OLED Market Size, Share, Industry Growth, Trends & Analysis by Product Type (Smartphones, Television Sets, Smart Wearables, Large Format Displays), Panel Type, Panel Size, Technology, Vertical, and Geography

Updated on : April 24, 2023

OLED Market Overview

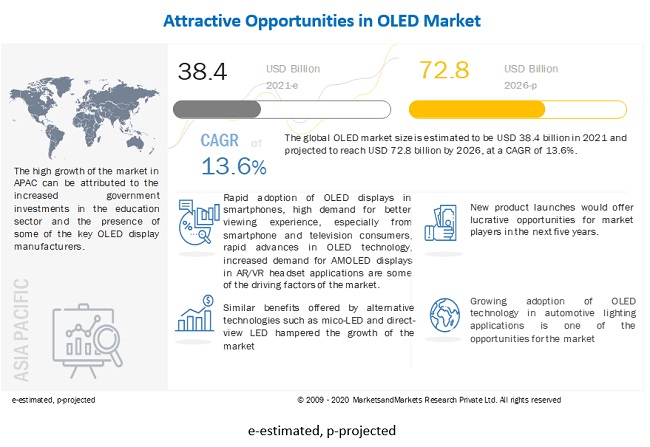

The OLED Market Size is projected to USD 72.8 billion by 2026 from USD 45.8 billion in 2022 at a CAGR of 13.6% during the forecast period. It was observed that the growth rate was 22.6% from 2021 to 2022. Automotive displays is expected to witness highest CAGR of 26.7%.

Rapid adoption of OLED displays in smartphones, significant investments in building new facilities to manufacture OLED panels, high demand for better viewing experience, especially from smartphone and television consumers, rapid advances in OLED technology, increased demand for AMOLED displays in AR/VR headset applications, and financial support from governments worldwide for OLED lighting research are the key driving factors for the OLED industry.

OLED Market Set to Expand: Smartphones and Television Sets Leading the Way

The Organic Light Emitting Diode (OLED) market is witnessing a robust expansion, with significant growth driven by the increasing adoption of OLED technology across various product types, including smartphones, television sets, smart wearables, and large format displays. This growth is propelled by the superior display quality, energy efficiency, and flexibility that OLED technology offers over traditional display technologies.

Smartphones: The Dominant Segment

Smartphones continue to be the dominant segment in the OLED market. Leading manufacturers like Apple, Samsung, and Google are increasingly incorporating OLED displays into their flagship models, citing benefits such as deeper blacks, more vibrant colors, and thinner form factors. OLED technology in smartphones is particularly favored for its ability to provide high contrast ratios and faster response times, enhancing the overall user experience, especially for gaming and multimedia consumption.

Television Sets: A Growing Market

The market for OLED television sets is experiencing significant growth as consumers seek high-end viewing experiences. Major brands like LG, Sony, and Panasonic are investing heavily in OLED technology to deliver televisions with exceptional picture quality. These OLED TVs offer unparalleled color accuracy and contrast, making them a top choice for home entertainment enthusiasts and professionals in fields requiring precise color representation. The recent trend towards larger screens and higher resolutions, such as 4K and 8K, further fuels the demand for OLED TVs.

Smart Wearables: Innovation at Its Best

In the realm of smart wearables, OLED displays are becoming increasingly prevalent. Devices such as smartwatches and fitness trackers benefit from OLED's lightweight, flexible, and energy-efficient properties. Companies like Apple, Fitbit, and Garmin are integrating OLED screens to provide users with crisp, clear displays that are easily readable in various lighting conditions. The flexibility of OLED technology also opens the door for innovative wearable designs that conform to the contours of the human body, enhancing comfort and usability.

Large Format Displays: Expanding Horizons

Large format displays, including digital signage, interactive whiteboards, and public information displays, are also seeing a surge in OLED adoption. Businesses and institutions are leveraging OLED technology for its wide viewing angles, high brightness, and energy efficiency. These features are particularly beneficial in environments such as retail spaces, corporate offices, and educational settings, where high visibility and clarity are crucial. Companies like Samsung and LG are at the forefront of developing large OLED displays that cater to these applications, driving further market expansion.

To know about the assumptions considered for the study, Request for Free Sample Report

OLED Market Dynamics:

Driver: Rapid advances in OLED technology

Over the years, OLEDs have secured constant attention from the scientific and industrial community worldwide. A wide range of OLEDs, finding applications in various sectors, have entered the market, focusing primarily on passive and active matrix solutions. The major area of research in the OLED market is the development of white OLEDs that have a long shelf life of more than 15,000 hours at a brightness level of 1,000 cd/m2. Also, flexible OLEDs with enhanced portability have been developed to offer bendable, lightweight, and unbreakable devices. OLED displays are made up of organic light-emitting materials and do not require any backlight and filtering systems that are usually used in LCDs.

In the next decade, OLEDs are expected to replace LCDs in most applications, ranging from small displays for smartwatches to large-sized displays for television sets. OLED displays are energy-efficient, sunlight-readable, and have an easier recycling process than LCDs. OLED displays have great contrast as the light on the screen comes from each individual pixel rather than backlight; when it needs to create contrast, it simply dims or turns off the relevant pixels for a true, deep black color, and consumes less power. High brightness, low power consumption, and a greater contrast ratio offered by OLED displays are the leading factors for their adoption in various applications.

Restraint: Similar benefits offered by alternative technologies such as micro-LED and direct-view LED

Micro-LEDs are light-emitting diodes fabricated in the sizes of micrometers and can be used in self-emitting display manufacturing. Thus, the backlit panel is not required in micro-LEDs, and these LEDs are much brighter and more power-efficient. Micro-LEDs are expected to be the disrupting innovation in terms of display and lighting applications. Micro-LED technology can be used in both display and lighting applications.

