Laparoscopic Instruments Market: Growth, Size, Share, and Trends

Laparoscopic Instruments Market by Product (Laparoscope, Insufflator, Suction, Closure Device, Accessory), Application (General, Urology, Colorectal, Bariatric), Usage, End User (Hospital, Ambulatory Surgical Center), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global laparoscopic instruments market is projected to reach USD 16.78 billion by 2030 from USD 11.07 billion in 2025, at a CAGR of 8.7% during the forecast period. The growth of the laparoscopic instruments market is driven by the rising preference for minimally invasive surgeries due to their benefits, such as reduced recovery time, shorter hospital stays, and lower risk of complications. Increasing prevalence of chronic diseases, advancements in surgical technologies, growing adoption of laparoscopic procedures across various specialties, and rising healthcare expenditure further support market expansion.

KEY TAKEAWAYS

-

BY PRODUCTThe laparoscopic instruments market is witnessing robust growth, driven by the upward trend toward minimally invasive surgical procedures, which are favored for their benefits of smaller incisions, less postoperative pain, shorter duration of hospital stays, and faster patient recoveries.

-

BY APPLICATIONThe laparoscopic instruments market is being increasingly driven largely due to the broad range of procedures it includes, such as hernia repairs, appendectomies, cholecystectomies, and bowel resections, which are increasingly performed through minimally invasive methods.

-

BY USAGEThe demand for laparoscopic instruments is shifting toward reusable instruments due to their cost-effectiveness and widespread adoption across hospitals and surgical centers. These instruments can be sterilized and used multiple times, significantly reducing the overall cost burden for healthcare facilities compared to disposable alternatives.

-

BY END USERHospitals remain the primary revenue source due to the sheer volume of inpatient surgeries, but ambulatory surgery centers (ASCs) and specialized outpatient clinics are growing rapidly as more procedures migrate to same-day settings, benefiting compact, cost-efficient laparoscopic kits and disposable systems.

-

BY REGIONAsia Pacific is projected to grow fastest, primarily driven by rising surgical volumes driven by a growing patient pool with chronic and lifestyle-related diseases (such as obesity and gastrointestinal disorders), rapid expansion of healthcare infrastructure, and increasing government investments to improve access to minimally invasive surgery.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and collaborations. Stryker Corporation announced a strategic partnership with a top surgical training center to promote reusable laparoscopic instruments via hands-on workshops.

The expansion of the market for laparoscopic instruments is prompted by various essential factors. Among the major drivers is increasing demand for minimally invasive surgery owing to its benefits, including smaller cuts, less postoperative pain, shorter hospitalization, and faster recovery. Secondly, rising global incidence of diseases such as colorectal cancer, obesity, and gallstones, which tend to necessitate laparoscopic procedures, spurs demand. Advancements in imaging technologies, energy equipment, and robotic support are also improving the accuracy and results of laparoscopic surgery, further driving market adoption. Furthermore, increased healthcare spending, enhanced surgical facilities in developing economies, and rising patient as well as healthcare professional awareness drive the market significantly. Government efforts to encourage sophisticated surgical methods and favorable reimbursement policies in developed countries further complement the growth pattern of the laparoscopic instruments market.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

A shift is observed in the revenue sources for laparoscopic instrument manufacturing companies due to the high growth of the laparoscopic instrument market, technological advancements in laparoscopic instrument modalities, and the impact of industry on the laparoscopic instrument industry. Technological advances have prompted end users to overhaul or update their manufacturing systems. These trends will result in significant business opportunities for players operating in the laparoscopic instrument market. The shift in revenue is expected from conventional rigid endoscopes, flexible endoscopes, capsule endoscopes, and visualization systems to AI-integrated equipment, robot-assisted endoscopes, and disposable endoscopes, owing to the advantages offered by them compared to their counterparts.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising volume of Minimally Invasive Surgeries (MIS)

-

Adoption of single-use laparoscopy instruments to prevent infectious diseases and offer increased efficiency and safety

