Hydraulic Workover Unit Market by Service (Workover & Snubbing), Installation (Skid Mounted & Trailer Mounted), Capacity (0–50 Tonnes, 51–150 Tonnes, and Above 150 Tonnes), Application (Onshore, Offshore), and Region - Global Forecast to 2025

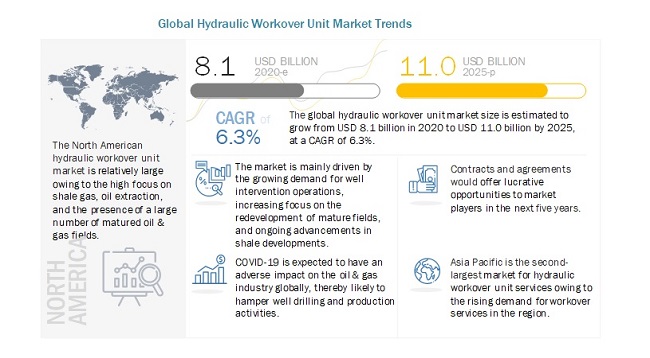

[ 194 Pages Report] The global hydraulic workover unit market is projected to reach USD 11.0 billion by 2025 from an estimated USD 8.1 billion in 2020, at a post-COVID-19 CAGR of 6.3% during the forecast period. Increasing efforts by upstream companies to enhance the production from the mature fields is driving the hydraulic workover unit market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Hydraulic workover unit Market

The ongoing COVID-19 pandemic has impacted the oil & gas industry globally. Due to the current scenario, various oil & gas companies across regions has to shut down their producing assets and services as countries practiced partial or full lockdown strategy to deal with the pandemic. The companies across the region has also suspended or delayed the major oil & gas projects. Furthermore, the COVID-19 pandemic has also impacted the crude oil prices, well drilling and production activities, and the rig count for oil and gas.

Hydraulic workover unit Market Dynamics

Driver: Growing shale oil & gas production activities

Shale natural gas resources are found in shale formations that contain significant accumulations of natural gas and/or oil. According to EIA (Energy Information Administration), natural gas production is projected to reach till 554 BcF/d by 2040. The largest component of this growth is natural gas production from shale resources, which is expected to grow till 168 BcF/d by 2040. Countries such as the US, Canada, China, and Argentina have commercial shale gas production. Moreover, countries such as Mexico and Algeria are expected to encourage the development of shale resources with the help of technological improvements. In 2019, the US shale gas production accounted for more than half of the natural gas production. China has been among the first country outside North America to develop shale resources. It has drilled more than 600 shale gas wells and is projected to account for more than 40% of the country’s total natural gas production by 2040, which could make China the second-largest shale gas producer in the world after the US. Furthermore, foreign investments in Argentina are increasing; therefore, the shortage of specialized rigs and fracturing equipment is expected to be resolved. The Algerian government plans for developing the shale gas production revising the investment laws, and has begun a pilot shale gas well project. Mexico is expected to develop shale resource basins after the recent opening of the upstream sector to foreign investments. Thus, these 6 countries are expected to account for 70% of the global shale gas production by 2040.

Restraints: Increasing focus on renewable energy

Many countries have a growing focus on renewable energy every year for reducing the carbon footprint and dependence on fossil fuel. The oil & gas sector has the potential to significantly after the global renewable investment. China, Europe, India, and the US are the top 4 markets for renewable investments. According to the MENA Solar Energy Report 2014, up to 37,000 MW of new solar, wind, and hydroelectric projects are planned to be commissioned worldwide till 2020. Solar energy projects would specifically source about 12,000–15,000 MW by 2020. According to World Energy Forum, 2020, total investments in renewable energy reached USD 282.2 billion in 2019. The growth in these investments is likely to affect the growth of oil & gas-based power plants, which is expected to impact the oil & gas industry directly and, in turn, affect the production activities. This would curb the market for hydraulic workover units during the forecast period. Moreover, wind energy is an important form of energy resource, accounting for approximately 50% of the wind power installations in Asia Pacific, Europe, and North America. The global cumulative wind power installations accounted for 496 GW in 2016 and is expected to reach approximately 792 GW by 2020. Thus, the growing focus and investments for renewable energy would restrain the market during the forecast period.

Opportunities: Increased focus on mature oil & gas fields with the implementation of digital technologies

A mature field is a source of hydrocarbon that is past peak production. Mature oilfields account for more than 70% of the world’s oil & gas production. The recovery of mature oil fields is increasing, with 80% estimated reserves found in the Middle East, North America, Asia Pacific, and Latin America. Increasing recovery from mature fields involves extending the life of the well and improving production using various methods such as artificial lifts, intervention, and snubbing. Mature oil fields can be found in conventional, unconventional, or deepwater reservoirs depending upon the permeability and flow regime of the reservoir. Moreover, with the decline in oil reserves, major oil & gas companies have shifted their attention toward technological advancements in inventing tools and techniques, which are required to access residual reserves on conventional acreages. Companies are currently focused on increasing recovery and extending the life of mature fields, hence exceeding natural production levels. Increased water cut with constrained topside facilities, increasing flow assurance challenges, growing operating costs, and integrity challenges due to aging facilities are the major factors that have led to a mature field or brownfield becoming operational and economically unviable with time. At present, the number of mature oilfields is quite high and even increasing due to rising oil & gas production, which results in the rapid depletion of new fields. Most of the oil fields in Texas, the US, South China Sea, Arabian Sea, and North Sea area are more than 20 years old and have crossed their peak oil production a long time ago. These fields require workover services to maximize production and recovery. Thus, increasing global energy demand and oil prices have stimulated the reactivation of mature oilfields.

