Medical Device Security Market by Solution (Encryption, Antivirus, Identity & Acess Management), Services (Professional, Managed), Type (Network Security, Endpoint Security), Device Type, End User (Healthcare Provider) - Global Forecast to 2023

[249 Pages Report] The Global Medical Device Security Market was valued at USD 4.04 Billion in 2017 and is projected to reach USD 6.59 Billion by 2023, at a CAGR of 8.6% during the forecast period. The base year considered for the study is 2017 and the forecast period is from 2018 to 2023.

Objectives of the study are:

- To define, describe, and forecast the global medical device security market by component (solution and services), type, device type, end user, and region

- To provide detailed information about factors affecting the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To profile key players in this market and comprehensively analyze their market shares and core competencies

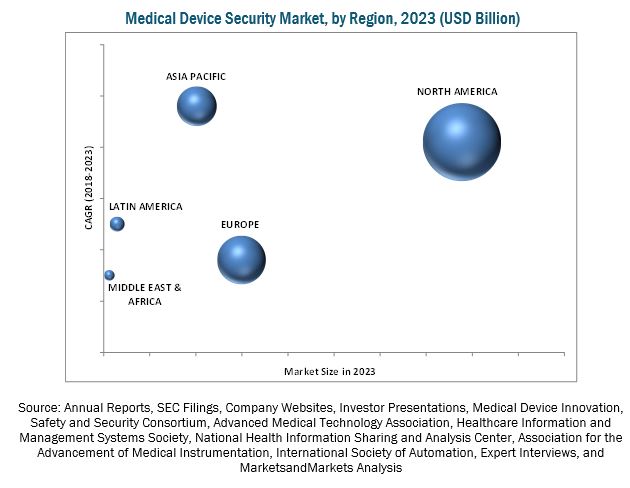

- To forecast the market size of the global market in North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa

- To track and analyze competitive developments such as acquisitions; product developments; agreements, partnerships, and collaborations; and expansions in the market

Research Methodology

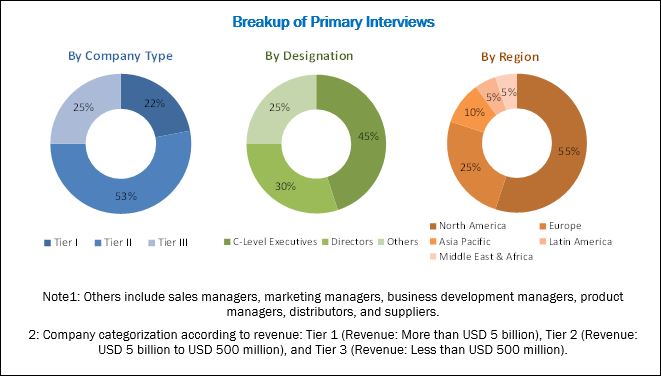

The study estimates the medical device security industry size for 2018 and projects its demand till 2023. In the primary research process, various sources from both demand side and supply side were interviewed to obtain qualitative and quantitative information for the report. Primary sources from the supply side include various industry CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from the various players in the market. Primary sources from the demand side include hospitals and clinics, medical device manufacturers, and healthcare payers. For the market estimation process, both top-down and bottom-up approaches were used to estimate and validate the market size of the market. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added to detailed inputs and analysis from MarketsandMarkets and presented in this report. This research study involves the extensive usage of secondary sources, directories, and databases, in order to identify and collect information useful for this technical, market-oriented, and financial study of the market. In-depth interviews were conducted with various primary respondents, including subject-matter experts (SMEs), C-level executives of key market players, and industry consultants to obtain and verify qualitative and quantitative information and to assess market prospects.

To know about the assumptions considered for the study, download the pdf brochure

In 2017, Cisco Systems (US), IBM (US), GE Healthcare (US), Symantec (US), CA Technologies (US), Philips (Netherlands), DXC Technology (US), CloudPassage (US), FireEye (US), Check Point Software Technologies (Israel), Sophos (UK), Imperva (US), Fortinet (US), Palo Alto Networks (US), ClearDATA (US), and Zscaler (US) were the other major players operating in this market.