The market for Micro-LED technology-based display panels is expected to grow rapidly due to the advantages offered by the technology over the existing display technologies such as LCD and OLED. The technology offers advantages including the faster response time, higher brightness, longer running of devices, especially for retail and corporate applications.

Opportunity: Increasing popularity of OLED smart TVs

OLED technology that provides efficient and beautiful lightning panels is nowadays used in smart TVs. A smart TV is a digital television with internet-connected technologies. It is basically a traditional television set but is integrated with the internet and interactive Web 2.0 features. This allows users to stream music and videos or browse the internet and view photos. Apart from the traditional functions of television sets, smart TVs can provide internet TV, over-the-top content (OTT), on-demand streaming, online interactive media, and much more. According to a Cisco study, in 2019, online video streaming accounted for 90% of the internet traffic. For these reasons, smart OLED TVs are redefining the concept of entertainment and are transforming the entertainment industry. Increasing disposable income due to rapid economic growth across the world is likely to result in high adoption of luxury products such as curved OLED TVs.

Challenge: Requirement for huge investment and relative increase in manufacturing complexity

The latest LTPS-LCD production plants can be transformed into OLED by installing new equipment. However, this requires a huge initial investment. Additionally, at present, the TFT-LCD industry is mired in losses due to panel oversupply. LG Display, Japan Display, and AU Optronics are expected to be the first lot to experience deep losses on the initial investment before recovering on OLED. Moreover, manufacturing an AMOLED panel still requires more sophisticated technologies than an LCD. The complex value chain and different suppliers also add significant complexity to the supply chain.

OLED Lighting by Application

OLED lighting to witness a higher CAGR during the forecast period.

OLED technology is gaining momentum in general lighting applications owing to superior performance and wide light source coverage offered by it. OLED lighting products are energy-efficient and are deployed in green buildings. The general lighting segment is expected to continue to account for the larger size of the OLED lighting during the forecast period. However, the automotive lighting segment is anticipated to grow at a higher CAGR during 2021–2026. The higher growth of the automotive lighting segment can be attributed to the high demand from luxury car manufacturers for premium quality lightings, along with a rise in the number of collaborations of OLED manufacturers with leading automotive companies for the development of flexible lightings for vehicles.

OLED Market by Consumer

Consumer vertical to account the largest share during the forecast period.

The consumer electronics market is growing at a very fast speed with remarkable advancements in technology, such as improving picture clarity in large-screen TVs and the evolution of smartphones. OLED technology enables the development of these advanced products. Factors driving the demand for OLED products in the consumer segment include technological advancements in consumer devices and economic growth worldwide. Smartphones and television sets use OLED display extensively. Moreover, various display panel manufacturers have reported an increase in the sale of mobile displays due to new product launches and an improved supply-demand environment for large panels even during the pandemic. Thus, smartphones, televisions, and smart wearables (especially smartwatches and VR HMDs) would be the major product categories driving the growth of the consumer segment during the forecast period.

OLED Market by APAC Region

APAC to account the largest share during 2021–2026.

APAC is leading the OLED market in terms of market share owing to the high demand for OLED display panels from smartphone vendors and OEMs in China, Japan, Taiwan, and South Korea. Additionally, several key original brand manufacturers and the majority of display manufacturers are based in APAC. Many operations, such as R&D, manufacturing, and assembly, related to OLED displays are being shifted to China owing to the low cost of logistics operations associated with the delivery of end products in the OLED display market. China is also emerging as a leading consumer product manufacturing hub with local players expanding their market share in all segments.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The OLED Companies such as Samsung Electronics (South Korea), LG Display (South Korea), BOE Technology (China), AU Optronics (Taiwan), and Universal Display Corporation (US) are among the major players in the display market.

OLED Market Scope:

|

Report Metric |

Details |

|

Estimated Market Size |

USD 38.4 billion |

|

Projected Market Size |

USD 72.8 billion |

|

Growth Rate |

CAGR of 13.6% |

|

Largest Market |

APAC |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million), and Volume (Million Units) |

|

Segments covered |

By Panel Type, Panel Size, Technology, Vertical |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Companies covered |

Samsung Electronics (South Korea), LG Display (South Korea), BOE Technology (China), AU Optronics (Taiwan), and Universal Display Corporation (US) |

Recent Developments in OLED Market

- In June 2020, LG announced the launch of a new vivid, transparent OLED display for digital signage solutions. The new display offers cutting-edge touch screen technology and uses projected capacitive (p-cap) film technology to deliver a highly responsive, accurate touch experience. The new OLED display is built from anti-reflective, tempered, shatter-resistant front glass to make it suitable for commercial use.

- In August 2019, AU Optronics launched a 17.3-inch OLED display with UHD 4K image quality and 120 Hz refresh rate, 5.6-inch AMOLED display, 12.1-inch full-color TFT driven Micro LED vehicle display, and optical in-cell fingerprint LTPS LCD.

- In November 2020, OLEDWorks partnered with Lumenique LLC. This partnership marks Lumenique, a manufacturer of lighted artwork, an early adopter of OLED lighting technology. The firm will integrate the latest OLED lighting panels into artistic portable lighting.

- In May 2020, Universal Display and Wuhan China Star Optoelectronics Semiconductor Display Technology Co., Ltd. signed a new OLED technology license agreement and supplemental material purchase agreement. Under the long-term agreements, UDC will supply phosphorescent OLED materials to Wuhan China Star Optoelectronics for use in display products through its wholly-owned subsidiary UDC Ireland Limited.

