Livestock Monitoring Market Size, Share and Growth Analysis, 2025 To 2030

Livestock Monitoring Market by Smart Tags (Ear, Leg, Neck), Cameras, Sensors, Livestock Type (Cattle (Dairy, Beef), Poultry, Swine, Equine), Health Monitoring, Feeding Management, Milk Harvesting Management and Heat Detection - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

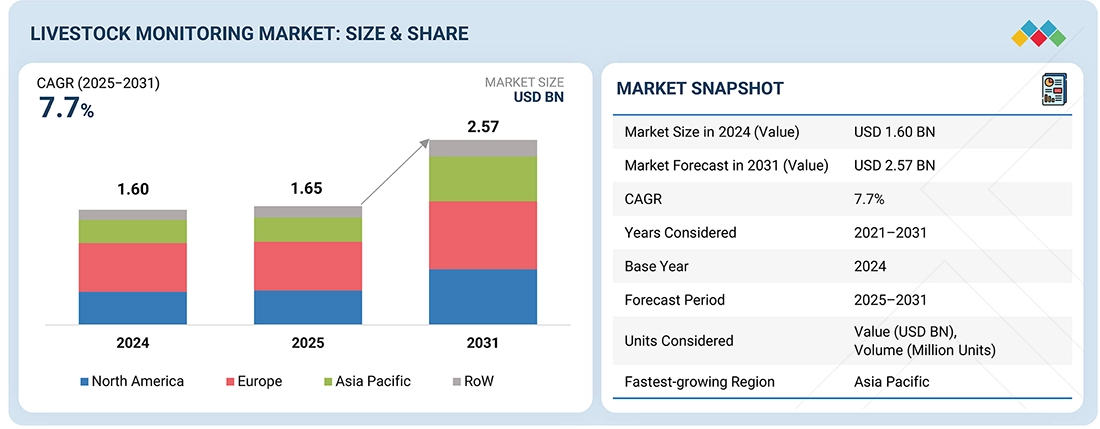

The livestock monitoring market is projected to reach USD 2.57 billion by 2031 from USD 1.65 billion in 2025, at a CAGR of 7.7% from 2025 to 2031. The market growth is driven by the increasing adoption of smart farming technologies for real-time health tracking, feeding optimization, and reproductive management of animals. Rising demand for automation in livestock operations, growing awareness of animal welfare, and the integration of IoT, AI, and data analytics across hardware, software, and service offerings are further accelerating market expansion across dairy, poultry, and swine farms globally.

KEY TAKEAWAYS

-

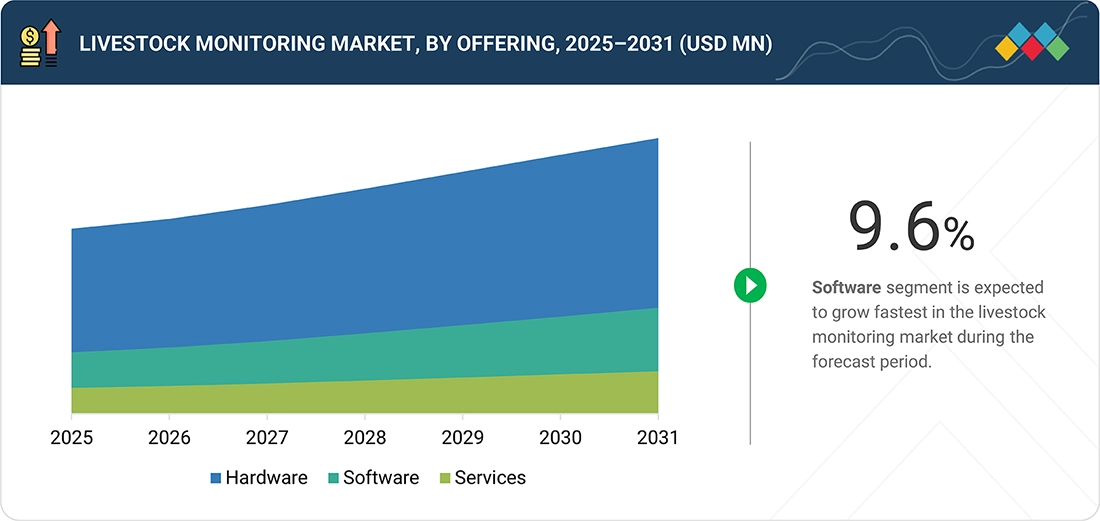

BY OFFERINGThe livestock monitoring market is segmented into hardware, software, and services. Hardware dominates the market, driven by the widespread use of smart tags, sensors, cameras, and GPS devices for real-time tracking and data collection. These solutions are essential for monitoring animal health, behavior, and location across large herds.