Challenges: Low oil prices resulting in abandoning of wells

Oil prices being in the range of USD 40 has resulted in declining CAPEX in the drilling and other exploration activities worldwide. As a result of low oil prices, workover units secured a lesser number of jobs in 2019 compared to the years with oil above USD 100. During the highs of 2014, major activities conducted were related to the exploration and discovery of oilfields. In 2018, existing drilling contracts were maintained yet not renewed, and the focus got shifted toward production. CAPEX reduced along with an increase in OPEX, thereby declining the revenues generated through production. In 2016 and 2017, governments in regions ranging from the North Sea to Malaysia enforced new regulations for P&A (Plugging & Abandonment). This sifted the market dynamics to P&A from production. It was observed that workovers have been profitable when crude prices range between USD 60 and 70 per barrel. If any field shows a negative effect, it is likely to undergo P&A owing to the enforcement of the newer regulations. In 2018, the focus was on the production of crude, especially from offshore (subsea). The constant fluctuations of crude prices also affect the demand for well intervention services in relation to various phases of a well’s lifecycle.

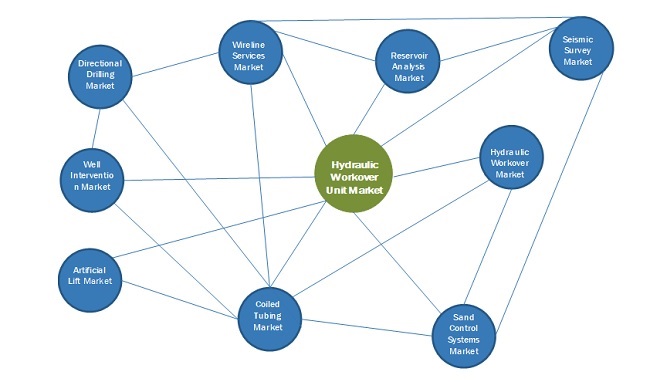

Market Interconnection

To know about the assumptions considered for the study, download the pdf brochure

By service, the workover segment is expected to make the largest contribution to the hydraulic workover unit market during the forecast period.

Services carried out by the hydraulic workover unit are completions/workover, plug & abandonment, ESP completion, sand screen installations, well deepening, fishing/clean-outs, casing repairs, and others. Moreover, the hydraulic workover can be used to install or remove tubular (pipes) in or out of dead wells. Mature oil & gas fields in North America and Europe require heavy intervention services to extract the trapped oil and safe operations for production, thus driving the workover service market.

By installation, trailer-mounted segment is expected to dominate to the hydraulic workover unit market during the forecast period.

Owing to the optimum structure and high-level integration of workover rigs, a trailer-mounted hydraulic workover unit requires less working space. Efficient drilling, cruise capability, and lateral stability are among the key features of these units. They can work under ambient temperature and are suitable for cold fields in countries such as Russia and Canada.

By capacity, the above 150 tonnes segment is expected to dominate the hydraulic workover unit market during the forecast period.

The services carried out in this segment are for both onshore and offshore oil and gas fields; these services include complicated applications such as fishing, drilling, plug, and abandonment. The hydraulic units under this capacity are for deepwater and ultra-deepwater wells.

By application, the onshore segment is expected to grow at the fastest rate during the forecast period.

The onshore fields have been producing for more than 150 years now, and most of them are depleting at faster rates. For instance, the South Belridge Oilfield in the US, the Kuparuk River Oilfield in the US, and the Appalachian Basin of Pennsylvania are some of the oldest onshore oilfields in North America. These oilfields are experiencing a decline in production, and the asset operators are investing in various recovery methods and heavy intervention operations to expand and optimize the production from the wells. Under well intervention, hydraulic workover unit services are used to achieve the most optimum production levels.

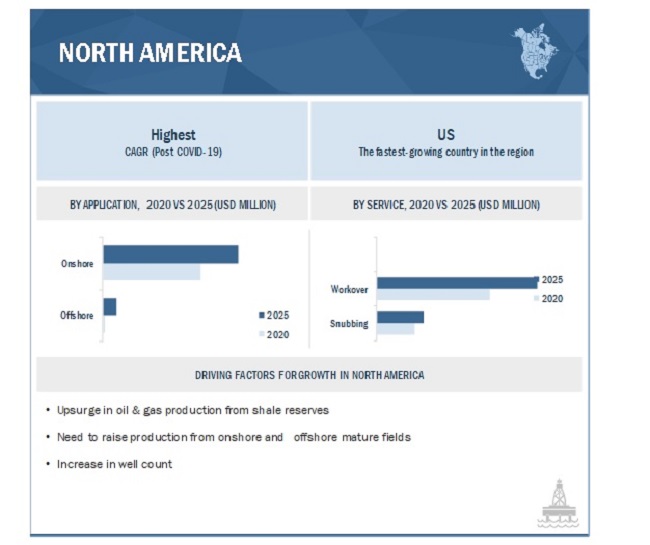

North America is expected to be the largest market during the forecast period.

North America, Europe, South America, Asia Pacific, and Middle East & Africa are the major regions considered for the study of the hydraulic workover unit market. North America is estimated to be the largest market from 2020 to 2025, driven by the growth in unconventional resources in the US and Canada. Additionally, the demand for intervention operations in the maturing offshore fields in the Gulf of Mexico and other onshore fields in the US is expected to drive market growth.

Key Market Players

The major players in the global hydraulic workover unit market are Halliburton (US), Superior Energy Services (US), Precision Drilling (Canada), Basic Energy Services (US), and Velesto Energy (Malaysia).