- In May 2020, Tianma started its 6th-generation flexible AMOLED production line project. With an investment of RMB 48 billion, the project covers a total land area of about 247.1 acres. It is currently the largest flexible AMOLED monomer factory in China.

Frequently Asked Questions (FAQ):

How big OLED market?

The OLED market size is expected to reach USD 72.8 billion by 2026 to grow at a CAGR of 13.6% during the forecast period.

Which is the potential market for OLED market in terms of the region?

Among all regions, APAC is expected to register the high growth in the OLED market during the forecast period. China, South Korea, Japan, India, and Rest of APAC are covered under the APAC OLED market analysis. The high growth of the market in APAC can be attributed to the increased government investments in the education sector and the presence of some of the key display manufacturers, such as Samsung, LG Display, Sharp Corporation, and Panasonic, in the region.

What are the opportunities for new market entrants?

Growing adoption of OLED technology in automotive lighting application and increasing popularity of OLED smart TVs to provide lucrative growth opportunities for manufacturers, and rapid adoption of OLED displays in smartphones and rapid advances in OLED technology driving the OLED market

Which vertical is expected to drive the growth of the market in the next five years?

The consumer electronics market is growing at a very fast speed with remarkable advancements in technology, such as improving picture clarity in large-screen TVs and the evolution of smartphones. OLED technology enables the development of these advanced products. Factors driving the demand for OLED products in the consumer segment include technological advancements in consumer devices and economic growth worldwide.

Which application is expected to grow with highest CAGR during forecast period?

The adoption of OLED displays in the automotive industry is likely to increase in the coming years. The rapid adoption of ADAS, flexible panels, and OLED screens, and increasing sales of premium segment vehicles are the major factors driving the global automotive display market. ADAS systems are built to assist, complement, and marginally substitute a driver in a vehicle. Future cars are expected to be equipped with as many as 10 displays. OLED displays are gradually emerging as the most preferred display technology among automotive companies such as General Motors, Audi, Toyota, Volkswagon, and Mercedez-Benz. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 OLED MARKET SEGMENTATION

1.3.3 OLED DISPLAY MARKET SEGMENTATION

1.3.4 GEOGRAPHIC SCOPE

1.3.5 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 OLED MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 2 SUPPLY-SIDE ANALYSIS: OLED MARKET (1/2)

FIGURE 3 SUPPLY-SIDE ANALYSIS: OLED MARKET (2/2)

FIGURE 4 DEMAND-SIDE ANALYSIS: OLED MARKET

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 40)

3.1 OLED MARKET: PRE-COVID-19 AND POST-COVID-19 SCENARIOS

FIGURE 8 OLED MARKET: OPTIMISTIC, REALISTIC, PESSIMISTIC, AND PRE-COVID-19 SCENARIO ANALYSIS (2017–2026)

3.1.1 OLED MARKET: REALISTIC SCENARIO

3.1.2 OLED MARKET: OPTIMISTIC SCENARIO

3.1.3 OLED MARKET: PESSIMISTIC SCENARIO

FIGURE 9 OLED MARKET SIZE, 2017–2026

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN OLED MARKET

FIGURE 10 APAC TO DOMINATE OLED MARKET DURING FORECAST PERIOD

4.2 OLED MARKET, BY PRODUCT TYPE

FIGURE 11 DISPLAY TO CONTINUE TO HOLD LARGEST SIZE OF OLED MARKET THROUGH 2026

4.3 OLED DISPLAY MARKET, BY APPLICATION

FIGURE 12 SMARTPHONES TO HOLD LARGEST SIZE OF OLED DISPLAY MARKET, BY APPLICATION, IN 2026

4.4 OLED DISPLAY MARKET, BY PANEL SIZE

FIGURE 13 UP TO 6 INCHES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.5 OLED DISPLAY MARKET, BY PANEL TYPE

FIGURE 14 FLEXIBLE SEGMENT TO HOLD LARGEST SIZE OF OLED DISPLAY MARKET IN 2026

4.6 OLED MARKET, BY REGION

FIGURE 15 OLED MARKET TO REGISTER HIGHEST CAGR IN EUROPE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rapid adoption of OLED displays in smartphones

FIGURE 17 TOTAL NUMBER AND PERCENTAGE OF SMARTPHONE USERS WORLDWIDE, 2018–2026 (BILLION)

5.2.1.2 Significant investments in building new facilities to manufacture OLED panels

5.2.1.3 High demand for better viewing experience, especially from smartphone and television consumers

5.2.1.4 Rapid advances in OLED technology

5.2.1.5 Increased demand for AMOLED displays in AR/VR headset applications

5.2.1.6 Financial support from governments worldwide for OLED lighting research

5.2.2 RESTRAINTS

5.2.2.1 Similar benefits of micro-LED and direct-view LED display technologies similar to OLED

FIGURE 18 MICRO-LED MARKET SIZE, 2017–2025 (USD BILLION)

