Industrial Automation Oil & Gas Market Size, Share, Statistics, Industry Growth Analysis Report by Component (Control Valves, HMI, Process Analyzers, Intelligent Pigging, Vibration Monitoring), Solutions (SCADA, PLC, DCS, MES, PAM), Stream and Region (2022-2025)

Updated on : October 22, 2024

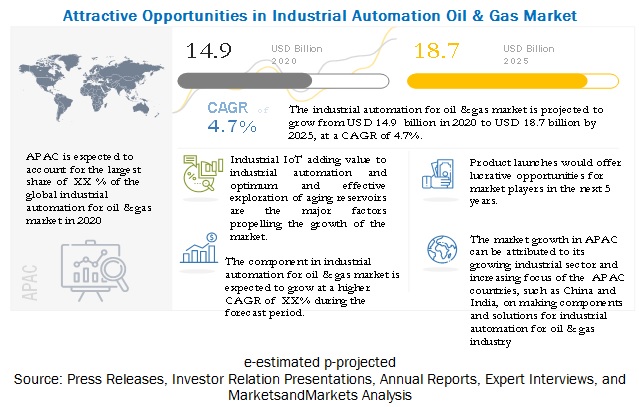

The Global industrial automation oil & gas market size is projected to grow from USD 14.9 billion in 2020 to USD 18.7 billion by 2025; it is expected to growing at a CAGR of 4.7% from 2020 to 2025. The growth of the industrial automation oil & gas market is driven IIoT adding value in the industrial automation and optimum and effective exploration of aging reservoirs.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the industrial automation oil & gas market

COVID-19 has emerged as a global pandemic that has spread across 215 countries worldwide and disrupted various industries around the world. The dynamics upon which various industries used to operate are set to change drastically. As the world continues to fight this crisis, multiple industries continue to experience a constant decline. COVID-19 has been spreading across the world, starting from APAC, then moving to Europe, and currently accelerating in North America. COVID-19 has affected nearly all continents; however, the US, Russia, Brazil, India, UK, Spain, Italy, and Germany have experienced a sharp increase in diagnosed cases. Globalization and interconnected economies of most countries would be affected due to COVID-19. Due to the imposition of lockdowns across different countries, companies are facing severe cash flow issues. Halting or slowing down of manufacturing of industrial automation oil & gas, as well as disruptions in the supply chain logistics globally owing to the outbreak of COVID-19, have resulted in reduced demand for industrial automation oil & gas Industry .

Market Dynamics

Driver: Optimum and effective exploration of aging reservoirs

An oil & gas exploration and production industry demands the most diverse set of human, political, mechanical, and technological capabilities compared with any other industries in present time. There are many factors need to be considered while exploring an oil field such as location, viability of exploration, returns on investment, environmental safety, and labor safety. In the shelf life of a well exploration, there are instances when the pressure drops, and water and sand content increases. These instances happen once the reservoirs have crossed a particular age, and it becomes unpredictable how much of the reserves are left and how much profitable it would be to operate the reservoir.

Industrial automation helps in collecting the data through various sensors and analyze them using software suites to form a pattern and predict any forthcoming issues beforehand. The production is optimized using comprehensive surveillance and analysis systems. The geographical data of the reservoir and surrounding area are analyzed for understanding the feasibility of operating aging reservoirs. The enterprise-wide monitoring of wells and production optimization through the analysis of the collected data of well decreases the risk of downtime and operation failure. Operation failures are predicted, power costs are reduced, and optimization opportunities are identified on a daily basis with the use of industrial automation, thus predicting the actual life span of an oil well.

Restraint: Lack of skilled professionals

Major problem in the industrial automation oil & gas industry is the amount of time it takes to acquire adequate engineering skills to address the variety of disciplines involved in a typical industrial automation oil & gas project. Most qualified analyzer engineers are employed at the systems integration level and only a few at the Engineering, Procurement, and Construction (EPC) level, and practically none at the front-end engineering design (FEED) level. There is a continuous need for skilled professionals who can effectively operate process equipment that are part of component and solutions. The proper usage of analytical equipment requires personnel with expertise, relevant experience and knowledge of process analytical tools. The selection of the right operational techniques (specific to a given task) plays a crucial role. Thus, there is a need for highly skilled personnel for method development, validation, operation, and troubleshooting activities in the industrial automation for oil & gas industry.

Opportunity: Industry 4.0 paving new opportunities for the industrial automation in oil & gas

Industry 4.0 is an integration of cyber-physical systems, IoT, and cloud computing. It consists of an industrial automation infrastructure and IoT, which enables operators to carry out processes at a refinery remotely, and the real-time information is collected intelligently to be used by the industry to operate on an optimum basis.

The integration of industrial automation in Industry 4.0 helps predict the maintenance needs of machines and plan the production accordingly and avoid emergency events and failure in production of valuable end products. The system escalates any security-related issues or maintenance issues right on time to be addressed for an optimum running of the plant. It is fit for harsh environment of the processing plants, which are mostly located offshore. It allows the onshore as well as offshore oil & gas plants to be operated remotely, and the data collected during the operation can be used for making changes for optimum utilization of the resources. Thus, Industrial Revolution 4.0 is paving new opportunities for the industrial automation in oil & gas.

Challenge: Issues related to data integration and upgradation of system

The number of sensors, switches and other such components mounted in any automation system for the oil & gas plant is huge. On an average, data (in terabytes) are collected through the number of components in a day. The data are raw and highly confusing if not structured properly. It becomes necessary to integrate it and analyze these data to undertake the operations at the plant and predict any future anomaly. The Integration of these data is a complex activity as the data generated by various components are based on different parameters and scales. The format in which data are transferred and the language used can also differ over the entire process and system. It requires a highly advanced system for collaborating data and representing them in the form of graphs and charts that are understandable. These software solutions and systems are costly and need skilled operators, who have to be updated with the new developments over a period. Owing to the various parameters and processes involved in the oil & gas industry, the components to be measured vary a lot, and hence integrating the entire data becomes difficult. The environment in which the components are installed is also very harsh, which may lead to breakage of these components or require maintenance over a period. If not tracked, these components may collect wrong data, which could be harmful for the plant.

The plant asset management solution is projected to grow at the highest CAGR from 2020 to 2025.

Plant asset management is expected to grow at highest CAGR during the forecast period. The growth of this segment can be attributed to the increasing deployment of PAM solutions in the oil & gas industry to build a comprehensive and complete data record related to different equipment installed in these plants, right from their uptime performance to their life cycle cost assessment.

The control valves component of the industrial automation oil & gas market is projected to grow at the highest CAGR during the forecast period.

Process plants consist of thousands of control loops that are connected to manufacture products. Control valves are the final control element in various process industries. They are directed by PLC to manage the flow passage of fluids. These valves control process variables such as pressure, temperature, and liquid levels. The increasing complexity of manufacturing and distribution units in process industries are contributing toward a steady rise in their demand. Control valves offer the benefit of remote monitoring and regulating the flow of a process. These factors give an impetus to the growth of the industrial automation oil & gas market for control valves component.

To know about the assumptions considered for the study, download the pdf brochure

The industrial automation oil & gas market in APAC is projected to grow at the highest CAGR during the forecast period.

