Roll-to-Roll Printing Market for flexible electronics by Printing Technology (Screen, Inkjet, Gravure, Flexographic), Application (Displays, Sensors, Batteries, RFID, Lighting), Material, End-use Industry, and Geography - Global Forecast to 2025

Updated on : April 24, 2023

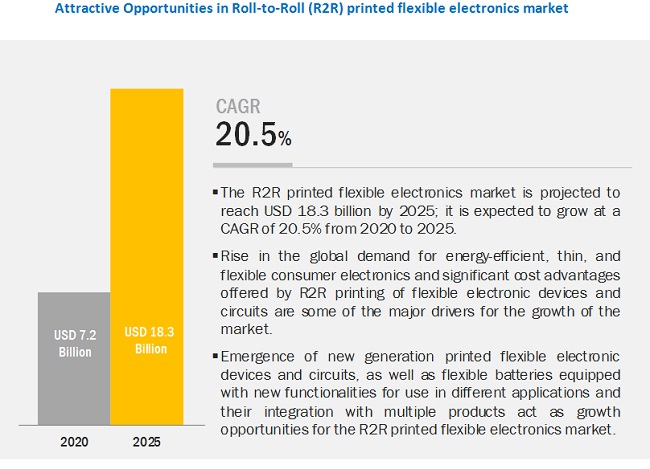

[193 Pages Report] The roll-to-roll printing market is estimated to be valued at USD 7.2 billion in 2020 and is projected to reach USD 18.3 billion by 2025; it is expected to grow at a CAGR of 20.5% from 2020 to 2025.

A few key factors driving the growth of this market include development of compact and lightweight electronic devices and circuits using roll-to-roll (R2R) printing; rise in global demand for energy-efficient, thin, and flexible roll-to-roll (R2R) printed consumer electronics; significant cost advantages offered by roll-to-roll (R2R) printing used for manufacturing electronic components and devices, and increased use of flexible electronics in healthcare applications.

“Roll-to-roll (R2R) printed flexible electronics market for flexible circuits segment expected to hold the largest share during the forecast period”

Roll-to-roll (R2R) printed flexible circuits are capable of reducing flaws in rigid circuits in terms of space constraints and conformability. R2R flexible circuits are built on flexible substrates for bending and twisting applications; therefore, these circuits are adopted in various industries as space constraints are increasingly affecting the designs of electronic devices. The growing demand for these circuits for use in consumer electronics has prompted manufacturers of electronic devices to design compact devices. This, in turn, has led to an increased demand for underlying R2R printed flexible circuits. In the healthcare end-use industry, R2R printed flexible circuits enable easy assembling of components on flexible substrates.

“Aerospace & defense segment of the R2R printed flexible electronics market projected to grow at the highest CAGR of during the forecast period”

The aerospace & defense segment of the R2R printed flexible electronics market is projected to grow at the highest CAGR during the forecast period. Printed electronics are largely being adopted in the aerospace & defense industry owing to their lightweight, less complexity, and high reliability, which ultimately results in their low maintenance requirements. Moreover, R2R printed electronics technology reduces wiring in different systems used in aircraft that include in-flight entertainment systems and aircraft structural health monitoring systems

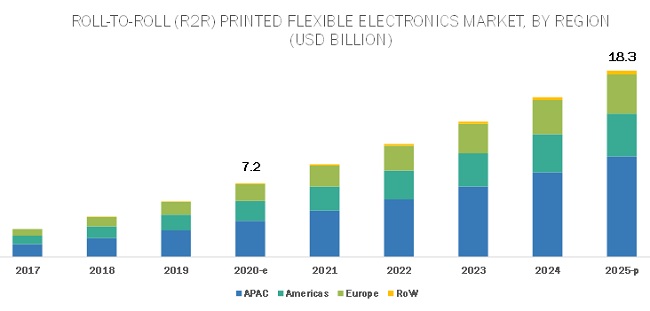

“ APAC is estimated to account for the largest share of the overall Roll-to-roll (R2R) printed flexible electronics market”

The growth of the R2R printed flexible electronics market in APAC can be attributed to the large-scale production of electronic components and increased investments in R&D activities related to printed electronics in the region. APAC has also emerged as a manufacturing hub for flexible OLED panels. Samsung (South Korea) and LG Electronics (South Korea) are the leading companies, which deploy flexible displays in their smartphones and television sets. APAC has witnessed an increase in the installation of thin-film PV cells in recent years, and their deployment is expected to increase steadily in China in coming years. With Japan and India being prominent countries in terms of the adoption of thin-film PVs, other countries in the region are also shifting toward renewable sources of energy.

Key Market Players

Samsung (South Korea), LG Electronics (South Korea), Palo Alto Research Center (US), Agfa-Gevaert (Belgium), Molex (US), Nissha USA (US), DuPont (US), BASF (Germany), NovaCentrix (US), E Ink Holdings (Taiwan), and Ynvisible Interactive (Portugal) are among a few major players in the roll-to-roll (R2R) printed flexible electronics market.

Samsung(South Korea) is strategically working toward improving the ecosystem of the printed electronics industry to accelerate the development of printed displays. It works closely with raw material suppliers to ensure the manufacturing of high-quality products, as well as to offer an uninterrupted supply of these materials. The company is continuously manufacturing technologically advanced and innovative consumer electronic devices and as such, has adopted the strategies of collaborations and partnerships with suppliers of raw materials of printed electronic components. In June 2019, it commissioned the Aerosol Jet 5X system of Optomec for the production of next-generation printed electronics. The company is also increasing its yearly R&D expenditure for the development of new and innovative R2R printed flexible consumer electronics.