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2016–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Service, installation, caacity, application, and region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East, & Africa, and South America |

|

Companies covered |

Halliburton (US), Superior Energy Services (US), Archer (Norway), Basic Energy Services (US), Key Energy Services(US), UZMA (), Cudd Energy Services (US), High Arctic Energy Services (Canada), Precision Drilling (Canada), Velesto Energy (Malasysia), Elnusa (Indonesia), Easternwell (Australia), ZYT Petrloeum Equipment (China) |

This research report categorizes the hydraulic workover unit market based on type, service type, operation type, application, well type, and region.

Based on service, the market has been segmented as follows:

- Workover

- Snubbing

Based on the installation, the market has been segmented as follows:

- Skid Mounted

- Trailer Mounted

Based on capcity, the market has been segmented as follows:

- 0-50 tonnes

- 51-150 tonnes

- Above 150 tonnes

Based on application, the market has been segmented as follows:

- Onshore

- Offshore

Based on the region, the market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In December 2018, Elnusa signed a partnership with Schlumberger for 5 years. Under this agreement, Master Cooperation Agreement (MCA) and Wireline Master Service Agreement (Wireline MSA) are the main points of focus.

- In March 2018, Boots & Coots, a subsidiary of Halliburton, announced that it entered into a contractual arrangement with Capstone Blowout Recovery (Calgary, Canada) for providing first responder and well control services for Boots & Coots customers throughout Canada.

Frequently Asked Questions (FAQ):

What is the current size of the hydraulic workover unit market?

The current market size of global hydraulic workover unit market is 9.8 billion in 2019.

What are the major drivers for hydraulic workover unit market?

Increasing oil & gas production of mature oil fields, continuous shale developments are some of the major drivers driving the market of hydraulic workover unit.

Which is the fastest growing region during the forecasted period in hydraulic workover unit market?

North America is the fastest-growing region during the forecasted period owing to rise in shale gas & tight oil production, favorable regulations related to the licensing of exploration & production activities, and an increase in well count.

Which is the fastest-growing segment, by service during the forecasted period in the hydraulic workover unit market?

The workover segment , by service is the fastest growing segment during the forecasted period due to increasing demand for hydraulic workover services from mature fields. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 HYDRAULIC WORKOVER UNIT MARKET, BY SERVICE: INCLUSIONS VS. EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATION

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 HYDRAULIC WORKOVR UNIT MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

TABLE 1 MARKET: PLAYERS/COMPANIES CONNECTED

2.3 SCOPE

2.3.1 IMPACT OF COVID-19

2.4 MARKET SIZE ESTIMATION

2.4.1 IDEAL DEMAND-SIDE ANALYSIS

FIGURE 3 OIL & GAS PRODUCTION ACROSS REGIONS IS THE MAJOR DETERMINING FACTOR FOR MARKET GROWTH

2.4.1.1 Assumptions

2.4.1.2 Calculation

2.4.2 SUPPLY-SIDE ANALYSIS

2.4.2.1 Assumptions

2.4.2.2 Calculation

2.4.3 FORECAST

2.5 INSIGHTS OF INDUSTRY EXPERTS

3 EXECUTIVE SUMMARY (Page No. - 46)

3.1 PRE- AND POST-COVID-19 SCENARIO ANALYSIS

FIGURE 4 PRE- AND POST-COVID-19 SCENARIO ANALYSIS

TABLE 2 MARKET SNAPSHOT

FIGURE 5 NORTH AMERICA DOMINATED THE HYDRAULIC WORKOVER UNIT MARKET IN 2019

FIGURE 6 NORTH AMERICA ACCOUNTED FOR THE LARGEST SIZE OF THE MARKET, IN TERMS OF VOLUME, DURING 2016-2019

FIGURE 7 WORKOVER SEGMENT IS EXPECTED TO LEAD THE MARKET, BY SERVICE, 2020-2025

FIGURE 8 TRAILER-MOUNTED HYDRAULIC WORKOVER UNITS HELD A LARGER MARKET SHARE IN 2019

FIGURE 9 ABOVE 150 TONNES SEGMENT IS EXPECTED TO DOMINATE THE MARKET, BY CAPACITY, DURING THE FORECAST PERIOD

FIGURE 10 ONSHORE SEGMENT IS EXPECTED TO LEAD THE MARKET, BY APPLICATION, DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN THE HYDRAULIC WORKOVER UNIT MARKET

FIGURE 11 MATURING OILFIELDS TO DRIVE THE DEMAND FOR WELL INTERVENTION ACTIVITIES AND BOOST MARKET GROWTH, 2020-2025

4.2 MARKET, BY SERVICE

FIGURE 12 WORKOVER SERVICES DOMINATED THE MARKET IN 2019

4.3 MARKET, BY INSTALLATION

FIGURE 13 TRAILER-MOUNTED SEGMENT IS EXPECTED TO LEAD THE MARKET, BY INSTALLATION, 2020-2025

4.4 MARKET, BY CAPACITY

FIGURE 14 ABOVE 150 TONNES SEGMENT IS EXPECTED TO DOMINATE THE MARKET, BY CAPACITY, BETWEEN 2020 AND 2025

4.5 MARKET, BY APPLICATION

FIGURE 15 MARKET FOR ONSHORE APPLICATION IS EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

4.6 MARKET, BY REGION

FIGURE 16 MARKET IN NORTH AMERICA IS EXPECTED TO REGISTER THE HIGHEST CAGR FROM 2020 TO 2025

4.7 NORTH AMERICAN MARKET, BY APPLICATION AND COUNTRY

FIGURE 17 ONSHORE APPLICATION AND THE US DOMINATED THE NORTH AMERICAN MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 18 COVID-19 GLOBAL PROPAGATION

