Pin Insertion Machine Market by Method (Manual, Semi-automatic, and Fully Automatic), Technology (Press-fit, Through-hole, and Surface-mount), Insertion Platform, Application, and Geography - Global Forecast to 2025

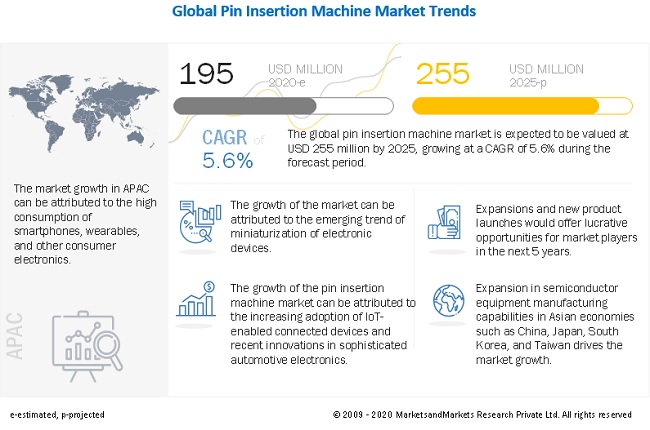

[181 Pages Report] The global pin insertion machine market is projected to reach USD 255 million by 2025, growing at a CAGR of 5.6%

The growth of the pin insertion machine market is fueled by rising demand for flexible, cost-effective, and precise techniques for inserting connectors on PCBs, emerging trend of miniaturization of electronic devices, and recent innovations in sophisticated automotive electronics. Moreover, surging demand for data centers and increasing adoption of IoT enabled connected devices amid the COVID-19 pandemic is expected to propel the pin insertion machine market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Pin Insertion Machine Market

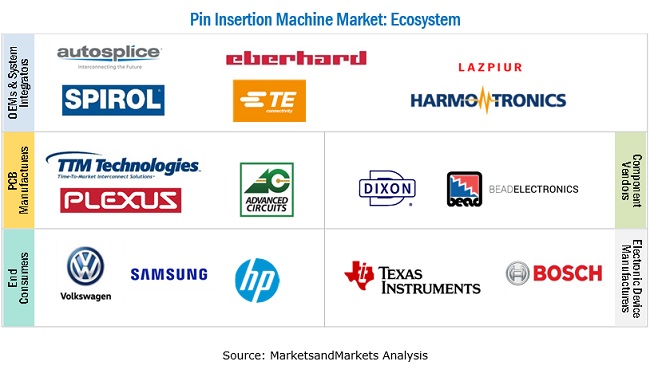

The pin insertion machine market includes major Tier 1 and 2 suppliers like TE Connectivity, Autosplice, Eberhard, HARMONTRONICS, and UMG Technologies. These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, and RoW. Pin insertion machines supplied by these companies are used by end-use industries such as consumer electronics, automotive, aerospace and defense, medical and few others. Covid-19 not only impacted the operations of the pin insertion machine market players, but also affected the businesses of companies from the above-mentioned industries. Leading automobile manufacturers have experienced a huge decline in the sales of vehicles in the first 2 quarters of the year. For instance, Volkswagen (Germany) recorded vehicle sales of just 3,736 units in the first 6 months of this year as compared to 5,339 units in 2019. Also, consumers have reduced their spending on expensive products, such as premium smartphones, wearables, and smart home systems. Product features are being considered as a second priority, and basic functionalities are being preferred. All these factors are expected to negatively impact the pin insertion machine market.

Pin Insertion Machine Market Dynamics

Driver : Emerging trend of miniaturization of electronic devices

Packaging of electronic components is an evolving art driven by the requirements for compact, lightweight, portable, battery-powered products, such as cell phones, tablets, and notebook computers. The demand for miniaturization in the electronics market and the growing complexity of devices have led to the need to pack a greater component density than traditional in any PCB assembly. The pin insertion machine is used for inserting connectors, components in the circuit board, which has become substantial for manufacturing electronic devices. Thus, the potential growth of electrical components in industries, such as medical, automotive, and aerospace, is driving the miniaturization technology, which, in turn, is driving the pin insertion machine market. Moreover, the increased global awareness regarding the COVID-19 situation has created an immense demand for personal health monitoring devices. This surge in demand for personal health monitoring devices is expected to drive the pin insertion machine market during the current pandemic situation.

Restraint: Occurrence of nesting error during feed—major issue with automated pin installation

Automatic inserters are completely self-contained and used for processing reeled press-fit and thru-hole components into PCBs. In automated assembly, pins are dumped into a hopper or bin and continuously delivered on the installation site where pins are consistently inserted into parts. Ideally, there should be no jams in the feed system or in the feed head to avoid machine downtime. The challenges with automated slotted-pin installation are the occurrence of nesting error during the feed, and no square ends on the PCB. Automated systems are jammed when pins stick together. If jamming problem does not occur during the feeding system, then pins are forwarded for escapement, but if the slotted pin is entangled with the adjacent pin in the feed tube, it prevents the advancement of the pins. This results in increased downtime of the process. However, this nesting error during feed is expected to be controlled within the next few years owing to the technological advancements made in the latest generation of pin insertion machines.

Opportunity : Recent innovations in sophisticated automotive electronics

The advent of IoT, coupled with the need for sophisticated electronic systems in the automotive sector for safety and infotainment capabilities, will contribute significantly towards the growth of the pin insertion machine market. The increased demand for vehicle connectivity will encourage new developments in the industry. With ongoing trends such as touch-free human-machine interfaces revolutionizing the automotive sector, there is a growing significance of connected cars. The introduction of technologies such as advanced driver assistance systems (ADAS), adaptive cruise control, and intelligent parking assistance systems will further drive the market growth. These electronic systems are continuously shrinking in size, which creates the need for more electrical interconnections within a smaller packaging space. This drives the demand for pin insertion machines for efficient assembly of interconnect components in automotive electronics.

