Control Valve Market Size, Share & Trends

Control Valve Market by Material (Stainless Steel, Cast Iron, Cryogenic, Alloy Based), Actuators (Pneumatic, Electrical, Hydraulic), Size, Rotary Valves (Ball, Butterfly, Plug), Linear Valves (Globe, Diaphragm), Industry - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

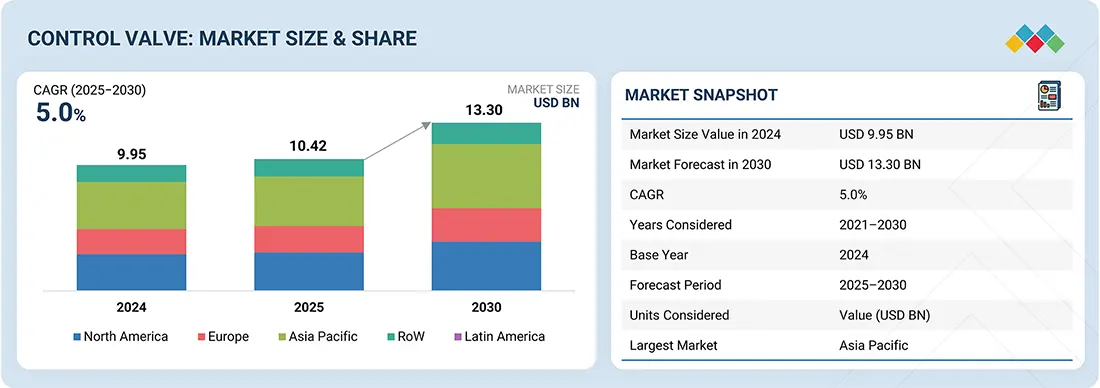

The global control valve market is projected to grow from USD 10.42 billion in 2025 to USD 13.30 billion by 2030, at a CAGR of 5.0%. The market is witnessing significant growth, due to the rising adoption of smart automation technologies and the increasing emphasis on energy efficiency across industrial processes. With the integration of Industrial Internet of Things (IIoT) and predictive maintenance capabilities, modern control valves enable real-time monitoring, reduced downtime, and optimized performance.

KEY TAKEAWAYS

-

BY MATERIALStainless steel's prominence in the control valve market continues to surge due to its corrosion resistance, durability, and suitability for various industrial applications.

-

BY COMPONENTThe actuator segment is driven by increasing industrial automation and the need for precise control in various processes, such as oil & gas, water treatment, and manufacturing.

-

BY SIZEThe >6"–25" control valve segment has seen robust growth, driven by expanding industrial infrastructure, particularly in the energy & power, oil & gas, and water & wastewater treatment sectors.

-

BY TYPERotary valves have widespread adoption across critical industries, such as oil & gas, petrochemicals, and power generation, and this adoption is reinforced by ongoing investments in energy infrastructure and refinery modernization projects.

-

BY INDUSTRYControl valves have seen significant expansion within the pulp & paper industry. They are essential tools for regulating fluid flow in manufacturing processes.