FIGURE 19 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 20 RECOVERY ROAD FOR 2020

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 21 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 22 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Growing shale oil & gas production activities

TABLE 3 TOP COUNTRIES WITH SIGNIFICANT TECHNICALLY RECOVERABLE SHALE RESOURCES, 2018

5.5.1.2 Rising primary energy consumption from APAC

FIGURE 23 WORLD OIL DEMAND GROWTH (2018-2024)

5.5.2 RESTRAINTS

5.5.2.1 Increasing focus on renewable energy

5.5.3 OPPORTUNITIES

5.5.3.1 Increased focus on mature oil & gas fields with implementation of digital technologies

FIGURE 24 PEAK LOSS OF OIL FROM MATURE CONVENTIONAL OILFIELDS (2010-2017)

5.5.3.2 Onset of exploration and drilling activities in Arctic region

5.5.4 CHALLENGES

5.5.4.1 Low oil prices resulting in abandoning of wells

5.5.4.2 Impact of COVID-19 on oil & gas production activities

5.6 ADJACENT AND INTERCONNECTED MARKETS

TABLE 4 ADJACENT AND INTERCONNECTED MARKETS (USD BILLION)

6 MARKET, BY SERVICE (Page No. - 65)

6.1 INTRODUCTION

FIGURE 25 WORKOVER SEGMENT HELD A LARGER MARKET SHARE IN 2019

TABLE 5 MARKET, BY SERVICE, 2016-2019 (UNITS)

TABLE 6 PRE-COVID-19: MARKET, BY SERVICE, 2020-2025 (UNITS)

TABLE 7 POST-COVID-19: MARKET, BY SERVICE, 2020-2025 (UNITS)

TABLE 8 MARKET SIZE, BY SERVICE, 2016-2019 (USD MILLION)

TABLE 9 PRE-COVID-19: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

TABLE 10 POST-COVID-19: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

6.2 WORKOVER

6.2.1 DEVELOPMENT OF MATURE OIL FIELDS IS DRIVING THE DEMAND FOR WORKOVER SERVICES

TABLE 11 WORKOVER: MARKET, BY REGION, 2016-2019 (UNITS)

TABLE 12 POST-COVID-19: WORKOVER: MARKET, BY REGION, 2020-2025 (UNITS)

TABLE 13 WORKOVER: MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 14 POST-COVID-19: WORKOVER: MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

6.3 SNUBBING

6.3.1 ADVANTAGES OF CARRYING OUT SNUBBING SERVICES USING HYDRAULIC WORKOVER UNITS OVER STIMULATION OPERATIONS DRIVE MARKET GROWTH

TABLE 15 SNUBBING: MARKET, BY REGION, 2016-2019 (UNITS)

TABLE 16 POST-COVID-19: SNUBBING: MARKET, BY REGION, 2020-2025 (UNITS)

TABLE 17 SNUBBING: MARKET SIZE, BY REGION,2016-2019 (USD MILLION)

TABLE 18 POST-COVID-19: SNUBBING: MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

7 MARKET, BY INSTALLATION (Page No. - 72)

7.1 INTRODUCTION

FIGURE 26 TRAILER-MOUNTED HYDRAULIC WORKOVER UNITS CAPTURED A LARGER MARKET SHARE IN 2019

TABLE 19 MARKET SIZE, BY INSTALLATION, 2016-2019 (USD MILLION)

TABLE 20 PRE-COVID-19: MARKET SIZE, BY INSTALLATION, 2020-2025 (USD MILLION)

TABLE 21 POST-COVID-19: MARKET SIZE, BY INSTALLATION, 2020-2025 (USD MILLION)

7.2 SKID MOUNTED

7.2.1 SKID-MOUNTED HYDRAULIC WORKOVER UNITS ARE CONVENIENT FOR BOTH ONSHORE AND OFFSHORE WELLS

TABLE 22 SKID MOUNTED: MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 23 POST-COVID-19: SKID MOUNTED: MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

7.3 TRAILER MOUNTED

7.3.1 COMPACT SIZE OF TRAILER-MOUNTED HYDRAULIC WORKOVER UNITS MAKE THEM PREFERABLE FOR WORKOVER SERVICES

TABLE 24 TRAILER MOUNTED: MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 25 POST-COVID-19: TRAILER MOUNTED: MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

8 MARKET, BY CAPACITY (Page No. - 77)

8.1 INTRODUCTION

FIGURE 27 ABOVE 150 TONNES SEGMENT HELD THE LARGEST MARKET SHARE IN 2019

TABLE 26 HYDRAULIC WORKOVER UNIT MARKET SIZE, BY CAPACITY, 2016-2019 (USD MILLION)

TABLE 27 PRE-COVID-19: MARKET SIZE, BY CAPACITY, 2020-2025 (USD MILLION)

TABLE 28 POST-COVID-19: MARKET SIZE, BY CAPACITY, 2020-2025 (USD MILLION)

8.2 0-50 TONNES

8.2.1 HYDRAULIC WORKOVER UNITS WITH UP TO 50 TONNES OF CAPACITY ARE PREFERRED TO DELIVER ONSHORE WORKOVER SERVICES

TABLE 29 0-50 TONNES: MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 30 POST-COVID-19: 0-50 TONNES: MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