Report Scope

|

Report Metric |

Details |

|

|

2017–2025 |

|

|

2019 |

|

|

Forecast Period |

2020–2025 |

|

|

Forecast Units |

Value (USD Billion) |

|

|

Segments Covered |

Printing Technology, Application, End-Use Industry, and Material |

|

|

Geographies Covered |

Americas, Europe, APAC, and RoW |

|

|

Companies Covered |

Samsung (South Korea), LG Electronics (South Korea), Palo Alto Research Center (US), Agfa-Gevaert (Belgium), Molex (US), Nissha USA (US), DuPont (US), BASF (Germany), NovaCentrix (US), E Ink Holdings (Taiwan), and Ynvisible Interactive (Portugal) —total 20 major players have been covered |

This report categorizes the roll-to-roll (R2R) printing market/roll-to-roll (R2R) printed flexible electronics market based on offering, vertical, and geography.

Roll-to-roll (R2R) printed flexible electronics market, by Material

-

Substrates

-

Organic Substrates

- Oligomers

- Molecules

- Polymers

- Paper

-

Inorganic Substrates

- Silicon

- Glass

- Metal Oxides

-

Organic Substrates

-

Inks

- Conductive Inks

- Dielectric Inks

Roll-to-roll (R2R) printed flexible electronics market, by Application

-

Displays

- E-paper Displays

- Electroluminescent Displays

- Radio-Frequency Identification (RFID) Tags

- Batteries

- Photovoltaic (PV) Cells

- Sensors

-

Lighting

- OLED

- Electroluminescent Lighting (EL)

- Flexible Circuits

Roll-to-roll (R2R) printed flexible electronics market, by Printing Technology

- Inkjet Printing

- Screen Printing

- Flexographic Printing

- Gravure Printing

- Others (Other printing technologies include nanoimprinting, offset printing, aerosol jet printing, pneumatic printing, and 3D printing)

Roll-to-roll (R2R) printed flexible electronics market, by End-Use Industry

- Automotive & Transportation

- Healthcare

- Consumer Electronics

- Retail & Packaging

- Aerospace & Defense

- Construction & Architecture

- Others (Other end-use industries primarily include advertising & media, textiles, and semiconductor)

Roll-to-roll (R2R) printed flexible electronics market, by Geography

- Americas

- Europe

- APAC

- RoW

Key Questions Addressed in the Report

- What are the major verticals where R2R printed flexible electronics are in great demand?

- Which R2R printed electronic devices will have the highest growth and largest market share during the forecast period?

- Which kind of R2R printing technology is best suited for the business to grow?

- Which applications should the R2R printing equipment manufacturers should target for revenue growth?

- Which region would lead the R2R printed flexible electronics market during the forecast period?

- What are the strategies followed by R2R printed flexible devices manufacturers to stay ahead in the market?

- What are the major drivers, restraints, opportunities, and challenges for the R2R printed flexible electronics market?

Frequently Asked Questions (FAQ):

Which end users are expected to drive the growth of the market in the next 5 years?

End Users such as automotive & transportation, healthcare, consumer electronics, retail & packaging are expected to drive the growth of the market in next 5 years. There has been an increasing demand for flexible lighting for use in automobiles being developed by the prominent automotive manufacturers such as Ford (US), General Motors (US), Nissan (Japan), Toyota (Japan), BMW (Germany), and Audi (Germany) across the world. For healthcare industry, R2R printed flexible sensors can be easily deployed for in-hospital patient monitoring and wearable applications to monitor vital parameters such as heart rate and blood pressure of patients

Which are the major companies in the market? What are their major strategies to strengthen their market presence?

Samsung (South Korea), LG Electronics (South Korea), Palo Alto Research Center Incorporated (PARC) (US), Agfa-Gevaert Group (Belgium), Molex (US), Nissha (US) are some major companies in the R2R printed flexible electronics market. All these players have adopted the strategy of new product launches and developments to sustain their position in the market. This strategy has also helped the players to efficiently cater to the growing demand for R2R printed flexible electronic devices and circuits from end users, as well as to expand their global footprint by offering their products in all major geographical regions

Which is the best region to invest for this market?

The Roll-to-Roll Printing market in APAC is foreseen to augment at a significant rate in the next 5 years. APAC is a manufacturing hub for electronic devices and components. The growth of the R2R printed flexible electronics market in APAC can be attributed to the large-scale production of electronic components and increased investments in R&D activities related to printed electronics in the region.

Which are the major applications of Roll-to-Roll Printing Market? How huge is the opportunity for their growth in the next five years?