-

BY LIVESTOCK TYPECattle, poultry, swine, equine, and others constitute the major livestock types. Cattle represent the largest livestock type segment, attributed to the extensive use of monitoring systems in dairy and beef production for health tracking, milk yield optimization, and reproduction management.

-

BY FARM SIZESmall farms, medium-sized farms, and large farms are the primary farm sizes. Large farms account for the largest share of the livestock monitoring market, as they require advanced and scalable monitoring technologies to manage extensive herds and optimize labor efficiency.

-

BY APPLICATIONKey applications of livestock monitoring solution and services are milk harvesting management, heat detection monitoring, feeding management, heat stress management, health monitoring management, and sorting & weighing management. Health Monitoring Management is the largest application segment, supported by the growing emphasis on early disease detection, preventive care, and welfare compliance across livestock operations.

-

BY REGIONThe livestock monitoring market covers North America, Europe, Asia Pacific, and the Rest of the World (ROW). North America holds the largest share, driven by advanced farming practices, high adoption of precision livestock technologies, and strong presence of market leaders in the US and Canada.

-

COMPETITIVE LANDSCAPEKey players are focusing on expanding IoT integration, AI-based analytics, and cloud platforms to enhance livestock productivity and health outcomes. Strategic partnerships among technology firms, agritech startups, and farm management companies are accelerating innovation and adoption. Major companies Merck & Co., Inc. (US), GEA Group (Germany), DeLaval (Sweden), Nedap N.V. (Netherlands), and Afimilk Ltd. (Israel), which offer comprehensive solutions across health monitoring, feeding management, and herd performance optimization.

The livestock monitoring market is experiencing steady growth, fueled by the increasing need for real-time tracking, data-driven herd management, and enhanced animal welfare across diverse farm operations. Growing adoption of smart tags, sensors, cameras, and AI-based analytics is transforming livestock management by enabling continuous monitoring of health, feeding, and reproduction parameters. Strategic collaborations among technology providers, agritech firms, and livestock producers, along with rising investments in precision farming, cloud-based monitoring platforms, and integrated farm management solutions, are accelerating market expansion across dairy, poultry, swine, and beef farming operations.

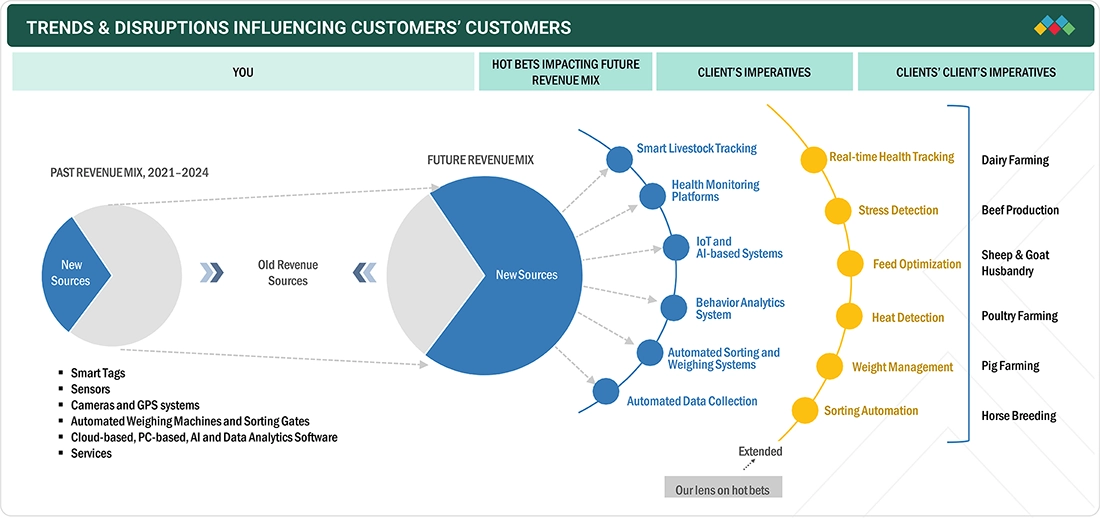

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions in the livestock monitoring market. It illustrates how companies' revenue mix is expected to evolve over the next 4-5 years, moving from current offerings to new use cases, technologies, and markets. The livestock monitoring market is shifting toward IoT-enabled, AI-driven systems that enhance animal health, welfare, and productivity through real-time tracking, predictive analytics, and automation in precision livestock management.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in meat production

