Pharmaceutical Packaging Market

Pharmaceutical Packaging Market by Raw Material (Plastic, Paper & Paperboard, Glass, Metal), Type (Plastic Bottles, Blisters, Caps & Closures, Labels & Accessories, Prefilled Syringes), Drug Delivery, and Region - Global Forecast to 2030

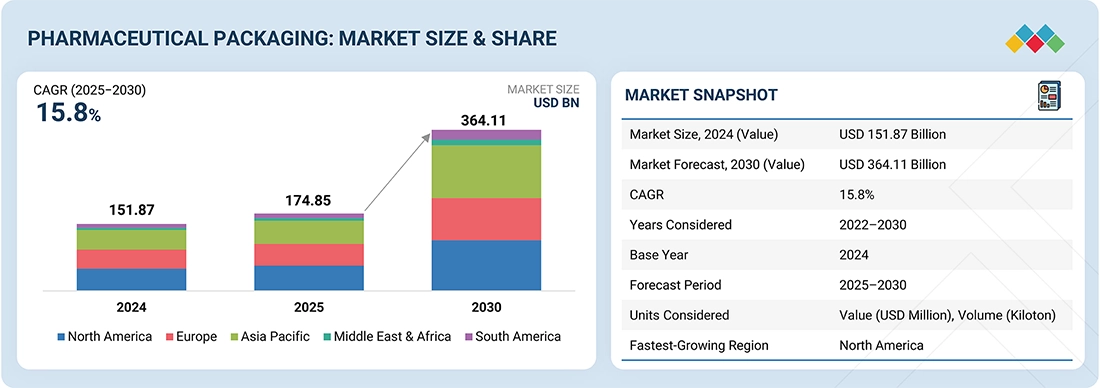

PHARMACEUTICAL PACKAGING MARKET SIZE & SHARE

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis | Updated on : February 23, 2026

The pharmaceutical packaging market size was valued at USD 174.85 billion in 2025 and is projected to reach USD 364.11 billion by 2030, growing at 15.8% cagr from 2025 to 2030. The market size continues to grow rapidly due to the increasing demand for safe and innovative packaging that provides stability, protection, and safety for patients. Innovative packaging materials such as plastics, glass, and aluminum are in high demand due to their barrier properties, strength/durability, and compatibility with various types of formulations. Representative factors contributing to the growth of the pharmaceutical packaging market include a greater supply of generics and biologics, government regulations concerning tamper-evident and child-resistant packaging, the transition to sustainable/ recyclable packaging material, and more access to healthcare in developing countries. Smart packaging and active packaging technology would also be considered a representative factor in the growth of the pharmaceutical packaging market.

KEY TAKEAWAYS

-

BY RAW MATERIALThe market of pharmaceutical packaging involves plastics, paper & paperboard, glass, metals, and other materials. These raw materials have varying strengths related to barrier protection, chemical compatibility, durability, and sustainability, making each suitable for packaging many dosage forms of health-related applications.

-

BY TYPEThe pharmaceutical packaging market includes bottles (plastic), blister packs, labels & other accessory items, closures & caps, specialty medical bags, prefilled syringes, temperature-controlled (CLS) packaging, pouches and strip packs, ampules, vials, pre-filled inhalers, tubes for medications, jars & canisters, cartridges, and other types of packaging. Each pharmaceutical packaging type has its own benefits, including protection, safety, convenience, and extended shelf life, which makes them viable packaging options for a range of drugs, dosage forms, and patient populations.

-

BY DRUG DELIVERYDrug delivery types include oral, pulmonary, transdermal, injectable, topical, nasal, ocular/ophthalmic, intravenous, and other drug delivery modes. The necessity for drug delivery is rooted in the patient's need for dosage accuracy to treat their conditions, as well as patient comfort and ease of self-administration, and worker safety for handling a delicate formulation, while maintaining stringent regulatory compliance to provide efficacy and dependability.

-

BY PACKAGING TYPEThere are two types of pharmaceutical packaging: primary and secondary packaging. The demand for primary pharmaceutical packaging is driven by the need for product protection to maintain drug stability, convenience for the patient and the healthcare provider, safety features such as tamper evidence and child resistance, and the ability to meet regulatory requirements worldwide.