In APAC, the deployment of industrial automation oil & gas and solutions is expected to increase rapidly during the forecast period in China, India, and Malaysia. The market in APAC is growing rapidly owing to the large-scale advancements and technological innovations in the oil & gas industry; this necessitates the use of industrial automation in oil & gas solutions and components.

Top Industrial Automation Oil & Gas Companies - Key Market Players:

The industrial automation oil & gas Companies have implemented various types of organic growth strategies, such as new product launches and product developments to strengthen their offerings in the market. The major players are ABB Ltd. (Switzerland), Endress+Hauser AG (Switzerland), Emerson Electric Co. (US), General Electric (US), Rockwell Automation, Inc. (US), Schneider Electric SE (France), Siemens AG (Germany), Mitsubishi Electric Corp. (Japan), Honeywell International Inc. (US), and Yokogawa Electric Corp. (Japan) were the major players in the industrial automation for oil & gas market.

The study includes an in-depth competitive analysis of these key players in the industrial automation for oil & gas market with their company profiles, recent developments, and key market strategies.

Industrial Automation Oil & Gas market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2020 | USD 14.9 Billion |

| Revenue Forecast in 2025 | USD 18.7 Billion |

| Growth Rate | 4.7% At a CAGR |

|

Forecast period |

2020–2025 |

|

Base year considered |

2019 |

| Years considered |

2016–2025 |

|

Forecast units |

Value (USD million/billion) |

|

Segments covered |

|

|

Regions covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Optimum and effective exploration of aging reservoirs |

| Key Market Opportunity | Industry 4.0 paving new opportunities for the industrial automation in oil & gas |

| Largest Growing Region | North America |

| Largest Market Share Segment | Plant asset management solution |

In this report, the overall industrial automation oil & gas market has been segmented based on component, solutions, stream, and region.

By Component:

- Industrial Robots

- Control Valves

- Field Instruments

- HMI

- Industrial PC

- Process Analyzer

- Intelligent Pigging

- Vibration Monitoring

By Solutions:

- SCADA

- PLC

- DCS

- MES

- Functional Safety

- PAM

By Stream:

- Upstream

- Midstream

- Downstream

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Norway

- UK

- Russia

- Azerbaijan

- Kazakhstan

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Malaysia

- India

- Rest of APAC

-

Rest of the World (RoW)

-

Middle East & Africa

- Iran

- Iraq

- Kuwait

- Saudi Arabia

- United Arab Emirates

- RoMEA

- South America

-

Middle East & Africa

Recent Developments

- In March 2020, ABB has launched a new range of colour-coded sensors that make it easy to choose and manage the optimal pH measurement solution. The sensors will help analyze the pH level of water in a more effective way.

- In July 2019, Emerson has introduced two new Rosemount 628 Universal Gas Sensors to measure carbon monoxide and oxygen depletion in addition to the existing capability to monitor hydrogen sulfide. These additions to the series cover a broader range of hazardous situations that can be monitored using the Rosemount 928 Wireless Gas Monitor platform.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET SEGMENTATION

1.4 INCLUSIONS/EXCLUSIONS

1.5 YEARS CONSIDERED FOR STUDY

1.6 CURRENCY

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of key secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Primary sources

2.1.3.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis (demand side)

FIGURE 3 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down analysis (supply side)

FIGURE 4 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET: TOP-DOWN APPROACH

FIGURE 5 METHODOLOGY FOR ESTIMATING SIZE OF INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET THROUGH SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 7 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 8 COVID-19 IMPACT ANALYSIS FOR INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 9 FIELD INSTRUMENTS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET IN 2020

FIGURE 10 PAM SEGMENT OF INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 11 DOWNSTREAM SEGMENT TO ACCOUNT FOR LARGEST SIZE OF INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET FROM 2020 TO 2025

FIGURE 12 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET IN APAC TO GROW HIGHEST CAGR FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET

FIGURE 13 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET

4.2 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET, BY COMPONENT

FIGURE 14 CONTROL VALVES SEGMENT OF INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

4.3 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET, BY SOLUTION

FIGURE 15 PAM SEGMENT OF INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

4.4 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET, BY STREAM

FIGURE 16 DOWNSTREAM SEGMENT TO ACCOUNT FOR LARGEST SIZE OF INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET FROM 2020 TO 2025

4.5 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET, BY REGION

FIGURE 17 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 IMPLEMENTATION OF IIOT AND NEED FOR OPTIMUM AND EFFECTIVE EXPLORATION OF AGING RESERVOIRS TO DRIVE INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET

5.2.1 DRIVERS

5.2.1.1 Implementation of IIoT

5.2.1.2 Need for optimum and effective exploration of aging reservoirs

5.2.1.3 Fiscal measures to boost industrial automation in oil & gas industry due to COVID-19

FIGURE 19 PACKAGE BREAKUP OF CARES ACT

FIGURE 20 DRIVERS FOR INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Lack of skilled professionals

5.2.2.2 High infrastructure costs

FIGURE 21 RESTRAINTS FOR INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Industry 4.0 paving new opportunities for automation in oil & gas industry

FIGURE 22 OPPORTUNITIES FOR INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Lockdowns and social distancing may restrict commercial trade growth in coming months

5.2.4.2 Issues related to data integration and upgradation of systems

FIGURE 23 CHALLENGES FOR INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET

5.4 ECOSYSTEM

FIGURE 25 INDUSTRIAL AUTOMATION: ECOSYSTEM

TABLE 1 COMPANIES INVOLVED IN INDUSTRIAL AUTOMATION FOR OIL & GAS ECOSYSTEM

5.5 PORTER’S FIVE FORCE ANALYSIS

TABLE 2 IMPACT OF EACH FORCE ON INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET

5.6 USE CASES

5.6.1 USE OF LIQUID DENSITY METER BY A FRENCH ELECTRICITY COMPANY

5.6.2 IDENTIFICATION OF POTENTIAL RISKS TO WORKERS USING FTIR TOXIC GAS ANALYZER

5.6.3 IMPROVING SAFETY IN OPERATIONS USING INDUSTRIAL ROBOTS

5.6.4 USE OF SCADA AND HUMAN-MACHINE INTERFACES TO CREATE OPERATIONS CONTROL CENTER

5.6.5 REDUCTION IN DOWNTIME USING PLC AND PAM

5.6.6 REDUCTION IN OPERATIONAL COSTS USING PRESSURE TRANSMITTERS

5.7 TECHNOLOGY TRENDS

5.7.1 AI AND IOT

5.7.2 IIOT CONNECTIVITY

5.7.3 CLOUD PLATFORM

5.7.4 PREDICTIVE MAINTENANCE

5.7.5 DIGITAL TWIN

5.7.6 COMMUNICATION PROTOCOLS

5.7.7 SPATIAL COMPUTING

5.7.8 TRANSPARENT DISPLAYS

5.7.9 BIOACOUSTIC SENSING

5.7.10 MACHINE LEARNING

5.7.11 GESTURE CONTROL DEVICES

5.7.12 FLEXIBLE DISPLAYS

5.7.13 AUGMENTED REALITY

5.7.14 SENSOR FUSION

5.7.15 VIRTUAL REALITY

5.8 PRICING ANALYSIS

5.8.1 PROCESS ANALYZERS

TABLE 3 PRICE RANGE OF PROCESS ANALYZERS

FIGURE 26 SERVICE COST RANGE OF PROCESS ANALYZERS

5.8.2 INTELLIGENT PIGGING

TABLE 4 PRICE RANGE OF LOW-RESOLUTION AND HIGH-RESOLUTION INTELLIGENT PIGGING

5.8.3 FIELD INSTRUMENTS

TABLE 5 PRICE RANGE OF FIELD INSTRUMENTS

5.8.4 INDUSTRIAL SAFETY COMPONENTS

TABLE 6 TENTATIVE AVERAGE SELLING PRICES OF COMPONENTS

5.8.5 INDUSTRIAL ROBOTS

TABLE 7 PRICE RANGE OF INDUSTRIAL ROBOTS

5.9 TRADE ANALYSIS

TABLE 8 GAS ANALYZERS: US IMPORT DATA, 2015–2019 (USD MILLION)

