Long Steel Market by Process (Basic Oxygen Furnace, Electric Arc Furnace), Product Type (Rebar, Merchant Bar, Wire Rod, Rail) End-Use Industry (Construction, Infrastructure, Others), and Region (NA, EUROPE, APAC, MEA, SA) - Global Forecast to 2025

Updated on : June 18, 2024

Long Steel Market

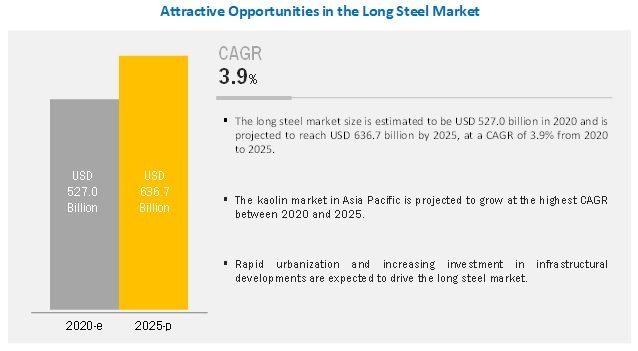

The global long steel market was valued at USD 527.0 billion in 2020 and is projected to reach USD 636.7 billion by 2025, growing at 3.9% cagr from 2020 to 2025. Increasing construction and infrastructure activities, rising population levels, and industrialization are the major factors responsible for the growth of the market. However, the recent outbreak of Covid-19 is expected to have a severe impact on the market.

The basic oxygen Furnace segment is expected to lead the long steel market during the forecast period.

Based on process, the long steel market has been classified into basic oxygen furnace and electric arc furnace. Among these, the basic oxygen furnace is projected to account for the largest share of the market during the forecast period. This growth can be attributed to its advantages, such as high production volume.

The rebar segment is expected to lead the long steel market during the forecast period.

Based on product type, the long steel market has been segregated into rebar, merchant bar, wire rod, rail, and others. Among these, the rebar segment is projected to account for the largest share of the market in 2019. Rebar is mainly used as a reinforcement in steel to increase its tensile strength. The wire rod segment is expected to grow at the highest CAGR during the forecast period, due to its wide application areas in various end-use industries.

The infrastructure industry is expected to account for the largest share of the long steel market during the forecast period

Based on end-use industry, the market has been classified into construction, infrastructure, and others. Other industries include automotive, hardware manufacturing, and machinery. Among these, the infrastructure segment accounted for the largest share in the long steel market in 2019 and is also expected to grow at the highest CAGR during the forecast period. Growing infrastructure activities, coupled with increasing investments, is expected to drive the growth of the market.

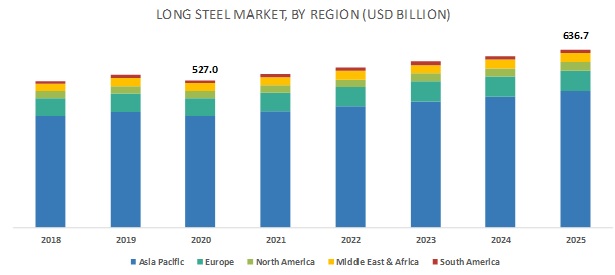

Asia Pacific is projected to be the largest consumer of the long steel market

Based on region, the long steel market is segmented into Asia Pacific, the Middle East & Africa, North America, Europe, and South America. Among these, Asia Pacific accounted for the largest share in 2019 and is also expected to grow at the highest CAGR during the forecast period. This growth can be attributed to the presence of various global steelmakers such as ArcelorMittal, Nippon Steel & Sumitomo Metal Corporation, Tata Steel, and POSCO Steel in the region. The availability of labor and raw materials at low-cost in the region are added advantages for these companies. The rapidly increasing population and urbanization are other factors expected to fuel the growth of the market.

Long Steel Market Players

Companies such as Arcelor Mittal (Germany), Gerdau S.A. (Brazil), Nippon Steel & Sumitomo Metal Corporation (Japan), POSCO (South Korea), and Nucor Corporation (US) are the major players in the long steel market. These players have been adopting strategies such as contracts, expansion, new product launches, acquisitions, and agreements that have helped them expand their businesses in untapped and potential markets.