The major application of Roll-to-Roll Printing market are displays, flexible circuits, RFID tags, batteries, PV Cells, sensors, and lighting. Flexible circuits are expected to hold the largest share in the coming 5 years due to the growing demand flexible circuits in consumer elelectronics and healthcare applications. The lighting application is projected to grow at the highest CAGR during the forecast period owing to increased use of printed electronics in automotive lighting solutions and home appliances .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 21)

1.1 Study Objectives

1.2 Market Definition and Scope

1.2.1 Inclusions and Exclusions

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 26)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Size Using Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share Using Top-Down Analysis (Supply Side)

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 36)

4 Premium Insights (Page No. - 41)

4.1 Attractive Opportunities in R2R Printed Flexible Electronics Market

4.2 Roll-to-Roll Printing Market in APAC, By End-Use Industry and Application

4.3 Market for Batteries, By Voltage

4.4 Market for Displays, By Type

4.5 Market, By Geography

5 Market Overview (Page No. - 45)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Development of Compact and Lightweight Electronic Devices and Circuits Using R2R Printing

5.2.1.2 Rise in Global Demand for Energy-Efficient, Thin, and Flexible R2R Printed Consumer Electronics

5.2.1.3 Significant Cost Advantages Offered By R2R Printing Used for Manufacturing Electronic Components and Devices

5.2.1.4 Deployment of Flexible Electronic Components in IoT Applications

5.2.1.5 Increased Use of Flexible Electronics in Healthcare Applications

5.2.2 Restraints

5.2.2.1 High Initial Capital Investments and Requirement of Large Funds to Carry Out R&D Activities Related to R2R Printing of Flexible Electronics

5.2.2.2 Risk of Failure of Interdependent Stages and Development of Limited Variety of Products

5.2.3 Opportunities

5.2.3.1 Emergence of New Generation R2R Printed Flexible Electronics

5.2.3.2 Advent of R2R Printed Flexible Batteries

5.2.3.3 Emergence of New Functionalities and Applications of R2R Printed Flexible Electronics and Their Integration With Multiple Products

5.2.3.4 Use of Graphene Ink for the Development of Cost-Effective, Flexible, Water-Repellent, and Highly Conductive R2R Printed Flexible Electronics

5.2.4 Challenges

5.2.4.1 Commercialization of New and Cost-Effective Inks

5.2.4.2 Lack of Awareness Among Manufacturers of Electronic Devices and Components About Benefits of R2R Printing

5.3 Value Chain Analysis

6 Roll-to-Roll Printing Market, By Printing Technology (Page No. - 58)

6.1 Introduction

6.2 Inkjet Printing

6.2.1 Continuous Inkjet Printing

6.2.1.1 Growing Adoption of Continuous Inkjet Printing Technology for Printing on Substrates Owing to Its Speed and Versatility

6.2.2 Drop-On-Demand Inkjet Printing

6.2.2.1 Thermal Drop-On-Demand Inkjet Printing

6.2.2.1.1 Increasing Use of Thermal Drop-On-Demand Inkjet Printing for Development of All-Inorganic Quantum Dot Leds

6.2.2.2 Piezo Drop-On-Demand Inkjet Printing

6.2.2.2.1 Rising Global Demand for Piezo Drop-On-Demand Inkjet Printing Owing to Optimum Resource Utilization and Reduction in Chemical Wastes Generated

6.2.2.3 Electrostatic Drop-On-Demand Inkjet Printing

6.2.2.3.1 Growing Use of Electrostatic Drop-On-Demand Inkjet Printing for Selected Cost-Effective Applications

6.3 Screen Printing

6.3.1 Flatbed Screen Printing

6.3.1.1 Increasing Adoption of Flatbed Screen Printing Technology for Volume-Based Production of Large-Scale Devices

6.3.2 Rotary Screen Printing

6.3.2.1 Rising Demand for Rotary Screen Printing Due to Its Durability

6.4 Flexographic Printing

6.4.1 Growing Adoption of Flexographic Printing Technology in Different Applications Owing to High-Speed Printing Carried Out By It

6.5 Gravure Printing

6.5.1 Increasing Use of Gravure Printing for Development of High-Resolution Images

6.6 Others

6.6.1 3D Printing

6.6.2 Offset Printing

6.6.3 Pneumatic Printing

6.6.4 Aerosol Jet Printing

6.6.5 Nanoimprinting

7 R2R Printed Flexible Electronics Market, By Application (Page No. - 71)

7.1 Introduction

7.2 Displays

7.2.1 E-Paper Displays

7.2.1.1 Electrochromatic Displays

7.2.1.1.1 Consistent Performance and Flexibility Leading to Rise in Global Adoption of Electrochromatic Displays

7.2.1.2 Electrophoretic Displays

7.2.1.2.1 Rise in Use of Electrophoretic Displays By E-Readers Contributing to Increased Demand for These Displays

7.2.1.3 Other Displays

7.2.2 Electroluminescent (EL) Displays

7.2.2.1 OLED Displays

7.2.2.1.1 Increased Demand for Thin and Highly Efficient Displays Driving Growth of Market for OLED Displays

7.2.2.2 Flexible OLED Displays

7.2.2.2.1 Rise in Demand for Flexible Consumer Electronic Devices Projected to Drive the Market for Flexible OLED Displays

7.2.2.3 LCD Displays

7.2.2.3.1 R2R Printed LCD Displays Hold the Smallest Share of R2R Printed Flexible Electronics Market

7.3 RFID Tags

7.3.1 Cost Benefits Offered By R2R Printed RFID Tags Over Silicon Chips Contributing to Their Adoption in Different Applications