-

Increasing focus on real-time monitoring and early disease detection

Level

-

High initial cost of implementation

-

Limited awareness and technology adoption in developing regions

Level

-

Increasing use of smart wearables for livestock

-

Growing focus on reproductive monitoring and breeding optimization

Level

-

Managing large volumes of data generated from multiple monitoring devices

-

Concerns about environmental impacts associated with livestock farming

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing focus on real-time monitoring and early disease detection

The growing focus on real-time monitoring and early disease detection is driving livestock monitoring adoption. AI- and IoT-enabled sensors track vital parameters, enabling early anomaly detection, reducing disease outbreaks, ensuring animal welfare, and improving farm productivity through proactive health management and regulatory compliance.

Restraint: Limited awareness and technology adoption in developing regions

Limited awareness of technology benefits, inadequate digital infrastructure, and high implementation costs hinder livestock monitoring adoption in developing regions. Traditional farming practices, poor connectivity, and low technical know-how restrict the use of smart sensors and analytics, slowing productivity and sustainability improvements in livestock management.

Opportunity: Rising demand for organic and sustainable livestock practices

The growing consumer demand for organic and sustainable livestock farming is driving the adoption of smart monitoring technologies. IoT- and AI-based systems enable efficient resource use, improved animal welfare, and reduced emissions, helping farmers align with regulatory requirements and sustainability goals while maintaining productivity.

Challenge: Concerns about environmental impacts associated with livestock farming

Livestock monitoring technologies address environmental challenges by optimizing feed use, reducing methane emissions, and improving resource efficiency. Through AI-enabled health and behavior tracking, these systems support sustainable farming, aligning with global initiatives like the EU’s Farm to Fork Strategy to lower the sector’s ecological footprint.

Livestock Monitoring Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

AI-based heat stress detection system "Project Pig Forte" using six cameras, edge server with NVIDIA T4 GPU, and environmental sensors to monitor pig behavior and validate Aeroforte feed supplement efficacy under specific farm conditions. | Early heat stress detection and intervention |

|

Livestock tracking and monitoring solution using wearable solar-powered ear tags with geolocation capabilities; tracks cattle location, heartbeat, temperature, and health status in real-time across entire ranches via centralized application. | Real-time cattle location tracking in remote areas |

|

Innovative ingestible wireless bolus technology for continuous monitoring of rumen temperature in dairy cows; bolus transmits data to receiver handset enabling farmers to monitor digestive health and detect ruminal acidosis signs. | Continuous digestive health monitoring | Early detection of ruminal acidosis | Optimized feed management | Improved production efficiency | Enhanced dairy farm profitability | Maintained optimal cow health through timely interventions. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The major players operating in the livestock monitoring market with a significant global presence include Merck & Co., Inc. (US), GEA Group (Germany), DeLaval (Sweden), Nedap N.V. (Netherlands), and Afimilk Ltd. (Israel). These companies develop livestock monitoring solutions and services to meet global demand across various applications, such as milk harvesting management, heat detection monitoring, feeding management, heat stress management, health monitoring, and sorting & weighing management.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Livestock Monitoring Market, By Offering

Hardware is expected to hold the largest share of the livestock monitoring market during 2025–2031. Devices such as smart tags, sensors, cameras, and GPS trackers are increasingly deployed to monitor animal health, behavior, and location in real time. These tools enhance herd efficiency, reduce manual labor, and improve traceability across livestock operations. Meanwhile, software is projected to record the fastest CAGR, driven by the rising integration of AI, data analytics, and cloud-based platforms that enable predictive insights, automate decision-making, and consolidate farm management functions. The growing shift toward connected, data-driven livestock management is reinforcing the prominence of both hardware and intelligent software ecosystems.

Livestock Monitoring Market, By Livestock Type

Cattle are expected to dominate the livestock monitoring market throughout the forecast period, owing to high adoption in dairy and beef production for optimizing milk yield, reproductive efficiency, and animal health management. The segment benefits from the extensive use of wearable sensors, automated milking systems, and behavior tracking solutions. Poultry, on the other hand, is projected to witness the fastest growth, fueled by increasing automation in feeding, environment control, and disease prevention within large-scale commercial farms. Rising global poultry consumption and the need for efficiency improvements are accelerating the adoption of precision monitoring tools in this segment.