-

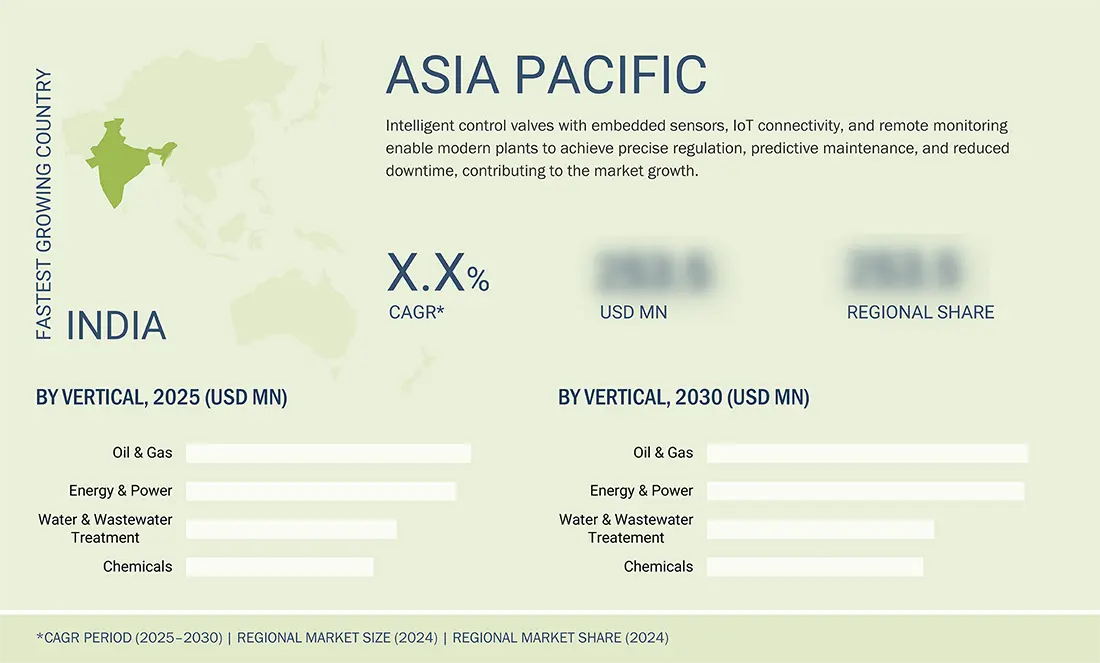

BY REGIONAsia Pacific leads the control valve market due to its massive industrial and infrastructure build-out (refining, petrochemicals, power, water), rapid automation upgrades, and deep local manufacturing.

-

COMPETITIVE LANDSCAPEMajor market players have adopted organic and inorganic strategies, including partnerships and investments. For instance, Emerson Electric Co., Flowserve Corporation, and IMI introduced new control valves equipped with enhanced features and improved performance capabilities.

Control valve market growth is fueled by the increasing demand for accurate flow regulation across oil & gas, power generation, and water treatment sectors. Rising automation, focusing on energy efficiency, and stricter safety rules encourage the use of advanced valves. Growth in chemical processing and LNG projects supports wider adoption, while smart technologies, such as IoT-based monitoring improve reliability and maintenance planning.

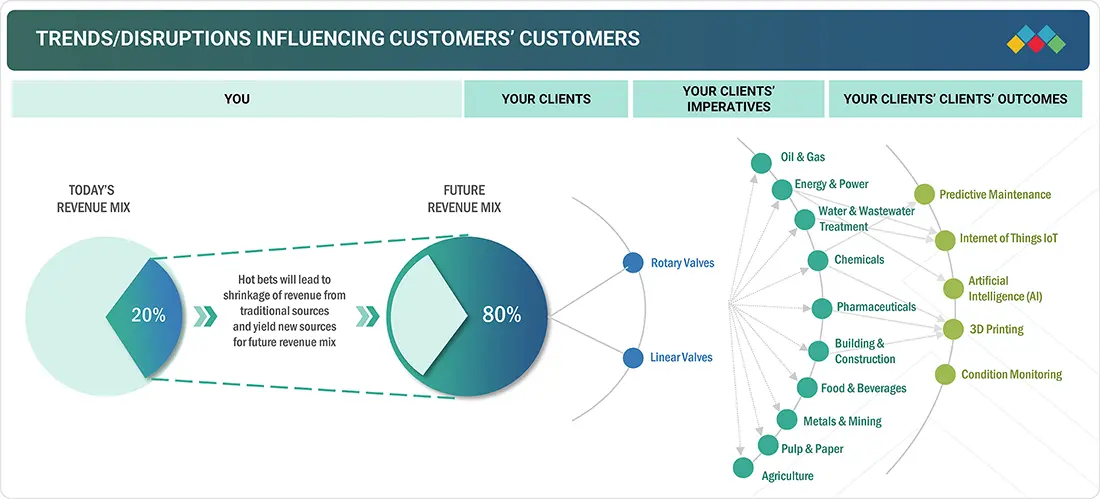

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

It illustrates how companies’ revenue mix is expected to evolve over the next 4–5 years, moving from current offerings to new use cases, technologies, and markets. The increasing inclination of industries toward digitalization and miniaturization of devices is driving the oil & gas, chemicals, and food & beverages industries, which, in turn, drives the control valve market. Control valves based on digital technology are expected to bring new revenue sources for manufacturers of control valves.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid industrial automation and energy infrastructure expansion

