Weathering Steel Market by Type (Corten-A, Corten-B), Form (Sheets, Plates, Bars), Availability (Painted, Unpainted), End-use Industry (Building & Construction, Transportation, Art & Architecture, Industrial), Region- Global Forecast to 2024

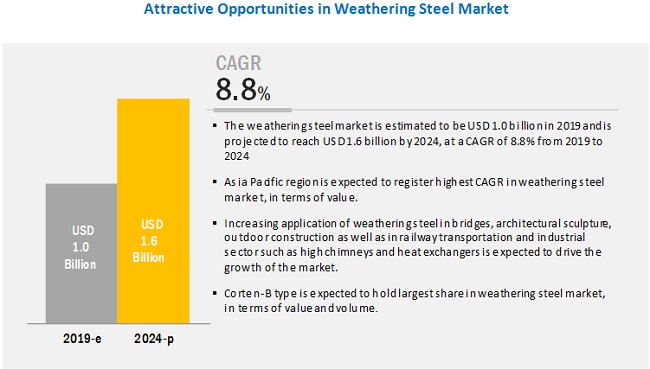

[150 Pages Report]The weathering steel market is estimated to be USD 1.0 billion in 2019 and is projected to reach USD 1.6 billion by 2024, at a CAGR of 8.8% from 2019 to 2024. Excellent high strength and increased corrosion resistant over entire life-cycle make it an ideal choice for application in bridge construction. Also, the extraordinary appeal of weathering steel is resulting in architectures and designers increasingly using the material in outdoor and architectural construction.

By type, Corten-B is expected to lead the weathering steel market during the forecast period.

Building & construction is the major application of weathering steel, especially in bridge construction. Use of weathering steel as a material for the construction of bridges has increased during the last decade. This trend is due to the low maintenance associated with the use of weathering steel, enhanced corrosion resistant, and longer shelf life of the structure. Corten-B type the preferred type for use in the structural application on account superior strength and high toughness.

By form, plates are expected to lead the weathering steel market during the forecast period.

Plates are the dominant and most widely used form of weathering steel. Weathering steel plates not only provide high strength to the buildings and structures but also add to their aesthetic appeal. Weathering plates are also employed in high temperature and sulfur-rich environments to extend the lifetime of metal. Heavy-duty transport is another major application of weathering steel plate. Shipping containers and railway rolling stock are subject to extreme conditions of changing climates. This makes weathering steel an ideal material as it requires changing climate conditions (wet or dry) to commence the oxidation process and provides a hard layer of protective rust.

Unpainted weathered steel segment occupied the majority of the market share in 2018.

Weathering steel is a specialty steel which generates patina (rust layer) while in contact with the atmosphere for a specific time. Moreover, to produce a patina layer on weathering steel, it requires alternate wet and dry cycles. Also, the generation of the layer depends on the area, climatic conditions, and other aspects. Thus, it is manufactured generally in the unpainted form which has a life span of 120 years. Unpainted weathering steel is used commonly in places where the steel is not always in contact with water such as railway bridges, containers, sculptures, and others. Some manufacturers offer pre-weathered weathering steel which is again a category of unpainted weathering steel.

Building & construction end-use industry to register the largest share in weathering steel market during the forecast period.

Based on end-use industry, the building & construction industry led the weathering steel market in 2018, owing to specific application areas, increasing investments, and product innovation in weathering steel. Additionally, emerging nations such as China, and India are undertaking infrastructure development, which is expected to create the demand for weathering steel in the near future. Moreover, the ability of weathering steel to exhibit aesthetic and antique appeal over a period of time makes it an attractive choice for art and architecture.

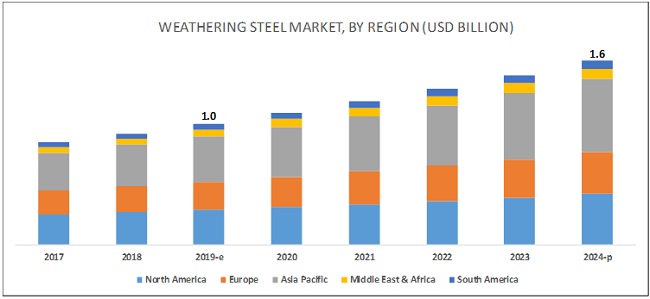

North America to remain one of the largest weathering steel markets during the forecast period.