Level

-

Unfavorable healthcare reforms in the US

-

Dearth of trained professionals in the field of laparoscopy

Level

-

Growing healthcare markets in emerging economies

-

Enhancements in the capabilities of laparoscopic instruments

Level

-

Regulatory hurdles and compliance complexity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising volume of minimally invasive surgeries (MIS)

The most important drivers of growth for the laparoscopic instruments market are the increasing global number of minimally invasive surgeries (MIS), specifically laparoscopic surgery. These provide undisputed benefits over open surgery, such as shorter hospital stays, less postoperative pain, quicker recovery, and fewer complications. Consequently, laparoscopic methods are being taken up more and more in specialties like general surgery, gynecology, urology, bariatrics, and colorectal surgery. Volumes continue to grow because of aging populations, the growing incidence of lifestyle diseases (such as obesity and gastrointestinal disease), and increasing surgical capacity in developing markets. India, China, Brazil, and Mexico have all seen a considerable increase in the uptake of laparoscopic procedures as a result of increases in healthcare infrastructure and awareness. Additionally, ambulatory surgical centers (ASCs) are at the forefront of growing MIS procedures within outpatient facilities, increasing demand for reusable and disposable laparoscopic instruments. This shift in procedures should continue to maintain market momentum through the next decade.

Restraint: Unfavorable healthcare reforms in the US

One of the key restraints for the laparoscopic instruments market is the impact of unfavorable healthcare reforms in the US. Changes in reimbursement policies, pricing pressures, and cost-containment measures have created financial challenges for hospitals and healthcare providers, limiting their ability to invest in advanced surgical instruments. Moreover, uncertainty around regulatory policies and healthcare coverage can slow the adoption of innovative laparoscopic technologies, as both manufacturers and end users face difficulties in ensuring adequate returns on investment. This environment may hinder market growth despite the rising demand for minimally invasive procedures.

Opportunity: Growing healthcare markets in emerging economies

Growing healthcare markets in emerging economies present a significant opportunity for the laparoscopic instruments market. Rapid improvements in healthcare infrastructure, rising government investments, and expanding access to advanced medical technologies are driving the adoption of minimally invasive procedures in countries across Asia, Latin America, and the Middle East. Increasing healthcare awareness, a growing middle-class population with higher disposable income, and a rising burden of chronic diseases further create demand for cost-effective and efficient surgical solutions. These factors make emerging economies attractive, high-growth regions for manufacturers to expand their presence and tap into untapped patient pools.

Challenge: Regulatory hurdles and compliance complexity

Managing the nuances and dynamic changes in the regulatory environment for laparoscopic devices is a key challenge for manufacturers. Every geography has specific expectations regarding product testing, sterility validation, labeling, and post-market monitoring. For example, meeting EU MDR, U.S. FDA Class II/III device regulation, or country-specific regulations may result in a longer time to approval and a higher cost of market access. Further, shifts in the classification of reusable versus disposable elements, and growing demands for compliance with Unique Device Identification (UDI), complicate operations further. Organizations without a strong regulatory and clinical affairs infrastructure can find themselves unable to bring products to market or even sustain market presence.

Laparoscopic Instruments Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Laparoscopes advanced optical instruments equipped with cameras and light sources that allow surgeons to view internal organs with high-definition clarity during minimally invasive procedures | Enable precise visualization of surgical sites, reduce the need for open surgery, shorten recovery time, and improve surgical outcomes |

|

Closure devices, specialized instruments such as clips, staplers, and suturing systems designed to securely close incisions, vessels, or tissue defects during laparoscopic surgery | Provide reliable wound and vessel closure, minimize leakage and infection risks, and support quicker post-surgical healing |

|

Energy devices electrosurgical, ultrasonic, or advanced bipolar instruments used for tissue cutting, sealing, and coagulation in laparoscopic procedures | Ensure precise tissue dissection, reduce intraoperative bleeding, shorten surgery duration, and enhance surgical efficiency |