Target Audience for this Report

- Medical device security service providers

- Suppliers and distributors of medical device security solutions

- Independent software vendors (ISVs)

- Medical device manufacturers

- Healthcare providers (including hospitals and clinics)

- Healthcare institutions

- Healthcare payers

- Market research and consulting firms

- Venture capitalists and investors

Scope of the Report

This report categorizes the global medical device security market into the following segments:

Global Medical Device Security Market, by Component

- Solutions

- Identity & Access Management (IAM)

- Antivirus/Antimalware

- Risk & Compliance Management

- Encryption

- Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

- Data Loss Prevention (DLP)

- Disaster Recovery

- Distributed Denial of Service (DDoS)

- Other Solutions (Firewall, Patch Management, Unified Threat Management (UTM), SIEM, and Security & Vulnerability Management)

- Services

- Professional services

- Consulting

- Support & Maintenance

- Design & Integration

- Training and Education Services

- Managed security services

Global Medical Device Security Market, by Type

- Application Security

- Endpoint Security

- Network Security

- Cloud Security

- Other Security Types (Email, Web, and Database Security)

Global Medical Device Security Market, by Device Type

- Hospital Medical Devices

- Internally Embedded Medical Devices

- Wearable and External Medical Devices

Global Medical Device Security Market, by End User

- Healthcare Providers

- Medical Device Manufacturers

- Healthcare Payers

Global Medical Device Security Market, by Region

- North America

- US

- Canada

- Europe

- Germany

- France

- Italy

- UK

- Spain

- RoE

- Asia Pacific

- Japan

- China

- India

- RoAPAC

- Latin America

- Middle East & Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the service portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific medical device security market in Russia, South Korea, Taiwan, Australia, New Zealand, and other countries

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global medical device security market is projected to reach USD 6.59 Billion by 2023 from 4.36 Billion in 2018, at a CAGR of 8.6%. Factors such as increasing instances of healthcare cyberattacks and threats, growth in geriatric population and subsequent growth in chronic disease management, government regulations and need for compliance, growing demand for connected medical devices, and increasing adoption of cybersecurity solutions are driving the growth of the market.

This report broadly segments the medical device security market by component, type, device type, end user, and region.

On the basis of component, the market is broadly divided into solutions and services. The services segment is expected to dominate the market in 2018. The large share of this segment is primarily attributed to the the growing demand for continuous consultation, support & maintenance services to protect connected medical devices and healthacre IT infrastructure from the growing number of cyberattacks. The solutions segment is further categorized into identity & access management, antivirus/antimalware, compliance management, encryption, intrusion detection system/intrusion prevention system, data loss prevention, disaster recovery, distributed denial of service and other solutions. The encryption solutions segment is projected to grow at the highest rate during the forecast period, owing to factors such as growing demand for advanced encryption-based services which are integrated with other security solutions to deliver enhanced Data Protection at a lower cost and these solutions secure user data on-premise as well as in the cloud.

On the basis of type, the endpoint security segment is expected to dominate the market in 2018. The large share of this segment is attributed to factors such as increasing number of connected medical devices, networks are becoming more vulnerable to new and sophisticated threats such as zero-day malware, trojans, and APTs. Additionally, the trend of BYOD, social media usage, and cloud-synchronizing tools are also driving the demand for endpoint security.

Based on device type, the market is segmented hospital medical devices, internally embedded medical devices, and wearable and external medical devices. The wearable and external medical devices segment is expected to register the highest CAGR during the forecast period. This growth is attributed to the demand for Home Healthcare owing to the high and rising prevalence of chronic diseases and the growing need to reduce healthcare costs. These factors are increasing the demand and uptake of wearable and external medical devices for remote patient monitoring.

The healthcare providers segment is expected to account for the largest share of the medical device security market in 2018. The growth of this segment is attributed to the high demand for connected networked medical devices among healthcare providers owing to the various benefits offered by these devices.

North America is expected to command the largest share of the market in 2018 primarily driven by increasing instances of cyberattacks on medical devices, growing adoption of connected medical devices, increasing awareness among healthcare professionals regarding cybersecurity, and government initiatives to implement security solutions are driving the medical device security market in the region. Asia Pacific is expected to grow at the highest CAGR during the forecast period. The growth of this market is attributed to factors such as increasing adoption of connected medical devices, improving healthcare infrastructure, increasing awareness about security of patient health information (PHI), and growing awareness about medical device security solutions due to the increasing number of cyberattacks in the healthcare organizations.