5.2.3 OPPORTUNITIES

5.2.3.1 Growing adoption of OLED technology in automotive lighting applications

5.2.3.2 Increasing popularity of OLED smart TVs

5.2.4 CHALLENGES

5.2.4.1 Complex value chain structure

5.2.4.2 Requirement for huge investment and relative increase in manufacturing complexity

5.2.4.3 Limited acceptance of OLED lighting fixtures compared to LED fixtures

5.3 VALUE CHAIN ANALYSIS

5.3.1 VALUE CHAIN ANALYSIS: OLED DISPLAY

FIGURE 19 VALUE CHAIN ANALYSIS: OLED DISPLAY

5.3.1.1 Research & development

5.3.1.2 Manufacturing

5.3.1.3 Assembly, packaging, and integration

5.3.1.4 Material and equipment supply and distribution

5.3.1.5 Marketing and post-sales services

5.3.2 VALUE CHAIN ANALYSIS: OLED LIGHTING

FIGURE 20 VALUE CHAIN ANALYSIS: OLED LIGHTING

5.4 DISPLAY ECOSYSTEM

FIGURE 21 DISPLAY ECOSYSTEM

TABLE 2 OLED MARKET: ECOSYSTEM

5.5 PRICING ANALYSIS

FIGURE 22 AVERAGE PRICE OF OLED TELEVISION SET FROM 2017 TO 2026

5.6 PORTER’S FIVE FORCES ANALYSIS

FIGURE 23 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 OLED MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 PATENT ANALYSIS

TABLE 4 TOP 20 COMPANIES WITH NUMBER OF PATENT REGISTERED IN LAST 10 YEARS: OLED MARKET

FIGURE 24 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 25 NO. OF PATENTS GRANTED PER YEAR, 2011–2020

5.8 STANDARDS AND REGULATIONS REGARDING DISPLAY PANELS

5.8.1 KEY REGULATIONS FOR DISPLAY PANELS

TABLE 5 KEY REGULATIONS: DISPLAY PANELS

5.9 TRADE ANALYSIS

5.9.1 IMPORT SCENARIO OF TELEPHONES FOR CELLULAR NETWORKS "MOBILE TELEPHONES" OR FOR OTHER WIRELESS NETWORKS

FIGURE 26 TELEPHONES FOR CELLULAR NETWORKS "MOBILE TELEPHONES" OR OTHER WIRELESS NETWORKS, IMPORT, BY KEY COUNTRY, 2016–2019

5.9.2 EXPORT SCENARIO OF TELEPHONES FOR CELLULAR NETWORKS MOBILE TELEPHONES OR FOR OTHER WIRELESS NETWORKS

FIGURE 27 TELEPHONES FOR CELLULAR NETWORKS "MOBILE TELEPHONES" OR OTHER WIRELESS NETWORKS, EXPORT, BY KEY COUNTRY, 2016–2019

5.10 CASE STUDIES

5.10.1 INTRODUCTION

TABLE 6 CASE STUDIES

6 OLED MARKET, BY PRODUCT TYPE (Page No. - 72)

6.1 INTRODUCTION

FIGURE 28 OLED MARKET SEGMENTATION, BY PRODUCT TYPE

FIGURE 29 DISPLAY PRODUCTS EXPECTED TO CONTINUE TO HOLD LARGER SIZE OF OLED MARKET DURING FORECAST PERIOD

TABLE 7 OLED MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 8 OLED MARKET, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

6.2 OLED DISPLAY

6.2.1 OLED DISPLAYS TO HOLD MAJOR SHARE OF OLED MARKET DURING FORECAST PERIOD

6.3 OLED LIGHTING

6.3.1 OLED LIGHTING MARKET, BY APPLICATION

FIGURE 30 OLED LIGHTING MARKET, BY APPLICATION

TABLE 9 OLED LIGHTING MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 10 OLED LIGHTING MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

6.3.1.1 General lighting

6.3.1.1.1 General lighting application to hold major share of OLED lighting market during forecast period

6.3.1.2 Automotive lighting

6.3.1.2.1 Automotive lighting application to grow at higher CAGR in OLED lighting market during forecast period

6.3.2 OLED LIGHTING MARKET, BY PANEL TYPE

FIGURE 31 OLED LIGHTING MARKET, BY PANEL TYPE

TABLE 11 OLED LIGHTING MARKET, BY PANEL TYPE, 2017–2020 (USD MILLION)

TABLE 12 OLED LIGHTING MARKET, BY PANEL TYPE, 2021–2026 (USD MILLION)

6.3.2.1 Rigid

6.3.2.1.1 Rigid panels are thin and lightweight and consume low power

6.3.2.2 Flexible

6.3.2.2.1 Flexible panels can be easily integrated into any kind of product

7 OLED DISPLAY MARKET, BY APPLICATION (Page No. - 78)

7.1 INTRODUCTION

FIGURE 32 OLED DISPLAY MARKET SEGMENTATION, BY APPLICATION

TABLE 13 OLED DISPLAY MARKET, BY APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 14 OLED DISPLAY MARKET, BY APPLICATION, 2021–2026 (MILLION UNITS)

FIGURE 33 SMARTPHONES TO DOMINATE OLED DISPLAY MARKET DURING FORECAST PERIOD

TABLE 15 OLED DISPLAY MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 16 OLED DISPLAY MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

7.2 SMARTPHONES

7.2.1 FLEXIBLE PANELS TO BE USED MOST IN SMARTPHONES DURING FORECAST PERIOD

TABLE 17 OLED DISPLAY MARKET FOR SMARTPHONES, BY PANEL TYPE, 2017–2020 (USD MILLION)

TABLE 18 OLED DISPLAY MARKET FOR SMARTPHONES, BY PANEL TYPE, 2021–2026 (USD MILLION)

FIGURE 34 APAC TO DOMINATE OLED DISPLAY MARKET FOR SMARTPHONES DURING FORECAST PERIOD

TABLE 19 OLED DISPLAY MARKET FOR SMARTPHONES, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 OLED DISPLAY MARKET FOR SMARTPHONES, BY REGION, 2021–2026 (USD MILLION)