Challenges: Investment in machinery deeply impacted by COVID-19

The outbreak of COVID-19 has negatively impacted the pin insertion machine market. The halt in demand for electronic components is expected to have a major setback for the market. After the initial supply and manufacturing disruptions in the automobile industry, it is now experiencing a demand shock. With a limited room to cut fixed costs, some OEMs have low liquidity to power through a long period of missing revenues. Also, leading automobile manufacturers have experienced a huge decline in sales of vehicles in the first two quarters of the year. This further resulted in diminishing demand for various electronic components used in these vehicles. All these factors resulted in a decline in production volume for PCBs, ultimately impacting the demand for pin insertion machines. Though for the past two months, the production situation has improved as the vehicle demand is taking pace, the investment in machinery is still totally stopped.

To know about the assumptions considered for the study, download the pdf brochure

Fully automatic pin insertion machines expected to grow at the highest CAGR during the forecast period

Fully automatic pin insertion machines are used for high-scale production in the assembly process of consumer electronics for pushing reeled press-fit and through-hole components into PCBs. Using this machine throughput of the assembly process is increased by lowering cycle time. Consistent demand for higher performance has triggered the need for improved automobile electronics such as telematics and in-car entertainment systems. Thus, the demand for higher levels of system performance in the automotive industry is driving the market for fully automatic pin insertion machines. Need for high-accuracy product miniaturization, improved speed, and flexibility also play vital roles in driving the growth of the market for fully automatic pin insertion machines.

Press-fit technology to account for largest market share of the pin insertion machine market in 2019

Press-fit technology is evolving at a rapid pace. The technology is largely preferred by semiconductor device manufacturers and PCB manufacturers, as they offer several advantages over the conventional soldering process. One of the major advantages of this technology is its reliability. Other advantages of press-fit technology include a speedy assembly process, high mechanical retaining force, the possibility of double-sided mounting on PCBs, and no thermal stress on the PCB or a connector. With an increasing number of electronics in automobiles, the volume of electrical connections required over a defined space is also increasing. In parallel with this, there is a trend for reducing PCB thickness. All these factors are mandating the requirement for effective and efficient pin insertion methods. The press-fit technology fits very well with the current trends in the market and can be used in almost every PCB interconnection.

Consumer electronics: The largest growing segment of pin insertion machine market, by application

The growing implementation of data center systems across various businesses and industries due to the high penetration of affordable cloud computing solutions is expected to drive the demand for LED monitors, touchscreen panels, and motherboard, which itself is a PCB. Manufacturers are making thinner monitors and compact screens, which require small PCBs with a high volume of connections. Also, the increasing adoption of IoT-enabled connected devices has led to a rise in the use of PCBs. The pin insertion machine is widely used for press-fit technology in the PCB assembly line for high-speed, precise insertion of pins and to reduce the processing time.

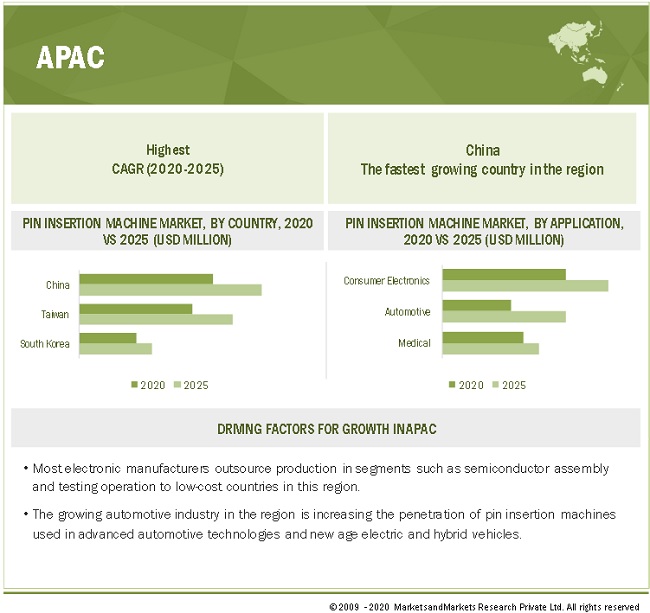

APAC is leading the pin insertion machine market, globally, by market share, in 2019

Based on geography, APAC dominated the pin insertion machine market in 2019.The commanding position of APAC can be contributed to factors such as the developing consumer electronics market in China, presence of several integrated device manufacturers and IC manufacturing firms in Taiwan, technological developments in automotive manufacturing capabilities in Japan, and innovations and advancements in semiconductor manufacturing in South Korea. Also, most electronic manufacturers outsource production in segments such as semiconductor assembly and testing operation to low-cost countries in this region. China has the major world market for semiconductors. Moreover, the global semiconductor market is expected to unveil substantial development in the APAC region due to favorable economic conditions and fewer trade barriers. All these factors are placing pin insertion machine market in APAC towards a positive growth trajectory.

The recent COVID-19 pandemic is expected to impact the global pin insertion machine industry. The entire supply chain got disrupted due to limited supply of parts during the first quarter of 2020. For instance, the outbreak of COVID-19 in China resulted in lockdown measures which included the shutdown of manufacturing facilities and warehouses and affected the global exports and shipments of various industries. The lockdown measures announced in several countries across the globe led to a fall in the domestic and export demand for consumer electronics, automotive vehicles, and other industrial equipment and embedded devices in these countries. A decrease in demand for pin insertion machines from the above-mentioned industries is expected to negatively impact the pin insertion machine market.