|

Insufflators: Devices that deliver and regulate carbon dioxide into the abdominal cavity to create pneumoperitoneum for laparoscopic surgeries | Maintain a stable surgical field with enhanced visibility, improve procedural safety, and allow accurate instrument maneuverability |

|

Hand instruments ergonomically designed tools such as graspers, scissors, dissectors, and needle holders used by surgeons for tissue manipulation and suturing | Provide tactile feedback, improve surgeon control, enhance precision in tissue handling, and increase overall operative efficiency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem market map of the laparoscopic instruments market comprises elements present in this market and defines these elements with a demonstration of the bodies involved. It includes manufacturers, distributors, research & product developers, and end users. Manufacturers include organizations involved in the entire process of research, design, product development, optimization, and launch. Distributors include third parties and e-commerce sites linked to the organization for the marketing of medical devices. Research & product developers include in-house research facilities of organizations, contract research organizations, and contract development and manufacturing organizations, which play an essential role in outsourcing research for product development to manufacturers. End users include hospitals and ambulatory surgical centers where laparoscopic surgeries are being carried out. On the other hand, investors/funders and health regulatory bodies are the major influencers in this market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Laparoscopic Instruments Market, by Product

Based on product type, laparoscopes command the largest market share in the laparoscopic instrumentation market, as they play a crucial role in facilitating visualization during minimal access surgeries. The increased demand for laparoscopic procedures among specialties like gynecology, urology, and general surgery has considerably heightened the demand for high-quality, high-resolution laparoscopes. Advances in technology, such as the creation of HD and 4K imaging systems, flexible and 3D laparoscopes, and incorporated camera technologies, have significantly enhanced surgical precision and effectiveness, further driving adoption. In addition, increasing surgical volumes as a result of expanding prevalence of chronic diseases, as well as ongoing replacement and upgrade cycles of image equipment within hospitals and surgery centers, support the robust market position for laparoscopes. The focus on enhancing diagnostic effectiveness and real-time visualization also underscores their critical contribution in contemporary minimally invasive surgery.

Laparoscopic Instruments Market, by Application

Based on application, general surgery dominates the market for laparoscopic instruments, largely because it encompasses a wide array of procedures, such as hernia repair, appendectomy, cholecystectomy, and bowel resection, which are being done more and more using minimally invasive techniques. The growing demand for laparoscopic approaches to general surgery is driven by benefits such as smaller incisions, reduced postoperative pain, faster recovery, and shorter hospitalization. The worldwide surge in gastrointestinal disorders, gallbladder disease, and abdominal infections has also propelled the market for general surgical procedures. In addition, the increased availability of laparoscopic technology, the expanding number of trained surgeons, and beneficial reimbursement schemes have aided greater adoption. The adaptability and common use of laparoscopy in general surgery solidify it as a key driver of market expansion.

Laparoscopic Instruments Market, by Usage

Based on usage, reusable instruments is projected to account for the highest share in the laparoscopic instruments market due to their cost-effectiveness and widespread adoption across hospitals and surgical centers. These instruments can be sterilized and used multiple times, significantly reducing the overall cost burden for healthcare facilities compared to disposable alternatives. Their durability, compatibility with various procedures, and ability to support high surgical volumes make them the preferred choice in both developed and emerging markets. Additionally, advancements in sterilization techniques and material design have further enhanced the safety and efficiency of reusable laparoscopic instruments, reinforcing their dominance in the market.

Laparoscopic Instruments Market, By End User

Based on the end user, hospitals and clinics account for the largest share of the laparoscopic instruments market, primarily due to the high volume of surgical procedures performed in these settings. These healthcare facilities are equipped with advanced infrastructure and skilled surgeons, making them the preferred centers for minimally invasive surgeries. The growing adoption of laparoscopic techniques for a wide range of procedures such as gynecological, urological, and general surgeries further drives demand. Additionally, hospitals and clinics are increasingly investing in technologically advanced instruments to improve surgical outcomes, reduce patient recovery time, and lower overall treatment costs, reinforcing their dominant position in the market.