The North America region led the weathering steel market in 2018, which is expected to grow at a high rate during the forecast period, owing to the increasing demand for weathering steel from the U.S., Canada, and Mexico. High demand from end-use industries such as aerospace & defense, medical & dental, automotive, electronics, and others are driving the growth of weathering steel markets in these countries.

Key Market Players

Companies such as Arcelor Mittal (Germany), United States Steel Corporation (US), Nippon Steel & Sumitomo Metal Corporation (Japan), Tata Steel (India), Posco (South Korea), SSAB AB (Sweden), JFE Steel Corporation (Japan), Bluescope Steel Limited (Australia), HBIS Group (China) and A. Zahner Company (US), among others, are the major players in the weathering steel market. These players have been focusing on strategies such as new contracts, product launches, acquisitions, collaborations, agreements, partnerships, expansions, joint ventures, and investments that have helped them to expand their businesses in untapped and potential markets. The diversified product portfolio and multiple uses are factors responsible for strengthening the position of these companies in the weathering steel market. They have also been adopting various organic and inorganic growth strategies, such as new product launches, acquisitions, and agreements, to enhance their current position in the weathering steel market.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Value (USD) & Volume (Kilo Tons) |

|

Segments covered |

Type, Form, Availability, End-use Industry, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

Arcelor Mittal (Germany), United States Steel Corporation (US), Nippon Steel & Sumitomo Metal Corporation (Japan), Tata Steel (India), Posco (South Korea), SSAB AB (Sweden), JFE Steel Corporation (Japan), Bluescope Steel Limited (Australia), HBIS Group (China) and A. Zahner Company (US) and others are considered for the study. |

This report categorizes the weathering steel market based on type, form, availability, end-use industry, and region.

On the basis of type, the weathering steel market is segmented as follows

- Corten-A

- Corten-B

- Others (A604, A606, etc.)

On the basis of form, the weathering steel market is segmented as follows

- Plates

- Sheets

- Bars

- Others (Coils, rivets, stripes, tubes, etc.)

On the basis of availability, the weathering steel market is segmented as follows

- Painted

- Unpainted

On the basis of end-use industry, the weathering steel market is segmented as follows

- Building & Construction

- Transportation

- Art & Architecture

- Industrial

- Others (Decorative pieces and street lights)

On the basis of region, the weathering steel market is segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In October 2018, Nippon Steel & Sumitomo Metal Corporation (NSSMC) engaged with ArcelorMittal (AM) for the acquisition procedures aiming at jointly acquiring and managing Essar Steel India Limited (ESIL), which is undergoing corporate insolvency resolution process under the Indian Insolvency and Bankruptcy Code from 2017. The resolution application has been declared successful by ESIL's Committee of Creditors.

- In June 2018, Nippon Steel & Sumitomo Metal Corporation (NSSMC) acquired Ovako AB, a European specialty steel manufacturer with headquarters in Sweden, as a wholly owned subsidiary. Ovako AB deals in the manufacturing of Nippon Steel & Sumitomo Metal Corporation specialty steel which includes weathering steel. This acquisition helped Nippon Steel & Sumitomo Metal Corporation in strengthening its position in specialty steels.

- In May 2017, Liberty House Group acquired Tata Steel UKs specialty steels (Weathering Steel, stainless steel, and others) business for a total consideration of £100 million (USD 112.7 million). This acquisition included electric arc steelworks and bar mill at Rotherham, the steel purifying facility in Stocksbridge and a mill in Brinsworth as well as service centers in Bolton and Wednesbury, UK, and in Suzhou and Xi'an, China.

- In March 2015, United States Steel Corporation announced the construction of a new electric arc furnace and tubular products coupling facility in Jefferson County, Alabama. It invested USD 277.5 million to produce technologically advanced electric arc furnace (EAF) steelmaking facility in Alabama.