Key Market Players

The pin insertion machine market is dominated by a few globally established players such as TE Connectivity (Switzerland), Autosplice (US), Eberhard (Germany), HARMONTRONICS (China), and UMG Technologies (US).

These companies focus on adopting both organic and inorganic growth strategies, such as expansions and new product launches to strengthen their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Pin Insertion Machine Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 195 Million |

| Projected Market Size | USD 255 Million |

| Growth Rate | 5.6% CAGR |

|

Market Size Available for Years |

2017–2025 |

|

Base Year |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Unit |

Value (USD Million/Thousand) |

|

Segments Covered |

|

|

Geographic Regions Covered |

|

|

Companies Covered |

|

| Key Market Driver |

Emerging trend of miniaturization of electronic devices

|

| Key Market Opportunity | Recent innovations in sophisticated automotive electronics |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Press-fit technology |

| Highest CAGR Segment | Fully automatic pin insertion machines |

| Largest Application Market Share | Consumer electronics |

This report categorizes the pin insertion machine market based on method, technology, insertion platform, application at the regional and global level

By Method:

- Manual

- Semi-automatic

- Fully Automatic

By Technology:

- Press-fit

- Through-hole

- Surface-mount

By Insertion Platform:

- PCB

- Coil Frame

- Lead Frame

- Transformer

- Plastic Connector

- Metal Component

By Application:

- Telecommunications

- Consumer Electronics

- Aerospace & Defense

- Automotive

- Medical

- Industrial

- Energy & Power

- Others

By Geography

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments in Pin Insertion Machine Industry

- In November 2019, SPIROL announced the official opening of its new, state-of-the-art facilities in Apodaca, Nuevo Leon, and Mexico. These factories are designed to improve the company’s product handling, house the latest technologies available in process control and product inspection, and provide the required space for growth and consolidation of production equipment.

- In March 2019, the head office and production plant of CMS Electronics in Klagenfurt moved to a new headquarters, which offers significant advantages such as improved and spacious infrastructure, increased production capabilities, and optimized in-house logistics.

- In January 2019, SPIROL announced the release of a new highly versatile, heavy-duty installation machine. The Model PMH is designed for low-to-moderate volume production that requires insertion forces up to 1,500 lbs (6.7 kN).

- In September 2018, Autosplice launched the new 0.4 mm press-fit pin, designed to replace soldered terminals on printed circuit boards (PCBs). This new pin ensures a reliable connection between the terminal and the plated-through-hole (PTH) of a PCB under severe temperature applications.

- In August 2017, Autosplice launched the Solderball Pin Technology that conforms with industry-standard SMT processes and, at the same time, overcomes the challenging coplanarity issues while achieving reliable inter-board surface mount connections. Also, this new connector design conserves PCB space for multi-board product designs.

Frequently Asked Questions (FAQ):

What is the current size of the global pin insertion machine market?

The global pin insertion machine market is estimated to be USD 195 million in 2020 and is projected to reach 255 million by 2025, growing at a CAGR of 5.6% during the forecast period. The factors attributing to the growth of this market include emerging trend of miniaturization of electronic devices, growing deployment of pin installation machines in surgical instrument assembly, rising demand for flexible, cost-effective, and precise techniques for inserting connectors on PCBs.

Who are the winners in the global pin insertion machine market?

Companies such as TE Connectivity (Switzerland), Autosplice (US), Eberhard (Germany), HARMONTRONICS (China), and UMG Technologies (US) fall under the winner’s category. These companies cater to the requirements of their customers by providing efficient pin insertion machines with a presence in majority of countries. Moreover, these companies have a strong and reliable distribution network which gives them an edge over other industry players.

What are the opportunities for the existing players and for those who are planning to enter various stages of the pin insertion machine value chain?

There are various opportunities for the existing players to enter the value chain of the pin insertion machine industry. Some of these include the growing use of pin insertion machines in automotive applications for the safety and in-vehicle communication systems and the increased requirement for pin insertion machines in portable medical devices.

What is the Covid-19 impact on pin insertion machine market?

The shutdown of manufacturing facilities globally combined with strict restrictions over social movement in various COVID-19 affected countries impacted the operations of pin insertion machine manufacturing facilities. Leading pin insertion machine provider TE Connectivity (Switzerland) has incurred significant losses owing to the pandemic. The company reported a decline of approximately 15% in its half-year revenue as compared to the previous year. The automotive industry is severely impacted due to the coronavirus pandemic. After initial supply and manufacturing disruptions, the industry is now experiencing a demand shock with an uncertain recovery timeline. Also, consumers have reduced their spending on expensive products, such as premium smartphones, wearables, and smart home systems. This has resulted in a decline in the demand for pin insertion machines, further weakening the financial position of most of the key manufacturers.

What are some of the technological advancements in the market?

Press-fit technology is evolving at a rapid pace. Press-fit technology is a solder-free electrical assembly process used for an interconnection method for joining electronic assemblies. The technology is largely preferred by semiconductor device manufacturers and PCB manufacturers, as they offer several advantages over the conventional soldering process. One of the major advantages of this technology is its reliability. Connections made through press-fit technology are the most reliable ones. Other advantages of press-fit technology include a speedy assembly process, high mechanical retaining force, the possibility of double-sided mounting on PCBs, and no thermal stress on the PCB or a connector. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 PIN INSERTION MACHINE MARKET

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 PIN INSERTION MACHINE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size by bottom-up analysis (demand side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis(supply side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

3.1 IMPACT OF COVID-19 ON PIN INSERTION MACHINE MARKET

FIGURE 6 COMPARISON OF PRE- AND POST-COVID-19 MARKET SIZE AND CAGR, 2017–2025

FIGURE 7 MARKET, BY INSERTION PLATFORM, 2020–2025 (USD MILLION)