TABLE 9 GAS ANALYZERS: US EXPORT DATA, 2015–2019 (USD MILLION)

TABLE 10 INDUSTRIAL ROBOTS: GLOBAL IMPORTS DATA, 2015–2019 (USD MILLION)

TABLE 11 INDUSTRIAL ROBOTS: GLOBAL EXPORTS DATA, 2019 (USD MILLION)

5.1 PATENTS ANALYSIS

TABLE 12 PATENTS FROM 2015 TO 2019

5.11 MARKET REGULATIONS

6 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET, BY COMPONENT (Page No. - 75)

6.1 INTRODUCTION

FIGURE 27 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET, BY COMPONENT

TABLE 13 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 14 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET, BY COMPONENT, 2020–2025 (USD MILLION)

6.2 INDUSTRIAL ROBOTS

6.2.1 TRADITIONAL INDUSTRIAL ROBOTS

6.2.1.1 Articulated robots

6.2.1.1.1 Increased payload capacity and reliability to fuel demand for articulated robots

6.2.1.2 Cartesian robots

6.2.1.2.1 Simple controls of Cartesian robots lead to their increased global demand

6.2.1.3 Selective Compliance Assembly Robot Arms (SCARA)

6.2.1.3.1 Best price-to-performance ratio offered by SCARA contributing to its increased adoption in various applications

6.2.1.4 Parallel robots

6.2.1.4.1 Increased use of parallel robots in high-speed applications

6.2.1.5 Others

6.2.2 COLLABORATIVE INDUSTRIAL ROBOTS

6.2.2.1 Safety features, ease of use, and affordability of collaborative industrial robots lead to their increased global demand

TABLE 15 INDUSTRIAL ROBOTS FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 INDUSTRIAL ROBOTS FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

6.3 CONTROL VALVES

6.3.1 SURGED USE OF CONTROL VALVES IN OIL & GAS PLANTS FOR REGULATION OF OIL FLOW RATE

TABLE 17 ADVANTAGES AND DISADVANTAGES OF DIFFERENT TYPES OF CONTROL VALVES

TABLE 18 CONTROL VALVES FOR OIL & GAS MARKET, BY MATERIAL, 2016–2019 (USD MILLION)

TABLE 19 CONTROL VALVES FOR OIL & GAS MARKET, BY MATERIAL, 2020–2025 (USD MILLION)

TABLE 20 CONTROL VALVES FOR OIL & GAS MARKET, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 21 CONTROL VALVES FOR OIL & GAS MARKET, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 22 CONTROL VALVE ACTUATORS FOR OIL & GAS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 23 CONTROL VALVE ACTUATORS FOR OIL & GAS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 24 CONTROL VALVES FOR OIL & GAS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 25 CONTROL VALVES FOR OIL & GAS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 26 ROTARY CONTROL VALVES FOR OIL & GAS MARKET, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 27 ROTARY CONTROL VALVES FOR OIL & GAS MARKET, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 28 LINEAR CONTROL VALVES FOR OIL & GAS MARKET, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 29 LINEAR CONTROL VALVES FOR OIL & GAS MARKET, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 30 CONTROL VALVES FOR OIL & GAS MARKET, BY SIZE, 2016–2019 (USD MILLION)

TABLE 31 CONTROL VALVES FOR OIL & GAS MARKET, BY SIZE, 2020–2025 (USD MILLION)

TABLE 32 CONTROL VALVES FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 CONTROL VALVES FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

6.4 FIELD INSTRUMENTS

6.4.1 FIELD INSTRUMENTS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET FROM 2020 TO 2025

TABLE 34 FIELD INSTRUMENTS FOR OIL & GAS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 35 FIELD INSTRUMENTS FOR OIL & GAS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 36 FIELD INSTRUMENTS FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 FIELD INSTRUMENTS FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

6.4.2 TRANSMITTERS

6.4.2.1 Quick response time and precise measurement capability of transmitters lead to their increased adoption in oil & gas plants

TABLE 38 TYPES OF TRANSMITTERS USED IN FIELD INSTRUMENTS

6.4.2.2 Pressure transmitters

6.4.2.2.1 Differential pressure transmitters segment to hold largest size of field instrument for oil & gas market in 2025

TABLE 39 PRESSURE TRANSMITTERS FIELD INSTRUMENT FOR OIL & GAS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 40 PRESSURE TRANSMITTERS FIELD INSTRUMENT FOR OIL & GAS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 41 PRESSURE TRANSMITTERS FIELD INSTRUMENT FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 PRESSURE TRANSMITTERS FIELD INSTRUMENT FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

6.4.2.3 Temperature transmitters

6.4.2.3.1 North America to hold largest size of temperature transmitters field instrument for oil & gas market in 2025

TABLE 43 TEMPERATURE TRANSMITTERS FIELD INSTRUMENT FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 44 TEMPERATURE TRANSMITTERS FIELD INSTRUMENT FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

6.4.2.4 Level transmitters

6.4.2.4.1 Differential pressure/hydrostatic segment to hold largest size of level transmitters field instrument for oil & gas market in 2025

TABLE 45 LEVEL TRANSMITTERS FIELD INSTRUMENT FOR OIL & GAS MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 46 LEVEL TRANSMITTERS FIELD INSTRUMENT FOR OIL & GAS MARKET, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 47 LEVEL TRANSMITTERS FIELD INSTRUMENT FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 48 LEVEL TRANSMITTERS FIELD INSTRUMENT FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

6.4.2.5 Vibration level switches

6.4.2.5.1 Vibrating forks segment of vibration level switches field instrument for oil & gas market to grow at high CAGR from 2020 to 2025

TABLE 49 VIBRATION LEVEL SWITCHES FIELD INSTRUMENT FOR OIL & GAS MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 50 VIBRATION LEVEL SWITCHES FIELD INSTRUMENT FOR OIL & GAS MARKET, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 51 VIBRATION LEVEL SWITCHES FIELD INSTRUMENT FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 52 VIBRATION LEVEL SWITCHES FIELD INSTRUMENT FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