Key Questions addressed by the report

- What are the future revenue pockets in the weathering steel market?

- Which key developments are expected to have a long-term impact on the weathering steel market?

- Which materials, grade, and processes are expected to cannibalize existing markets?

- How is the current regulatory framework expected to impact the market?

- What will be the future product mix of the weathering steel market?

- What are the prime strategies of leaders in the weathering steel market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in Weathering Steel Market

4.2 Weathering Steel Market, By Type

4.3 Weathering Steel Market, By End-Use Industry

4.4 Weathering Steel Market, By Region

4.5 Asia Pacific Weathering Steel Market, By Country and Availability

5 Market Overview (Page No. - 34)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Long Shelf Life With Low Maintenance Cost

5.1.1.2 Growth of the Infrastructure Segment

5.1.1.3 Growing Use of Weathering Steel in Sculptures in Western Regions

5.1.2 Restraints

5.1.2.1 Fluctuation in Raw Material Prices of Steel

5.1.2.2 Inferior Performance in Damp Conditions

5.1.2.3 Lack of Awareness and Knowledge About the Use of Weathering Steel

5.1.3 Opportunities

5.1.3.1 Increasing Opportunities in Various Emerging Economies

5.1.4 Challenges

5.1.4.1 Trade War Between China and the Us

5.1.4.2 Dealing With Overcapacity of Steel

5.2 Porters Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Threat of New Entrants

5.2.3 Threat of Substitutes

5.2.4 Bargaining Power of Buyers

5.2.5 Intensity of Competitive Rivalry

6 Weathering Steel Market, By Form (Page No. - 39)

6.1 Introduction

6.2 Sheets

6.2.1 Weathering Sheets are Preferred Material in High-Temperature and Corrosive Environment

6.3 Plates

6.3.1 Corrosion Resistance and Strength Make Weathering Steel Plates an Ideal Choice for Structural and Architectural Applications

6.4 Bars

6.4.1 Versatility of Weathering Steel Bars Leading to High Demand in the Construction Industry

6.5 Others

6.5.1 Welded, Bolted, and Riveted Construction is Driving the Demand for Other Forms of Weathering Steel

7 Weathering Steel Market, By Type (Page No. - 46)

7.1 Introduction

7.2 Corten-A

7.2.1 Corten-A is Widely Used in Industrial Applications

7.3 Corten-B

7.3.1 Growing Use in Structural Applications Such as Bridges and Tunnels is Driving the Demand for Corten-B

7.4 Others

7.4.1 Increasing Use in Outdoor Applications is Driving the Demand for Other Weathering Steel Types

8 Weathering Steel Market, By Availability (Page No. - 52)

8.1 Introduction

8.2 Unpainted

8.2.1 Properties Such as High Tensile Strength, Corrosion Resistance and Low Cost as Compared to Painted Weathering Steel is Expected to Drive the Growth of Unpainted Weathering Steel Market

8.3 Painted

8.3.1 Increasing Application in Areas Where the Steel is Always in Contact With Water is Expected to Fuel the Painted Weathering Steel Market During the Forecast Period

9 Weathering Steel Market, By End-Use Industry (Page No. - 56)

9.1 Introduction

9.2 Building & Construction

9.2.1 Increasing Infrastructure Activities Across the Globe is Expected to Drive the Growth of Weathering Steel Market

9.3 Transportation

9.3.1 Government Initiatives for the Development of Transportation Industry Especially Railway Network is Expected to Drive the Growth of Weathering Steel Market

9.4 Art & Architecture

9.4.1 Longer Shelf Life and Aesthetics of Weathering Steel is Enhancing the Growth of Weathering Steel Market in Art & Architecture Industry

9.5 Industrial

9.5.1 Increasing Demand for Containers and Water Tanks With Longer Shelf Life is Expected to Drive the Growth of Weathering Steel Market

