Integrated Workplace Management System (IWMS) Market by Offering (Solution and Services (Professional & Managed)), Deployment Type, Organization Size, Vertical (Real Estate & Construction, Healthcare, Retail, Education), and Region - Global forecast to 2025

Integrated Workplace Management System Market Size & Forecast

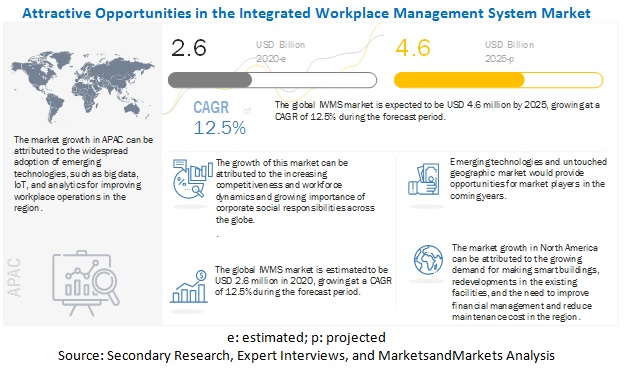

The global Integrated Workplace Management System (IWMS) Market is projected to expand at a CAGR of 12.5 % during the forecast period to reach USD 4.6 billion by 2025, size was valued USD 2.6 billion in 2020. The IWMS market saw a rise mainly due to increased adoption of the Internet of Things (IoT), and Information and Communications Technology (ICT) across different industry verticals. The demand for IWMS is driven by the requirement of improved and efficient operational solutions, which is leading to increased sophistication of solutions and services.

COVID -19 Impact on Integrated Workplace Management System Market

IWMS solution is constantly becoming a necessary requirement for infrastructure and manufacturing companies. However, with halted projects and low profitabilities owing to global COVID-19 lockdowns, companies are showing a slow adoption of IWMS solutions and services. Moreover, the return of the workforce at the workplace post-COVID-19 demands an advanced IWMS solution with risk management capabilities and social distancing benefits, best suited to new guidelines and regulations regarding workforce safety. In addition, the demands for cloud-based IWMS solutions have increased owing to its low Total Cost of Ownership (TCO), anywhere access, and scalability benefits, which is a must-have requirement during the COVID-19 crisis.

IWMS Market Dynamics

Driver: Growing cloud-based application deployments

Nowadays, the trend is shifting from complex on-premises deployment to cloud-based (SaaS-based) deployment. The SaaS-based implementation of IWMS enables more granular, less costly, and resource-intensive projects. Cloud deployment is widely adopted by small companies, as it enables them to spend a minimum amount of their revenue on data center infrastructure and onsite implementation, deployment cost, and training cost. Cloud platforms present a perfectly cost-effective and easily deployable alternative, eliminating the need to build on-premises data centers specifically for small organizations. Moreover, cloud technology can offer multiple benefits to the integrated workplace management system market, such as real-time tracking, integrated processes, less energy consumption, safety and security, disaster recovery, and data center consolidation. For instance, mobile usage, along with cloud technology, has made it much easier for facility managers to send alerts to employees in remote areas anywhere, anytime.

Restraint: Unexplored benefits of facility and workplace management

The major restraining factor impacting the growth of the integrated workplace management system market is the lack of awareness and its importance in organizations. Earlier, the task of workplace management was tedious, as every work had to be managed manually. It was considered a less important department of an organization with very less exposure. With the increasing need for operational efficiency, managers started aiming for proper management of the workplace. Moreover, even though workplace management is an important aspect of organizations, people are not fully aware of the changing products and services that have made this department equally important as other core business processes.

Many of the countries, specifically developing countries, such as Malaysia, Saudi Arabia, Mexico, and Columbia, are offering a wide range of opportunities for IWMS providers. Still, due to a lack of awareness about the importance of facility management development, the growth is very slow. Myths such as facility managers feel customization is very costly, and extensive training is required for IWMS are also restraining the growth of the IWMS market. Therefore, several associations have been formed so that they can help create awareness in the end user sector.

Opportunity: Emerging technologies

Currently, the market is gaining momentum around technologies such as IoT, advanced analytics, cutting-edge new sensors, mobility, SaaS, and new development environments, enabling more demand for enterprise integration than ever before, which in turn, is impacting the deployment of IWMS across organizations. The IWMS platform can connect over social media, impacting project collaboration, and space utilization. IWMS can support machine and device data from sensors, meters, smartphones, etc., thereby driving operations, decisions, and facilities automation. Unlike traditional analytic tools, IWMS is already integrated with the Real Estate Financial Modeling (REFM) business process as well as pre-configured for business use. This solution can offer real-time analytics, predictive analytics, and newly emerging cognitive analytics and presence analytics.