The prominent players in the global Medical Device Security Market include Cisco Systems (US), IBM (US), GE Healthcare (US), Symantec (US), CA Technologies (US), Philips (Netherlands), DXC Technology (US), CloudPassage (US), FireEye (US), Check Point Software Technologies (Israel), Sophos (UK), Imperva (US), Fortinet (US), Palo Alto Networks (US), ClearDATA (US), and Zscaler (US)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 22)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 26)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 36)

4 Premium Insights (Page No. - 43)

4.1 Medical Device Security: Market Overview

4.2 Asia Pacific: Medical Device Security Market, By Type

4.3 Geographic Snapshot of the Medical Device Security Market

4.4 Geographic Mix: Medical Device Security Market

4.5 Medical Device Security Market: Developing vs Developed Markets

5 Market Overview (Page No. - 48)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Instances of Healthcare Cyberattacks and Threats

5.2.1.2 Growth in Geriatric Population and Subsequent Growth in Chronic Disease Management

5.2.1.3 Government Regulations and Need for Compliance

5.2.1.4 Growing Demand for Connected Medical Devices

5.2.1.5 Increasing Adoption of Byod and IoT

5.2.2 Restraint

5.2.2.1 Limited Healthcare Security Budgets

5.2.3 Opportunities

5.2.3.1 Sensor-Based Wireless Mobile Medical Devices

5.2.3.2 Rise in the Adoption of Advanced Cloud Security Solutions in Healthcare

5.2.4 Challenges

5.2.4.1 Endpoint Devices Pose Challenges to Healthcare Cybersecurity

5.2.4.2 Lack of Awareness About Healthcare Security

6 Industry Insights (Page No. - 58)

6.1 Introduction

6.2 Industry Trends

6.2.1 Technological Advancements

6.2.2 Growing Machine-To-Machine and Machine-To-People Automation

6.3 Regulatory Implications

6.3.1 Food and Drug Administration (FDA)

6.3.2 ISAO Standards Organization (ISAO SO)

6.3.3 ISO Standards - ISO 27799:2008 & ISO/TR 27809: 2007

6.3.4 Health Insurance Portability and Accountability Act (HIPAA)

6.3.4.1 HIPAA Privacy Rule

6.3.4.2 HIPAA Security Rule

6.3.5 Health Information Technology for Economic and Clinical Health Act (HiTech)

6.3.6 CEN ISO/IEEE 11073

6.3.7 CEN/Cenelec

6.3.8 European Union Agency for Network and Information Security (ENISA)

6.3.9 European Technical Standards Institute (ETSI)

7 Medical Device Security Market, By Component (Page No. - 63)

7.1 Introduction

7.2 Solutions

7.2.1 Identity & Access Management Solutions

7.2.2 Antivirus/Antimalware Solutions

7.2.3 Encryption Solutions

7.2.4 Data Loss Prevention Solutions

7.2.5 Risk & Compliance Management

7.2.6 Intrusion Detection Systems/Intrusion Prevention Systems

7.2.7 Disaster Recovery Solutions

7.2.8 Distributed Denial of Service Solutions

7.2.9 Other Solutions

7.3 Services

7.3.1 Professional Services

7.3.1.1 Consulting Services

7.3.1.2 Training & Education

7.3.1.3 Support & Maintenance

7.3.1.4 Design & Integration

7.3.2 Managed Security Services

8 Medical Device Security Market, By Type (Page No. - 89)

8.1 Introduction

8.2 Network Security

8.3 Endpoint Security

8.4 Application Security

8.5 Cloud Security

8.6 Other Security Types

9 Medical Device Security Market, By Device Type (Page No. - 101)

9.1 Introduction

9.2 Hospital Medical Devices

9.3 Wearable and External Medical Devices

9.4 Internally Embedded Medical Devices

10 Medical Device Security Market, By End User (Page No. - 107)

10.1 Introduction

10.2 Healthcare Providers

10.3 Medical Device Manufacturers

10.4 Healthcare Payers

11 Medical Device Security Market, By Region (Page No. - 113)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.3 Europe