6.5 HUMAN–MACHINE INTERFACES

6.5.1 SOFTWARE SEGMENT OF HUMAN-MACHINE INTERFACES FOR OIL & GAS MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 53 HUMAN-MACHINE INTERFACES FOR OIL & GAS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 54 HUMAN-MACHINE INTERFACES FOR OIL & GAS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 55 HUMAN-MACHINE INTERFACES FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 56 HUMAN-MACHINE INTERFACES FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

6.6 INDUSTRIAL PERSONAL COMPUTERS

6.6.1 AVAILABILITY OF OPTION OF EXPANDING MEMORY SLOTS IN INDUSTRIAL PERSONAL COMPUTERS LEADS TO THEIR INCREASED ADOPTION IN OIL & GAS INDUSTRY

TABLE 57 INDUSTRIAL PERSONAL COMPUTERS FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 58 INDUSTRIAL PERSONAL COMPUTERS FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

6.7 PROCESS ANALYZERS

6.7.1 LIQUID ANALYZERS

6.7.1.1 Increased global adoption of liquid analyzers to perform chemical analysis of sample liquids in oil & gas plants

TABLE 59 LIQUID PROCESS ANALYZERS FOR OIL & GAS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 60 LIQUID PROCESS ANALYZERS FOR OIL & GAS MARKET, BY TYPE, 2020–2025 (USD MILLION)

6.7.2 GAS ANALYZERS

6.7.2.1 Oxygen analyzers segment to lead gas process analyzers for oil & gas market from 2020 to 2025

TABLE 61 GAS PROCESS ANALYZERS FOR OIL & GAS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 62 GAS PROCESS ANALYZERS FOR OIL & GAS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 63 PROCESS ANALYZERS FOR OIL & GAS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 64 PROCESS ANALYZERS FOR OIL & GAS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 65 PROCESS ANALYZERS FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 66 PROCESS ANALYZERS FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

6.8 INTELLIGENT PIGGING

6.8.1 ADOPTION OF INTELLIGENT PIGGING TO CARRY OUT MAINTENANCE OPERATIONS OF OIL & GAS PIPELINES

TABLE 67 INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 68 INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 69 INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 70 INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 71 INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY PIPELINE TYPE, 2016–2019 (USD MILLION)

TABLE 72 INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY PIPELINE TYPE, 2020–2025 (USD MILLION)

TABLE 73 INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 74 INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 75 LIQUID PIPELINES INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 76 LIQUID PIPELINES INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 77 GAS PIPELINES INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 78 GAS PIPELINES INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

6.8.2 TECHNOLOGY

6.8.2.1 Magnetic flux leakage (MFL)

6.8.2.1.1 MFL segment of intelligent pigging for oil & gas market to grow at highest CAGR from 2020 to 2025

TABLE 79 MFL-BASED INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 80 MFL-BASED INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

6.8.2.2 Ultrasonic (UT)

6.8.2.2.1 Ultrasonic testing requires liquid couplants to facilitate travel of signal pulses

TABLE 81 UT-BASED INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 82 UT-BASED INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

6.8.2.3 Caliper

6.8.2.3.1 Caliper technology enables carrying out of cheapest in-line inspection of pipelines

TABLE 83 CALIPER-BASED INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 84 CALIPER-BASED INTELLIGENT PIGGING FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

6.8.3 APPLICATION

6.8.3.1 Metal loss/corrosion detection

6.8.3.1.1 Increased use of MFL technology for corrosion detection in pipelines

TABLE 85 INTELLIGENT PIGGING FOR OIL & GAS MARKET IN METAL LOSS/CORROSION DETECTION APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 86 INTELLIGENT PIGGING FOR OIL & GAS MARKET IN METAL LOSS/CORROSION DETECTION APPLICATION, BY REGION, 2020–2025 (USD MILLION)

6.8.3.2 Crack detection

6.8.3.2.1 Ultrasonic technology carries out most accurate crack detection in pipelines

TABLE 87 INTELLIGENT PIGGING FOR OIL & GAS MARKET IN CRACK DETECTION APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 88 INTELLIGENT PIGGING FOR OIL & GAS MARKET IN CRACK DETECTION APPLICATION, BY REGION, 2020–2025 (USD MILLION)

6.8.3.3 Geometry measurement and bend detection

6.8.3.3.1 Caliper technology carries out cheapest geometry measurement and bend detection in pipelines

TABLE 89 INTELLIGENT PIGGING FOR OIL & GAS MARKET IN GEOMETRY AND BEND DETECTION APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 90 INTELLIGENT PIGGING FOR OIL & GAS MARKET IN GEOMETRY AND BEND DETECTION APPLICATION, BY REGION, 2020–2025 (USD MILLION)

6.9 VIBRATION MONITORING

6.9.1 SURGED USE OF VIBRATION MONITORING FOR CONDITION MONITORING IN OIL & GAS INDUSTRY

TABLE 91 VIBRATION MONITORING FOR OIL & GAS MARKET, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 92 VIBRATION MONITORING FOR OIL & GAS MARKET, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 93 VIBRATION MONITORING FOR OIL & GAS MARKET, BY MONITORING PROCESS, 2016–2019 (USD MILLION)

TABLE 94 VIBRATION MONITORING FOR OIL & GAS MARKET, BY MONITORING PROCESS, 2020–2025 (USD MILLION)

TABLE 95 VIBRATION MONITORING FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 96 VIBRATION MONITORING FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

6.9.2 HARDWARE TYPE

6.9.2.1 Accelerometers

6.9.2.1.1 Increased deployment of accelerometers in oil & gas plants for vibration monitoring

6.9.2.2 Proximity probes

6.9.2.2.1 Proximity probes monitor movement of rotating equipment and detect defects in plant instruments

6.9.2.3 Velocity sensors

6.9.2.3.1 Ability of velocity sensors to record low-to-medium frequency measurements leads to their increased adoption globally

6.9.2.4 Transmitters

6.9.2.4.1 Transmitters form significant components of vibration monitoring systems

6.9.2.5 Others

TABLE 97 VIBRATION MONITORING FOR OIL & GAS MARKET, BY HARDWARE TYPE, 2016–2019 (USD MILLION)

TABLE 98 VIBRATION MONITORING FOR OIL & GAS MARKET, BY HARDWARE TYPE, 2020–2025 (USD MILLION)

6.9.3 SOFTWARE

6.9.4 SYSTEM TYPE

6.9.4.1 Embedded vibration monitoring systems

6.9.4.1.1 Increased adoption of embedded vibration monitoring systems in oil & gas plants

6.9.4.2 Vibration analyzers

6.9.4.2.1 Vibration data gathered through vibration analyzers supports efficient machine condition monitoring

6.9.4.3 Vibration meters

6.9.4.3.1 Risen use of vibration meters for simple vibration measurements of machines

TABLE 99 VIBRATION MONITORING FOR OIL & GAS MARKET, BY SYSTEM TYPE, 2016–2019 (USD MILLION)

TABLE 100 VIBRATION MONITORING FOR OIL & GAS MARKET, BY SYSTEM TYPE, 2020–2025 (USD MILLION)

7 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET, BY SOLUTION (Page No. - 117)