Long Steel Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Volume (Million Tons) and Value (USD Billion) |

|

Segments covered |

Process, Product Type, End-use Industry, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

Arcelor Mittal (Germany), Gerdau S.A. (Brazil), Nippon Steel & Sumitomo Metal Corporation (Japan), POSCO (South Korea), and Nucor Corporation (US) are some of the leading companies considered for the study. |

Based on Process

- Basic Oxygen Furnace

- Electric Arc Furnace

Based on Product Type

- Rebar

- Wire Rod

- Merchant Bar

- Rail

- Others

Based on End-use Industry

- Construction

- Industrial

- Others

Based on Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments:

- In 2019, ArcelorMittal announced the acquisition of Essar Steel India Limited (ESIL), a fully integrated flat carbon steel manufacturer located in Gujarat, India. The company simultaneously formed a joint venture with Nippon Steel Corporation, called ArcelorMittal Nippon Steel India Limited, which will own and operate ESIL. This acquisition helped the company strengthen its market presence in India.

- In November 2019, Gerdau agreed to buy a 96.4% share of Siderúrgica Latino-Americana (Silat) from a Spanish group Hierros Añón for USD 110.8 million. Silat is located in Caucaia, a city in the northeastern Brazilian state of Ceará, and has a production capacity for 600,000 tons of long rolled steel per year. The company mainly produces rebar and wire rod. Silat was a close competitor of Gerdau in the rebar market, and with this acquisition, Gerdau has strengthened its market position in the rebar market.

- In November 2019, POSCO launched INNOVILT, a premium brand of steel products for the construction industry. These products were launched to raise the standard of steel products for construction.

- In June 2018, NSSMC acquired Ovako AB, a European specialty steel manufacturer headquartered in Sweden, as a wholly-owned subsidiary. Ovako AB manufactures Nippon Steel & Sumitomo Metal Corporation’s specialty steels, including weathering steel. This acquisition helped NSSMC strengthen its position in the specialty steel sector.

Key Questions Addressed by the Report:

- What are the future revenue pockets in the long steel market?

- Which key developments are expected to have a long-term impact on the long steel market?

- Which process is expected to cannibalize existing markets?

- How is the current regulatory framework expected to impact the market?

- What will be the future product mix of the long steel (scrap and new)?

- What are the prime strategies of leaders in the long steel market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.6.1 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 MARKET DEFINITION AND SCOPE