-

Increasing investment in oil & gas infrastructure in Middle East

Level

-

Lack of standardized certifications and government policies

-

Complications associated with installation and maintenance

Level

-

Rising integration of advanced technologies into smart valves

-

Increasing green hydrogen production for industrial use

Level

-

Risks associated with safety and operational efficiency

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid industrial automation and energy infrastructure expansion

The control valve market is witnessing robust growth due to the rapid expansion of industrial automation and energy infrastructure, particularly in process industries, such as oil & gas, chemicals, and power generation. With industries increasingly embracing automation to improve operational efficiency, safety, and reliability, control valves have become essential components for managing flow, pressure, and temperature in complex systems.

Restraint: Complications associated with installation and maintenance

Control valves are essential components requiring precise installation and regular maintenance for optimal performance. However, the complexity of these tasks can deter end users lacking expertise or resources. The intricate setup process involves understanding fluid dynamics, system integration, and compliance with regulations.

Opportunity: Rising integration of advanced technologies into smart valves

End users are increasingly prioritizing the adoption of highly reliable, integrated, and cutting-edge solutions to address maintenance challenges. The valve industry is also employing advanced technologies in its offerings. Smart valves offer several benefits to end-use industries or operators of valves.

Challenge: Risks associated with safety and operational efficiency

Unexpected operational halts caused by valve malfunctions or failures are major concerns in industrial operations. Valves are critical components in process systems, and their failure can lead to unplanned plant downtime or complete shutdowns. In such cases, valve repair or replacement is often the only option, which results in extended outages and operational disruptions.

Control Valve Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Digital smart control valves with Fisher FIELDVUE diagnostics for continuous monitoring and predictive maintenance | Early detection of wear | Less downtime | Optimized process control |

|

High-performance control/choke valves for precise flow and pressure regulation in upstream oil & gas | Accurate control in erosive/high-pressure service | Longer valve life |

|

Control valves with advanced digital positioners and performance diagnostics for process automation | Higher positioning accuracy | Reduced energy loss | Predictive maintenance |

|

Severe-service globe/angle control valves for cavitating, flashing, or noisy services | Reliable operation under extreme pressure drops | Lower maintenance |

|

Custom-engineered control valves (e.g., DRAG multi-stage trims) for high-pressure/temperature duties | Stable flow | Minimized cavitation & noise | Extended service life |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

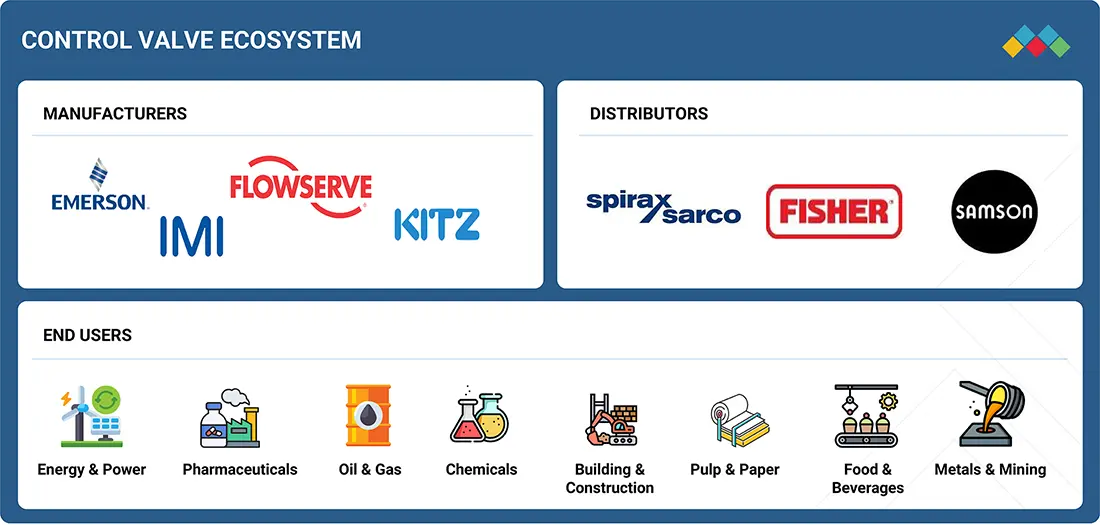

MARKET ECOSYSTEM

The control valve ecosystem involves identifying and analyzing interconnected relationships among various stakeholders, including control valve manufacturers, distributors, and end users. The distributors establish contact between the manufacturing companies and end users to concentrate on the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Control Valve Market, By Component