7.1 INTRODUCTION

FIGURE 28 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET, BY SOLUTION

TABLE 101 USES OF DIFFERENT SOLUTIONS IN MANUFACTURING INDUSTRIES

TABLE 102 INDUSTRIAL AUTOMATION IN OIL & GAS MARKET, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 103 INDUSTRIAL AUTOMATION IN OIL & GAS MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

7.2 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

7.2.1 SCADA SYSTEMS FACILITATE REAL-TIME DATA COLLECTION FROM REMOTE LOCATIONS TO CONTROL DIFFERENT DEVICES

FIGURE 29 SCOPE OF SCADA IN INDUSTRIAL AUTOMATION IN OIL & GAS MARKET

TABLE 104 SCADA MARKET FOR OIL & GAS INDUSTRY, BY ARCHITECTURE, 2016–2019 (USD MILLION)

TABLE 105 SCADA MARKET FOR OIL & GAS INDUSTRY, BY ARCHITECTURE, 2020–2025 (USD MILLION)

TABLE 106 SCADA MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 107 SCADA MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

7.3 PROGRAMMABLE LOGIC CONTROLLERS (PLC)

7.3.1 PROGRAMMABLE LOGIC CONTROLLERS CONTROL AUTOMATION OF DIFFERENT O&G PROCESSES

FIGURE 30 ADVANTAGES OF PLC IN AUTOMATION PROCESS

TABLE 108 PLC MARKET FOR OIL & GAS INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 109 PLC MARKET FOR OIL & GAS INDUSTRY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 110 PLC MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 111 PLC MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

7.4 DISTRIBUTED CONTROL SYSTEMS (DCS)

7.4.1 DCS CAN OVERSEE MULTIPLE INTEGRATED SUBSYSTEMS IN OIL & GAS PLANTS

FIGURE 31 BENEFITS OF DCS IN OIL & GAS PLANTS

TABLE 112 VARIOUS DCS OFFERED BY DIFFERENT COMPANIES

TABLE 113 DCS MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 114 DCS MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

7.5 MANUFACTURING EXECUTION SYSTEMS (MES)

7.5.1 COST-SAVINGS AND OPERATION OPTIMIZATION TO DRIVE DEMAND FOR MES IN OIL & GAS INDUSTRY

TABLE 115 MANUFACTURING EXECUTION SYSTEM MARKET FOR OIL & GAS INDUSTRY, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 116 MANUFACTURING EXECUTION SYSTEM MARKET FOR OIL & GAS INDUSTRY, BY DEPLOYMENT, 2020–2025 (USD MILLION)

TABLE 117 MANUFACTURING EXECUTION SYSTEM MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 118 MANUFACTURING EXECUTION SYSTEM MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

7.6 FUNCTIONAL SAFETY

7.6.1 FUNCTIONAL SAFETY SYSTEMS HELP TO PREVENT HAZARDS IN OIL & GAS INDUSTRY

TABLE 119 SAFETY-RELATED STANDARDS

TABLE 120 FUNCTIONAL SAFETY MARKET FOR OIL & GAS INDUSTRY, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 121 FUNCTIONAL SAFETY MARKET FOR OIL & GAS INDUSTRY, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 122 EMERGENCY SHUTDOWN SYSTEM MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 123 EMERGENCY SHUTDOWN SYSTEM MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 124 HIGH-INTEGRITY PRESSURE PROTECTION SYSTEM MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 125 HIGH-INTEGRITY PRESSURE PROTECTION SYSTEM MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 126 BURNER MANAGEMENT SYSTEM MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 127 BURNER MANAGEMENT SYSTEM MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 128 FIRE & GAS MONITORING SYSTEM MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 129 FIRE & GAS MONITORING SYSTEM MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 130 TURBOMACHINERY CONTROL SYSTEM MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 131 TURBOMACHINERY CONTROL SYSTEM MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 132 FUNCTIONAL SAFETY MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 133 FUNCTIONAL SAFETY MARKET FOR OIL & GAS, BY REGION, 2020–2025 (USD MILLION)

7.7 PLANT ASSET MANAGEMENT (PAM)

7.7.1 PAM SOLUTIONS HELP TO REDUCE DOWNTIME IN OIL & GAS PLANTS

TABLE 134 PAM MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 135 PAM MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

8 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET, BY STREAM (Page No. - 133)

8.1 INTRODUCTION

TABLE 136 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET, BY STREAM, 2016–2019 (USD MILLION)

TABLE 137 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET, BY STREAM, 2020–2025 (USD MILLION)

8.2 UPSTREAM

8.2.1 DISCOVERY AND EXPLORATION OF CRUDE OIL TAKE PLACE IN UPSTREAM PROCESS

TABLE 138 SCOPE OF AUTOMATION IN UPSTREAM PROCESS

8.3 MIDSTREAM

8.3.1 MIDSTREAM SEGMENT OF INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

8.4 DOWNSTREAM

8.4.1 DOWNSTREAM SEGMENT TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET IN 2025

9 GEOGRAPHIC ANALYSIS (Page No. - 138)

9.1 INTRODUCTION

FIGURE 32 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET, BY REGION

TABLE 139 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 140 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET, BY REGION, 2020–2025 (USD MILLION)

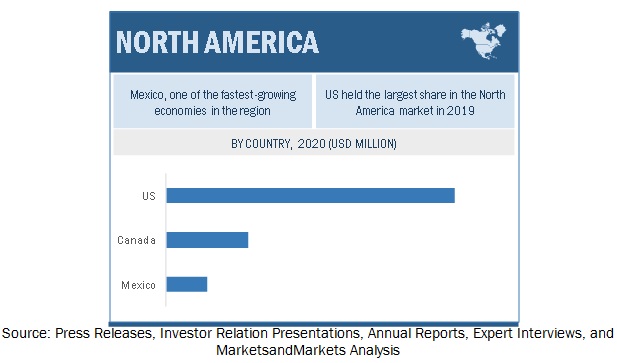

9.2 NORTH AMERICA

TABLE 141 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 142 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

FIGURE 33 SNAPSHOT: INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET IN NORTH AMERICA

9.2.1 US

9.2.1.1 US held largest share of industrial automation for oil & gas market in North America in 2019

9.2.2 CANADA

9.2.2.1 Canada houses third-largest oil reserves in world

9.2.3 MEXICO

9.2.3.1 Industrial automation for oil & gas market in Mexico to record highest CAGR from 2020 to 2025

9.3 EUROPE

TABLE 143 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 144 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

9.3.1 UK

9.3.1.1 Industrial automation components and solutions widely being used in UK

9.3.2 NORWAY

9.3.2.1 Norway witnessing increased adoption of automation in oil & gas industry

9.3.3 RUSSIA

9.3.3.1 Industrial automation for oil & gas market in Russia to grow at significant CAGR from 2020 to 2025

9.3.4 KAZAKHSTAN

9.3.4.1 Kazakhstan has the second largest oil reserves in the world

9.3.5 AZERBAIJAN

9.3.5.1 Azerbaijan’s economy largely depends on oil & gas exports

9.3.6 REST OF EUROPE

9.4 APAC

TABLE 145 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 146 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

FIGURE 34 SNAPSHOT: INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET IN APAC