2.2 BASE NUMBER CALCULATION

2.3 FORECAST NUMBER CALCULATION

2.4 MARKET ENGINEERING PROCESS

2.4.1 TOP-DOWN APPROACH

2.4.2 BOTTOM-UP APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.6 ASSUMPTIONS

2.7 RESEARCH DATA

2.7.1 SECONDARY DATA

2.7.1.1 Key data from secondary sources

2.7.2 PRIMARY DATA

2.7.2.1 Key data from primary sources

2.7.2.2 Key industry insights

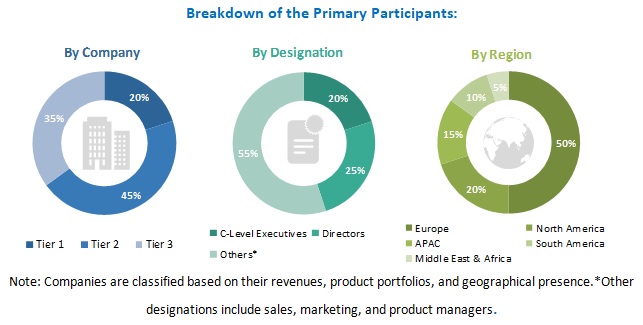

2.7.2.3 Breakdown of primary interviews

3 EXECUTIVE SUMMARY (Page No. - 30)

4 PREMIUM INSIGHTS (Page No. - 33)

4.1 ATTRACTIVE OPPORTUNITIES IN LONG STEEL MARKET

4.2 LONG STEEL MARKET, BY END-USE INDUSTRY

4.3 LONG STEEL MARKET, BY REGION

4.4 LONG STEEL MARKET, BY PROCESS & COUNTRY

5 MARKET OVERVIEW (Page No. - 35)

5.1 INTRODUCTION

5.1.1 DRIVERS

5.1.1.1 Rapid rate of urbanization

5.1.1.2 Increasing investment in infrastructural activities

5.1.2 RESTRAINTS

5.1.2.1 COVID-19 outbreak and susceptibility of the construction industry

5.1.2.2 Volatile prices of raw materials

5.1.3 OPPORTUNITIES

5.1.3.1 Emergence of value-added rebar products

5.1.3.2 Increasing capacity utilization and capacity extension

5.1.4 CHALLENGES

5.1.4.1 Global situation of overcapacity

5.1.5 PORTER'S FIVE FORCES ANALYSIS

5.1.5.1 Bargaining power of suppliers

5.1.5.2 Threat of new entrants

5.1.5.3 Threat of substitutes

5.1.5.4 The threat of substitutes

5.1.5.5 Bargaining power of buyers

5.1.5.6 Intensity of competitive rivalry

5.2 MACROECONOMIC INDICATORS (COVID-19)

5.2.1 COVID-19

5.2.2 COVID-19 IMPACT ON STEEL INDUSTRY

5.2.3 CONCLUSION

6 LONG STEEL MARKET, BY PROCESS (Page No. - 48)

6.1 INTRODUCTION

6.2 BASIC OXYGEN FURNACE

6.2.1 BOF IS A PREFERRED PROCESS DUE TO ITS HIGH PRODUCTION CAPABILITIES

6.3 ELECTRIC ARC FURNACE

6.3.1 GOVERNMENT MANDATES TO IMPROVE THE RECYCLABILITY OF STEEL SCRAP DRIVE THE DEMAND FOR EAF PROCESS

7 LONG STEEL MARKET, BY PRODUCT TYPE (Page No. - 53)

7.1 INTRODUCTION

7.2 REBAR

7.2.1 INCREASING CONSTRUCTION AND INFRASTRUCTURE ACTIVITIES IS ONE OF THE MAJOR DRIVER RESPONSIBLE FOR THE GROWTH OF THE REBAR SEGMENT

7.3 WIRE ROD

7.3.1 VARIOUS APPLICATION AREAS ACROSS END-USE INDUSTRIES IS EXPECTED TO DRIVE THE WIRE ROD SEGMENT

7.4 MERCHANT BAR

7.4.1 USE OF MERCHANT BARS IMPROVES THE OVERALL PHYSICAL & MECHANICAL PROPERTIES AND DIMENSIONAL TOLERANCES IN STRUCTURES

7.5 RAIL

7.5.1 GOVERNMENT STANDARDS OF MANUFACTURING RAIL STEEL ARE EXPECTED TO DRIVE THIS SEGMENT

7.6 OTHERS

7.6.1 WIDE APPLICATION AREAS OF LIGHT AND HEAVY SECTIONS ARE EXPECTED TO DRIVE THE DEMAND FOR OTHER PRODUCTS

8 LONG STEEL MARKET, BY END-USE INDUSTRY (Page No. - 61)

8.1 INTRODUCTION

8.2 INFRASTRUCTURE

8.2.1 INCREASING INVESTMENTS IN INFRASTRUCTURAL DEVELOPMENTS EXPECTED TO FUEL THE GROWTH OF THE INFRASTRUCTURE SEGMENT

8.3 CONSTRUCTION

8.3.1 RAPID URBANIZATION IS THE MAJOR FACTOR RESPONSIBLE FOR THE GROWTH OF THE CONSTRUCTION SEGMENT

8.4 OTHERS

8.4.1 CHANGING DEMAND DYNAMICS IN THE AUTOMOTIVE INDUSTRY AND RISING POPULATION ARE EXPECTED TO DRIVE OTHER END-USE INDUSTRIES

9 REGIONAL ANALYSIS (Page No. - 68)

9.1 INTRODUCTION

9.2 ASIA PACIFIC

9.2.1 CHINA

9.2.1.1 Recent outbreak of COVID-19 in China to reduce the demand for long steel in 2020 with gradual recovery expected post-2021

9.2.2 INDIA

9.2.2.1 Growth in construction activities, infrastructural investments are expected to drive long steel market in India

9.2.3 JAPAN

9.2.3.1 Presence of major players and increasing investments are expected to drive the market for long steel in Japan

9.2.4 SOUTH KOREA

9.2.4.1 High construction output and economic growth, are driving the market for long steel in South Korea

9.2.5 VIETNAM

9.2.5.1 Increasing population and government policies are favoring the growth of long steel market in Vietnam

9.2.6 REST OF ASIA PACIFIC

9.2.6.1 Increasing investment and industrialization expected to drive the long steel market in Rest of Asia Pacific

9.3 EUROPE

9.3.1 TURKEY

9.3.1.1 Large manufacturing capacity of EAF mills coupled with increasing investments in the construction industry is expected to drive the market

