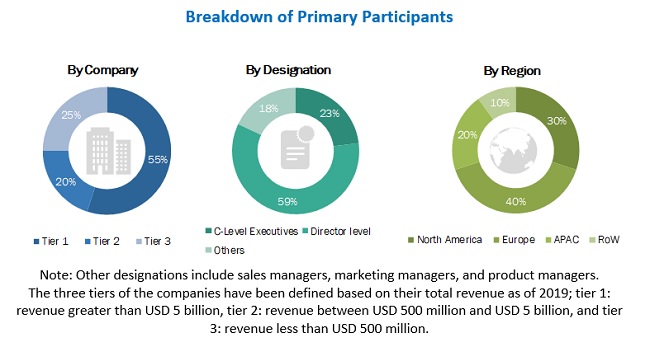

The study involves four major activities for estimating the size of the hermetic packaging market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the hermetic packaging market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as encyclopedias, directories, databases, the association for computing machinery, animation magazine, and VFX voice have been used to identify and collect information for an extensive technical and commercial study of the hermetic packaging market.

Primary Research

In the primary research process, primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as assess prospects. Key players in the hermetic packaging market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as chief executive officers (CEOs), directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the hermetic packaging market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To estimate and forecast the size of the hermetic packaging market, in terms of value, based on configuration, type, application, and industry

- To describe and forecast the market size, in terms of value, for four key regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the COVID-19 impact on the hermetic packaging market

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a comprehensive overview of the value chain of the hermetic packaging ecosystem

- To strategically analyze micro markets concerning individual market trends, growth prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze major growth strategies implemented by key market players, such as contracts, agreements, acquisitions, product launches, expansions, and partnerships

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Hermetic Packaging Market

Could you provide the market share for harsh environment sensors for industrial use. Please send a sample of the Hermetic Packaging Market report.

Hi, we are a small company in Israel. Our field of interest is custom products of GTMS and multi-layered ceramics, in Middle east, then the rest of the world. How much the report can cost for us?

I would like additional detail for the report like what are the market dynamic for Hermetic Packaging, what are the strategies used by market players to strong their business position and all.