The research encompassed four primary actions in assessing the present market size of polyamide. Comprehensive secondary research was conducted to gather information on the market, the peer market, and the parent market. The subsequent stage involved corroborating these findings, assumptions, and dimensions with industry specialists throughout the polyamide value chain via primary research. The total market size is ascertained using both top-down and bottom-up methodologies. Subsequently, market segmentation analysis and data triangulation were employed to ascertain the dimensions of the market segments and subsegments.

Secondary Research

The research approach employed to assess and project the market begins with the collection of revenue data from prominent suppliers using secondary research. In the course of secondary research, many secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines, were utilized to identify and compile information for this study. The secondary sources comprised annual reports, press releases, and investor presentations from corporations, white papers, accredited periodicals, writings by esteemed authors, announcements from regulatory agencies, trade directories, and databases. Vendor offerings have been considered to ascertain market segmentation.

Primary Research

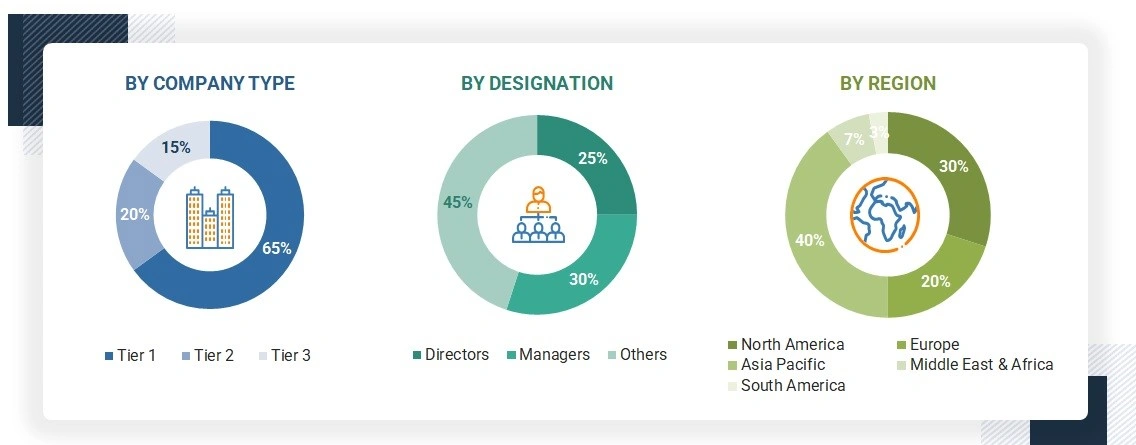

The polyamide market comprises several stakeholders, such as manufacturers, suppliers, traders, associations, and regulatory organizations, in the supply chain. The demand side of this market is characterized by the development of various applications, including automotive, electrical & electronics, textile, and others. Advancements in technology characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

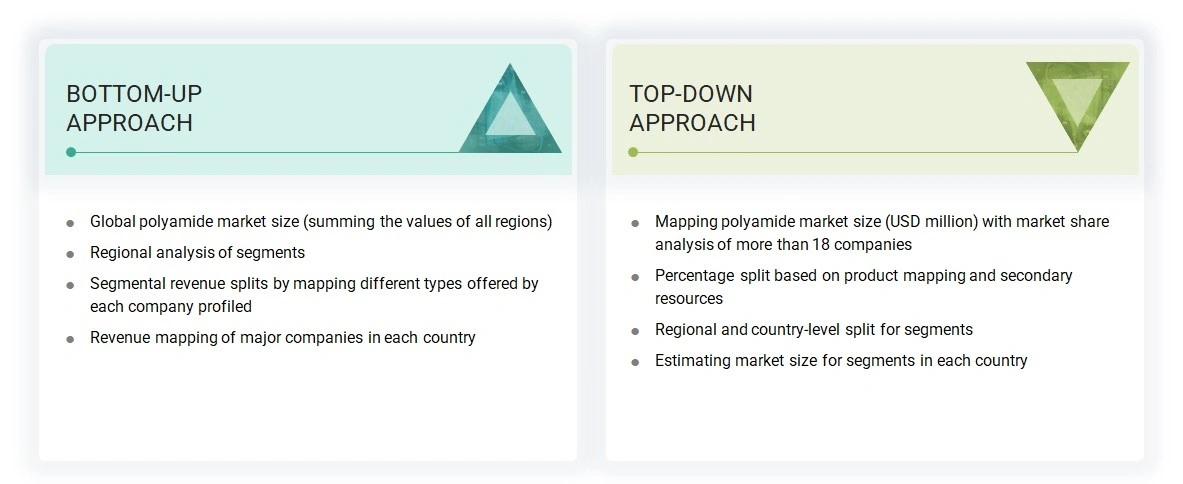

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the polyamide market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

-

The key players were identified through extensive primary and secondary research.

-

The value chain and market size of the polyamide market, in terms of value and volume, were determined through primary and secondary research.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

-

The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

Polyamides are engineering thermoplastics characterized by repeating amide bonds in their molecular structure. Known for their high mechanical strength, thermal stability, and chemical resistance, they are widely used in demanding applications. Common types include PA6 and PA66, along with high-performance variants tailored for specific requirements. Their versatility makes them suitable for use in automotive, electrical, industrial, and consumer goods. Polyamides can be reinforced or modified to enhance properties like impact strength or flame resistance.

Stakeholders

-

Polyamide Manufacturers

-

Polyamide Suppliers

-

Polyamide Traders, Distributors, and Suppliers

-

Investment Banks and Private Equity Firms

-

Raw Material Suppliers

-

Government and Research Organizations

-

Consulting Companies/Consultants in the Chemicals and Materials Sectors

-

Industry Associations

-

Contract Manufacturing Organizations (CMOs)

-

NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

-

To define, describe, and forecast the size of the global polyamide market in terms of volume and value

-

To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the global polyamide market

-

To analyze and forecast the size of various segments of the polyamide market based on five major regions—North America, Asia Pacific, Europe, Middle East & Africa, and South America, along with key countries in each of these regions

-

To analyze recent developments and competitive strategies, such as acquisitions, agreements, partnerships, product launches, and others, to draw the competitive landscape of the market

-

To strategically profile the key players in the market and comprehensively analyze their core competencies

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

-

Additional country-level analysis of the polyamide market

-

Profiling of additional market players (up to 5)

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company.

Paul

Aug, 2018

Looking for 3-5 years historical and 1-2 forecaste price of PA10 and P12.

Jinhee

Jun, 2016

Information on Automotive Polyamide market.

Ferran

Jul, 2019

General information about Polyamide Market for personal use.

Dhruv

Sep, 2014

Polyamides for energy (oil & gas, solar, wind) markets. Also interested in polyamides for wire & cable. Focus on specialty polyamides..

Frederic

May, 2013

General information on all types of Polyamides.

Roman

Mar, 2017

Market information on Nylon 6 and Nylon 66 on application for protective wear, work wear, back packs, military and others.

Antonio

Jun, 2017

Interested in the market demand size of polyamide in European countries (quantity and/or sales).