Emerging technologies such as IoT are one of the biggest opportunities, as they can act as a game-changer technology for managers. The adoption of IoT will significantly simplify the operations, as data can be automatically collected through sensors, which can later be analyzed for maintenance operation at the maximum efficiency. The use of IoT will significantly lessen the pressure on workplace management tools, such as Computerized Maintenance Management System (CMMS), and help in getting accurate results in minimum time. IoT is still in the nascent stage but holds immense growth potential in the future. Hence, as the market of IoT evolves, it will impact the market of IWMS solutions.

Challenge: Lack of expertise

The major challenge while implementing IWMS is the lack of required skill sets as well as knowledge. The big IWMS projects comprise multiple sites located in different countries, resulting in implementation challenges due to lack of expertise. At this point, IWMS projects are responsible for accounting and resolving the issues associated with multiple cultures, languages, specific legislations, and local business customs.

The poor image of facility management is also one of the biggest barriers to the adoption of workplace management as a profession. Moreover, a lack of awareness about IWMS solutions is another growth inhibitor in this market. Lack of expertise at management and executive level has created a complex understanding among organizations to define the alignment between regulatory objectives and company goals, which also makes companies incapable of understanding the need for expertise to manage their facilities.

Professional Services to hold the largest market share among services during the forecast period

Professional services are categorized into three categories, namely, Information Technology (IT) consulting, system integration and deployment, and support and maintenance. The professional services segment growth is mainly attributed to the increasing complexities in business operations and the growing deployment of IWMS solutions.

Manufacturing vertical to hold the largest market size during the forecast period

The manufacturing vertical is expected to hold the largest market size in the integrated workplace management system market. With the rapid technology implementation across the manufacturing vertical, the degree of competitiveness among organizations has increased drastically. As a result, organizations are keen to implement efficient workplace solutions in their manufacturing facilities.

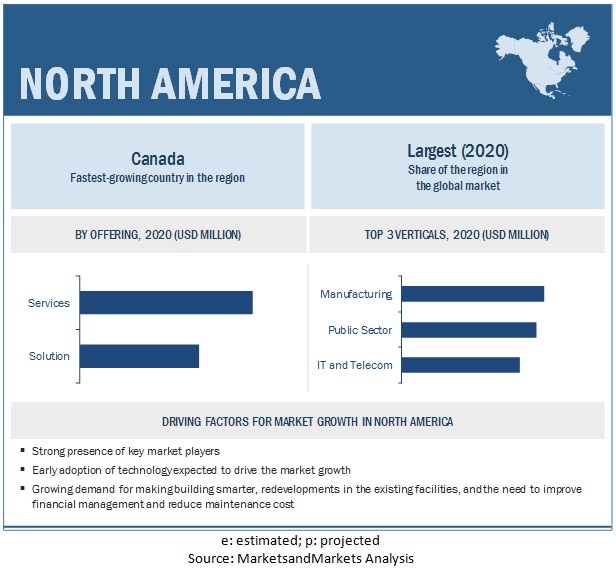

North America to hold the largest market size during the forecast period

North America has always been an innovative and competitive ground for every technology. The region remains one of the fastest in the adoption of innovative technologies. Currently, the United States (US) holds the highest share in the integrated workplace management system market, due to increasing developments in smart building projects in the US. This has led to the use of IWMS solutions for space management, asset and maintenance management, and real estate and lease management. Most of the leading market players, such as IBM, Oracle, Trimble, Accruent, and Archibus, have their headquarters in this region. New advancements and establishments of real estate and infrastructure sector demand IWMS solutions in this region. North America, in the coming years, is estimated to continue to lead the IWMS market.

Market Players:

Key integrated workplace management system (IWMS) market players profiled in this report include IBM (US), Oracle (US), Trimble (US), Planon (Netherlands), Accruent (US), Archibus (US), Service Works Global (United Kingdom [UK]), Causeway (UK), SAP (Germany), FSI (FM Solutions) (UK), FM:Systems (US), iOFFICE (US), Spacewell (Belgium), MRI Software (US), Facilio (US), zLink (US), Nuvolo (US), VLogic Systems (US), Rapal (Finland), AssetWorks (US), Smartsheet (US), SIERRA (India), OfficeSpace (US), IDASA SISTEMAS (Spain), Collectiveview (US), Budgetrac (US), Tango (US), QuickFMS (US), and ServiceChannel (US). These players offer various IWMS solutions to cater to the demands and needs of the market. Major growth strategies adopted by the players include partnerships, collaborations and agreements, and new product launches/product enhancements.