Livestock Monitoring Market, By Farm Size

Large farms hold the largest share of the livestock monitoring market due to their strong focus on herd scalability, resource optimization, and productivity enhancement through IoT-enabled monitoring systems. These farms rely heavily on integrated solutions to improve profitability and maintain high operational standards. Medium-sized farms are expected to register the fastest CAGR during 2025–2031, driven by greater affordability of connected devices, supportive government initiatives, and growing awareness of technology’s role in improving yield and animal welfare. The increasing availability of modular, cost-effective monitoring systems is facilitating technology adoption among mid-scale farm operators.

Livestock Monitoring Market, By Application

Health Monitoring Management represents the largest application segment in the livestock monitoring market, supported by the growing emphasis on disease prevention, early detection, and welfare optimization. Continuous health data enables better veterinary decision-making, reducing mortality and improving productivity. Feeding Management is projected to grow at the highest rate, driven by the need to optimize feed utilization, minimize waste, and enhance animal nutrition through data analytics and automation. The integration of AI-driven feeding systems and real-time tracking tools is transforming farm operations toward precision nutrition and efficiency.

REGION

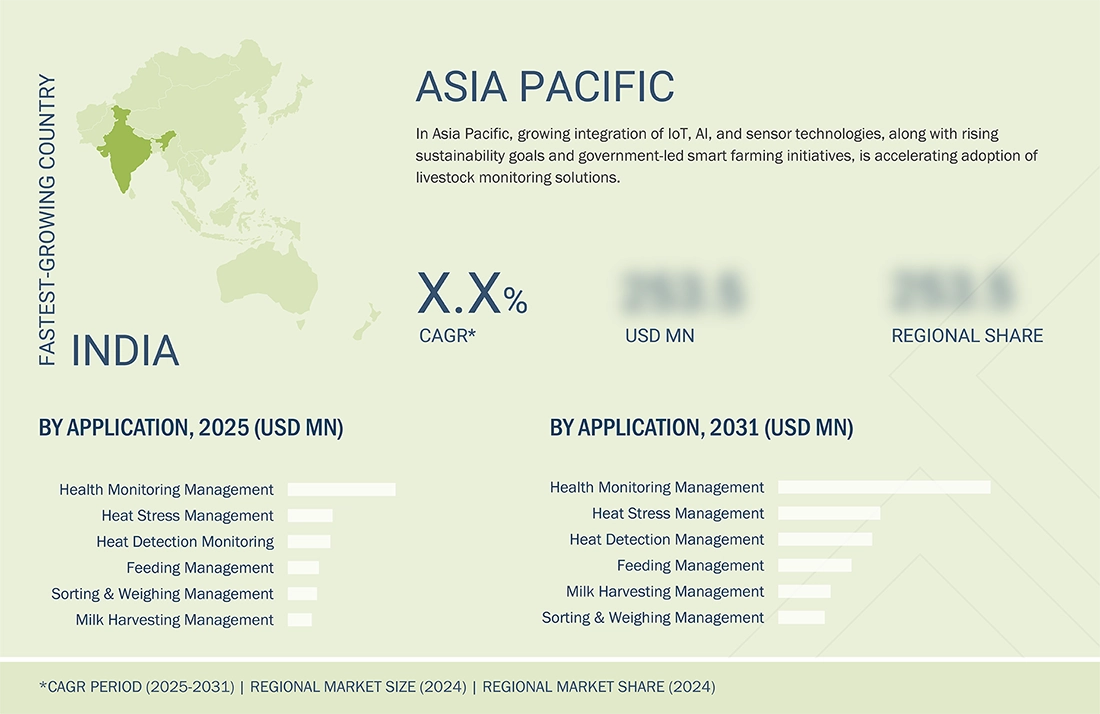

Asia Pacific to be fastest-growing region in global livestock monitoring market during forecast period

The Asia Pacific region is expected to witness the highest CAGR in the livestock monitoring industry during 2025–2031, driven by rapid adoption of IoT, AI, and RFID-based solutions for real-time tracking, health monitoring, and performance optimization across China, Japan, India, Australia, and New Zealand. Government initiatives such as China’s Made in China 2025, India’s Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), and Australia’s Smart Farming Partnerships program are promoting precision agriculture and sustainable livestock management. Additionally, rising demand for process automation, data-driven decision-making, and efficiency improvements in herd management is further fueling market expansion across the region.