FIGURE 8 MARKET FOR FULLY AUTOMATIC METHOD OF PIN INSERTION MACHINE TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

FIGURE 9 AUTOMOTIVE APPLICATION OF MARKET TO GROW AT HIGHEST CAGR BETWEEN 2020 AND 2025

FIGURE 10 APAC TO BE MOST FAVORABLE REGION FOR PIN INSERTION MACHINE MARKET IN 2025

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

FIGURE 11 PIN INSERTION MACHINES TO WITNESS HIGH ADOPTION RATE DURING FORECAST PERIOD

4.2 MARKET SIZE, BY APPLICATION

FIGURE 12 MARKET FOR AUTOMOTIVE APPLICATION TO GROW AT HIGHEST CAGR BETWEEN 2020 AND 2025

4.3 MARKET, BY TECHNOLOGY

FIGURE 13 PRESS-FIT TECHNOLOGY HELD LARGEST MARKET SHARE FROM 2019 TO 2025

4.4 MARKET FOR PRESS-FIT TECHNOLOGY, BY TYPE

FIGURE 14 MULTI-PIN INSERTION USING PRESS-FIT TECHNOLOGY TO OBSERVE HIGH ADOPTION RATE IN 2025

4.5 MARKET, BY METHOD AND APPLICATION

FIGURE 15 CONSUMER ELECTRONICS AND AUTOMOTIVE TO BE MOST FAVORABLE INDUSTRIES FOR MARKET IN 2025

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Emerging trend of miniaturization of electronic devices

5.2.1.2 Rising demand for flexible, cost-effective, and precise techniques for inserting connectors on PCBs

5.2.1.3 Growing deployment of pin installation machines in surgical instrument assembly

5.2.1.4 Surging demand for data centers complemented by COVID-19

FIGURE 17 DATA CENTER TRAFFIC, BY 2021 (ZETTABYTE)

FIGURE 18 ESTIMATED NUMBER OF HYPERSCALE DATA CENTERS, BY 2021

5.2.1.5 Increasing adoption of IoT-enabled connected devices amid COVID-19

FIGURE 19 ESTIMATION OF IOT CONNECTIONS BY 2025 (BILLION)

FIGURE 20 MARKET DRIVERS: IMPACT ANALYSIS

5.2.2 RESTRAINTS

5.2.2.1 Requirement for huge capital to deploy semi-automatic and automatic machinery for pin insertion

5.2.2.2 Occurrence of nesting error during feed—major issue with automated pin installation

FIGURE 21 MARKET RESTRAINTS: IMPACT ANALYSIS

5.2.3 OPPORTUNITIES

5.2.3.1 Recent innovations in sophisticated automotive electronics

5.2.3.2 Huge prospects for market in aerospace & defense

FIGURE 22 TRENDS IN WORLD MILITARY EXPENDITURE FOR THE PAST THREE YEARS (USD BILLION)

FIGURE 23 MARKET OPPORTUNITIES: IMPACT ANALYSIS

5.2.4 CHALLENGES

5.2.4.1 Issues related to pin pressing while inserting pins in circuit boards

5.2.4.2 Investment in machinery deeply impacted by COVID-19

FIGURE 24 MARKET CHALLENGES: IMPACT ANALYSIS

5.3 PRICE TREND ANALYSIS

5.4 REGULATORY UPDATE

5.5 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS: PIN INSERTION MACHINE MANUFACTURERS ADD MAJOR VALUE

5.6 MARKET ECOSYSTEM

5.7 TECHNOLOGY ANALYSIS

5.7.1 PRESS-FIT TECHNOLOGY

TABLE 1 COMPARISON OF BENEFITS OF PRESS-FIT TECHNOLOGY WITH OTHER TECHNOLOGIES

5.8 PATENT ANALYSIS

TABLE 2 SOME KEY INNOVATIONS & PATENT REGISTRATIONS, 2003-2019

5.9 CASE STUDY ANALYSIS

5.9.1 ODD FORM FACTOR COMPONENT HANDLING FOR PCB ASSEMBLY

5.9.2 G2 TECHNOLOGIES AUTOMATES CONNECTOR PIN INSPECTION IN AEROSPACE APPLICATIONS

6 PIN INSERTION MACHINE MARKET, BY METHOD (Page No. - 63)

6.1 INTRODUCTION

TABLE 3 MARKET, BY METHOD, 2017–2019 (USD MILLION)

TABLE 4 MARKET, BY METHOD, 2020–2025 (USD MILLION)

TABLE 5 MARKET, BY METHOD, 2017–2019 (# UNITS)

TABLE 6 PIN INSERTION MACHINE MARKET, BY METHOD, 2020–2025 (# UNITS)

FIGURE 26 FULLY AUTOMATIC PIN INSERTION MACHINES TO GROW AT HIGHEST CAGR BETWEEN 2020 AND 2025

6.2 MANUAL METHOD

6.2.1 MANUAL PIN INSERTION MACHINES PREFERRED FOR LOW-VOLUME APPLICATIONS WHICH REQUIRE SKILLED AND DEDICATED EMPLOYEES

TABLE 7 MARKET FOR MANUAL METHOD, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 8 PIN INSERTION MACHINE MARKET FOR MANUAL METHOD, BY APPLICATION, 2020–2025 (USD MILLION)

FIGURE 27 MANUAL PIN INSERTION MACHINE FOR AEROSPACE & DEFENSE APPLICATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 9 MARKET FOR MANUAL METHOD, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 10 MARKET FOR MANUAL METHOD, BY TECHNOLOGY, 2020–2025 (USD MILLION)