Please visit 360Quadrants to see the vendor listing of Best IWMS Software Quadrant

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2020 |

USD 2.6 billion |

|

Revenue forecast for 2025 |

USD 4.6 billion |

|

Growth Rate |

12.5 % CAGR |

|

Market size available for years |

2016–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

USD Billion |

|

Segments covered |

Offering, Deployment Type, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

IBM (United States [US]), Oracle (US), Trimble (US), Planon (Netherlands), Accruent (US), Archibus (US), Service Works Global (United Kingdom [UK]), Causeway (UK), SAP (Germany), FSI (FM Solutions) (UK), FM: Systems (US), iOFFICE (US), Spacewell (Belgium), MRI Software (US), Facilio (US), zLink (US), Nuvolo (US), VLogic Systems (US), Rapal (Finland), AssetWorks (US), Smartsheet (US), SIERRA (India), OfficeSpace (US), IDASA SISTEMAS (Spain), Collectiveview (US), Budgetrac (US), Tango (US), QuickFMS (US), and ServiceChannel (US) |

The research report categorizes the Integrated Workplace Management System Market to forecast revenues and analyze trends in each of the following submarkets:

By offering:

- Solution

-

Services

-

Professional Services

- Consulting

- System Integration and Deployment

- Support & Maintenance

- Managed Services

-

Professional Services

By deployment type:

- On-premises

- Cloud

By organization size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By vertical:

- Public Sector

- IT and Telecom

- Manufacturing

- BFSI

- Real Estate and Construction

- Retail

- Healthcare

- Education

- Others (F&B, Chemical, Transportation, and Agriculture)

By region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- United Arab Emirates (UAE)

- Saudi Arabia

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In June 2020, IBM introduced Watson Works, a curated set of products that incorporates IBM Watson AI models and applications to address post-COVID-19 workplace requirements, such as prioritizing employee health, facilities management, workplace re-entry, space allocation, contract retracing, and communication and collaboration.

- In June 2020, SAP and Honeywell entered into a partnership to launch a cloud-based solution by combining SAP Cloud for Real Estate solution and Honeywell Forge, an enterprise performance management offering. The solution is aimed at improving tenant experience by helping real estate companies optimize building performance and ensure building occupant safety post-COVID-19 scenario.

- In June 2020, Planon released 40 use cases within its IWMS product, for safe and controlled workplace re-entry, some of which include providing COVID-19 guidelines in e-mail confirmation, limiting the number of available workspaces, adding Social Distance Setup to meeting rooms, and blocking workspaces to ensure distance. The new use cases support real estate and facilities teams across nine sets of processes, including visitor management, space & workspace management, access management, and meeting management.

- In May 2020, Trimble introduced ManhattanONE, a comprehensive software suite for centralizing portfolio, building, workplace, and finance lease information to enable data monitoring of key real-estate data and facilitate evidence-based decision-making. Built for cloud, the new software suite comprises modules for financial management, room booking, project management, maintenance, and energy management. The suite aims at addressing the back-to-work challenges posed by COVID-19.

- In April 2020, Oracle integrated its Oracle Aconex and Primavera P6 EPPM solutions with Reconstruct, a construction project workflow management tool, to bring together its PPM capabilities and Reconstructs’ s project scheduling capabilities. The integration enhances both progress visibility and remote monitoring of construction projects.

- In April 2020, Accruent partnered with Mitie, a UK-based facilities management and professional services company, to provide its customers with exceptional facilities management and remote monitoring services. With the partnership, Accruent added its remote monitoring solution, vx Observe IoT platform, to Mitie’s service portfolio to deliver comprehensive asset performance analytics and workflows.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 43)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 52)

2.1 RESEARCH DATA

FIGURE 6 INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE GENERATION FROM INTEGRATED WORKPLACE MANAGEMENT SYSTEM SOLUTION AND SERVICE VENDORS

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPETITIVE LEADERSHIP MAPPING METHODOLOGY

FIGURE 9 COMPETITIVE LEADERSHIP MAPPING: CRITERIA WEIGHTAGE

2.6 ASSUMPTIONS FOR THE STUDY

2.6.1 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 61)

FIGURE 10 TOP THREE LEADING SEGMENTS IN THE INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET IN 2020

FIGURE 11 MARKET TO WITNESS SIGNIFICANT GROWTH DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 64)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 12 INCREASING STRINGENT REGULATORY MANDATES AND RISING ADOPTION OF CLOUD-BASED SOLUTIONS DRIVING THE MARKET GROWTH