The Europe livestock monitoring market is projected to reach USD 943.1 million by 2031 from USD 681.4 billion in 2025, at a CAGR of 5.6% from 2025 to 2031. A strong regulatory push for animal welfare and traceability, combined with increasing dairy and meat production in Europe, is driving market growth. Increasing precision livestock farming initiatives in Europe, along with the growing adoption of smart wearables and biosensors, are further providing opportunities for market players.

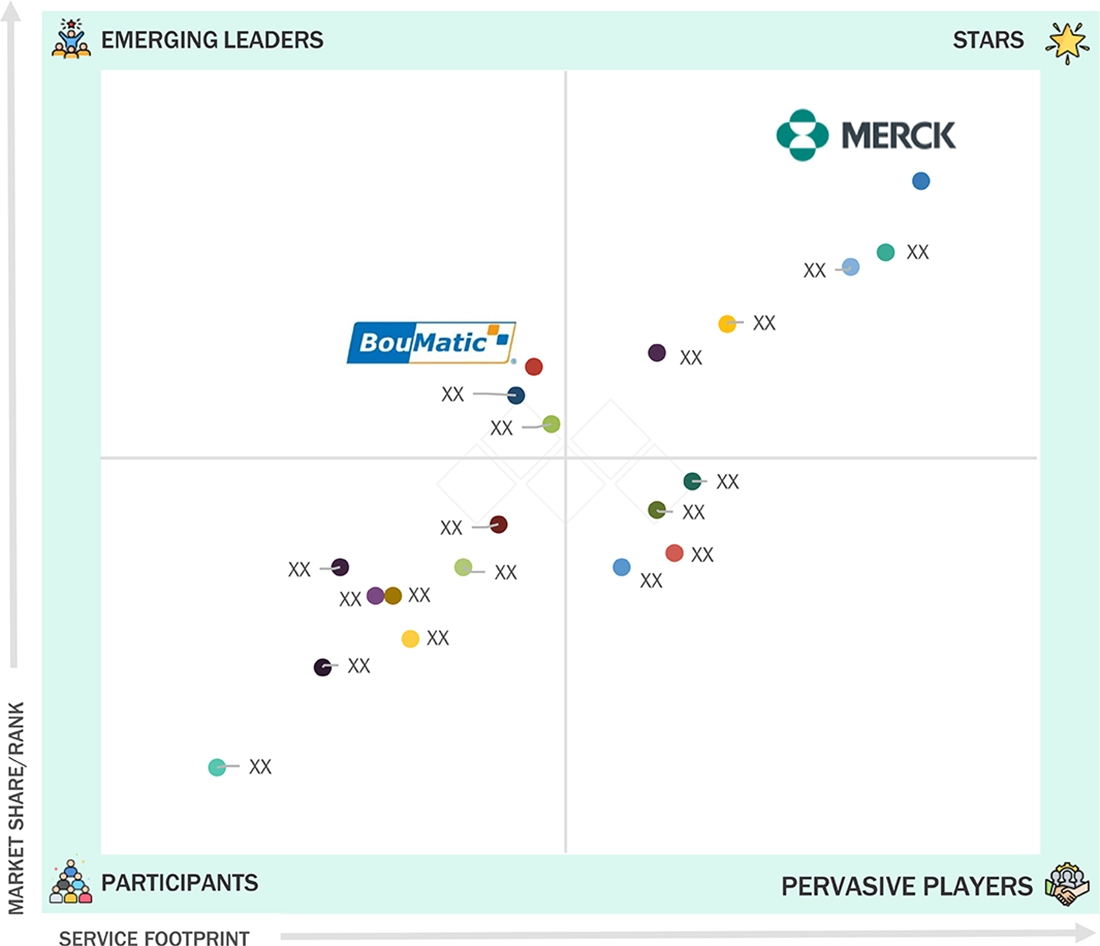

Livestock Monitoring Market: COMPANY EVALUATION MATRIX

In the livestock monitoring companies matrix, Merck & Co., Inc. (Star) leads with a strong market presence and comprehensive solutions, driven by its advanced animal health monitoring technologies, wearable devices, and integrated herd management systems, widely adopted across dairy, beef, poultry, and swine operations. BouMatic (Emerging Leader) is gaining visibility with its smart milking systems, precision feeding solutions, and IoT-enabled herd management platforms, strengthening its position through innovation and expanding product offerings. While Merck & Co. dominates through scale and a broad technology portfolio, BouMatic shows significant potential to move toward the leaders' quadrant as demand for precision livestock management and real-time, data-driven farm monitoring continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.60 Billion |

| Market Forecast in 2031 (Value) | USD 2.57 Billion |

| Growth Rate | CAGR of 7.7% from 2025-2031 |

| Years Considered | 2021-2031 |

| Base Year | 2024 |

| Forecast Period | 2025-2031 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Rest of the World (RoW) |