9.4.1 CHINA

9.4.1.1 China accounted for largest share of industrial automation for oil & gas market in APAC in 2019

9.4.2 MALAYSIA

9.4.2.1 Industrial automation for oil & gas market in Malaysia to grow at highest CAGR from 2020 to 2025

9.4.3 INDIA

9.4.3.1 India ranks second among growing economies of APAC

9.4.4 REST OF APAC

9.5 REST OF THE WORLD (ROW)

TABLE 147 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET IN ROW, BY REGION, 2016–2019, (USD MILLION)

TABLE 148 INDUSTRIAL AUTOMATION IN OIL & GAS MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

9.5.1 SOUTH AMERICA

9.5.1.1 Brazil—largest oil consumer in South America

9.5.2 MIDDLE EAST AND AFRICA

9.5.2.1 Industrial automation for oil & gas market in Middle East and Africa to grow at high CAGR from 2020 to 2025

TABLE 149 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET IN MIDDLE EAST AND AFRICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 150 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET IN MIDDLE EAST AND AFRICA, BY COUNTRY, 2020–2025 (USD MILLION)

9.5.2.2 Saudi Arabia

9.5.2.3 Iran

9.5.2.4 United Arab Emirates

9.5.2.5 Kuwait

9.5.2.6 Iraq

9.5.2.7 Rest of Middle East and Africa

10 COMPETITIVE LANDSCAPE (Page No. - 153)

10.1 OVERVIEW

10.2 5 YEARS REVENUE AND MARKET SHARE ANALYSES

FIGURE 35 TOP 5 PLAYERS DOMINATED MARKET IN LAST 5 YEARS

TABLE 151 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET: MARKET SHARE ANALYSIS (2019)

TABLE 152 PROCESS ANALYZER MARKET: MARKET SHARE ANALYSIS (2019)

10.3 COMPETITIVE EVALUATION QUADRANT

10.3.1 STAR

10.3.2 EMERGING LEADER

10.3.3 PERVASIVE

10.3.4 PARTICIPANT

FIGURE 36 INDUSTRIAL AUTOMATION FOR OIL & GAS MARKET (GLOBAL) COMPETITIVE EVALUATION QUADRANT, 2019

TABLE 153 COMPANY PRODUCT FOOTPRINT

TABLE 154 COMPANY COMPONENT AND SOLUTIONS FOOTPRINT

TABLE 155 COMPANY REGIONAL FOOTPRINT

10.4 STARTUP/SME EVALUATION QUADRANT

10.4.1 PROGRESSIVE COMPANY

10.4.2 RESPONSIVE COMPANY

10.4.3 DYNAMIC COMPANY

10.4.4 STARTING BLOCK

FIGURE 37 STARTUP/SME EVALUATION MATRIX

10.5 COMPETITIVE SITUATION AND TRENDS

10.5.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 156 PRODUCT LAUNCHES AND DEVELOPMENTS, 2019–2020

11 COMPANY PROFILES (Page No. - 161)

(Business overview, Products/solutions/services offered, Recent developments & MnM View)*

11.1 KEY PLAYERS

11.1.1 ABB

FIGURE 38 ABB: COMPANY SNAPSHOT

11.1.2 EMERSON

FIGURE 39 EMERSON: COMPANY SNAPSHOT

11.1.3 SIEMENS

FIGURE 40 SIEMENS: COMPANY SNAPSHOT

11.1.4 SCHNEIDER ELECTRIC

FIGURE 41 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

11.1.5 HONEYWELL

FIGURE 42 HONEYWELL: COMPANY SNAPSHOT

11.1.6 MITSUBISHI ELECTRIC CORPORATION

FIGURE 43 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

11.1.7 GENERAL ELECTRIC

FIGURE 44 GENERAL ELECTRIC: COMPANY SNAPSHOT

11.1.8 ROCKWELL AUTOMATION

FIGURE 45 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

11.1.9 YOKOGAWA ELECTRIC CORPORATION

FIGURE 46 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

11.1.10 ENDRESS+HAUSER

FIGURE 47 ENDRESS+HAUSER: COMPANY SNAPSHOT

*Details on Business overview, Products/solutions/services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

11.2 OTHER KEY PLAYERS

11.2.1 FANUC CORPORATION

11.2.2 OMRON CORPORATION

11.2.3 AZBIL

11.2.4 KUKA

11.2.5 VEGA GRIESHABER

11.2.6 HITACHI

11.2.7 UNIVERSAL ROBOTS

11.2.8 AMETEK

11.2.9 WIKA

11.2.10 DANFOSS

11.2.11 DWYER INSTRUMENTS

11.2.12 FUJI ELECTRIC

11.2.13 KROHNE

11.2.14 METTLER-TOLEDO

11.2.15 THERMO FISHER SCIENTIFIC

12 ADJACENT AND RELATED MARKET (Page No. - 189)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 PROCESS ANALYZER MARKET

12.3.1 DEFINITION

12.3.2 MARKET OVERVIEW

12.3.3 PROCESS ANALYZER MARKET, BY INDUSTRY

TABLE 157 PROCESS ANALYZER MARKET, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 158 PROCESS ANALYZER MARKET, BY INDUSTRY, 2020–2025 (USD MILLION)

12.3.3.1 Oil & Gas

12.3.3.1.1 Liquid analyzer segment to hold large market share in oil & gas industry

TABLE 159 LIQUID ANALYZER MARKET FOR OIL & GAS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 160 LIQUID ANALYZER MARKET FOR OIL & GAS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 161 GAS ANALYZER MARKET FOR OIL & GAS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 162 GAS ANALYZER MARKET FOR OIL & GAS, BY TYPE, 2020–2025 (USD MILLION)

12.3.3.2 Petrochemicals

12.3.3.2.1 Liquid analyzer segment to grow at high CAGR in petrochemicals industry

TABLE 163 LIQUID ANALYZER MARKET FOR PETROCHEMICALS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 164 LIQUID ANALYZER MARKET FOR PETROCHEMICALS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 165 GAS ANALYZER MARKET FOR PETROCHEMICALS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 166 GAS ANALYZER MARKET FOR PETROCHEMICALS, BY TYPE, 2020–2025 (USD MILLION)

12.3.3.3 Pharmaceuticals

12.3.3.3.1 Pharmaceuticals segment of market to grow at highest CAGR during forecast period

TABLE 167 LIQUID ANALYZER MARKET FOR PHARMACEUTICALS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 168 LIQUID ANALYZER MARKET FOR PHARMACEUTICALS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 169 GAS ANALYZER MARKET FOR PHARMACEUTICALS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 170 GAS ANALYZER MARKET FOR PHARMACEUTICALS, BY TYPE, 2020–2025 (USD MILLION)

12.3.3.4 Water & Wastewater

12.3.3.4.1 Increased use of liquid analyzers in water & wastewater industry

TABLE 171 LIQUID ANALYZER MARKET FOR WATER & WASTEWATER, BY TYPE, 2016–2019 (USD MILLION)

TABLE 172 LIQUID ANALYZER MARKET FOR WATER & WASTEWATER, BY TYPE, 2020–2025 (USD MILLION)

TABLE 173 GAS ANALYZER MARKET FOR WATER & WASTEWATER, BY TYPE, 2016–2019 (USD MILLION)