In 2024, the actuator segment accounted for the largest share of the control valve market in 2024. It is experiencing robust growth, owing to the increasing industrial automation and the need for precise control in various processes, such as oil & gas, water treatment, and manufacturing. Technological advancements and the emphasis on efficiency further propel the market, fostering innovation and adoption.

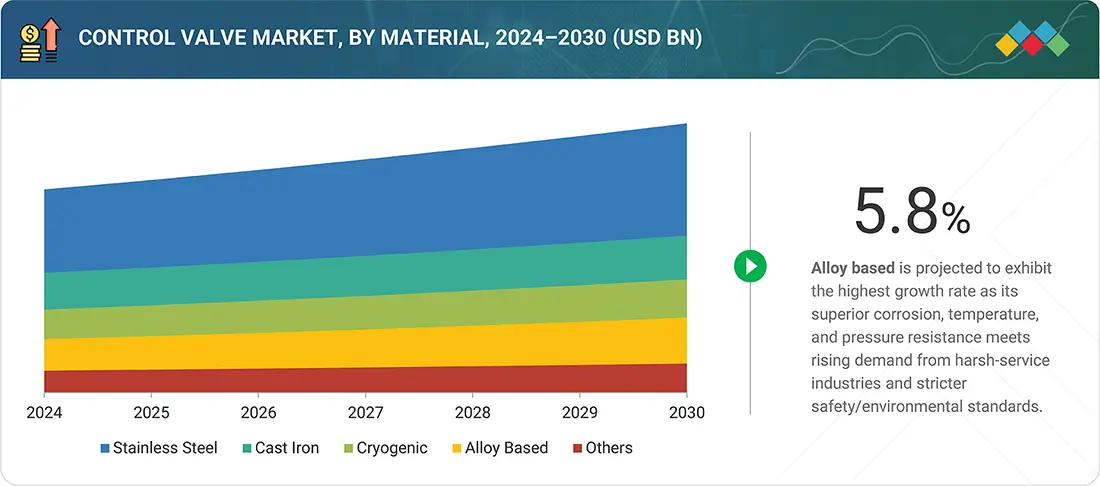

Control Valve Market, By Material

The stainless steel segment held the largest share of the overall control valve market in 2024. Stainless steel's prominence in the control valve market continues to surge due to its corrosion resistance, durability, and suitability for various industrial applications. With the increasing demands for reliability and longevity in valve systems, stainless steel's robust properties make it a preferred choice, driving its significant growth trajectory.

Control Valve Market, By Type

The rotary valve segment accounts for the largest share of the overall control valve market. The market has witnessed a notable rise in the adoption of rotary valves. Renowned for their precision control and reliability, rotary valves offer enhanced performance across diverse industrial applications, including oil & gas, chemical processing, and power generation.

Control Valve Market, By Size

The >6"–25" control valve segment accounts for the largest share of the control valve market. The segment has seen robust growth, owing to the expanding industrial infrastructure, particularly in energy, oil & gas, and water treatment sectors. Increasing automation demands and technological advancements in valve design have further fueled this expansion, catering to diverse industrial needs.

Control Valve Market, By Industry

The oil & gas segment is the largest industry in the control valve market. Control valves are vital in the oil & gas industry by regulating the flow of fluids within pipelines and processing systems. The segmental growth has been significant, driven by advancements in technology, increasing demand for efficiency, safety, and environmental regulations. These valves enable precise control over flow rates, pressures, and temperatures, enhancing overall operational reliability and performance across exploration, production, refining, and distribution processes.

REGION

Asia Pacific to hold the largest market share in global control valve market during the forecast period

Asia Pacific accounted for the largest share of the global control valve industry in 2024. In Asia Pacific, the growth of the control valve market has been remarkable in recent years, driven by various factors, such as industrialization, infrastructural development, and increasing demand for process automation across diverse sectors, such as oil & gas, power generation, and water & wastewater treatment. With advancements in technology and the adoption of smart valve solutions, the market is witnessing significant expansion.