9.6 Others

9.6.1 Aesthetic and Rustic Appearance With Low Maintenance is Expected to Fuel the Growth of Weathering Steel Market

10 Weathering Steel Market, By Region (Page No. - 64)

10.1 Introduction

10.2 Asia Pacific

10.2.1 China Weathering Steel Market

10.2.1.1 China is Projected to Lead the Asia Pacific Weathering Steel Market During the Forecast Period

10.2.2 Japan Weathering Steel Market

10.2.2.1 Compatibility of Weathering Steel With Japans Hot and Humid Climate Drives Its Demand

10.2.3 South Korea Weathering Steel Market

10.2.3.1 Increasing Use in Structural Applications Projected to Drive the Market for Weathering Steel in South Korea

10.2.4 Taiwan Weathering Steel Market

10.2.4.1 Weathering Steel With High Phosphorus Content is Popular Across the Country

10.2.5 India Weathering Steel Market

10.2.5.1 Low Prevalence of Weathering Steel Makes India an Attractive Destination for Market Development

10.2.6 Rest of Asia Pacific Weathering Steel Market

10.2.6.1 Limited Use of Weathering Steel Across Rest of Asia Pacific

10.3 North America

10.3.1 North America Weathering Steel Market, By Country

10.3.2 US Weathering Steel Market

10.3.2.1 Government Initiatives and Increasing Demand From End-Use Industries Such as Building & Construction are Expected to Fuel the Growth of the US Weathering Steel Market

10.3.3 Canada Weathering Steel Market

10.3.3.1 Increasing Investment in Construction and Transportation is Expected to Drive the Growth of the Weathering Steel Market in Canada

10.3.4 Mexico Weathering Steel Market

10.3.4.1 Technological Advancements and Foreign Investments are Expected to Drive the Growth of the Weathering Steel Market in Mexico

10.4 Europe

10.4.1 Germany Weathering Steel Market

10.4.1.1 Increasing Infrastructure Spending is Expected to Increase the Demand for Weathering Steel in Germany

10.4.2 France Weathering Steel Market

10.4.2.1 Increasing Investment in End-Use Industries is A Significant Driving Factor for the Growth of the Weathering Steel Market in France

10.4.3 UK Weathering Steel Market

10.4.3.1 Growth in the Construction Industry is Expected to Increase the Demand for Weathering Steel in the UK

10.4.4 Italy Weathering Steel Market

10.4.4.1 Government Initiatives and Growth in End-Use Industries are Expected to Drive the Growth of the Weathering Steel Market in Italy

10.4.5 Spain Weathering Steel Market, By End-Use Industry

10.4.5.1 Growth in Building & Construction and Transportation is Expected to Drive the Demand for Weathering Steel in Spain

10.4.6 Russia Weathering Steel Market

10.4.6.1 Growth in Infrastructure and Increasing Application Areas are Expected to Drive the Demand for Weathering Steel in Russia

10.4.7 Rest of Europe Weathering Steel Market, By End-Use Industry

10.4.7.1 Investments and Initiatives Taken By Governments to Promote Manufacturing are Projected to Boost the Demand for Weathering Steel in the Rest of Europe

10.5 Middle East & Africa

10.5.1 Saudi Arabia Weathering Steel Market

10.5.1.1 Ongoing Shift From Concrete Toward Steel Structures is Expected to Drive the Demand for Weathering Steel in the Country

10.5.2 UAE Weathering Steel Market

10.5.2.1 Upcoming Construction and Infrastructure Projects are Expected to Drive the Demand for Weathering Steel in the UAE

10.5.3 South Africa Weathering Steel Market

10.5.3.1 Import of Cheap, Subsidized Steel and Infrastructure Underspending are Expected to Deter the Demand for Weathering Steel in South Africa

10.5.4 Rest of Middle East & Africa Weathering Steel Market

10.5.4.1 Market Growth is Expected to Be Subdued in the Rest of Middle East & Africa

10.6 South America

10.6.1 Brazil Weathering Steel Market

10.6.1.1 Growth in Construction and Transportation is Expected to Drive to Growth of the Weathering Steel Market in Brazil During the Forecast Period