9.3.2 RUSSIA

9.3.2.1 Long steel market in Russia is driven by government initiatives and growing construction industry

9.3.3 GERMANY

9.3.3.1 Increased spending on infrastructure drive the long steel market in Germany

9.3.4 ITALY

9.3.4.1 Severity of COVID-19 pandemic in Italy hampered economic growth and is expected t to affect the demand for long steel

9.3.5 POLAND

9.3.5.1 Growth of the construction industry expected to fuel the market in Poland

9.3.6 FRANCE

9.3.6.1 Government initiatives drive the market for long steel France

9.3.7 UK

9.3.7.1 Infrastructural development activities, coupled with increasing construction of private buildings expected to drive the long steel market in the UK

9.3.8 REST OF EUROPE

9.3.8.1 Booming construction industry projected to boost the long steel market in Rest of Europe

9.4 NORTH AMERICA

9.4.1 US

9.4.1.1 Growth in non-residential construction activities projected to create demand for long steel in the US

9.4.2 MEXICO

9.4.2.1 Growth of infrastructural developments is expected to fuel the long steel market in Mexico

9.4.3 CANADA

9.4.3.1 Increasing investments and infrastructural developments are expected to drive the market for long steel in Canada

9.5 MIDDLE EAST & AFRICA

9.5.1 UAE

9.5.1.1 Investments from government and the increase in construction activities expected to drive the demand for long steel in the UAE

9.5.2 SAUDI ARABIA

9.5.2.1 Ongoing fiscal policies coupled with flourishing industrial sector is expected to drive the demand for long steel in Saudi Arabia

9.5.3 IRAN

9.5.3.1 Increasing investments and favorable government policies are expected to drive the market in Iran

9.5.4 EGYPT

9.5.4.1 Import duty on steel products will foster domestic production of long steel in Egypt

9.5.5 REST OF MIDDLE EAST & AFRICA

9.5.5.1 Increasing population, rising income, industrialization, and urbanization are expected to fuel the market in Rest of MEA

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.1.1 Government focus on infrastructure spending and growth in construction activities expected to drive long steel market in Brazil

9.6.2 ARGENTINA

9.6.2.1 Foreign investment in construction and infrastructure to drive the long steel market in Argentina

9.6.3 REST OF SOUTH AMERICA

9.6.3.1 Increasing investments for infrastructural developments expected to drive long steel market in Rest of South America

10 COMPETITIVE LANDSCAPE (Page No. - 117)

10.1 INTRODUCTION

10.2 COMPETITIVE LEADERSHIP MAPPING (OVERALL MARKET)

10.2.1 VISIONARY LEADERS

10.2.2 INNOVATORS

10.2.3 DYNAMIC DIFFERENTIATORS

10.2.4 EMERGING COMPANIES

10.3 RANKING OF KEY MARKET PLAYERS IN THE LONG STEEL MARKET

11 COMPANY PROFILES (Page No. - 120)

11.1 ARCELORMITTAL

11.2 GERDAU SA

11.3 NIPPON STEEL & SUMITOMO METAL CORPORATION

11.4 POSCO

11.5 NUCOR CORPORATION

11.6 CHINA BAOWU STEEL GROUP CORPORATION LIMITED

11.7 COMMERCIAL METALS COMPANY

11.8 MECHEL PAO

11.9 STEEL DYNAMICS, INC.

11.10 NOVOLIPETSK STEEL (NLMK)

11.11 OUTOKUMPU OYJ

11.12 ACERINOX S.A.

11.13 TATA STEEL

11.14 DAIDO STEEL

11.15 SHAGANG GROUP

11.16 ANSTEEL GROUP CORPORATION LIMITED

11.17 JFE STEEL CORPORATION

11.18 EVRAZ PLC

11.19 HBIS GROUP

11.20 HYUNDAI STEEL

11.21 STEEL AUTHORITY OF INDIA LIMITED

11.22 METINVEST HOLDING LLC

11.23 SEVERSTAL JSC

11.24 WUHAN IRON AND STEEL CORPORATION

11.25 JSW STEEL

12 APPENDIX (Page No. - 177)

12.1 INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

LIST OF TABLES (128 Tables)