7.4 Batteries

7.4.1 Requirement of Flexible and Lightweight Batteries to Drive Demand for R2R Printed Flexible Batteries

7.5 Photovoltaics Cells

7.5.1 Increased Use of R2R Printed Flexible PV Cells to Enhance Efficiency of Solar Conversion Devices

7.6 Sensors

7.6.1 Touch Sensors

7.6.1.1 R2R Touch Sensing Solutions to Rapidly Emerge as Substitutes of Mechanical Buttons Or Membrane Keyboards

7.6.2 Gas Sensors

7.6.2.1 R2R Printed Gas Sensors Expected to Be Used in Wearables and Wireless Systems in Coming Years

7.6.3 Humidity Sensors

7.6.3.1 R2R Printed Humidity Sensors Expected to Be Used in Numerous Applications in Coming Years

7.6.4 Pressure Sensors

7.6.4.1 R2R Printed Pressure Sensors Expected to Be Used in Healthcare Industry to Monitor Different Health Parameters

7.6.5 Image Sensors

7.6.5.1 Biometric Systems to Be Among the Key Applications of R2R Printed Image Sensors

7.6.6 Temperature Sensors

7.6.6.1 R2R Printed Flexible Electronics Expected to Enable Mass Production of Miniaturized and Power-Efficient Temperature Sensors

7.6.7 Others

7.7 Lighting

7.7.1 Electroluminescent Lighting

7.7.1.1 Flexibility and Thin-Form Factor of Electroluminescent Lighting Leading to Rise in Their Global Demand

7.7.2 OLED Lighting

7.7.2.1 Rise in Demand for Flexible, Rollable, and Transparent Printed OLED Lighting in Automotive and Consumer Electronics Industries

7.8 Flexible Circuits

7.8.1 R2R Printed Flexible Circuits Enable High Volume Production of Flexible Electronics

8 R2R Printed Flexible Electronics Market, By End-Use Industry (Page No. - 90)

8.1 Introduction

8.2 Automotive & Transportation

8.2.1 Automotive & Transportation Segment Projected to Account for the Largest Share of R2R Printed Flexible Electronics Market From 2020 to 2025

8.3 Healthcare

8.3.1 Increased Adoption of Patient Monitoring Solutions and Wearable Devices in Healthcare to Fuel Growth of R2R Printed Flexible Electronics Market

8.4 Consumer Electronics

8.4.1 Rise in Use of R2R Printed Flexible Electronic Displays in Consumer Electronics to Contribute to Growth of R2R Printed Flexible Electronics Market

8.5 Aerospace & Defense

8.5.1 Aerospace & Defense Segment of R2R Printed Flexible Electronics Market Projected to Grow at the Highest CAGR From 2020 to 2025

8.6 Construction & Architecture

8.6.1 Increase in Demand for Smart Buildings Equipped With R2R Printed Flexible Electronics to Lead to Growth of R2R Printed Flexible Electronics Market for Construction & Architecture

8.7 Retail & Packaging

8.7.1 Rise in Demand for Thin and Rugged R2R Printed Flexible Electronics Projected to Drive Growth of R2R Printed Flexible Electronics Market for Retail & Packaging

8.8 Others

9 R2R Printed Flexible Electronics Market, By Material (Page No. - 100)

9.1 Introduction

9.2 Substrates

9.2.1 Organic Substrates

9.2.1.1 Polymers

9.2.1.1.1 Polyimides

9.2.1.1.2 Polyethylene Naphthalate

9.2.1.1.3 Polyethylene Terephthalate

9.2.1.2 Paper

9.2.1.2.1 Polyacrylate

9.2.1.2.2 Polystyrene

9.2.1.2.3 Polyvinylpyrrolidone (PVP)

9.2.1.2.4 Polyvinyl Alcohol

9.2.1.3 Molecules

9.2.1.4 Oligomers

9.2.2 Inorganic Substrates

9.2.2.1 Silicon

9.2.2.2 Glass

9.2.2.3 Metal Oxides

9.2.2.3.1 Silicon Dioxide

9.2.2.3.2 Aluminum Oxide

9.2.2.3.3 Titanium Oxide

9.3 Inks

9.3.1 Conductive Inks

9.3.1.1 Conductive Silver Inks

9.3.1.2 Conductive Copper Inks

9.3.1.3 Transparent Conductive Inks

9.3.1.4 Silver Copper Inks

9.3.1.5 Carbon Inks

9.3.2 Dielectric Inks

9.3.3 Others

9.3.3.1 Carbon Nanotubes (CNT)

9.3.3.2 Graphene Inks

10 Manufacturing Stages of R2R Printed Flexible Electronics (Page No. - 110)

10.1 Introduction

10.2 Substrate Selection

10.3 Film Deposition

10.4 Curing

10.5 Assembling & Cutting

10.6 Testing & Packaging

11 R2R Printed Flexible Electronics Market, By Geography (Page No. - 113)

11.1 Introduction

11.2 Americas

11.2.1 North America

11.2.1.1 US

11.2.1.1.1 US Projected to Account for the Largest Size of R2R Printed Flexible Electronics Market in North America

11.2.1.2 Canada

11.2.1.2.1 R2R Printed Flexible Electronics Market in Canada Projected to Grow at the Highest Rate During the Forecast Period

11.2.1.3 Mexico

11.2.1.3.1 R2R Printed Flexible Electronics Market in Mexico Projected to Grow Slowly Owing to Low Adoption Rate of R2R Printed Flexible Electronics in A Number of Industries

11.2.2 South America

11.2.2.1 Significant Investments in Organic PV Cells By Companies Expected to Fuel Growth of R2R Printed Flexible Electronics Market in South America