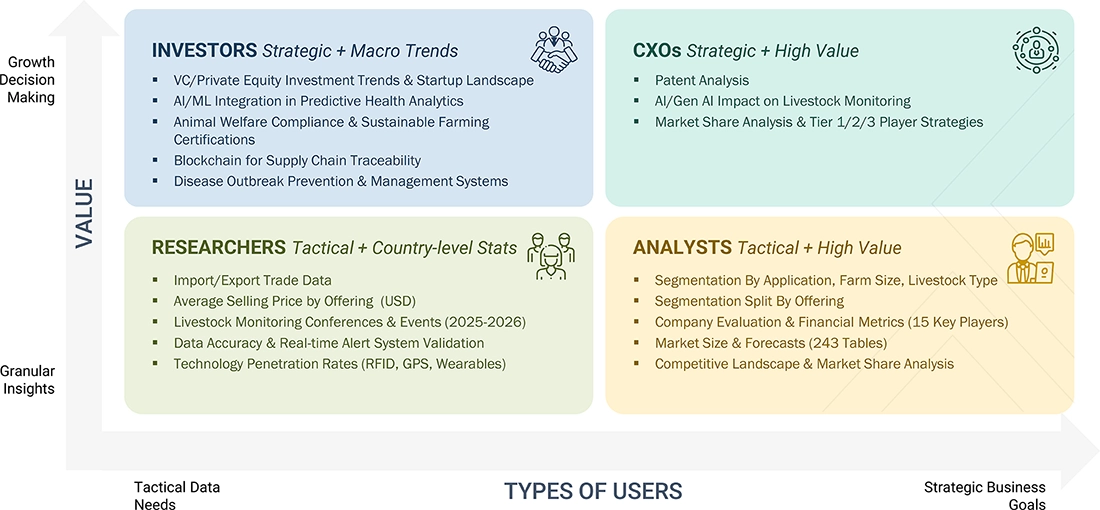

WHAT IS IN IT FOR YOU: Livestock Monitoring Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Large Dairy Farm Operator | Competitive profiling of livestock monitoring solutions (smart tags, sensors, cameras, GPS, AI analytics) | Identification of best-fit monitoring solutions, enabling optimized herd management, improved health tracking, and increased productivity |

| Poultry & Swine Producer | Market adoption analysis of precision feeding, health monitoring, and automated behavior tracking systems | Insights on technology adoption gaps and actionable recommendations to enhance feed efficiency, reduce mortality, and improve overall farm performance |

| AgriTech Consulting Firm | Global livestock monitoring market capacity, trends, and growth forecasting | Comprehensive understanding of emerging technologies, regional adoption patterns, and growth opportunities to support client advisory and strategic planning |

| Smart Farm Solutions Provider | Technical and economic evaluation of integrated livestock management platforms (hardware + software + services) | Clear assessment of operational efficiency, resource utilization, and potential ROI to guide technology implementation decisions |

RECENT DEVELOPMENTS

- December 2024 : CowManager (Netherlands) launched the Youngstock Monitor, an innovative solution for monitoring calf behavior. Powered by Al, the system provides real-time alerts for early disease detection and helps optimize calf health management, reducing treatment intensity and mortality rates while enhancing future herd productivity.

- November 2024 : GEA Group (Germany) released its cattle eye solution with Body Condition Scoring for dairy farms. This AI-powered system provides real-time assessment of cow health through lameness detection and scoring of body conditions to provide insight into management optimization, the prevention of metabolic diseases, and increased productivity.

- October 2024 : MSD Animal Health (US) launched SENSEHUB Cow Calf. This remote monitoring technology optimizes breeding results for cow/calf producers using artificial insemination or embryo transfer. The product monitors behaviors, detects estrus, and alerts caregivers to possible reproductive issues more efficiently and less labor-intensively than herd management through observation.