11.3.1 Germany

11.3.2 France

11.3.3 UK

11.3.4 Italy

11.3.5 Spain

11.3.6 Rest of Europe

11.4 Asia Pacific

11.4.1 Japan

11.4.2 China

11.4.3 India

11.4.4 Rest of Asia Pacific

11.5 Latin America

11.6 Middle East & Africa

12 Competitive Landscape (Page No. - 175)

12.1 Overview

12.2 Market Share Analysis

12.3 Competitive Situation and Trends

12.3.1 Product Launches

12.3.2 Partnerships, Agreements, and Collaborations

12.3.3 Mergers and Acquisitions

12.3.4 Expansions

13 Company Profiles (Page No. - 185)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Cisco Systems

13.2 Symantec Corporation

13.3 International Business Machines Corporation (IBM)

13.4 GE Healthcare

13.5 Koninklijke Philips N.V.

13.6 CA Technologies

13.7 Mcafee

13.8 Check Point Software Technologies

13.9 Cloudpassage

13.10 Palo Alto Networks

13.11 Cleardata

13.12 DXC Technology

13.13 Sophos

13.14 Imperva

13.15 Fortinet

13.16 Zscaler

13.17 Fireeye

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 237)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Report

14.7 Author Details

List of Tables (175 Tables)

Table 1 Medical Device Security Market Snapshot

Table 2 Some of the Important Healthcare Data Breaches in 2017

Table 3 Drivers: Impact Analysis

Table 4 Restraint: Impact Analysis

Table 5 Opportunities: Impact Analysis

Table 6 Challenges: Impact Analysis

Table 7 Recent Product Launches

Table 8 Market, By Component, 20162023 (USD Million)

Table 9 Medical Device Security Solutions Market, By Type, 20162023 (USD Million)

Table 10 Major Identity & Access Management Solutions in the Market

Table 11 Identity & Access Management Solutions Market, By Country, 20162023 (USD Million)

Table 12 Major Antivirus/Antimalware Solutions Available in the Market

Table 13 Antivirus/ Antimalware Solutions Market, By Country, 20162023 (USD Million)

Table 14 Major Encryption Solutions in the Market

Table 15 Encryption Solutions Market, By Country, 20162023 (USD Million)

Table 16 Major Data Loss Prevention Solutions Available in the Market

Table 17 Data Loss Prevention Solutions Market, By Country, 20162023 (USD Million)

Table 18 Risk & Compliance Management Solutions Market, By Country, 20162023 (USD Million)

Table 19 Major Intrusion Detection Systems/Intrusion Prevention Systems in the Market

Table 20 Intrusion Detection Systems/Intrusion Prevention Systems Market, By Country, 20162023 (USD Million)

Table 21 Major Disaster Recovery Solutions Available in the Market

Table 22 Disaster Recovery Solutions Market, By Country, 20162023 (USD Million)

Table 23 Distributed Denial of Service Solutions Available in the Market

Table 24 Distributed Denial of Service Solutions Market, By Country, 20162023 (USD Million)

Table 25 Other Medical Device Security Solutions Market, By Country, 20162023 (USD Million)

Table 26 Medical Device Security Services Market, By Type, 20162023 (USD Million)

Table 27 Medical Device Security Services Market, By Country, 20162023 (USD Million)

Table 28 Professional Services Market, By Type, 20162023 (USD Million)

Table 29 Professional Services Market, By Country, 20162023 (USD Million)

Table 30 Consulting Services Market, By Country, 20162023 (USD Million)

Table 31 Training and Education Services Market, By Country, 20162023 (USD Million)

Table 32 Support & Maintenance Services Market, By Country, 20162023 (USD Million)

Table 33 Design and Integration Services Market, By Country, 20162023 (USD Million)

Table 34 Managed Security Services Market, By Country, 20162023 (USD Million)

Table 35 Medical Device Security Market, By Type, 20162023 (USD Million)

Table 36 Major Network Security Offerings in the Market

Table 37 Network Security Market, By Country, 20162023 (USD Million)

Table 38 Major Endpoint Security Offerings in the Market

Table 39 Endpoint Security Market, By Country, 20162023 (USD Million)

Table 40 Major Application Security Offerings in the Market

Table 41 Application Security Market, By Country, 20162023 (USD Million)

Table 42 Major Cloud Security Offerings in the Market

Table 43 Cloud Security Market, By Country, 20162023 (USD Million)

Table 44 Major Database Security Offerings in the Market

Table 45 Major Email and Web Security Offerings in the Market

Table 46 Other Security Market, By Country, 20162023 (USD Million)

Table 47 Medical Device Security Market, By Device Type, 20162023 (USD Million)

Table 48 Hospital Medical Device Security Market, By Country/Region, 20162023 (USD Million)

Table 49 Wearable and External Market, By Country/Region, 20162023 (USD Million)

Table 50 Internally Embedded Market, By Country, 20162023 (USD Million)