4.2 NORTH AMERICA: MARKET, BY VERTICAL AND COUNTRY, 2020

FIGURE 13 MANUFACTURING AND UNITED STATES TO HOLD A HIGHER MARKET SHARE IN 2020

4.3 MARKET, BY COUNTRY

FIGURE 14 MARKET, BY COUNTRY

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 66)

5.1 INTRODUCTION

5.2 DRIVERS AND OPPORTUNITIES

5.3 RESTRAINTS AND CHALLENGES

5.4 CUMULATIVE GROWTH ANALYSIS

5.5 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET

5.5.1 DRIVERS

5.5.1.1 Growing cloud-based application deployments

5.5.1.2 Increasing competitiveness and workforce dynamics

5.5.1.3 Growing importance of corporate social responsibilities across the globe

5.5.1.4 Increasing government regulatory compliances

5.5.2 RESTRAINTS

5.5.2.1 Unexplored benefits of facility and workplace management

5.5.3 OPPORTUNITIES

5.5.3.1 Emerging technologies

5.5.3.2 Untouched geographic market

5.5.3.3 Growing need for safeguarding employees at workplaces post-COVID-19

5.5.4 CHALLENGES

5.5.4.1 Lack of expertise

5.6 ENABLING TECHNOLOGIES

FIGURE 16 INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET: ENABLING TECHNOLOGIES

5.6.1 INTERNET OF THINGS

5.6.2 CLOUD COMPUTING

5.6.3 ARTIFICIAL INTELLIGENCE

5.7 USE CASES

5.7.1 USE CASE 1

5.7.2 USE CASE 2

5.7.3 USE CASE 3

5.7.4 USE CASE 4

5.7.5 USE CASE 5

5.7.6 USE CASE 6

5.7.7 USE CASE 7

5.7.8 USE CASE 8

6 INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY OFFERING (Page No. - 80)

6.1 INTRODUCTION

6.1.1 OFFERINGS: MARKET DRIVERS

6.2 OFFERINGS: COVID– -19 IMPACT ON MARKET

FIGURE 17 SERVICES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 3 MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 4 MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

6.3 SOLUTION

6.3.1 SOLUTION: MARKET DRIVERS

6.3.2 OPERATIONS AND SERVICES MANAGEMENT

6.3.3 REAL ESTATE MANAGEMENT

6.3.4 ENVIRONMENTAL AND ENERGY MANAGEMENT

6.3.5 FACILITY MANAGEMENT

6.3.6 PROJECT MANAGEMENT

TABLE 5 SOLUTION: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 6 SOLUTION: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.4 SERVICES

6.4.1 SERVICES: MARKET DRIVERS

FIGURE 18 PROFESSIONAL SERVICES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 7 SERVICES: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 8 SERVICES: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 9 SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 10 SERVICES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.4.2 PROFESSIONAL SERVICES

FIGURE 19 INTEGRATION AND DEPLOYMENT SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 11 PROFESSIONAL SERVICES: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 12 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 13 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 14 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.4.2.1 Consulting

TABLE 15 CONSULTING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 CONSULTING MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.4.2.2 Integration and deployment

TABLE 17 INTEGRATION AND DEPLOYMENT MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 INTEGRATION AND DEPLOYMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.4.2.3 Support and maintenance

TABLE 19 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.4.3 MANAGED SERVICES

TABLE 21 MANAGED SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 MANAGED SERVICES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7 INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE (Page No. - 93)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT TYPES: MARKET DRIVERS

7.2 DEPLOYMENT TYPES: COVID-19 IMPACT ON THE MARKET

FIGURE 20 CLOUD SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 23 MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 24 MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

7.3 ON-PREMISES

7.3.1 INCREASING DEMAND FOR SECURITY TO PAVE WAY FOR ON-PREMISES SOLUTIONS ACROSS DIFFERENT VERTICALS

TABLE 25 ON-PREMISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 ON-PREMISES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.4 CLOUD

7.4.1 NEED FOR COST-EFFECTIVENESS AND GLOBAL AVAILABILITY TO DRIVE THE ADOPTION OF CLOUD-BASED INTEGRATED WORKPLACE MANAGEMENT SYSTEM

TABLE 27 CLOUD: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 CLOUD: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8 INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE (Page No. - 98)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.2 ORGANIZATION SIZE: COVID-19 IMPACT ON THE MARKET

FIGURE 21 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 29 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 30 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 31 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 33 NORTH AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 34 NORTH AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 35 EUROPE: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 36 EUROPE: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 37 ASIA PACIFIC: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 38 ASIA PACIFIC: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 41 LATIN AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 42 LATIN AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