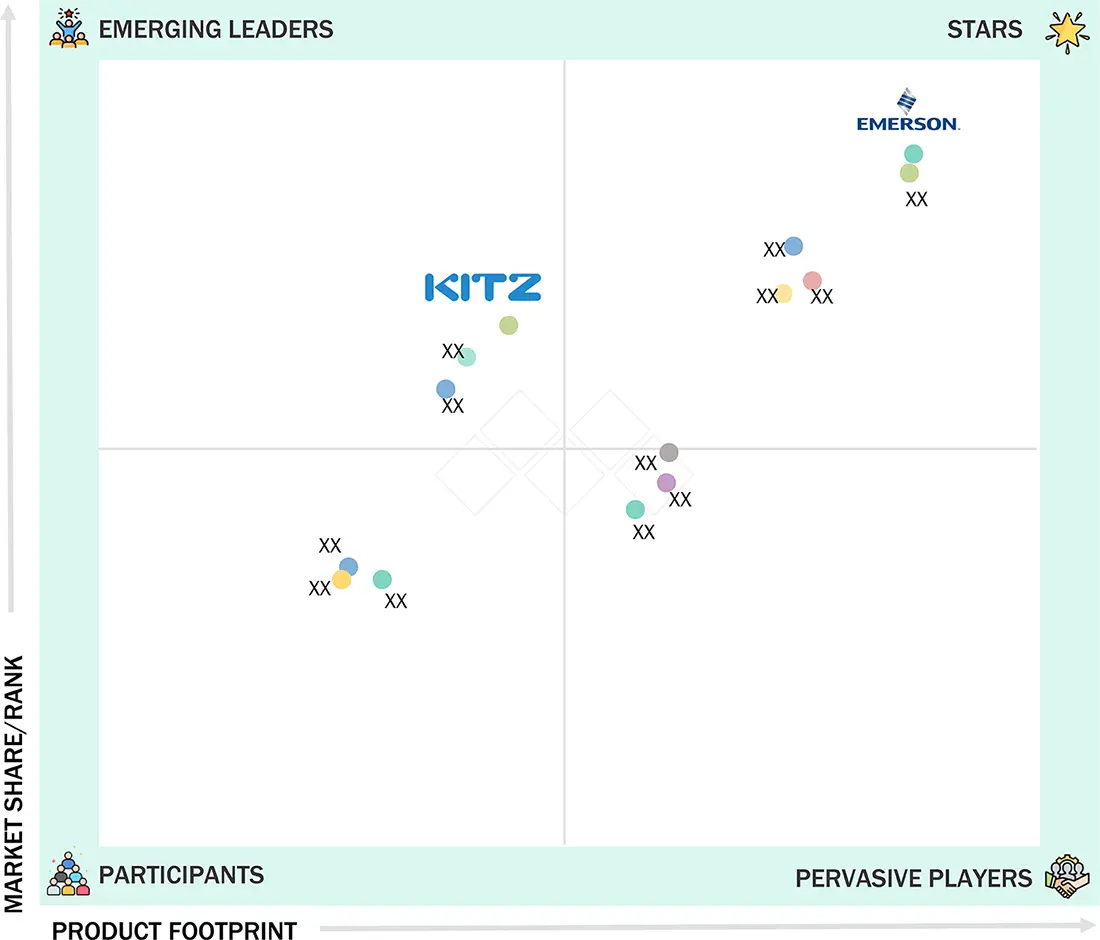

Control Valve Market: COMPANY EVALUATION MATRIX

In the control valve companies matrix, Emerson Electric Co. (Star) leads with a strong market presence and an extensive product portfolio, while Kitz Corporation (Emerging Leader) is steadily gaining traction in the control valve segment.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 9.95 Billion |

| Market Forecast in 2030 | USD 13.30 Billion |

| Growth Rate | CAGR of 5.0% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Gactors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, and RoW |