Table 51 Market, By End User, 20162023 (USD Million)

Table 52 Market for Healthcare Providers, By Country, 20162023 (USD Million)

Table 53 Market for Medical Device Manufacturers, By Country, 20162023 (USD Million)

Table 54 Market for Healthcare Payers, By Country, 20162023 (USD Million)

Table 55 Medical Device Security Market, By Region, 20162023 (USD Million)

Table 56 North America: Market, By Country, 20162023 (USD Million)

Table 57 North America: Market, By Component, 20162023 (USD Million)

Table 58 North America: Solutions Market, By Type, 20162023 (USD Million)

Table 59 North America: Services Market, By Type, 20162023 (USD Million)

Table 60 North America: Market, By Type, 20162023 (USD Million)

Table 61 North America: Market, By Device Type, 20162023 (USD Million)

Table 62 North America: Market, By End User, 20162023 (USD Million)

Table 63 US: Key Macroindicators

Table 64 US: Market, By Component, 20162023 (USD Million)

Table 65 US: Solutions Market, By Type, 20162023 (USD Million)

Table 66 US: Services Market, By Type, 20162023 (USD Million)

Table 67 US: Market, By Type, 20162023 (USD Million)

Table 68 US: Market, By Device Type, 20162023 (USD Million)

Table 69 US: Market, By End User, 20162023 (USD Million)

Table 70 Canada: Key Macroindicators

Table 71 Canada: Medical Device Security Market, By Component, 20162023 (USD Million)

Table 72 Canada: Medical Device Security Solutions Market, By Type, 20162023 (USD Million)

Table 73 Canada: Medical Device Security Services Market, By Type, 20162023 (USD Million)

Table 74 Canada: Market, By Type, 20162023 (USD Million)

Table 75 Canada: Market, By Device Type, 20162023 (USD Million)

Table 76 Canada: Market, By End User, 20162023 (USD Million)

Table 77 Europe: Market, By Country, 20162023 (USD Million)

Table 78 Europe: Market, By Component, 20162023 (USD Million)

Table 79 Europe: Medical Device Security Solutions Market, By Type, 20162023 (USD Million)

Table 80 Europe: Medical Device Security Services Market, By Type, 20162023 (USD Million)

Table 81 Europe: Market, By Type, 20162023 (USD Million)

Table 82 Europe: Market, By Device Type, 20162023 (USD Million)

Table 83 Europe: Market, By End User, 20162023 (USD Million)

Table 84 Germany: Key Macroindicators

Table 85 Germany: Medical Device Security Market, By Component, 20162023 (USD Million)

Table 86 Germany: Medical Device Security Solutions Market, By Type, 20162023 (USD Million)

Table 87 Germany: Medical Device Security Services Market, By Type, 20162023 (USD Million)

Table 88 Germany: Market, By Type, 20162023 (USD Million)

Table 89 Germany: Market, By Device Type, 20162023 (USD Million)

Table 90 Germany: Market, By End User, 20162023 (USD Million)

Table 91 France: Key Macroindicators

Table 92 France: Medical Device Security Market, By Component, 20162023 (USD Million)

Table 93 France: Medical Device Security Solutions Market, By Type, 20162023 (USD Million)

Table 94 France: Medical Device Security Services Market, By Type, 20162023 (USD Million)

Table 95 France: Market, By Type, 20162023 (USD Million)

Table 96 France: Market, By Device Type, 20162023 (USD Million)

Table 97 France: Market, By End User, 20162023 (USD Million)

Table 98 UK: Key Macroindicators

Table 99 UK: Medical Device Security Market, By Component, 20162023 (USD Million)

Table 100 UK: Medical Device Security Solutions Market, By Type, 20162023 (USD Million)

Table 101 UK: Medical Device Security Services Market, By Type, 20162023 (USD Million)

Table 102 UK: Market, By Type, 20162023 (USD Million)

Table 103 UK: Market, By Device Type, 20162023 (USD Million)

Table 104 UK: Market, By End User, 20162023 (USD Million)

Table 105 Italy: Key Macroindicators

Table 106 Italy: Medical Device Security Market, By Component, 20162023 (USD Million)

Table 107 Italy: Medical Device Security Solutions Market, By Type, 20162023 (USD Million)

Table 108 Italy: Medical Device Security Services Market, By Type, 20162023 (USD Million)