6.3 SEMI-AUTOMATIC METHOD

6.3.1 SEMI-AUTOMATIC PIN INSERTION MACHINES TO ACCOUNT FOR LARGEST MARKET SHARE

TABLE 11MARKET FOR SEMI-AUTOMATIC METHOD, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 12 MARKET FOR SEMI-AUTOMATIC METHOD, BY APPLICATION, 2020–2025 (USD MILLION)

FIGURE 28 AUTOMOTIVE APPLICATION TO GROW AT HIGHEST RATE FOR SEMI-AUTOMATIC PIN INSERTION MACHINES DURING FORECAST PERIOD

TABLE 13 MARKET FOR SEMI-AUTOMATIC METHOD, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 14 MARKET FOR SEMI-AUTOMATIC METHOD, BY TECHNOLOGY, 2020–2025 (USD MILLION)

6.4 FULLY AUTOMATIC METHOD

6.4.1 REDUCED MANUFACTURING COSTS, IMPROVISATION OF MANUFACTURING PROCESS, AND MINIMAL REWORK FEW ADVANTAGES OF FULLY AUTOMATIC PIN INSERTION MACHINES

TABLE 15 MARKET FOR FULLY AUTOMATIC METHOD, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 16 MARKET FOR FULLY AUTOMATIC METHOD, BY APPLICATION, 2020–2025 (USD MILLION)

FIGURE 29 AUTOMOTIVE APPLICATION TO GROW AT FASTER RATE THAN OTHER INDUSTRIES FOR FULLY AUTOMATIC PIN INSERTION METHOD DURING FORECAST PERIOD

TABLE 17 PIN INSERTION MACHINE MARKET FOR FULLY AUTOMATIC METHOD, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 18 MARKET FOR FULLY AUTOMATIC METHOD, BY TECHNOLOGY, 2020–2025 (USD MILLION)

7 PIN INSERTION MACHINE MARKET, BY TECHNOLOGY (Page No. - 74)

7.1 INTRODUCTION

TABLE 19 MARKET SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 20 MARKET SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

7.2 PRESS-FIT TECHNOLOGY

7.2.1 SINGLE PIN INSERTION

7.2.2 MULTI-PIN INSERTION

TABLE 21 MARKET FOR PRESS-FIT TECHNOLOGY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 22 MARKET FOR PRESS-FIT TECHNOLOGY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 23 MARKET FOR PRESS-FIT TECHNOLOGY, BY METHOD, 2017–2019 (USD MILLION)

TABLE 24 MARKET FOR PRESS-FIT TECHNOLOGY, BY METHOD, 2020–2025 (USD MILLION)

7.2.3 ADVANTAGES OF PRESS-FIT TECHNOLOGY

7.3 SURFACE-MOUNT TECHNOLOGY (SMT)

7.3.1 ADVANTAGES OF SMT

7.4 THROUGH-HOLE TECHNOLOGY (THT)

TABLE 25 DIFFERENCES BETWEEN SURFACE-MOUNTED TECHNOLOGY AND THROUGH- HOLE TECHNOLOGY

TABLE 26 MARKET FOR THT, BY METHOD, 2017–2019 (USD MILLION)

TABLE 27 MARKET FOR THT, BY METHOD, 2020–2025 (USD MILLION)

8 PIN INSERTION MACHINE MARKET, BY INSERTION PLATFORM (Page No. - 80)

8.1 INTRODUCTION

TABLE 28 MARKET, BY INSERTION PLATFORM, 2017–2019 (USD MILLION)

TABLE 29 MARKET, BY INSERTION PLATFORM, 2020–2025 (USD MILLION)

8.2 PCB

8.3 COIL FRAME

8.4 LEAD FRAME

8.5 TRANSFORMER

8.6 PLASTIC CONNECTOR

8.7 METAL COMPONENT

9 PIN INSERTION MACHINE MARKET, BY APPLICATION (Page No. - 84)

9.1 INTRODUCTION

TABLE 30MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 31 MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

FIGURE 30 MARKET FOR AUTOMOTIVE APPLICATION TO GROW AT HIGHEST RATE BETWEEN 2020 AND 2025

9.2 TELECOMMUNICATIONS

9.2.1 INCREASING DEMAND FOR WIRELESS TELECOMMUNICATION INFRASTRUCTURE DRIVING DEMAND FOR HIGH PRECISION PIN INSERTION MACHINES

TABLE 32 PIN INSERTION MACHINE MARKET FOR TELECOMMUNICATIONS APPLICATION, BY METHOD, 2017–2019 (USD MILLION)

TABLE 33 MARKET FOR TELECOMMUNICATIONS APPLICATION, BY METHOD, 2020–2025 (USD MILLION)

TABLE 34 MARKET FOR TELECOMMUNICATIONS APPLICATION, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 35 MARKET FOR TELECOMMUNICATIONS APPLICATION, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 36 NORTH AMERICA MARKET FOR TELECOMMUNICATIONS APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 37 MARKET FOR TELECOMMUNICATIONS APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 38 EUROPE MARKET FOR TELECOMMUNICATIONS APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 39 MARKET FOR TELECOMMUNICATIONS APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 40 APAC MARKET FOR TELECOMMUNICATIONS APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 41MARKET FOR TELECOMMUNICATIONS APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

9.3 CONSUMER ELECTRONICS

9.3.1 MINIATURIZATION TREND OF ELECTRONIC DEVICES DEMANDS CONVENIENT COMPONENT INSERTION IN PCB

TABLE 42 MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY METHOD, 2017–2019 (USD MILLION)

TABLE 43 MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY METHOD, 2020–2025 (USD MILLION)

FIGURE 31 MARKET FOR CONSUMER ELECTRONICS APPLICATION TO BE DOMINATED BY SEMI-AUTOMATIC METHOD DURING FORECAST PERIOD

TABLE 44 MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY REGION, 2017–2019 (USD MILLION)