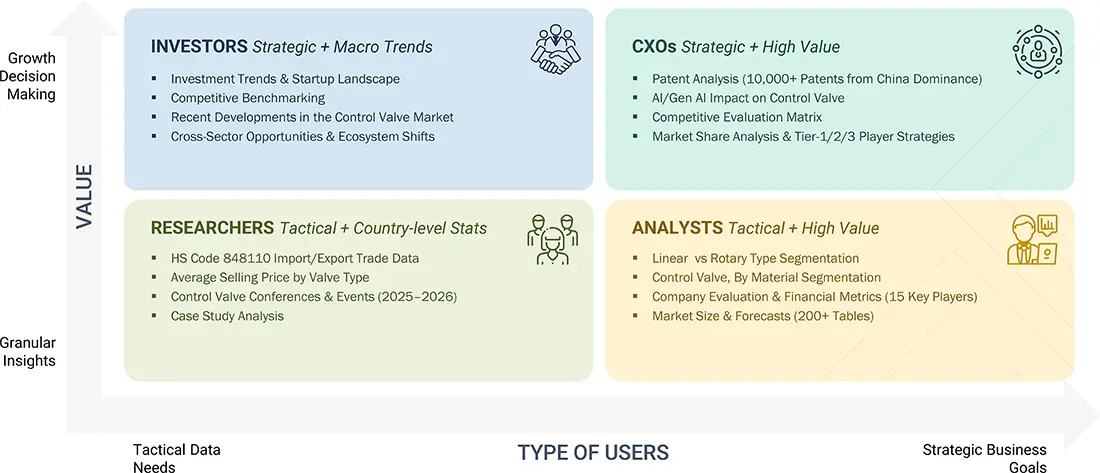

WHAT IS IN IT FOR YOU: Control Valve Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Identify growth prospects in smart valve segment | In-depth assessment of Industrial IoT and digitally enabled valve adoption trends | Equipped the client with clear business cases and ROI insights to support investment in automation-ready valve solutions |

| Assess potential in high-growth countries in Asia Pacific | Region-specific market sizing with 5-year CAGR and providing country level insights | Helped focus marketing budgets on fastest-growing regions |

RECENT DEVELOPMENTS

- January 2025 : IMI (UK) announced plans to establish a new USD 38 million manufacturing facility in Lake Forest, California, the US. The facility will primarily support the production of actuator and control valves under its IMI CCI brand.

- May 2024 : Emerson Electric Co. (US) launched the AVENTICSTM Series 625 Sentronic Proportional Pressure Control Valves. Engineered for precise electronic proportional pressure control, these valves offer a control deviation of less than 0.5%, making them ideal for advanced pneumatic control engineering applications.

- November 2023 : Emerson Electric Co. (US) introduced its pioneering Fisher, Whisper, Trim Technology, designed for rotary and globe valves. This advancement expands Emerson's existing Whisper noise solutions portfolio. Leveraging additive manufacturing and advanced methods, this next-gen Fisher Whisper Trim technology tackles noise challenges by enhancing trim designs for superior performance.

- June 2023 : Flowserve Corporation (US), a prominent supplier of flow control solutions and services, declared that its Valtek Valdisk, a high-performance butterfly valve, has received approval from licensors for utilization in pressure swing adsorption (PSA) applications.