Table 109 Italy: Market, By Type, 20162023 (USD Million)

Table 110 Italy: Market, By Device Type, 20162023 (USD Million)

Table 111 Italy: Market, By End User, 20162023 (USD Million)

Table 112 Spain: Key Macroindicators

Table 113 Spain: Medical Device Security Market, By Component, 20162023 (USD Million)

Table 114 Spain: Medical Device Security Solutions Market, By Type, 20162023 (USD Million)

Table 115 Spain: Medical Device Security Services Market, By Type, 20162023 (USD Million)

Table 116 Spain: Market, By Type, 20162023 (USD Million)

Table 117 Spain: Market, By Device Type 20162023 (USD Million)

Table 118 Spain: Market, By End User, 20162023 (USD Million)

Table 119 RoE: Medical Device Security Market, By Component, 20162023 (USD Million)

Table 120 RoE: Medical Device Security Solutions Market, By Type, 20162023 (USD Million)

Table 121 RoE: Medical Device Security Services Market, By Type, 20162023 (USD Million)

Table 122 RoE: Market, By Type, 20162023 (USD Million)

Table 123 RoE: Market, By Device Type, 20162023 (USD Million)

Table 124 RoE: Market, By End User, 20162023 (USD Million)

Table 125 Asia Pacific: Medical Device Security Market, By Country, 20162023 (USD Million)

Table 126 Asia Pacific: Medical Device Security Market, By Component, 20162023 (USD Million)

Table 127 Asia Pacific: Medical Device Security Solutions Market, By Type, 20162023 (USD Million)

Table 128 Asia Pacific: Medical Device Security Services Market, By Type, 20162023 (USD Million)

Table 129 Asia Pacific: Market, By Type, 20162023 (USD Million)

Table 130 Asia Pacific: Market, By Device Type, 20162023 (USD Million)

Table 131 Asia Pacific: Market, By End User, 20162023 (USD Million)

Table 132 Japan: Key Macroindicators

Table 133 Japan: Medical Device Security Market, By Component, 20162023 (USD Million)

Table 134 Japan: Medical Device Security Solutions Market, By Type, 20162023 (USD Million)

Table 135 Japan: Medical Device Security Services Market, By Type, 20162023 (USD Million)

Table 136 Japan: Market, By Type, 20162023 (USD Million)

Table 137 Japan: Market, By Device Type, 20162023 (USD Million)

Table 138 Japan: Market, By End User, 20162023 (USD Million)

Table 139 China: Key Macroindicators

Table 140 China: Medical Device Security Market, By Component, 20162023 (USD Million)

Table 141 China: Medical Device Security Solutions Market, By Type, 20162023 (USD Million)

Table 142 China: Medical Device Security Services Market, By Type, 20162023 (USD Million)

Table 143 China: Market, By Type, 20162023 (USD Million)

Table 144 China: Market, By Device Type, 20162023 (USD Million)

Table 145 China: Market, By End User, 20162023 (USD Million)

Table 146 India: Key Macroindicators

Table 147 India: Medical Device Security Market, By Component, 20162023 (USD Million)

Table 148 India: Medical Device Security Solutions Market, By Type, 20162023 (USD Million)

Table 149 India: Medical Device Security Services Market, By Type, 20162023 (USD Million)

Table 150 India: Market, By Type, 20162023 (USD Million)

Table 151 India: Market, By Device Type, 20162023 (USD Million)

Table 152 India: Market, By End User, 20162023 (USD Million)

Table 153 RoAPAC: Medical Device Security Market, By Component, 20162023 (USD Million)

Table 154 RoAPAC: Medical Device Security Solutions Market, By Type, 20162023 (USD Million)

Table 155 RoAPAC: Medical Device Security Services Market, By Type, 20162023 (USD Million)

Table 156 RoAPAC: Medical Device Security Market, By Type, 20162023 (USD Million)

Table 157 RoAPAC: Medical Device Security Market, By Device Type, 20162023 (USD Million)

Table 158 RoAPAC: Medical Device Security Market, By End User, 20162023 (USD Million)

Table 159 Latin America: Medical Device Security Market, By Component, 20162023 (USD Million)

Table 160 Latin America: Medical Device Security Solutions Market, By Type, 20162023 (USD Million)

Table 161 Latin America: Medical Device Security Services Market, By Type, 20162023 (USD Million)

Table 162 Latin America: Medical Device Security Market, By Type, 20162023 (USD Million)