TABLE 174 GAS ANALYZER MARKET FOR WATER & WASTEWATER, BY TYPE, 2020–2025 (USD MILLION)

12.3.3.5 Power

12.3.3.5.1 Oxygen analyzers to witness highest demand from power industry during forecast period

TABLE 175 PROCESS ANALYZER MARKET FOR POWER, BY TYPE, 2016–2019 (USD MILLION)

TABLE 176 PROCESS ANALYZER MARKET FOR POWER, BY TYPE, 2020–2025 (USD MILLION)

TABLE 177 LIQUID ANALYZER MARKET FOR POWER, BY TYPE, 2016–2019 (USD MILLION)

TABLE 178 LIQUID ANALYZER MARKET FOR POWER, BY TYPE, 2020–2025 (USD MILLION)

TABLE 179 GAS ANALYZER MARKET FOR POWER, BY TYPE, 2016–2019 (USD MILLION)

TABLE 180 GAS ANALYZER MARKET FOR POWER, BY TYPE, 2020–2025 (USD MILLION)

12.3.3.6 Food & Beverages

12.3.3.6.1 Liquid analyzer segment to hold largest market share in food & beverages industry

TABLE 181 LIQUID ANALYZER MARKET FOR FOOD & BEVERAGES, BY TYPE, 2016–2019 (USD MILLION)

TABLE 182 LIQUID ANALYZER MARKET FOR FOOD & BEVERAGES, BY TYPE, 2020–2025 (USD MILLION)

TABLE 183 GAS ANALYZER MARKET FOR FOOD & BEVERAGES, BY TYPE, 2016–2019 (USD MILLION)

TABLE 184 GAS ANALYZER MARKET FOR FOOD & BEVERAGES, BY TYPE, 2020–2025 (USD MILLION)

12.3.3.7 Paper & Pulp

12.3.3.7.1 Gas analyzer segment to hold large share in paper & pulp industry

TABLE 185 LIQUID ANALYZER MARKET FOR PAPER & PULP, BY TYPE, 2016–2019 (USD MILLION)

TABLE 186 LIQUID ANALYZER MARKET FOR PAPER & PULP, BY TYPE, 2020–2025 (USD MILLION)

TABLE 187 GAS ANALYZER MARKET FOR PAPER & PULP, BY TYPE, 2016–2019 (USD MILLION)

TABLE 188 GAS ANALYZER MARKET FOR PAPER & PULP, BY TYPE, 2020–2025 (USD MILLION)

12.3.3.8 Metals & Mining

12.3.3.8.1 Oxygen analyzer segment to grow at highest CAGR in metals & mining industry

TABLE 189 LIQUID ANALYZER MARKET FOR METALS & MINING, BY TYPE, 2016–2019 (USD MILLION)

TABLE 190 LIQUID ANALYZER MARKET FOR METALS & MINING, BY TYPE, 2020–2025 (USD MILLION)

TABLE 191 GAS ANALYZER MARKET FOR METALS & MINING, BY TYPE, 2016–2019 (USD MILLION)

TABLE 192 GAS ANALYZER MARKET FOR METALS & MINING, BY TYPE, 2020–2025 (USD MILLION)

12.3.3.9 Cement & Glass

12.3.3.9.1 Hydrogen sulfide analyzer segment to record highest CAGR in cement & glass industry

TABLE 193 LIQUID ANALYZER MARKET FOR CEMENT & GLASS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 194 LIQUID ANALYZER MARKET FOR CEMENT & GLASS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 195 GAS ANALYZER MARKET FOR CEMENT & GLASS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 196 GAS ANALYZER MARKET FOR CEMENT & GLASS, BY TYPE, 2020–2025 (USD MILLION)

12.3.3.10 Others

TABLE 197 LIQUID ANALYZER MARKET FOR OTHER INDUSTRIES, BY TYPE, 2016–2019 (USD MILLION)

TABLE 198 LIQUID ANALYZER MARKET FOR OTHER INDUSTRIES, BY TYPE, 2020–2025 (USD MILLION)

TABLE 199 GAS ANALYZER MARKET FOR OTHER INDUSTRIES, BY TYPE, 2016–2019 (USD MILLION)

TABLE 200 GAS ANALYZER MARKET FOR OTHER INDUSTRIES, BY TYPE, 2020–2025 (USD MILLION)

12.3.4 PROCESS ANALYZER MARKET, BY REGION

TABLE 201 PROCESS ANALYZER MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 202 PROCESS ANALYZER MARKET, BY REGION, 2020–2025 (USD MILLION)

12.3.4.1 North America

TABLE 203 PROCESS ANALYZER MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 204 PROCESS ANALYZER MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

12.3.4.2 Europe

TABLE 205 PROCESS ANALYZER MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 206 PROCESS ANALYZER MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

12.3.4.3 APAC

TABLE 207 PROCESS ANALYZER MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 208 PROCESS ANALYZER MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

12.3.4.4 ROW

TABLE 209 PROCESS ANALYZER MARKET IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 210 PROCESS ANALYZER MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

13 APPENDIX (Page No. - 213)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

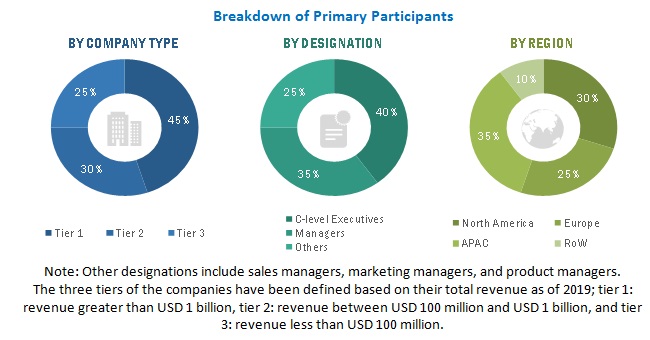

The study involves four major activities for estimating the size of the industrial automation oil & gas market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the industrial automation oil & gas market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as encyclopedias, directories, databases, the association for security industry, and magazine have been used to identify and collect information for an extensive technical and commercial study of the industrial automation oil & gas market.

Primary Research

In the primary research process, primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as assess prospects. Key players in the industrial automation oil & gas market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players, their guidance reports for the year 2020, and interviews with key opinion leaders, such as chief executive officers (CEOs), directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the industrial automation oil & gas market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To estimate and forecast the size of the industrial automation oil & gas market, in terms of value, based on component, solution, and stream

- To describe and forecast the market size, in terms of value, for four key regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the technologies of the industrial automation oil & gas

- To provide detailed information regarding the COVID-19 impact on the industrial automation oil & gas market

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micro markets concerning individual market trends, growth prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market position in terms of their ranking and core competencies, along with detailed competitive landscape for the market leaders

- To analyze key growth strategies such as product launches and product developement undertaken by the key market players to enhance their position in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Future of oil and gas automation Market

The future of oil and gas automation market looks promising, with increasing adoption of automation technologies in the industry. Automation technologies, such as artificial intelligence, machine learning, and the Internet of Things, can help companies improve efficiency, reduce costs, and enhance safety in their operations.