8.4 LARGE ENTERPRISES

TABLE 43 LARGE ENTERPRISES: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 44 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 45 NORTH AMERICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 46 NORTH AMERICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 47 EUROPE: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 48 EUROPE: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 49 ASIA PACIFIC: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 50 ASIA PACIFIC: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 53 LATIN AMERICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 54 LATIN AMERICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9 INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY VERTICAL (Page No. - 109)

9.1 INTRODUCTION

9.1.1 VERTICALS: MARKET DRIVERS

9.2 VERTICALS: COVID-19 IMPACT ON THE MARKET

FIGURE 22 MANUFACTURING VERTICAL TO REGISTER THE LARGEST MAREKT SIZE DURING THE FORECAST PERIOD

TABLE 55 MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 56 MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

9.3 PUBLIC SECTOR

TABLE 57 PUBLIC SECTOR: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 58 PUBLIC SECTOR: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.4 IT AND TELECOM

TABLE 59 IT AND TELECOM: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 60 IT AND TELECOM: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.5 MANUFACTURING

TABLE 61 MANUFACTURING: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 62 MANUFACTURING: SYSTEM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.6 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 63 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 64 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.7 REAL ESTATE AND CONSTRUCTION

TABLE 65 REAL ESTATE AND CONSTRUCTION: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 66 REAL ESTATE AND CONSTRUCTION: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.8 RETAIL

TABLE 67 RETAIL: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 68 RETAIL: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.9 HEALTHCARE

TABLE 69 HEALTHCARE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 70 HEALTHCARE: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.10 EDUCATION

TABLE 71 EDUCATION: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 72 EDUCATION: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.11 OTHERS

TABLE 73 OTHERS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 74 OTHERS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10 INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, BY REGION (Page No. - 122)

10.1 INTRODUCTION

10.2 REGIONS: COVID-19 IMPACT ON THE MARKET

TABLE 75 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 76 MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

FIGURE 23 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

10.3 NORTH AMERICA

10.3.1 NORTH AMERICA: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET DRIVERS

FIGURE 24 NORTH AMERICA: MARKET SNAPSHOT

TABLE 77 NORTH AMERICA: MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

10.3.2 UNITED STATES

10.3.2.1 Increasing demand for smart buildings and growing presence of a large number of IWMS vendors to drive the market growth in the US

TABLE 91 UNITED STATES: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 92 UNITED STATES: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 93 UNITED STATES: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 94 UNITED STATES: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 95 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 96 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 97 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 98 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.3.3 CANADA

10.3.3.1 Increasing number of public-private partnership projects to boost the market growth in Canada

TABLE 99 CANADA: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 100 CANADA: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 101 CANADA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 102 CANADA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 103 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 104 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 105 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 106 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.4 EUROPE

10.4.1 EUROPE: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET DRIVERS

TABLE 107 EUROPE: MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

10.4.2 UNITED KINGDOM

10.4.2.1 Digital transformation to drive the growth of the market in the UK

TABLE 121 UNITED KINGDOM: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 122 UNITED KINGDOM: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 123 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 124 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 125 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 126 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 127 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 128 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.4.3 GERMANY

10.4.3.1 High public investments in infrastructure to drive the market growth in Germany

TABLE 129 GERMANY: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 130 GERMANY: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 131 GERMANY: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 132 GERMANY: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 133 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 134 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 135 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 136 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.4.4 FRANCE

10.4.4.1 Wide adoption of AI, ML, and data analytics technologies among enterprises to drive the growth of the market in France

TABLE 137 FRANCE: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 138 FRANCE: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 139 FRANCE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 140 FRANCE: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 141 FRANCE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 142 FRANCE: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 143 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 144 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.4.5 REST OF EUROPE

TABLE 145 REST OF EUROPE: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 146 REST OF EUROPE: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 147 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 148 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 149 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 150 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 151 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 152 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.5 ASIA PACIFIC

10.5.1 ASIA PACIFIC: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET DRIVERS

FIGURE 25 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 165 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 166 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

10.5.2 CHINA

10.5.2.1 High investments in the private sector and huge population to boost the market growth in China

TABLE 167 CHINA: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 168 CHINA: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 169 CHINA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 170 CHINA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 171 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 172 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 173 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 174 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.5.3 JAPAN

10.5.3.1 Huge investments in the real estate sector to drive the market growth in Japan

TABLE 175 JAPAN: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 176 JAPAN: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 177 JAPAN: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 178 JAPAN: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 179 JAPAN: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 180 JAPAN: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 181 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 182 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.5.4 INDIA

10.5.4.1 Emphasis on urban development and modernization to drive the market growth in India

TABLE 183 INDIA: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 184 INDIA: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 185 INDIA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 186 INDIA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 187 INDIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 188 INDIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 189 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 190 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.5.5 REST OF ASIA PACIFIC