TABLE 1 LONG STEEL MARKET SNAPSHOT

TABLE 2 URBAN POPULATION, BY COUNTRY, 2014-2018

TABLE 3 INTERIM ECONOMIC OUTLOOK FORECAST, 2019-2021

TABLE 4 GLOBAL CRUDE STEELMAKING CAPACITY, BY 2001-2018 (MILLION METRIC TONS)

TABLE 5 CURRENT CRUDE STEEL NOMINAL CAPACITY AND POTENTIAL GROSS CAPACITY ADDITIONS, BY REGION (MILLION METRIC TONS)

TABLE 6 LONG STEEL MARKET, BY PROCESS, 2018–2025 (MILLION TONS)

TABLE 7 LONG STEEL MARKET, BY PROCESS, 2018–2025 (USD BILLION)

TABLE 8 BASIC OXYGEN FURNACE LONG STEEL MARKET, BY REGION, 2018–2025 (MILLION TONS)

TABLE 9 BASIC OXYGEN FURNACE LONG STEEL MARKET, BY REGION, 2018–2025 (USD BILLION)

TABLE 10 ELECTRIC ARC FURNACE LONG STEEL MARKET, BY REGION, 2018–2025 (MILLION TONS)

TABLE 11 ELECTRIC ARC FURNACE LONG STEEL MARKET, BY REGION, 2018–2025 (USD BILLION)

TABLE 12 LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 13 LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 14 LONG STEEL MARKET FOR REBAR, BY REGION, 2018–2025 (MILLION TONS)

TABLE 15 LONG STEEL MARKET FOR REBAR, BY REGION, 2018–2025 (USD BILLION)

TABLE 16 LONG STEEL MARKET FOR WIRE ROD, BY REGION, 2018–2025 (MILLION TONS)

TABLE 17 LONG STEEL MARKET FOR WIRE ROD, BY REGION, 2018–2025 (USD BILLION)

TABLE 18 LONG STEEL MARKET FOR MERCHANT BAR, BY REGION, 2018–2025 (MILLION TONS)

TABLE 19 LONG STEEL MARKET FOR MERCHANT BAR, BY REGION, 2018–2025 (USD BILLION)

TABLE 20 LONG STEEL MARKET FOR RAIL, BY REGION, 2018–2025 (MILLION TONS)

TABLE 21 LONG STEEL MARKET FOR RAIL, BY REGION, 2018–2025 (USD BILLION)

TABLE 22 LONG STEEL MARKET FOR OTHER PRODUCTS, BY REGION, 2018–2025 (MILLION TONS)

TABLE 23 LONG STEEL MARKET FOR OTHER PRODUCTS, BY REGION, 2018–2025 (USD BILLION)

TABLE 24 LONG STEEL MARKET, BY END-USE INDUSTRY, 2018–2025 (MILLION TONS)

TABLE 25 LONG STEEL MARKET, BY END-USE INDUSTRY, 2018–2025 (USD BILLION)

TABLE 26 LONG STEEL MARKET FOR INFRASTRUCTURE INDUSTRY, BY REGION, 2018–2025 (MILLION TONS)

TABLE 27 LONG STEEL MARKET FOR INFRASTRUCTURE INDUSTRY, BY REGION, 2018–2025 (USD BILLION)

TABLE 28 LONG STEEL MARKET FOR CONSTRUCTION INDUSTRY, BY REGION, 2018–2025 (MILLION TONS)

TABLE 29 LONG STEEL MARKET FOR CONSTRUCTION INDUSTRY, BY REGION, 2018–2025 (USD BILLION)

TABLE 30 LONG STEEL MARKET FOR OTHER INDUSTRIES, BY REGION, 2018–2025 (MILLION TONS)

TABLE 31 LONG STEEL MARKET FOR OTHER INDUSTRIES, BY REGION, 2018–2025 (USD BILLION)

TABLE 32 INTERIM ECONOMIC OUTLOOK FORECAST, 2019-2021

TABLE 33 LONG STEEL MARKET, BY REGION, 2018–2025 (MILLION TONS)