-

BY REGIONAsia Pacific is projected to be the fastest-growing region in the pharmaceutical packaging market, supported by rising healthcare expenditures, expanding pharmaceutical manufacturing, and growing demand for affordable generics.

-

COMPETITIVE LANDSCAPEThe major players in the pharmaceutical packaging market are adopting both organic and inorganic growth strategies, including acquisitions, partnerships, and new product developments. Companies such as Amcor plc., Gerresheimer AG, Schott AG, AptarGroup, and West Pharmaceutical Services are expanding their portfolios with sustainable packaging solutions, smart packaging technologies, and regional expansions to meet the increasing demand for safe, innovative, and eco-friendly pharmaceutical packaging.

The pharmaceutical packaging market is anticipated to undergo significant growth across the next few years due to rising universal healthcare demands and advancements in packaging technologies. Pharmaceutical packaging is evolving to address stringent regulations and increased demand for new products, in addition to the many advantages of drug safety, improved patient convenience, and longer shelf-life. The necessity of lightweight, strong, and sustainable packaging configurations across diverse applications such as oral solids, injectables, biologics, and specialty drugs will put the pharmaceutical packaging market in a position to be an integral method of safe, secure, and effective healthcare access.

PHARMACEUTICAL PACKAGING MARKET TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The pharmaceutical sector's business is impacted by changing customer patterns and disruptions in various areas of the market. Drug product manufacturers, contract manufacturing organizations, and healthcare providers are crucial for pharmaceutical packaging manufacturers. The end users are patients or medical professionals. The demand in those market areas was affected by trends such as the demand for packaging that is friendly to the patient, sustainability, combining digital health with pharmaceuticals, and regulatory compliance, which can affect drug delivery and patient adherence. Changes in pharmaceutical sales and patient outcomes affect packaging suppliers' revenue, which in turn affects the overall growth and competitiveness of the pharmaceutical packaging industry.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

PHARMACEUTICAL PACKAGING MARKET DYNAMICS

Level

-

Growing healthcare expenditure and pharmaceutical industry in emerging economies

-

Growing demand for drug delivery devices and blister packaging

Level

-

Increasing overall packaging costs owing to dynamic regulatory policies

-

Lack of access to proper healthcare in emerging economies

Level

-

Growing demand for primary pharmaceutical packaging

-

Growth in personalized medicine

Level

-

Safeguarding counterfeit products

-

Balancing innovations with cost efficiency

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing healthcare expenditure and pharmaceutical industry in emerging economies

The pharmaceutical industry is growing at a rapid pace in emerging economies. Advanced manufacturing processes, technological innovations, and increased integration of companies have resulted in the industry's rapid growth, thus driving the pharmaceutical packaging market. Emerging economies such as Brazil, Russia, India, and China will likely witness remarkable growth. The market in certain countries is experiencing growth due to rising income levels and increased awareness about the benefits of good healthcare systems and healthier lifestyles. The key drivers of this growth are the large population (particularly the increasing young population) and higher life expectancy. The US has the largest pharmaceutical market globally, followed by China. The rapidly increasing elderly population and its corresponding need for medical assistance are supporting the market's growth in the country. The Indian pharmaceuticals market has grown significantly in the last two decades, driven by the increasing production of generic drugs. According to Invest India, the country constitutes around 20% of the global generics supply and 62% of the vaccine demand.

Restraint: Lack of access to proper healthcare in emerging economies

According to a WHO report, nearly half of the global population is unable to afford the required healthcare services. Emerging economies are likely to play a vital role in market growth. Increasing population and attractive demographics serve as growth drivers for the pharmaceutical industry in these markets. This provides high growth opportunities for leading pharmaceutical companies experiencing issues pertaining to the stagnancy of markets, stringent regulatory policies, and patent expiry. However, poverty, lack of appropriate infrastructure, low literacy rate, and prevalence of unorganized healthcare systems in emerging economies are restraining market growth. In India, most of the population still suffers due to poor healthcare quality and lack of access. According to an article by India Today, the rate of maternal mortality during childbirth in private hospitals is approximately 3.84%. Also, the health worker density in India is approximately 23 per 10,000 people. In China, primary healthcare services continue to face suboptimal conditions. Poverty is a major barrier to accessing healthcare facilities in emerging economies. Financial constraints, lack of information, outdated equipment, lack of proper staff, and awareness of appropriate healthcare practices are the major challenges that limit access to healthcare services. These issues restrain the growth of the pharmaceutical packaging market in India, Brazil, South Africa, and other emerging economies.