8.3 51-150 TONNES

8.3.1 HYDRAULIC WORKOVER UNITS WITH 51-150 TONNES OF CAPACITY ARE USED FOR ARTIFICIAL LIFTS

TABLE 31 51-150 TONNES: MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 32 POST-COVID-19: 51-150 TONNES: MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

8.4 ABOVE 150 TONNES

8.4.1 HYDRAULIC WORKOVER UNITS WITH CAPACITY OF ABOVE 150 TONNES ARE SUITABLE FOR DEEP-WATER AND ULTRA-DEEP-WATER WELLS

TABLE 33 ABOVE 150 TONNES: MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 34 POST-COVID-19: ABOVE 150 TONNES: MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

9 MARKET, BY APPLICATION (Page No. - 83)

9.1 INTRODUCTION

FIGURE 28 ONSHORE SEGMENT LED MARKET, BY APPLICATION, IN 2019 84

TABLE 35 MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 36 PRE-COVID-19: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 37 POST-COVID-19: MARKET SIZE,BY APPLICATION, 2020-2025 (USD MILLION)

9.2 ONSHORE

9.2.1 ONSHORE SHALE DEVELOPMENT IN NORTH AMERICA AND HIGHER NUMBER OF MATURE ONSHORE OILFIELDS IN THE MIDDLE EAST WILL CREATE OPPORTUNITIES FOR HYDRAULIC WORKOVER UNIT SERVICE PROVIDERS

TABLE 38 ONSHORE: MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 39 POST-COVID-19: ONSHORE: MARKET SIZE, BY REGION, BY REGION, 2020-2025 (USD MILLION)

9.3 OFFSHORE

9.3.1 COMPLEX TECHNICALITIES AT OFFSHORE LOCATIONS AFFECTING WORKOVER SERVICES

TABLE 40 OFFSHORE: MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 41 POST-COVID-19: OFFSHORE: MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

10 MARKET, BY REGION (Page No. - 89)

10.1 INTRODUCTION

FIGURE 29 THE US MARKET TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 30 NORTH AMERICA TO COMMAND THE MARKET DURING THE FORECAST PERIOD

TABLE 42 MARKET, BY REGION, 2016-2019 (UNITS)

TABLE 43 PRE-COVID-19: MARKET, BY REGION, 2020-2025 (UNITS)

TABLE 44 POST-COVID-19: MARKET, BY REGION, 2020-2025 (UNITS)

TABLE 45 MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 46 PRE-COVID-19: MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 47 POST-COVID-19: MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 31 REGIONAL SNAPSHOT: NORTH AMERICA, 2019

10.2.1 BY SERVICE

TABLE 48 NORTH AMERICA: MARKET, BY SERVICE, 2016-2019 (UNITS)

TABLE 49 POST-COVID-19 NORTH AMERICA: MARKET, BY SERVICE, 2020-2025 (UNITS)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016-2019 (USD MILLION)

TABLE 51 POST-COVID-19 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

10.2.2 BY INSTALLATION

TABLE 52 NORTH AMERICA: MARKET SIZE, BY INSTALLATION, 2016-2019 (USD MILLION)

TABLE 53 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY INSTALLATION, 2020-2025 (USD MILLION)

10.2.3 BY CAPACITY

TABLE 54 NORTH AMERICA: MARKET SIZE, BY CAPACITY, 2016-2019 (USD MILLION)

TABLE 55 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY CAPACITY, 2020-2025 (USD MILLION)

10.2.4 BY APPLICATION

TABLE 56 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 57 POST-COVID-19 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.2.5 BY COUNTRY

TABLE 58 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 59 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

10.2.5.1 US

10.2.5.1.1 Shale gas production is the key driver

10.2.5.1.2 By application

TABLE 60 US: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 61 POST-COVID-19 US: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.2.5.2 Canada

10.2.5.2.1 Growing oil & gas activities to grow market

10.2.5.2.2 By application

TABLE 62 CANADA: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 63 POST-COVID-19: CANADA: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.2.5.3 Mexico

10.2.5.3.1 Plans for increasing oil & gas production to boost market growth

10.2.5.3.2 By application

TABLE 64 MEXICO: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 65 POST-COVID-19: MEXICO: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.3 ASIA PACIFIC

FIGURE 32 REGIONAL SNAPSHOT: ASIA PACIFIC, 2019

10.3.1 BY SERVICE

TABLE 66 ASIA PACIFIC: MARKET, BY SERVICE, 2016-2019 (UNITS)

TABLE 67 POST-COVID-19: ASIA PACIFIC: MARKET, BY SERVICE, 2020-2025 (UNITS)

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016-2019 (USD MILLION)

TABLE 69 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

10.3.2 BY INSTALLATION

TABLE 70 ASIA PACIFIC: MARKET SIZE, BY INSTALLATION, 2016-2019 (USD MILLION)

TABLE 71 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY INSTALLATION, 2020-2025 (USD MILLION)

10.3.3 BY CAPACITY

TABLE 72 ASIA PACIFIC: MARKET SIZE, BY CAPACITY, 2016-2019 (USD MILLION)

TABLE 73 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY CAPACITY, 2020-2025 (USD MILLION)

10.3.4 BY APPLICATION

TABLE 74 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 75 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.3.5 BY COUNTRY

TABLE 76 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 77 POST-COVID-19: ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

10.3.5.1 China

10.3.5.1.1 Growing production & focus on shale gas reserves are likely to boost market growth during the forecast period

10.3.5.1.2 By application

TABLE 78 CHINA: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 79 POST-COVID-19: CHINA: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.3.5.2 India