- July 2024 : Nedap N.V. (Netherlands) launched the CowControl monitoring system in collaboration with FrieslandCampina, a global dairy cooperative. The system was installed on five dairy farms in Pakistan. The CowControl monitoring system has health and heat detection features to enhance milk production, cow health, and timely insemination, addressing local challenges such as heat and humidity.

- March 2023 : GEA Group (Germany) acquired agricultural software company CattleEye Ltd. (Ireland) to expand its portfolio of AI-driven early lameness detection solutions for dairy cows. The acquisition aims to improve animal welfare, farm productivity, and financial stability by providing critical health insights through AI-powered video analytics.

Table of Contents

Methodology

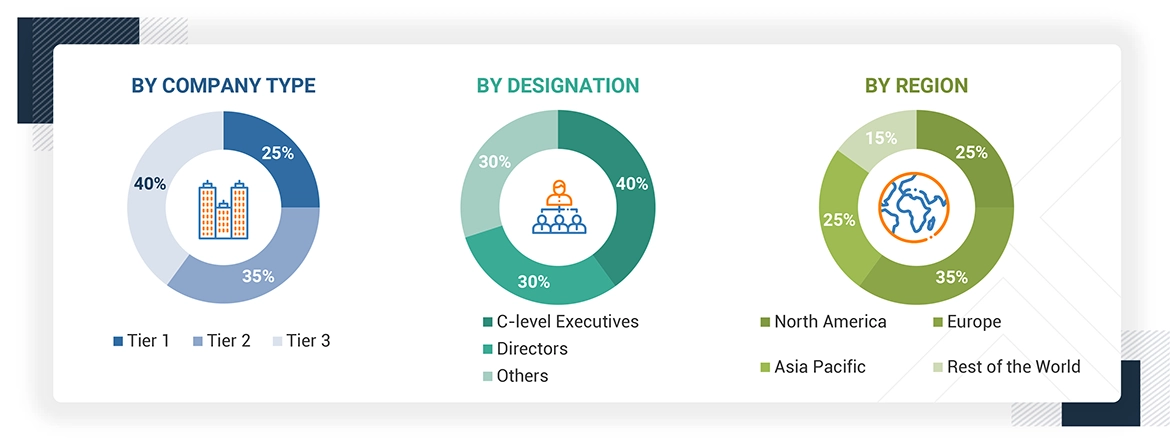

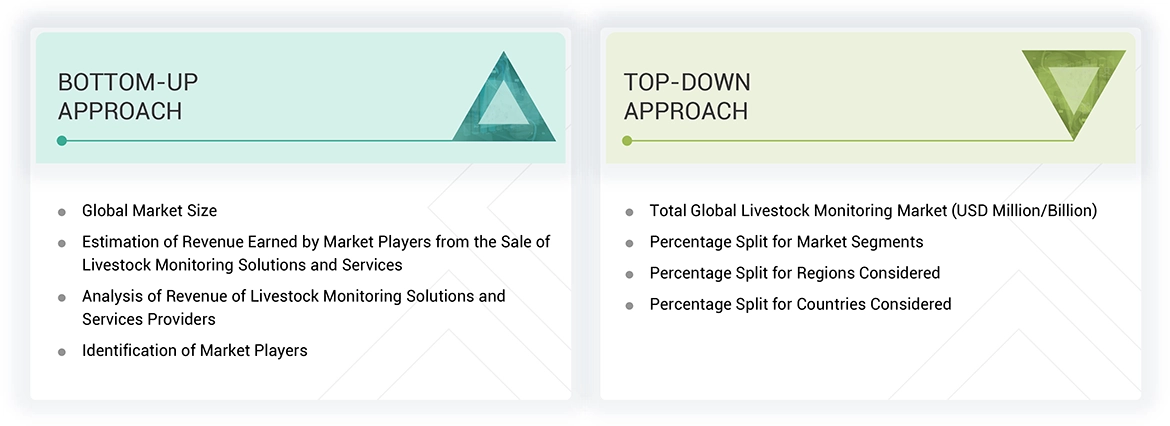

The research study involved 4 major activities in estimating the size of the livestock monitoring market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

In the livestock monitoring market report, the global market size has been estimated using both the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after understanding the livestock monitoring market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions—North America, Europe, Asia Pacific, and Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the livestock monitoring solutions and services and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying top-line investments and spending in the ecosystem and considering segment-level splits and major market developments