10.6.2 Argentina Weathering Steel Market

10.6.2.1 Sustainable Economic Development and Growth in End-Use Industries Expected to Drive the Growth of the Weathering Steel Market in Argentina

10.6.3 Rest of South America Weathering Steel Market

10.6.3.1 Growth in Various Building & Construction, Transportation, and Art & Architecture, Drives Growth of the Weathering Steel Market in Rest of South America

11 Weathering Steel Market, Dive (Page No. - 112)

11.1 Introduction

11.1.1 Visionaries

11.1.2 Innovators

11.1.3 Dynamic Differentiators

11.1.4 Emerging Companies

11.2 Ranking of Key Market Players in the Weathering Steel Market

12 Company Profiles (Page No. - 114)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Arcelormittal

12.2 United States Steel Corporation

12.3 Nippon Steel & Sumitomo Metal Corporation

12.4 Tata Steel

12.5 Posco

12.6 SSAB AB

12.7 JFE Steel Corporation

12.8 Bluescope Steel Limited

12.9 HBIS Group

12.10 A. Zahner Company

12.11 Metal Sales Manufacturing Corporation

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12.12 Other Key Players

12.12.1 Liberty House Group

12.12.2 Tubeco, Inc.

12.12.3 Conquest Steel and Alloys

12.12.4 Shanghai Metal Corporation

12.12.5 Pushpak Steel & Engineering Co.

12.12.6 Kloeckner UK Holdings LTD.

12.12.7 Amardeep Steel

12.12.8 Henan Gang Iron and Steel Co., LTD. (Gangsteel)

12.12.9 Zekelman Industries

12.12.10 Johnson Brothers Metal Forming Co.

12.12.11 Weathering Steel Company

12.12.12 NLMK

12.12.13 Champak Steel & Engg. Co.

12.12.14 Cooper & Turner LTD.

13 Appendix (Page No. - 141)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (138 Tables)

Table 1 Weathering Steel Market Snapshot

Table 2 Weathering Steel Market, By Form, 20172024 (USD Million)

Table 3 Weathering Steel Market, By Form, 20172024 (Kilotons)

Table 4 Weathering Steel Market for Sheets, By Region, 20172024 (USD Million)

Table 5 Weathering Steel Market for Sheets, By Region, 20172024 (Kilotons)

Table 6 Weathering Steel Market for Plates, By Region, 20172024 (USD Million)

Table 7 Weathering Steel Market for Plates, By Region, 20172024 (Kilotons)

Table 8 Weathering Steel Market for Bars, By Region, 20172024 (USD Million)

Table 9 Weathering Steel Market for Bars, By Region, 20172024 (Kilotons)

Table 10 Weathering Steel Market for Others, By Region, 20172024 (USD Million)

Table 11 Weathering Steel Market for Others, By Region, 20172024 (Kilotons)

Table 12 Physical Properties of Corten-A & Corten-B Weathering Steel

Table 13 Chemical Composition of Corten-A & Corten-B Weathering Steel (% Wt)

Table 14 Application and Weldability of Corten-A & Corten-B Weathering Steel

Table 15 Weathering Steel Market, By Type, 20172024 (USD Million)

Table 16 Weathering Steel Market, By Type, 20172024 (Kilotons)

Table 17 Corten-A Weathering Steel Market, By Region, 20172024 (USD Million)

Table 18 Corten-A Weathering Steel Market, By Region, 20172024 (Kilotons)

Table 19 Corten-B Weathering Steel Market, By Region, 20172024 (USD Million)

Table 20 Corten-B Weathering Steel Market, By Region, 20172024 (Kilotons)

Table 21 Other Weathering Steel Market, By Region, 20172024 (USD Million)

Table 22 Other Weathering Steel Market, By Region, 20172024 (Kilotons)

Table 23 Weathering Steel Market, By Availability, 20172024 (USD Million)

Table 24 Weathering Steel Market, By Availability, 20172024 (Kilotons)

Table 25 Unpainted Weathering Steel Market, By Region, 20172024 (USD Million)