TABLE 191 REST OF ASIA PACIFIC: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 192 REST OF ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 193 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 194 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 195 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 196 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 197 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 198 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.6 MIDDLE EAST AND AFRICA

10.6.1 MIDDLE EAST AND AFRICA: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET DRIVERS

TABLE 199 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 200 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 201 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 202 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 203 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 204 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 205 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 206 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 207 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 208 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 209 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 210 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 211 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 212 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

10.6.2 UNITED ARAB EMIRATES

10.6.2.1 Rapid technological adoption to drive the market growth in the UAE market

TABLE 213 UNITED ARAB EMIRATES: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 214 UNITED ARAB EMIRATES: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 215 UNITED ARAB EMIRATES: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 216 UNITED ARAB EMIRATES: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 217 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 218 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 219 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 220 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.6.3 SAUDI ARABIA

10.6.3.1 Growing population to drive the growth of the market in Saudi Arabia

TABLE 221 SAUDI ARABIA: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 222 SAUDI ARABIA: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 223 SAUDI ARABIA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 224 SAUDI ARABIA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 225 SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 226 SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 227 SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 228 SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.6.4 REST OF MIDDLE EAST AND AFRICA

TABLE 229 REST OF MIDDLE EAST AND AFRICA: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 230 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 231 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 232 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 233 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 234 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 235 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 236 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.7 LATIN AMERICA

10.7.1 LATIN AMERICA: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET DRIVERS

TABLE 237 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 238 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 239 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 240 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 241 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 242 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 243 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 244 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 245 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 246 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 247 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 248 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 249 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 250 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

10.7.2 BRAZIL

10.7.2.1 Rapid technological advancements and high foreign direct investments to drive the market growth in Brazil

TABLE 251 BRAZIL: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 252 BRAZIL: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 253 BRAZIL: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 254 BRAZIL: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 255 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 256 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 257 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 258 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.7.3 MEXICO

10.7.3.1 Increasing IT investments and growing presence of leading players to boost the market growth in Mexico

TABLE 259 MEXICO: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 260 MEXICO: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 261 MEXICO: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 262 MEXICO: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 263 MEXICO: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 264 MEXICO: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 265 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 266 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

10.7.4 REST OF LATIN AMERICA

TABLE 267 REST OF LATIN AMERICA: INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 268 REST OF LATIN AMERICA: MARKET SIZE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 269 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 270 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 271 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 272 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

TABLE 273 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 274 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 185)

11.1 OVERVIEW

FIGURE 26 KEY DEVELOPMENTS BY THE LEADING PLAYERS IN THE INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, 2018–2020

11.2 COMPETITIVE SCENARIO

11.2.1 NEW PRODUCT/SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 275 NEW PRODUCT/SOLUTION LAUNCHES AND ENHANCEMENTS, 2019–2020