7.3 TABLETS

7.3.1 FLEXIBLE OLED DISPLAY PANELS TO DOMINATE TABLETS DURING FORECAST PERIOD

TABLE 21 OLED DISPLAY MARKET FOR TABLETS, BY PANEL TYPE, 2017–2020 (USD MILLION)

TABLE 22 OLED DISPLAY MARKET FOR TABLETS, BY PANEL TYPE, 2021–2026 (USD MILLION)

TABLE 23 OLED DISPLAY MARKET FOR TABLETS, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 OLED DISPLAY MARKET FOR TABLETS, BY REGION, 2021–2026 (USD MILLION)

7.4 PC MONITORS & LAPTOPS

7.4.1 RIGID PANELS TO HOLD MAJOR SHARE OF PC MONITOR & LAPTOP MARKET DURING FORECAST PERIOD

TABLE 25 OLED DISPLAY MARKET FOR PC MONITORS & LAPTOPS, BY PANEL TYPE, 2017–2020 (USD MILLION)

TABLE 26 OLED DISPLAY MARKET FOR PC MONITORS & LAPTOPS, BY PANEL TYPE, 2021–2026 (USD MILLION)

TABLE 27 OLED DISPLAY MARKET FOR PC MONITORS & LAPTOPS, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 OLED DISPLAY MARKET FOR PC MONITORS & LAPTOPS, BY REGION, 2021–2026 (USD MILLION)

7.5 TELEVISION SETS

7.5.1 FLEXIBLE PANELS TO CAPTURE MAJOR SHARE OF MARKET FOR TELEVISION SETS DURING FORECAST PERIOD

TABLE 29 OLED DISPLAY MARKET FOR TELEVISION SETS, BY PANEL TYPE, 2017–2020 (USD MILLION)

TABLE 30 OLED DISPLAY MARKET FOR TELEVISION SETS, BY PANEL TYPE, 2021–2026 (USD MILLION)

FIGURE 35 APAC TO HOLD MAJOR SHARE OF OLED DISPLAY MARKET FOR TELEVISION SETS DURING FORECAST PERIOD

TABLE 31 OLED DISPLAY MARKET FOR TELEVISION SETS, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 OLED DISPLAY MARKET FOR TELEVISION SETS, BY REGION, 2021–2026 (USD MILLION)

7.6 DIGITAL SIGNAGE/LARGE FORMAT DISPLAYS

7.6.1 LARGE FORMAT DISPLAYS ARE MAINLY USED IN PUBLIC PLACES, TRANSPORTATION, RETAIL, AND OUTDOOR ADVERTISING

TABLE 33 OLED DISPLAY MARKET FOR DIGITAL SIGNAGE/LARGE FORMAT DISPLAYS, BY PANEL TYPE, 2017–2020 (USD MILLION)

TABLE 34 OLED DISPLAY MARKET FOR DIGITAL SIGNAGE/LARGE FORMAT DISPLAYS, BY PANEL TYPE, 2021–2026 (USD MILLION)

TABLE 35 OLED DISPLAY MARKET FOR DIGITAL SIGNAGE/LARGE FORMAT DISPLAYS, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 OLED DISPLAY MARKET FOR DIGITAL SIGNAGE/LARGE FORMAT DISPLAYS, BY REGION, 2021–2026 (USD MILLION)

7.7 SMART WEARABLES

TABLE 37 OLED DISPLAY MARKET FOR SMART WEARABLES, BY PANEL TYPE, 2017–2020 (USD MILLION)

TABLE 38 OLED DISPLAY MARKET FOR SMART WEARABLES, BY PANEL TYPE, 2021–2026 (USD MILLION)

FIGURE 36 APAC TO DOMINATE OLED DISPLAY MARKET FOR SMART WEARABLES DURING FORECAST PERIOD

TABLE 39 OLED DISPLAY MARKET FOR SMART WEARABLES, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 OLED DISPLAY MARKET FOR SMART WEARABLES, BY REGION, 2021–2026 (USD MILLION)

TABLE 41 OLED DISPLAY MARKET FOR SMART WEARABLES, BY WEARABLE TYPE, 2017–2020 (USD MILLION)

TABLE 42 OLED DISPLAY MARKET FOR SMART WEARABLES, BY WEARABLE TYPE, 2021–2026 (USD MILLION)

7.7.1 SMARTWATCH

7.7.1.1 Smartwatch application to hold major share of OLED smart wearable market during forecast period

7.7.2 AR HMD

7.7.2.1 Major applications of AR HMDs in healthcare include pre-hospital medical care, nursing care in clinical environments, and medical treatment in hospitals

7.7.3 VR HMD

7.7.3.1 Virtual reality HMDs find major applications in gaming and entertainment, healthcare, retail, and e-commerce sectors during forecast period

7.8 AUTOMOTIVE DISPLAYS

7.8.1 OLED TECHNOLOGY IS EXPECTED TO GAIN TRACTION IN AUTOMOTIVE DISPLAYS DURING FORECAST PERIOD

TABLE 43 AUTOMOTIVE OLED DISPLAY MARKET, BY PANEL TYPE, 2017–2020 (USD MILLION)

TABLE 44 AUTOMOTIVE OLED DISPLAY MARKET, BY PANEL TYPE, 2021–2026 (USD MILLION)

TABLE 45 AUTOMOTIVE OLED DISPLAY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 AUTOMOTIVE OLED DISPLAY MARKET, BY REGION, 2021–2026 (USD MILLION)

7.9 OTHERS

TABLE 47 OLED DISPLAY MARKET FOR OTHER APPLICATIONS, BY PANEL TYPE, 2017–2020 (USD MILLION)

TABLE 48 OLED DISPLAY MARKET FOR OTHER APPLICATIONS, BY PANEL TYPE, 2021–2026 (USD MILLION)