11.3 APAC

11.3.1 China

11.3.1.1 China Projected to Lead R2R Printed Flexible Electronics Market in APAC From 2020 to 2025

11.3.2 Australia

11.3.2.1 Increased R&D Activities Related to R2R Printed Flexible Electronics Expected to Fuel Growth of R2R Printed Flexible Electronics Market in Australia

11.3.3 Japan

11.3.3.1 Increased Adoption of Next-Generation Technologies Expected to Contribute to Growth of Roll-to-Roll Printing Market for flexible electronics in Japan

11.3.4 South Korea

11.3.4.1 Flourished Consumer Electronics Industry and Presence of Key Manufacturers of R2R Printed Flexible Electronics Fueling Growth of R2R Printed Flexible Electronics Market in South Korea

11.3.5 Rest of APAC

11.4 Europe

11.4.1 Germany

11.4.1.1 Widespread Adoption of R2R Printed Electronics in Automotive and Consumer Electronics Industries Contributing to Growth of R2R Printed Flexible Electronics Market in Germany

11.4.2 France

11.4.2.1 France is the Second-Largest Market for R2R Printed Flexible Electronics in Europe

11.4.3 UK

11.4.3.1 Roll-to-Roll Printing Market for flexible electronics in UK Projected to Grow at A Significant Rate From 2020 to 2025

11.4.4 Rest of Europe

11.5 RoW

11.5.1 Middle East

11.5.1.1 Increased Customer Awareness Regarding the Latest Innovative Technologies Expected to Drive Growth of R2R Printed Flexible Electronics Market in the Middle East

11.5.2 Africa

11.5.2.1 Significant Growth in Terms of Infrastructure Development and Technological Improvements Driving R2R Printed Flexible Electronics Market in Africa

12 Competitive Landscape (Page No. - 146)

12.1 Overview

12.2 Ranking Analysis

12.3 Competitive Scenario

12.3.1 Product Launches and Developments

12.3.2 Partnerships, Agreements, and Collaborations

12.4 Competitive Leadership Mapping

12.4.1 Visionary Leaders

12.4.2 Dynamic Differentiators

12.4.3 Innovators

12.4.4 Emerging Companies

12.5 Strength of Product Portfolio

12.6 Business Strategy Excellence

13 Company Profiles (Page No. - 154)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Key Players

13.1.1 Samsung

13.1.2 LG

13.1.3 Palo Alto Research Center (PARC)

13.1.4 Agfa-Gevaert

13.1.5 Molex

13.1.6 Nissha USA

13.1.7 DuPont

13.1.8 BASF

13.1.9 NovaCentrix

13.1.10 E Ink Holdings

13.1.11 Ynvisible Interactive

13.2 Other Key Players

13.2.1 Optomec

13.2.2 Cambridge Display Technologies (CDT)

13.2.3 Enfucell

13.2.4 Thin Film Electronics

13.2.5 Applied Ink Solutions

13.2.6 Brightvolt

13.2.7 T+Ink

13.2.8 Printed Electronics Limited

13.2.9 Intrinsiq Materials

13.2.10 Vorbeck Materials

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13.3 Right-To-Win

14 Appendix (Page No. - 186)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (107 Tables)

Table 1 Comparison Between Conventional and R2R Printed Electronics Manufacturing

Table 2 Roll-to-Roll Printing Market for flexible electronics, By Printing Technology, 2017–2025 (USD Million)

Table 3 Roll-to-Roll Printing Market for Inkjet Printing, By Application, 2017–2025 (USD Million)

Table 4 Roll-to-Roll Printing Market for Inkjet Printing, By Region, 2017–2025 (USD Million)

Table 5 Roll-to-Roll Printing Market for Screen Printing, By Application, 2017–2025 (USD Million)

Table 6 R2R Printed Flexible Electronics Market for Screen Printing, By Region, 2017–2025 (USD Million)

Table 7 R2R Printed Flexible Electronics Market for Flexographic Printing, By Application, 2017–2025 (USD Million)

Table 8 R2R Printed Flexible Electronics Market for Flexographic Printing, By Region, 2017–2025 (USD Million)

Table 9 R2R Printed Flexible Electronics Market for Gravure Printing, By Application, 2017–2025 (USD Million)

Table 10 R2R Printed Flexible Electronics Market for Gravure Printing, By Region, 2017–2025 (USD Million)

Table 11 R2R Printed Flexible Electronics Market for Other Printing Technologies, By Application, 2017–2025 (USD Million)

Table 12 R2R Printed Flexible Electronics Market for Other Printing Technologies, By Region, 2017–2025 (USD Million)

Table 13 R2R Printed Flexible Electronics Market, By Application, 2017–2025 (USD Million)

Table 14 R2R Printed Flexible Electronics Market for Displays, By Printing Technology, 2017–2025 (USD Million)

Table 15 R2R Printed Flexible Electronics Market for Displays, By Region, 2017–2025 (USD Million)

Table 16 R2R Printed Flexible Electronics Market for Displays, By Type, 2017–2025 (USD Million)

Table 17 R2R Printed Flexible Electronics Market for E-Paper Displays, By Type, 2017–2025 (USD Million)

Table 18 R2R Printed Flexible Electronics Market for RFID Tags, By Printing Technology, 2017–2025 (USD Million)

Table 19 Roll-to-Roll Printing Market for RFID Tags, By Region, 2017–2025 (USD Million)