11.2.2 ACQUISITIONS

TABLE 276 ACQUISITIONS, 2018–2020

11.2.3 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

TABLE 277 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, 2019–2020

11.3 COMPETITIVE LEADERSHIP MAPPING

TABLE 278 EVALUATION CRITERIA

11.3.1 VISIONARY LEADERS

11.3.2 INNOVATORS

11.3.3 DYNAMIC DIFFERENTIATORS

11.3.4 EMERGING COMPANIES

FIGURE 27 INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET, COMPETITIVE LEADERSHIP MAPPING, 2020

12 COMPANY PROFILES (Page No. - 193)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

12.1 INTRODUCTION

12.2 IBM

FIGURE 28 IBM: COMPANY SNAPSHOT

FIGURE 29 IBM: SWOT ANALYSIS

12.3 ORACLE

FIGURE 30 ORACLE: COMPANY SNAPSHOT

FIGURE 31 ORACLE: SWOT ANALYSIS

12.4 TRIMBLE

FIGURE 32 TRIMBLE: COMPANY SNAPSHOT

FIGURE 33 TRIMBLE: SWOT ANALYSIS

12.5 ACCRUENT

FIGURE 34 ACCRUENT: SWOT ANALYSIS

12.6 SAP

FIGURE 35 SAP: COMPANY SNAPSHOT

FIGURE 36 SAP: SWOT ANALYSIS

12.7 PLANON

12.8 ARCHIBUS

12.9 SERVICE WORKS GLOBAL

12.10 CAUSEWAY TECHNOLOGIES

12.11 FSI

12.12 FACILIO

12.13 FM:SYSTEMS

12.14 IOFFICE

12.15 SPACEWELL

12.16 MRI SOFTWARE

12.17 ZLINK

12.18 NUVOLO

12.19 VLOGIC SYSTEMS

12.20 RAPAL

12.21 ASSETWORKS

12.22 SMARTSHEET

12.23 SIERRA

12.24 OFFICESPACE

12.25 IDASA SISTEMAS

12.26 COLLECTIVEVIEW

12.27 BUDGETRAC

12.28 TANGO

12.29 QUICKFMS

12.30 SERVICECHANNEL

12.31 RIGHT-TO-WIN

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

13 ADJACENT MARKETS AND RELATED MARKETS (Page No. - 240)

13.1 INTRODUCTION

TABLE 279 RELATED MARKETS

13.2 LIMITATIONS

13.3 DIGITAL WORKPLACE MARKET

13.3.1 DIGITAL WORKPLACE MARKET, BY COMPONENT

TABLE 280 DIGITAL WORKPLACE MARKET SIZE, BY COMPONENT, 2016–2023 (USD MILLION)

13.3.2 DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE

TABLE 281 DIGITAL WORKPLACE MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

13.3.3 DIGITAL WORKPLACE MARKET, BY VERTICAL

TABLE 282 DIGITAL WORKPLACE MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

13.3.4 DIGITAL WORKPLACE MARKET, BY REGION

TABLE 283 DIGITAL WORKPLACE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 284 NORTH AMERICA: DIGITAL WORKPLACE MARKET SIZE, BY COMPONENT, 2016–2023 (USD MILLION)

TABLE 285 NORTH AMERICA: DIGITAL WORKPLACE MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

TABLE 286 NORTH AMERICA: DIGITAL WORKPLACE MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 287 NORTH AMERICA: DIGITAL WORKPLACE MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

TABLE 288 EUROPE: DIGITAL WORKPLACE MARKET SIZE, BY COMPONENT, 2016–2023 (USD MILLION)

TABLE 289 EUROPE: DIGITAL WORKPLACE MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

TABLE 290 EUROPE: DIGITAL WORKPLACE MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 291 EUROPE: DIGITAL WORKPLACE MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

TABLE 292 ASIA PACIFIC: DIGITAL WORKPLACE MARKET SIZE, BY COMPONENT, 2016–2023 (USD MILLION)

TABLE 293 ASIA PACIFIC: DIGITAL WORKPLACE MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

TABLE 294 ASIA PACIFIC: DIGITAL WORKPLACE MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 295 ASIA PACIFIC: DIGITAL WORKPLACE MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

TABLE 296 MIDDLE EAST AND AFRICA: DIGITAL WORKPLACE MARKET SIZE, BY COMPONENT, 2016–2023 (USD MILLION)

TABLE 297 MIDDLE EAST AND AFRICA: DIGITAL WORKPLACE MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

TABLE 298 MIDDLE EAST AND AFRICA: DIGITAL WORKPLACE MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 299 MIDDLE EAST AND AFRICA: DIGITAL WORKPLACE MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

TABLE 300 LATIN AMERICA: DIGITAL WORKPLACE MARKET SIZE, BY COMPONENT, 2016–2023 (USD MILLION)

TABLE 301 LATIN AMERICA: DIGITAL WORKPLACE MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

TABLE 302 LATIN AMERICA: DIGITAL WORKPLACE MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 303 LATIN AMERICA: DIGITAL WORKPLACE MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

13.4 FACILITY MANAGEMENT MARKET

13.4.1 FACILITY MANAGEMENT MARKET, BY SOLUTION

TABLE 304 FACILITY MANAGEMENT MARKET SIZE, BY SOLUTION, 2016–2023 (USD MILLION)

13.4.2 FACILITY MANAGEMENT MARKET, BY SERVICE

TABLE 305 FACILITY MANAGEMENT MARKET SIZE, BY SERVICE, 2016–2023 (USD MILLION)

13.4.3 FACILITY MANAGEMENT MARKET, BY DEPLOYMENT TYPE

TABLE 306 FACILITY MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2023 (USD MILLION)

13.4.4 FACILITY MANAGEMENT MARKET, BY ORGANIZATION SIZE

TABLE 307 FACILITY MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

13.4.5 FACILITY MANAGEMENT MARKET, BY VERTICAL

TABLE 308 FACILITY MANAGEMENT MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

13.4.6 FACILITY MANAGEMENT MARKET, BY REGION

TABLE 309 FACILITY MANAGEMENT MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 310 NORTH AMERICA: FACILITY MANAGEMENT MARKET SIZE, BY SOLUTION, 2016–2023 (USD MILLION)