Table 26 Unpainted Weathering Steel Market, By Region, 20172024 (Kilotons)

Table 27 Painted Weathering Steel Market, By Region, 20172024 (USD Million)

Table 28 Painted Weathering Steel Market, By Region, 20172024 (Kilotons)

Table 29 Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 30 Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 31 Weathering Steel Market in Building & Construction, By Region, 20172024 (USD Million)

Table 32 Weathering Steel Market in Building & Construction, By Region, 20172024 (Kilotons)

Table 33 Weathering Steel Market in Transportation, By Region, 20172024 (USD Million)

Table 34 Weathering Steel Market in Transportation, By Region, 20172024 (Kilotons)

Table 35 Weathering Steel Market in Art & Architecture, By Region, 20172024 (USD Million)

Table 36 Weathering Steel Market in Art & Architecture, By Region, 20172024 (Kilotons)

Table 37 Weathering Steel Market in Industrial, By Region, 20172024 (USD Million)

Table 38 Weathering Steel Market in Industrial, By Region, 20172024 (Kilotons)

Table 39 Weathering Steel Market in Other End-Use Industries, By Region, 20172024 (USD Million)

Table 40 Weathering Steel Market in Other End-Use Industries, By Region, 20172024 (Kilo Tons)

Table 41 Weathering Steel Market, By Region, 20172024 (USD Million)

Table 42 Weathering Steel Market, By Region, 20172024 (Kilotons)

Table 43 Asia Pacific Weathering Steel Market, By Country, 20172024 (USD Million)

Table 44 Asia Pacific Weathering Steel Market, By Country, 20172024 (Kilotons)

Table 45 Asia Pacific Weathering Steel Market, By Type,20172024 (USD Million)

Table 46 Asia Pacific Weathering Steel Market, By Type, 20172024 (Kilotons)

Table 47 Asia Pacific Weathering Steel Market, By Form, 20182024 (USD Million)

Table 48 Asia Pacific Weathering Steel Market, By Form, 20172024 (Kilotons)

Table 49 Asia Pacific Weathering Steel Market, By Availability, 20172024 (USD Million)

Table 50 Asia Pacific Weathering Steel Market, By Availability, 20172024 (Kilotons)

Table 51 Asia Pacific Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 52 Asia Pacific Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 53 China Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 54 China Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 55 Japan Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 56 Japan Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 57 South Korea Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 58 South Korea Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 59 Taiwan Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 60 Taiwan Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 61 India Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 62 India Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 63 Rest of Asia Pacific Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 64 Rest of Asia Pacific Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 65 North America Weathering Steel Market, By Country, 20172024 (USD Million)

Table 66 North America Weathering Steel Market, By Country, 20172024 (Kilotons)

Table 67 North America Weathering Steel Market, By Type, 20172024 (USD Million)

Table 68 North America Weathering Steel Market, By Type, 20172024 (Kilotons)

Table 69 North America Weathering Steel Market, By Form, 20172024 (USD Million)

Table 70 North America Weathering Steel Market, By Form, 20172024 (Kilotons)

Table 71 North America Weathering Steel Market, By Availability, 20172024 (USD Million)

Table 72 North America Weathering Steel Market, By Availability, 20172024 (Kilotons)

Table 73 North America Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 74 North America Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 75 US Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 76 US Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 77 Canada Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 78 Canada Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 79 Mexico Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 80 Mexico Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 81 Europe Weathering Steel Market, By Country, 20172024 (USD Million)

Table 82 Europe Weathering Steel Market, By Country, 20172024 (Kilotons)

Table 83 Europe Weathering Steel Market, By Type, 20172024 (USD Million)

Table 84 Europe Weathering Steel Market, By Type, 20172024 (Kilotons)

Table 85 Europe Weathering Steel Market, By Form, 20172024 (USD Million)

Table 86 Europe Weathering Steel Market, By Form, 20172024 (Kilotons)

Table 87 Europe Weathering Steel Market, By Availability, 20172024 (USD Million)

Table 88 Europe Weathering Steel Market, By Availability, 20172024 (Kilotons)