Table of Contents

Methodology

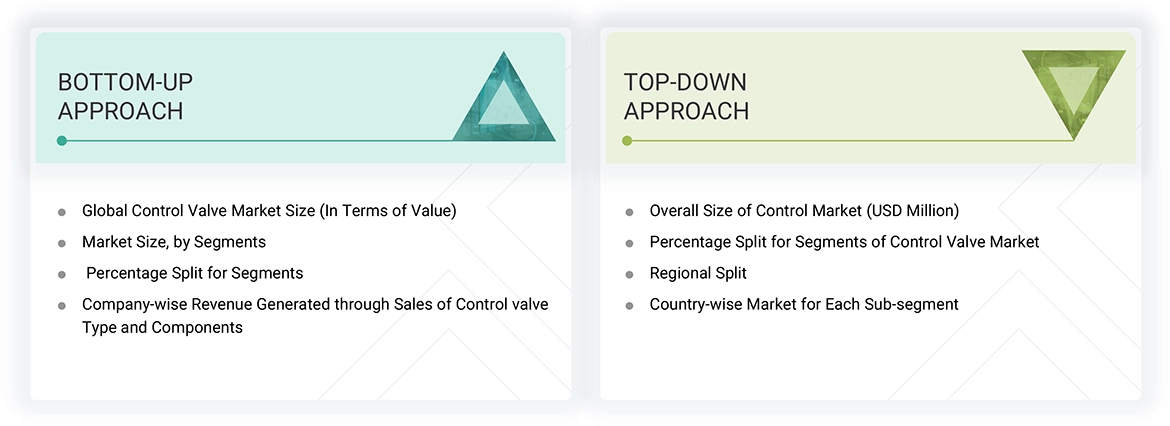

The study involved major activities in estimating the current market size for the control valve market. Exhaustive secondary research was done to collect information on the industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the control valve market.

Secondary Research

The market for the companies offering control valves is arrived at through secondary data obtained from paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of vendors, forums, certified publications, and whitepapers. Secondary research was used to obtain critical information on the industry's value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

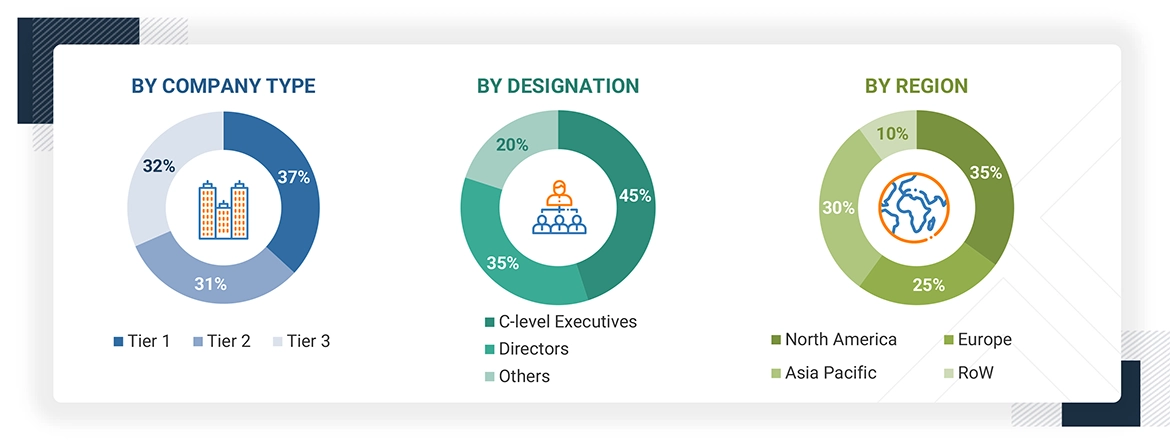

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the control valve market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions—North America, Europe, Asia Pacific, and the Rest of World. Approximately 30% of the primary interviews were conducted with the demand-side respondents, while approximately 70% were conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephone interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary interviews. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the control valve market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Control Valve Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

A valve is a mechanical device that regulates the flow of liquid or gas in a process stream. A control valve is a device that uses an actuator to provide power for flow control. It is the most common final control element used in process industries to automatically regulate the pressure and flow rate of media (flowing gas, steam, water, or chemical compounds) within the required operating range. Control valves are vital when reliability and productivity are the primary objectives. The use of control valves helps prevent revenue loss due to leakages. Hence, these valves are an integral part of every industrial process. Varieties of valves, such as ball valves, butterfly valves, plug valves, and globe valves, are available in the market. Ball and globe valves are the most widely used valves in several end-use industries, such as oil & gas, energy & power, and water & wastewater treatment. The key players operating in this market are Christian Bürkert GmbH & Co. KG (Germany), Emerson Electric Co. (US), Flowserve Corporation (US), IMI (UK), Curtiss-Wright Corporation (US), Valmet (Finland), SLB (US), Spirax Sarco Limited (US), Crane Company (US), and KITZ Corporation (Japan).

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Providers of technology solutions

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations related to control valves

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- Existing end users and prospective ones

Report Objectives

- To describe and forecast the control valve market in terms of value based on component, material, type, size, industry, and region

- To describe and forecast the control valve market size in terms of value for four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the control valve market

- To provide a detailed overview of the supply chain of the ecosystem

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To analyze the impact of AI and US tariff on the control valve market in the future

- To benchmark the market players using the company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market ranking/share and product portfolio.