TABLE 45 MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 46 NORTH AMERICA MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 47 NORTH AMERICA MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 48 EUROPE FOR CONSUMER ELECTRONICS APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 49 MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 50 APAC MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 51 MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

9.4 AEROSPACE & DEFENSE

9.4.1 HUGE PROSPECTS FOR MARKET IN AEROSPACE & DEFENSE SECTOR

TABLE 52 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY METHOD, 2017–2019 (USD MILLION)

TABLE 53 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY METHOD, 2020–2025 (USD MILLION)

TABLE 54 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 55 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 56 NORTH AMERICA MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 57 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 58 EUROPE MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 59 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 60 APAC MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 61 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

9.5 AUTOMOTIVE

9.5.1 USE OF SOLDERLESS PRESS-FIT TERMINALS IN SEVERAL ELECTRONIC COMPONENTS OF AUTOMOBILES ATTRIBUTING TO MARKET GROWTH

TABLE 62 MARKET FOR AUTOMOTIVE APPLICATION, BY METHOD, 2017–2019 (USD MILLION)

TABLE 63 MARKET FOR AUTOMOTIVE APPLICATION, BY METHOD, 2020–2025 (USD MILLION)

TABLE 64 MARKET FOR AUTOMOTIVE APPLICATION, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 65 MARKET FOR AUTOMOTIVE APPLICATION, BY REGION, 2020–2025 (USD THOUSAND)

FIGURE 32 APAC EXPECTED TO DOMINATE MARKET FOR AUTOMOTIVE APPLICATION DURING FORECAST PERIOD

TABLE 66 NORTH AMERICA MARKET FOR AUTOMOTIVE APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 67 NORTH AMERICA MARKET FOR AUTOMOTIVE APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 68 MARKET FOR AUTOMOTIVE APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 69 EUROPE MARKET FOR AUTOMOTIVE APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 70 MARKET FOR AUTOMOTIVE APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 71 MARKET FOR AUTOMOTIVE APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

9.6 MEDICAL

9.6.1 INCREASING COMPLEXITY OF PCBS AND ADVANCEMENTS IN MEDICAL ELECTRONICS DRIVING DEMAND FOR PIN INSERTION MACHINES

TABLE 72 MARKET FOR MEDICAL APPLICATION, BY METHOD, 2017–2019 (USD MILLION)

TABLE 73 MARKET FOR MEDICAL APPLICATION, BY METHOD, 2020–2025 (USD MILLION)

TABLE 74 MARKET FOR MEDICAL APPLICATION, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 75 MARKET FOR MEDICAL APPLICATION, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 76 NORTH AMERICA PIN INSERTION MACHINE MARKET FOR MEDICAL APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 77 NORTH AMERICA MARKET FOR MEDICAL APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 78 MARKET FOR MEDICAL APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

&nbsnbsp; TABLE 79 MARKET FOR MEDICAL APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 80 APAC PMARKET FOR MEDICAL APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 81 MARKET FOR MEDICAL APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

9.7 INDUSTRIAL

9.7.1 GROWTH DRIVEN BY EVER-INCREASING DEMAND FOR MEMORY DEVICES

TABLE 82 MARKET FOR INDUSTRIAL APPLICATION, BY METHOD, 2017–2019 (USD MILLION)

TABLE 83 MARKET FOR INDUSTRIAL APPLICATION, BY METHOD, 2020–2025 (USD MILLION)

FIGURE 33 FULLY AUTOMATIC PIN INSERTION METHOD TO GROW AT FASTER RATE THAN OTHER METHODS FOR INDUSTRIAL APPLICATION DURING FORECAST PERIOD

TABLE 84 MARKET FOR INDUSTRIAL APPLICATION, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 85 MARKET FOR INDUSTRIAL APPLICATION, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 86 NORTH AMERICA PIN INSERTION MACHINE MARKET FOR INDUSTRIAL APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 87 MARKET FOR INDUSTRIAL APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 88 MARKET FOR INDUSTRIAL APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 89 EUROPE MARKET FOR INDUSTRIAL APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 90 MARKET FOR INDUSTRIAL APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 91 APAC MARKET FOR INDUSTRIAL APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

9.8 ENERGY & POWER

9.8.1 DEMAND FOR COMPACT CIRCUITS IN POWER APPLICATIONS TO DRIVE MARKET

TABLE 92 MARKET FOR ENERGY & POWER APPLICATION, BY METHOD, 2017–2019 (USD THOUSAND)

TABLE 93 MARKET FOR ENERGY & POWER APPLICATION, BY METHOD, 2020–2025 (USD THOUSAND)

TABLE 94 MARKET FOR ENERGY & POWER APPLICATION, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 95 MARKET FOR ENERGY & POWER APPLICATION, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 96 NORTH AMERICA MARKET FOR ENERGY & POWER APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 97 MARKET FOR ENERGY & POWER APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 98 MARKET FOR ENERGY & POWER APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 99 MARKET FOR ENERGY & POWER APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 100 MARKET FOR ENERGY & POWER APPLICATION, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 101 APAC PIN INSERTION MACHINE MARKET FOR ENERGY & POWER APPLICATION, BY COUNTRY, 2020–2025 (USD THOUSAND)

9.9 OTHERS

9.9.1 DEMAND FOR PIN INSERTION MACHINES TO INCREASE IN PACKAGING, TRANSPORTATION, AND BIOMEDICAL SECTORS IN COMING YEARS

TABLE 102 MARKET FOR OTHER APPLICATIONS, BY METHOD, 2017–2019 (USD THOUSAND)