Table 89 Europe Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 90 Europe Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 91 Germany Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 92 Germany Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 93 France Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 94 France Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 95 UK Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 96 UK Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 97 Italy Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 98 Italy Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 99 Spain Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 100 Spain Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 101 Russia Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 102 Russia Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 103 Rest of Europe Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 104 Rest of Europe Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 105 Middle East & Africa Weathering Steel Market, By Country, 20172024 (USD Million)

Table 106 Middle East & Africa Weathering Steel Market, By Country, 20172024 (Kilotons)

Table 107 Middle East & Africa Weathering Steel Market, By Type, 20172024 (USD Million)

Table 108 Middle East & Africa Weathering Steel Market, By Type, 20172024 (Kilotons)

Table 109 Middle East & Africa Weathering Steel Market, By Form, 20172024 (USD Million)

Table 110 Middle East & Africa Weathering Steel Market, By Form, 20172024 (Kilotons)

Table 111 Middle East & Africa Weathering Steel Market, By Availability, 20172024 (USD Million)

Table 112 Middle East & Africa Weathering Steel Market, By Availability, 20172024 (Kilotons)

Table 113 Middle East & Africa Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 114 Middle East & Africa Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 115 Saudi Arabia Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 116 Saudi Arabia Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 117 UAE Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 118 UAE Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 119 South Africa Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 120 South Africa Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 121 Rest of Middle East & Africa Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 122 Rest of Middle East & Africa Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 123 South America Weathering Steel Market, By Country, 20172024 (USD Million)

Table 124 South America Weathering Steel Market, By Country, 20172024 (Kilotons)

Table 125 South America Weathering Steel Market, By Type, 20172024 (USD Million)

Table 126 South America Weathering Steel Market, By Type, 20172024 (Kilotons)

Table 127 South America Weathering Steel Market, By Form, 20172024 (USD Million)

Table 128 South America Weathering Steel Market, By Form, 20172024 (Kilotons)

Table 129 South America Weathering Steel Market, By Availability, 20172024 (USD Million)

Table 130 South America Weathering Steel Market, By Availability, 20172024 (Kilotons)

Table 131 South America Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 132 South America Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 133 Brazil Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 134 Brazil Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 135 Argentina Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 136 Argentina Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

Table 137 Rest of South America Weathering Steel Market, By End-Use Industry, 20172024 (USD Million)

Table 138 Rest of South America Weathering Steel Market, By End-Use Industry, 20172024 (Kilotons)

List of Figures (44 Figures)

Figure 1 Weathering Steel Market Segmentation

Figure 2 Weathering Steel Market: Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Weathering Steel Market: Data Triangulation

Figure 6 Plates Projected to Be Most Widely Consumed Type of Weathering Steel Between 2019 and 2024, in Terms of Value

Figure 7 Building & Construction Projected to Be Largest End-Use Industry for Weathering Steel Between 2019 and 2024, in Terms of Value

Figure 8 Asia Pacific Weathering Steel Market to Grow at Highest CAGR During Forecast Period, in Terms of Volume

Figure 9 Corten-B Segment Expected to Lead the Market During Forecast Period, in Terms of Volume

Figure 10 Building & Construction Segment Projected to Lead the Market During Forecast Period, in Terms of Volume

Figure 11 Asia Pacific Accounted for Largest Share of Weathering Steel Market in 2018, in Terms of Volume

Figure 12 China Accounted for Largest Share of Asia Pacific Weathering Steel Market in 2018, in Terms of Volume

Figure 13 Drivers, Restraints, Opportunities, and Challenges: Weathering Steel Market

Figure 14 Porters Five Forces Analysis

Figure 15 Weathering Steel Market, By Form, 2019 & 2024 (USD Million)

Figure 16 Weathering Steel Market, By Type, 2019 & 2024 (USD Million)

Figure 17 Unpainted Segment to Grow at Higher CAGR Than Painted Segment During Forecast Period, in Terms of Value

Figure 18 Building & Construction End-Use Industry Segment to Witness Highest CAGR During Forecast Period