10.3.5.2.1 Increasing focus on exploration activities to boost demand for HWUs during the forecast period

10.3.5.2.2 By application

TABLE 80 INDIA: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 81 POST-COVID-19: INDIA: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.3.5.3 Australia

10.3.5.3.1 Development of natural gas resources to fuel market growth during the forecast period

10.3.5.3.2 By application

TABLE 82 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 83 POST-COVID-19: AUSTRALIA: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.3.5.4 Indonesia

10.3.5.4.1 Enhancement of oil & gas fields and exploration activities to foster market growth in coming years

10.3.5.4.2 By application

TABLE 84 INDONESIA: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 85 POST-COVID-19: INDONESIA: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.3.5.5 Rest of Asia Pacific

10.3.5.5.1 By application

TABLE 86 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 87 POST-COVID-19: REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.4 EUROPE

10.4.1 BY SERVICE

TABLE 88 EUROPE: MARKET, BY SERVICE, 2016-2019 (UNITS)

TABLE 89 POST-COVID-19: EUROPE: MARKET, BY SERVICE, 2020-2025 (UNITS)

TABLE 90 EUROPE: MARKET SIZE, BY SERVICE, 2016-2019 (USD MILLION)

TABLE 91 POST-COVID-19: EUROPE: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

10.4.2 BY INSTALLATION

TABLE 92 EUROPE: MARKET SIZE, BY INSTALLATION, 2016-2019 (USD MILLION)

TABLE 93 POST-COVID-19: EUROPE: MARKET SIZE, BY INSTALLATION, 2020-2025 (USD MILLION)

10.4.3 BY CAPACITY

TABLE 94 EUROPE: MARKET SIZE, BY CAPACITY, 2016-2019 (USD MILLION)

TABLE 95 POST-COVID-19: EUROPE: MARKET SIZE, BY CAPACITY, 2020-2025 (USD MILLION)

10.4.4 BY APPLICATION

TABLE 96 EUROPE: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 97 POST-COVID-19: EUROPE: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.4.5 BY COUNTRY

TABLE 98 EUROPE: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 99 POST-COVID-19: EUROPE: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

10.4.5.1 Russia

10.4.5.1.1 Growing focus on oil & gas production to boost market growth

10.4.5.1.2 By application

TABLE 100 RUSSIA: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 101 POST-COVID-19: RUSSIA: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.4.5.2 UK

10.4.5.2.1 Increasing investment and growing focus on mature oilfields to create opportunities for market players

10.4.5.2.2 By application

TABLE 102 UK: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 103 POST-COVID-19: UK: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.4.5.3 Norway

10.4.5.3.1 Growing exploration activities and discoveries to spur market growth during the forecast period

10.4.5.3.2 By application

TABLE 104 NORWAY: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 105 POST-COVID-19: NORWAY: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.4.5.4 Rest of Europe

10.4.5.4.1 By application

TABLE 106 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 107 POST-COVID-19: REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 BY SERVICE

TABLE 108 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2016-2019 (UNITS)

TABLE 109 POST-COVID-19: MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2020-2025 (UNITS)

TABLE 110 MIDDLE EAST & AFRICA: MARKET SIZE, BY SERVICE, 2016-2019 (USD MILLION)

TABLE 111 POST-COVID-19: MIDDLE EAST & AFRICA: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

10.5.2 BY INSTALLATION

TABLE 112 MIDDLE EAST & AFRICA: MARKET SIZE, BY INSTALLATION, 2016-2019 (USD MILLION)

TABLE 113 POST-COVID-19: MIDDLE EAST & AFRICA: MARKET SIZE, BY INSTALLATION, 2020-2025 (USD MILLION)

10.5.3 BY CAPACITY

TABLE 114 MIDDLE EAST & AFRICA: MARKET SIZE, BY CAPACITY, 2016-2019 (USD MILLION)

TABLE 115 POST-COVID-19: MIDDLE EAST & AFRICA: MARKET SIZE, BY CAPACITY, 2020-2025 (USD MILLION)

10.5.4 BY APPLICATION

TABLE 116 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 117 POST-COVID-19: MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.5.5 BY COUNTRY

TABLE 118 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 119 POST-COVID-19: MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

10.5.5.1 Saudi Arabia

10.5.5.1.1 Enhanced crude production from oilfields & increased offshore exploration activities to drive demand for hydraulic workover units

10.5.5.1.2 By application

TABLE 120 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 121 POST-COVID-19: SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.5.5.2 UAE

10.5.5.2.1 Growing focus on expanding natural gas production to drive market growth during the forecast period

10.5.5.2.2 By application

TABLE 122 UAE: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 123 POST-COVID-19: UAE: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.5.5.3 Kuwait

10.5.5.3.1 Increasing investments in oil & gas sector to spur market growth during the forecast period

10.5.5.3.2 By application

TABLE 124 KUWAIT: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 125 POST-COVID-19: KUWAIT: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.5.5.4 Algeria

10.5.5.4.1 Upcoming investments in upstream activities to boost demand for HWUs in coming years

10.5.5.4.2 By application

TABLE 126 ALGERIA: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 127 POST-COVID-19: ALGERIA: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.5.5.5 Nigeria

10.5.5.5.1 Offshore segment holds largest market share

10.5.5.5.2 By application

TABLE 128 NIGERIA: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 129 POST-COVID-19: NIGERIA: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.5.5.6 Rest of Middle East & Africa

10.5.5.6.1 By application

TABLE 130 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 131 POST-COVID-19: REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.6 SOUTH AMERICA

10.6.1 BY SERVICE

TABLE 132 SOUTH AMERICA: MARKET, BY SERVICE, 2016-2019 (UNITS)