TABLE 34 LONG STEEL MARKET, BY REGION, 2018–2025 (USD BILLION)

TABLE 35 ASIA PACIFIC: LONG STEEL MARKET, BY COUNTRY, 2018-2025 (MILLION TONS)

TABLE 36 ASIA PACIFIC: LONG STEEL MARKET, BY COUNTRY, 2018-2025 (USD BILLION)

TABLE 37 ASIA PACIFIC: LONG STEEL MARKET, BY PROCESS, 2018-2025 (MILLION TONS)

TABLE 38 ASIA PACIFIC: LONG STEEL MARKET, BY PROCESS, 2018-2025 (USD BILLION)

TABLE 39 ASIA PACIFIC: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (MILLION TONS)

TABLE 40 ASIA PACIFIC: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 41 ASIA PACIFIC: LONG STEEL MARKET, BY END-USE INDUSTRY, 2018-2025 (MILLION TONS)

TABLE 42 ASIA PACIFIC: LONG STEEL MARKET, BY END-USE INDUSTRY, 2018-2025 (USD BILLION)

TABLE 43 CHINA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 44 CHINA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 45 INDIA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 46 INDIA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 47 JAPAN: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 48 JAPAN: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 49 SOUTH KOREA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 50 SOUTH KOREA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 51 VIETNAM: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 52 VIETNAM: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 53 REST OF ASIA PACIFIC: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 54 REST OF ASIA PACIFIC: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 55 EUROPE: LONG STEEL MARKET, BY COUNTRY, 2018-2025 (MILLION TONS)

TABLE 56 EUROPE: LONG STEEL MARKET, BY COUNTRY, 2018-2025 (USD BILLION)

TABLE 57 EUROPE: LONG STEEL MARKET, BY PROCESS, 2018-2025 (MILLION TONS)

TABLE 58 EUROPE: LONG STEEL MARKET, BY PROCESS, 2018-2025 (USD BILLION)

TABLE 59 EUROPE: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (MILLION TONS)

TABLE 60 EUROPE: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 61 EUROPE: LONG STEEL MARKET, BY END-USE INDUSTRY, 2018-2025 (MILLION TONS)

TABLE 62 EUROPE: LONG STEEL MARKET, BY END-USE INDUSTRY, 2018-2025 (USD BILLION)

TABLE 63 TURKEY: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 64 TURKEY: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 65 RUSSIA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 66 RUSSIA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 67 GERMANY: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 68 GERMANY: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 69 ITALY: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 70 ITALY: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 71 POLAND: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 72 POLAND: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 73 FRANCE: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 74 FRANCE: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 75 UK: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 76 UK: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 77 REST OF EUROPE: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 78 REST OF EUROPE: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 79 NORTH AMERICA: LONG STEEL MARKET, BY COUNTRY, 2018-2025 (MILLION TONS)

TABLE 80 NORTH AMERICA: LONG STEEL MARKET, BY COUNTRY, 2018-2025 (USD BILLION)

TABLE 81 NORTH AMERICA: LONG STEEL MARKET, BY PROCESS, 2018-2025 (MILLION TONS)

TABLE 82 NORTH AMERICA: LONG STEEL MARKET, BY PROCESS, 2018-2025 (USD BILLION)

TABLE 83 NORTH AMERICA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (MILLION TONS)

TABLE 84 NORTH AMERICA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 85 NORTH AMERICA: LONG STEEL MARKET, BY END-USE INDUSTRY, 2018-2025 (MILLION TONS)

TABLE 86 NORTH AMERICA: LONG STEEL MARKET, BY END-USE INDUSTRY, 2018-2025 (USD BILLION)

TABLE 87 US: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (MILLION TONS)

TABLE 88 US: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 89 MEXICO: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (MILLION TONS)

TABLE 90 MEXICO: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 91 CANADA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (MILLION TONS)

TABLE 92 CANADA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 93 MIDDLE EAST & AFRICA: LONG STEEL MARKET, BY COUNTRY, 2018-2025 (MILLION TONS)

TABLE 94 MIDDLE EAST & AFRICA: LONG STEEL MARKET, BY COUNTRY, 2018-2025 (USD BILLION)

TABLE 95 MIDDLE EAST & AFRICA: LONG STEEL MARKET, BY PROCESS, 2018-2025 (MILLION TONS)