Figure 19 Asia Pacific is Projected to Be the Fastest-Growing Market for Weathering Steel During the Forecast Period

Figure 20 Asia Pacific Weathering Steel Market Snapshot

Figure 21 North America Weathering Steel Market Snapshot

Figure 22 Europe Weathering Steel Market Snapshot

Figure 23 Middle East & Africa Weathering Steel Market Snapshot

Figure 24 South America Weathering Steel Market Snapshot

Figure 25 Dive Chart

Figure 26 Arcelormittal: Company Snapshot

Figure 27 Arcelormittal: SWOT Analysis

Figure 28 United States Steel Corporation: Company Snapshot

Figure 29 United States Steel Corporation: SWOT Analysis

Figure 30 Nippon Steel & Sumitomo Metal Corporation: Company Snapshot

Figure 31 Nippon Steel & Sumitomo Metal Corporation: SWOT Analysis

Figure 32 Tata Steel: Company Snapshot

Figure 33 Tata Steel: SWOT Analysis

Figure 34 Posco: Company Snapshot

Figure 35 Posco: SWOT Analysis

Figure 36 SSAB AB: Company Snapshot

Figure 37 SSAB AB: SWOT Analysis

Figure 38 JFE Steel Corporation: Company Snapshot

Figure 39 JFE Steel Corporation: SWOT Analysis

Figure 40 Bluescope Steel Limited: Company Snapshot

Figure 41 Bluescope Steel Limited: SWOT Analysis

Figure 42 HBIS Group: SWOT Analysis

Figure 43 A. Zahner Company: SWOT Analysis

Figure 44 Metal Sales Manufacturing Corporation: SWOT Analysis

The study involved four major activities to estimate the current market size for weathering steel. Exhaustive secondary research was done to collect information on market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation was used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. Secondary sources include annual reports, press releases & investor presentations of companies, whitepapers, certified publications, articles by recognized authors, gold standard & silver standard websites, associations, regulatory bodies, trade directories, and databases.

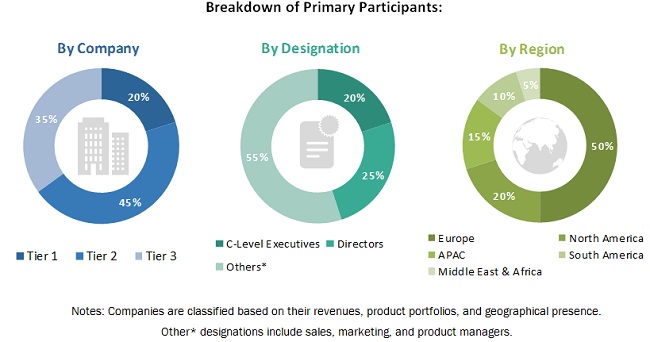

Primary Research

The weathering steel market comprises several stakeholders such as raw material suppliers, weathering steel manufacturers, OEMs, end product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the developments in the building and construction, transportation, industrial and other end-use industries. The supply side is characterized by market consolidation activities undertaken by weathering steel producers. Several primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following are the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the weathering steel market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value & volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation:

After arriving at the overall market sizeusing the market size estimation process explained abovethe market was split into several segments and sub-segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, and forecast the weathering steel market based on type, form, availability and end-use industry, and region

- To estimate and forecast the size of the weathering steel market in terms of value & volume

- To estimate and forecast the size of the weathering steel market by type, and end-use industry for North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To identify and analyze the drivers, restraints, challenges, and opportunities that are influencing the growth of the weathering steel market

- To analyze region-specific trends in North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To strategically analyze markets with respect to individual growth trends, future prospects, and their contribution to the market

- To track and analyze recent developments and competitive strategies, such as partnerships, agreements, contracts, collaborations, mergers & acquisitions, new product developments, divestments and expansions adopted by the leading players to strengthen their position in the weathering steel market

- To identify and profile key players in the weathering steel market and analyze their core competencies

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis

- A further breakdown of the regional weathering steel market to the country level by type

Country Information

- Regional market split by major countries

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Weathering Steel Market