TABLE 49 OLED DISPLAY MARKET FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 OLED DISPLAY MARKET FOR OTHER APPLICATION, BY REGION, 2021–2026 (USD MILLION)

8 OLED DISPLAY MARKET, BY TECHNOLOGY (Page No. - 100)

8.1 INTRODUCTION

FIGURE 37 OLED DISPLAY MARKET, BY TECHNOLOGY

FIGURE 38 AMOLED TECHNOLOGY IS EXPECTED TO DOMINATE OLED DISPLAY MARKET DURING FORECAST PERIOD

TABLE 51 OLED DISPLAY MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 52 OLED DISPLAY MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

8.2 PMOLED

8.2.1 PMOLEDS ARE BEST SUITED FOR SMALL SCREEN DEVICES

8.3 AMOLED

8.3.1 AMOLED TECHNOLOGY-BASED DISPLAY PANELS PROVIDE FASTER PIXEL-SWITCHING RESPONSE TIMES THAN TRADITIONAL OLEDS

8.3.2 FMM RGB

8.3.2.1 Fine metal mask (FMM) is used to pattern individual red, green, and blue sub-pixels in an AMOLED display panel manufacturing process

8.3.3 WOLED

8.3.3.1 WOLEDs are used in large display panels

9 OLED DISPLAY MARKET, BY PANEL SIZE (Page No. - 104)

9.1 INTRODUCTION

FIGURE 39 OLED DISPLAY MARKET SEGMENTATION, BY PANEL SIZE

FIGURE 40 UP TO 6 INCHES DISPLAYS TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING FORECAST PERIOD

TABLE 53 OLED DISPLAY MARKET, BY PANEL SIZE, 2017–2020 (USD MILLION)

TABLE 54 OLED DISPLAY MARKET, BY PANEL SIZE, 2021–2026 (USD MILLION)

9.2 UP TO 6 INCHES

9.2.1 OLED DISPLAY PANELS OF UP TO 6 INCHES ARE USED IN SEVERAL SMALL DEVICES

9.3 6–20 INCHES

9.3.1 6–20 INCHES OLED DISPLAYS ARE WIDELY USED IN HEALTHCARE SECTOR

9.4 20–50 INCHES

9.4.1 LARGE DISPLAY PANELS ARE MOSTLY USED FOR OUTDOOR APPLICATIONS

9.5 MORE THAN 50 INCHES

9.5.1 DISPLAYS ABOVE 50 INCHES ARE USED FOR APPLICATIONS IN OUTDOOR LOCATIONS

10 OLED DISPLAY MARKET, BY PANEL TYPE (Page No. - 108)

10.1 INTRODUCTION

FIGURE 41 OLED DISPLAY MARKET SEGMENTATION, BY PANEL TYPE

FIGURE 42 FLEXIBLE OLED DISPLAYS TO ACCOUNT FOR MARKET LARGEST SIZE IN 2026

TABLE 55 OLED DISPLAY MARKET, BY PANEL TYPE, 2017–2020 (USD MILLION)

TABLE 56 OLED DISPLAY MARKET, BY PANEL TYPE, 2021–2026 (USD MILLION)

10.2 RIGID

10.2.1 RIGID OLED PANELS ARE USUALLY FABRICATED ON METAL OR GLASS SUBSTRATES

TABLE 57 OLED DISPLAY MARKET FOR RIGID PANEL TYPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 58 OLED DISPLAY MARKET FOR RIGID PANEL TYPE, BY APPLICATION, 2021–2026 (USD MILLION)

10.3 FLEXIBLE

10.3.1 SMARTPHONES AND SMART WEARABLES ARE EXPECTED TO GENERATE SUBSTANTIAL DEMAND FOR FLEXIBLE OLED DISPLAYS DURING FORECAST PERIOD

TABLE 59 OLED DISPLAY MARKET FOR FLEXIBLE PANEL TYPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 60 OLED DISPLAY MARKET FOR FLEXIBLE PANEL TYPE, BY APPLICATION, 2021–2026 (USD MILLION)

10.4 OTHERS

TABLE 61 OLED DISPLAY MARKET FOR OTHER PANEL TYPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 62 OLED DISPLAY MARKET FOR OTHER PANEL TYPE, BY APPLICATION, 2021–2026 (USD MILLION)

11 OLED MARKET, BY VERTICAL (Page No. - 115)

11.1 INTRODUCTION

FIGURE 43 OLED MARKET SEGMENTATION, BY VERTICAL

TABLE 63 OLED MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 64 OLED MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.2 CONSUMER

11.2.1 CONSUMER SEGMENT TO CAPTURE LARGEST SIZE OF OLED MARKET DURING FORECAST PERIOD

11.3 AUTOMOTIVE

11.3.1 GROWING REPLACEMENT OF ANALOG COMPONENTS WITH DIGITAL ONES IN VEHICLES TO BOOST DEMAND FOR OLED DISPLAY PANELS IN AUTOMOTIVE VERTICAL

11.4 SPORTS & ENTERTAINMENT

11.4.1 RAPID PENETRATION OF AR/VR HMDS INTO SPORTS AND ENTERTAINMENT INDUSTRIES TO FUEL MARKET GROWTH DURING FORECAST PERIOD