TABLE 96 MIDDLE EAST & AFRICA: LONG STEEL MARKET, BY PROCESS, 2018-2025 (USD BILLION)

TABLE 97 MIDDLE EAST & AFRICA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (MILLION TONS)

TABLE 98 MIDDLE EAST & AFRICA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 99 MIDDLE EAST & AFRICA: LONG STEEL MARKET, BY END-USE INDUSTRY, 2018-2025 (MILLION TONS)

TABLE 100 MIDDLE EAST & AFRICA: LONG STEEL MARKET, BY END-USE INDUSTRY, 2018-2025 (USD BILLION)

TABLE 101 UAE: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 102 UAE: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 103 SAUDI ARABIA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 104 SAUDI ARABIA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 105 IRAN: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 106 IRAN: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 107 EGYPT: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 108 EGYPT: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 109 REST OF MIDDLE EAST & AFRICA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (MILLION TONS)

TABLE 110 REST OF MIDDLE EAST & AFRICA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018–2025 (USD BILLION)

TABLE 111 SOUTH AMERICA: LONG STEEL MARKET, BY COUNTRY, 2018-2025 (MILLION TONS)

TABLE 112 SOUTH AMERICA: LONG STEEL MARKET, BY COUNTRY, 2018-2025 (USD BILLION)

TABLE 113 SOUTH AMERICA: LONG STEEL MARKET, BY PROCESS, 2018-2025 (MILLION TONS)

TABLE 114 SOUTH AMERICA: LONG STEEL MARKET, BY PROCESS, 2018-2025 (USD BILLION)

TABLE 115 SOUTH AMERICA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (MILLION TONS)

TABLE 116 SOUTH AMERICA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 117 SOUTH AMERICA: LONG STEEL MARKET, BY END-USE INDUSTRY, 2018-2025 (MILLION TONS)

TABLE 118 SOUTH AMERICA LONG STEEL MARKET, BY END-USE INDUSTRY, 2018-2025 (USD BILLION)

TABLE 119 BRAZIL: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (MILLION TONS)

TABLE 120 BRAZIL: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 121 ARGENTINA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (MILLION TONS)

TABLE 122 ARGENTINA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

TABLE 123 REST OF SOUTH AMERICA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (MILLION TONS)

TABLE 124 ARGENTINA: LONG STEEL MARKET, BY PRODUCT TYPE, 2018-2025 (USD BILLION)

LIST OF FIGURES (48 Figures)

FIGURE 1 LONG STEEL MARKET SEGMENTATION

FIGURE 2 BASE NUMBER CALCULATION APPROACH 1

FIGURE 3 BASE NUMBER CALCULATION APPROACH 2

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 BASIC OXYGEN FURNACE SEGMENT EXPECTED TO LEAD THE LONG STEEL MARKET GROWTH DURING FORECAST PERIOD

FIGURE 7 INFRASTRUCTURE SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR BETWEEN 2020 AND 2025

FIGURE 8 GROWTH OF CONSTRUCTION INDUSTRY IS ONE OF THE MAJOR FACTORS DRIVING THE LONG STEEL MARKET

FIGURE 9 INFRASTRUCTURE SEGMENT EXPECTED TO GROW AT THE HIGHEST RATE DURING FORECAST PERIOD

FIGURE 10 ASIA PACIFIC ACCOUNTED FOR THE LARGEST SHARE OF LONG STEEL MARKET IN 2019

FIGURE 11 BASIC OXYGEN FURNACE SEGMENT AND CHINA LED THE LONG STEEL MARKET IN ASIA PACIFIC IN 2019

FIGURE 12 LONG STEEL MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES

FIGURE 13 GLOBAL CRUDE STEELMAKING CAPACITY, PRODUCTION, AND CAPACITY-PRODUCTION GAP, 2008-2018

FIGURE 14 GLOBAL EVOLUTION OF CRUDE STEELMAKING CAPACITY

FIGURE 15 PORTER'S FIVE FORCES ANALYSIS

FIGURE 16 EAF SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD AS COMPARED TO BOF SEGMENT

FIGURE 17 WIRE ROD SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 18 INFRASTRUCTURE SEGMENT TO LEAD LONG STEEL MARKET GROWTH DURING FORECAST PERIOD