TABLE 103 MARKET FOR OTHER APPLICATIONS, BY METHOD, 2020–2025 (USD THOUSAND)

TABLE 104 MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 105 MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (USD THOUSAND)

TABLE 106 MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 107 MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 108 MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 109 EUROPE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 110 APAC MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 111 MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2025 (USD THOUSAND)

9.10 MOST NEGATIVELY IMPACTED APPLICATION SEGMENT BY COVID-19

9.10.1 AUTOMOTIVE

FIGURE 34 PRE- AND POST-COVID-19 MARKET COMPARISON FOR AUTOMOTIVE APPLICATION SEGMENT

TABLE 112 MARKET FOR AUTOMOTIVE APPLICATION, BY PRE- AND POST-COVID-19 SCENARIO, 2017–2025 (USD MILLION)

9.11 LEAST IMPACTED APPLICATION SEGMENT BY COVID-19

9.11.1 MEDICAL

FIGURE 35 PRE- AND POST-COVID-19 MARKET COMPARISON FOR MEDICAL APPLICATION SEGMENT

TABLE 113 MARKET FOR MEDICAL APPLICATION, BY PRE- AND POST-COVID-19 SCENARIO, 2017–2025 (USD MILLION)

10 PIN INSERTION MACHINE MARKET, BY GEOGRAPHY (Page No. - 120)

10.1 INTRODUCTION

FIGURE 36 MARKET: GEOGRAPHIC SNAPSHOT, 2020–2025

TABLE 114 PIN INSERTION MACHINE MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 115 MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: GEOGRAPHIC SNAPSHOT, 2019

TABLE 116 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

10.2.1 IMPACT OF COVID-19 ON MARKET IN NORTH AMERICA

FIGURE 38 PRE- AND POST-COVID-19 MARKET SCENARIOS FOR MARKET IN NORTH AMERICA

TABLE 118 MARKET IN NORTH AMERICA, BY PRE- AND POST-COVID-19 SCENARIO, 2017–2025 (USD MILLION)

10.2.2 US

10.2.2.1 US semiconductor industry has been leading in worldwide technological development

10.2.3 CANADA

10.2.3.1 Demand for high accuracy PCB systems for LED application to drive market

10.2.4 MEXICO

10.2.4.1 Market to grow at highest rate during forecast period

TABLE 119 NORTH AMERICA:MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

10.3 EUROPE

FIGURE 39 EUROPE: GEOGRAPHIC SNAPSHOT, 2019

TABLE 121 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

10.3.1 IMPACT OF COVID-19 ON PIN INSERTION MACHINE MARKET IN EUROPE

FIGURE 40 PRE- AND POST-COVID-19 MARKET SCENARIOS FOR MARKET IN EUROPE

TABLE 123 MARKET IN EUROPE, BY PRE- AND POST-COVID-19 SCENARIO, 2017–2025 (USD MILLION)

10.3.2 UK

10.3.2.1 UK—substantially mature market

10.3.3 GERMANY

10.3.3.1 Growing adoption of MEMS devices in automotive industry to drive market

10.3.4 FRANCE

10.3.4.1 Increased EV manufacturing to bolster market growth

10.3.5 REST OF EUROPE

10.3.5.1 Constant demand for high-end consumer electronics driving market

TABLE 124 EUROPE: PIN INSERTION MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 125 EUROPE: PIN INSERTION MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

10.4 APAC

FIGURE 41 APAC: GEOGRAPHIC SNAPSHOT, 2019

TABLE 126 APAC: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 127 APAC: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

10.4.1 IMPACT OF COVID-19 ON PIN INSERTION MACHINE MARKET IN APAC

FIGURE 42 PRE- AND POST-COVID-19 MARKET SCENARIOS FOR MARKET IN APAC

TABLE 128 MARKET IN APAC, BY PRE- AND POST-COVID-19 SCENARIO, 2017–2025 (USD MILLION)

10.4.2 CHINA

10.4.2.1 China dominated market in APAC

10.4.3 JAPAN

10.4.3.1 Presence of key automobile manufacturers to drive market

10.4.4 SOUTH KOREA

10.4.4.1 Government focus on technological development of semiconductor manufacturing to drive market growth

10.4.5 TAIWAN

10.4.5.1 Taiwan—world’s most favorable manufacturing destination for the microelectronics industry

10.4.6 REST OF APAC

10.4.6.1 Growing demand for connected devices to drive market

TABLE 129 APAC: PIN INSERTION MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 130 APAC: PIN INSERTION MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

10.5 REST OF THE WORLD (ROW)

TABLE 131 ROW: PIN INSERTION MARKET, BY APPLICATION, 2017–2019 (USD THOUSAND)

TABLE 132 ROW: PIN INSERTION MARKET, BY APPLICATION, 2020–2025 (USD THOUSAND)

10.5.1 IMPACT OF COVID-19 ON PIN INSERTION MACHINE MARKET IN ROW

FIGURE 43 PRE- AND POST-COVID-19 MARKET SCENARIOS FOR MARKET IN ROW

TABLE 133 MARKET IN ROW, BY PRE- AND POST-COVID-19 SCENARIO, 2017–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 141)