- Identifying different stakeholders in the livestock monitoring market that influence the entire market, along with participants across the supply chain

- Analyzing major manufacturers and service providers in the market and studying their solutions

- Analyzing trends related to the adoption of livestock monitoring solutions and services

- Tracking recent and upcoming market developments, including investments, R&D activities, product launches, expansions, acquisitions, partnerships, collaborations, agreements, and investments, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of livestock monitoring solutions and services

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Livestock Monitoring Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall livestock monitoring market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

Livestock monitoring market tracks and monitors the health, behavior, and location of livestock using advanced technologies. Such systems have huge benefits in farm management, including real-time data about health, movement, and activity tracking using IoT sensors, GPS tracking, RFID tags, and wearable devices. Sensors, tracking devices, data transmission networks, and software platforms for data analysis and decision-making are some of the key components of a livestock monitoring system. These technologies help farmers improve herd management, optimize feed usage, monitor animal well-being, and enhance overall productivity. Such technology is applied to various sectors, such as dairy, beef, and poultry. It assists with the tracking of milk production in the dairy industries; it helps detect heat cycles and diseases. For the beef farming sector, it provides insights into weight gain, growth patterns, and overall health of the animal. In poultry rearing, this technology monitors the feed efficiency and health status of the flock. Also, it aids in improving animal welfare as it enables early detection of health issues and prevents disease outbreaks with more efficiency in productivity. Major applications of livestock monitoring technology include milk harvesting management, which optimizes the entire process of milk production, and heat detection monitoring to improve breeding efficiency by monitoring the heat cycles. Feeding management ensures the proper nutrition and growth of animals; heat stress management helps in mitigating adverse effects of heat stress, keeping the welfare status of animals in check. Also, health monitoring systems provide an early warning of disease so that it is prevented from spreading further; with sorting and weighing management, automation of sorting and weighing of animals is achieved that boosts operational efficiency. Increasing demand in sustainable farming methods and precision agriculture will lead to a high increase in livestock monitoring.

Key Stakeholders

- Raw Material Supplier

- Device Manufacturers

- Software Developers

- System Integrators

- Distributors and Resellers

- Consultants and Service Providers

- Regulatory Bodies

- Government and Agricultural Agencies

- Research and Development Institutes

- End Users

Report Objectives

- To define, describe, and forecast the size of the livestock monitoring market, by offering, livestock type, farm size, application, and region, in terms of value

- To forecast the market of hardware segment for smart tags and GPS systems, in terms of volume

- To forecast the size of various segments with respect to four regions, namely, North America, Asia Pacific, Europe, and Rest of the World (Middle East, Africa and South America)

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To study the value chain and related industry segments of the livestock monitoring market

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and contributions to the overall market

- To assess the trends and disruptions impacting customers’ businesses’ pricing trends, patents and innovations, trade data, regulatory landscape, Porter’s five forces, case studies, key stakeholders and buying criteria, technology trends, market ecosystem, key conferences and events, and impact of AI/Gen AI related to the market

- To analyze opportunities for various stakeholders by identifying the high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market position in terms of revenue, market share, and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments such as product launches, expansions, acquisitions, partnerships, collaborations, agreements, and investments carried out by players in the livestock monitoring market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

The impact is as follows:

|

Real-time Health Monitoring and Disease Prediction |

9 |

|

Automated Behavioral Analysis and Welfare Monitoring |

8 |

|

Feed Optimization and Nutrition Management |

7 |

|

Reproductive Cycle Monitoring |

8 |

|

Production Efficiency and Yield Prediction |

9 |

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Livestock Monitoring Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Livestock Monitoring Market

Dave

Jun, 2019

Looking data for beef monitoring market potential in Canada. AI breeding with seedstock herds Health monitoring ROI, overall market potential for livestock monitoring in Canada..

Helio

Jan, 2019

Dear Sirs, I am looking for more information about livestock monitoring market, companies, size to start up a business in Brazil. We are very small company and all information available for free is appreciated. Best regards, Helio.

nweke

Feb, 2019

I want to download a full PDF copy of "Livestock Monitoring Market by Offering (Hardware, Software, and Service), Species (Cattle, Poultry, Swine, Equine), Application (Milk Harvesting, Feeding, Breeding, Behaviour Monitoring & Control), and Geography - Global Forecast to 2022 ".

Mayamiko

Oct, 2022

Looking for data of Livestock monitoring market in Southeast Africa especially Malawi.