- To analyze competitive developments such as acquisitions, product launches, partnerships, expansions, and collaborations undertaken in the control valve market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for this report:

- Company Information: Detailed analysis and profiling of additional five market players

Key Questions Addressed by the Report

What was the size of the control valve market in 2024?

The control valve market was valued at USD 9.95 billion in 2024.

What will be the CAGR for the control valve market from 2025 to 2030?

The global control valve market is expected to record a CAGR of 5.0% from 2025 to 2030.

Who are the top players in the control valve market?

The significant vendors operating in the control valve market include Emerson Electric Co. (US), Flowserve Corporation (US), IMI (UK), Curtiss-Wright Corporation (US), Valmet (Finland), SLB (US), Spirax Sarco Limited (US), Crane Company (US), and KITZ Corporation (Japan), among others.

Which significant countries are considered in the Asia Pacific region?

The report includes an analysis of China, Japan, India, and the rest of the Asia Pacific region.

Which types have been considered in the control valve market?

Rotary valves and linear valves are considered in the market study.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Control Valve Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Control Valve Market

Arthur

Dec, 2016

We would like to know market size, industry trends, and industry players information operating into 6" to 60" Control Flow Valves business used for liquids, cryogenics, gasses, and steam applications. .

Arthur

Dec, 2016

Dose this report contains shipments for different valve sizes, specially for liquid applications?.

Ritesh

Mar, 2015

As I am focusing on solenoid valves, angle seat valves, media separated valves. I want to know weather it is part of the market mentioned in this report and what all details I would able to extract from your report. .

Héctor

Mar, 2015

I am interesting to get complete report of Control Valve Market, but I want more specific data on actuators and European countries..

darwish

Mar, 2015

I am interested for market sizing of solenoid valves, angle seat valves, media separated valves for North America region. Specifically US and Canada.

Ingo

Apr, 2019

Dose this report covers middle east countries market size in detail? We would like to understand oil & gas market of control valve for all middle east countries. .

Kumar

Mar, 2019

Do you provide excel version of the underlying data used in the report? We would like to understand methodology of the report and scope of control valves?.

Elliot

Sep, 2015

I would like to see a summary of the control valves report. We are into global market, we want to understand futuristic market and impact of IIOT on control valve business..

Dr.J.Rangiha

Dec, 2018

We intend to invest in production of control valves for oil & gas industries. Need to collect some information about control valve markets locally and internationally. What all you can provide us?.

Alexandra

Oct, 2017

Could you please mention what is included in this category. We are more intrested into pressure relief valves, hydronic heating valves and respective global market size? .

Mohammad

Jun, 2019

We would like to have a better understanding of the valves sold around the US and specifically in Texas. What information you can provide for the same..

Martin

Dec, 2017

dose this report includes shipments for rotary and linear control valves? We need to understand technological shift happening into this market..

Keith

Oct, 2016

I am really looking for Marketing research on the the usage of Rotary Valves in the NAFTA region, market size, competitors, products offerings. Is it covered in your report?.

Martin

Sep, 2017

I am looking for information on global USD market volume of Butterfly Valves and tripple eccentric valves. Do you have any seprate report for the same. .

Jeffrey

Jun, 2017

Mostly interested in Actuators, Valve Body and Diaphragm Valves (Sanitary/Hygienic Valves) specifically US, Europe and Asia Pacific region. What granularity is covered into the report?.

Rafe

Apr, 2019

we are planning to enter into APAC market for control valve business, we want to understand APAC market trend, industry players strategies, and rules & regulation into this region. Dose report include all these?.

Eric

Apr, 2015

I am working in industrial and control valves business, I need to understand the scope difference between industrial valve and control valve reports. I would like to see sample and research methodology behind both the reports..

lily

Mar, 2019

I am more intrested in actuators used along with control valves. I would like to know market size of various actuators types by industries. .

Paolo

Feb, 2019

we are more keen to know European valve market particularly for Power and Steam Conditioning applications. In addition, looking for brief about valve business with deep dive on Control Valves. .