Opportunity: Growing demand for primary pharmaceutical packaging

Primary pharmaceutical packaging products come in direct contact with the medicine or drug. They mainly include plastic bottles, glass bottles, prefilled syringes, prefilled inhalers, medication tubes, and blister packaging. The major contributors to the growth of this segment are prefillable syringes and prefillable inhalers. Plastic bottles, blister packs, and ampoules & vials are also some of the primary pharmaceutical packaging products that are growing rapidly. Advancements in biotechnology are driving demand for high-visibility unit dosage packaging, particularly for injectable parenteral therapies used to treat diseases like diabetes. Growth of the inhalers segment is expected to be supported by the rising number of chronic asthma, allergy, and migraine patients treated with inhalation drugs. Primary packaging is also growing due to the advent of biologics and other specialty drugs. Biologics require specialized packaging to avoid contamination and leaching. It needs to be flexible to encompass the packaging of biology and grow in the ready-to-use pharma products segment. Increased spending and R&D in self-medication drugs and biologics are expected to boost the demand for primary packaging globally. Biologics are mostly used through prefilled syringes, which provide a significant opportunity for the packaging type to grow soon. In addition, a rise in the use of the self-medication approach is also projected to boost the consumption of biologics and PFS globally.

Challenge: Safeguarding counterfeit products

Counterfeit drugs are made with incorrect ingredients in inappropriate quantities, which, when consumed, would result in harmful effects such as allergic reactions or sometimes death. According to the Pharmaceutical-technology website, counterfeit drugs amount to a valuation of USD 200 billion per year. Nearly half of the counterfeit drugs are reported in emerging economies such as China, the Philippines, and Vietnam, followed by Africa with 18.7% and Europe with 13.6%, as per the WHO. According to the CDC, 10% to 30% of medicines sold in emerging economies are counterfeit. Anti-malarial and antibiotics are among the most counterfeited medical products. WHO is constantly taking initiatives against counterfeiters by setting new standards for drug packaging. All activities related to drug serialization that evolve in different countries are backed by global initiatives managed by the WHO. The governments of developed and emerging economies are implementing stringent legislation, such as the US Code 2320, for tracking counterfeit products and related acts to prevent the counterfeiting of pharmaceutical products.

Pharmaceutical Packaging Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Developed AmSky, a recyclable high-barrier blister pack designed to replace PVC in solid oral dosage packaging | Delivered an eco-friendly, fully recyclable solution without compromising on barrier protection, helping pharmaceutical companies meet sustainability goals |

|

Developed prefillable syringes and high-quality vials using advanced glass and cyclic olefin polymers to support the growing demand for biologics and biosimilars | Delivered high chemical resistance and low breakage risk, ensured compatibility with sensitive drugs, improved safety, and supported efficient fill-and-finish operations |

|

Launched FIOLAX borosilicate glass tubing and ready-to-use vials to meet the stringent requirements of biotech and vaccine manufacturers | Provided superior chemical durability and resistance to delamination, enabled faster filling processes, and ensured compliance with international regulatory standards |

|

Created connected drug delivery devices such as digital inhalers with embedded sensors for asthma and COPD treatment | Enhanced patient adherence and monitoring, enabled real-time data tracking, and improved therapeutic outcomes through digital healthcare integration |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