Table 20 R2R Printed Flexible Electronics Market for Batteries, By Printing Technology, 2017–2025 (USD Million)

Table 21 R2R Printed Flexible Electronics Market for Batteries, By Region, 2017–2025 (USD Million)

Table 22 R2R Printed Flexible Electronics Market for Batteries, By Voltage, 2017–2025 (USD Million)

Table 23 R2R Printed Flexible Electronics Market for PV Cells, By Printing Technology, 2017–2025 (USD Million)

Table 24 R2R Printed Flexible Electronics Market for PV Cells, By Region, 2017–2025 (USD Million)

Table 25 Roll-to-Roll Printing Market for Sensors, By Printing Technology, 2017–2025 (USD Million)

Table 26 R2R Printed Flexible Electronics Market for Sensors, By Region, 2017–2025 (USD Million)

Table 27 R2R Printed Flexible Electronics Market for Sensors, By Type, 2017–2025 (USD Million)

Table 28 R2R Printed Flexible Electronics Market for Lighting, By Printing Technology, 2017–2025 (USD Million)

Table 29 R2R Printed Flexible Electronics Market for Lighting, By Region, 2017–2025 (USD Million)

Table 30 R2R Printed Flexible Electronics Market for Lighting, By Type, 2017–2025 (USD Million)

Table 31 R2R Printed Flexible Electronics Market for Flexible Circuits, By Printing Technology, 2017–2025 (USD Million)

Table 32 Roll-to-Roll Printing Market for Flexible Circuits, By Region, 2017–2025 (USD Million)

Table 33 R2R Printed Flexible Electronics Market, By End-Use Industry, 2017–2025 (USD Million)

Table 34 Roll-to-Roll Printing Market for Automotive & Transportation, By Region, 2017–2025 (USD Million)

Table 35 R2R Printed Flexible Electronics Market for Automotive & Transportation, By Sector, 2017–2025 (USD Million)

Table 36 R2R Printed Flexible Electronics Market for Healthcare, By Region, 2017–2025 (USD Million)

Table 37 Roll-to-Roll Printing Market for Consumer Electronics, By Region, 2017–2025 (USD Million)

Table 38 R2R Printed Flexible Electronics Market for Aerospace & Defense, By Region, 2017–2025 (USD Million)

Table 39 R2R Printed Flexible Electronics Market for Aerospace & Defense, By Sector, 2017–2025 (USD Million)

Table 40 R2R Printed Flexible Electronics Market for Construction & Architecture, By Region, 2017–2025 (USD Million)

Table 41 Roll-to-Roll Printing Market for Retail & Packaging, By Region, 2017–2025 (USD Million)

Table 42 R2R Printed Flexible Electronics Market for Retail & Packaging, By Sector, 2017–2025 (USD Million)

Table 43 R2R Printed Flexible Electronics Market for Other End-Use Industries, By Region, 2017–2025 (USD Million)

Table 44 Roll-to-Roll Printing Market for flexible electronics, By Material, 2017–2025 (USD Million)

Table 45 R2R Printed Flexible Electronics Market for Substrates, By Type, 2017–2025 (USD Million)

Table 46 Roll-to-Roll Printing Market for Substrates, By Region, 2017–2025 (USD Million)

Table 47 Benefits and Applications of Polyethylene Naphthalate (PEN)

Table 48 Benefits and Applications of Polyethylene Terephthalate (PET)

Table 49 R2R Printed Flexible Electronics Market for Inks, By Type, 2017–2025 (USD Million)

Table 50 R2R Printed Flexible Electronics Market for Inks, By Region, 2017–2025 (USD Million)

Table 51 R2R Printed Flexible Electronics Market for Inks in Americas, By Region, 2017–2025 (USD Million)

Table 52 R2R Printed Flexible Electronics Market for Inks in Europe, By Country, 2017–2025 (USD Million)

Table 53 R2R Printed Flexible Electronics Market for Inks in APAC, By Country, 2017–2025 (USD Million)

Table 54 Market for flexible electronics, By Region, 2017–2025 (USD Million)

Table 55 Market for flexible electronics in Americas, By Region, 2017–2025 (USD Million)

Table 56 Market for flexible electronics in Americas, By End-Use Industry, 2017–2025 (USD Million)

Table 57 Roll-to-Roll Printing Market for flexible electronicsin Americas, By Printing Technology, 2017–2025 (USD Million)

Table 58 Market for flexible electronics in Americas, By Application, 2017–2025 (USD Million)

Table 59 R2R Printed Flexible Electronics Market in Americas for Sensors, By Geography, 2017–2025 (USD Million)

Table 60 R2R Printed Flexible Electronics Market in Americas for Displays, By Geography, 2017–2025 (USD Million)

Table 61 R2R Printed Flexible Electronics Market in Americas for RFID Tags, By Geography, 2017–2025 (USD Million)

Table 62 R2R Printed Flexible Electronics Market in Americas for Batteries, By Geography, 2017–2025 (USD Million)

Table 63 Market in Americas for Lighting, By Geography, 2017–2025 (USD Million)

Table 64 R2R Printed Flexible Electronics Market in Americas for PV Cells, By Geography, 2017–2025 (USD Million)

Table 65 Market in Americas for Flexible Circuits, By Geography, 2017–2025 (USD Million)