11.5 TRANSPORTATION

11.5.1 TRANSPORTATION VERTICAL TO GENERATE HIGH DEMAND FOR LARGE FORMAT DISPLAYS DURING FORECAST PERIOD

11.6 RETAIL, HOSPITALITY, AND BFSI

11.6.1 RETAIL, HOSPITALITY, AND BFSI VERTICALS TO ADOPT OLED DIGITAL SIGNAGE DISPLAYS AT LARGE DURING FORECAST PERIOD

11.7 INDUSTRIAL & ENTERPRISE

11.7.1 INCREASING ADOPTION OF AR/VR HMDS TO DRIVE GROWTH OF OLED MARKET FOR INDUSTRIAL AND ENTERPRISE VERTICALS

11.8 EDUCATION

11.8.1 TRANSITION TO ONLINE LEARNING TO FAVOR GROWTH OF OLED DISPLAY MARKET

11.9 HEALTHCARE

11.9.1 DIGITALIZATION OF HEALTHCARE SYSTEM TO PROPEL DEMAND FOR OLED DISPLAYS DURING FORECAST PERIOD

11.10 MILITARY & AEROSPACE

11.10.1 ADOPTION OF AR AND VR HMDS IN MILITARY & AEROSPACE VERTICALS TO FAVOR GROWTH OF OLED MARKET DURING FORECAST PERIOD

11.11 OTHERS

12 GEOGRAPHIC ANALYSIS (Page No. - 122)

12.1 INTRODUCTION

FIGURE 44 OLED MARKET, BY REGION

FIGURE 45 APAC ACCOUNTED FOR LARGEST SHARE OF GLOBAL OLED MARKET IN 2020

TABLE 65 OLED MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 OLED MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 67 OLED DISPLAY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 68 OLED DISPLAY MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 69 OLED LIGHTING MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 70 OLED LIGHTING MARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 46 NORTH AMERICA: OLED MARKET SNAPSHOT

TABLE 71 OLED DISPLAY MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 72 OLED DISPLAY MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 73 OLED MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 74 OLED MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 75 OLED MARKET IN NORTH AMERICA, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 76 OLED MARKET IN NORTH AMERICA, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 Presence of giant consumers of OLED displays to foster market growth in US during forecast period

12.2.2 CANADA

12.2.2.1 Heightened demand from food service industry to generate demand for OLED displays in Canada during forecast period

12.2.3 MEXICO

12.2.3.1 Growth of end-user industries to underpin OLED market growth in Mexico

12.3 EUROPE

FIGURE 47 EUROPE: OLED MARKET SNAPSHOT

TABLE 77 OLED DISPLAY MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 78 OLED DISPLAY MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 79 OLED MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 80 OLED MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 81 OLED MARKET IN EUROPE, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 82 OLED MARKET IN EUROPE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Germany to lead OLED market in Europe during forecast period

12.3.2 UK

12.3.2.1 Heightened demand from smartphone and AR/VR technology developers to foster market growth in UK during forecast period

12.3.3 FRANCE

12.3.3.1 Growing expenditure on programmatic digital display advertising to support market growth in France

12.3.4 REST OF EUROPE

12.4 APAC

FIGURE 48 APAC: OLED MARKET SNAPSHOT

TABLE 83 OLED DISPLAY MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 84 OLED DISPLAY MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 85 OLED MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 86 OLED MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 87 OLED MARKET IN APAC, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 88 OLED MARKET IN APAC, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.4.1 CHINA

12.4.1.1 China to dominate OLED market in APAC during forecast period

12.4.2 SOUTH KOREA

12.4.2.1 Samsung and LG to lead growth of OLED market in South Korea during forecast period

12.4.3 JAPAN

12.4.3.1 Presence of key component suppliers favors market growth in Japan

12.4.4 TAIWAN

12.4.4.1 OLED display panel production in Taiwan to surge during forecast period

12.4.5 REST OF APAC

12.5 REST OF THE WORLD (ROW)

TABLE 89 OLED DISPLAY MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 90 OLED DISPLAY MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 91 OLED MARKET IN ROW, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 92 OLED MARKET IN ROW, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

12.5.1 MIDDLE EAST & AFRICA

12.5.1.1 Shopping malls and museums to generate demand for OLED displays in Middle East

12.5.2 SOUTH AMERICA

12.5.2.1 Market growth in South America to be driven by outdoor advertising events

13 COMPETITIVE LANDSCAPE (Page No. - 143)

13.1 OVERVIEW

13.2 MARKET SHARE ANALYSIS

TABLE 93 OLED DISPLAY MARKET DEGREE OF COMPETITION

13.3 REVENUE ANALYSIS (OLED DISPLAY BUSINESS)

FIGURE 49 OLED DISPLAY MARKET REVENUE ANALYSIS (OLED DISPLAY BUSINESS) OF TOP 5 PLAYERS

13.4 MARKET EVALUATION FRAMEWORK

FIGURE 50 MARKET EVALUATION FRAMEWORK (2017–2020)

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STAR

13.5.2 EMERGING LEADER

13.5.3 PERVASIVE

13.5.4 PARTICIPANT

FIGURE 51 OLED MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2020

13.6 STARTUP/SME EVALUATION MATRIX: OLED MARKET

13.6.1 PROGRESSIVE COMPANIES

13.6.2 RESPONSIVE COMPANIES

13.6.3 DYNAMIC COMPANIES

13.6.4 STARTING BLOCKS

FIGURE 52 OLED MARKET: STARTUP/SME EVALUATION MATRIX, 2020

13.7 RIGHT-TO-WIN

TABLE 94 OLED MARKET: RIGHT-TO-WIN (KEY MARKET PLAYERS)