TABLE 133 POST-COVID-19: SOUTH AMERICA: MARKET, BY SERVICE, 2020-2025 (UNITS)

TABLE 134 SOUTH AMERICA: MARKET SIZE, BY SERVICE, 2016-2019 (USD MILLION)

TABLE 135 POST-COVID-19: SOUTH AMERICA: MARKET SIZE, BY SERVICE, 2020-2025 (USD MILLION)

10.6.2 BY INSTALLATION

TABLE 136 SOUTH AMERICA: MARKET SIZE, BY INSTALLATION, 2016-2019 (USD MILLION)

TABLE 137 POST-COVID-19: SOUTH AMERICA: MARKET SIZE, BY INSTALLATION, 2020-2025 (USD MILLION)

10.6.3 BY CAPACITY

TABLE 138 SOUTH AMERICA: MARKET SIZE, BY CAPACITY, 2016-2019 (USD MILLION)

TABLE 139 POST-COVID-19: SOUTH AMERICA: MARKET SIZE, BY CAPACITY, 2020-2025 (USD MILLION)

10.6.4 BY APPLICATION

TABLE 140 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 141 POST-COVID-19: SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.6.5 BY COUNTRY

TABLE 142 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 143 POST-COVID-19 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

10.6.5.1 Brazil

10.6.5.1.1 Upcoming investments in oil exploration activities in the country are expected to drive market growth during the forecast period

10.6.5.1.2 By application

TABLE 144 BRAZIL: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 145 POST-COVID-19: BRAZIL: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.6.5.2 Venezuela

10.6.5.2.1 Offshore E&P activities to boost demand for HWUs during forecast period

10.6.5.2.2 By application

TABLE 146 VENEZUELA: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 147 POST-COVID-19: VENEZUELA: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

10.6.5.3 Rest of South America

10.6.5.3.1 By application

TABLE 148 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 149 POST-COVID-19: REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 131)

11.1 OVERVIEW

FIGURE 33 KEY DEVELOPMENTS IN THE MARKET, JANUARY 2017-SEPTEMBER 2020

11.2 INDUSTRY CONCENTRATION, 2019

FIGURE 34 INDUSTRY CONCENTRATION, 2019

11.3 COMPANY EVALUATION MATRIX DEFINITION AND METHODOLOGY

11.3.1 STAR

11.3.2 EMERGING LEADER

11.3.3 PERVASIVE

11.3.4 EMERGING COMPANY

FIGURE 35 MARKET (GLOBAL

11.4 COMPETITIVE SCENARIO

11.4.1 CONTRACTS AND AGREEMENTS

11.4.2 MERGERS AND ACQUISITIONS

12 COMPANY PROFILES (Page No. - 137)

(Business overview, Products offered, Recent Developments, MNM view

12.1 HALLIBURTON

FIGURE 36 HALLIBURTON: COMPANY SNAPSHOT

12.2 SUPERIOR ENERGY SERVICES

FIGURE 37 SUPERIOR ENERGY SERVICES: COMPANY SNAPSHOT

12.3 ARCHER

FIGURE 38 ARCHER: COMPANY SNAPSHOT

12.4 BASIC ENERGY SERVICES

FIGURE 39 BASIC ENERGY SERVICES: COMPANY SNAPSHOT

12.5 CUDD ENERGY SERVICES

12.6 HIGH ARCTIC ENERGY SERVICES

FIGURE 40 HIGH ARCTIC ENERGY SERVICES: COMPANY SNAPSHOT

12.7 PRECISION DRILLING

FIGURE 41 PRECISION DRILLING: COMPANY SNAPSHOT

12.8 KEY ENERGY SERVICES

FIGURE 42 KEY ENERGY SERVICES: COMPANY SNAPSHOT

12.9 VELESTO ENERGY

FIGURE 43 VELESTO ENERGY: COMPANY SNAPSHOT

12.1 ELNUSA

FIGURE 44 ELNUSA: COMPANY SNAPSHOT

12.11 EASTERNWELL

12.12 ZYT PETROLEUM EQUIPMENT

12.13 UZMA

FIGURE 45 UZMA: COMPANY SNAPSHOT

12.14 EEST ENERGY SERVICES

12.15 TECON OIL SERVICES

12.16 THE WELLGEAR GROUP

12.17 NKA ENERGY VENTURES

12.18 CASED HOLE WELL SERVICES

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS (Page No. - 161)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 OIL AND GAS INTERCONNECTED MARKETS

13.4 COILED TUBING MARKET

13.4.1 MARKET DEFINITION

13.4.2 COILED TUBING MARKET, BY SERVICE: INCLUSIONS VS. EXCLUSIONS

13.4.3 LIMITATION

13.4.4 MARKET OVERVIEW

FIGURE 46 COILED TUBING MARKET, 2018-2025 (USD MILLION)

13.4.5 COILED TUBING MARKET, BY APPLICATION

13.4.5.1 Onshore

TABLE 150 ONSHORE: COILED TUBING MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 151 POST-COVID-19: ONSHORE: COILED TUBING MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

13.4.5.2 Offshore

TABLE 152 OFFSHORE: COILED TUBING MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 153 POST-COVID-19: OFFSHORE: COILED TUBING MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

13.4.6 COILED TUBING MARKET, BY REGION

13.4.6.1 North America

TABLE 154 NORTH AMERICA: COILED TUBING MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 155 POST-COVID-19: NORTH AMERICA: COILED TUBING MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

13.4.6.2 Europe

TABLE 156 EUROPE: COILED TUBING MARKET SIZE, BY APPLICATION,2016-2019 (USD MILLION)