REGION

Asia Pacific to be fastest-growing region in global laparoscopic instruments market during forecast period

Asia Pacific is projected to be the fastest-growing region in the laparoscopic instruments market, driven by a combination of rising healthcare expenditure, rapid expansion of hospital infrastructure, and increasing adoption of minimally invasive surgeries. Growing awareness among patients about the benefits of laparoscopic procedures, such as reduced pain, shorter hospital stays, and faster recovery, is further boosting demand. Additionally, a large patient population, higher incidence of chronic diseases requiring surgical interventions, and government initiatives to improve access to advanced healthcare technologies are accelerating market growth. The presence of cost-effective manufacturing hubs and expanding medical tourism in countries like India, China, and Thailand also contributes to the region’s rapid expansion.

Laparoscopic Instruments Market: COMPANY EVALUATION MATRIX

In the laparoscopic instruments market matrix, Stryker Corporation (Star) leads with scale, extensive distribution, and a broad solutions portfolio. Teleflex Incorporated (Emerging Leader) is gaining momentum by providing medical technology products that enhance clinical benefits, improve patient safety, and reduce total procedural costs. While Stryker Corporation dominates through reach, Teleflex Incorporated's innovation positions it for rapid growth toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Olympus Corporation (Japan)

- Karl Storz SE & Co. KG (Germany)

- Johnson & Johnson (US)

- Fujifilm Holdings Corporation (Japan)

- Medtronic plc (Ireland)

- Stryker Corporation (US)

- B. Braun Melsungen AG (Germany)

- Becton, Dickinson and Company (US)

- Smith & Nephew plc (UK)

- Hoya Corporation (Japan)

- Schölly Fiberoptic GmbH (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 10.23 Billion |

| Market Forecast, 2030 (Value) | USD 16.78 Billion |

| Growth Rate | CAGR of 8.7% from 2025 to 2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Laparoscopic Instruments Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of top laparoscopic instruments: Laparoscopes, Energy Devices, Hand Instruments, Closure Devices, Access Devices, Accessories, Insufflators, Suction/Irrigation Pumps |

|

| Company Information |

|

Insights on revenue shifts toward emerging therapeutic applications and device innovations |

| Geographic Analysis |

|

Country level demand mapping for new product launches and localization strategy planning |

RECENT DEVELOPMENTS

- May 2025 : Johnson & Johnson launched its ETHICON 4000 Stapler, a next-gen surgical stapler aimed at improving precision and reliability in minimally invasive procedures. The launch highlighted Johnson & Johnson’s continued innovation in advanced surgical tools aimed at supporting surgeons in complex laparoscopic operations.

- March 2025 : Johnson & Johnson released the DUALTO Energy System, a versatile energy-based laparoscopic tool supporting multiple surgical approaches. This innovation was aimed at streamlining operating room workflows and reduce the need for multiple devices during laparoscopic procedures.

- May 2024 : B. Braun Melsungen AG inaugurated a new Swiss manufacturing facility to boost production capacity for advanced laparoscopic devices. In March 2024, Advanced Medical Solutions announced the acquisition of Peters Surgical. This facility was established to expand production capacity for advanced laparoscopic devices, ensuring better supply chain resilience and meeting growing global demand.

- August 2023 : Stryker Corporation announced a strategic partnership with a top surgical training center to promote reusable laparoscopic instruments via hands-on workshops. This partnership involved conducting hands-on workshops for surgeons, encouraging best practices, cost-effectiveness, and sustainability by shifting away from single-use devices. It also aligns with healthcare’s increasing focus on eco-friendly practices.

- November 2023 : Olympus corporation Launched a broad range of reusable laparoscopic devices integrated with advanced imaging and energy-based tech. This launch reinforced Olympus’s position as a leader in surgical imaging and minimally invasive solutions.