Table 66 Roll-to-Roll Printing Market for flexible electronics in North America, By End-Use Industry, 2017–2025 (USD Million)

Table 67 Market for flexible electronics in North America, By Country, 2017–2025 (USD Million)

Table 68 Market for flexible electronics in US, By End-Use Industry, 2017–2025 (USD Million)

Table 69 R2R Printed Flexible Electronics Market in APAC, By Country, 2017–2025 (USD Million)

Table 70 R2R Printed Flexible Electronics Market in APAC, By End-Use Industry, 2017–2025 (USD Million)

Table 71 Roll-to-Roll Printing Market for flexible electronics in APAC, By Printing Technology, 2017–2025 (USD Million)

Table 72 R2R Roll-to-Roll Printing Market for flexible electronics in APAC, By Application, 2017–2025 (USD Million)

Table 73 Roll-to-Roll Printing Market for flexible electronics in APAC for Sensors, By Country, 2017–2025 (USD Million)

Table 74 R2R Printed Flexible Electronics Market in APAC for Displays, By Country, 2017–2025 (USD Million)

Table 75 R2R Printed Flexible Electronics Market in APAC for RFID Tags, By Country, 2017–2025 (USD Million)

Table 76 R2R Printed Flexible Electronics Market in APAC for Batteries, By Country, 2017–2025 (USD Million)

Table 77 R2R Printed Flexible Electronics Market in APAC for Lighting, By Country, 2017–2025 (USD Million)

Table 78 R2R Printed Flexible Electronics Market in APAC for PV Cells, By Country, 2017–2025 (USD Million)

Table 79 R2R Printed Flexible Electronics Market in APAC for Flexible Circuits, By Country, 2017–2025 (USD Million)

Table 80 R2R Printed Flexible Electronics Market in China, By End-Use Industry, 2017–2025 (USD Million)

Table 81 R2R Printed Flexible Electronics Market in Japan, By End-Use Industry, 2017–2025 (USD Million)

Table 82 Roll-to-Roll Printing Market for flexible electronics in Europe, By Country, 2017–2025 (USD Million)

Table 83 Roll-to-Roll Printing Market for flexible electronics in Europe, By End-Use Industry, 2017–2025 (USD Million)

Table 84 R2R Printed Flexible Electronics Market in Europe, By Printing Technology, 2017–2025 (USD Million)

Table 85 R2R Printed Flexible Electronics Market in Europe, By Application, 2017–2025 (USD Million)

Table 86 R2R Printed Flexible Electronics Market in Europe for Sensors, By Country, 2017–2025 (USD Million)

Table 87 R2R Printed Flexible Electronics Market in Europe for Displays, By Country, 2017–2025 (USD Million)

Table 88 R2R Printed Flexible Electronics Market in Europe for RFID Tags, By Country, 2017–2025 (USD Million)

Table 89 R2R Printed Flexible Electronics Market in Europe for Batteries, By Country, 2017–2025 (USD Million)

Table 90 R2R Printed Flexible Electronics Market in Europe for Lighting, By Country, 2017–2025 (USD Million)

Table 91 Roll-to-Roll Printing Market for flexible electronics in Europe for PV Cells, By Country, 2017–2025 (USD Million)

Table 92 R2R Printed Flexible Electronics Market in Europe for Flexible Circuits, By Country, 2017–2025 (USD Million)

Table 93 R2R Printed Flexible Electronics Market in Germany, By End-Use Industry, 2017–2025 (USD Million)

Table 94 Roll-to-Roll Printing Market for flexible electronics in RoW, By Region, 2017–2025 (USD Million)

Table 95 Roll-to-Roll Printing Market for flexible electronics in RoW, By End-Use Industry, 2017–2025 (USD Million)

Table 96 R2R Printed Flexible Electronics Market in RoW, By Printing Technology, 2017–2025 (USD Million)

Table 97 Roll-to-Roll Printing Market for flexible electronics in RoW, By Application, 2017–2025 (USD Million)

Table 98 R2R Printed Flexible Electronics Market in RoW for Sensors, By Region, 2017–2025 (USD Million)

Table 99 R2R Printed Flexible Electronics Market in RoW for Displays, By Region, 2017–2025 (USD Million)

Table 100 R2R Printed Flexible Electronics Market in RoW for RFID Tags, By Region, 2017–2025 (USD Million)

Table 101 Roll-to-Roll Printing Market for flexible electronics in RoW for Batteries, By Region, 2017–2025 (USD Million)

Table 102 Roll-to-Roll Printing Market for flexible electronics in RoW for Lighting, By Region, 2017–2025 (USD Million)

Table 103 R2R Printed Flexible Electronics Market in RoW for PV Cells, By Region, 2017–2025 (USD Million)

Table 104 R2R Printed Flexible Electronics Market in RoW for Flexible Circuits, By Region, 2017–2025 (USD Million)

Table 105 Ranking Analysis of Top 5 Players in R2R Printed Flexible Electronics Market for 2019

Table 106 Top 5 Product Launches and Developments, 2017—2019

Table 107 Top 5 Partnerships, Agreements, and Collaborations, 2017— 2019

List of Figures (39 Figures)

Figure 1 R2R Printed Flexible Electronics Market Segmentation

Figure 2 Research Flow

Figure 3 Roll-to-Roll Printing Market for flexible electronics: Research Design

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Inks Segment Projected to Lead R2R Printed Flexible Electronics Market From 2020 to 2025