One of the major drivers of the oil and gas automation market is the increasing demand for energy worldwide. As demand for energy continues to grow, oil and gas companies are under pressure to increase production while reducing costs. Automation technologies can help companies achieve these goals by optimizing production processes, reducing downtime, and improving safety.

Another driver of the oil and gas automation market is the need to replace aging infrastructure. Many of the world's oil and gas fields are in mature stages of production, and the infrastructure supporting these fields is often outdated and in need of replacement. Automation technologies can help companies manage this transition by improving the efficiency and safety of new infrastructure.

However, the oil and gas automation market also faces challenges. One of the major challenges is the high cost of implementing automation technologies. Oil and gas companies often operate in remote and harsh environments, which can make it difficult and expensive to install and maintain automation technologies.

Additionally, the industry is heavily regulated, and companies must ensure that their automation systems comply with various safety and environmental regulations. Failure to comply with these regulations can result in costly fines and damage to a company's reputation.

Despite these challenges, the future of the oil and gas automation market looks bright, as companies continue to invest in new technologies to improve efficiency and safety in their operations.

Growth Opportunities for oil and gas automation Market

The oil and gas automation market presents several growth opportunities, including :

Increased adoption of digital technologies: Oil and gas companies are increasingly adopting digital technologies, such as artificial intelligence, machine learning, and the Internet of Things, to optimize production processes and reduce costs. These technologies can help companies improve their operations and increase efficiency, which can result in significant cost savings.

Emphasis on safety: Safety is a top priority for oil and gas companies, and automation technologies can help improve safety by reducing the need for human intervention in hazardous areas. Automation technologies can also help companies identify potential safety issues before they become serious problems

Expansion into new markets: The oil and gas industry is expanding into new regions, and companies are looking to leverage automation technologies to improve their operations in these regions. Automation technologies can help companies optimize production processes and reduce costs, which can make it more economical to operate in new markets

Adoption of cloud-based technologies: Cloud-based technologies are becoming increasingly popular in the oil and gas industry, as they can help companies improve collaboration and data sharing across geographically dispersed teams. Cloud-based technologies can also help companies reduce costs by eliminating the need for on-premise infrastructure.

Focus on sustainability: Sustainability is becoming an increasingly important issue for the oil and gas industry, and companies are looking to adopt automation technologies to improve their environmental footprint. Automation technologies can help companies reduce their energy consumption and emissions, which can improve their sustainability credentials.

Niche Threats for the oil and gas automation Market

Despite the growth opportunities, the oil and gas automation market also faces some niche threats, including:

Cybersecurity threats: Automation technologies can be vulnerable to cybersecurity threats, which can compromise the safety and security of oil and gas operations. Companies need to invest in robust cybersecurity measures to protect their automation systems from cyber-attacks.

High implementation costs: Implementing automation technologies in the oil and gas industry can be expensive, particularly for smaller companies with limited budgets. This can limit the adoption of automation technologies and put smaller companies at a competitive disadvantage.

Limited availability of skilled personnel: Implementing automation technologies requires skilled personnel, including engineers and technicians. However, there is a shortage of skilled personnel in the oil and gas industry, which can limit the adoption of automation technologies.

Regulatory challenges: The oil and gas industry is heavily regulated, and companies need to ensure that their automation systems comply with various safety and environmental regulations. Compliance with these regulations can be a complex and time-consuming process.

Resistance to change: The adoption of automation technologies requires significant changes to traditional workflows and processes, which can be met with resistance from employees and stakeholders. Companies need to invest in change management to ensure that the adoption of automation technologies is successful.

Market Scope of oil and gas automation Market

The market scope of the oil and gas automation market is significant, as automation technologies are increasingly being adopted by companies in the industry. The market includes various automation technologies, such as artificial intelligence, machine learning, and the Internet of Things, which can help companies improve efficiency, reduce costs, and enhance safety in their operations.

The market scope includes various applications of automation technologies, such as drilling and well completion, production optimization, pipeline management, and safety and environmental monitoring. Automation technologies can help companies optimize production processes, reduce downtime, and improve safety in these applications, which can result in significant cost savings.

The market scope also includes various end-users of automation technologies, including upstream, midstream, and downstream companies in the oil and gas industry. Upstream companies are involved in exploration and production, midstream companies are involved in transportation and storage, and downstream companies are involved in refining and marketing. Automation technologies can help companies in each of these segments improve their operations and increase efficiency.

The market scope is global, as the oil and gas industry operates in various regions around the world. The market includes various players, including automation technology providers, oil and gas companies, and engineering and consulting firms. The market is highly competitive, with players competing on the basis of product features, performance, and price.

The market scope of oil and gas automation also includes various applications such as:

Drilling and well completion: Automation technologies can help improve the efficiency and safety of drilling and well completion operations. For example, automation can help companies optimize drilling parameters, reduce non-productive time, and improve safety by reducing the need for human intervention in hazardous areas.

Production optimization: Automation technologies can help companies optimize production processes and increase efficiency. For example, automation can help companies monitor production in real-time, identify potential issues before they become problems, and adjust production processes to improve efficiency.

Pipeline management: Automation technologies can help companies manage pipelines more efficiently and reduce the risk of leaks and spills. For example, automation can help companies monitor pipelines in real-time, identify potential issues, and take corrective action to prevent accidents.

Safety and environmental monitoring: Automation technologies can help companies improve safety and reduce their environmental footprint. For example, automation can help companies monitor emissions, detect leaks, and prevent accidents.

Futuristic growth use-cases of Industrial Automation Oil & Gas Market?

The industrial automation oil and gas market presents several futuristic growth use-cases, including:

Advanced analytics: As the volume of data generated by oil and gas operations continues to grow, companies are looking to leverage advanced analytics and machine learning to make sense of this data. Advanced analytics can help companies optimize production processes, reduce downtime, and improve safety by identifying potential issues before they become problems.

Autonomous operations: The use of autonomous technologies, such as unmanned aerial vehicles and underwater drones, is expected to increase in the oil and gas industry. Autonomous technologies can help companies reduce the need for human intervention in hazardous areas and improve the efficiency of operations.

Digital twins: Digital twin technology involves creating a digital replica of physical assets and using this data to optimize operations. The use of digital twin technology is expected to increase in the oil and gas industry, as companies look to improve efficiency and reduce costs.

Augmented reality: Augmented reality technology can help companies improve safety and reduce downtime by providing workers with real-time information about equipment and operations. For example, workers can use augmented reality glasses to access equipment manuals or receive real-time instructions on how to repair equipment.

Robotics: The use of robotics in the oil and gas industry is expected to increase, particularly in hazardous areas. Robots can be used to perform tasks such as inspection, maintenance, and cleaning in areas that are difficult or dangerous for humans to access.

Top Companies in Industrial Automation Oil & Gas Market

The industrial automation oil and gas market is led by several top companies, including ABB Ltd., Emerson Electric Co., Honeywell International Inc., Mitsubishi Electric Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Yokogawa Electric Corporation, General Electric Company, and Fanuc Corporation. These companies offer a wide range of industrial automation solutions, such as control systems, sensors, software, and robotics, and have a strong presence in the industry. They are constantly innovating to meet the evolving needs of their customers and have formed strategic partnerships with other companies in the industry to provide comprehensive solutions to their clients.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Automation Oil & Gas Market