PHARMACEUTICAL PACKAGING MARKET ECOSYSTEM

Analysis of the pharmaceutical packaging market ecosystem indicates a broad and interconnected set of stakeholders, all contributing to the safe production, distribution, and ultimate use of packaging solutions for medicines. Within the ecosystem lie upstream raw material suppliers (including producers of plastics, glass, aluminum, and paperboard), specialized pharmaceutical packaging manufacturers, global and regional distributors, regulatory agencies, and a wide range of end-use industries led by pharmaceutical and biotechnology companies. The market’s response to increasing demand for innovative formats, stricter regulatory mandates on serialization and sustainability, and evolving drug delivery systems highlights the importance of a relationship-based value chain that spans from material innovation to patient compliance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

PHARMACEUTICAL PACKAGING MARKET OUTLOOK & FORECAST (MARKET SEGMENTS)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Pharmaceutical Packaging Market, by Type

Prefilled syringes are projected to be the fastest-growing type of pharmaceutical packaging during the forecast period. The growth will be driven by their enhanced convenience of use, accuracy of dosing, reduced drug waste, and improved patient safety compared to glass vials. They offer enhanced convenience, accurate dosage delivery, reduced drug wastage, and improved patient safety compared to traditional vials. A shift toward prefilled syringes is being driven by both global trends in chronic diseases, increasing demand for self-administration, and the rapid incorporation of biologics and biosimilars into the healthcare system. Pharmaceutical manufacturers and providers view prefilled syringes as preferable due to the lower risk of patient contamination, simplified adherence, and support of single-use sterile applications. To enhance patient safety, sterility, and the ultimate increase of global demand, regulators (e.g., FDA, EMA) are also advocating for packaging configurations. Recent innovations are continuing to promote their use in both developed and emerging healthcare markets with dual chamber designs for lyophilized products, systems for needle safety, and advanced components that promote enhanced drug stability.

Pharmaceutical packaging Market, by Packaging Type

It is projected that primary packaging will have a higher rate of growth in the pharmaceutical packaging space during the forecast period, due to its value in drug safety, efficacy, and the promotion of patient adherence. Primary packaging formats will include things like blister packs, bottles, prefilled syringes, and vials, all of which are critical in the protection of sensitive drugs from contamination, moisture, and light while also retaining their stability over shelf-life. The increasing use of biologics, injectables, and personalized medicine will increase demand for new primary packaging formats that can evidence tampering, be child-resistant, and enable controlled doses. Finally, the anticipated investment levels in smart packaging will drive strong growth in primary packaging. Examples of this smart packaging will include serialization, QR codes, and real-time monitoring.

REGION

Asia Pacific to be the fastest-growing region in the global pharmaceutical packaging market during the forecast period

The Asia Pacific region is projected to be the fastest-growing pharmaceutical packaging market by value during the forecast period because of the rising healthcare spending, rapid growth of pharmaceutical manufacturing, and expanding access to modern healthcare systems. Countries like China and India are becoming global hubs for manufacturing and exporting generic drugs and fostering substantial demand for affordable and quality packaging materials. The introduction of government programs in India, including Pharma Vision 2030, and China is engendering a policy environment that drives the investment in new packaging technologies and packaging standards. The increasing occurrence of chronic and lifestyle diseases, coupled with a growing middle class, will broaden the market for new packaging formats or new drug delivery systems. Moreover, as multi-national pharmaceutical companies are looking to expand into this region, market demand for more advanced, centrally sourced, sustainable, and smart pharmaceutical packaging will surge, with Asia Pacific becoming the primary growth engine of the market.

Pharmaceutical Packaging Market: COMPANY EVALUATION MATRIX

With a broad global footprint, a deep portfolio across flexible, rigid, and specialty packaging, and a meaningful concentration on sustainable research and innovation, Amcor plc (Star) leads the market matrix for pharmaceutical packaging companies. The business provides safe and reliable delivery of pharmaceuticals while addressing the varied pharmaceutical needs globally, securing its leadership position. Gerresheimer AG (Emerging Leader) is slowly advancing through its knowledge benefit for primary packaging, increased focus on biologics, and customized drug delivery systems. Amcor continues to bolster its leadership by sheer size and innovation, with Gerresheimer displaying strong movement to the leader position quadrant with its specialization, business expansions, and focus.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 151.87 Billion |