Table 163 Latin America: Medical Device Security Market, By Device Type, 20162023 (USD Million)

Table 164 Latin America: Medical Device Security Market, By End User, 20162023 (USD Million)

Table 165 MEA: Medical Device Security Market, By Component, 20162023 (USD Million)

Table 166 MEA: Medical Device Security Solutions Market, By Type, 20162023 (USD Million)

Table 167 MEA: Medical Device Security Services Market, By Type, 20162023 (USD Million)

Table 168 MEA: Medical Device Security Market, By Type, 20162023 (USD Million)

Table 169 MEA: Medical Device Security Market, By Device Type, 20162023 (USD Million)

Table 170 MEA: Medical Device Security Market, By End User, 20162023 (USD Million)

Table 171 Growth Strategy Matrix (20152018)

Table 172 Product Launches, 20152018

Table 173 Partnerships, Agreements, and Collaborations, 20152018

Table 174 Mergers and Acquisitions, 20152018

Table 175 Expansions 20152018

List of Figures (48 Figures)

Figure 1 Global Medical Device Security Market

Figure 2 Market Segmentation, By Region

Figure 3 Research Design

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Medical Device Security Market, By Component, 2018 vs 2023 (USD Million)

Figure 8 Medical Device Security Solutions Market, By Type, 2018 vs 2023 (USD Million)

Figure 9 Medical Device Security Services Market, By Type, 2018 vs 2023 (USD Million)

Figure 10 Medical Device Security Market, By Type, 2018 vs 2023 (USD Million)

Figure 11 Medical Device Security Market, By Device Type, 2018 vs 2023 (USD Million)

Figure 12 Medical Device Security Market, By End User, 2018 vs 2023 (USD Million)

Figure 13 Geographic Snapshot of the Medical Device Security Market

Figure 14 Increase in the Instances of Cyber Attacks and Threats Due to Vulnerability in Medical Devices

Figure 15 Endpoint Security Commanded the Largest Share in 2017

Figure 16 The US Accounted for the Largest Share of the Medical Device Security Market in 2017

Figure 17 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 18 Developing Markets to Register A Higher Growth During the Forecast Period

Figure 19 Medical Device Security Market: Drivers, Restraints, Opportunities, & Challenges

Figure 20 Increase in Geriatric Population, By Country (20112030)

Figure 21 Services Segment to Witness the Highest Growth During the Forecast Period

Figure 22 Encryption Solutions Segment to Grow at the Highest CAGR During the Forecast Period

Figure 23 Application Security Segment to Register the Highest Growth Rate During the Forecast Period

Figure 24 Wearable & External Medical Devices Segment to Witness the Highest Growth Rate During the Forecast Period

Figure 25 Medical Device Manufacturers to Witness the Highest Growth During the Forecast Period

Figure 26 Healthcare Expenditure Across Major Countries, 2000 vs 2014

Figure 27 North America Continue to Dominate the Medical Device Security Market During the Forecast Period

Figure 28 Geographical Snapshot of the Global Medical Device Security Market

Figure 29 North America: Medical Device Security Market Snapshot

Figure 30 Europe: Medical Device Security Market Snapshot

Figure 31 Asia Pacific: Medical Device Security Market Snapshot

Figure 32 New Product Launches: Key Growth Strategy Adopted By Market Players (20152018)

Figure 33 Global Medical Device Security Market Share Analysis, By Key Player, 2017

Figure 34 Battle for Market Share: Product Launches Was the Key Strategy

Figure 35 Cisco Systems: Company Snapshot (2017)

Figure 36 Symantec Corporation: Company Snapshot (2017)

Figure 37 IBM: Company Snapshot (2017)

Figure 38 GE Healthcare: Company Snapshot (2017)

Figure 39 Koninklijke Philips N.V.: Company Snapshot (2017)

Figure 40 CA Technologies: Company Snapshot (2017)

Figure 41 Check Point Software Technologies: Company Snapshot (2017)

Figure 42 Palo Alto Networks: Company Snapshot (2017)

Figure 43 DXC Technology: Company Snapshot (2017)

Figure 44 Sophos: Company Snapshot (2017)

Figure 45 Imperva: Company Snapshot (2017)

Figure 46 Fortinet: Company Snapshot (2017)

Figure 47 Zscaler: Company Snapshot (2017)

Figure 48 Fireeye: Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Device Security Market