TABLE 95 COMPANY FOOTPRINT

FIGURE 53 COMPANY INDUSTRY FOOTPRINT

FIGURE 54 COMPANY APPLICATION FOOTPRINT

TABLE 96 COMPANY REGION FOOTPRINT

13.8 COMPETITIVE SCENARIO

13.8.1 PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 97 KEY PRODUCT LAUNCHES/DEVELOPMENTS (2017–2020)

13.8.2 PARTNERSHIPS, AGREEMENTS, CONTRACTS, JOINT VENTURES, AND COLLABORATIONS

TABLE 98 OLED MARKET: DEALS JANUARY 2017–DECEMBER 2020

13.8.3 EXPANSIONS

TABLE 99 KEY EXPANSIONS (2017–2020)

14 COMPANY PROFILES (Page No. - 160)

14.1 INTRODUCTION

14.2 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

14.2.1 SAMSUNG ELECTRONICS

TABLE 100 SAMSUNG ELECTRONICS: BUSINESS OVERVIEW

FIGURE 55 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

TABLE 101 SAMSUNG ELECTRONICS: PRODUCT OFFERED

14.2.2 LG DISPLAY

TABLE 102 LG DISPLAY: BUSINESS OVERVIEW

FIGURE 56 LG DISPLAY: COMPANY SNAPSHOT

TABLE 103 LG DISPLAY: PRODUCT OFFERED

14.2.3 AU OPTRONICS (AUO)

TABLE 104 AU OPTRONICS: BUSINESS OVERVIEW

FIGURE 57 AU OPTRONICS: COMPANY SNAPSHOT

TABLE 105 AU OPTRONICS: PRODUCT OFFERED

14.2.4 BOE TECHNOLOGY

TABLE 106 BOE TECHNOLOGY: BUSINESS OVERVIEW

FIGURE 58 BOE TECHNOLOGY: COMPANY SNAPSHOT

TABLE 107 BOE TECHNOLOGY: PRODUCT OFFERED

14.2.5 UNIVERSAL DISPLAY

TABLE 108 UNIVERSAL DISPLAY: BUSINESS OVERVIEW

FIGURE 59 UNIVERSAL DISPLAY: COMPANY SNAPSHOT

TABLE 109 UNIVERSAL DISPLAY: PRODUCT OFFERED

14.2.6 TIANMA MICROELECTRONICS

TABLE 110 TIANMA MICROELECTRONICS: BUSINESS OVERVIEW

FIGURE 60 TIANMA MICROELECTRONICS: COMPANY SNAPSHOT

TABLE 111 TIANMA MICROELECTRONICS: PRODUCT OFFERED

14.2.7 OSRAM

TABLE 112 OSRAM: BUSINESS OVERVIEW

FIGURE 61 OSRAM: COMPANY SNAPSHOT

TABLE 113 OSRAM: PRODUCT OFFERED

14.2.8 ACUITY BRANDS

TABLE 114 ACUITY BRANDS: BUSINESS OVERVIEW

FIGURE 62 ACUITY BRANDS: COMPANY SNAPSHOT

TABLE 115 ACUITY BRANDS: PRODUCT OFFERED

14.2.9 OLEDWORKS

TABLE 116 OLEDWORKS: BUSINESS OVERVIEW

TABLE 117 OLEDWORKS: PRODUCT OFFERED

14.2.10 KONICA MINOLTA

TABLE 118 KONICA MINOLTA: BUSINESS OVERVIEW

FIGURE 63 KONICA MINOLTA: COMPANY SNAPSHOT

TABLE 119 KONICA MINOLTA: PRODUCT OFFERED

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

14.3 OTHER PLAYERS

14.3.1 KOPIN CORPORATION

14.3.2 EMAGIN CORPORATION

14.3.3 TRULY INTERNATIONAL

14.3.4 PANASONIC

14.3.5 CHINA STAR OPTOELECTRONICS TECHNOLOGY (CSOT) (CDOT) (TCL)

14.3.6 RAYSTAR OPTRONICS

14.3.7 VISIONOX

14.3.8 JOLED

14.3.9 WINSTAR DISPLAY

14.3.10 WISECHIP SEMICONDUCTOR

15 APPENDIX (Page No. - 199)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATION

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study has involved four major activities in estimating the size of the OLED market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods have been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

Primary Research

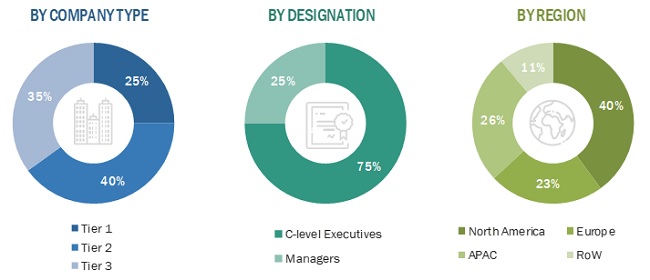

Extensive primary research has been conducted after understanding and analyzing the OLED market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand-side and supply-side vendors across four major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the OLED market. These methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- Revenue of various OLED device manufacturers is considered to arrive at global numbers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained earlier, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the OLED market has been validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the size of the OLED market, by product type and vertical, in terms of value

- To describe and forecast the size of the OLED display market, by application, panel type, technology, and panel size, in terms of value

- To define and forecast the size for various segments of the OLED market with respect to 4 regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To analyze the emerging applications/use-cases and technologies in the OLED market

- To analyze OLED manufacturers, their production capabilities, and new production fab construction plans in the OLED market

- To analyze the ecosystem/supply chain of OLED devices consisting of material & component suppliers, driver IC suppliers, manufacturing equipment suppliers, manufacturers, and brand product manufacturers

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape

- To analyze competitive developments, such as joint ventures, collaborations, agreements, contracts, partnerships, mergers and acquisitions, and product launches and developments, in the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in OLED Market