| Market Forecast in 2030 (value) | USD 364.11 Billion |

| Growth Rate | CAGR of 15.80% from 2025 to 2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Pharmaceutical Packaging Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Pharmaceutical Packaging Manufacturer | Detailed profiles of leading pharma packaging companies (financials, product range, regulatory approvals, sustainability strategies) | Identified high-growth regional markets (Asia Pacific, South America) |

| Plastic Bottles Manufacturer | Comparative benchmarking of HDPE, LDPE, and PET bottles by application (OTC drugs, syrups, solid orals) | Identified and forecasted material substitution risks (glass → PET/HDPE) |

| Blister Packaging Manufacturer | Competitive analysis of blister formats (PVC/PVDC, Alu-Alu, multi-layer laminates) | Enabled entry into fast-growing segments (generics in Asia, unit-dose adherence packs) |

RECENT DEVELOPMENTS

- August 2025 : Schott AG inaugurated local production of FIOLAX glass tubing at its Jambusar, Gujarat facility (the first in India), addressing growing GLP-1 injectable demand with high-precision syringe and cartridge glass tubing.

- August 2025 : BD announced plans to invest in expanding BD PosiFlush Prefilled Flush Syringe production at the Columbus, Nebraska, facility in the US.

- July 2025 : AptarGroup, Inc. introduced the first nasal spray pump made with 52% bio-based feedstock, enhancing sustainability in pharmaceutical packaging.

- April 2025 : Amcor secured an order for AmSky, a recycle-ready, PVC-free thermoform blister system designed for healthcare and pharma, offering strong barrier performance and lower carbon footprint.

- January 2025 : Gerresheimer AG launched and marketed Gx Cap, a digitally networked closure enabling remote therapeutic monitoring and enhanced digital traceability for prescription medication containers.

Table of Contents

Methodology

The study involved four major activities to estimate the current size of the global pharmaceutical packaging market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of pharmaceutical packaging through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the pharmaceutical packaging market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

The market for the companies offering pharmaceutical packaging is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to in order to identify and collect information for this study on the pharmaceutical packaging market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the pharmaceutical packaging market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of pharmaceutical packaging offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Notes: Other designations include sales, marketing, and product managers.

Tier 1: Revenues greater than USD 1 Billion; Tier 2: Revenues between USD 500 million and USD 1

Billion; and Tier 3: Revenues less than USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global pharmaceutical packaging market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Pharmaceutical Packaging Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation procedure was employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Pharmaceutical packaging pertains to the materials and systems designed to protect, preserve, and deliver pharmaceutical products for oral, injectable, inhalation, and topical drug delivery modalities. It plays an important role in the stability and sterility of a drug, avoids contamination, and provides accurate dosing for the life of the product. Pharmaceutical packaging denotes the numerous varieties of available options, like plastic bottles, blister packs, vials, ampoules, prefillable syringes, tubes, pouches, and cartons to meet drug formulation requirements and regulatory obligations. Some of the significant functionalities of pharmaceutical packaging include moisture, oxygen, and light barrier protection, tamper evidence, patient convenience, and functionality with active pharmaceutical ingredients (APIs).

Areas of interest include ISO 15378 relating specifically to primary packaging materials, ISO 9001 regarding quality management systems, and GMP compliance. The DSCSA and the EU FMD identified serialized, tracking, and anti-counterfeiting programs, creating an opportunity for the packaging industry to help with drug quality and patient safety.

Stakeholders

- Pharmaceutical packaging manufacturers

- Raw material suppliers

- Converters & processors

- Distributors and traders

- Industry associations and regulatory bodies

- End users

Report Objectives

- To define, describe, and forecast the size of the pharmaceutical packaging market, based on type, packaging type, drug delivery, raw material, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments and subsegments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as acquisitions, product launches, expansions, partnerships, and agreements in the pharmaceutical packaging market

- To provide the impact of AI/Gen AI on the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the pharmaceutical packaging market report:

Product Analysis

- A product matrix that gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- A further breakdown of the pharmaceutical packaging market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Pharmaceutical Packaging Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Pharmaceutical Packaging Market