TABLE 157 POST-COVID-19: EUROPE: COILED TUBING MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

13.4.6.3 South & Central America

TABLE 158 SOUTH & CENTRAL AMERICA: COILED TUBING MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 159 POST-COVID-19: SOUTH & CENTRAL AMERICA: COILED TUBING MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

13.4.6.4 Asia Pacific

TABLE 160 ASIA PACIFIC: COILED TUBING MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 161 POST-COVID-19: ASIA PACIFIC: COILED TUBING MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

13.4.6.5 Middle East

TABLE 162 MIDDLE EAST: COILED TUBING MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 163 POST-COVID-19: MIDDLE EAST: COILED TUBING MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

13.4.6.6 Africa

TABLE 164 AFRICA: COILED TUBING MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 165 POST-COVID-19: AFRICA: COILED TUBING MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

13.5 WELL INTERVENTION MARKET

13.5.1 MARKET DEFINITION

13.5.2 LIMITATION

13.5.3 MARKET OVERVIEW

FIGURE 47 WELL INTERVENTION MARKET, 2018-2025 (USD MILLION)

13.5.4 WELL INTERVENTION MARKET, BY APPLICATION

13.5.4.1 Onshore

TABLE 166 ONSHORE: WELL INTERVENTION MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 167 POST-COVID-19: ONSHORE: WELL INTERVENTION MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

13.5.4.2 Offshore

TABLE 168 OFFSHORE: WELL INTERVENTION MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 169 POST-COVID-19: OFFSHORE: WELL INTERVENTION MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

13.5.5 WELL INTERVENTION MARKET, BY REGION

13.5.5.1 North America

TABLE 170 NORTH AMERICA: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 171 POST-COVID-19: NORTH AMERICA: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

13.5.5.2 Europe

TABLE 172 EUROPE: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 173 POST-COVID-19: EUROPE: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

13.5.5.3 South and Central America

TABLE 174 SOUTH AND CENTRAL AMERICA: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 175 POST-COVID -19: SOUTH & CENTRAL AMERICA: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

13.5.5.4 Asia Pacific

TABLE 176 ASIA PACIFIC: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 177 POST-COVID-19: ASIA PACIFIC: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

13.5.5.5 Middle East

TABLE 178 MIDDLE EAST: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 179 POST-COVID-19: MIDDLE EAST: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

13.5.5.6 Africa

TABLE 180 AFRICA: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 181 POST-COVID-19: AFRICA: WELL INTERVENTION MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

13.6 ARTIFICIAL LIFT MARKET

13.6.1 MARKET DEFINITION

13.6.2 ARTIFICIAL LIFT MARKET, BY MECHANISM: INCLUSIONS VS. EXCLUSIONS

13.6.3 LIMITATIONS

13.6.4 MARKET OVERVIEW

FIGURE 48 ARTIFICIAL LIFT MARKET, 2018-2025 (USD MILLION)

13.6.5 ARTIFICIAL LIFT MARKET, BY APPLICATION

13.6.5.1 Onshore

TABLE 182 ONSHORE: ARTIFICIAL LIFT MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

13.6.5.2 Offshore

TABLE 183 OFFSHORE: ARTIFICIAL LIFT MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

13.6.6 ARTIFICIAL LIFT MARKET, BY REGION

13.6.6.1 North America

TABLE 184 NORTH AMERICA: ARTIFICIAL LIFT MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

13.6.6.2 Europe

TABLE 185 EUROPE: ARTIFICIAL LIFT MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

13.6.6.3 Asia Pacific

TABLE 186 ASIA PACIFIC: ARTIFICIAL LIFT MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

13.6.6.4 South & Central America

TABLE 187 SOUTH & CENTRAL AMERICA: ARTIFICIAL LIFT MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

13.6.6.5 Middle East & Africa

TABLE 188 MIDDLE EAST & AFRICA: ARTIFICIAL LIFT MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

14 APPENDIX (Page No. - 185)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

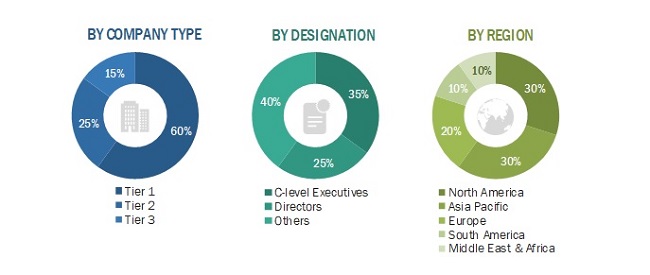

This study involved four major activities in estimating the current size of the hydraulic workover unit market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The hydraulic workover unit market comprises several stakeholders, such as end-product manufacturers and end-users in the supply chain. The demand-side of this market is characterized by its end-users, such as drilling service providers, upstream operators, and others. The supply-side is characterized by intervention service providers, tool providers, integrators, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global hydraulic workover unit market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Hydraulic workover unit Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas upstream sector.

Report Objectives

- To define, describe, segment, and forecast the hydraulic workover unit market by service, capacity, installation, application, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, future expansions, and contribution of each segment to the market

- To analyze the impact of the COVID-19 pandemic on the market while estimating the market size

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of the hydraulic workover unit market with respect to the main regions (North America, Europe, Asia Pacific, Middle East & Africa, and South America)

- To profile and rank key players and comprehensively analyze their market share

- To analyze competitive developments such as contracts and agreements, expansions and investments, new product launches, mergers and acquisitions, joint ventures, and partnerships and collaborations in the hydraulic workover unit market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Hydraulic Workover Unit Market