TABLE 311 NORTH AMERICA: FACILITY MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2023 (USD MILLION)

TABLE 312 NORTH AMERICA: FACILITY MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

TABLE 313 NORTH AMERICA: FACILITY MANAGEMENT MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 314 EUROPE: FACILITY MANAGEMENT MARKET SIZE, BY SOLUTION, 2016–2023 (USD MILLION)

TABLE 315 EUROPE: FACILITY MANAGEMENT MARKET SIZE, BY SERVICE, 2016–2023 (USD MILLION)

TABLE 316 EUROPE: FACILITY MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2023 (USD MILLION)

TABLE 317 EUROPE: FACILITY MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

TABLE 318 EUROPE: FACILITY MANAGEMENT MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 319 ASIA PACIFIC: FACILITY MANAGEMENT MARKET SIZE, BY SOLUTION, 2016–2023 (USD MILLION)

TABLE 320 ASIA PACIFIC: FACILITY MANAGEMENT MARKET SIZE, BY SERVICE, 2016–2023 (USD MILLION)

TABLE 321 ASIA PACIFIC: FACILITY MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2023 (USD MILLION)

TABLE 322 ASIA PACIFIC: FACILITY MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

TABLE 323 ASIA PACIFIC: FACILITY MANAGEMENT MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 324 MIDDLE EAST AND AFRICA: FACILITY MANAGEMENT MARKET SIZE, BY SOLUTION, 2016–2023 (USD MILLION)

TABLE 325 MIDDLE EAST AND AFRICA: FACILITY MANAGEMENT MARKET SIZE, BY SERVICE, 2016–2023 (USD MILLION)

TABLE 326 MIDDLE EAST AND AFRICA: FACILITY MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2023 (USD MILLION)

TABLE 327 MIDDLE EAST AND AFRICA: FACILITY MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

TABLE 328 MIDDLE EAST AND AFRICA: FACILITY MANAGEMENT MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 329 LATIN AMERICA: FACILITY MANAGEMENT MARKET SIZE, BY SOLUTION, 2016–2023 (USD MILLION)

TABLE 330 LATIN AMERICA: FACILITY MANAGEMENT MARKET SIZE, BY SERVICE, 2016–2023 (USD MILLION)

TABLE 331 LATIN AMERICA: FACILITY MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2023 (USD MILLION)

TABLE 332 LATIN AMERICA: FACILITY MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

TABLE 333 LATIN AMERICA: FACILITY MANAGEMENT MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 334 FACILITY MANAGEMENT MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

14 APPENDIX (Page No. - 261)

14.1 INDUSTRY EXCERPTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the Integrated Workplace Management System (IWMS) market. Exhaustive secondary research was done to collect information on the PPM market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the integrated workplace management system market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

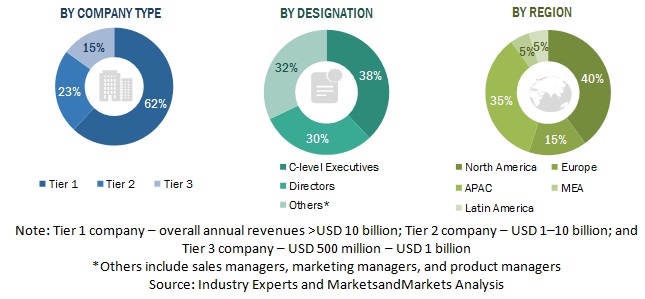

Primary Research

The integrated workplace management system market comprises several stakeholders, such as IWMS vendors, cloud solution providers, system integrators, professional service providers, resellers and distributors, government and research organizations, enterprise users, venture capitalists, private equity firms, and startup companies. The demand side of the IWMS market consists of organizations from different verticals, such as public sector, manufacturing, real estate, and construction, Information Technology (IT) and telecom, Banking, Financial Services and Insurance (BFSI), healthcare, retail, education, others (Food and Beverages (F&B), agriculture, and transportation). The supply-side includes IWMS providers, offering IWMS solutions and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the integrated workplace management system market. The methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the size of the Integrated Workplace Management System (IWMS) market based on offerings, deployment types, organization sizes, verticals, and regions from 2020 to 2025

- To analyze various macroeconomic and microeconomic factors that affect the growth of the market across the globe

- To forecast the size of the market and its segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information about the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market across the globe

- To profile key players operating in the integrated workplace management system market and generate a comparative analysis based on their business overviews, service offerings, regional presence, business strategies, and key financials

- To analyze competitive developments, such as acquisitions; new product launches/product enhancements; partnerships, agreements, and collaborations; and Research and Development (R&D) activities in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the APAC market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Integrated Workplace Management System (IWMS) Market