Figure 8 Inkjet Printing Segment of R2R Printed Flexible Electronics Market Projected to Grow at the Highest CAGR From 2020 to 2025

Figure 9 Lighting Segment of R2R Printed Flexible Electronics Market Projected to Grow at the Highest CAGR From 2020 to 2025

Figure 10 Automotive & Transportation Segment to Hold the Largest Size of R2R Printed Flexible Electronics Market From 2020 to 2025

Figure 11 APAC Estimated to Account for the Largest Share of R2R Printed Flexible Electronics Market in 2020

Figure 12 Increasing Demand for Energy-Efficient, Thin, and Flexible Consumer Electronics Driving Growth of R2R Printed Flexible Electronics Market From 2020 to 2025

Figure 13 Consumer Electronics and Flexible Circuits Segments to Hold Largest Shares of R2R Printed Flexible Electronics Market in APAC in 2020

Figure 14 Below 1 V Segment Projected to Hold the Largest Size of R2R Printed Flexible Electronics Market for Batteries in 2025

Figure 15 R2R Printed Flexible Electronics Market for E-Paper Displays Projected to Grow at A Higher Rate From 2020 to 2025

Figure 16 China Estimated to Account for the Largest Share of R2R Printed Flexible Electronics Market in 2020

Figure 17 Roll-to-Roll Printing Market for flexible electronics: Drivers, Restraints, Opportunities, and Challenges

Figure 18 R2R Printed Flexible Electronics Market Drivers and Their Impact

Figure 19 Roll-to-Roll Printing Market for flexible electronics Restraints and Their Impact

Figure 20 Roll-to-Roll Printing Market for flexible electronics Opportunities and Their Impact

Figure 21 Roll-to-Roll Printing Market for flexible electronics: Challenges and Their Impact

Figure 22 Roll-to-Roll Printing Market for flexible electronics : Value Chain Analysis

Figure 23 Screen Printing Segment Projected to Hold the Largest Size of R2R Printed Flexible Electronics Market From 2020 to 2025

Figure 24 Flexible Circuits Segment to Hold the Largest Size of R2R Printed Flexible Electronics Market From 2020 to 2025

Figure 25 Automotive & Transportation Segment to Hold the Largest Size of R2R Printed Flexible Electronics Market From 2020 to 2025

Figure 26 Inks Segment Projected to Lead R2R Printed Flexible Electronics Market From 2020 to 2025

Figure 27 Geographic Snapshot of R2R Printed Flexible Electronics Market

Figure 28 APAC Projected to Lead R2R Printed Flexible Electronics Market From 2020 to 2025

Figure 29 Market in Americas Snapshot

Figure 30 Market in APAC Snapshot

Figure 31 Market in Europe Snapshot

Figure 32 Companies Adopted Partnerships, Agreements, and Collaborations as Key Growth Strategies From 2017 to 2019

Figure 33 R2R Printed Flexible Electronics Market (Global) Competitive Leadership Mapping, 2019

Figure 34 Samsung: Company Snapshot

Figure 35 LG: Company Snapshot

Figure 36 Agfa-Gevaert: Company Snapshot

Figure 37 DuPont: Company Snapshot

Figure 38 BASF: Company Snapshot

Figure 39 E Ink Holdings: Company Snapshot

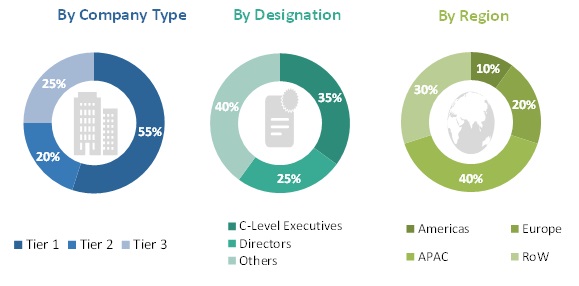

The study involved 4 major activities in estimating the size of the roll-to-roll (R2R) printing market/roll-to-roll (R2R) printed flexible electronics market. Exhaustive secondary research has been done to collect information on the R2R printed flexible electronics market. Validation of these findings, assumptions, and sizing with industry experts across value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, security–related journals, and certified publications; articles from recognized authors; gold and silver standard websites; directories; and databases. Few examples of secondary sources are International Electronics Manufacturing Initiative (iNEMI), Organic Electronics Association (OE-A), Canadian Printable Electronics Industry Association (CPEIA), Korea Flexible & Printed Electronics Association (KoPEA), and Consumer Technology Association (CES).

Primary Research

In the primary research, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the R2R printed flexible electronics market. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the R2R printed flexible electronics market and its subsegments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the estimation processes explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both demand and supply sides of the security solutions market.

Report Objectives

- To describe and forecast the roll-to-roll (R2R) printing market/roll-to-roll (R2R) printed flexible electronics market, in terms of value, based on printing technology, material, application, and end-use industry

- To describe and forecast the market, in terms of value, for 4 major regions—the Americas, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, and contributions to the total market

- To profile key players and comprehensively analyze their position in terms of the market ranking and core competencies, along with a detailed competitive landscape of the market

- To analyze the competitive growth strategies—collaborations, agreements, partnerships, acquisitions, product launches and developments, research and development (R&D) activities—adopted by major players operating in the R2R printed flexible electronics market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Roll-to-Roll Printing Market