Table of Contents

Methodology

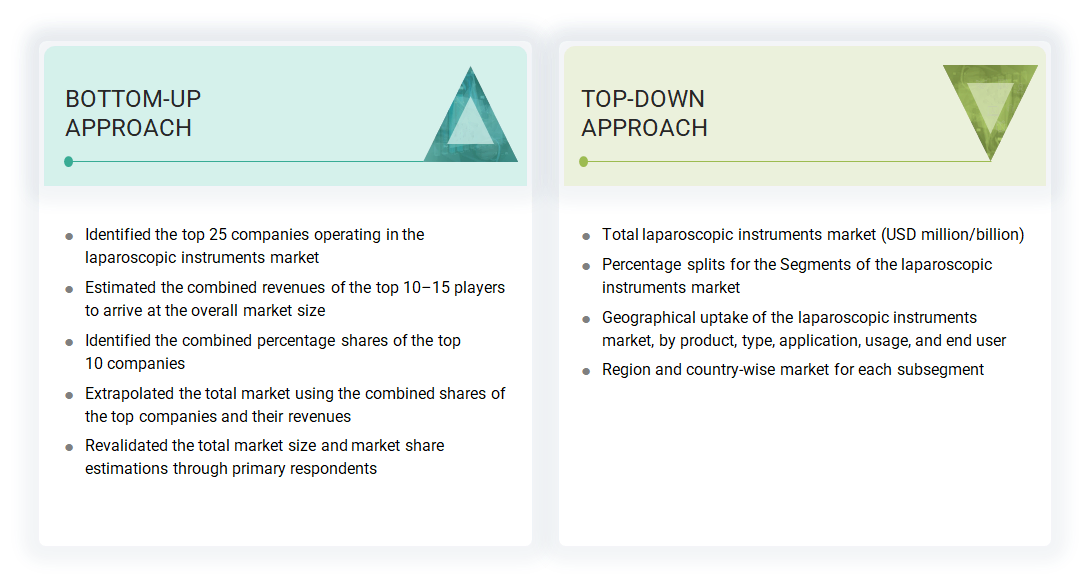

This study involved four major activities in estimating the current market size of laparoscopic instruments. First, extensive secondary research was conducted to gather information on the market, including related and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved extensively using secondary sources, such as directories, databases (like Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. This research aimed to identify and collect information essential for the detailed, technical, market-oriented, and commercial analysis of the laparoscopic instruments market. It also helped identify key players, categorize and segment the market classification and segmentation according to industry trends down to the most detailed level, and highlight major developments in market and technology perspectives. Additionally, a database of leading industry leaders was created using secondary research.

Primary Research

During the primary research process, various sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other key executives from various companies and organizations operating in the laparoscopic instrument market. On the demand side, primary sources included industry experts, purchase and sales managers, doctors, and personnel from research organizations. This primary research aimed to validate the market segmentation, identify key players, and gather insights on major industry trends and market dynamics.

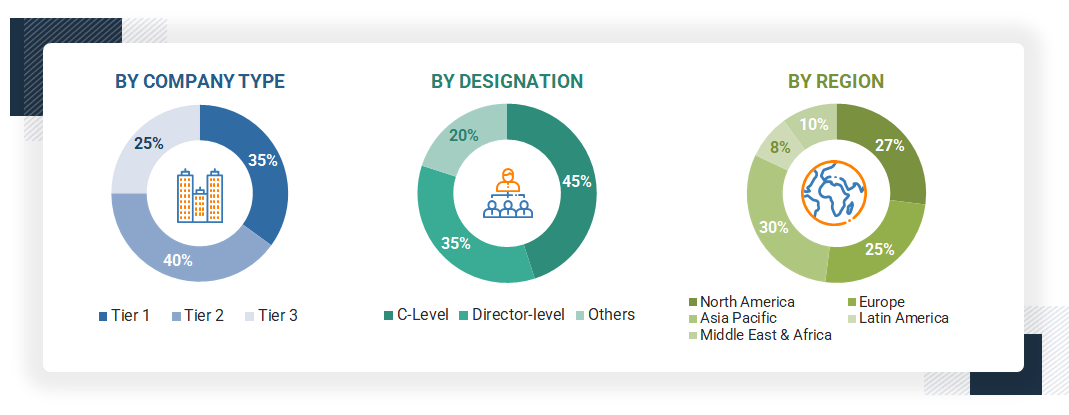

A breakdown of the primary respondents for the laparoscopic instruments market is provided below:

Note 1: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 2: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market size, annual revenues were calculated based on revenue mapping of key product manufacturers and OEMs operating in the worldwide laparoscopic instruments market. All major product manufacturers were identified at the global or country/regional level. Revenue mapping was conducted for the relevant business segments and sub-segments for the leading players. Additionally, the global laparoscopic instruments market was divided into various segments and sub-segments based on:

- List of major players operating in the product market at the regional and/or country level

- Product mapping of various laparoscopic instruments manufacturers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from laparoscopic instruments (or the nearest reported business unit/product category)

- Revenue mapping of major players is covered.

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global point-of-care diagnostics market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size Estimation (Bottom-up & Top-down Approach)

Data Triangulation

After determining the overall size of the global laparoscopic instruments market using the methodology mentioned above, this market was divided into several segments and subsegments. Data triangulation and market breakdown methods were used, where applicable, to complete the market analysis and determine precise market values for the key segments and subsegments. The estimated market data was triangulated by analyzing various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

Laparoscopic instruments are used during laparoscopy, a minimally invasive surgical procedure performed for diagnostic and treatment purposes. This procedure enables surgeons to access the inside of the abdomen and pelvis without making large skin incisions. It involves creating small incisions in the abdominal wall through which a laparoscope (viewing tube) is inserted, allowing the doctor to examine the abdominal and pelvic organs on a video monitor connected to the tube.

Stakeholders

- Laparoscopes and related instrument manufacturing companies

- Suppliers and distributors of laparoscopic instruments

- Hospitals, diagnostic centers, and medical colleges

- Independent surgeons and private offices of physicians

- Ambulatory surgical centers (ASC)

- Teaching hospitals and academic medical centers (AMCs)

- Government bodies/municipal corporations

- Business research and consulting service providers

- Venture capitalists

Report Objectives

- To define and measure the global laparoscopic instruments market on the basis of product, usage, application, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall laparoscopic instruments market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the laparoscopic instruments market in five main regions, along with their respective key countries, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the laparoscopic instruments market and comprehensively analyze their core competencies2 and market shares

- To track and analyze company developments such as partnerships, agreements, collaborations, expansions, acquisitions, and product launches

Frequently Asked Questions (FAQ)

What is the key driver of the laparoscopic instruments market?

One of the key drivers in the laparoscopic instruments market includes the rising volume of minimally invasive surgeries.

Which product dominates the laparoscopic instruments market?

The laparoscopes segment, by product, is dominating the laparoscopic instruments market.

Who are the end users of the laparoscopic instruments market? Which end user is leading the market?

The laparoscopic instruments market is segmented into hospitals & clinics, ambulatory surgical centers, and other end users. The Hospitals segment accounted for the largest share of the laparoscopic instruments market in 2024.

Who are the key players in the laparoscopic instruments market?

The key players in the laparoscopic instruments market are Olympus Corporation (Japan), Karl Storz SE & Co. KG (Germany), Johnson & Johnson Services, Inc. (US), Fujifilm Holdings Corporation (Japan), Medtronic plc (Ireland), Stryker Corporation (US), B. Braun Melsungen AG (Germany), Becton, Dickinson and Company (US), Smith & Nephew PLC (UK).

Which region is lucrative for the laparoscopic instruments market?

The North American market is expected to witness the highest growth during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Laparoscopic Instruments Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Laparoscopic Instruments Market