11.1 COMPETITIVE LANDSCAPE OVERVIEW

FIGURE 44 KEY DEVELOPMENTS OF LEADING PLAYERS IN PIN INSERTION MACHINE MARKET BETWEEN JANUARY 2017 AND SEPTEMBER 2020

11.2 MARKET SHARE ANALYSIS OF KEY COMPANIES, 2019

FIGURE 45 SHARE OF TOP 5 PLAYERS IN MARKET, 2019

11.3 COMPETITIVE SCENARIO

FIGURE 46 PRODUCT LAUNCHES EMERGED AS KEY STRATEGY ADOPTED BY PLAYERS IN MARKET BETWEEN JANUARY 2017 AND SEPTEMBER 2020

11.3.1 PRODUCT LAUNCHES

TABLE 134 PRODUCT LAUNCHES, JANUARY 2017–SEPTEMBER 2020

11.3.2 EXPANSIONS

TABLE 135 EXPANSIONS, JANUARY 2017–SEPTEMBER 2020

11.4 COMPANY EVALUATION MATRIX, 2019

11.4.1 STAR

11.4.2 PERVASIVE

11.4.3 PARTICIPANT

11.4.4 EMERGING LEADER

FIGURE 47 MARKET (GLOBAL), COMPANY EVALUATION MATRIX (2019)

11.5 STARTUP/SME EVALUATION MATRIX, 2019

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 DYNAMIC COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 48 MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX (2019)

12 COMPANY PROFILES (Page No. - 149)

(Business Overview, Products/Solutions/Services offered, Recent Developments, and MnM View (Key Strengths/Right to Win, Strategic Intent and Growth Opportunities, Weaknesses and Competitive Threats))*

12.1 INTRODUCTION

12.2 KEY PLAYERS

12.2.1 TE CONNECTIVITY

FIGURE 49 TE CONNECTIVITY: COMPANY SNAPSHOT

12.2.2 AUTOSPLICE

12.2.3 EBERHARD

12.2.4 HARMONTRONICS

12.2.5 UMG TECHNOLOGIES

12.2.6 SPIROL

12.2.7 CMS ELECTRONICS

12.2.8 FINECS

12.2.9 FÖHRENBACH APPLICATION TOOLING

12.2.10 ASSEMBLY & AUTOMATION TECHNOLOGY

12.2.11 VISUMATIC

12.2.12 ZIERICK

12.2.13 LAZPIUR

12.3 OTHER IMPORTANT PLAYERS

12.3.1 SM CONTACT

12.3.2 UNIVERSAL INSTRUMENTS

12.3.3 EUN SEONG F.A.

12.3.4 SHENZHEN ZHIZHAN

12.3.5 SYNEO

12.3.6 TEEMING MACHINERY

12.3.7 YICHUAN

12.3.8 SOUTHERN MACHINERY

12.3.9 ADVANCED MECHATRONICS SOLUTIONS

12.3.10 NIAN CHIN MACHINERY

12.3.11 WINCO ELECTRIC

12.3.12 LMET TEAP

*Details on Business Overview, Products/Solutions/Services offered, Recent Developments, and MnM View (Key Strengths/Right to Win, Strategic Intent and Growth Opportunities, Weaknesses and Competitive Threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 174)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

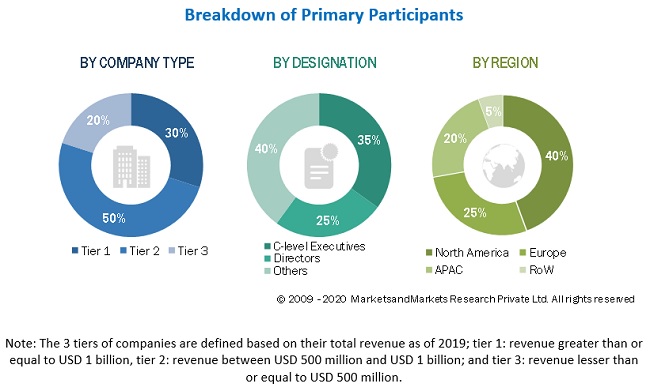

The study involved four major activities in estimating the size of the pin insertion machine market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market sizes of segments and sub-segments.

Secondary Research

In the pin insertion machine market report, both top-down and bottom-up approaches have been used to estimate and validate the size of the pin insertion machine market, along with other dependent submarkets. The key players in the pin insertion machine market have been identified through secondary research, and their market ranks have been determined through primary and secondary research. This entire research methodology involved studying annual and financial reports of the top players and interviewing experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that may affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Primary Research

The pin insertion machine market supply chain comprises several stakeholders, such as component vendors, OEMs, system integrators, distribution channels, electronic device manufacturers, and end consumers. The demand side of this market is characterized by consumer electronics, telecommunications, aerospace and defense, automotive, medical, industrial, energy and power, biotech, transportation and packaging industries; while the supply side is characterized by OEMs and system integrators. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of pin insertion machine market and its segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- The supply chain and the size of the pin insertion machine market, in terms of value, have been determined through primary and secondary research processes

- Several primary interviews have been conducted with key opinion leaders related to pin insertion machine supply chain, including key OEMs and Tier I suppliers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each segment and subsegment of the market. The data has been triangulated by studying various factors and trends from both demand and supply sides of the pin insertion machine market.

Report Objectives

- To describe and forecast the global pin insertion machine market, by method, technology, insertion platform, industry, and geography, in terms of value

- To describe and forecast the market for various segments of the pin insertion machine market with respect to 4 main geographies, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the pin insertion machine market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the global pin insertion machine landscape

- To describe the impact of COVID-19 on the pin insertion machine market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze growth opportunities for stakeholders in the pin insertion machine market

- To strategically profile key players and comprehensively analyze their position in the pin insertion machine market in terms of their market share and core competencies2 and detail the competitive landscape for market leaders

- To analyze various developments such as expansions and product launches, along with research and development activities, in the global pin insertion machine market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Product matrix, which gives a detailed comparison of the pin insertion machine product portfolio of each company

- Market size and forecast of different methods of pin insertion machine by insertion platform

- Market size and forecast of different insertion platform by method

- Market volume analysis (based on good faith estimates and primary’s viewpoint)

Growth opportunities and latent adjacency in Pin Insertion Machine Market