FIGURE 19 ASIA PACIFIC PROJECTED TO BE FASTEST-GROWING MARKET FOR LONG STEEL DURING FORECAST PERIOD

FIGURE 20 ASIA PACIFIC LONG STEEL MARKET SNAPSHOT

FIGURE 21 EUROPE: LONG STEEL MARKET SNAPSHOT

FIGURE 22 NORTH AMERICA LONG STEEL MARKET SNAPSHOT

FIGURE 23 MIDDLE EAST & AFRICA: LONG STEEL MARKET SNAPSHOT

FIGURE 24 SOUTH AMERICA: LONG STEEL MARKET SNAPSHOT

FIGURE 25 LONG STEEL COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 26 ARCELORMITTAL: COMPANY SNAPSHOT

FIGURE 27 ARCELORMITTAL: SWOT ANALYSIS

FIGURE 28 GERDAU SA: COMPANY SNAPSHOT

FIGURE 29 GERDAU SA: SWOT ANALYSIS

FIGURE 30 NIPPON STEEL & SUMITOMO METAL CORPORATION: COMPANY SNAPSHOT

FIGURE 31 NIPPON STEEL & SUMITOMO METAL CORPORATION: SWOT ANALYSIS

FIGURE 32 POSCO: COMPANY SNAPSHOT

FIGURE 33 POSCO: SWOT ANALYSIS

FIGURE 34 NUCOR CORPORATION: COMPANY SNAPSHOT

FIGURE 35 NUCOR CORPORATION: SWOT ANALYSIS

FIGURE 36 COMMERCIAL METALS COMPY: COMPANY SNAPSHOT

FIGURE 37 MECHEL PAO: COMPANY SNAPSHOT

FIGURE 38 STEEL DYNAMICS: COMPANY SNAPSHOT

FIGURE 39 NOVOLIPETSK STEEL (NLMK): COMPANY SNAPSHOT

FIGURE 40 OUTOKUMPU OYJ: COMPANY SNAPSHOT

FIGURE 41 ACERINOX S.A.: COMPANY SNAPSHOT

FIGURE 42 TATA STEEL: COMPANY SNAPSHOT

FIGURE 43 TATA STEEL: SWOT ANALYSIS

FIGURE 44 JFE HOLDINGS INC: COMPANY SNAPSHOT

FIGURE 45 JFE STEEL CORPORATION: SWOT ANALYSIS

FIGURE 46 EVRAZ PLC

FIGURE 47 HYUNDAI STEEL: COMPANY SNAPSHOT

FIGURE 48 STEEL AUTHORITY OF INDIA LIMITED: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size for the long steel market. Exhaustive secondary research was undertaken to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as directories, and databases, such as D&B Hoovers, Bloomberg, the World Bank, IMF, The World Factbook, American Iron and Steel Institute, the World Steel Association, EUROCONSTRUCT, Factiva, and other government & private websites and associations related to the steel sector were referred to identify and collect information for this study. Secondary sources include long steel manufacturers, annual reports, press releases & investor presentations of companies, whitepapers, certified publications, articles by recognized authors, gold standard & silver standard websites, associations, regulatory bodies, trade directories, and databases.

Primary Research

The long steel market comprises several stakeholders, such as core and related industries and suppliers, manufacturers, distributors, technology developers, alliances, and organizations related to all segments of the value chain of this industry. The demand side of this market is characterized by the developments in the Construction, infrastructure, and other industries. The supply side is characterized by market consolidation activities undertaken by long steel producers. Several primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the long steel market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and long steel market size, in terms of volume and value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall long steel market size-using the market size estimation process explained above-the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives:

- To estimate and forecast the size of the long steel market in terms of volume (million tons) and value (USD billion)

- To define, describe, and forecast the size of the long steel market based on process, product type, end-use industry, and region

- To forecast the size of various segments of the market based on five major regions—Asia Pacific, North America, Europe, the Middle East & Africa, and South America, along with major countries in each region

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities in the market for stakeholders and draw a competitive landscape of market leaders

- To strategically profile key players and comprehensively analyze their core competencies

- To analyze competitive developments such as expansions, acquisitions, new product developments/launches, and investments in the global long steel market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis

- A further breakdown of the regional long steel market to the country level by process

Country Information

- Regional market split by major countries

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Long Steel Market